Market Overview

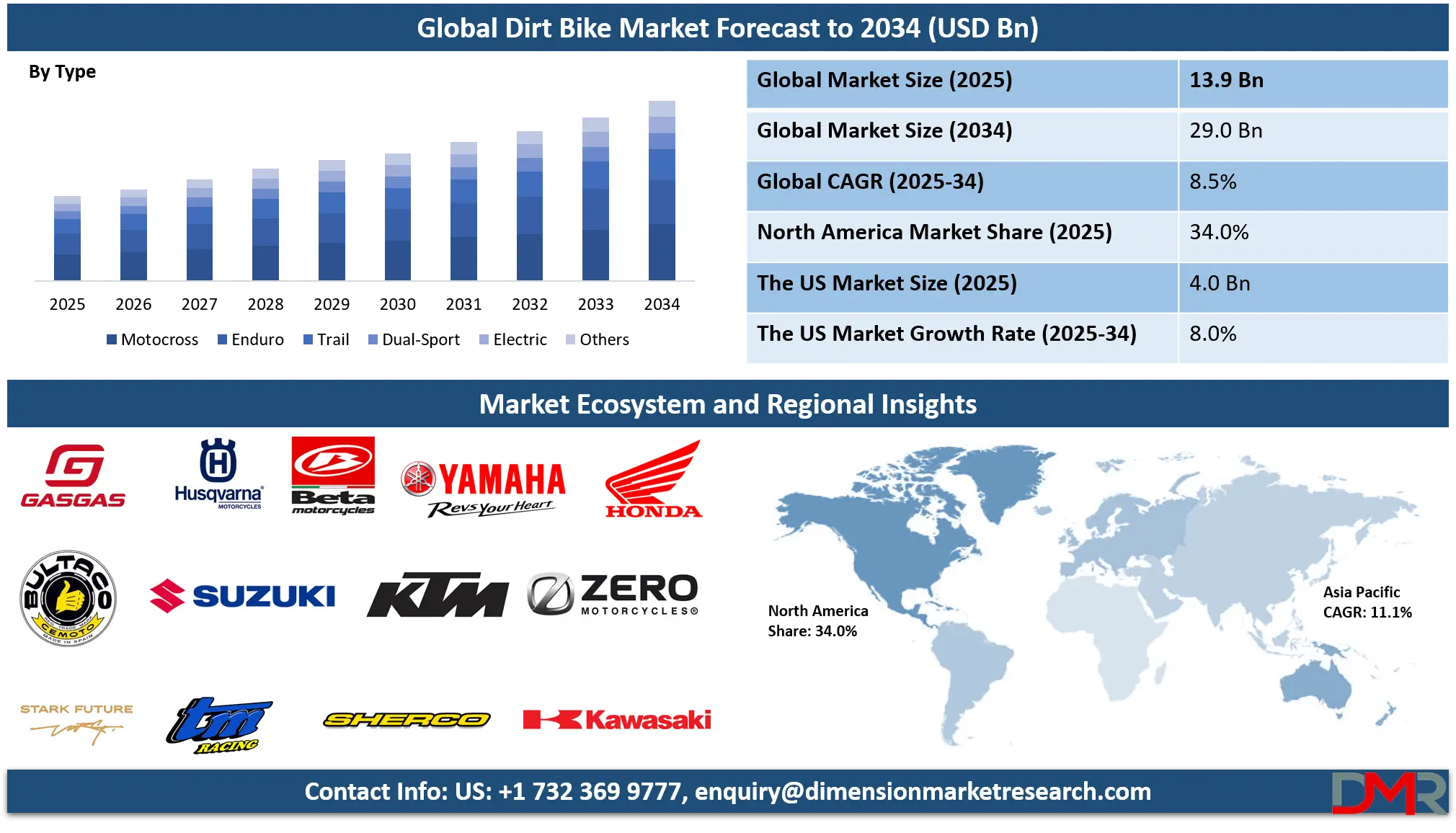

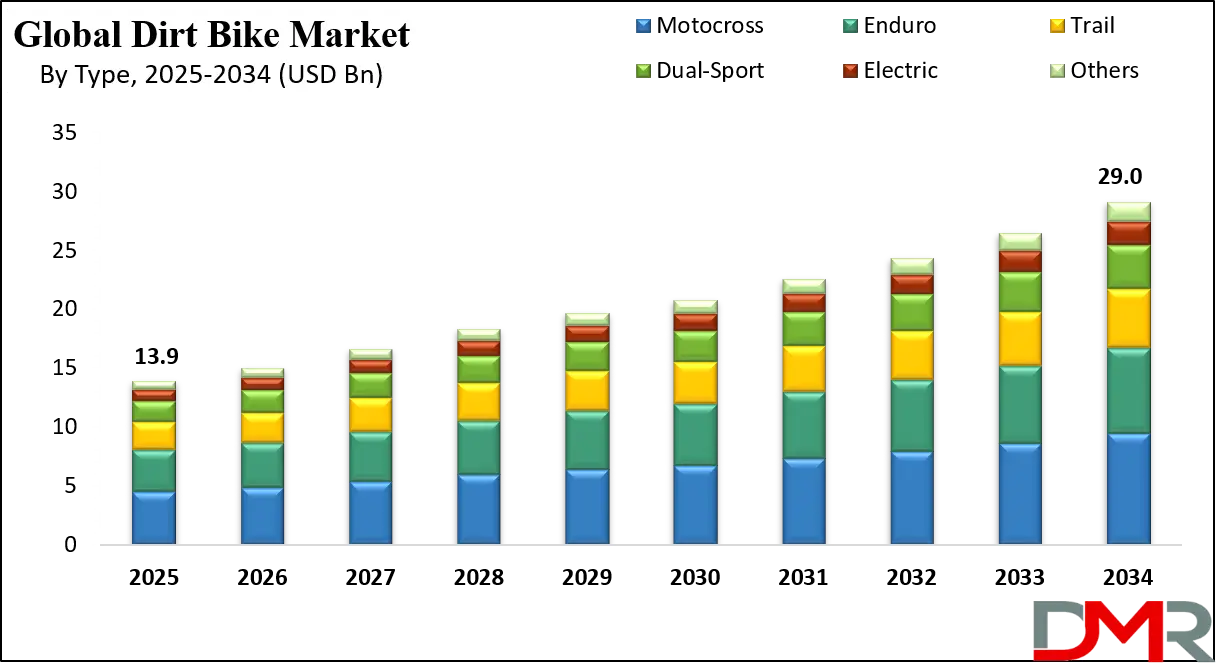

The global dirt bike market is forecast to achieve a valuation of USD 13.9 billion in 2025 and is anticipated to expand at a compound annual growth rate (CAGR) of 8.5% between 2025 and 2034. Driven by rising demand for off-road motorcycles, motocross and enduro bikes, and increasing participation in adventure sports and recreational riding, the market is expected to reach approximately USD 29.0 billion by 2034.

Dirt bikes enable high-performance off-road riding through advanced engine technologies, lightweight chassis designs, and enhanced suspension systems, supporting both competitive racing and recreational use. The model addresses global demand for outdoor adventure vehicles, with a growing community of enthusiasts and professional riders worldwide.

Technological advancements, including electric powertrains, GPS navigation systems, advanced fuel injection, LED lighting, and smartphone connectivity, are transforming the market into a more innovative and accessible ecosystem. Integration of lightweight materials such as carbon fiber and aluminum alloys is reshaping performance and durability.

Growing government initiatives promoting motorsports tourism, infrastructure development for off-road trails, and safety regulations further accelerate global adoption. However, barriers such as high costs, stringent emission norms, limited off-road legal areas, and safety concerns remain. Despite these limitations, the convergence of performance innovation, electric vehicle trends, and rising motorsport culture positions the dirt bike market as a central driver of global outdoor recreational vehicle growth through 2034.

