Digital twin technology provides a virtual representation of any physical object, system, or process, enabling real-time monitoring, data analysis, and operational optimization. Digital twins have quickly gained popularity for their ability to bridge the physical and digital worlds, offering a powerful tool for predictive maintenance, remote monitoring, and simulation modeling. The rising adoption of virtual modeling solutions is accelerating the growth of the global digital twin platforms ecosystem.

The global market for data management systems and digital twin solutions is projected to experience rapid expansion due to the increasing adoption of IoT technologies, AI-driven analytics, and big data platforms. Businesses seek cost-efficient operations, optimized workflows, and reduced time to market—making digital twin platforms a central component in digital transformation strategies.

Advancements in virtual reality (VR) and augmented reality (AR) are expected to further fuel the evolution of digital twins, accelerating market growth. Both public and private investments in Industry 4.0 and digital transformation initiatives are driving widespread adoption. Countries such as the U.S.A, India, Australia, Brazil, Saudi Arabia, and South Africa are heavily investing in smart infrastructure and intelligent systems powered by digital twin technology.

As per Hexagon, the adoption of digital twin systems is growing at a projected average rate of 36% over the next five years. Around 70% of technology leaders in major corporations are actively investing in digital twin projects, and 42% of executives recognize their tangible business benefits. Notably, 59% plan to integrate digital twins by 2028, and sustainability is a key driver for 57% of organizations implementing them.

In the

Aerospace and Defense Materials, digital twin simulation is enhancing operations from design through maintenance. About 24% of organizations prioritize using digital twins to optimize product lifecycle management, and 19% focus on improving sustainability metrics. The sector plans to allocate 2.7% of its revenue to digital twin applications, signaling a significant investment shift.

Digital twins improve operational efficiency, with organizations reporting an average 15% increase in sales, turnaround time, and performance optimization. In aerospace, 75% of companies find value in digital twins during the early design stages. For example, the U.S. Air Force saved €7.47 million in wind tunnel testing costs by implementing digital twin models.

The US Digital Twin Market

The US Digital Twin Market is projected to reach USD 7.3 billion by the end of 2024 and grow substantially to an expected USD 104.8 billion market by 2033 at an anticipated CAGR of 34.5 percent.

The integration of IoT, AI, and big data analytics enables more sophisticated and accurate digital twin models, driving adoption across industries. The shift towards automation and smart manufacturing technologies fuels the demand for digital twins to optimize processes, enhance efficiency, and reduce downtime.

Prominent U.S. companies like International Business Machines Corporation, Microsoft Corporation, and General Electric are actively engaged in developing new products and improving existing ones to attract customers and increase their market share.

