Market Overview

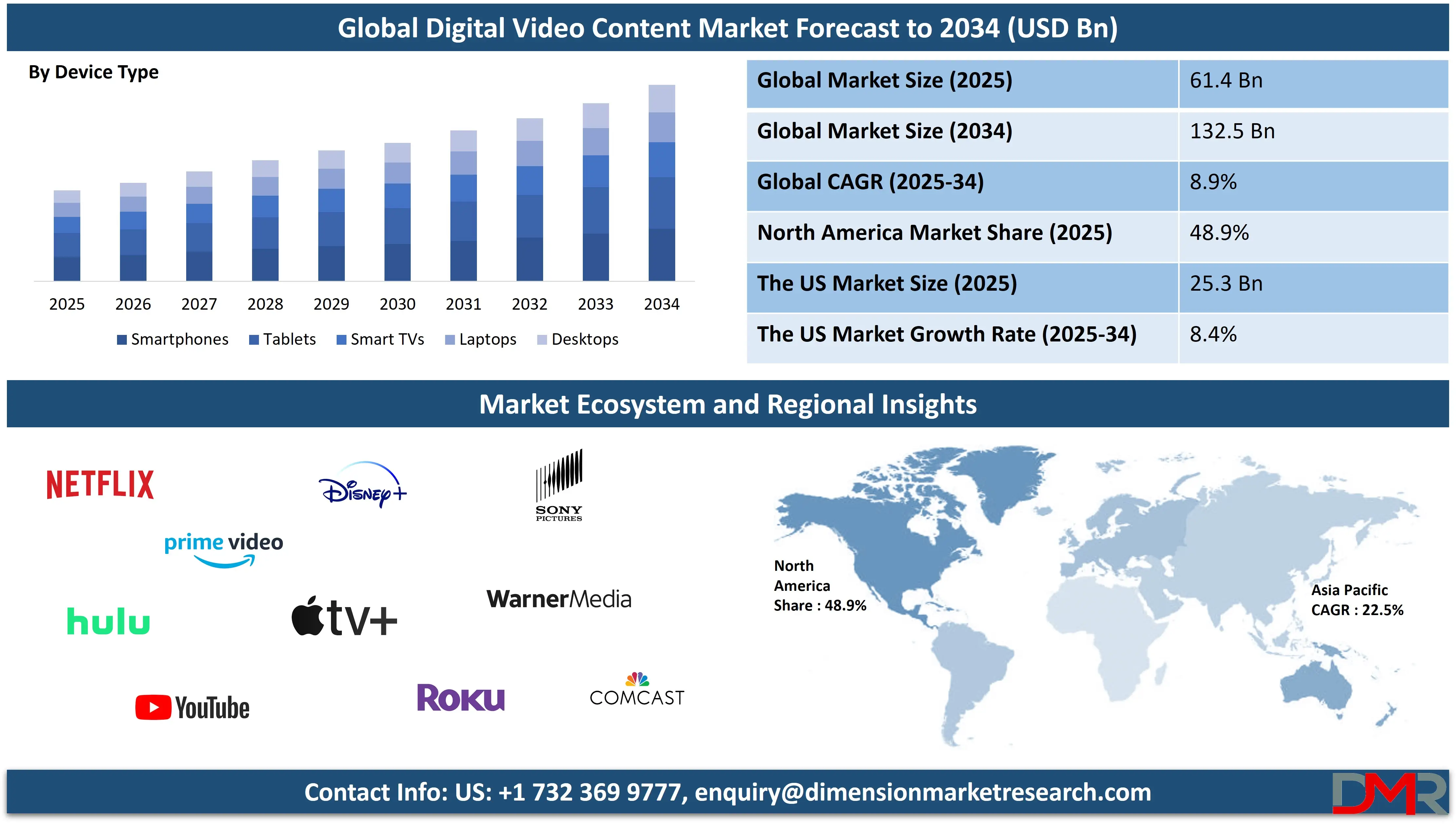

The global digital video content market size is poised for robust growth, with its valuation expected to reach USD 61.4 billion in 2025. This reflects the growing consumption of streaming media, on-demand entertainment, and short-form video formats across platforms. Fueled by the widespread adoption of high-speed internet, mobile video streaming, and the exponential rise of OTT services, the market is expected to reach a value of 132.5 billion by 2034 and is projected to experience a strong compound annual growth rate (CAGR) of 8.9% during the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Digital video content refers to any video material created, formatted, and distributed in a digital format for consumption on various electronic devices such as smartphones, tablets, computers, and smart TVs. This content includes various formats such as short-form videos, web series, live streams, video blogs (vlogs), tutorials, advertisements, music videos, and user-generated clips. Distributed through platforms like YouTube, Netflix, TikTok, and other over-the-top (OTT) services, digital video content leverages the power of internet connectivity and cloud-based infrastructure to reach global audiences instantly.