The US Dirt Bike Market

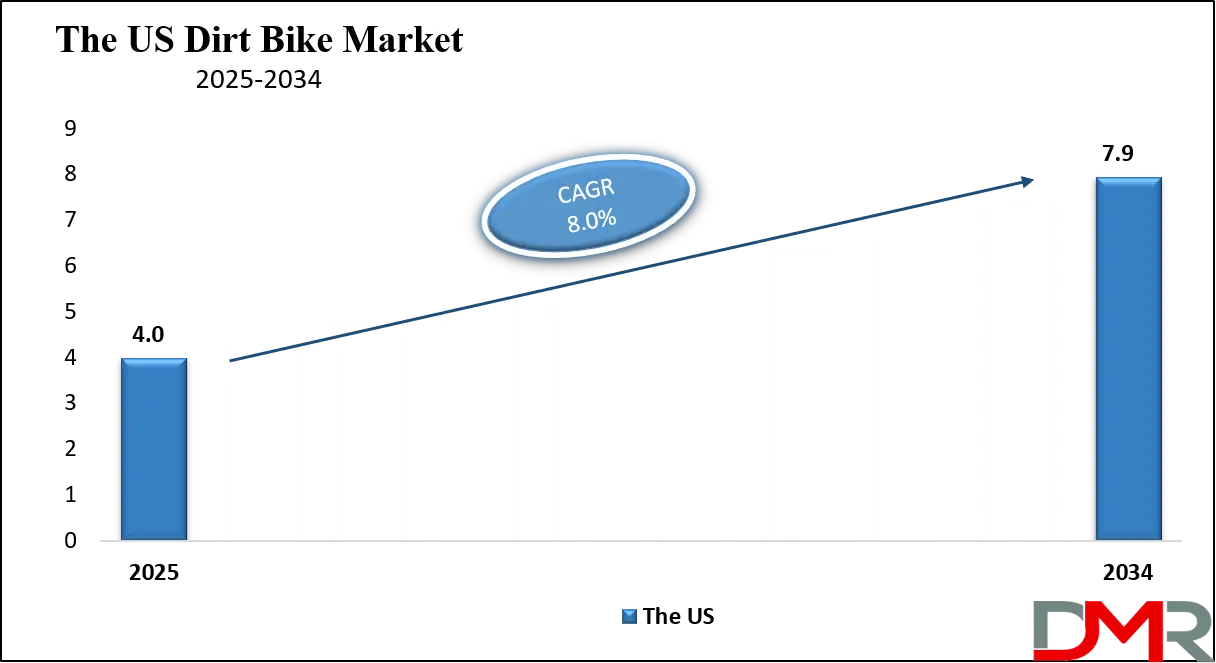

The U.S. Dirt Bike Market is projected to reach USD 4.0 billion in 2025 and grow at a CAGR of 8.0%, reaching USD 7.9 billion by 2034. The U.S. leads global adoption due to its strong motorsports culture, extensive trail networks, and high participation in off-road racing events.

More than 30 million Americans participate in off-road riding annually, fueling demand for high-performance motocross, enduro, and trail bikes. Organizations such as the AMA (American Motorcyclist Association) and MX Sports are scaling dirt bike events and safety programs across the country. Major manufacturers such as Honda, Yamaha, and KTM dominate sales through advanced models tailored for varied terrains.

U.S. regulatory support for off-road vehicle areas and state-level tourism initiatives promotes market growth. Meanwhile, national initiatives such as the Bureau of Land Management (BLM) trail grants have demonstrated increased accessibility and sustained interest in off-road riding.

The rapid rise of electric dirt bikes, adventure riding clubs, and aftermarket customization continues to redefine the U.S. off-road landscape, positioning the country as a global leader in dirt bike innovation.

The Europe Dirt Bike Market

The Europe Dirt Bike Market is projected to be valued at approximately USD 3.5 billion in 2025 and is projected to reach around USD 6.9 billion by 2034, growing at a CAGR of about 7.9% from 2025 to 2034. Europe's leadership is anchored by strong motorsport heritage, well-established enduro and trial competitions, and government-supported off-road trail systems.

Countries such as Germany, France, the U.K., Italy, and Spain have widely adopted dirt biking for both sport and recreation, driven by clubs and organized racing series. Events like the International Six Days Enduro (ISDE) and national motocross championships represent some of the world's largest dirt bike competitions.

Europe's growing adventure tourism sector, increasing interest in outdoor activities, and development of legal riding zones further drive dirt bike uptake. Funding through regional tourism boards and motorsport associations supports trail maintenance and rider training programs.

Urban and rural dealers increasingly stock advanced off-road models, electric variants, and youth-focused bikes. With strong regulatory frameworks for vehicle safety and environmental compliance, Europe remains one of the most advanced regions in the dirt bike market.