Digital Twin Market Key Takeaways

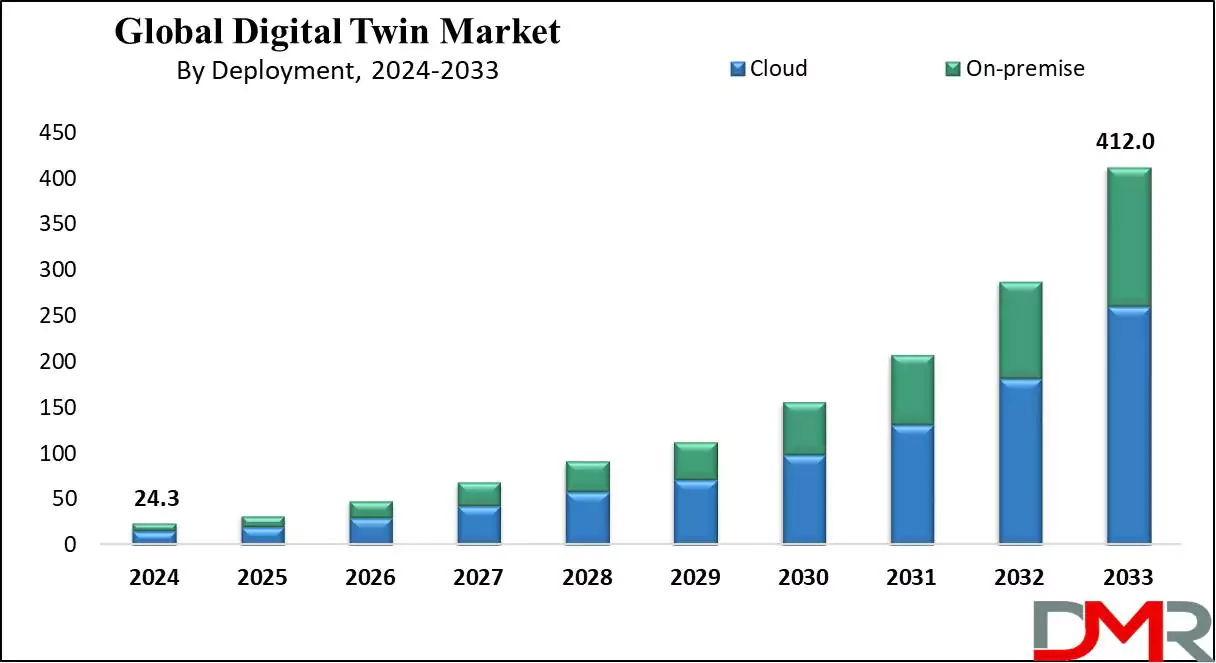

- Market Growth: It is expected that the global digital twin market will experience a growth of USD 379.6 billion at an average CAGR of 36.9 %.

- Market Definition: Digital Twin is a digital replica of a physical object, system, or process that mirrors its real-time conditions and behaviors.

- Analysis by Solution: The system segment is projected to hold the largest revenue share of 43.0% based on solution in 2024.

- Deployment Analysis: Cloud-based deployment is predicted to capture a significant revenue share by the end of 2024.

- Enterprises Analysis: Large Enterprises are anticipated to hold the highest market share in 2024.

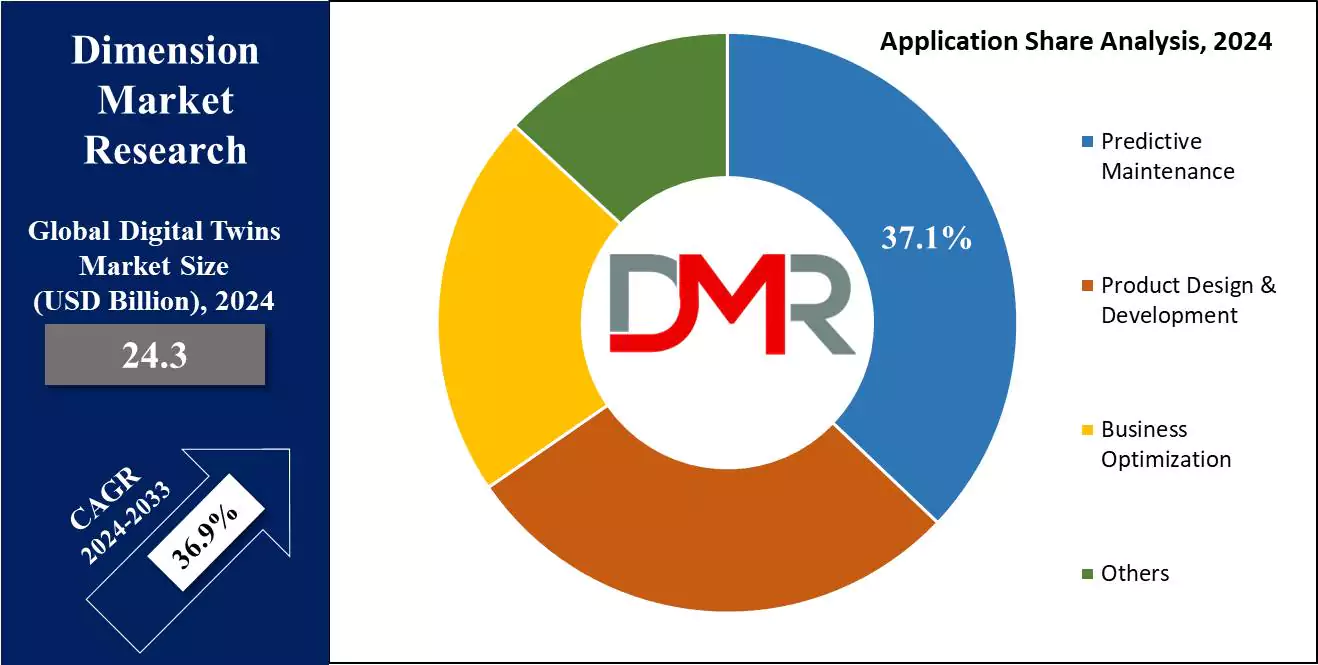

- Analysis by Application: Predictive Maintenance is expected to lead the market with the largest revenue share by 2024.

