Market Overview

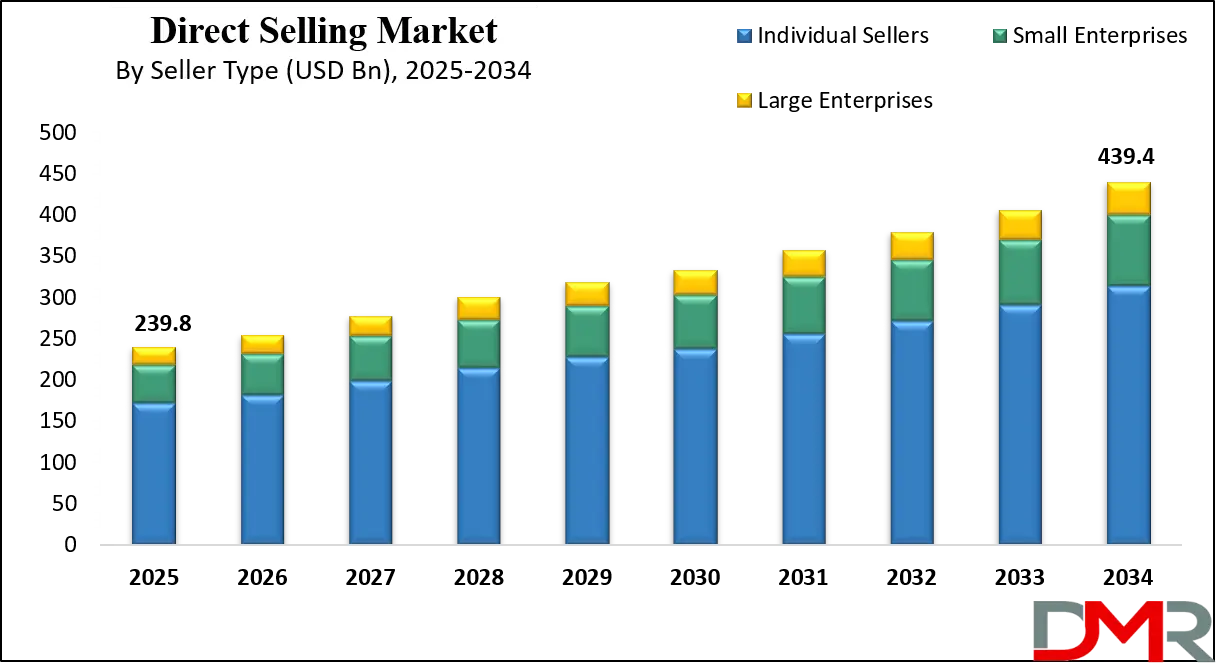

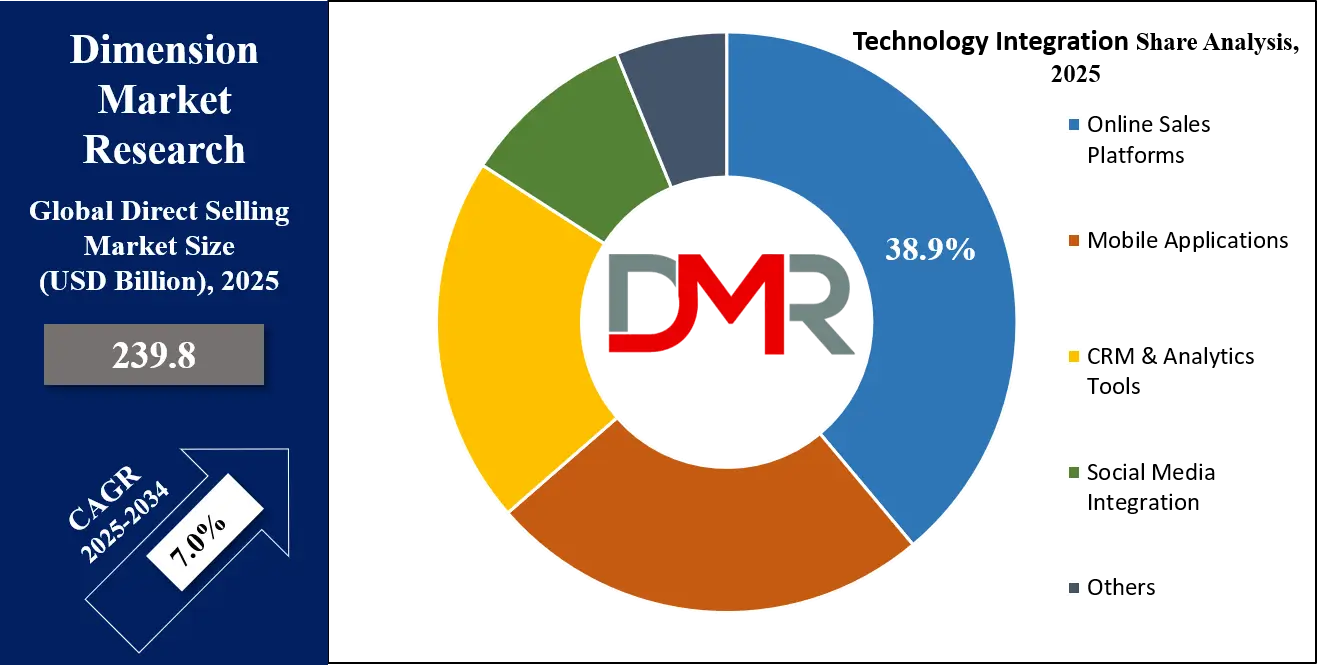

The Global Direct Selling Market size is projected to reach USD 239.8 billion in 2025 and grow at compound annual growth rate of 7.0% from there until 2034 to reach a value of USD 439.4 billion.

Direct selling is a method of marketing and selling products directly to consumers away from a fixed retail location. Instead of shopping in stores or online platforms, people buy from sellers who present products personally, usually through in-home demonstrations, catalogues, or online social networks. This approach allows for a personal connection between the seller and the buyer, often resulting in more trust and better customer service.

In recent years, direct selling has experienced steady growth due to changing consumer preferences. Many buyers now value convenience and personalization over traditional shopping experiences. With more people working from home and spending time online, direct selling has adapted to include virtual parties and social media outreach. This shift makes it easier for sellers to reach larger audiences without face-to-face interaction. The rise of mobile apps and

digital payment systems has further supported this growth.

One of the biggest drivers of demand is the increasing number of people looking for flexible income opportunities. Direct selling often appeals to individuals who want to earn part-time income or start a small business without needing large investments. It provides flexibility, especially for stay-at-home parents, students, and retirees. Sellers can work around their own schedule, which is especially attractive during uncertain economic times when job security is not guaranteed.

The market has also seen growing interest in wellness, personal care, and eco-friendly products—segments where direct selling companies often perform well. Sellers can build personal brands and form loyal customer bases by offering products they genuinely use and believe in. This personal touch often leads to stronger word-of-mouth promotion and repeat purchases.

Key industry events over the past few years include the shift from traditional face-to-face methods to online and hybrid selling, especially during the pandemic. Many companies trained their salesforce to use video calls, live streaming, and social platforms like Instagram and WhatsApp for product demonstrations. As a result, digital skills have become just as important as communication and sales techniques in this field.

