Market Overview

The

Global Dioctyl Adipate Market is projected to reach

USD 2.3 billion in 2024 and grow at a compound annual

growth rate of 5.3% from there until 2033 to reach a

value of USD 3.7 billion.

Dioctyl Adipate (DOA) is a chemical compound commonly utilized as a plasticizer, which means it makes plastics more flexible and easier to handle. It's majorly useful in making flexible PVC (polyvinyl chloride) products like electrical cables, flooring, synthetic leather, and medical devices. DOA is valued for its ability to keep plastics flexible even at low temperatures, making it ideal for products that need to stay soft in cold conditions.

Further, growth in the market is driven by the growing demand for flexible PVC products in many industries, like automotive, construction, and consumer goods. The growth in infrastructure projects and the demand for durable, flexible materials contribute significantly to this demand.

Also, various trends have emerged in the DOA market, as there is a transformation towards environmentally friendly plasticizers.

DOA is considered a safer alternative to traditional phthalate-based plasticizers, which have higher health and environmental concerns. As a result, manufacturers are majorly adopting DOA to meet regulatory requirements and consumer preferences for greener products. Current events have also influenced the DOA market. In the past, the COVID-19 pandemic initially disrupted supply chains and reduced industrial activities, leading to a temporary decline in demand.

However, as economies recovered and industries started operations, the DOA market regained momentum. In addition, the pandemic also created awareness of hygiene and safety, boosting the demand for PVC-based medical products, which, in turn, fuels the need for DOA. Moreover, the DOA market is expected to continue growing. Factors like technological development in production processes, the advancement of sustainable solutions, and the expansion of industries in emerging economies are expected to drive this growth.

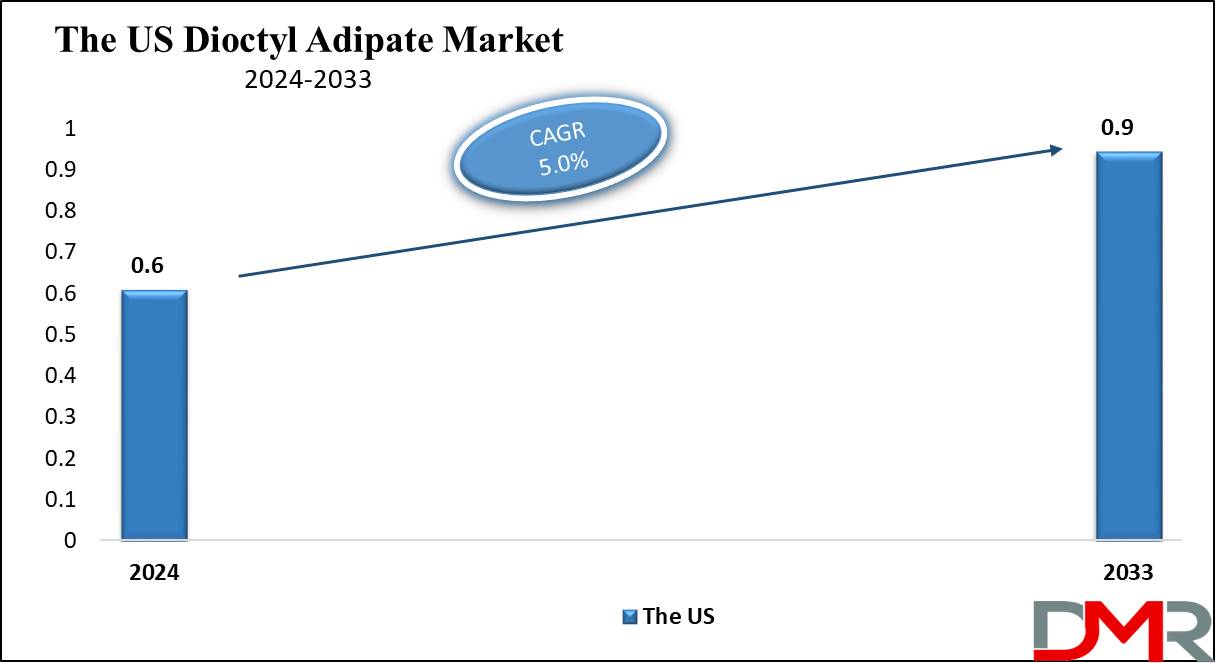

The US Dioctyl Adipate Market

The

US Dioctyl Adipate Market is projected to

reach USD 0.6 billion in 2024 at a compound annual growth

rate of 5.0% over its forecast period.