- Analysis by End User: Automotive and Transport is expected to dominate the market with the largest revenue share of 25.0% by 2024.

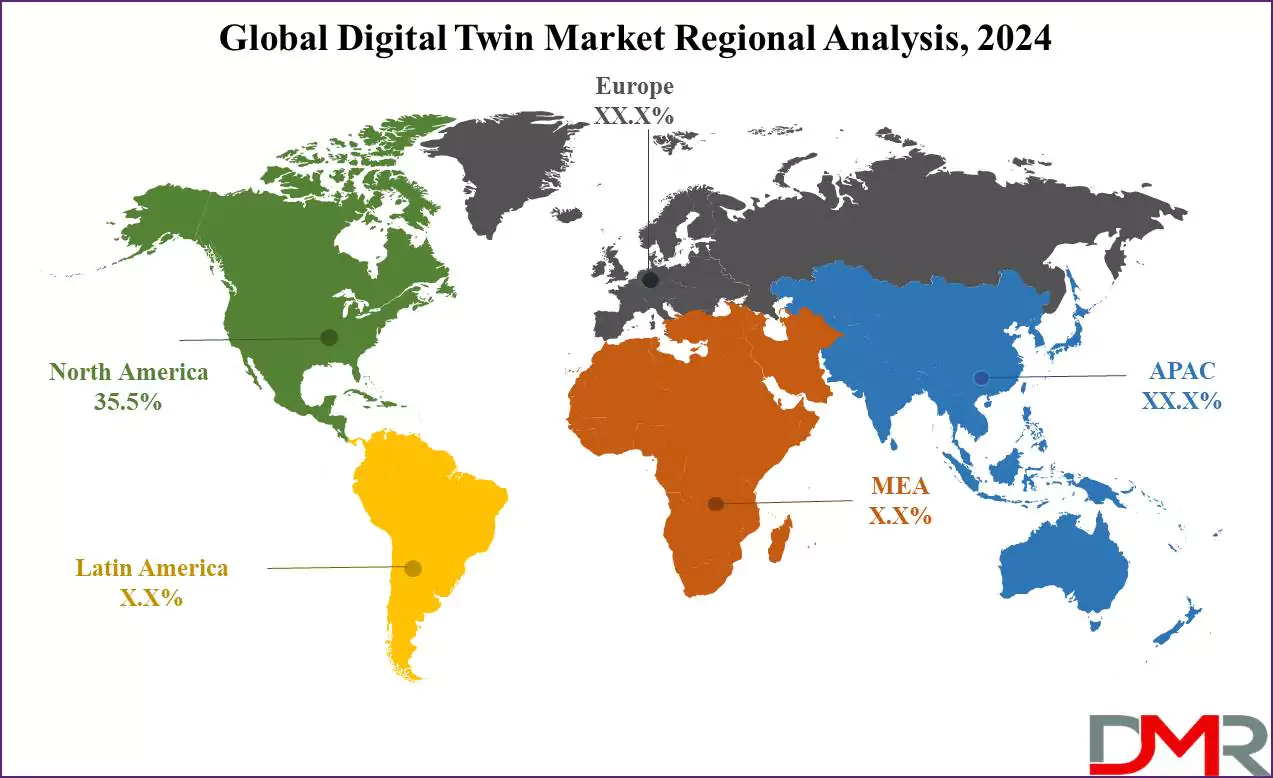

- Regional Analysis: North America is predicted to lead the global digital twin market globally with a 35.5% market share by 2024.

Digital Twin Market Use Cases

- Manufacturing Optimization: Digital twins simulate manufacturing processes, allowing for real-time monitoring and optimization of production lines which offer improved efficiency, reduced downtime, and enhanced quality control.

- Predictive Maintenance: Equipment and machinery are mirrored digitally to predict failures before they occur by analyzing performance data which minimizes unplanned downtime and extends the lifespan of assets.

- Urban Planning and Smart Cities: Digital twins of cities help planners simulate infrastructure changes, traffic patterns, and resource management. It is helpful with decision-making for urban development and improved resource allocation.