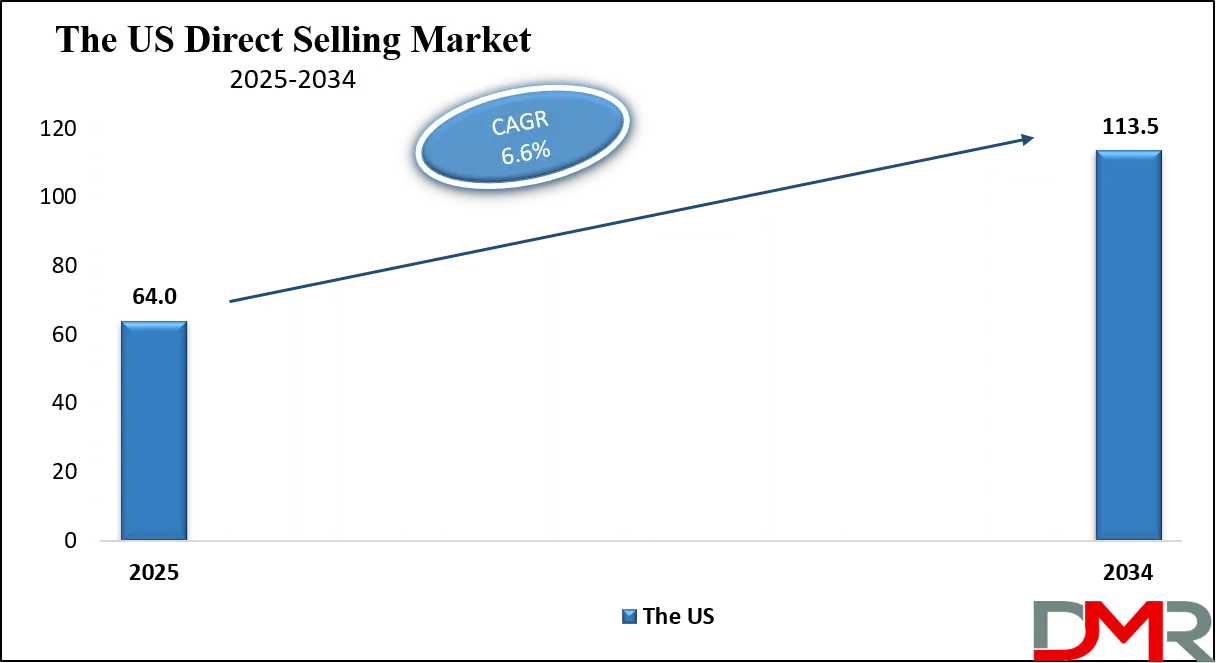

The US Direct Selling Market

The US Direct Selling Market size is projected to reach USD 64.0 billion in 2025 at a compound annual growth rate of 6.6% over its forecast period.

The US plays a leading role in the global direct selling market, both in terms of size and innovation. It serves as a key hub for major companies, product development, and training programs. The US has a strong culture of entrepreneurship, which supports a large and active base of independent sellers across various categories like wellness, beauty, and home care.

Advanced digital infrastructure in the US allows sellers to adopt online tools, apps, and social media quickly, enhancing customer outreach. The market also benefits from supportive legal frameworks and consumer awareness, which help maintain trust and transparency. With its mature structure and constant innovation, the US continues to shape global trends and drive overall market expansion in direct selling.

Europe Direct Selling Market

Europe Direct Selling Market size is projected to reach USD 57.6 billion in 2025 at a compound annual growth rate of 6.7% over its forecast period.

Europe holds a strong and stable position in the global direct selling market, driven by a mix of tradition, regulation, and evolving consumer preferences. Many European countries have a long history of direct selling, especially in wellness, cosmetics, and household products. The region benefits from well-established networks of independent sellers and a strong emphasis on ethical business practices.

European consumers value quality, sustainability, and trust, making it ideal for personalized and relationship-based selling. Strict regulatory standards in Europe also encourage transparency and protect consumer rights, boosting confidence in the model. With rising interest in flexible work and eco-friendly products, Europe continues to see steady growth, with both established markets and emerging Eastern European countries contributing to its overall expansion.

Japan Direct Selling Market

Japan Direct Selling Market size is projected to reach USD 12.0 billion in 2025 at a compound annual growth rate of 6.8% over its forecast period.

Japan holds a key position in the direct selling market, especially within the Asia-Pacific region. The country has a well-established and mature direct selling culture, primarily driven by strong demand for wellness and beauty products. A large network of independent distributors, many of whom are women, supports this industry and contributes to its steady performance.

Japanese consumers value product quality, trust, and personal service, which aligns well with the direct selling model. The market also benefits from clear regulations and industry support, promoting transparency and consumer protection. In recent years, there has been a shift toward online and hybrid sales methods, alongside a gradual return to face-to-face selling. Japan continues to offer stable growth opportunities through innovation and evolving consumer preferences.

Direct Selling Market: Key Takeaways

- Market Growth: The Direct Selling Market size is expected to grow by USD 193.6 billion, at a CAGR of 7.0%, during the forecasted period of 2026 to 2034.

- By Seller Type: The Individual Seller is anticipated to get the majority share of the Direct Selling Market in 2025.

- By Technology Integration: Online Sales Platforms segment is expected to get the largest revenue share in 2025 in the Direct Selling Market.

- Regional Insight: Asia Pacific is expected to hold a 44.1% share of revenue in the Global Direct Selling Market in 2025.

- Use Cases: Some of the use cases of Direct Selling include flexible income opportunities, low-cost business start-up, and more.

Direct Selling Market: Use Cases

- Flexible Income Opportunities: Direct selling allows individuals to earn extra income by selling products directly to customers. This is especially useful for students, homemakers, or retirees who need flexible work hours. People can start with minimal investment and scale up as they gain experience.

- Personalized Customer Experience: Customers often get personalized service through direct sellers who understand their preferences. Recommendations are tailored, and product explanations are clear and interactive. This personal connection increases trust and often leads to long-term customer relationships.

- Low-Cost Business Start-Up: Direct selling offers a simple way to start a business without needing a storefront or a large inventory. Most companies provide marketing tools, training, and product samples. This makes it easier for individuals with limited resources to become entrepreneurs.

- Expansion Through Social Media: Social platforms have transformed direct selling by enabling sellers to host virtual parties, showcase products live, and connect with more people. It helps reach wider audiences quickly and efficiently. This digital shift makes selling easier and more scalable than ever before.

Stats & Facts

- According to the U.S. Direct Selling Association (DSA):

- Retail sales through direct selling in the U.S. reached USD 36.7 billion in 2023, showing the continued strength of the model in a mature market.

- The channel served 37.7 million customers in 2023, proving that consumer interest in personalized, direct buying experiences remains high.

- The number of active direct sellers declined slightly from the previous year, settling at 6.1 million, reflecting some shifts in participation levels.

- Growth & Outlook Survey is audited by Nathan Associates, ensuring third-party credibility for DSA’s reporting on market size and structure.

- As per Electro IQ:

- Approximately 84% of people who join network marketing do it part-time, favoring the low-risk, flexible nature of the opportunity.

- The U.S. segment alone contributes USD 200 billion to the market, placing it at the forefront globally.

- Most network marketers—about 96%—fall between the ages of 25 and 54, showing the appeal among working-age adults.

- Over 20 million people in the U.S. have either participated in or explored multi-level marketing at some point, suggesting widespread national exposure.

- A large portion of individuals—roughly one-third—begin their MLM journey through a friend, emphasizing the community-based entry mechanism.

- According to Network Marketing Industry Statistics:

- Around 73% of direct sellers are women, highlighting the industry’s strong connection to female entrepreneurship and flexibility.

- The average yearly income of a network marketer is about USD 2,400, showing that many use it as a supplementary earning method.

- Roughly 25% of MLM participants actually make a profit, reflecting the competitive and effort-based nature of income generation.

- The top 1% of performers earn around $65,000 annually, showcasing the potential of high rewards for committed and skilled sellers.

- About 20% of network marketers earn over USD 100,000 per year, proving that the model can be financially rewarding for a focused few.

- Over 20% of participants have a college degree, suggesting educational diversity among those engaged in the sector.

- 67% of network marketers report being satisfied with their jobs, indicating positive perceptions and personal fulfillment.

- Nearly 89% of top salespeople believe social media is critical to closing deals, reflecting the growing role of digital selling in direct sales today.

- More than 60% of marketers work in the beauty and personal care space, showing the dominance of this segment within the network marketing model.

Market Dynamic

Driving Factors in the Direct Selling Market

Rising Demand for Flexible and Supplementary Income

One of the biggest drivers of growth in the direct selling market is the increasing desire for flexible and part-time income opportunities. In many regions, individuals are seeking ways to earn money without committing to full-time jobs, especially students, homemakers, and retirees. Direct selling provides a low-barrier entry point where people can start their own businesses with minimal costs and manage their schedules independently.

This model allows individuals to balance personal and professional responsibilities while generating income. Economic uncertainties and rising living costs have further pushed people toward alternative income sources. As more people explore side hustles and gig work, direct selling fits well into this evolving employment landscape. The freedom to work from home and set personal goals makes it a popular choice across age groups.

Shift Toward Personalized and Social Shopping Experiences

Today’s consumers are leaning toward shopping experiences that feel more personalized, engaging, and socially connected. Direct selling matches these preferences by offering tailored recommendations, detailed product knowledge, and one-on-one interactions. Instead of browsing through countless online listings or walking through stores, customers can receive specific advice from trusted sellers.

The experience feels more personal and often includes live product demonstrations or testimonials. Social media has made it easier for sellers to interact with buyers in real-time, building trust and community. Platforms like Instagram, Facebook, and WhatsApp allow sellers to reach wider audiences while keeping the interaction friendly and direct. This trend toward human-centered, socially driven shopping is pushing the direct selling model forward and making it more relevant in the digital age.

Restraints in the Direct Selling Market

Negative Perception and Trust Issues

A key restraint in the direct selling market is the ongoing negative perception surrounding some companies and business practices. Over the years, some organizations have been criticized for operating like pyramid schemes or using high-pressure sales tactics. This has caused skepticism among both potential sellers and buyers, making it harder for genuine businesses to gain trust. New sellers often face resistance from friends or family who associate direct selling with scams or financial loss.

Regulatory scrutiny and legal challenges in several countries have also raised concerns about transparency. These trust issues can limit the recruitment of new sellers and slow down market expansion. Building credibility through ethical practices and clear communication remains a major challenge for the industry.

High Dropout Rates and Seller Retention Problems

Another major restraint is the high turnover rate among independent sellers, which affects business stability and growth. Many individuals join direct selling with high expectations but leave after a short period due to inconsistent income or lack of motivation. Some sellers struggle to build a customer base or find it difficult to meet sales targets, especially without strong training or support.

When sellers drop out quickly, companies must constantly recruit and train new ones, which is time-consuming and costly. Retention becomes even harder when sellers don’t see quick returns or feel disconnected from the business. Without long-term commitment from their networks, direct selling companies may find it hard to maintain sales momentum and brand loyalty.

Opportunities in the Direct Selling Market

Digital Transformation and E-Commerce Integration

The growing adoption of digital tools presents a strong opportunity for the direct selling market. Companies and individual sellers can now leverage e-commerce platforms, mobile apps, and social media to connect with customers in real-time. This shift allows sellers to expand beyond their local communities and tap into wider, even global, markets. Online tools also make it easier to manage orders, track sales, and offer virtual product demonstrations.

Social commerce features—like live selling, stories, and direct messaging—enhance engagement and improve customer retention. As more consumers embrace digital shopping, direct sellers who adapt to these technologies can gain a significant edge. Embracing digital solutions allows for better efficiency, stronger branding, and increased scalability, unlocking new growth avenues for the entire industry.

Growing Demand for Niche and Wellness Products

Consumers today are more health-conscious and environmentally aware, leading to rising demand for niche products such as organic skincare, plant-based supplements, and eco-friendly household goods. Direct selling is well-suited to promote these specialized items, as sellers can offer personal stories, demonstrations, and detailed product explanations that build trust. Many buyers prefer to learn about wellness products through word-of-mouth and peer recommendations, which are central to direct selling.

This creates a unique opportunity for companies to launch innovative, small-batch, or sustainable products that may not yet have a mass-market presence. Sellers can position themselves as trusted advisors in wellness and lifestyle, boosting both credibility and repeat sales. As niche product categories grow, they can become strong pillars of success within the direct selling channel.

Trends in the Direct Selling Market

Digital & AI-Enhanced Selling Experiences

In recent years, direct selling has embraced advanced technologies like AI, data analytics, and mobile-first tools. AI chatbots and predictive systems are being used to offer personalized product suggestions and automated after-sales support, helping sellers better understand and meet customer needs. Mobile apps that simplify order processing, training, and payments have become essential, with digital-first sellers reporting significant boosts in engagement.

These tools make the business more efficient, scalable, and accessible, enabling real-time communication and reducing manual tasks. Virtual catalogs, automated follow-ups, and smart inventory tools are making operations smoother. As consumers increasingly expect seamless and tailored shopping journeys, tech-integrated strategies are revolutionizing how direct sellers attract and retain customers.

Social Commerce & Sustainability Focus

Another growing trend in direct selling is the rise of social commerce and eco-conscious products. Platforms like TikTok, Instagram, and Facebook now facilitate live product demos, virtual parties, and influencer-led sales turning social media into a key sales channel. At the same time, consumers especially Gen Z are seeking sustainable, ethically sourced goods.

Direct sellers are responding by providing wellness, organic, and eco-friendly options, boosting credibility and brand loyalty. Sellers can now share their stories and product experiences more openly with followers, building trust through authentic content. This also encourages word-of-mouth marketing, which remains a strength in direct selling. The blending of digital engagement with purpose-driven products is reshaping how sellers connect with value-conscious buyers.

Impact of Artificial Intelligence in Direct Selling Market

Here are some of the key pointers on the impact of Artificial Intelligence (AI) in the Direct Selling Market:

- Personalized Customer Experience: AI helps direct sellers deliver more personalized recommendations by analyzing customer preferences, past purchases, and browsing behavior. This builds stronger relationships and improves customer satisfaction.

- Automated Sales and Support Tools: Chatbots and virtual assistants powered by AI provide instant customer support, product information, and follow-ups. This reduces response time and allows sellers to focus more on engagement and sales strategies.

- Smarter Inventory and Order Management: AI tools forecast demand and automate stock management, ensuring timely product availability and avoiding overstock or shortages. This helps sellers maintain a smooth operation with fewer errors.

- Sales Performance Analysis: AI-driven dashboards track performance metrics, highlight top-selling products, and suggest ways to improve outreach. Sellers can use this data to refine their strategies and grow faster.

- Fraud Detection and Compliance Monitoring: AI systems can flag unusual transactions, monitor seller activities, and help companies stay compliant with direct selling regulations, increasing trust and market integrity.

Research Scope and Analysis

By Product Type Analysis

Wellness & nutraceuticals are anticipated to be the leading product type in the direct selling market in 2025, with a share of 35.8%, driven by rising health awareness and lifestyle-related concerns among consumers. The growing demand for vitamins, supplements, herbal remedies, and functional foods is pushing more people to seek trusted sources, and direct selling provides a personal and informative approach. Consumers prefer receiving guidance from knowledgeable sellers who can explain benefits and usage in simple terms.

The flexibility to try samples, get one-on-one advice, and make repeat purchases through a familiar contact has helped this segment grow. Wellness products also fit perfectly with the direct selling model, where sellers often share personal success stories. As interest in preventive health, immune support, and natural ingredients increases, the segment continues to attract both consumers and aspiring entrepreneurs, making it a powerful contributor to the market's overall expansion.

Cosmetics & personal care is another product segment having significant growth over the forecast period, supported by rising beauty consciousness and demand for personalized skincare and grooming solutions. Consumers are increasingly drawn to cruelty-free, organic, and science-backed formulations, which are commonly promoted in the direct selling space. This segment benefits from hands-on product demonstrations, sampling, and social media exposure, which help build trust and brand loyalty.

Direct sellers often act as beauty advisors, providing product suggestions based on skin types, routines, or trends. Social platforms have allowed beauty-focused sellers to reach younger audiences who value authenticity and peer recommendations. With consumers seeking convenience and expert advice in beauty purchases, cosmetics and personal care products are gaining steady momentum within the direct selling channel.

By Seller Type Analysis

Individual sellers are set to lead the direct selling market in 2025 with a share of 71.4%, supported by their strong personal connections, flexible working style, and ability to reach customers directly through word-of-mouth and social media. These sellers, often working independently from home, bring a personalized approach to sales that builds trust and loyalty among buyers. They share product experiences, offer tailored advice, and follow up regularly, which encourages repeat purchases and customer satisfaction.

Many individual sellers use online tools like messaging apps and video calls to showcase products, making it easier to manage their small business efficiently. With low startup costs and minimal risk, more people are joining the direct selling industry as a side hustle or full-time venture. This grassroots model continues to play a vital role in expanding the market, especially in communities where personal relationships strongly influence buying behavior.

Small enterprises are showing significant growth as seller types in the direct selling market, owing to their ability to organize structured networks and offer professional customer service. These businesses often support a group of individual sellers by providing marketing support, training, and inventory management. Unlike large corporations, small enterprises are more agile and responsive to market changes, allowing them to introduce niche or local products that cater to specific customer needs.

They are also adopting digital platforms to streamline operations, improve reach, and stay competitive. With a focus on innovation and building strong community connections, small enterprises are contributing to the evolution of direct selling by bridging traditional approaches with modern business tools. As entrepreneurship rises and digital literacy grows, this seller type is becoming an important pillar in the market’s ongoing development.

By Technology Integration

Online sales platforms are expected to lead technology integration in the direct selling market in 2025 with a share of 38.9%, driven by growing consumer preference for digital convenience and ease of shopping. These platforms allow individual sellers and small businesses to create digital storefronts, manage inventory, and process orders quickly and securely. They also enable round-the-clock access, giving customers the freedom to browse and purchase products anytime, from anywhere. For sellers, online platforms provide dashboards to track sales, customer data, and performance insights, helping them make informed business decisions.

Many direct selling companies are integrating user-friendly features like chat support, video demos, and auto-ship options to enhance the digital shopping journey. This shift toward e-commerce is transforming how direct selling operates by reducing physical barriers, expanding customer reach, and offering scalable growth opportunities for both new and established sellers.

Social media integration is set to have a significant growth over the forecast period as a key technology driver in the direct selling market, fueled by rising user engagement on platforms like Facebook, Instagram, and WhatsApp. Sellers are now able to connect with customers in real time, share product stories, and host live demonstrations all from their phones. This form of selling feels more personal and authentic, creating a stronger sense of community and trust.

Through posts, stories, and direct messages, sellers can maintain regular contact with their audience and respond quickly to questions or orders. Social platforms also support targeted marketing, allowing sellers to reach the right audience based on interests and behavior. As more people rely on social media for product discovery and recommendations, this channel is becoming an essential tool for building customer relationships and growing direct selling businesses.

The Direct Selling Market Report is segmented on the basis of the following:

By Product Type

- Wellness Products

- Nutritional Supplements

- Weight Management

- Sports Nutrition

- Herbal Products

- Cosmetics & Personal Care

- Skincare

- Haircare

- Fragrances

- Makeup

- Household Goods & Durables

- Kitchenware

- Cleaning Products

- Home Appliances

- Clothing & Accessories

- Apparel

- Footwear

- Fashion Accessories

- Books, Toys & Educational Products

- Children’s Books

- Educational Kits

- Toys

- Food & Beverages

- Packaged Foods

- Health Drinks

- Organic Products

- Financial Services

- Insurance

- Investment Plans

- Others

By Sellers Type

- Individual Sellers

- Small Enterprises

- Large Enterprises

By Technology Integration

- Online Sales Platforms

- Mobile Applications

- CRM & Analytics Tools

- Social Media Integration

- Others

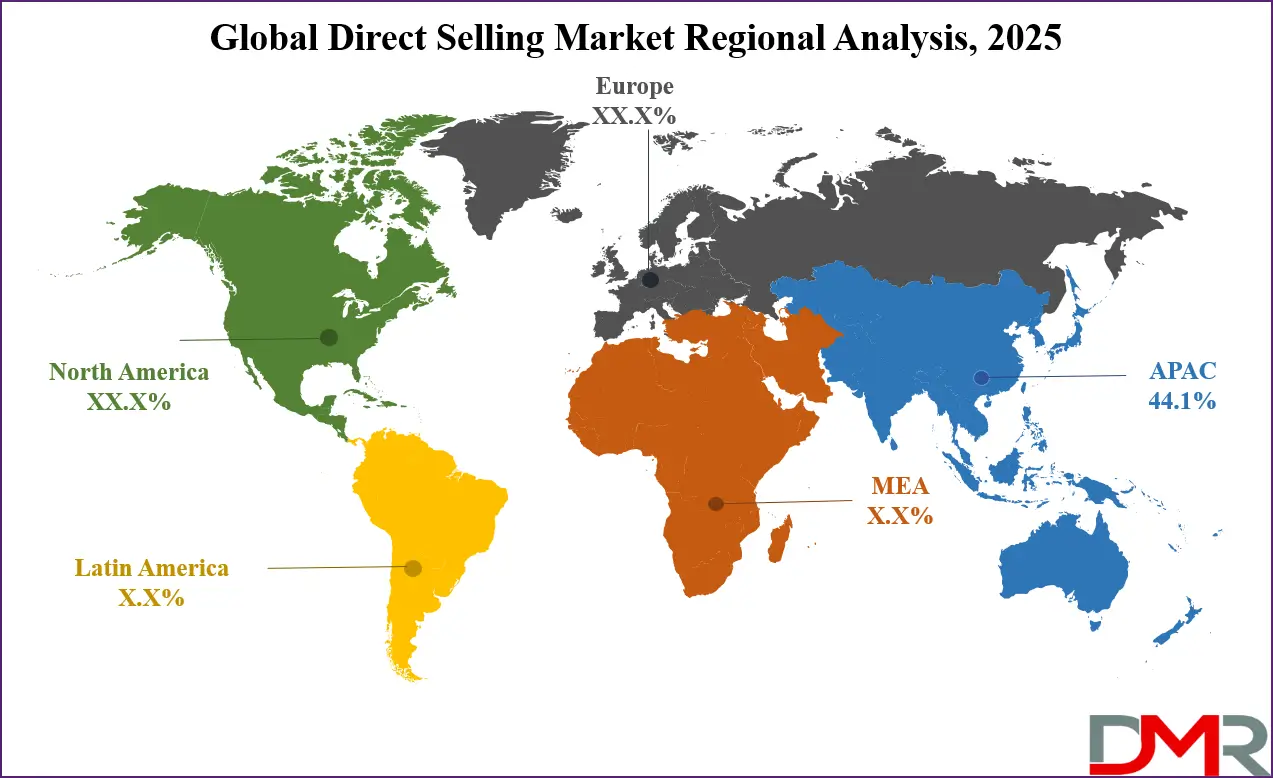

Regional Analysis

Leading Region in the Direct Selling Market

Asia Pacific will be leading the direct selling market in 2025 with a share of 44.1%, supported by rising consumer demand, expanding middle-class populations, and a strong cultural acceptance of relationship-based selling. The region is witnessing growing interest in health, beauty, and wellness products, which aligns well with the strengths of the direct selling model. Countries like China, India, South Korea, and Indonesia are showing strong participation from younger demographics and women entrepreneurs who are increasingly turning to direct selling for flexible income opportunities.

As lifestyles shift and digital tools become more common, sellers in the Asia Pacific region are using social media, messaging apps, and live video platforms to reach and engage customers. The region’s rapid urbanization and mobile-first economy are also making it easier for companies to connect with consumers directly. With its mix of tradition, innovation, and growing digital adoption, Asia Pacific is playing a major role in shaping the present and future growth of the direct selling market.

Fastest Growing Region in the Direct Selling Market

Middle East and Africa (MEA) is showing significant growth in the direct selling market as set to have major growth over the forecast period, driven by rising entrepreneurship, increasing youth population, and growing demand for wellness and beauty products. The region is seeing a shift in consumer behavior as more people explore personalized and convenient shopping experiences.