The US dioctyl adipate market provides growth opportunities driven by a rise in demand for flexible PVC in the construction, automotive, and packaging sectors. The transformation towards sustainable, non-phthalate plasticizers provides new avenues for eco-friendly DOA adoption. In addition, developments in manufacturing technologies and the growing need for high-performance materials across many industries further contribute to market expansion.

Further, the growth of the dioctyl adipate market is driven by the need for flexible PVC in industries like construction, automotive, and packaging, along with the transformation towards eco-friendly plasticizers. However, the market experiences a restraint due to strict environmental regulations and the availability of cheaper alternatives, which can limit the broader adoption of DOA.

Key Takeaways

- Market Growth: The Dioctyl Adipate Market size is expected to grow by 1.3 billion, at a CAGR of 5.3% during the forecasted period of 2025 to 2033.

- By Grade: The technical grade segment is anticipated to get the majority share of the Dioctyl Adipate Market in 2024.

- By Application: Plasticizers are expected to be leading the market in 2024

- By End User: The packaging segment is expected to get the largest revenue share in 2024 in the Dioctyl Adipate Market.

- Regional Insight: Asia Pacific is expected to hold a 37.9% share of revenue in the Global Dioctyl Adipate Market in 2024.

- Use Cases: Some of the use cases of Dioctyl Adipate include medical devices, eco-friendly plasticizers, and more.

Use Cases

- Flexible PVC Products: DOA is broadly used as a plasticizer in flexible PVC applications, like electrical cables, synthetic leather, flooring, and packaging films, providing flexibility and durability.

- Cold-Resistant Applications: It improves low-temperature performance in products like outdoor hoses, automotive parts, and industrial gaskets, ensuring flexibility in cold climates.

- Medical Devices: DOA is utilized in medical-grade PVC for products like IV bags, tubing, and gloves, providing safety and flexibility in healthcare applications.

- Eco-Friendly Plasticizer: As a non-phthalate alternative, DOA is highly used in applications demanding environmentally friendly and regulatory-compliant plasticizers.

Market Dynamic

Driving Factors

Rising Demand for Flexible PVC ProductsThe growing demand for durable, flexible materials in industries like construction, automotive, and consumer goods drives the need for DOA. Its ability to maintain plastic flexibility, even in low temperatures, makes it vital for applications like flooring, cables, and synthetic leather, which are experiencing steady growth due to urbanization & infrastructure development

Shift Towards Eco-Friendly Alternatives

The increase in environmental concerns and stricter regulations on traditional phthalate-based plasticizers are expanding the adoption of DOA as a safer, non-toxic alternative. Its use in sustainable manufacturing aligns with global trends toward green and recyclable materials, further driving market growth, mainly in regions emphasizing eco-friendly production.

Restraints

High Cost of Production

The manufacturing process for Dioctyl Adipate can be expensive and for other plasticizers, making it less competitive in price-sensitive markets. In addition, fluctuations in raw material prices, like adipic acid and 2-ethylhexanol, can hike prices, discouraging its adoption, mainly in industries with tight budget constraints.

Availability of Alternatives

The presence of less expensive and widely available plasticizers, like phthalates, creates a challenge for the DOA market. Despite regulatory concerns about phthalates, their lesser cost and established use in many applications can limit the growth potential of DOA, majorly in regions with fewer environmental regulations.

Opportunities

Growing Demand for Medical-Grade PVC

The growth in the demand for high-quality medical devices, like IV bags and tubing, provides a significant opportunity for DOA as a safe and flexible plasticizer. The healthcare industry's expansion, primarily in emerging markets, along with growing hygiene standards post-pandemic, boosts the demand for DOA in medical applications.

Expansion in Emerging Economies

Fast industrialization and urbanization in regions like Asia-Pacific and Latin America are developing opportunities for DOA in the construction, automotive, and consumer goods industries. With an increase in the focus on sustainable materials, manufacturers in these regions are highly adopting eco-friendly plasticizers like DOA to meet regulatory standards and consumer preferences.

Trends

Shift Toward Sustainable Plasticizers

A major trend is the increase in the preference for environmentally friendly and non-phthalate plasticizers like DOA. With growing consumer awareness and strict regulations on hazardous substances, industries are adopting DOA to produce sustainable and recyclable products, majorly in packaging, automotive, and medical applications.

Advancements in Production Technologies

Manufacturers are funding innovative production processes to improve the efficiency and quality of DOA. These developments focus on reducing production costs, improving product purity, and meeting the increase in the demand for high-performance plasticizers in emerging markets, thereby expanding DOA's application range.

Research Scope and Analysis

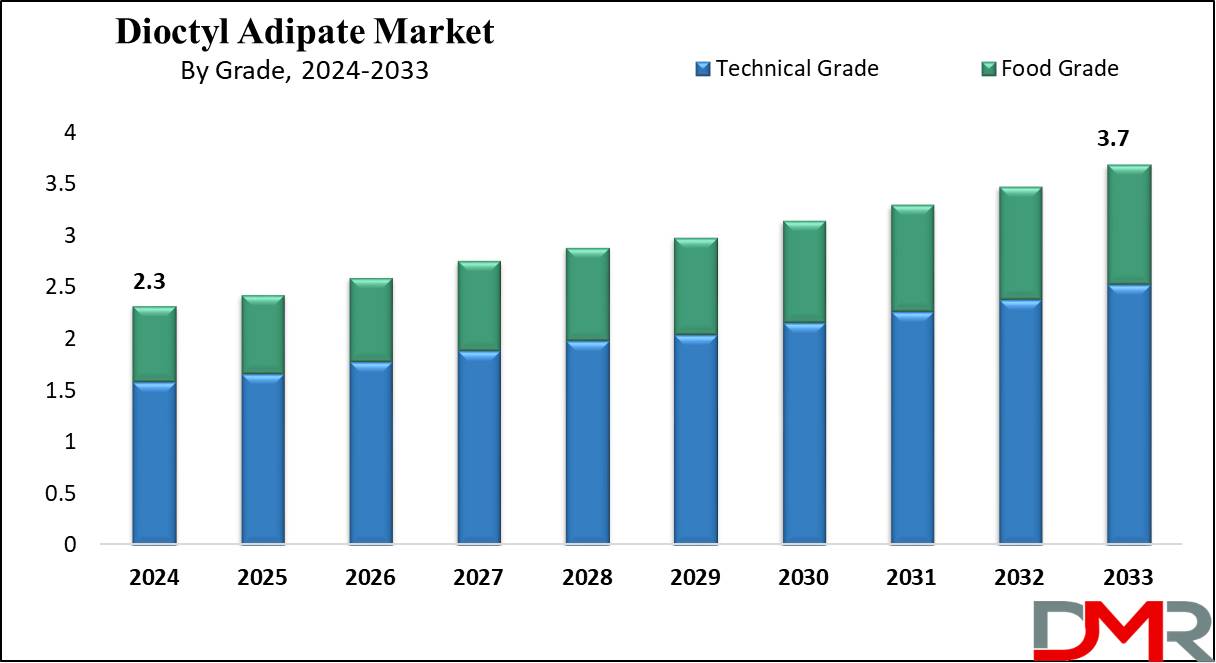

By Grade

The dioctyl adipate (DOA) market is divided into two main grades: food grade and technical grade. Among these, the technical grade is expected to dominate the market, holding the largest share in 2024, as technical grade DOA is highly used in many industrial applications due to its affordability and suitability for large-scale processes. It is an important plasticizer in the production of flexible PVC, which is used in products like cables, hoses, and flooring.

The growing need for flexible PVC across industries like construction, automotive, and consumer goods is a major factor driving the growth. In addition, it is preferred by manufacturers owing to its ability to improve the flexibility, strength, and durability of PVC products. In addition, quick industrialization and infrastructure development in emerging economies further boost the demand for technical-grade DOA, as these sectors demand reliable and high-performance plasticizers. Its versatility and affordability make it the top choice for many manufacturers, ensuring its constant dominance in the market.

Further, the food grade segment is expected to have a smaller share; it serves important applications in areas like food packaging and food contact materials. Food-grade DOA is mainly designed to meet strict safety and regulatory standards, making it specific for use in packaging materials that come into direct contact with food. The rise in the need for safe, reliable, and compliant food packaging solutions is helping in the demand for food-grade DOA.

However, its market share remains limited in comparison to technical grade due to its lower range of applications and the higher costs included in its production. Despite this, the food grade segment plays an essential role in ensuring safety and compliance in food-related industries.

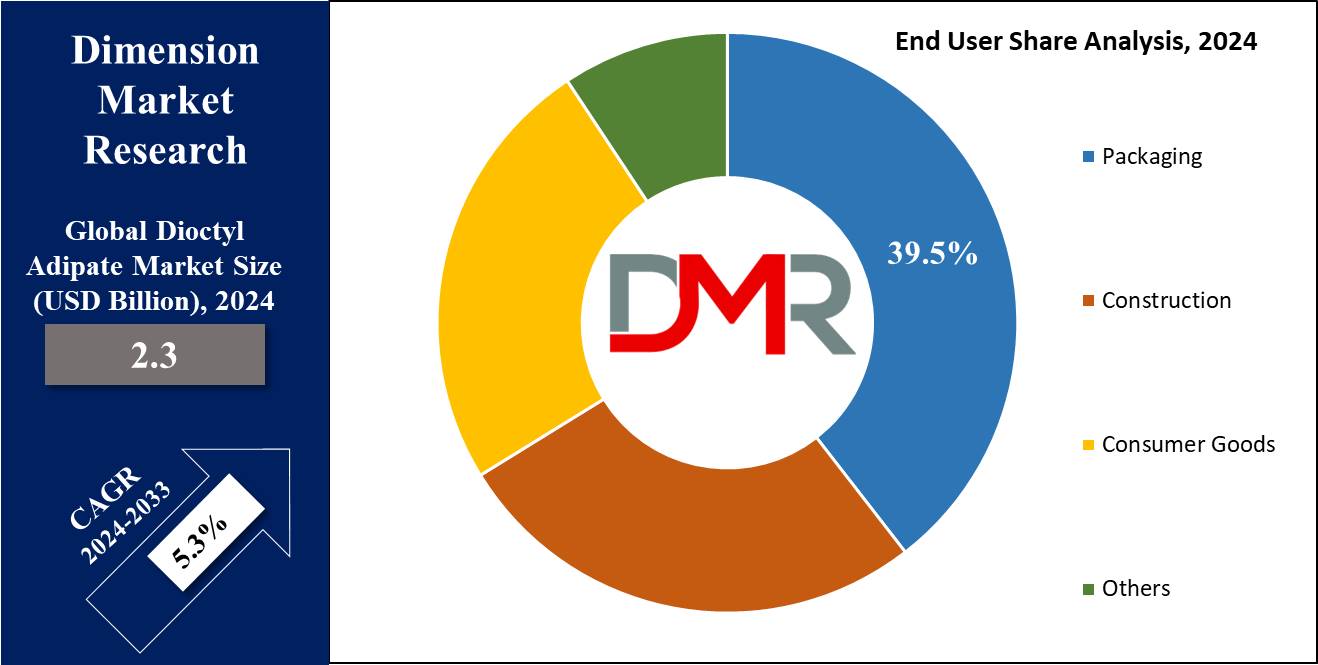

By End User

The packaging industry is expected to be the largest end-use segment in the dioctyl adipate (DOA) market by 2024, owing to the growing demand for flexible and durable packaging solutions across various industries. DOA is widely used in manufacturing flexible PVC films and sheets, which are key packaging materials. The growth of the global packaging sector is driven by the growth in consumer goods demand, the rapid expansion of e-commerce, and the major focus on sustainable packaging options.

Packaging plays an important role in protecting product quality, extending shelf life, and providing convenience to consumers, making high-performance materials like DOA essential. Also, developments in packaging technology and a transformation toward eco-friendly substitutes are promoting the adoption of DOA-based products. As these trends constantly shape the packaging industry, its position as the dominant end-use segment in the DOA market is expected to remain strong.

Apart from packaging, dioctyl adipate is utilized in other industries like construction, consumer goods, and miscellaneous applications. In the construction sector, DOA enhances PVC products used in pipes, cables, and flooring, with demand driven by infrastructure projects and urbanization. The consumer goods industry depends on DOA for products that demand flexibility and durability. While these segments contribute to the complete market growth, their impact is smaller in comparison to the packaging industry, which remains the primary driver of demand for DOA-based materials.

By Application

In the dioctyl adipate (DOA) market, plasticizers are expected to be the largest application segment in 2024 by having a significant market share. Plasticizers are critical additives that improve the flexibility, durability, and workability of polymer materials, mostly PVC. Dioctyl adipate is broadly used as a plasticizer in the production of flexible PVC products like films, cables, and sheets, which are vital in many industries.

The automotive, construction, and packaging sectors drive the demand for flexible PVC, making plasticizers a major part of their growth. DOA-based plasticizers play a major role in improving the physical properties of polymers, allowing their utilization in various applications. In addition, developments in polymer technology and the growing demand for high-performance, lightweight materials in industries like automotive and construction further boost the demand for DOA-based plasticizers, solidifying this segment’s dominance.

Besides plasticizers, dioctyl adipate is also utilized in adhesives, sealants, and sheets, along with other smaller applications. Adhesives and sealants benefit from DOA’s ability to enhance their performance under tough conditions, making them more reliable and effective. The sheets segment, while lower in scale, continues to grow steadily owing to its applications in industrial and packaging products. These secondary applications, although not as impactful as the plasticizers segment, contribute to the complete growth of the DOA market. Together, these applications ensure that dioctyl adipate remains a valuable chemical in various industries.

The Dioctyl Adipate Market Report is segmented on the basis of the following

By Grade

- Technical Grade

- Food Grade

By End User

- Packaging

- Construction

- Consumer Goods

- Others

By Application

- Plasticizers

- Adhesives & Sealants

- Sheets

- Other

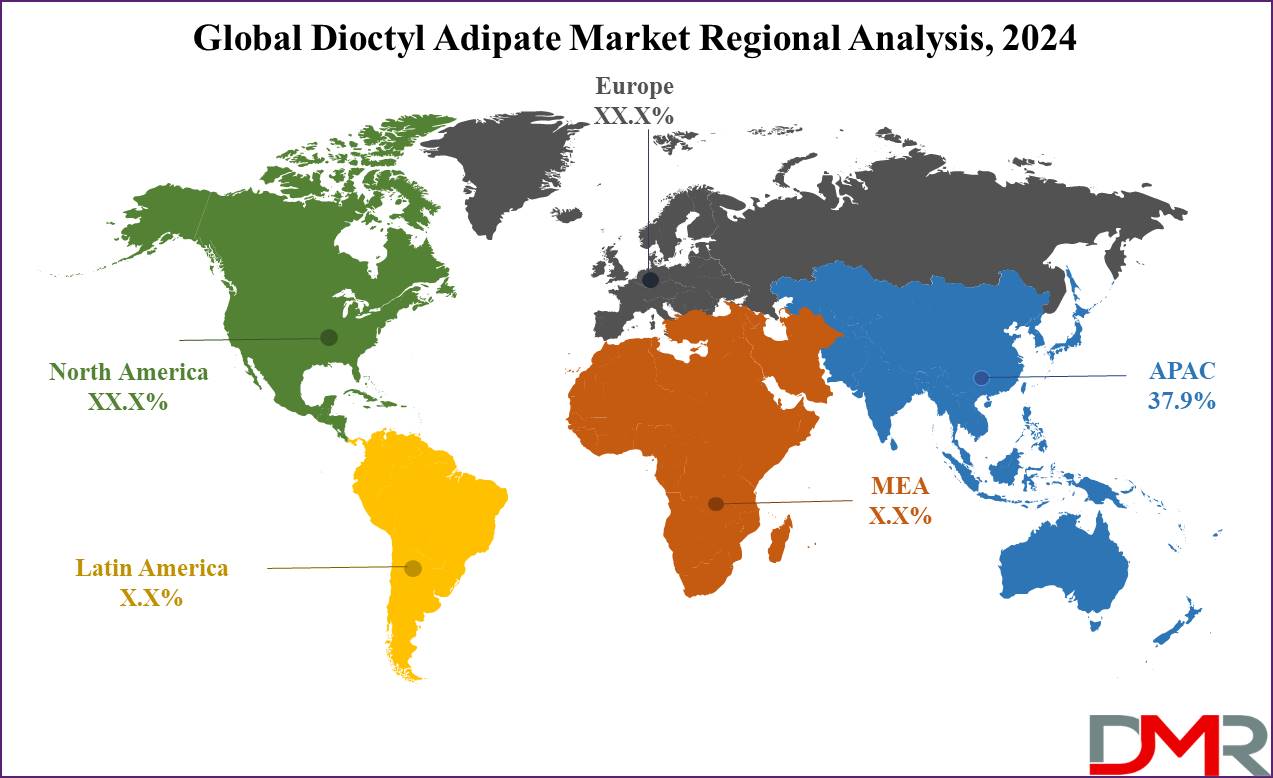

Regional Analysis

The Asia-Pacific (APAC) region is expected to dominate the dioctyl adipate (DOA) market in 2024,

capturing 37.9% of the market share, due to rapid industrialization, urbanization, and the growth of the construction and automotive sectors in countries like India, China, and Japan. The growth in demand for flexible PVC products, majorly in packaging and consumer goods, is a major factor driving the market.

In addition, APAC’s large and growing population, along with increasing disposable incomes, drives the use of DOA in personal care and cosmetic products. The region’s strong manufacturing base and favorable economic conditions further help market growth. Investments in infrastructure & industrial projects create a high demand for DOA, while the availability of affordable labor and raw materials provides a competitive edge in production. Furthermore, the relatively easy regulatory environment in comparison to Western regions makes it easier to adopt and expand DOA-based products in the market.

Further, North America is also set to hold a considerable share of the dioctyl adipate market, assisted by its advanced industrial infrastructure and strong presence in the automotive and packaging sectors. The region’s transformation toward sustainable solutions and adherence to strict environmental regulations drive the adoption of bio-based and non-phthalate plasticizers like DOA.

Further, Europe contributes to the market with its focus on sustainability and strict environmental policies, encouraging the use of eco-friendly plasticizers. The region’s well-established automotive and construction industries further boost demand for DOA, ensuring steady market growth across these developed economies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the dioctyl adipate (DOA) market is marked by a mix of established players and new entrants competing for market share. Key factors driving competition are product innovation, affordability, and the ability to meet the growing demand for sustainable and eco-friendly plasticizers.

Companies aim to enhance production efficiency, improve the quality of DOA-based products, and expand their product portfolios to meet various industries such as packaging, construction, and automotive. Strategic partnerships, regional expansions, and investments in research and development are common strategies employed to gain a competitive edge.

Some of the prominent players in the Global Dioctyl Adipate are:

- ExxonMobil Corporation

- BASF SE

- Aarti Industries

- New Japan Chemical Co Ltd

- Eastman Chemical Company

- GJ Chemical

- LG Chem

- The HallStar Company

- Mitsubishi Chemical

- J-Plus

- Other Key Players

Recent Developments

- In October 2024, Manali Petrochemical Ltd (MPL) announced that the company is looking to expand its petrochemical production portfolio through the launch of new projects for propylene glycol and polyester glycol, using both Greenfield and brownfield routes, which is expected to involve a total investment of over INR 130 crore. Further, the company intends to fund these projects through a combination of internal accruals and debt, with the specific funding proportions to be determined at a later stage.

- In October 2024, BC Jindal Group Company, JPFL Films Pvt Ltd, plans to double its Capacitor Film capacity with an investment of INR 250 crore, which is expected to be completed by 2025. Further, the company announced a similar investment for expanding its Biaxially Oriented Polypropylene (BOPP) film production, focused on the packaging industry. JPFL Films, a subsidiary of the flexible packaging giant Jindal Poly Films Ltd, has been on a constant expansion spree to meet India’s growing demand for packaging materials

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2.3 Bn |

| Forecast Value (2033) |

USD 3.7 Bn |

| CAGR (2024-2033) |

5.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 0.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Grade (Technical Grade and Food Grade), By End User (Packaging, Construction, Consumer Goods, and Others), By Application (Plasticizers, Adhesives & Sealants, Sheets, and Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

ExxonMobil Corporation, BASF SE, Aarti Industries, New Japan Chemical Co Ltd, Eastman Chemical Company, GJ Chemical, LG Chem, The HallStar Company, Mitsubishi Chemical, J-Plus, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Dioctyl Adipate Market size is expected to reach a value of USD 2.3 billion in 2024 and is expected to reach USD 3.7 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Dioctyl Adipate Market with a share of about 37.9% in 2024.

The Dioctyl Adipate Market in the US is expected to reach USD 0.6 billion in 2024.

Some of the major key players in the Global Dioctyl Adipate Market are ExxonMobil Corporation, BASF SE, Aarti Industries, and others

The market is growing at a CAGR of 5.3 percent over the forecasted period.