Market Overview

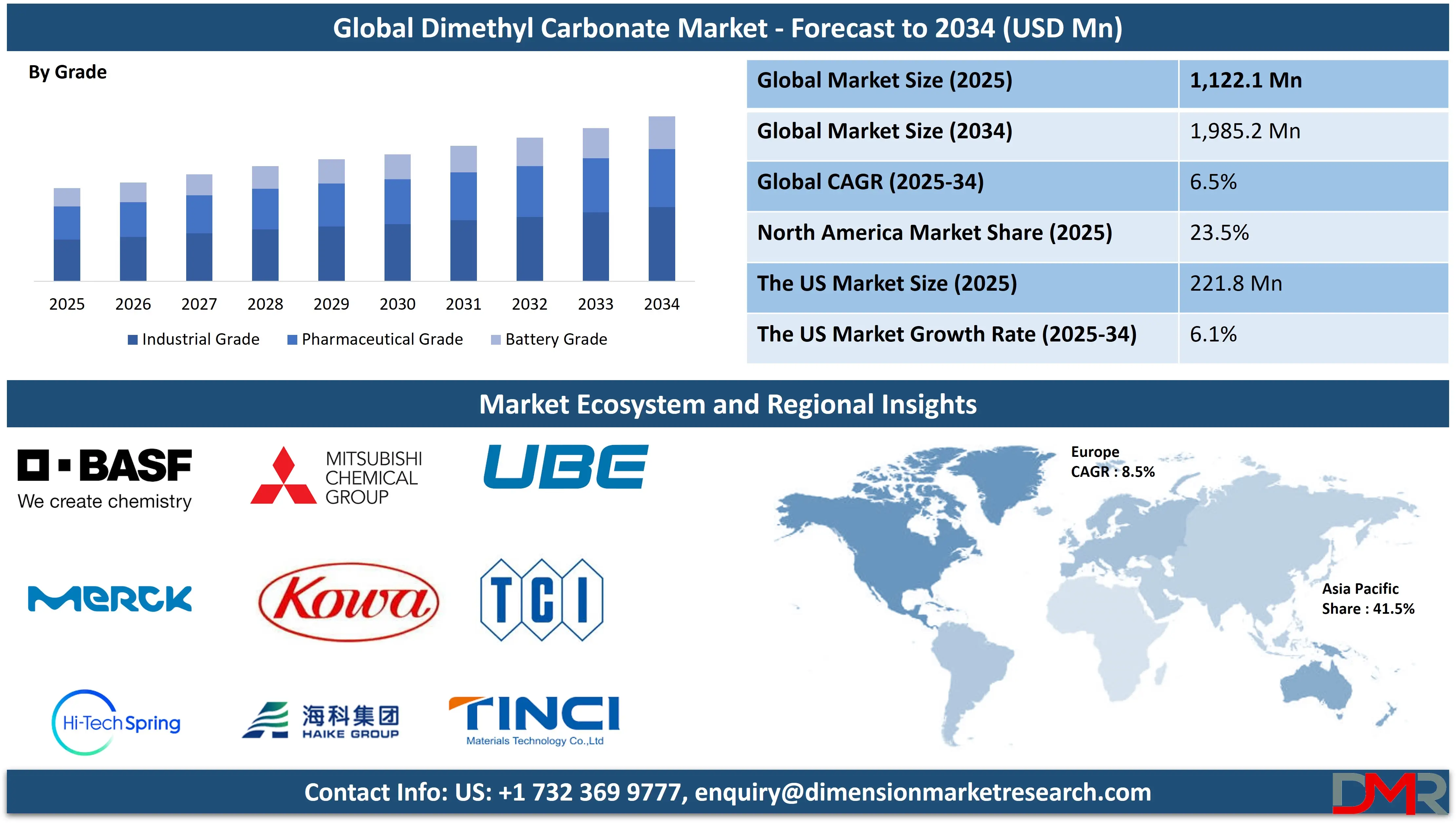

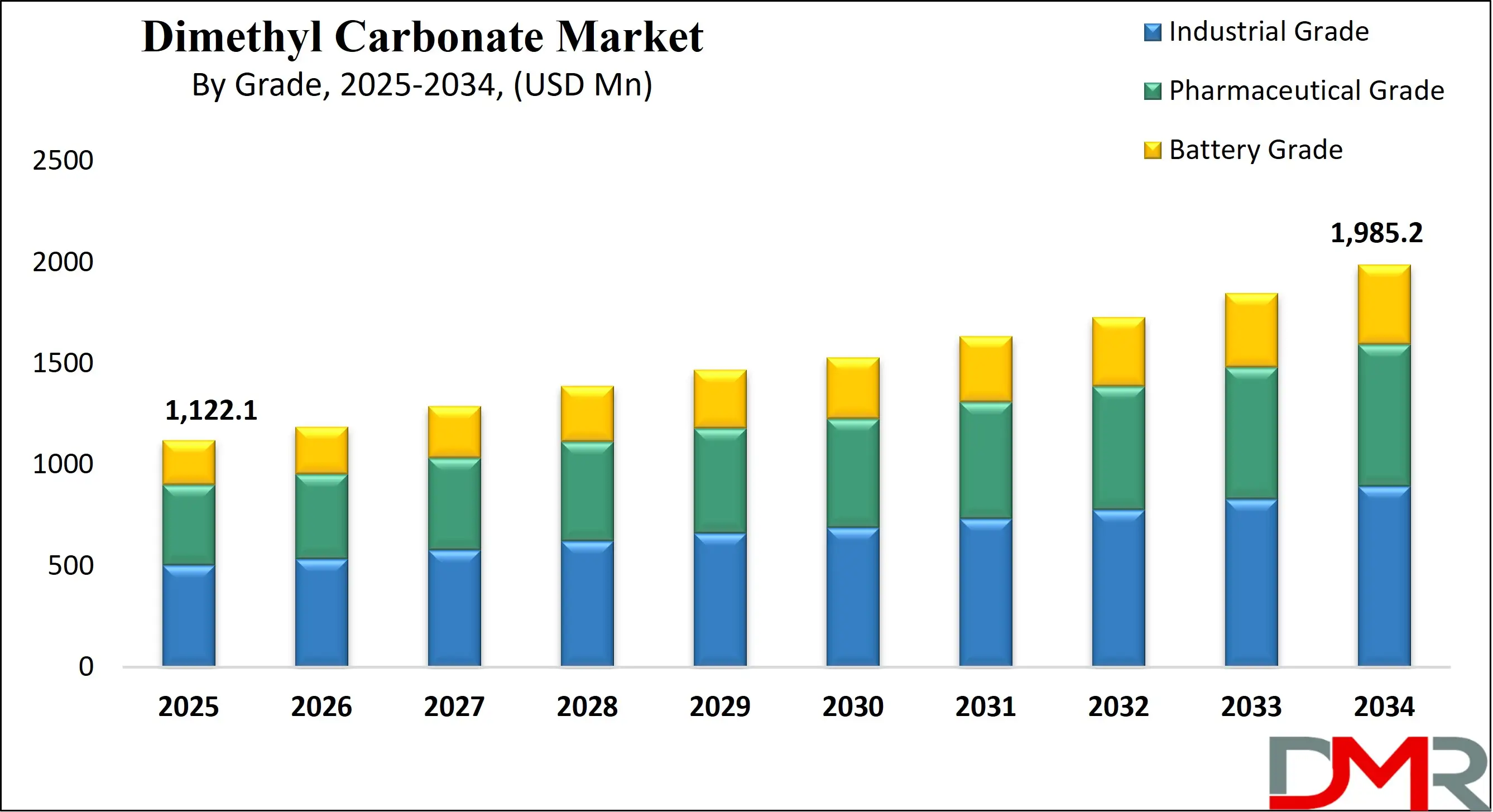

The Global Dimethyl Carbonate Market is predicted to be valued at USD 1,122.1 million in 2025 and is expected to grow to USD 1,985.2 million by 2034, registering a compound annual growth rate (CAGR) of 6.5% from 2025 to 2034.

Dimethyl carbonate (DMC) is a versatile, non-toxic, and eco-friendly organic compound with the chemical formula C₃H₆O₃. It is a clear, flammable liquid with a mild, pleasant odor. DMC is widely used as a solvent, methylating agent, and intermediate in chemical synthesis. It serves as a safer alternative to traditional toxic substances like phosgene and dimethyl sulfate. Common applications include lithium-ion battery electrolytes, polycarbonate production, and fuel additives. Due to its low toxicity and biodegradability, DMC is considered a green chemical, making it increasingly popular in various industries such as pharmaceuticals, electronics, paints, coatings, and automotive manufacturing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global dimethyl carbonate market is witnessing substantial growth driven by rising demand across a variety of end-use industries. Dimethyl carbonate is increasingly being adopted due to its environmental advantages and low toxicity, positioning it as a sustainable alternative to traditional chemical reagents. It is widely used as a methylating and carbonylating agent in organic synthesis, gaining traction in pharmaceutical manufacturing, agrochemical production, and polymer processing.

One of the key growth drivers in the market is the surge in electric vehicle production, which has boosted the demand for lithium-ion batteries. Dimethyl carbonate serves as a vital electrolyte solvent in battery-grade formulations, enhancing battery performance and safety. Moreover, its use as a green solvent in paints, coatings, and adhesives is expanding due to stricter environmental regulations and a global shift toward low-emission solutions.

The market is also benefiting from increasing applications in the production of polycarbonate plastics. As a crucial intermediate in non-phosgene routes for polycarbonate synthesis, dimethyl carbonate supports the movement toward safer and cleaner chemical processes. Additionally, the rising use of eco-friendly fuel additives has led to greater consumption of dimethyl carbonate in the automotive and transportation sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Asia-Pacific remains a dominant region in the dimethyl carbonate industry, driven by rapid industrialization, increasing energy storage needs, and significant investments in clean technologies. Meanwhile, technological advancements in synthesis methods and ongoing research in sustainable chemical applications are expected to create new growth opportunities. Overall, the global dimethyl carbonate market is poised for steady expansion with a strong focus on green chemistry and industrial efficiency.