It offers high interactivity and personalization, allowing creators to engage directly with viewers and track real-time performance metrics. With advancements in mobile technology, video production tools, and high-speed internet, digital video has become a dominant medium in the entertainment, marketing, education, and social media landscapes, reshaping how consumers discover, consume, and interact with multimedia content.

The global digital video content market has seen rapid growth over the past decade, fueled by widespread internet penetration, growing smartphone usage, and the proliferation of video-on-demand platforms. Consumers are spending more time streaming visual media across subscription-based services and ad-supported platforms, moving away from traditional broadcast television.

The integration of

artificial intelligence in content recommendation engines has also revolutionized the user experience, offering personalized content delivery that boosts viewer engagement and retention. This transformation is further driven by content localization and dubbing, enabling platforms to cater to diverse linguistic and regional preferences. The widespread availability of 4G and 5G networks continues to support seamless video streaming and mobile video consumption, especially in emerging economies.

Market dynamics for digital video content are being shaped by strategic collaborations between production studios, OTT platforms, and telecom operators. These partnerships are enhancing content distribution capabilities and expanding audience reach. Additionally, the surge in short video formats driven by platforms like Instagram Reels, YouTube Shorts, and TikTok has created new monetization opportunities for creators and marketers alike. Brands are integrating branded video content and influencer-driven storytelling into their digital campaigns to achieve higher engagement. This shift has given rise to a

creator economy where independent content producers, vloggers, and live streamers build niche communities and generate significant revenue through sponsorships, subscriptions, and merchandise.

The US Digital Video Content Market

The U.S. digital video market size is projected to be valued at

USD 25.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding

USD 52.0 billion in 2034 at a

CAGR of 8.4%.

The US digital video content market stands at the forefront of the global streaming revolution, driven by high consumer demand for on-demand entertainment, interactive media experiences, and multi-platform accessibility. With a mature internet infrastructure, widespread use of smart devices, and a tech-savvy population, the United States has become a powerhouse for both content creation and consumption.

Major players such as Netflix, Hulu, Disney+, YouTube, and Amazon Prime Video dominate the landscape, continuously investing in original programming, high-definition formats, and personalized viewing experiences. The popularity of subscription video-on-demand (SVOD), ad-supported video-on-demand (AVOD), and live-streaming platforms has reshaped the traditional broadcasting model, shifting viewer preferences toward mobile-first and binge-worthy digital content. Additionally, the growth of connected TV usage and cord-cutting trends reflects a significant transformation in American media habits.

The rise of user-generated content, short-form video apps like TikTok and Instagram Reels, and influencer marketing is also fueling the US market's expansion, with creators playing a central role in audience engagement and monetization. Enhanced video analytics, AI-driven recommendation systems, and targeted advertising are optimizing content delivery and boosting platform revenue.

Furthermore, the US market is witnessing increased integration of branded entertainment and immersive storytelling through augmented reality and 360-degree video experiences. Media companies are leveraging consumer data to tailor content strategies, while regulatory discussions around data privacy and copyright continue to shape industry practices. As innovation in video technology, platform interactivity, and monetization models accelerates, the US digital video content market is set to maintain its leadership position, serving as a benchmark for global digital media development.

The Japan Digital Video Content Market

Japan's digital video content market is poised for substantial growth, with projections indicating it will reach USD 3.2 billion by 2025, driven by a robust CAGR of 9.3%. Japan's digital video market is driven by several factors, including widespread smartphone penetration, high-speed internet infrastructure, and the growing preference for both local and international streaming content. Platforms like Netflix, Amazon Prime Video, and local services such as U-NEXT and AbemaTV have significantly contributed to the market's expansion. The growing demand for anime, dramas, and films tailored to Japanese tastes, along with the rise of mobile video consumption, is further boosting the market's trajectory.

This growth also reflects the growing digital transformation in entertainment and the willingness of Japanese consumers to adopt OTT services and pay for premium video content. Additionally, advancements in technologies like 4K and VR content are likely to enhance viewing experiences, further accelerating demand.

In terms of market share, Japan's digital video content segment is expected to continue expanding rapidly due to these ongoing technological and consumer behavior shifts. The 9.3% CAGR highlights a strong momentum that positions Japan as a key player in the global digital video content landscape, particularly within the Asia Pacific region.

The European Digital Video Content Market

Europe's digital video content market is expected to reach USD 14.1 billion in 2025, growing at a CAGR of 8.5%. This robust growth is fueled by several key factors, including the widespread adoption of OTT platforms such as Netflix, Amazon Prime Video, and Disney+, alongside strong local streaming services like BBC iPlayer, Sky Go, and Ziggo. The region's advanced internet infrastructure, high-speed broadband availability, and growing smartphone penetration are making digital video content more accessible across various devices.

In addition, the rise in demand for diverse content, including regional films, TV shows, and live sports, is propelling the growth of the European market. The ability of streaming platforms to localize content for multiple languages and cultures within Europe helps to cater to a broad and diverse audience. Moreover, the growing popularity of live sports streaming, particularly football, Formula 1, and other high-demand sports, continues to drive subscriber numbers and revenue in the region.

The growing trend of cord-cutting, where consumers are replacing traditional cable and satellite services with more flexible and cost-effective OTT solutions, is another factor contributing to this market expansion. Additionally, the proliferation of 4K and interactive video formats is enhancing the viewing experience and attracting more consumers to premium subscription services. With these factors combined, Europe's digital video content market is expected to maintain its growth trajectory, making it one of the leading regions globally for streaming and digital entertainment.

Global Digital Video Content Market: Key Takeaways

- Market Value: The global digital video content market size is expected to reach a value of USD 132.5 billion by 2034 from a base value of USD 61.4 billion in 2025 at a CAGR of 8.9%.

- By Content Type Segment Analysis: Streaming Video is expected to maintain its dominance in the content type segment, capturing 39.3% of the total market share in 2025.

- By Device Type Segment Analysis: Smartphones are poised to consolidate their dominance in the device type segment, capturing 26.8% of the total market share in 2025.

- By Content Category Type Segment Analysis: The Entertainment category is expected to maintain its dominance in the content category type segment, capturing 27.4% of the market share in 2025.

- By End-User Segment Analysis: Individual users are expected to maintain their dominance in the end-user type segment, capturing 56.2% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global digital video content market landscape with 48.9% of total global market revenue in 2025.

- Key Players: Some key players in the global digital video content market are Netflix, Amazon Prime Video, Hulu, YouTube, Disney+, Apple TV+, Roku, Sony Pictures Entertainment, WarnerMedia, Comcast, ViacomCBS, BBC Studios, MGM Studios, Lionsgate, Tencent Video, iQIYI, Vimeo, Dailymotion, Sling TV, FuboTV, and Other Key Players.

Global Digital Video Content Market: Use Cases

- OTT Platform Expansion into Emerging Markets: Over-the-top (OTT) streaming platforms are rapidly expanding into emerging regions such as Southeast Asia, Latin America, and Africa, where internet accessibility and smartphone adoption are rising. Companies like Netflix and Disney+ are localizing content through regional language dubbing, subtitles, and culturally relevant storytelling to resonate with diverse audiences. This use case illustrates how digital video platforms are tapping into new subscriber bases by customizing offerings and leveraging mobile-friendly video formats. The deployment of adaptive streaming, affordable subscription models, and partnerships with telecom operators plays a key role in market penetration, supporting revenue growth and platform scalability.

- Monetization through Ad-Supported Video on Demand (AVOD): AVOD platforms such as YouTube, Roku Channel, and Tubi are transforming video consumption by offering free access to premium content supported by targeted advertising. This model is particularly effective in cost-sensitive markets where consumers prefer ad-supported formats over paid subscriptions. Brands use programmatic video advertising and viewer analytics to deliver highly personalized video ads that improve engagement and conversion rates. AVOD also benefits content creators and media houses by enabling diversified monetization strategies beyond traditional paywalls.

- Digital Learning and Educational Video Platforms: The surge in e-learning platforms and digital classrooms has elevated the role of video content in education and skill development. Platforms such as Khan Academy, Coursera, and YouTube Education leverage digital videos to offer interactive lessons, tutorials, and webinars across various subjects and age groups. High-definition instructional videos, virtual labs, and real-time lecture streaming enhance learning experiences while enabling flexible access for students globally. Educational institutions are also producing proprietary video libraries for hybrid and remote learning models.

- Branded Content and Influencer-Led Marketing Campaigns: Brands are partnering with digital influencers and content creators to develop branded video content that connects authentically with niche audiences. Through platforms like Instagram Reels, TikTok, and YouTube Shorts, companies promote products via storytelling, behind-the-scenes clips, and interactive live streams. This approach builds trust and drives higher engagement compared to traditional advertising. Video marketing strategies include unboxing videos, product demos, and lifestyle vlogs, often enhanced with call-to-action overlays and real-time audience feedback.

Global Digital Video Content Market: Stats & Facts

- United States Government Agencies

- S. Census Bureau:

- The U.S. Census Bureau's Economic Census provides data on the digital video content market, including information on revenue, employment, and industry trends.

- S. Department of Commerce:

- The U.S. Department of Commerce's National Telecommunications and Information Administration (NTIA) reports on broadband adoption and internet usage, which are closely linked to digital video consumption.

- Federal Communications Commission (FCC):

-

- The FCC's Broadband Deployment Report tracks the availability of broadband services, impacting the accessibility of digital video content.

- Federal Trade Commission (FTC):

- The FTC monitors and reports on advertising practices, including those related to digital video content, ensuring consumer protection in the marketplace.

- Library of Congress:

- The Library of Congress provides access to a vast collection of digital video content through its American Memory and other digital archives.

- Global Organizations

- World Bank:

- The World Bank's Digital Progress and Trends Report highlights the growth of digital services, including video content, in various economies.

- The information technology (IT) services sector, such as tech consulting and software development, grew twice as fast as the rest of the economy, creating jobs at six times the rate of the global economy.

- The top six economies accounted for 70 percent of global value added in IT services.

- East Asia has been the clear front-runner in business digitalization among developing regions, with the share of firms investing in digital solutions quadrupling from 13 percent to 54 percent between 2020 and 2022.

- In other regions, less than 30 percent of firms invested in digital solutions by the end of 2022.

- From April 2020 to December 2022, the percentage of micro firms (zero to four employees) investing in digital solutions doubled from 10 percent to 20 percent.

- For large firms (more than 100 employees), investment in digital solutions tripled from 20 percent to 60 percent.

- International Telecommunication Union (ITU):

- The ITU's Measuring the Information Society Report provides data on broadband penetration and internet usage, which are essential for digital video consumption.

- Organisation for Economic Co-operation and Development (OECD):

- The OECD's Communications Outlook reports on trends in broadband and digital services, including video content, across member countries.

- European Commission:

- The European Commission's Digital Economy and Society Index (DESI) monitors the digital performance of EU countries, including aspects related to digital video consumption.

- United Nations Educational, Scientific, and Cultural Organization (UNESCO):

- UNESCO's reports on digital education and media highlight the role of digital video content in learning and information dissemination.

- Indian Government Bodies

- Press Information Bureau (PIB), Government of India:

- As of October 2024, urban telephone connections in India rose to 661.36 million, up from 555.23 million in March 2014.

- Rural telephone connections increased from 377.78 million in March 2014 to 527.34 million in October 2024.

- Internet connections jumped from 25.15 crore in March 2014 to 96.96 crore in June 2024, registering a growth of 285.53%.

- Broadband connections rose from 6.1 crore in March 2014 to 94.92 crore in August 2024, growing by 1452%.

- Out of 6,44,131 villages, 6,15,836 villages had 4G mobile connectivity in the country as of December 2024.

- Average revenue realization per subscriber per GB of wireless data reduced to Rs 8.31 in June 2024 from Rs 268.97 in December 2014, a reduction of more than 96.91%.

- Average monthly data consumption per wireless data subscriber increased by 353 times to 21.30 GB in June 2024 from 61.66 MB in March 2014.

- India has seen the fastest rollout of 5G services in the world with 4,62,084 Base Transceiver Stations (BTS) deployed across 779 districts as of December 2024.

- Invest India:

- India’s media and entertainment (M&E) sector is growing at a CAGR of 10% between 2023 and 2026, driven by digital media through the adoption of OTT platforms and government incentives.

- In 2023, India released approximately 2,00,000 hours of content, and regional OTT content volumes surpassed Hindi-language content.

- Wired home broadband is anticipated to double its current size, growing from 38 million to 70 million in 2026.

- India is the fastest in the world with the 5G rollout, enhancing media consumption capabilities.

- Advancements in 4K and 8K technology are expected to further boost media consumption.

- The Indian online gaming ecosystem is projected to cross INR 388 billion by 2026, with gamers growing from 455 million to over 500 million.

- In 2023, 35 foreign film projects were granted permission for production in India.

- India's media industry represents evolving consumer preferences and emerges as one of the transformative paths for the digital landscape.

Global Digital Video Content Market: Market Dynamics

Global Digital Video Content Market: Driving Factors

Surge in Mobile Video Consumption and 5G Rollout

The exponential rise in smartphone penetration, combined with the global rollout of 5G technology, is significantly boosting mobile video streaming. With faster internet speeds and lower latency, consumers now enjoy buffer-free, high-resolution digital video on the go, including 4K and live-streamed content. This shift in user behavior is encouraging content platforms to optimize mobile-first experiences, including vertical video formats and responsive player interfaces.

Rising Demand for Personalized and On-Demand Content

Consumers favor personalized recommendations and binge-worthy content experiences tailored to their viewing habits. The integration of AI and

machine learning in content recommendation engines enables streaming platforms to deliver hyper-targeted media, growing user satisfaction and retention. The demand for non-linear viewing formats has fueled the rise of subscription-based and freemium models.

Global Digital Video Content Market: Restraints

Intense Content Licensing and Distribution Challenges

Securing global licensing rights for digital video content remains a major hurdle, especially when negotiating multi-region deals and ensuring copyright compliance. Content restrictions, geo-blocking, and fragmented distribution laws create legal and financial complexities for OTT players trying to scale across borders. These constraints hinder content accessibility and delay international expansion.

Market Saturation and Subscription Fatigue

With numerous streaming services entering the market, users are facing subscription overload, leading to fragmented viewing experiences and reduced willingness to pay for multiple platforms. The competitive landscape has made it difficult for new entrants to acquire and retain subscribers, especially without exclusive content or differentiated offerings.

Global Digital Video Content Market: Opportunities

Growth of Niche and Regional Streaming Platforms

As global audiences become more diverse, there is growing potential for niche OTT services that cater to specific cultural, linguistic, or interest-based communities. Platforms focusing on regional storytelling, independent cinema, or genre-specific content can cultivate loyal audiences with targeted marketing and curated libraries.

Expansion of Interactive and Immersive Video Formats

Technological innovation is opening doors for interactive storytelling, 360-degree video, and augmented reality (AR) experiences within digital video content. These formats create immersive environments that enhance viewer engagement, especially in gaming, virtual concerts, education, and branded storytelling. Interactive video also enables real-time user feedback, branching narratives, and gamified media experiences.

Global Digital Video Content Market: Trends

Integration of AI and Predictive Analytics in Content Creation

Streaming services are using AI not just for content recommendation, but also to guide content creation decisions such as script development, character profiling, and audience sentiment analysis. Predictive models help platforms determine which genres, formats, and themes are likely to perform well, streamlining production and maximizing ROI.

Rise of Short-Form Vertical Video and Snackable Content

The popularity of platforms like TikTok, Instagram Reels, and YouTube Shorts has sparked a global trend toward bite-sized video content tailored for quick consumption on mobile devices. These vertical formats cater to shrinking attention spans and are highly shareable, making them effective tools for virality and brand storytelling. Media companies are adapting their strategies to produce frequent, engaging short-form videos optimized for mobile viewing.

Global Digital Video Content Market: Research Scope and Analysis

By Content Type Analysis

Streaming Video is projected to hold a dominant position in the global digital video content market by content type, accounting for 39.3% of the total market share in 2025. This dominance is largely attributed to the growing consumer shift from traditional broadcast media to real-time, internet-delivered content across platforms like YouTube Live, Twitch, Facebook Live, and major OTT services such as Netflix and Amazon Prime Video. Streaming video offers a seamless and interactive viewing experience, often enhanced by real-time engagement features such as live chats, polls, and comment sections.

The availability of high-speed broadband, 4G/5G mobile networks, and smart TVs has further streamlined the streaming experience, enabling audiences to access high-resolution, low-latency content anytime, anywhere. Additionally, the rise of connected TV and second-screen behavior is fueling advertisers’ interest in live video placements, thus enhancing monetization opportunities.

Video on Demand (VoD) is another critical segment within the content type category, encompassing both Subscription Video on Demand (SVOD) and Ad-Supported Video on Demand (AVOD) services. VoD allows users to access video content at their convenience, giving them control over what to watch and when. This format includes full-length movies, TV shows, educational videos, and exclusive series available through platforms like Disney+, Hulu, HBO Max, and regional services tailored to local audiences.

The growing preference for binge-watching, content personalization, and uninterrupted viewing has contributed to the widespread adoption of VoD across age groups and regions. While SVOD platforms offer ad-free premium content for a monthly fee, AVOD platforms provide free access supported by targeted advertisements, expanding reach to price-sensitive consumers. As digital consumption habits evolve, VoD continues to bridge entertainment, learning, and brand engagement in a flexible and scalable manner.

By Device Type Analysis

Smartphones are set to solidify their leading position in the global digital video content market by device type, projected to capture 26.8% of the total market share in 2025. This dominance is driven by the widespread proliferation of affordable smartphones, growing mobile internet penetration, and the growing consumption of short-form and snackable video content on the go. With larger screens, higher display resolutions, and improved processing capabilities, modern smartphones deliver an immersive video viewing experience that rivals traditional devices.

Consumers rely on their mobile devices to access streaming services, social video platforms like TikTok, YouTube, and Instagram Reels, as well as mobile-optimized OTT apps. The preference for vertical video, push notifications for live broadcasts, and download options for offline viewing further contribute to smartphones becoming the primary gateway for digital content consumption.

Smart TVs, on the other hand, represent a rapidly growing segment in the device landscape, playing a pivotal role in the home entertainment ecosystem. As internet-connected televisions become more common in households globally, they are transforming the way users consume long-form and high-definition content. Smart TVs offer integrated access to a wide array of streaming applications such as Netflix, Hulu, Disney+, and Amazon Prime Video, without the need for external set-top boxes or casting devices.

Their large screens, voice-enabled search, personalized dashboards, and compatibility with 4K and HDR content make them ideal for cinematic viewing experiences. Additionally, smart TVs are being used for interactive applications such as fitness videos, educational programs, and gaming content, all accessible via internet-enabled platforms. With consumers embracing cord-cutting and shifting toward connected ecosystems, Smart TVs are expected to significantly contribute to the growth of digital video consumption in living rooms and shared environments.

By Content Category Analysis

Entertainment is anticipated to remain the dominant content category type in the global digital video content market, securing 27.4% of the total market share in 2025. This dominance is fueled by the explosive demand for movies, web series, reality shows, comedy skits, music videos, and drama across both long-form and short-form formats. Platforms such as Netflix, Amazon Prime Video, Disney+, and YouTube continue to invest heavily in original programming and global content licensing to cater to a diverse, entertainment-hungry audience.

The ease of access, on-demand availability, and personalized viewing experience are encouraging users to replace traditional cable TV with digital platforms. Moreover, the rise of binge-watching culture, regional storytelling, and genre-specific content, such as thrillers, rom-coms, and sci-fi, has intensified consumer engagement. The entertainment segment also benefits from cross-industry collaborations involving celebrities, influencers, and digital creators, expanding its reach and monetization potential.

Sports content is emerging as a highly influential segment within the digital video content ecosystem, reshaping how fans engage with live and on-demand athletic events. From professional leagues like the NFL, NBA, and UEFA to niche sporting events and eSports tournaments, digital platforms are becoming the go-to destination for immersive sports coverage.

Streaming services like ESPN+, DAZN, and Amazon Prime Video offer live match coverage, post-game analysis, player interviews, and highlights, often complemented by interactive features such as live stats, real-time commentary, and social media integration. Additionally, short-form sports content tailored for mobile apps, such as match recaps, behind-the-scenes clips, and fan-generated content, caters to younger audiences and enhances fan engagement. The global rise in fantasy sports, sports betting, and digital fan communities is further amplifying the value of sports video content.

By End-User Analysis

Individual users are projected to dominate the global digital video content market by end-user type, accounting for an impressive 56.2% of the total market share in 2025. This overwhelming dominance is attributed to the widespread adoption of personal devices such as smartphones, tablets, laptops, and smart TVs, which empower users to consume content anytime, anywhere. The growing popularity of personalized entertainment, social video platforms, and subscription-based streaming services has transformed viewing from a family or communal activity into an individual, on-demand experience.

From binge-watching OTT series and live-streaming events to consuming user-generated content on platforms like YouTube and TikTok, individual users are driving engagement, traffic, and revenue. Furthermore, the growing use of artificial intelligence in recommendation engines is making digital content consumption more personalized and habit-forming, enhancing user stickiness and boosting platform loyalty.

Educational institutions represent a steadily expanding segment within the digital video content market, as schools, colleges, and training centers embrace video as a core component of modern learning ecosystems. The shift toward e-learning, hybrid classrooms, and remote education models has accelerated the integration of digital video content for lectures, tutorials, explainer videos, and virtual labs.

Platforms like Coursera, edX, Khan Academy, and institution-specific LMS systems are delivering structured educational content in engaging video formats that support self-paced learning, student retention, and conceptual clarity. Educational videos often feature multimedia enhancements such as animations, captions, interactive quizzes, and multilingual support to cater to diverse learning needs. As academic institutions aim to increase accessibility and reach broader student populations, digital video is playing a central role in knowledge dissemination and curriculum innovation.

The Digital Video Content Market Report is segmented on the basis of the following

By Content Type

- Streaming Video

- Video on Demand

- Live Video

By Device Type

- Smartphones

- Tablets

- Smart TVs

- Laptops

- Desktops

By Content Category

- Entertainment

- Education

- News

- Sports

- Gaming

By End-User

- Individuals

- Businesses

- Educational Institutions

Global Digital Video Content Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to maintain its leadership in the global digital video content market, capturing

48.9% of the total market revenue in 2025. This dominance is driven by a combination of factors, including a mature digital infrastructure, high internet penetration, and the presence of major players in the entertainment and tech industries, such as Netflix, Amazon, Disney+, and YouTube.

The region’s advanced mobile and broadband networks, coupled with high consumer spending on subscription-based video services and a rapidly growing adoption of OTT platforms, continue to fuel market growth. Additionally, North America’s early adoption of 4K, VR, and interactive video technologies has set the pace for global content consumption trends. The growing demand for diverse, high-quality content, coupled with the integration of AI-driven recommendations, has further solidified the region's central role in shaping the future of digital video entertainment.

Region with significant growth

The Asia Pacific (APAC) region is expected to experience the highest compound annual growth rate (CAGR) in the global digital video content market due to rapid advancements in internet infrastructure, growing mobile device usage, and a large, digitally engaged population. Countries like China, India, and Japan are witnessing significant improvements in 4G/5G networks and broadband access, which are driving the adoption of OTT platforms and streaming services.

Additionally, the rise of mobile video consumption, fueled by affordable data plans and the popularity of short-form video apps like TikTok, is expanding the market further. The region’s demand for localized and culturally relevant content, coupled with the growing willingness to spend on subscription services, positions APAC as a key growth driver for the digital video content sector.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Video Content Market: Competitive Landscape

The global comparative landscape of the digital video content market is shaped by the diverse regional dynamics, competitive forces, and consumer behaviors that influence content production, distribution, and consumption. North America currently dominates the market, accounting for nearly half of the global market share. This is primarily due to the strong presence of major OTT platforms such as Netflix, Amazon Prime Video, and Disney+, which have a robust subscriber base in the region.

The high internet penetration, advanced technological infrastructure, and significant spending power of consumers in North America contribute to its leading position. Additionally, the region has seen considerable advancements in content personalization, AI-driven recommendations, and a variety of content types, including movies, TV shows, live sports, and documentaries, which continue to attract large audiences.

In contrast, Europe offers a more fragmented yet rapidly growing market, with strong regional players like BBC iPlayer, DAZN, and Sky Go competing alongside global streaming giants. Consumer preferences in Europe tend to favor both premium subscription services and ad-supported platforms. The growing trend of mobile video consumption, along with a growing demand for local content and multi-language offerings, further defines Europe’s digital video content market landscape.

Some of the prominent players in the global digital video content are:

- Netflix

- Amazon Prime Video

- Hulu

- YouTube

- Disney+

- Apple TV+

- Roku

- Sony Pictures Entertainment

- WarnerMedia

- Comcast

- ViacomCBS

- BBC Studios

- MGM Studios

- Lionsgate

- Tencent Video

- iQIYI

- Vimeo

- Dailymotion

- Sling TV

- FuboTV

- Other Key Players

Global Digital Video Content Market: Recent Developments

- April 2025: WarnerMedia merges with Discovery, Inc. to form Warner Bros. Discovery, combining a wide range of popular streaming and broadcast services, including HBO Max and Discovery+.

- March 2025: Netflix acquires Next Games, a mobile game development studio, to expand its interactive and gaming capabilities alongside its streaming service.

- February 2025: Amazon announces the acquisition of MGM Studios, bringing a vast library of classic films and television shows under the Amazon Prime Video umbrella.

- December 2024: The Walt Disney Company completes its acquisition of 20th Century Fox, bolstering its streaming service Disney+ with an extensive content library, including hit franchises like "Avatar" and "X-Men."

- November 2024: YouTube acquires Giphy, the popular GIF-sharing platform, to enhance its visual content offerings and strengthen user engagement with more dynamic, short-form media.

- October 2024: Comcast agrees to purchase Sky Group for approximately USD 40 billion, expanding its streaming presence across Europe and complementing its Xfinity and Peacock services.

- July 2024: Spotify acquires The Ringer, a sports and pop culture podcast network, marking its push into podcasting and potentially offering exclusive sports content to its subscribers.

- June 2024: Apple acquires Shazam, a music identification service, to enhance its music streaming experience and integrate it into Apple TV+ for a more personalized content offering.

- May 2024: Tencent Video merges with iQIYI, creating the largest online streaming platform in China with an extensive mix of local content, international films, and dramas.

- April 2024: Hulu merges with ESPN+ under the Disney brand, consolidating their position in the streaming sports and entertainment space to offer a more competitive bundle in the U.S. market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 61.4 Bn |

| Forecast Value (2034) |

USD 132.5 Bn |

| CAGR (2025–2034) |

8.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 25.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Content Type (Streaming Video, Video on Demand, and Live Video), By Device Type (Smartphones, Tablets, Smart TVs, Laptops, and Desktops), By Content Category (Entertainment, Education, News, Sports, and Gaming), and By End-User (Individuals, Businesses, and Educational Institutions) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Netflix, Amazon Prime Video, Hulu, YouTube, Disney+, Apple TV+, Roku, Sony Pictures Entertainment, WarnerMedia, Comcast, ViacomCBS, BBC Studios, MGM Studios, Lionsgate, Tencent Video, iQIYI, Vimeo, Dailymotion, Sling TV, FuboTV, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global digital video content market?

▾ The global digital video content market size is estimated to have a value of USD 61.4 billion in 2025 and is expected to reach USD 132.5 billion by the end of 2034.

What is the size of the US digital video content market?

▾ The US digital video content market is projected to be valued at USD 25.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 52.0 billion in 2034 at a CAGR of 8.4%.

Which region accounted for the largest global digital video content market?

▾ North America is expected to have the largest market share in the global digital video content market, with a share of about 48.9% in 2025.

Who are the key players in the global digital video content market?

▾ Some of the major key players in the global digital video content market are Netflix, Amazon Prime Video, Hulu, YouTube, Disney+, Apple TV+, Roku, Sony Pictures Entertainment, WarnerMedia, Comcast, ViacomCBS, BBC Studios, MGM Studios, Lionsgate, Tencent Video, iQIYI, Vimeo, Dailymotion, Sling TV, FuboTV, and Other Key Players.

What is the growth rate of the global digital video content market?

▾ The market is growing at a CAGR of 8.9 percent over the forecasted period.