The Japan Dirt Bike Market

The Japan Dirt Bike Market is anticipated to be valued at approximately USD 680 million in 2025 and is expected to attain nearly USD 1.3 billion by 2034, expanding at a CAGR of about 8.5% during the forecast period. Japan's strong engineering heritage, leadership in motorcycle manufacturing, and cultural interest in motorsports drive demand for high-performance off-road bikes.

The Ministry of Economy, Trade and Industry (METI) supports automotive innovation through advanced manufacturing incentives, enabling the development of lightweight and electric dirt bike models. Japan's leadership in precision engineering and battery technology accelerates innovation in electric off-road vehicles.

Japan's concept of "Adventure Mobility", driven by companies like Honda, Yamaha, and Kawasaki, integrates smart connectivity with off-road performance. Regions such as Hokkaido and Nagano are popular for trail riding, while youth participation in motocross events continues to grow. Japan's emphasis on quality, innovation, and rider safety positions the country as a high-growth innovator in the dirt bike segment.

Global Dirt Bike Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Dirt Bike Market is expected to be valued at USD 13.9 billion in 2025 and is projected to reach USD 29.0 billion by 2034, showcasing steady expansion supported by rising interest in off-road recreation and motorsports.

- Moderate CAGR Driven by Outdoor Recreation Trends: The market is expected to grow at a CAGR of 8.5% from 2025 to 2034, fueled by increasing adventure tourism, youth participation, electric bike adoption, and aftermarket customization.

- Strong Growth Trajectory in the United States: The U.S. Dirt Bike Market stands at USD 4.0 billion in 2025 and is projected to reach USD 7.9 billion by 2034, expanding at a CAGR of 8.0% due to extensive trail networks and a robust racing culture.

- North America Maintains Regional Dominance: North America is expected to capture approximately 34.0% of the global market share in 2025, supported by high disposable income, well-established off-road infrastructure, and major industry players.

- Rapid Advancement in Dirt Bike Technologies: Innovations including electric powertrains, advanced suspension systems, GPS integration, and lightweight composite materials are significantly enhancing the performance, accessibility, and sustainability of off-road bikes.

- Growing Interest in Motorsports Boosts Adoption: Rising participation in motocross, enduro, and trail riding events is driving sustained demand for high-performance, durable, and versatile off-road motorcycles globally.

Global Dirt Bike Market: Use Cases

- Motocross Racing: Professional and amateur riders use purpose-built motocross bikes for competitive racing on closed-off-road circuits, emphasizing agility, speed, and jump capability.

- Enduro and Trail Riding: Enthusiasts use enduro and trail bikes for long-distance off-road adventures, often featuring lighting and registration for mixed terrain use.

- Recreational Trail Use: Families and casual riders use trail bikes in designated off-road parks and forest trails for weekend recreation and skill development.

- Electric Dirt Biking: Riders adopt electric dirt bikes for quieter operation, instant torque, and eco-friendly trail access in noise-sensitive or regulated areas.

- Dual-Sport Riding: Riders use dual-sport bikes for both on-road commuting and off-road exploration, offering versatility for adventure touring.

Global Dirt Bike Market: Stats & Facts

- The Fédération Internationale de Motocyclisme (FIM) reports that over 70 countries host national motocross championships, with global rider participation increasing by 12% annually, reinforcing how organized racing drives market growth.

- The Outdoor Industry Association projects adventure motorcycling participation reaching 50 million enthusiasts globally by 2030, with over 40% under age 35, driving dirt bike adoption as youth engagement in motorsports rises.

- The U.S. Consumer Product Safety Commission (CPSC) notes that advanced safety gear and training programs have reduced serious off-road riding injuries by up to 30% in the past decade, supporting safer market expansion.

- The International Motorcycle Manufacturers Association (IMMA) reports electric dirt bike sales are growing over 25% annually across Europe and North America, as brands like Zero and KTM expand zero-emission off-road offerings.

- According to Global Motorsport Surveys, smartphone-connected riding apps are used by over 60% of off-road riders for navigation, performance tracking, and social sharing, integrating digital experiences with physical riding.

- The Bureau of Land Management (U.S.) reports over 60,000 miles of designated off-road vehicle trails, with annual trail usage increasing by 8%, highlighting sustained demand for recreational riding areas.