The US Dimethyl Carbonate Market

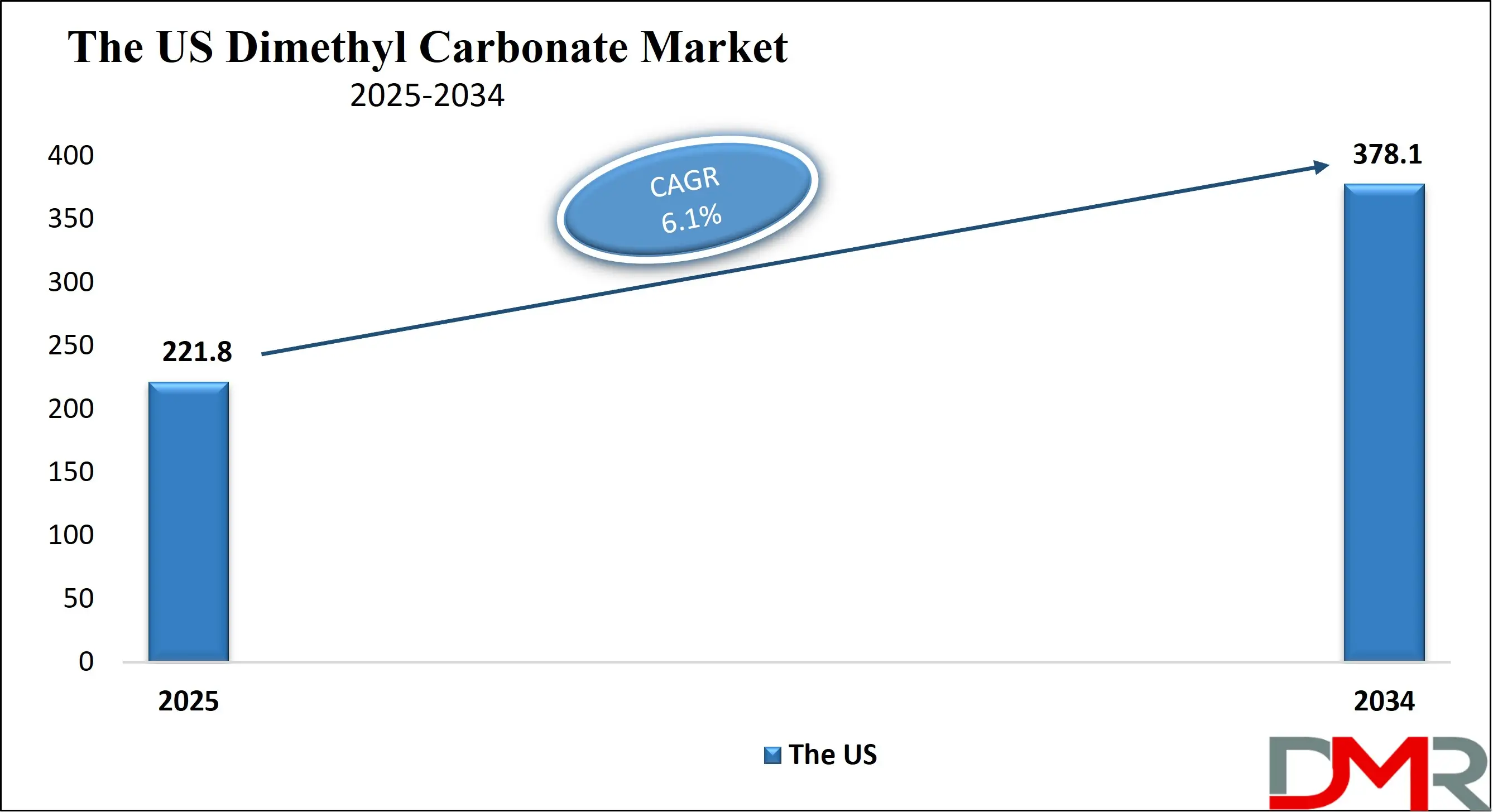

The US Dimethyl Carbonate Market is projected to be valued at USD 221.8 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 378.1 million in 2034 at a CAGR of 6.1%.

The US Dimethyl Carbonate (DMC) market is primarily driven by the rising demand for environmentally friendly and non-toxic chemical intermediates. The push for green solvents in industrial manufacturing, especially in paints, coatings, and adhesives, supports wider adoption. Additionally, the expansion of the lithium-ion battery industry, particularly for electric vehicles, boosts the use of battery-grade DMC. Increasing regulatory pressure on phosgene-based carbonate production is prompting a shift toward DMC as a safer alternative. Furthermore, advancements in bio-based production technologies are gaining traction, aligning with sustainability goals across key manufacturing sectors, thereby propelling demand for Dimethyl Carbonate in the U.S. market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the key trends in the US DMC market is the transition toward bio-based and sustainable production methods, minimizing environmental impact. There is a noticeable increase in R&D investments aimed at improving catalytic processes for high-purity DMC synthesis. Growth in electric vehicle manufacturing is fostering demand for DMC as an electrolyte solvent. The market is also witnessing strategic collaborations between chemical manufacturers and battery producers. Additionally, emerging applications in polycarbonate resin production and pharmaceuticals are expanding the product’s footprint. Regulatory alignment with eco-friendly practices and a shift away from toxic raw materials are reinforcing long-term market stability.

The Japan Dimethyl Carbonate Market

The Japan Dimethyl Carbonate Market is projected to be valued at USD 78.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 129.4 million in 2034 at a CAGR of 5.7%.

Japan’s Dimethyl Carbonate market is primarily driven by the rapid advancement of its electric vehicle and energy storage industries. With strong government backing for EV adoption and battery innovation, the demand for high-purity DMC as an electrolyte solvent is growing significantly. Additionally, Japan’s robust chemical manufacturing sector values DMC for its low toxicity and versatility as a solvent and intermediate. The focus on cleaner production methods and reduced carbon emissions aligns with DMC’s eco-friendly profile. Supportive government initiatives and industrial incentives for sustainable chemical production further reinforce the adoption of DMC in Japan’s industrial applications.

A notable trend in Japan’s DMC market is the emphasis on high-purity, battery-grade DMC for next-generation lithium-ion batteries. Companies are investing in advanced refining technologies to meet the increasing quality demands of the electronics and automotive sectors. The country is also seeing a shift toward domestic sourcing and production of DMC to reduce dependence on imports. Technological collaborations and joint ventures are rising, aimed at innovating more efficient and sustainable DMC synthesis methods. Furthermore, integration of DMC in biodegradable polymer manufacturing and pharmaceutical formulations reflects the country’s ongoing shift toward safer, greener alternatives across multiple end-use industries.

The Europe Dimethyl Carbonate Market

The Europe Dimethyl Carbonate Market is projected to be valued at USD 196.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 331.3 million in 2034 at a CAGR of 8.5%.