Direct selling is gaining popularity among women and young professionals seeking flexible income opportunities and low-investment business models. With improved internet access and smartphone usage, social commerce and digital selling tools are becoming more common. As more people turn to alternative retail channels, the MEA region is estimated to become a promising area for direct selling expansion and long-term market development.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The direct selling market is highly competitive, with many players offering similar products across health, beauty, wellness, and household categories. Companies in this space work hard to build strong networks of independent sellers who act as brand ambassadors. Success often depends on how well a company supports its sellers with training, digital tools, and attractive compensation plans. Many also invest in social media and mobile platforms to reach younger audiences.

Competition is not just about price or product quality, but also about building trust, community, and personalized experiences. New startups often enter with fresh ideas and digital-first approaches, while older players try to stay relevant by modernizing their strategies and expanding into new markets or product lines.

Some of the prominent players in the global Direct Selling are:

- Amway

- Herbalife Nutrition

- Vorwerk

- Natura & Co

- Mary Kay

- Tupperware

- Nu Skin Enterprises

- Oriflame

- PM-International

- Coway

- Primerica

- Rodan + Fields

- Young Living

- Ambit Energy

- Scentsy

- USANA Health Sciences

- Belcorp

- Arbonne

- Modere

- Mannatech

- Other Key Players

Recent Developments

- In July 2025, Herbalife Ltd. introduced MultiBurn™, a next-generation dietary supplement developed to support key aspects of metabolic health. Created by Herbalife’s global team of scientists and nutrition experts, the formula includes clinically studied botanical extracts. MultiBurn™ is vegan, gluten-free, and made without synthetic colors or dyes, aligning with the brand’s clean-label approach. As demand for weight management solutions grows, Herbalife delivers an innovative, science-backed, non-pharmaceutical option to support consumers' wellness journeys.

- In June 2025, Amway has strengthened its long-standing partnership with HEM Pharma, a microbiome solutions company, to drive innovation in gut health. Over the past decade, the two companies have collaborated to advance research and technology, building one of the world’s largest gut microbiome databases. This data is expected to fuel valuable health insights and strategic growth. Amway will now expand its microbiome research into Japan, Thailand, Malaysia, Taiwan, and the US, while also broadening its innovation ecosystem to include nutrition, skin health, oral care, and clean air and water solutions.

- In September 2024, Amway launched its four advanced Research & Development (R&D) labs across India, backed by a USD 4 million investment. Located in Gurugram, Chennai, Bengaluru, and Dindigul, these labs span a combined 24,700 square feet. They are designed to drive innovation in high-quality health and wellness products using modern science, advanced technology, and thought leadership. As one of Amway’s global R&D hubs, India plays a key role in meeting evolving consumer needs and promoting a healthier, more empowered future for millions.

- In July 2024, Nutri Co has raised USD 2 million in funding from Uruguayan bioactives producer Terraflos, following its pre-seed round in 2023. The investment will strengthen Nutri Co’s presence in Chile and Mexico, while supporting its planned expansion into Argentina and Colombia by late 2024 and into 2025. Further, Nutri Co aims to launch 18 new products, growing its current portfolio of 51 items. The partnership with Terraflos focuses on developing innovative products with plant-based active ingredients, all while keeping prices accessible for consumers.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 239.8 Bn |

| Forecast Value (2034) |

USD 439.4 Bn |

| CAGR (2025–2034) |

7.0% |

| The US Market Size (2025) |

USD 64.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Wellness Products, Cosmetics & Personal Care, Household Goods & Durables, Clothing & Accessories, Books, Toys & Educational Products, Food & Beverages, Financial Services, and Others), By Sellers Type (Individual Sellers, Small Enterprises, and Large Enterprises), By Technology Integration (Online Sales Platforms, Mobile Applications, CRM & Analytics Tools, Social Media Integration, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amway, Herbalife Nutrition, Vorwerk, Natura & Co, Mary Kay, Tupperware, Nu Skin Enterprises, Oriflame, PM-International, Coway, Primerica, Rodan + Fields, Young Living, Ambit Energy, Scentsy, USANA Health Sciences, Belcorp, Arbonne, Modere, Mannatech, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Direct Selling Market size is expected to reach a value of USD 239.8 billion in 2025 and is expected to reach USD 439.4 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Direct Selling Market, with a share of about 44.1% in 2025.

The Direct Selling Market in the US is expected to reach USD 64.0 billion in 2025.

Some of the major key players in the Global Direct Selling Market are Amway, Herbalife Nutrition, Vorwerk, and others

The market is growing at a CAGR of 7.0 percent over the forecasted period.