- Healthcare Applications: Patient-specific digital twins model individual health conditions, allowing for personalized treatment plans.

Digital Twin Market Dynamic

Drivers

Increasing Adoption of 3D Simulation and 3D Printing

Recent advances in

3D printing technology have expanded the variety of materials that can be printed. Unfortunately, some materials warp during printing processes leading to extended trial-and-error periods which increase both costs and timeline for part production.

Digital twins can simulate this process to predict where distortions might arise so adjustments can be made beforehand to optimize models fully to account for these variations resulting in growth for market.

Growing Embrace of Industry 4.0

The rising adoption of Industry 4.0 initiatives is significantly impacting the digital twin market. This manufacturing paradigm emphasizes automation, data exchange, and the integration of smart digital technologies, making it a key driver for the digital twin’s market. Digital twins play an essential role in enhancing monitoring, optimization, and data-driven decision-making in manufacturing processes

Restraints

High Investment

The global market for digital twin solutions faces growth constraints primarily due to the substantial investments required for implementation. Establishing digital twins, along with associated technologies such as smart automation, connected control, computer-aided design (CAD), and product lifecycle management (PLM), involves significant financial commitments.

Financial Burden and Its Implications for Adoption

The financial burden of implementing digital twins can be particularly daunting for organizations that require additional infrastructure and supporting technologies, leading to substantially higher overall expenses. While these costs can pose a barrier to entry for some companies, they may also catalyze for manufacturers to adopt digital twin technology.

Opportunities

Enhanced Innovation and Growth

The insights gained from digital twins are expected to drive significant opportunities for innovation & growth. By analyzing performance indicators & identifying areas for improvement, businesses can continuously refine their products & processes. This feedback loop accelerates product development while reducing costs associated with creating and testing physical prototypes.

Improved Cross-Disciplinary Collaboration

Digital twins facilitate better collaboration among experts from various fields during the development process. Mechanical engineers, software developers, and designers can work together on the same virtual model, enhancing communication and teamwork. This collaborative approach allows teams to predict and address production issues proactively, leading to more efficient manufacturing operations.

Trends

Medical Procedure Planning and Device Development

The growing adoption of digital twin technology in healthcare is revolutionizing how medical procedures and device designs are approached. By allowing healthcare professionals to simulate complex medical interventions, digital twins enhance pre-operative planning, minimize risks, and increase the accuracy of treatments.

Additionally, this technology facilitates the creation of virtual prototypes for

medical devices, streamlining the design process, ensuring safety, and optimizing performance before the production of physical models.

Support for Healthcare Response and Training

Digital twins have proven invaluable in addressing challenges faced by healthcare systems as they have been instrumental in optimizing ventilator usage, minimizing person-to-person contact, & supporting contactless health monitoring initiatives.

In addition, digital replicas serve as effective training tools for healthcare professionals, providing virtual simulations that allow trainees to practice medical procedures in a risk-free environment, thereby enhancing their skills and preparedness for real-world scenarios.

Digital Twin Market Research Scope and Analysis

By Solution

The system segment is likely to dominate the digital twin market by accounting for 43.1 % of total revenues in 2024. Digital twin technologies have grown increasingly prevalent in recent years as more industries such as oil & gas, automotive, & aerospace utilize these technologies for designing assembly lines, communication networks, and piping systems across an assembly process. System twins enable engineers to evaluate how well components synchronize during operations and system performance - driving growth in this segment.

Due to the increasing complexity of systems across industries like manufacturing, healthcare, and automotive production facilities. System-based digital twins provide an aggregate view of connected components and processes, making them essential tools for monitoring, optimizing, and forecasting overall system performance.

This is particularly vital in environments in which efficiency and predictive maintenance are critical to minimizing downtime and improving operational outcomes. Demand for system-wide insights provided by advanced simulations is driving this segment's expansion its expected compound annual growth rate can be seen particularly among industries like logistics, energy supply chain management, or supply chain management.

By Deployment

On-premise deployment is expected to command the largest revenue share in 2024 due to widespread adoption by large enterprises, that favor on-premise solutions due to improved security & compliance with government regulations. Organizations operating within highly regulated sectors such as aerospace, healthcare, & manufacturing often prefer on-premise solutions for better control over their data and systems.

