Market Overview

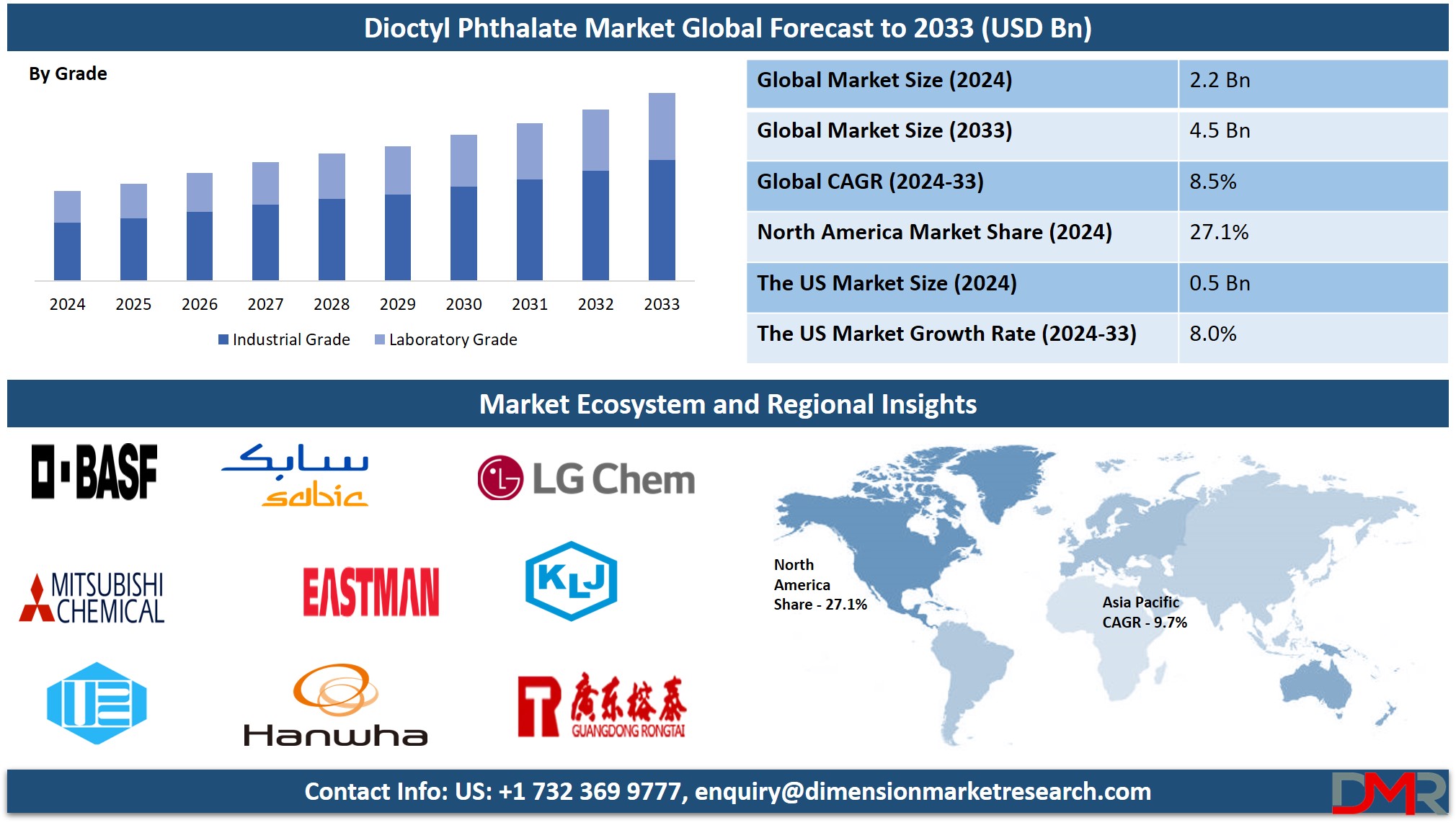

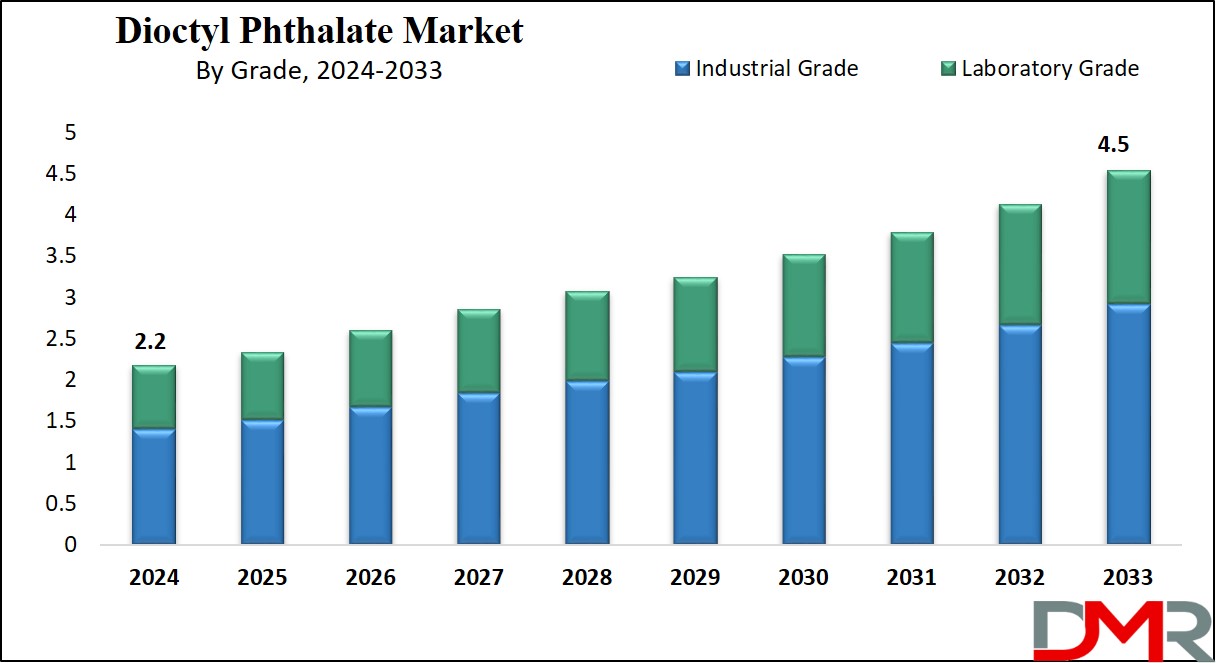

The Global Dioctyl Phthalate Market is projected to reach

USD 2.2 billion in 2024 and grow at a compound annual growth rate of

8.5% from there until 2033 to reach a value of

USD 4.5 billion.

Dioctyl Phthalate (DOP) is a chemical compound that is mostly used as a plasticizer. It helps grow the flexibility and durability of plastic products, mainly polyvinyl chloride (PVC). DOP is colorless, odorless, and oily, making it ideal for utilized in manufacturing items like cables, flooring, and medical equipment. It enhances the performance and texture of plastic, ensuring it remains pliable and easy to process.

Further, the demand for DOP has grown steadily due to its broad use in various industries, like automotive, construction, and healthcare. As the construction and automotive sectors expand, the demand for flexible, durable plastic materials increases, driving up the need for DOP. In addition, the rise in medical and consumer goods production further boosts its usage in numerous applications.

In addition, there has been a transformation towards finding substitutes for DOP due to health and environmental concerns. However, its low cost and effective plasticizing properties constantly make it a preferred option in many markets. Newer regulations and sustainability trends are encouraging manufacturers to explore safer substitutes, though DOP is still dominant in certain regions and applications.

Moreover, factors like environmental regulations and shifting consumer preferences. While alternatives like bio-based plasticizers are gaining popularity, DOP remains a key ingredient in many industries due to its effectiveness and cost-efficiency. Manufacturers are expected to face more pressure to reduce environmental impacts, pushing for innovation in more sustainable plasticizer options in the future.

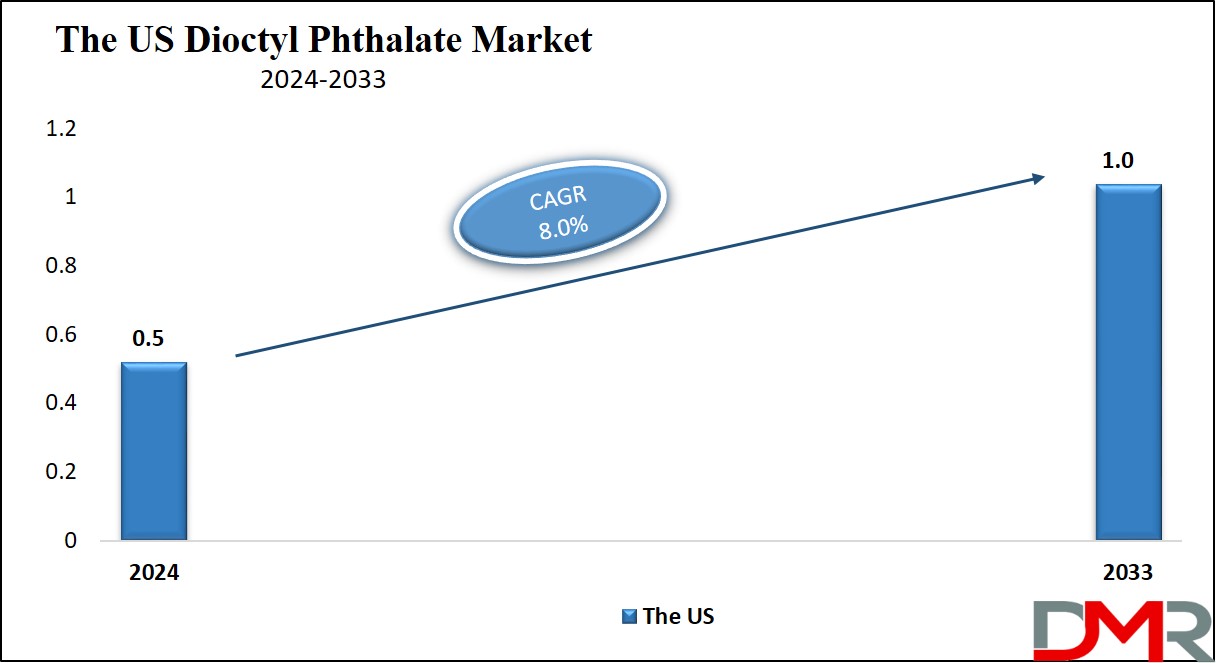

The US Dioctyl Phthalate Market

The US Dioctyl Phthalate Market is projected to reach

USD 0.5 billion in 2024 at a compound annual growth rate of

8.0% over its forecast period.

The U.S. provides growth opportunities in the Dioctyl Phthalate (DOP) market through its expanding construction, automotive, and healthcare sectors. The rise in demand for flexible PVC in infrastructure projects, durable automotive components, and medical devices drives market growth. In addition, developments in sustainable plasticizers and compliance with environmental regulations create innovation opportunities, enhancing the market’s potential in the region.

Further, the market is driven by growth in demand for flexible PVC in the construction, automotive, and healthcare industries, driven by infrastructure development and durable product needs. However, growth is restrained by strict environmental regulations and increasing awareness of health risks linked with phthalates, prompting manufacturers to explore safer, eco-friendly plasticizer alternatives to meet compliance standards.

Key Takeaways

- Market Growth: The Dioctyl Phthalate Market size is expected to grow by USD 2.2 billion, at a CAGR of 8.5% during the forecasted period of 2025 to 2033.

- By Grade: The industrial grade segment is anticipated to get the majority share of the Dioctyl Phthalate Market in 2024.

- By End Use Industry: The construction sector is expected to be leading the market in 2024

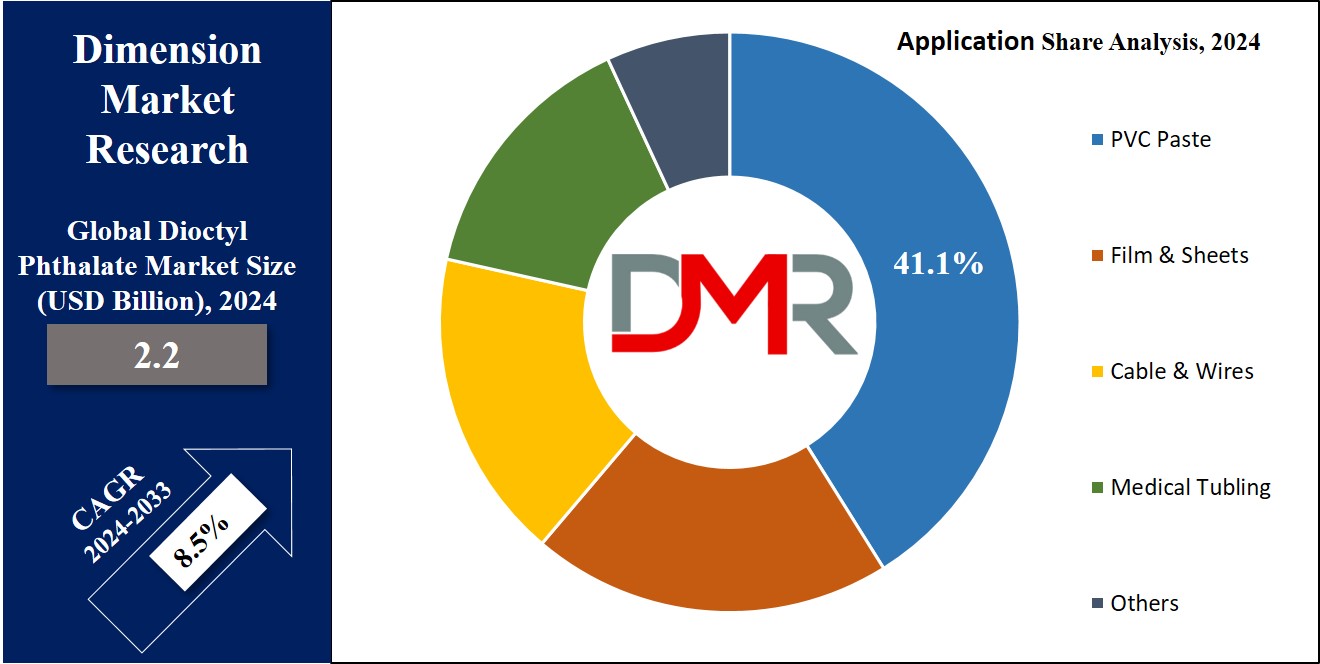

- By Application: The PVC paste segment is expected to get the largest revenue share in 2024 in the Dioctyl Phthalate Market.

- Regional Insight: Asia Pacific is expected to hold a 41.4% share of revenue in the Global Dioctyl Phthalate Market in 2024.

- Use Cases: Some of the use cases of Dioctyl Phthalate include flexible PVC products, medical equipment, and more.

Use Cases

- Flexible PVC Products: DOP is highly used in the production of flexible PVC materials like cables, flooring, and medical tubing, enhancing their durability and pliability.

- Automotive Industry: It is used in automotive components like dashboards, upholstery, and wires, helping to improve the flexibility and performance of plastic parts exposed to heat and stress.

- Medical Equipment: DOP is used in medical devices like IV bags, catheters, and blood bags, where flexibility and safety are important for patient care.

- Consumer Goods: It is found in items like toys, vinyl fabrics, and wallpapers, providing the necessary flexibility and longevity for everyday products.

Market Dynamic

Driving Factors

Increasing Demand for Flexible PVC

The growth in the demand for flexible PVC in numerous industries, such as construction, automotive, and healthcare, drives the need for DOP. As these sectors expand, the demand for durable and flexible plastic materials increases, boosting the DOP market.

Rising Automotive and Construction Activities

As urbanization and infrastructure development increase, there is a higher demand for automotive components and construction materials. DOP is a key ingredient in producing flexible, durable plastics in these industries, fueling its market growth.

Restraints

Health and Environmental Concerns

The rise in awareness about the potential health risks and environmental impact of DOP is a major restraint. Phthalates are linked to hormonal disruption, prompting many industries to look for safer, more sustainable alternatives, which could limit DOP's market growth.

Regulatory Challenges

Highly strict regulations regarding the use of phthalates, mostly in products like toys, medical devices, and children's items, restrict the broad use of DOP. Compliance with these regulations pushes manufacturers to explore alternative plasticizers, reducing the demand for DOP in some sectors.

Opportunities

Shift to Bio-based Plasticizers

The growth in demand for sustainable and eco-friendly materials provides an opportunity for the development of bio-based alternatives to DOP. Manufacturers can innovate by creating new, non-toxic plasticizers that meet environmental regulations, tapping into the growing green products market.

Growth in Emerging Markets

The expanding industrial sectors in developing regions, like Asia-Pacific and Latin America, offer a major opportunity for DOP. With rapid urbanization and infrastructure development, the demand for flexible PVC in the construction and automotive industries is set to rise, further boosting DOP usage.

Trends

Shift toward Safer Alternatives

There is a major trend towards the replacement of DOP with safer, non-toxic alternatives owing to concerns about its potential health effects. Industries are highly adopting bio-based and non-phthalate plasticizers to meet regulatory needs and appeal to environmentally conscious consumers.

Focus on Sustainable Manufacturing

The DOP market is experiencing a trend toward sustainable production practices. Manufacturers are exploring methods to minimize environmental impact, such as using recyclable or biodegradable plasticizers, in response to growing environmental awareness and stricter regulatory standards.

Research Scope and Analysis

By Purity

The dioctyl phthalate (DOP) market, with a purity level of up to 99%, is projected to dominate the market in 2024, securing the largest share, due to being broadly used in general commercial applications where extremely high purity is not a strict requirement. Industries use this variant for producing flexible PVC products like cables, hoses, and vinyl flooring. Its better plasticizing properties improve the flexibility and durability of PVC, making it ideal for these

practical applications. The affordability and effectiveness of this grade make it a main choice for large-scale manufacturing, mostly in sectors like construction and industrial goods, where affordability and reliable performance are key priorities.

In addition, the DOP segment with a purity level above 99% caters to more specialized and demanding applications that demand exceptional material quality, which is vital for producing medical devices, high-end electronics, and other products where even minor impurities can compromise performance or safety.

Like in medical and healthcare settings, the use of ultra-pure DOP ensures compliance with strict safety standards and minimizes the risks in sensitive environments. Similarly, in advanced electronics, high-purity DOP prevents defects that could affect the functionality of components. While this segment represents a smaller share of the market, it plays a vital role in meeting the strict requirements of critical industries where precision and reliability are non-negotiable.

By Grade

Based on grade, the industrial-grade Dioctyl Phthalate (DOP) is set to dominate the dioctyl phthalate market in 2024 by holding the largest share due to its extensive use in large-scale applications. It plays a major role in manufacturing PVC products like cables, wires, flooring, and roofing materials, where flexibility and durability are essential. Industrial-grade DOP improves the physical properties of PVC, making it more strong and versatile for demanding uses in the construction and manufacturing industries.

Its affordability and ability to improve the performance of PVC products make it a preferred choice for manufacturers, mostly in sectors where strength and reliability are key requirements, which drives its dominance in the market as industries continue to depend on it for creating durable plastic solutions.

Further, laboratory-grade DOP holds a smaller yet significant part of the market, catering mostly to specialized applications that demand high purity and precision, as it is widely used in research and development, mostly in controlled environments like laboratories and medical fields. It is important in applications where the chemical composition must meet strict standards to ensure accuracy, like specialty chemical formulations or medical devices. Laboratory-grade DOP is important for innovation, as it allows scientists and researchers to create new products and enhance existing materials with consistency and reliability.

By End Use Industry

The construction sector as an end-use industry in 2024 is projected to emerge as the leading contributor to the Dioctyl Phthalate (DOP) market, holding a significant share, which depends heavily on DOP as a plasticizer for manufacturing flexible PVC materials used in construction products like flooring, roofing, cables, and wall coverings.

The flexibility provided by DOP is important for these materials to endure environmental challenges including temperature fluctuations and physical wear, ensuring their durability and long-term performance. Its ability to enhance the strength and resilience of PVC makes it a preferred choice in construction projects, where reliability and cost-effectiveness are critical factors.

Moreover, the automotive industry provides another key market for DOP and is set to grow significantly. It is highly used in creating flexible PVC for dashboards, door panels, and wiring insulation, where flexibility and resistance to extreme weather conditions are essential. In addition, the medical device sector depends on DOP for its non-toxic properties and high purity levels in products like blood bags, medical tubing, and dialysis equipment.

The safety & compliance requirements in this industry make DOP an indispensable component. Furthermore, DOP plays a major role in the consumer goods sector, improving the flexibility and usability of products like artificial leather, toys, and other everyday items, highlighting its versatility across industries.

By Application

PVC paste in terms of applications is anticipated to be the leading segment in the Dioctyl Phthalate (DOP) market, holding the largest share in 2024. DOP is mostly used as a key plasticizer in producing PVC paste, which is important for applications like flooring, decorative films, and wallpapers. Its ability to improve plasticity and ensure smooth processing makes it a major choice for manufacturers.

The use of DOP helps produce PVC paste that is easy to work with and results in durable, high-quality end products. These attributes have made it indispensable in industries that aim to create flexible and aesthetically appealing materials, mainly in construction and interior design, which shows the dominant role of PVC paste in the DOP market.

In addition, the Film & Sheets sector also heavily depends on DOP for its ability to improve flexibility and durability in PVC-based products. These include packaging materials, shower curtains, and inflatables, where strength and elasticity are critical. Also, the Cable & Wires segment utilizes the DOP to soften PVC insulation and sheathing, making cables more pliable and easier to install, which is mostly valuable in the electrical and construction industries, where flexible cables are important for safety and efficient installation. Whether in packaging, home goods, or critical infrastructure, DOP’s ability to improve the performance of PVC ensures its continued importance across diverse industries, solidifying its role in driving innovation and practicality in plastic products.

The Dioctyl Phthalate Market Report is segmented on the basis of the following

By Purity

By Grade

- Laboratory Grade

- Industrial Grade

By End Use Industry

- Automotive

- Construction

- Medical Device

- Consumer Goods

- Others

By Application

- PVC Paste

- Fil & Sheets

- Medical Tubing

- Cable & Wires

- Others

Regional Analysis

Asia Pacific plays is anticipated to play a vital role in the growth of the dioctyl phthalate (DOP) market by having a share of

41.4% in 2024, driven by its rapidly expanding industrial and construction sectors. The region's increase in population, urbanization, and infrastructure development has led to a growth in demand for flexible PVC products, like cables, flooring, and roofing materials, which highly depend on DOP as a plasticizer.

In addition, the automotive and consumer goods industries in countries like China, India, and Southeast Asia are booming, further expanding the demand for DOP to manufacture durable and flexible materials. The availability of raw materials and affordability of production facilities also make Asia Pacific a key manufacturing hub. With increasing investments in the construction, automotive, and medical industries, the region continues to significantly contribute to the global growth of the DOP market.

Further, the North American market is expected to expand significantly in the coming years due to its well-established industries, like construction, automotive, and healthcare. The region’s aims for advanced infrastructure and high-quality manufacturing drive the demand for flexible PVC products, where DOP is highly used as a plasticizer.

In the medical sector, the need for safe and durable materials like medical tubing and blood bags further supports market growth. Additionally, the push for innovation and compliance with environmental regulations encourages manufacturers to refine production processes, ensuring the steady growth of the DOP market in North America.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Dioctyl Phthalate (DOP) market is highly competitive, driven by a mix of established manufacturers and regional players competing to meet the growing demand across industries. Competition is shaped by factors like product quality, pricing, and the ability to meet transforming regulatory standards. Companies are aiming to develop efficient production processes and expand their geographical reach to strengthen their market position. In addition, there is major pressure to innovate and provide alternatives to traditional DOP as environmental concerns and stricter regulations push the industry toward safer, sustainable plasticizers.

Some of the prominent players in the Global Dioctyl Phthalate are

- BASF SE

- SABIC

- LG Chem

- Mitsubishi Chemical

- Bluesail

- Eastman

- KLJ Plasticizers Ltd

- UPC Group

- Guangdong Rongtai

- Hanwha Chemical

- Other Key Players

Recent Developments

- In December 2024, The U.S. Environmental Protection Agency (EPA) seeks nominations of scientific and technical experts to act as ad hoc reviewers for the Science Advisory Committee on Chemicals (SACC). These experts will help in reviewing EPA's data, methods, models, and evaluations for benzyl butyl phthalate (BBP), dibutyl phthalate (DBP), DEHP, DIBP, and DCHP, including human health and risk analyses.

- In June 2024, Guangdong Rongtai Industry Co., Ltd acquired Beijing Jinyun Yachuang IOT Technology Co., Ltd. from Hainan Yunzhijin Enterprise Management Partnership Enterprise and Yang Lingya for USD 16.5 million in 2024. Further USD 9.9 million will be paid by Guangdong Rongtai Industry Co., Ltd. Guangdong Rongtai Industry Co.,Ltd will pay contingent payment of USD 6.6 million cash.

- In January 2024, The European Chemicals Agency (ECHA) unveiled the addition of five substances to the Candidate List of substances of very high concern (SVHC), which expands the number of entries on the Candidate List from 235 to 240. In addition, the ECHA expands the classification of one existing entry for dibutyl phthalate (DBP) to involve its endocrine-disrupting properties for the environment.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2.2 Bn |

| Forecast Value (2033) |

USD 4.5 Bn |

| CAGR (2024-2033) |

8.5% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 0.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Purity (Above 99% and Up to 99%), By Grade (Laboratory Grade and Industrial Grade), By End Use Industry (Automotive, Construction, Medical Device, Consumer Goods, and Others), By Application (PVC Paste, Fil & Sheets, Medical Tubing, Cable & Wires, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BASF SE, SABIC, LG Chem, Mitsubishi Chemical, Bluesail, Eastman, KLJ Plasticizers Ltd, UPC Group, Guangdong Rongtai, Hanwha Chemical, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Dioctyl Phthalate Market size is expected to reach a value of USD 2.2 billion in 2024 and is expected to reach USD 4.5 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Dioctyl Phthalate Market with a share of about 41.4% in 2024.

The Dioctyl Phthalate Market in the US is expected to reach USD 0.5 billion in 2024.

Some of the major key players in the Global Dioctyl Phthalate Market are BASF SE, SABIC, LG Chem, and others

The market is growing at a CAGR of 8.5 percent over the forecasted period.