Europe's Dimethyl Carbonate market is driven by stringent environmental regulations encouraging the replacement of hazardous chemicals with safer alternatives. The region's strong automotive sector, with a growing shift to electric mobility, has increased the need for battery-grade DMC. Rising demand for lightweight, recyclable polycarbonates in electronics and packaging also fuels market growth. Supportive policies and funding for green chemistry initiatives contribute to the research and development of DMC production. Moreover, Europe's advanced pharmaceutical and cosmetics sectors are adopting DMC as a less toxic solvent, further supporting its uptake across industries committed to sustainability and environmental compliance.

The Europe Dimethyl Carbonate market is trending toward circular economy solutions, focusing on renewable feedstocks and closed-loop production systems. Manufacturers are increasingly implementing phosgene-free processes to produce high-purity DMC for sensitive applications. There's growing integration of DMC in sustainable battery technologies as EV infrastructure expands. Also, partnerships between academic institutions and chemical companies are accelerating innovation in eco-efficient synthesis. Digitalization and automation in chemical production are enhancing the efficiency and scalability of DMC manufacturing. Additionally, market players are pursuing certifications and compliance with REACH and other EU safety standards to strengthen their competitive positioning in the region’s eco-conscious industrial landscape.

Dimethyl Carbonate Market: Key Takeaways

- Market Overview: The global dimethyl carbonate market is projected to reach a value of USD 1,122.1 million in 2025 and is expected to expand to USD 1,985.2 million by 2034, growing at a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2025 to 2034.

- By Grade Analysis: Industrial grade dimethyl carbonate is anticipated to hold the leading position in the market by 2025, accounting for roughly 47.6% of the overall market share.

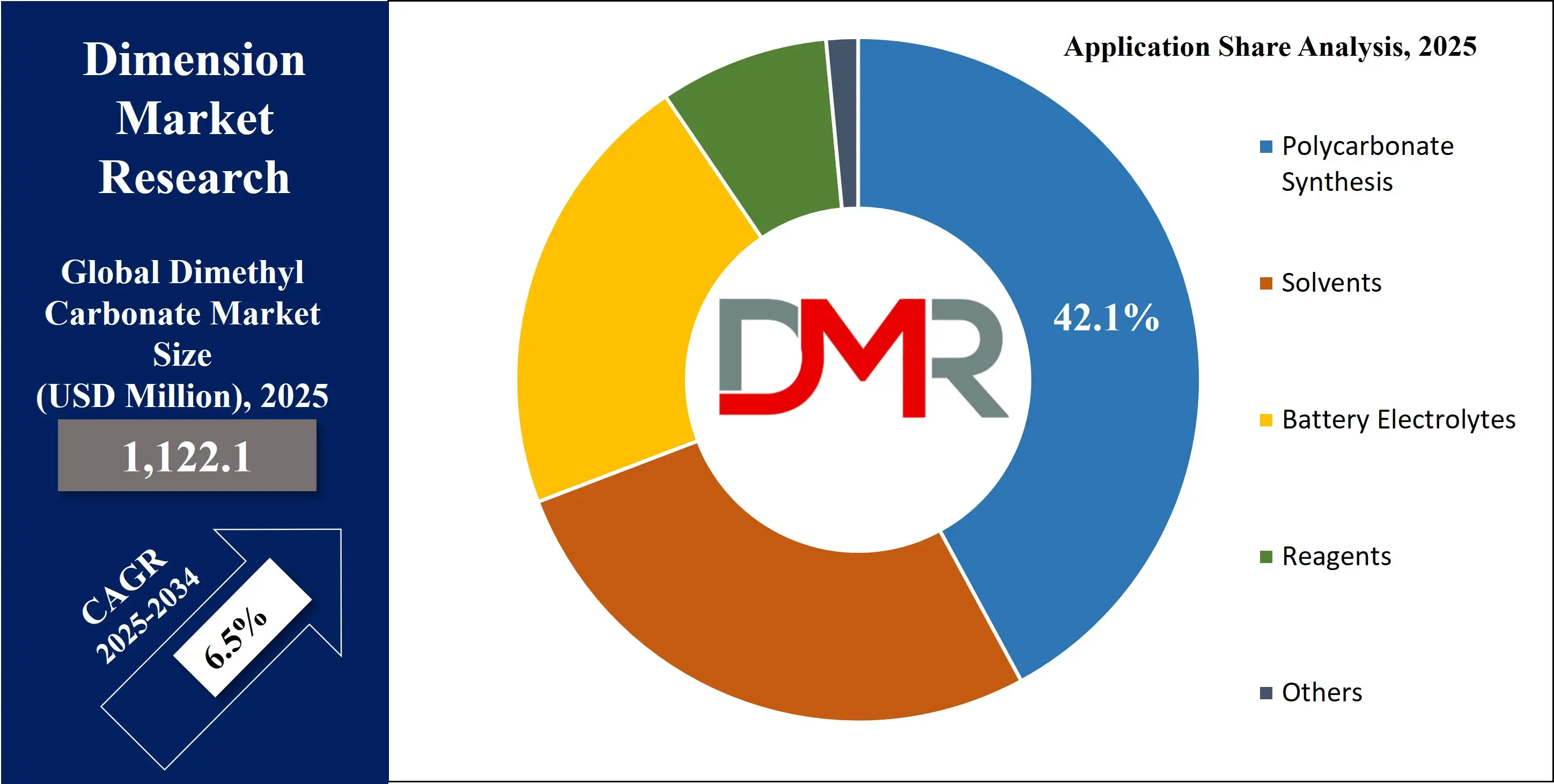

- By Application Analysis: Polycarbonate synthesis is projected to remain the primary application segment, contributing about 42.1% of the global dimethyl carbonate market by the end of 2025.