Additionally, on-premise systems offer improved performance & reduced latency since data processing takes place locally - this makes real-time monitoring and analytics possible. By choosing on-premise deployment, organizations can tailor digital twin solutions specifically to their operational environments and integrate existing legacy systems and infrastructure more seamlessly, for a smoother transition into digital twin technologies.

Companies also benefit from improved customization options offered by cloud solutions, allowing them to modify and optimize systems without the restrictions that often accompany cloud solutions. The cloud deployment segment is expected to experience the fastest CAGR from 2024-2030 and provides businesses with greater cost efficiency by eliminating physical infrastructure requirements while decreasing maintenance expenses.

By Enterprise Size

Large enterprises are predicted to dominate the digital twin market with the highest revenue share in 2024. These enterprises are gaining traction due to their substantial resources, technological infrastructure, & the complex operational needs that digital twin technologies can address.

These organizations are better positioned to invest in advanced digital twin solutions that require considerable upfront investment and ongoing maintenance with significant budgets for research & development. The complexity and scale of operations in large enterprises like manufacturing plants, logistics networks, and supply chains, create a strong demand for comprehensive digital twin implementations that can provide insights for optimization, predictive maintenance, and real-time monitoring.

Digital twins provide comprehensive visibility into products and their operations, aiding organizations in planning machinery maintenance and contributing to the growth of this segment. Meanwhile, small and medium enterprises are expected to show notable growth as they typically have more limited financial and technical resources, which can restrict their ability to invest in the necessary infrastructure and skilled personnel required to implement digital twin solutions effectively.

By Application

Predictive Maintenance is anticipated to lead the global digital twin market with revenue share based on application in 2024. Its overwhelming dominance stems from its positive impact on operational efficiencies and cost reduction across numerous industries.

Organizations can utilize digital twins to monitor equipment in real-time, analyze historical performance data, and predict potential failures before they arise - providing organizations with real-time monitoring of physical assets as well as increased predictability regarding potential failures before they happen. By taking proactive measures, this proactive approach reduces unscheduled downtime, reduces maintenance costs, and extends equipment lifespan.

Digital twins play an invaluable role in predictive maintenance by providing engineers with the ability to assess and schedule maintenance accordingly, helping prevent machine failures and minimize downtime. Businesses can utilize this approach to address performance issues more efficiently, thereby minimizing both underinvestment and overinvestment in critical resources.

Product design & development should experience the fastest CAGR during its forecast period, driven by growing interest for digital twin solutions that enable engineers and designers to visualize design concepts quickly, review manufacturing operations with computer-aided manufacturing (CAM) software, and simulate the performance of designs.

By End User

Automotive and Transport is likely to capture the largest revenue share, approximately 25.0%, due to its global adoption of digital twin technology in this sector. This dominance can be attributed to the various advantages digital twins offer, such as cost optimization, increased vehicle safety, and boosted productivity throughout the vehicle lifecycle.

Digital twins technology allows automotive manufacturers to create virtual models of vehicles, which can be tested and analyzed under different conditions before actual production. Furthermore, it improves the automotive supply chain by providing real-time visibility into production processes and logistics. This helps identify bottlenecks, optimize resource allocation, and improve inventory management. It plays a vital role in optimizing operations and maintenance beyond design.

Manufacturers and operators gain deeper insights into vehicle performance by using real-time data, which allows better decisions for operating vehicles more efficiently and reducing the frequency of unexpected breakdowns. The manufacturing industry dominates the market after automotive and transport due to its increasing adoption for optimizing production processes, reducing downtime, & improving product quality.

In manufacturing, digital twins are widely used to simulate, monitor, & control equipment, processes, and systems in real time, enabling predictive maintenance and efficient resource utilization. The ability to visualize operations & predict outcomes helps manufacturers enhance productivity & minimize costs.

The Global Digital Twin Market Report is segmented based on the following

By Solution

By Deployment

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- Predictive Maintenance

- Product Design & Development

- Business Optimization

- Others

By End User

- Manufacturing

- Agriculture

- Automotive & Transport

- Energy & Utilities

- Healthcare & Life Sciences

- Residential & Commercial

- Retail & Consumer Goods

- Aerospace

- Telecommunication

- Others

Digital Twin Market Research Regional Analysis

North America is expected to dominate the global digital twin market with a

revenue share of 35.5% in 2024, due to the global adoption of digital twin technology by manufacturing facilities in the region. This technology has been key to improving efficiency, optimizing production processes, and implementing Industry 4.0 practices.