Global Dirt Bike Market: Market Dynamic

Driving Factors in the Global Dirt Bike Market

Rising Popularity of Off-Road Motorsports and Adventure Tourism

The expanding global enthusiasm for off-road motorsports, including Motocross, Supercross, Enduro, and Hard Enduro competitions, serves as a primary driver for market growth. Increased media coverage via digital streaming platforms, the professionalization of racing leagues, and rising sponsorship investments are attracting a new generation of riders. Concurrently, the surge in adventure tourism, particularly in regions like Latin America, Southeast Asia, and Africa, is fueling demand for rental fleets and guided touring bikes. Dirt bikes provide an accessible gateway to motorsport participation, fostering skill development, competitive engagement, and community building, especially in regions where off-road infrastructure is developing.

Technological Innovation and Electrification

The dirt bike market is undergoing a significant transformation driven by rapid technological advancements. The development and commercialization of high-performance electric powertrains represent a paradigm shift, offering instant torque, reduced noise, and lower maintenance. Innovations in battery energy density and fast-charging infrastructure are alleviating range anxiety. Beyond electrification, advancements in materials science, such as carbon fiber frames and aluminum alloy components, reduce weight while enhancing durability. Furthermore, the integration of digital technologies, including GPS navigation, ride-by-wire throttle systems, smartphone connectivity for diagnostics and telemetry, and advanced suspension with electronic adjustment, greatly enhances the rider experience, safety, and bike performance, appealing to a broader and more tech-savvy consumer base.

Restraints in the Global Dirt Bike Market

High Total Cost of Ownership and Economic Volatility

The acquisition cost of a new dirt bike, particularly high-performance competition or advanced electric models, represents a significant financial outlay. This is compounded by the ongoing costs of maintenance, insurance, protective gear, transportation, and trail fees. In price-sensitive markets and during periods of economic downturn or inflation, discretionary spending on recreational vehicles is often among the first expenses to be curtailed by consumers. This economic sensitivity can lead to volatile sales cycles and limit market penetration in developing regions.

Stringent Regulatory and Environmental Constraints

Off-road riding faces growing challenges from regulatory frameworks aimed at environmental protection, land use, and noise control. Many public lands are restricting or prohibiting motorized vehicle access to preserve natural habitats, leading to a scarcity of legal riding areas. Stricter emissions standards (such as Euro 5 and beyond) increase compliance costs for manufacturers of gasoline-powered models. Additionally, noise ordinances in suburban and rural communities near riding areas can lead to trail closures. The lack of dedicated, legally sanctioned riding zones in many parts of the world remains a significant barrier to market expansion.

Opportunities in the Global Dirt Bike Market

Accelerated Growth of Electric Dirt Bikes

The global transition toward sustainable mobility presents a monumental opportunity. Electric dirt bikes, with their zero tailpipe emissions, quiet operation, and lower long-term maintenance, are poised for explosive growth. They offer access to trails where noise restrictions have previously banned gasoline bikes. Governments worldwide are incentivizing electric vehicle adoption through subsidies, tax breaks, and investments in charging infrastructure. Companies that lead in battery technology, lightweight design, and performance parity with combustion engines are positioned to capture a dominant share of this emerging and high-growth segment.

Expansion into Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa represent largely untapped potential. Rising disposable incomes, growing youth populations, and increasing interest in motorsports create fertile ground for market entry. Opportunities exist not only for selling entry-level and affordable models but also for developing associated ecosystems: establishing riding schools, creating rental and tour operator businesses, and building dedicated off-road parks. Local assembly and manufacturing can reduce costs and tailor products to regional terrain and preferences, driving volume growth.

Trends in the Global Dirt Bike Market

Dominance of Electric and Hybrid Model Development

The most pronounced trend is the industry-wide pivot toward electrification. All major manufacturers have electric models in development or already on the market, with continuous improvements in range, power, and charging speed. Parallel to this is exploration into hybrid technologies that combine electric motors with small combustion engines to extend range for adventure touring, merging the benefits of both powertrains.

Rising Popularity of Adventure and Dual-Sport Bikes

There is a clear consumer shift toward versatility. Adventure-style and dual-sport bikes, which are legally registered for both on-road and off-road use, are experiencing surging popularity. These bikes cater to riders seeking multi-day exploration, adventure touring, and practical daily usability, driving innovation in comfort, fuel capacity, luggage systems, and advanced electronics suites.