- By End User Analysis: The plastic sector is expected to be the dominant end-user of dimethyl carbonate, capturing close to 36.8% of the total market share by 2025.

- Regional Insight: Asia Pacific is forecasted to lead the global market in terms of regional share, comprising approximately 41.5% of the total dimethyl carbonate market by the end of 2025.

Dimethyl Carbonate Market: Use Cases

- Battery Electrolytes: Dimethyl Carbonate is widely used as a solvent in lithium-ion battery electrolytes due to its high electrochemical stability and low toxicity. It enhances battery performance, thermal stability, and charge-discharge efficiency, making it ideal for electric vehicles, consumer electronics, and renewable energy storage systems.

- Polycarbonate Production: DMC serves as an eco-friendly alternative to phosgene in polycarbonate production. It reacts with phenols to form polycarbonate plastics, used in automotive parts, optical discs, and electronics. This application supports green chemistry initiatives by minimizing hazardous by-products and improving safety in polymer manufacturing.

- Solvent in Coatings and Inks: As a fast-evaporating, low-toxicity solvent, DMC is utilized in paints, coatings, and printing inks. It provides excellent solvency power while reducing VOC emissions. Its application in surface coatings ensures better film formation, faster drying times, and compliance with environmental regulations in industrial and commercial settings.

- Intermediate in Pharmaceuticals: DMC acts as a methylating and carbonylating agent in synthesizing active pharmaceutical ingredients (APIs). It is preferred in green chemistry for its non-toxic nature and ability to replace hazardous reagents, playing a vital role in producing antibiotics, analgesics, and other essential drug compounds.

- Fuel Additive: In the fuel industry, Dimethyl Carbonate is used as an oxygenate additive to enhance gasoline combustion efficiency. It improves octane ratings and reduces carbon monoxide and hydrocarbon emissions. Its biodegradable and non-toxic nature makes it a cleaner alternative to traditional fuel additives like MTBE.

Dimethyl Carbonate Market: Stats & Facts

- PubChem states that Dimethyl Carbonate (CAS Number 616-38-6) has a molecular weight of 90.08 g/mol and a boiling point of 90°C, making it suitable for low-temperature industrial processes.

- European Chemicals Agency (ECHA) lists DMC as a readily biodegradable compound under REACH, with 96% degradation in 28 days under OECD 301D testing, highlighting its eco-friendly profile.

- National Center for Biotechnology Information (NCBI) notes that DMC exhibits low acute toxicity, with an LD50 (oral, rat) of 12,900 mg/kg, supporting its reputation as a safer solvent.

- ScienceDirect reports that in lithium-ion battery electrolyte formulations, DMC is commonly used at 20–30% volume due to its high dielectric constant and low viscosity, improving ionic conductivity.

- U.S. Environmental Protection Agency (EPA) includes DMC in its Safer Chemical Ingredients List, highlighting that its flash point is 18.3°C and its vapor pressure at 25°C is 55 mmHg, which supports its utility in coatings and paints.

- Chemical Book identifies DMC as a green methylating agent replacing traditional reagents like dimethyl sulfate, and its density at 20°C is 1.069 g/cm³, which contributes to easy blending in formulations.

- PubChem also highlights DMC’s miscibility with common organic solvents and partial miscibility with water (around 13.9 g/100 mL at 20°C), enabling wide formulation flexibility in industrial applications.

- The Royal Society of Chemistry mentions DMC's use in polycarbonate synthesis and notes that over 1 million tons per year are consumed globally for non-phosgene polycarbonate production processes.

- ScienceDirect highlights that in battery electrolytes, especially lithium-ion batteries, Dimethyl Carbonate is typically blended in ratios of 1:1 or 1:2 with ethylene carbonate, significantly improving ion transport and thermal stability.

- Journal of Power Sources notes that DMC is used in over 70% of commercial lithium-ion battery electrolytes as a co-solvent, especially in electric vehicles and consumer electronics.

- ChemSpider states that DMC is utilized in the production of polycarbonate plastics, and approximately 40–50% of DMC produced globally is used in non-phosgene polycarbonate synthesis as a safer substitute for phosgene gas.

- SpringerLink reports that in pharmaceutical synthesis, Dimethyl Carbonate is employed as a methylating agent in producing APIs such as ibuprofen, with reaction yields often exceeding 85–90%, making it an efficient alternative to toxic reagents.

- American Chemical Society (ACS) publications indicate that DMC is increasingly used in pesticide formulations and agrochemical intermediates, contributing to the synthesis of over 25 active compounds in herbicides and insecticides.

- ResearchGate shows that in the coatings industry, DMC is used as a green solvent, replacing VOC-heavy solvents, and can reduce overall VOC content by up to 50% in automotive and architectural paints.

- Elsevier’s Green Chemistry Series documents that DMC can replace halogenated solvents in cleaning agents, achieving comparable solvency power with a lower environmental footprint in electronics and precision instrument industries.

- NCBI highlights that in fuel additives, DMC is used in reformulated gasoline to raise oxygen content, and blends of 5–10% DMC with gasoline show enhanced combustion efficiency and lower CO emissions.

Dimethyl Carbonate Market: Market Dynamics

Driving Factors in the Dimethyl Carbonate Market

Rising Demand for Lithium-ion Batteries

The growing adoption of electric vehicles (EVs) and portable electronics is significantly boosting the demand for lithium-ion batteries, where battery-grade dimethyl carbonate is used as a critical electrolyte solvent. DMC’s low viscosity and high dielectric constant make it an ideal component in battery formulations. With governments pushing for clean energy transition and the automotive industry shifting toward electrification, the need for high-purity DMC is surging. Moreover, energy storage systems (ESS) in renewable power installations are further catalyzing the DMC market growth, especially in regions like Asia-Pacific. The material’s role in enhancing battery efficiency and lifespan underscores its rising importance in the energy storage materials supply chain.