Industries in the United States, including healthcare, home, and commercial sectors, are increasingly investing in parts and product twins, which is driving market growth. Key market players in this region are forming mergers and partnerships with technology companies to improve their service offerings and attract new clients.

For instance, Siemens AG and IBM Corporation r announced the availability of an improved solution that integrates IBM Maximo's components with Siemens' Xcelerator software. This solution aims to boost production capacity and enhance service lifecycle management (SLM) assets by creating a digital thread that connects equipment manufacturers, product design teams, and project owners. Meanwhile, the Asia-Pacific region is anticipated to experience the highest growth during the forecast period.

Countries such as China, India, Japan, and South Korea have been increasingly investing in digital twin technologies. The region shows great potential due to the presence of various industries, including automotive, transportation, manufacturing, and energy.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Digital Twin Market Competitive Landscape

Intense competition among major players in the digital twin market is driving significant investments in product research and development, as well as process automation. Companies are focusing on enhancing their offerings with innovative solutions to gain a competitive edge. Automotive firms, in particular, are leveraging digital twin technology to enhance consumer engagement through interactive dashboards that allow potential buyers to customize vehicles online.

This approach not only fosters a deeper understanding of consumer preferences but also enables companies to rapidly adapt existing models based on real-time feedback. As more organizations embrace digital twins, the competitive landscape is likely to evolve, fostering continuous innovation and collaboration among industry leaders. Some key players in this market include IBM Corporation, Amazon Web Services, Inc., and Autodesk Inc.

Major players operating in the market are adopting strategies such as innovating their products and services and engaging in mergers and acquisitions to expand the functionality of their product portfolios and maintain competitiveness.

Some of the prominent players in the global digital twin market are

Digital Twin Market Recent Development

- In January 2024, Valeo, a leading provider of automotive technology, partnered with Applied Intuition, a vehicle software supplier, to develop a digital twin platform for simulating advanced driver-assistance systems (ADAS) sensors. This joint solution aims to help OEMs accelerate the introduction of reliable and safe ADAS features to the market.

- In April 2023, Rockwell Automation implemented a Robotic Supervision System (RSS) for TotalEnergies. This system integrates the Internet of Things (IoT), gamification, and digital twin technology to enhance the management and monitoring of industrial robots. The goal is to improve robot performance, maintenance, and productivity, underscoring the increasing adoption of automation and digital solutions in the renewable energy sector.

- In March 2023, WSP partnered with Amazon Web Services, Inc. (AWS) to create digital twins for complex infrastructure projects. This collaboration seeks to harness AWS's cloud data processing and analytics capabilities to drive innovation and sustainable solutions across multiple industries. WSP aims to use AWS technology to improve services in areas such as infrastructure planning, environmental sustainability, and data-driven decision-making.

- In September 2023, Dassault Systèmes SE introduced "Emma," an avatar for its digital twin technology, designed to raise awareness about health research.

- In June 2023, U.K.-based technology company Helixx teamed up with Siemens to utilize Siemens' digital twin software, "Xcelerator," in the production of commercial electric vehicle (EV) manufacturing hubs.

- In January 2023, Dassault Systèmes SE collaborated with IBM Corporation to accelerate sustainable transformations in asset-heavy industries. The partnership focuses on sectors such as energy, infrastructure, and data centers.

Digital Twin Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 24.3 Bn |

| Forecast Value (2033) |

USD 412.0 Bn |

| CAGR (2024-2033) |

36.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 7.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution (System, Process, and Component), By Deployment (Cloud, and On-premise), By Enterprise Size (Large Enterprises, and Small and Medium Enterprises), By Application (Predictive Maintenance, Product Design & Development, Business Optimization, and Others), By End User (Manufacturing, Agriculture, Automotive & Transport, Energy & Utilities, Healthcare & Life Sciences, Residential & Commercial, Retail & Consumer Goods, Aerospace, Telecommunication, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ABB Group, Amazon Web Services, Inc., ANSYS, Inc., Autodesk Inc., AVEVA Group plc, General Electric, International Business Machines Corporation, Microsoft Corporation, SAP SE, Siemens AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |