Market Overview

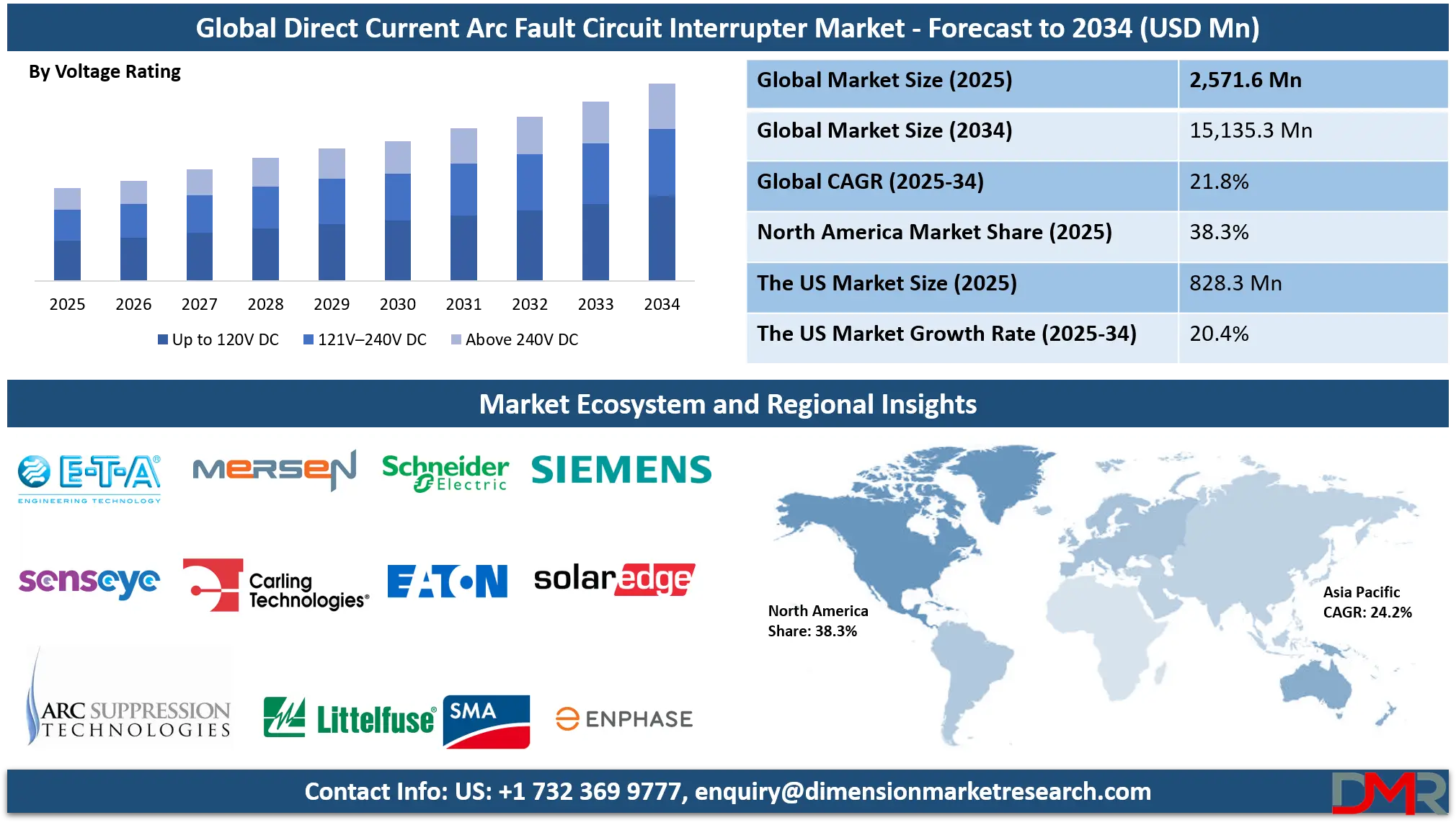

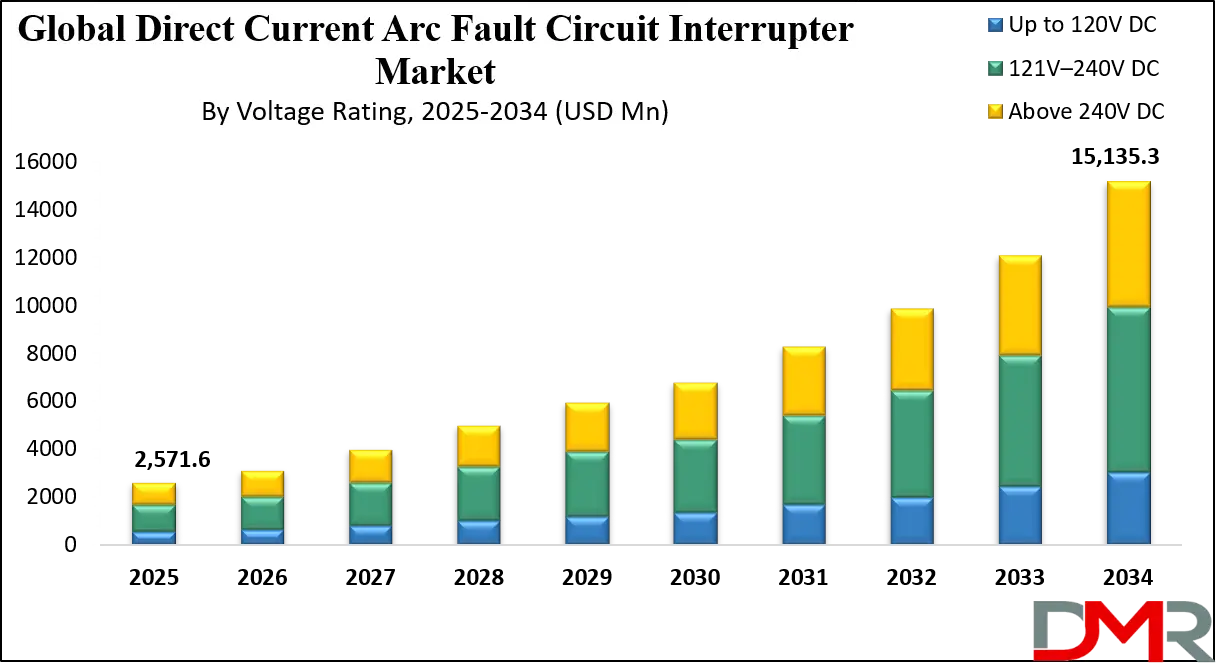

The Global Direct Current Arc Fault Circuit Interrupter (DC AFCI) Market is projected to reach USD 2,571.6 million in 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 21.8% from 2025 to 2034, attaining a value of USD 15,135.3 million by 2034. This significant growth trajectory is primarily fueled by the accelerating global transition to distributed renewable energy generation, the exponential rise in electric vehicle (EV) adoption and infrastructure, and increasingly stringent international electrical safety standards and building codes aimed at mitigating fire risks inherent to DC power systems.

DC AFCIs are advanced protective devices engineered to detect and interrupt hazardous arc faults within direct current electrical circuits. These faults, characterized by unintended high-temperature plasma discharges, pose a significant fire risk in critical modern infrastructure such as solar photovoltaic (PV) arrays, stationary battery energy storage systems (BESS), EV charging stations, data center power distribution, and industrial DC microgrids. The technology addresses a pressing global safety challenge, with electrical arc faults identified as a leading ignition source in building fires involving DC systems. By instantaneously de-energizing a circuit upon detecting the unique current and voltage signatures of a dangerous arc, DC AFCIs prevent catastrophic failures and enhance overall system resilience.

The market is being fundamentally reshaped by a wave of technological convergence. Innovations in artificial intelligence (AI) and

machine learning (ML) for intelligent arc signature analysis, wide-bandgap semiconductors (SiC/GaN) enabling ultra-fast solid-state interruption,

Internet of Things (IoT) connectivity for real-time remote monitoring and diagnostics, and seamless integration with smart building and energy management systems are creating a new paradigm of proactive, predictive electrical safety. The development of miniaturized, modular AFCI components for embedding into inverters, charge controllers, and battery management systems (BMS) is further driving adoption by simplifying design and installation.

Expansive government-led initiatives are a powerful catalyst. Updates to flagship codes like the U.S. National Electrical Code (NEC), the International Electrotechnical Commission (IEC) 63027 standard, and regional equivalents in Europe and Asia-Pacific mandate or strongly recommend arc fault protection for new DC installations. These regulatory pushes are complemented by subsidies, tax credits, and green financing for renewable energy and EV projects, which increasingly stipulate the use of code-compliant safety equipment.

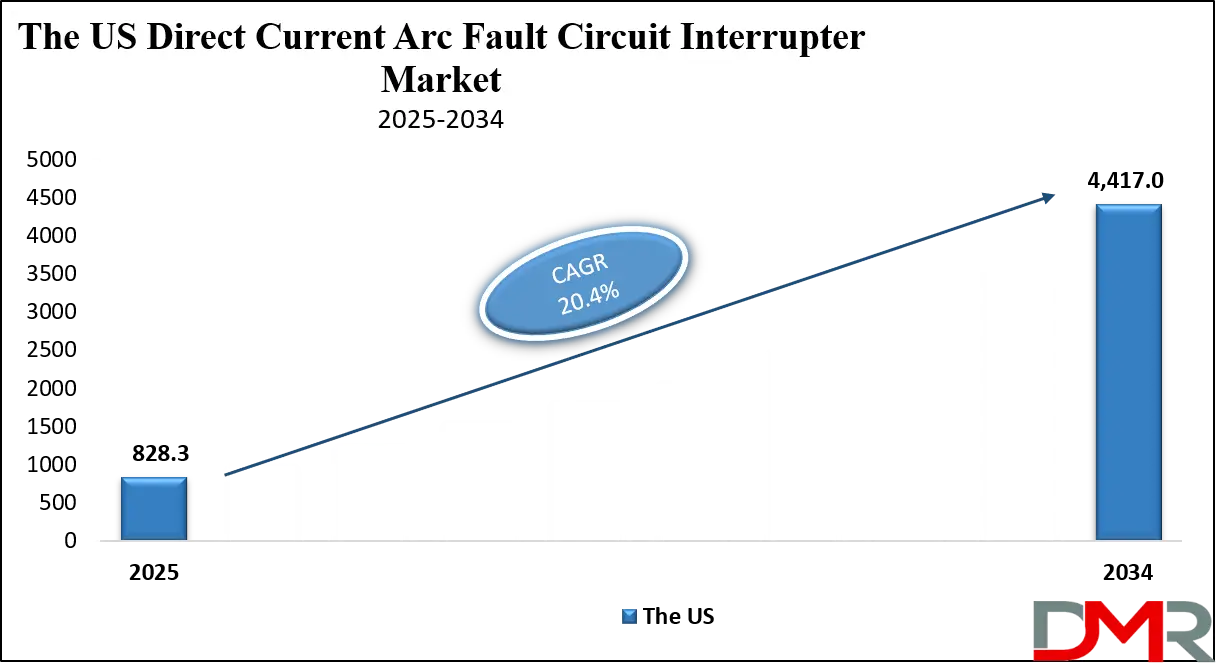

The US Direct Current Arc Fault Circuit Interrupter Market

The U.S. Direct Current Arc Fault Circuit Interrupter Market is projected to reach USD 828.3 million in 2025 and grow at a CAGR of 20.4%, reaching USD 4,417.0 million by 2034. The United States represents the single largest and most mature market globally, a position driven by its pioneering and rigorous regulatory framework, the world's second-largest installed base of residential, commercial, and utility-scale solar PV, and the rapid nationwide deployment of public and private EV charging networks.

The National Electrical Code (NEC), administered by the National Fire Protection Association (NFPA), serves as the primary market driver. Article 690.11, which mandates arc-fault circuit interruption for DC PV systems, was a landmark requirement that created a substantial compliance-based market.

Ongoing code cycles (2023, 2026) continue to refine and expand these requirements, influencing millions of installations. With over 4 million solar installations operational and continued strong policy support via the federal Investment Tax Credit (ITC), state-level Renewable Portfolio Standards (RPS), and net metering policies, demand for integrated and standalone DC AFCI solutions remains robust. Leading electrical equipment manufacturers, including Siemens, Eaton, Schneider Electric, and ABB, have responded with comprehensive portfolios of AFCI-enabled solar combiners, dedicated protection devices, and smart circuit breakers.

The U.S. market benefits from well-established reimbursement pathways and financial incentives. Beyond the ITC, many state and municipal building codes now mandate AFCI protection, and certain utility rebate programs for solar and storage offer higher incentives for systems incorporating advanced safety features.

Furthermore, insurance providers are beginning to offer premium reductions for properties with AFCI-protected electrical systems, recognizing the reduced fire risk. National research and deployment initiatives, such as those funded by the Department of Energy’s (DOE) Solar Energy Technologies Office (SETO) and the Fire Prevention Research Foundation, continuously validate and improve AFCI technology, fostering innovation and consumer confidence. The concurrent growth of community solar projects, resilience-focused microgrids, and home energy storage systems is creating complex, interconnected DC environments where arc fault protection is non-negotiable, solidifying the U.S. role as the global innovation and adoption leader.

The Europe Direct Current Arc Fault Circuit Interrupter Market

The Europe Direct Current Arc Fault Circuit Interrupter Market is projected to be valued at approximately USD 540 million in 2025 and is projected to reach around USD 2,950 million by 2034, growing at a CAGR of about 19.8% from 2025 to 2034. Europe's market strength is anchored in its comprehensive and ambitious Green Deal policy framework, legally binding carbon neutrality targets, and a long-standing tradition of high-stringency product safety certification governed by bodies like the European Committee for Electrotechnical Standardization (CENELEC).

Key national markets, including Germany, the United Kingdom, France, Italy, Spain, and the Nordic countries, are at the forefront of adoption. This leadership is propelled by the EU’s Renewable Energy Directive (RED III) and aggressive national subsidies for solar, wind, and storage deployments. Technical standards such as Germany’s VDE-AR-E 2100-712, the UK’s BS 7671 (IET Wiring Regulations), and the harmonized IEC 63027 standard provide clear, stringent guidelines for arc fault protection in DC systems, creating a predictable regulatory environment for manufacturers and installers. Europe's dual challenge of modernizing aging building stock while constructing new Nearly Zero Energy Buildings (NZEB) under the Energy Performance of Buildings Directive (EPBD) generates consistent demand for upgraded electrical safety components, including AFCIs.

Substantial public funding accelerates market maturity. Programs under the European Green Deal, the Innovation Fund, and Horizon Europe directly and indirectly support the development and deployment of next-generation smart AFCI devices, grid-interactive safety systems, and IoT-based preventive maintenance platforms. The region's industrial and manufacturing base is actively deploying cloud-monitored protection relays, 5G-connected intelligent distribution boards, and AI-enhanced diagnostic suites for large-scale renewable assets. With its combination of strong regulatory enforcement, high consumer and industrial awareness of quality and safety, and strategic investments in a digitalized, decarbonized energy system, Europe stands as one of the most advanced and steadily growing regional markets for DC AFCI technology.

The Japan Direct Current Arc Fault Circuit Interrupter Market

The Japan Direct Current Arc Fault Circuit Interrupter Market is anticipated to be valued at approximately USD 48 million in 2025 and is expected to attain nearly USD 280 million by 2034, expanding at a CAGR of about 21.5% during the forecast period. Japan's distinctive market dynamics are shaped by its acute focus on energy security and independence, a national imperative for resilience against frequent earthquakes and natural disasters, and strategic government promotion of next-generation mobility and hydrogen economy ecosystems.

The Ministry of Economy, Trade and Industry (METI) plays a central role, actively fostering safety innovation through Japan Electrical Safety & Environment Technology Laboratories (JET) certification mandates and direct subsidies for PV system upgrades, residential storage (e.g., ENE-FARM), and EV charging infrastructure. Japan's world-class expertise in precision power electronics, semiconductor manufacturing, and robotics provides a formidable foundation for domestic innovation, leading to advancements in high-density AFCI modules, all-solid-state interrupters, and multi-channel, centralized monitoring systems for large facilities.

The national "Society 5.0" vision, championed by industrial leaders like Panasonic, Toshiba, and Fuji Electric, seeks to deeply integrate cyber-physical systems. This drives the convergence of IoT-enabled AFCI safety devices with smart city energy grids, building automation, and vehicle-to-grid (V2G) networks. Urban centers are piloting AFCI-protected ultra-fast EV charging hubs and building-integrated photovoltaics (BIPV), while remote and island communities rely on DC AFCI technology within off-grid solar-diesel-storage hybrid systems critical for disaster preparedness and energy independence. Japan's deeply ingrained culture of precision engineering, meticulous maintenance, and preventive risk management, coupled with its technological prowess and unique demographic and geographic challenges, positions it as a high-growth, high-innovation niche within the global DC AFCI landscape.

Global Direct Current Arc Fault Circuit Interrupter Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global DC AFCI Market is expected to be valued at USD 2,571.6 million in 2025 and is projected to reach USD 15,135.3 million by 2034, showcasing rapid expansion underpinned by the irreversible global shift to DC-powered renewable energy and transportation infrastructures.

- High CAGR Driven by Clean Energy Transition: The market is projected to grow at an impressive CAGR of 21.8% from 2025 to 2034, fueled by accelerated global solar PV deployment, exponential EV adoption, proliferating grid-scale and behind-the-meter battery storage, and the deepening integration of AI into fault detection and diagnostics.

- Strong Growth Trajectory in the United States: The U.S. DC AFCI Market stands at USD 828.3 million in 2025 and is projected to reach USD 4,417.0 million by 2034, expanding at a CAGR of 20.4%, a growth story fundamentally anchored in robust NEC mandates and the deep integration of safety devices into the national renewable energy project pipeline.

- North America Maintains Regional Dominance: North America is expected to capture approximately 38.5% of the global market share in 2025, supported by its first-mover regulatory advantage, high penetration rates of rooftop and utility solar, early adoption of AI in grid-edge safety, and the dominant presence of global electrical equipment manufacturers.

- Rapid Advancement in AFCI Technologies: Continuous innovations, including AI/ML-based arc signature recognition, ultra-fast wide-bandgap semiconductor (SiC/GaN) switching, wireless mesh networking for precise fault location, and seamless integration with digital twin platforms, are significantly enhancing the speed, intelligence, reliability, and value proposition of DC arc fault protection systems.

- Growing Emphasis on Fire Safety and System Reliability Boosts Adoption: The rising global installation of DC power systems across residential, commercial, industrial, and utility settings coupled with heightened awareness of arc fault fire risks among insurers, regulators, and system owners is driving sustained, code-compliant demand for advanced protection solutions to ensure asset longevity and public safety.

Global Direct Current Arc Fault Circuit Interrupter Market: Use Cases

- Solar PV Array Protection: DC AFCIs are integrally deployed within solar combiner boxes, string inverters, and power optimizers to continuously monitor for series and parallel arc faults in PV string wiring and module connections, preventing ignition events and minimizing system downtime and maintenance costs.

- EV Charging Station Safety: Dedicated AFCI protection circuits are embedded within DC fast-charging (DCFC) station cabinets and charging gun assemblies to safeguard against high-energy arcing in 400V-800V+ battery connections, charging cables, and internal buswork, ensuring user safety and protecting expensive charging infrastructure.

- Battery Energy Storage Systems (BESS): AFCI devices are critical safety components monitoring DC busbars, cell interconnections, and main disconnects within lithium-ion, flow, and other stationary battery racks. They provide rapid fault interruption to prevent a single cell failure from cascading into thermal runaway and a major fire event.

- Data Center Power Distribution: Applied in modern 380V/400V DC power distribution units (PDUs) and server racks within hyperscale and enterprise data centers, AFCIs protect critical IT load from arc faults, enhancing the overall fire safety and electrical resilience of mission-critical digital infrastructure.

- Microgrid and Off-Grid Systems: DC AFCIs are essential in islanded microgrids and remote off-grid installations that utilize solar, wind, and battery storage. They protect decentralized, often unattended power networks in communities, telecom towers, and agricultural operations, ensuring reliable and safe operation in locations with limited emergency response.

Global Direct Current Arc Fault Circuit Interrupter Market: Stats & Facts

U.S. Consumer Product Safety Commission (CPSC)

- The CPSC estimates that more than 50% of electrical fires in homes could be prevented with proper Arc Fault Circuit Interrupter (AFCI) protection.

- The CPSC formally defines an AFCI as a device designed to mitigate fire hazards caused by arcing faults in electrical wiring systems.

- The CPSC identifies arc faults as a leading ignition source in residential electrical fires.

National Fire Protection Association (NFPA)

- Electrical failures or malfunctions account for approximately 13% of all U.S. home structure fires.

- Electrical failure is the second leading cause of residential fires in the United States.

- Fires caused by electrical failure result in hundreds of civilian deaths annually.

- Electrical fires lead to over one billion dollars in property damage per year in the U.S.

- Arcing is identified as the heat source in nearly 60% of electrical fires caused by wiring or equipment failures.

- Homes built before modern electrical codes face a higher electrical fire risk due to outdated wiring practices.

U.S. Fire Administration (USFA – FEMA)

- U.S. fire departments respond to over 340,000 residential building fires annually.

- Electrical malfunction is consistently ranked among the top causes of residential fires nationwide.

- The U.S. Fire Administration reports that electrical fires cause thousands of injuries each year.

- Fire incident data used by USFA comes from more than 23,000 fire departments nationwide.

National Fire Incident Reporting System (NFIRS)

- NFIRS is the largest fire incident database in the world, collecting standardized fire data.

- NFIRS tracks electrical ignition sources, arc faults, casualties, and property loss.

- NFIRS data is used by federal and state agencies to shape electrical safety regulations.

Electrical Safety Foundation International (ESFI)

- ESFI reports that arcing faults are a primary contributor to residential electrical fires.

- ESFI states that AFCIs are designed to detect dangerous arc conditions standard breakers cannot.

- In contractor surveys, over half of electrical service calls involve tripped breakers or blown fuses.

- AFCI breakers account for a significant share of breaker trips in residential systems.

- The majority of electricians surveyed observed visible evidence of dangerous arcing during AFCI-related service calls.

National Electrical Code (NEC)

- The NEC is updated every three years to address evolving electrical fire hazards.

- AFCI requirements have expanded steadily since their introduction in the NEC.

- AFCI protection is required in most living areas of new residential construction.

- Many U.S. states legally enforce NEC AFCI requirements through building codes.

State Electrical Safety Agencies / U.S. Code Adoption Bodies

- AFCI breakers cost significantly more than standard breakers, but represent a small fraction of total home construction cost.

- Government safety agencies report that AFCI installation adds less than 0.2% to the cost of a new home.

Global Direct Current Arc Fault Circuit Interrupter Market: Market Dynamic

Driving Factors in the Global Direct Current Arc Fault Circuit Interrupter Market

Rising Global Deployment of DC Power Infrastructures

The most powerful driver is the exponential growth of distributed energy resources (DERs), primarily solar photovoltaic (PV) systems and stationary battery storage, alongside the revolutionary expansion of electric vehicle (EV) fleets and their associated DC fast-charging infrastructure. This is compounded by the increasing adoption of efficient DC microgrids for commercial campuses, data centers, and remote communities, and the gradual shift towards low-voltage DC (LVDC) power distribution within buildings. This proliferation of DC systems at all scales creates a vast and growing addressable market for specialized protective devices like AFCIs to mitigate their unique arc fault risks.

Stringent and Evolving Safety Regulations & Building Codes

The market is fundamentally shaped by a global wave of regulatory updates and code mandates. Key standards-setting bodies, including the NFPA (publishing the NEC in the US), the International Electrotechnical Commission (IEC), and regional authorities like Europe's CENELEC and Germany's VDE, have introduced or are strengthening explicit requirements for arc fault circuit interruption in DC installations, particularly for PV systems. This compliance-driven demand ensures that AFCIs are no longer optional but a required component in system design, permitting, and inspection for new installations and major retrofits, providing a powerful, non-cyclical growth foundation.

Restraints in the Global Direct Current Arc Fault Circuit Interrupter Market

High Initial Cost and System Integration Complexity

The advanced sensing, processing, and ultra-fast switching technology embedded in high-performance DC AFCIs results in a significantly higher per-unit cost compared to traditional overcurrent protection devices like fuses or standard circuit breakers. This cost premium can be a substantial barrier, especially for large-scale utility projects with thin margins or in highly price-sensitive emerging markets. Furthermore, the technical complexity of correctly specifying, installing, calibrating, and integrating AFCI devices with existing inverter controls, monitoring systems, and building management networks often requires specialized skilled labor, increasing the total installed cost and creating a adoption hurdle.

Lack of Global Standardization and Persistent Technical Challenges

While safety standards are evolving, significant heterogeneity exists across different regions and applications regarding required detection sensitivity, testing and certification protocols, and performance validation methods. This fragmentation complicates product development, certification, and market entry for manufacturers aiming for a global footprint. From a technical standpoint, reliably discriminating between a hazardous arc fault (series or parallel) and benign but similar electrical signatures such as those from inverter switching, motor commutation (e.g., in HVAC), or conducted electromagnetic interference (EMI) remains an engineering challenge. Inadequate discrimination can lead to nuisance tripping, which erodes end-user confidence, increases operational costs, and can compromise system reliability.

Opportunities in the Global Direct Current Arc Fault Circuit Interrupter Market

Deep Integration with Smart Grids, IoT, and Digital Twin Platforms

The ongoing digital transformation of energy infrastructure presents a transformative opportunity. DC AFCIs can evolve from standalone protective devices into intelligent, networked sensor nodes within a broader IoT ecosystem. By streaming real-time and historical operational data, they can contribute to predictive grid health analytics, enable condition-based maintenance, and integrate with building automation systems (BAS) and utility supervisory control and data acquisition (SCADA) systems. This creates lucrative value-added service models, such as safety-as-a-service subscriptions, cyber-physical security enhancements, and performance optimization insights, opening new revenue streams beyond hardware sales.

Massive Expansion in Emerging Economies with Greenfield Renewable Projects

Emerging economies across Asia-Pacific (e.g., India, Vietnam, Indonesia), Latin America (e.g., Brazil, Chile), and Africa (e.g., South Africa, Kenya) are launching ambitious, large-scale renewable energy projects, often supported by international development banks and climate finance that mandate adherence to high safety standards. These regions represent vast greenfield opportunities for DC AFCI adoption, largely unencumbered by the challenges of retrofitting legacy systems. Strategic partnerships with local electrical distributors, Engineering-Procurement-Construction (EPC) contractors, and government agencies, coupled with the development of cost-optimized, modular AFCI designs suitable for these markets, can unlock tremendous growth potential.

Trends in the Global Direct Current Arc Fault Circuit Interrupter Market

AI-Enhanced Arc Fault Detection, Diagnostics, and Prognostics

Artificial Intelligence, particularly machine learning (ML), is revolutionizing the core functionality of AFCIs. ML algorithms are trained on massive, curated datasets of current and voltage waveforms to achieve unprecedented accuracy in arc signature recognition. This trend dramatically reduces false positives, enables the classification of fault type and probable cause, and even allows for predictive analytics by identifying subtle pre-fault signatures indicative of deteriorating connections or insulation. This evolution shifts the device's role from a simple safety switch to an intelligent system health monitor.

Solid-State Circuit Interruption and Pervasive Miniaturization

A pivotal technological trend is the transition from traditional electromechanical relays and contactors to silicon carbide (SiC) and gallium nitride (GaN) semiconductor-based solid-state power switches. This enables arc quenching in microseconds (vastly faster than mechanical devices), reduces physical size and heat generation, and increases operational lifespan. This miniaturization is crucial for the trend of pervasive protection, allowing AFCI functionality to be embedded directly into PV modules (as part of module-level power electronics - MLPE), EV battery pack disconnect units, charging gun handles, and individual battery cell monitoring boards, placing protection at the very point of potential failure.

Global Direct Current Arc Fault Circuit Interrupter Market: Research Scope and Analysis

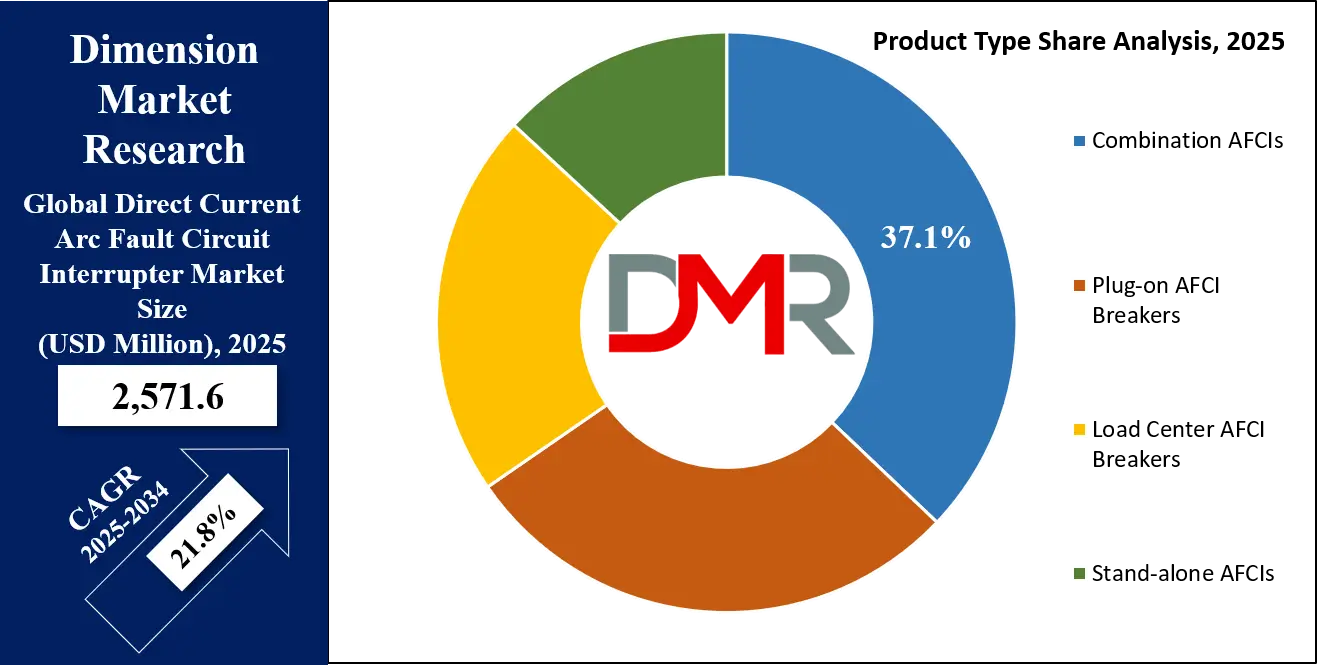

By Product Type Analysis

Combination AFCIs dominate the global DC Arc Fault Circuit Interrupter market due to their advanced capability to detect both series and parallel arc faults, which are common in high-voltage and high-risk DC environments. These devices are particularly critical in applications such as solar photovoltaic (PV) systems, electric vehicle (EV) charging infrastructure, and energy storage systems, where sustained DC arcs pose significant fire hazards. Regulatory emphasis on comprehensive arc-fault protection and the increasing complexity of DC electrical networks have further accelerated the adoption of combination AFCIs. Their ability to provide enhanced safety, reduce fire incidents, and meet stringent international electrical standards positions them as the preferred choice across commercial and industrial installations.

Plug-on AFCI breakers represent the second-largest segment, primarily driven by their ease of installation, reduced labor costs, and suitability for retrofit applications. These breakers are widely adopted in residential and light commercial settings, particularly in regions experiencing rapid rooftop solar deployment. Load center AFCI breakers maintain steady demand in new construction projects, while stand-alone AFCIs are increasingly used in specialized applications where flexible installation and system customization are required. Overall, product innovation, safety compliance, and expanding DC infrastructure continue to reinforce the dominance of combination AFCIs within this segment.

By Voltage Rating Analysis

The 121V–240V DC segment holds the largest share of the global DC AFCI market, supported by its widespread use in residential and commercial solar PV installations, EV charging stations, and low- to mid-voltage DC distribution systems. This voltage range aligns with standard operating requirements for rooftop solar arrays, commercial buildings, and public EV charging infrastructure, making it the most commonly deployed category. Growing urban electrification, renewable energy integration, and supportive government policies have further strengthened demand within this segment.

The above 240V DC segment is the fastest-growing voltage category, driven by the rapid expansion of utility-scale solar power plants, large energy storage systems, and industrial DC applications. High-voltage DC systems present increased arc-fault risks, necessitating advanced AFCI solutions capable of handling higher power loads safely. Technological advancements in power electronics and the shift toward high-capacity DC architectures in data centers and industrial automation are also contributing to growth. Meanwhile, the up to 120V DC segment continues to serve niche residential and low-power applications. Overall, rising adoption of high-voltage DC systems is expected to significantly influence future market dynamics.

By Installation Type Analysis

Panel-mounted AFCIs dominate the installation-type segment due to their standardized integration into electrical distribution panels and widespread acceptance across residential, commercial, and industrial settings. These systems offer centralized protection, ease of maintenance, and compliance with established electrical safety codes, making them the preferred choice for permanent installations. Panel-mounted AFCIs are extensively deployed in solar inverters, commercial buildings, and industrial control panels, where reliability and regulatory compliance are critical.

In-line and embedded AFCIs are gaining increasing traction as DC systems become more modular and application-specific. These solutions are particularly well-suited for EV charging cables, portable energy storage systems, telecommunications power supplies, and distributed DC architectures. Their compact design and flexibility allow them to be embedded directly into equipment or wiring systems, enhancing localized protection and system efficiency. Technological advancements and the growing adoption of plug-and-play DC solutions are further supporting this trend. While panel-mounted AFCIs continue to dominate overall market share, the rising demand for compact, application-oriented protection solutions is expected to drive strong growth in the in-line and embedded segment.

By Current Rating Analysis

The 16–30 amperes segment leads the global DC AFCI market, reflecting its widespread use in residential solar installations, EV charging systems, and small commercial DC applications. This current range aligns with typical operating requirements for rooftop solar arrays and Level 2 EV chargers, making it the most commonly deployed category. Increased adoption of distributed energy resources and residential electrification initiatives have further reinforced demand in this segment.

The above 60 amperes segment is witnessing rapid growth, driven by expanding industrial energy storage systems, data centers, and high-capacity EV charging infrastructure. These applications require robust AFCI solutions capable of managing higher current loads while ensuring safety and reliability. The 31–60 amperes segment also shows steady growth, supported by medium-scale commercial and industrial DC systems. Meanwhile, the up to 15 amperes category continues to serve low-power residential and specialized applications. Overall, increasing power density in DC systems and the rise of high-current industrial applications are reshaping demand across current rating segments.

By Application Analysis

Solar photovoltaic (PV) systems represent the dominant application segment in the global DC AFCI market, driven by the rapid expansion of renewable energy installations worldwide. DC arc faults pose significant fire risks in PV systems due to long cable runs and high exposure to environmental factors, making AFCIs essential for compliance with safety regulations. Government incentives, renewable energy targets, and strict fire-safety standards continue to support strong adoption in this segment.

Electric vehicle (EV) charging infrastructure is the fastest-growing application, fueled by global electrification policies, rising EV adoption, and expanding charging networks. High-power DC fast chargers, in particular, require advanced arc-fault protection solutions to ensure operational safety. Data centers, energy storage systems, and telecommunications applications also contribute significantly, as these sectors increasingly rely on DC power architectures for efficiency and reliability. Collectively, the diversification of DC applications is driving sustained growth across the market.

By End-User Analysis

The commercial segment dominates the global DC AFCI market, supported by widespread deployment across office buildings, data centers, EV fleet charging facilities, and telecommunications infrastructure. Commercial users prioritize safety, system reliability, and regulatory compliance, driving consistent investment in advanced AFCI solutions. The increasing adoption of DC microgrids and renewable energy systems in commercial buildings further strengthens this segment’s position.

Industrial end-users represent a growing share of the market, driven by large-scale solar installations, energy storage facilities, and industrial automation systems. These applications require high-capacity, durable AFCIs capable of operating in demanding environments. Residential adoption remains steady, primarily driven by rooftop solar installations and home EV charging systems. While residential systems typically operate at lower voltages and currents, growing awareness of electrical safety and renewable energy integration continues to support demand. Overall, commercial end-users remain the primary revenue contributors, with industrial adoption accelerating rapidly.

The Global Direct Current Arc Fault Circuit Interrupter Market Report is segmented on the basis of the following:

By Product Type

- Combination AFCIs

- Plug-on AFCI Breakers

- Load Center AFCI Breakers

- Stand-alone AFCIs

By Voltage Rating

- Up to 120V DC

- 121V–240V DC

- Above 240V DC

By Installation Type

- Panel-Mounted AFCIs

- In-Line / Embedded AFCIs

By Current Rating

- Up to 15 Amperes

- 16–30 Amperes

- 31–60 Amperes

- Above 60 Amperes

By Application

- Solar Photovoltaic (PV) Systems

- Electric Vehicle (EV) Charging Infrastructure

- Data Centers

- Energy Storage Systems (ESS)

- Telecommunications

By End-User

- Residential

- Commercial

- Industrial

Impact of Artificial Intelligence in the Global Direct Current Arc Fault Circuit Interrupter Market

- AI for Precise Arc Signature Recognition and Discrimination: Advanced AI algorithms perform real-time, multi-dimensional analysis of current and voltage waveforms to accurately distinguish the unique "fingerprint" of a hazardous arc fault from benign but similar electrical noise generated by inverter switching, motor loads, or electromagnetic interference, drastically reducing nuisance tripping and improving system availability.

- Predictive Fault Analytics and Condition Monitoring: Machine learning models process streams of historical operational data from fleets of protected systems to identify subtle patterns and anomalies indicative of incipient failures, such as corroding connectors, loosening terminals, or degrading insulation. This enables a shift from reactive protection to predictive, scheduled maintenance, preventing faults before they occur.

- Adaptive and Self-Learning Trip Thresholds: AI-enabled AFCIs can continuously learn the unique electrical "background noise" and normal operational signatures of the specific circuit they protect. This allows for dynamic, context-aware adjustment of detection sensitivity thresholds, optimizing performance for the unique environment of each installation (e.g., a noisy industrial setting vs. a quiet residential rooftop).

- Automated Fault Localization, Classification, and Reporting: Upon arc detection, AI can analyze signal propagation characteristics and other sensor data to pinpoint the physical location of the fault within a long PV string or complex DC busbar system. It can then classify the fault type and automatically generate detailed diagnostic reports for maintenance crews, dramatically reducing Mean Time To Repair (MTTR).

- Enhanced Cybersecurity for Critical Infrastructure: AI algorithms can be employed to differentiate between a genuine physical arc fault and a sophisticated cyber-physical attack designed to spoof fault signals and trigger a malicious shutdown of critical power infrastructure. This adds a vital layer of grid security and resilience to the core physical safety function of the AFCI.

Global Direct Current Arc Fault Circuit Interrupter Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global DC AFCI Market, capturing an estimated 38.5% of the total market share by the end of 2025. This leadership position is the direct result of a first-mover regulatory advantage established through the NEC, which created a large, compliance-driven market years ahead of other regions. The continent hosts the world's most mature utility-scale solar market and a vast, growing base of residential and commercial PV installations, all of which must adhere to AFCI mandates.

The strong presence of global electrical equipment giants (Siemens, Eaton, Schneider, ABB) and innovative solar technology firms (SolarEdge, Enphase) within the region fosters a competitive and advanced ecosystem. Financial mechanisms like the federal Investment Tax Credit (ITC) and various state-level incentives often implicitly require code compliance, further cementing AFCI adoption. Growing utility focus on wildfire mitigation and grid modernization also positions advanced electrical safety devices as a strategic priority.

Region with the Highest CAGR

Asia-Pacific (APAC) is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period and is poised to become the largest market in terms of volume and, eventually, value. This explosive growth is fueled by the region's unmatched scale and pace of renewable energy additions, particularly in China, India, Japan, and Australia. APAC accounts for over 70% of global solar panel manufacturing and a majority of new installations.

Governments across the region are rapidly modernizing their national electrical safety codes to align with international best practices (IEC standards), creating a powerful wave of new regulatory demand. While initial cost sensitivity is higher, the sheer volume of projects, coupled with government quality certification programs (e.g., India's Approved List of Models and Manufacturers - ALMM) and export requirements for systems destined for Western markets, is driving rapid and widespread AFCI adoption. The relative shortage of highly skilled electrical technicians in some APAC countries also favors the adoption of intelligent, self-diagnosing protection devices that simplify installation and maintenance.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Direct Current Arc Fault Circuit Interrupter Market: Competitive Landscape

The Global DC AFCI Market exhibits a moderately fragmented competitive structure, characterized by the presence of long-established multinational electrical equipment conglomerates, specialized protection and power electronics manufacturers, and a growing cohort of innovative semiconductor and AI software startups. The market leaders, including Siemens AG, ABB Ltd., Schneider Electric SE, and Eaton Corporation plc, leverage their unparalleled brand recognition, extensive global distribution and service networks, and deep integration capabilities to offer DC AFCI solutions as part of broader portfolios encompassing solar combiners, switchgear, EV charging stations, and building management systems.

A highly influential layer of competition comes from solar-specific power electronics specialists such as SMA Solar Technology AG, SolarEdge Technologies Inc., and Enphase Energy, Inc.. These companies are critical innovators, often embedding AFCI functionality directly into their core products inverters, power optimizers, and rapid shutdown devices creating tightly integrated, system-level safety solutions that are particularly dominant in the residential and commercial solar segments. Companies like Littelfuse, Inc. play a key role as suppliers of specialized protection components and modules to these OEMs.

Some of the prominent players in the Global Direct Current Arc Fault Circuit Interrupter Market are:

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation plc

- SMA Solar Technology AG

- SolarEdge Technologies Inc.

- Enphase Energy, Inc.

- Littelfuse, Inc.

- Carling Technologies, Inc.

- Mersen S.A.

- Zhejiang Zhengyuan Electric Co., Ltd.

- Senseye Inc. (specializing in Arc Fault Detection)

- E-T-A Circuit Breakers

- Arc Suppression Technologies

- General Electric (GE)

- Mitsubishi Electric Corporation

- Legrand

- Hubbell Incorporated

- Nader

- CHINT Group

- Other Key Players

Recent Developments in the Global Direct Current Arc Fault Circuit Interrupter Market

- November 2025: Siemens introduced its next-generation Sentron 5ML series of AI-optimized DC AFCIs for commercial and industrial applications. The platform features integrated cloud connectivity for remote diagnostics, predictive fault trend analysis, and seamless data integration with building and energy management systems, establishing a new benchmark for intelligent electrical safety.

- October 2025: The NFPA released committee drafts for the 2026 National Electrical Code (NEC), which propose extending DC arc fault protection requirements to include mandatory retrofits on existing large-scale PV systems over a certain age/size and introduce clearer, stricter standards for arc fault detection in battery storage systems exceeding 100kWh capacity, signaling continued regulatory expansion.

- September 2025: SolarEdge announced the finalization of its acquisition of ArcSense, a pioneer in machine learning algorithms for electrical arc signature analysis. The strategic move aims to deeply integrate ArcSense's AI technology into future generations of SolarEdge's power optimizers and inverters, enhancing native, system-level safety intelligence and reliability.

- August 2025: Underwriters Laboratories (UL) launched a new certification extension under UL 1699C specifically designed to evaluate and validate the performance, reliability, and cybersecurity of AI-enhanced Arc Fault Circuit Interrupters. This provides a crucial industry benchmark and quality assurance for the next wave of smart protection devices.

- March 2025: The Standardization Administration of China (SAC) circulated a draft of new national standard GB/T XXXXX, which will mandate arc fault detection and interruption devices for all new grid-connected photovoltaic power systems above a specified capacity (e.g., 10kW), aligning with international practices and poised to unlock massive domestic market demand upon finalization.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,571.6 Mn |

| Forecast Value (2034) |

USD 15,135.3 Mn |

| CAGR (2025–2034) |

21.8% |

| The US Market Size (2025) |

USD 828.3 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Plug-on AFCI Breakers, Load Center AFCI Breakers, Stand-alone AFCIs, Combination AFCIs), By Voltage Rating (Up to 120V DC, 121V–240V DC, Above 240V DC), By Installation Type (Panel-Mounted AFCIs, In-Line / Embedded AFCIs), By Current Rating (Up to 15 Amperes, 16–30 Amperes, 31–60 Amperes, Above 60 Amperes), By Application (Solar Photovoltaic (PV) Systems, Electric Vehicle (EV) Charging Infrastructure, Data Centers, Energy Storage Systems (ESS), Telecommunications), By End-User (Residential, Commercial, Industrial) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens AG, ABB Ltd., Schneider Electric SE, Eaton Corporation plc, SMA Solar Technology AG, SolarEdge Technologies Inc., Enphase Energy, Inc., Littelfuse, Inc., Carling Technologies, Inc., Mersen S.A., Zhejiang Zhengyuan Electric Co., Ltd., Senseye Inc. (specializing in Arc Fault Detection), E-T-A Circuit Breakers, Arc Suppression Technologies, General Electric (GE), Mitsubishi Electric Corporation, Legrand, Hubbell Incorporated, Nader, CHINT Group, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Direct Current Arc Fault Circuit Interrupter (DC AFCI) Market size is estimated to have a value of USD 2,571.6 million in 2025 and is expected to reach USD 15,135.3 million by the end of 2034.

The market is growing at a Compound Annual Growth Rate (CAGR) of 21.8 percent over the forecasted period from 2025 to 2034.

The US DC AFCI Market is projected to be valued at USD 828.3 million in 2025. It is expected to witness subsequent growth, reaching USD 4,417.0 million in 2034, expanding at a CAGR of 20.4%.

North America is expected to have the largest market share in the Global DC AFCI Market with a share of about 38.5% in 2025.

Some of the major key players in the Global DC AFCI Market are Siemens AG, ABB Ltd., Schneider Electric SE, Eaton Corporation plc, SMA Solar Technology AG, SolarEdge Technologies Inc., and many others.