Growth in Polycarbonate and Coatings Industry

The expansion of the polycarbonate production industry, especially in construction, automotive, and electronics, is a major growth driver for the dimethyl carbonate market. DMC serves as a key intermediate in the synthesis of polycarbonates, replacing toxic phosgene-based methods. The increasing demand for lightweight, durable plastics in automotive interiors and electronics has led to higher DMC usage. Simultaneously, DMC’s use as a low-VOC solvent in coatings, paints, and adhesives enhances its market attractiveness. As industries shift toward green chemistry and sustainable raw materials, the eco-friendly profile of dimethyl carbonate supports its broader adoption across manufacturing sectors.

Restraints in the Dimethyl Carbonate Market

Volatility in Raw Material Prices

The production of dimethyl carbonate relies heavily on methanol and carbon dioxide, whose market prices can fluctuate due to geopolitical instability, supply chain disruptions, and seasonal variations. These feedstock price instabilities directly affect dimethyl carbonate manufacturing costs, especially in developing markets where infrastructure is less resilient. Furthermore, increased natural gas price which influence methanol production which can ripple through the DMC market. Such economic unpredictability challenges manufacturers in maintaining profit margins, especially for small and medium enterprises (SMEs). This raw material dependency acts as a restraint to the long-term sustainability and pricing stability of DMC supply chains globally.

Stringent Regulatory and Environmental Constraints

Although dimethyl carbonate is considered a safer alternative to phosgene and methyl chloroformate, the DMC market is still subject to strict chemical safety regulations, particularly in North America and Europe. These include compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and other national environmental frameworks. Handling, storage, and transport of DMC also require adherence to hazardous material guidelines, adding to operational costs. Moreover, improper production or waste disposal practices can lead to environmental liabilities. These regulatory hurdles can discourage new entrants and limit production scalability, particularly for companies operating in highly controlled chemical sectors.

Opportunities in the Dimethyl Carbonate Market

Shift toward Eco-Friendly Solvents in Industrial Applications

Growing environmental awareness and stricter emissions regulations are encouraging industries to adopt eco-friendly solvents. Dimethyl carbonate, being biodegradable and low in toxicity, is increasingly used as a green solvent in manufacturing processes across paints, coatings, and cleaning agents. Its low VOC content makes it a suitable alternative to traditional petrochemical solvents. As industries pivot toward sustainable chemical alternatives, the demand for DMC is expected to expand, especially in pharmaceutical synthesis and agrochemical formulations. This green transition opens lucrative avenues for manufacturers focusing on bio-based dimethyl carbonate and low-carbon production technologies.

Expansion of EV and Energy Storage Infrastructure

The rapid expansion of electric vehicle (EV) infrastructure and grid-level energy storage systems provides a promising opportunity for the dimethyl carbonate market. As a key electrolyte component in lithium-ion batteries, battery-grade DMC is crucial to maintaining battery stability and performance. With nations investing in charging stations, renewable energy integration, and battery recycling facilities, the demand for high-performance battery chemicals is on the rise. This growing focus on sustainable mobility and energy independence creates long-term growth potential for companies involved in DMC production, particularly in the Asia-Pacific battery materials market.

Trends in the Dimethyl Carbonate Market

Rising Adoption of Non-phosgene DMC Production Routes

A major trend in the dimethyl carbonate market is the shift toward non-phosgene synthesis technologies, which are safer, more sustainable, and environmentally compliant. Traditional DMC production used phosgene, a toxic and hazardous compound, but innovations now enable DMC to be synthesized using carbon dioxide and methanol, promoting circular chemistry. This aligns with the global move toward carbon capture utilization (CCU) and sustainable manufacturing. The development of catalytic and greener production pathways enhances the scalability of DMC while minimizing environmental risks. This trend is also being driven by increasing R&D in low-emission chemical processes across Europe and Asia.

Integration in Pharmaceutical and Personal Care Applications

Dimethyl carbonate is gaining traction in pharmaceutical intermediates and personal care product formulations due to its mild reactivity, non-toxic profile, and solvent properties. In the pharmaceutical industry, DMC is used for methylation reactions and as a reaction medium for APIs (Active Pharmaceutical Ingredients). Simultaneously, in the cosmetics sector, DMC is emerging as a substitute for harmful solvents in lotions, creams, and sprays. As consumers demand cleaner-label products and regulatory agencies promote safe cosmetic ingredients, the role of DMC in low-toxicity formulations is expanding, representing a key trend across specialty chemical applications.

Dimethyl Carbonate Market: Research Scope and Analysis

By Grade Analysis

Industrial grade dimethyl carbonate is expected to dominate the global dimethyl carbonate market by the end of 2025, capturing approximately 47.6% of the total market share. This dominance is driven by its widespread application in the production of paints, coatings, and adhesives, due to its environmentally friendly characteristics and low toxicity. The industrial grade variant is favored for large-scale manufacturing because of its cost-effectiveness and availability. Additionally, regulatory support for green solvents and the rise in demand from sectors like construction and automotive are propelling its growth. Increasing usage in intermediate chemical synthesis across various industrial processes further strengthens its position in the global supply chain for organic carbonates.

Battery grade dimethyl carbonate is projected to witness the highest CAGR by the end of 2025, fueled by its rising demand in lithium-ion battery production for electric vehicles and energy storage systems. Its high purity level and favorable electrochemical stability make it a preferred electrolyte solvent in battery manufacturing. With increasing investments in renewable energy infrastructure and e-mobility, particularly in Asia-Pacific and Europe, the demand for high-performance and safe energy storage solutions is growing rapidly. The expansion of gigafactories and government incentives promoting electric mobility further drive this segment’s rapid expansion. Moreover, the clean energy transition and decarbonization goals globally amplify the need for advanced battery materials.

By Application Analysis

Polycarbonate synthesis is anticipated to lead the global dimethyl carbonate market by the end of 2025, holding around 42.1% market share. Dimethyl carbonate serves as a key intermediate in the eco-friendly production of polycarbonate resins, replacing traditional toxic reagents like phosgene. The growth of the consumer electronics, construction, and automotive sectors is increasing the demand for lightweight, durable, and transparent polymers, propelling the use of polycarbonates. Additionally, as manufacturers increasingly prioritize non-toxic carbonylation agents, DMC's role in sustainable polymer production becomes more prominent. Expanding infrastructure development and rising consumption of high-performance plastics in emerging economies also support this segment’s strong market position.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Battery electrolytes are forecasted to grow at the highest CAGR in the dimethyl carbonate market by the end of 2025, driven by the surging demand for energy storage systems and electric vehicles. Dimethyl carbonate’s low viscosity and high dielectric constant enhance battery performance, making it a core component in lithium-ion electrolyte formulations. With global initiatives focused on reducing carbon emissions and enhancing energy efficiency, the EV sector is experiencing exponential growth. Technological advancements in battery chemistry and increasing investments in EV charging infrastructure also fuel the demand for advanced electrolytes. Strategic collaborations among automakers and battery manufacturers further accelerate the segment’s rapid expansion.

By End User Analysis

The plastics is predicted to dominate the global dimethyl carbonate market by 2025, accounting for nearly 36.8% of the total share. This is primarily due to its critical role in the manufacture of polycarbonate plastics, widely used in automotive components, electronics, packaging, and construction materials. Rising demand for sustainable, lightweight, and shatter-resistant materials is encouraging manufacturers to adopt dimethyl carbonate as a green precursor in polymer synthesis. Moreover, environmental regulations restricting the use of hazardous chemicals like phosgene are boosting its adoption. The continued expansion of consumer goods and infrastructure sectors further supports the growing demand for DMC in the global plastics industry.

The battery segment is expected to register the highest CAGR by 2025, owing to the increasing application of dimethyl carbonate in high-performance battery systems, particularly for electric mobility and stationary energy storage. DMC acts as a vital solvent in lithium battery electrolytes, enabling efficient ion transport and thermal stability. The worldwide push toward clean transportation, along with the development of advanced battery technologies like solid-state batteries, is stimulating growth in this segment. Additionally, government policies supporting EV adoption and subsidies for green energy projects are driving demand for energy-dense, safe, and reliable batteries, where dimethyl carbonate plays an essential role.

The Dimethyl Carbonate Market Report is segmented on the basis of the following:

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Battery Grade

By Application

- Battery Electrolytes

- Solvents

- Polycarbonate Synthesis

- Reagents

- Others

By End User

- Plastics

- Pharmaceuticals

- Paints & Coatings

- Battery

- Agrochemicals

- Others

Regional Analysis

Region with the largest Share

Asia Pacific is projected to hold the largest share of the global dimethyl carbonate market by the end of 2025, accounting for approximately 41.5% of the total market. This dominance is attributed to the region's robust manufacturing infrastructure, cost-effective production capabilities, and rising demand from end-use industries such as automotive, plastics, and electronics. China, India, South Korea, and Japan are the key contributors, driven by rapid urbanization and industrialization. Additionally, the growing adoption of electric vehicles and expanding polycarbonate production capacity across the region further amplify the consumption of dimethyl carbonate. Favorable government policies, environmental regulations promoting green chemicals, and investments in battery manufacturing solidify Asia Pacific’s leading position.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Europe is expected to witness the highest CAGR in the dimethyl carbonate market by the end of 2025, driven by stringent environmental regulations and a strong push towards sustainable chemical alternatives. The rising adoption of electric vehicles, supported by ambitious climate goals and emission reduction targets, is accelerating the demand for dimethyl carbonate in lithium-ion battery applications. Additionally, increased investments in green chemistry and circular economy initiatives are promoting the replacement of toxic substances in industrial processes with eco-friendly compounds like DMC. Countries such as Germany, France, and the Netherlands are at the forefront of clean energy transitions and sustainable manufacturing, fostering favorable market conditions for dimethyl carbonate across diverse sectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Dimethyl Carbonate Market

- Accelerated Product Development and Formulation: AI facilitates the design of optimized Dimethyl Carbonate (DMC) formulations by predicting reaction outcomes, purity levels, and environmental impact. Machine learning models analyze molecular interactions to enhance DMC’s performance in applications like lithium-ion batteries, polycarbonates, and solvents, reducing development time and improving product efficiency and sustainability.

- Manufacturing Process Optimization: AI enhances DMC production by controlling reaction conditions such as temperature, pressure, and catalyst dosage in real time. Predictive analytics minimizes waste, improves yield, and ensures consistent quality. This automation reduces production costs and energy consumption, increasing profitability while meeting stringent environmental and safety standards.

- Quality Control and Safety Monitoring: AI-powered vision systems and sensor technologies ensure high product quality by detecting impurities, inconsistencies, or hazardous conditions during DMC manufacturing. Real-time monitoring and anomaly detection contribute to safe operations, lower rejection rates, and adherence to industry-specific regulations, particularly in pharmaceuticals, electronics, and chemical manufacturing sectors.