Global Dirt Bike Market: Research Scope and Analysis

By Type Analysis

The Motocross segment is projected to dominate the global market, owing to its status as the core of competitive off-road motorcycling. These bikes are engineered for peak performance on closed, technical tracks, prioritizing lightweight frames, powerful yet responsive engines, and sophisticated suspension systems capable of handling high-impact jumps and rapid direction changes. Their specialized design makes them the benchmark for performance, directly influencing technology and aesthetics across all other dirt bike categories.

The segment's dominance is fueled by a powerful ecosystem: global professional circuits like the FIM Motocross World Championship and AMA Supercross create aspirational heroes and continuous media exposure. This visibility drives substantial sponsorship, accelerating R&D and marketing.

Furthermore, manufacturer-backed youth racing academies and amateur series cultivate brand loyalty from an early age, ensuring a pipeline of future consumers. The technological innovations pioneered in motocross, from advanced fuel injection and titanium components to cutting-edge composite materials, frequently trickle down to enduro and trail models, reinforcing the segment's central role in industry advancement. The extensive aftermarket industry, focused on performance parts, custom graphics, and high-end protective gear, is disproportionately centered on motocross, creating significant ancillary revenue streams. As the definitive representation of off-road racing, motocross commands the highest brand prestige and marketing investment, ensuring its position as the largest and most influential market segment through 2034.