- Supply Chain and Demand Forecasting: AI-driven analytics help forecast market demand for DMC by assessing industry trends, raw material availability, and geopolitical risks. It supports better inventory management, procurement planning, and pricing strategies, enabling manufacturers to respond swiftly to market shifts and maintain a competitive advantage in a rapidly evolving chemical landscape.

Competitive Landscape

The competitive landscape of the global dimethyl carbonate market is characterized by the presence of several key players focusing on strategic initiatives such as capacity expansion, technological innovation, partnerships, and sustainable production methods. Leading companies like Ube Industries, Shandong Shida Shenghua Chemical Group, Sabic, Kowa Company, Ltd., and Merck KGaA are actively investing in R&D to develop high-purity dimethyl carbonate suitable for battery-grade applications, particularly for use in electric vehicle batteries. These players are also prioritizing the development of eco-friendly solvents and green synthesis methods, responding to increasing environmental regulations and demand for non-toxic chemical alternatives.

Mergers and acquisitions are also shaping the competitive dynamics, with companies aiming to strengthen their global supply chain and enhance market penetration in high-growth regions like Asia-Pacific and Europe. With rising demand across applications such as polycarbonate production, pharmaceutical excipients, and industrial solvents, firms are streamlining operations to improve cost-efficiency and product quality.

In addition, the emergence of local manufacturers in developing economies is intensifying price competition. To stay competitive, global players are focusing on offering multi-grade dimethyl carbonate products that cater to various industries, leveraging their technological expertise and expansive distribution networks to sustain long-term growth in the market.

Some of the prominent players in the Global Dimethyl Carbonate Market are:

- UBE Industries

- Shandong Shida Shenghua Chemical Group

- BASF SE

- Mitsubishi Chemical Corporation

- Kishida Chemical Co., Ltd.

- Merck KGaA

- Kowa Company, Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Dongying Hi-tech Spring Chemical Industry Co., Ltd.

- Haike Chemical Group

- Guangzhou Tinci Materials Technology Co., Ltd.

- Shandong Haike Chemical Group Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Lotte Chemical Corporation

- Shandong Depu Chemical Industry Science & Technology Co., Ltd.

- Shandong Jinling Chemical Co., Ltd.

- Alfa Aesar

- Huntsman Corporation

- Novaphene Speciality Chemicals

- Arrow Fine Chemicals

- Other Key Players

Recent Developments

- In February 2025, UBE Corporation reaffirmed its USD 500 million investment in the Louisiana facility, emphasizing its role in securing a stable DMC supply for the North American market. The project supports UBE’s commitment to localized production and enhanced supply chain resilience.

- In May 2025, a report highlighted that companies such as UBE Industries, Kishida Chemical, Tokyo Chemical Industry, and Kowa Company are advancing innovations in transesterification-based DMC production. These efforts are focused on improving process efficiency, product purity, and reducing environmental impact.

- In December 2024, Jiangsu Sailboat Petrochemical, in collaboration with Asahi Kasei, launched a new high-purity DMC and ethylene carbonate facility in Lianyungang, China. The plant utilizes carbon dioxide as a feedstock, marking a significant step toward greener chemical production technologies.

- In September 2024, Mitsubishi Chemical Corporation announced plans to expand its dimethyl carbonate production capacity in the United States. This move aims to meet the growing demand for DMC in lithium-ion battery electrolytes, particularly driven by the accelerating electric vehicle sector.

- In June 2024, SABIC’s production unit in Spain completed a significant upgrade to its DMC production line. The improvements focused on boosting output efficiency and reducing chemical waste, with a 22% increase in production capability and an 18% reduction in process waste, aligning with SABIC’s sustainability goals.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,122.1 Mn |

| Forecast Value (2034) |

USD 1,985.2 Mn |

| CAGR (2025–2034) |

6.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 221.8 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Grade (Industrial Grade, Pharmaceutical Grade, Battery Grade), By Application (Battery Electrolytes, Solvents, Polycarbonate Synthesis, Reagents, Others), By End User (Plastics, Pharmaceuticals, Paints & Coatings, Battery, Agrochemicals, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

UBE Industries, Shandong Shida Shenghua Chemical Group, BASF SE, Mitsubishi Chemical Corporation, Kishida Chemical Co., Ltd., Merck KGaA, Kowa Company, Ltd., Tokyo Chemical Industry Co., Ltd. (TCI), Dongying Hi-tech Spring Chemical Industry Co., Ltd., Haike Chemical Group, Guangzhou Tinci Materials Technology Co., Ltd., Shandong Haike Chemical Group Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., Lotte Chemical Corporation, Shandong Depu Chemical Industry Science & Technology Co., Ltd., Shandong Jinling Chemical Co., Ltd., Alfa Aesar, Huntsman Corporation, Novaphene Speciality Chemicals, Arrow Fine Chemicals, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Dimethyl Carbonate Market?

▾ The Global Dimethyl Carbonate Market size is estimated to have a value of USD 1,122.1 million in 2025 and is expected to reach USD 1,985.2 million by the end of 2034.

Which region accounted for the largest Global Dimethyl Carbonate Market?

▾ Asia Pacific is expected to be the largest market share for the Global Dimethyl Carbonate Market with a share of about 41.5% in 2025.

Who are the key players in the Global Dimethyl Carbonate Market?

▾ Some of the major key players in the Global Dimethyl Carbonate Market are BASF SE, Mitsubishi Chemical Corporation, UBE Industries, and many others.

What is the growth rate in the Global Dimethyl Carbonate Market?

▾ The market is growing at a CAGR of 6.5% over the forecasted period.

How big is the US Dimethyl Carbonate Market?

▾ The US Dimethyl Carbonate Market size is estimated to have a value of USD 221.8 million in 2025 and is expected to reach USD 378.1 million by the end of 2034.