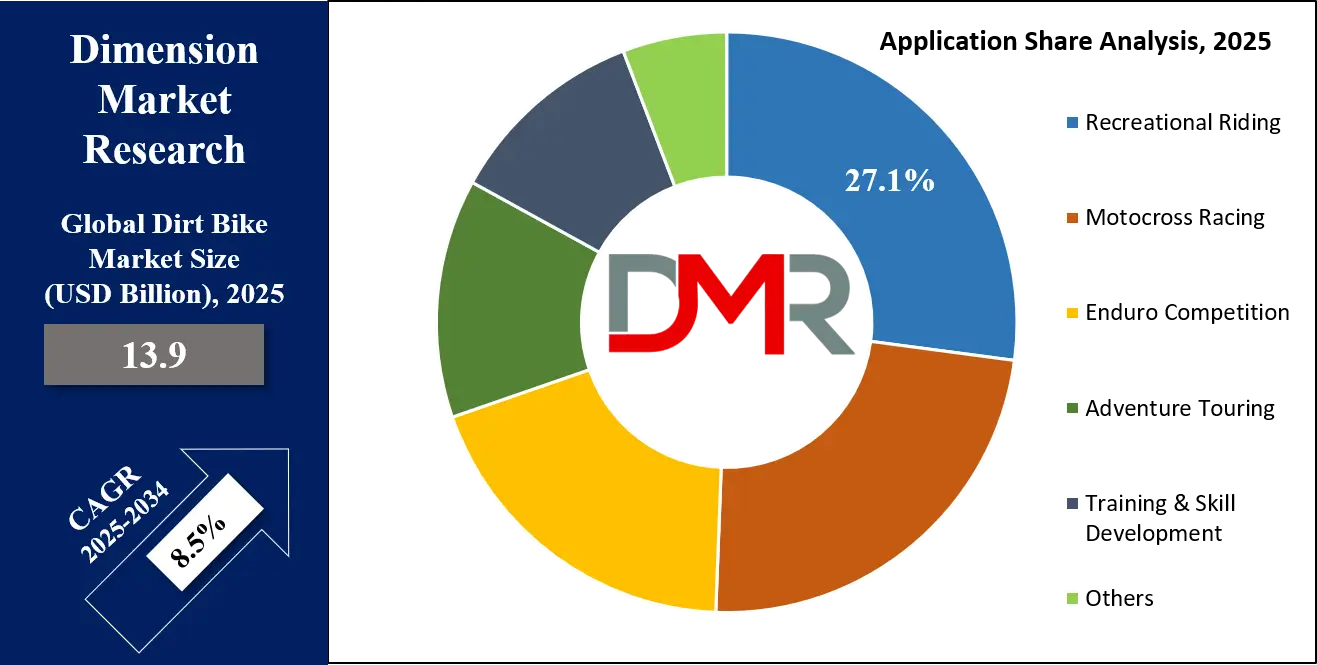

By Application Analysis

Recreational riding is poised to be the largest and most dominant application segment, accounting for the highest volume share globally. This expansive category encompasses trail riding in forests and public lands, casual use at dedicated off-road parks, and weekend family adventures, representing the primary entry point for new riders. Unlike specialized racing applications, recreational use demands versatility, reliability, and user-friendliness, leading to bikes designed for durability across varied terrains, manageable power delivery, and lower maintenance requirements. The segment's growth is fundamentally driven by macro trends: the global rise in outdoor recreation, the pursuit of experiential leisure activities, and the expansion of adventure tourism.

This is structurally supported by the development of new legal riding areas, including government-funded trail networks and privately operated off-road resorts that offer rental fleets, training, and family-friendly amenities. The broad demographic appeal spanning teenagers, adults, and increasingly, families ensures a vast and stable consumer base. Manufacturers strategically target this segment with a wide range of models, from affordable, air-cooled four-strokes to sophisticated trail bikes with electric start and modern suspension. The rise of "adventure riding" as a lifestyle further blurs lines, attracting traditional street motorcyclists to off-road recreation. As accessibility and infrastructure improve, recreational riding will remain the primary volume driver for the entire market, underpinning sustained expansion.

By End User Analysis

Individual consumers are anticipated to dominate the market as the largest end-user segment, comprising enthusiasts, hobbyists, and families purchasing for personal and recreational use. This group is the foundational driver of unit sales, fueled by discretionary spending on lifestyle and leisure activities. Purchasing decisions are influenced by factors such as brand affinity, peer recommendations within riding communities, and aspirations shaped by motorsport media. The segment's strength is underpinned by robust financial infrastructure, including manufacturer-backed financing plans, leasing options, and a vibrant secondary market for used bikes that lowers the barrier to entry. Individual ownership also fuels the expansive aftermarket industry, as riders personalize their bikes with performance upgrades, aesthetic modifications, and specialized gear, creating a continuous revenue cycle beyond the initial sale.

Marketing strategies are intensely focused on this demographic, utilizing digital campaigns, influencer partnerships, and experiential events like demo days to foster direct engagement. While other segments like rental services and clubs are growing, they ultimately serve the individual rider. The enduring cultural appeal of motorcycle ownership, symbolizing freedom, skill, and community, solidifies the individual consumer's central role. As interest in outdoor sports and digital communities grows, this segment will continue to be the primary engine of market demand and brand loyalty.

The Global Dirt Bike Market Report is segmented on the basis of the following:

By Type

- Motocross

- Enduro

- Trail

- Dual-Sport

- Electric

- Others

By Application

- Recreational Riding

- Motocross Racing

- Enduro Competition

- Adventure Touring

- Training & Skill Development

- Others

By End User

- Individual Consumers

- Rental Services

- Sports Clubs & Teams

- Tourism & Adventure Companies

- Others

Impact of Artificial Intelligence in the Global Dirt Bike Market

- Electric Powertrains for Instant Torque: Electric motors deliver immediate power, enhancing acceleration and control on challenging terrain, appealing to performance-oriented riders.

- Reduced Noise and Emissions: Electric bikes operate quietly with zero tailpipe emissions, improving trail access in noise-sensitive and environmentally protected areas.

- Lower Maintenance Requirements: Electric models have fewer moving parts, reducing maintenance costs and increasing reliability for frequent riders.

- Battery and Range Innovations: Advances in battery technology are extending ride range and reducing charging times, making electric dirt bikes more practical for longer adventures.

- Smart Connectivity Integration: Electric bikes often feature digital displays, app connectivity, and ride data tracking, enhancing the user experience and providing valuable performance metrics.

Global Dirt Bike Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Dirt Bike Market with 34.0% of market share by the end of 2025, owing to a powerful combination of high consumer purchasing power, extensive legal riding areas, strong motorsports culture, and leading manufacturers. The United States and Canada have deeply entrenched off-road riding communities, supported by well-maintained trail systems, national parks, and organized racing events.

The region has one of the highest participation rates in motocross and trail riding, driving continuous demand for new models and upgrades. Major brands like Honda, Yamaha, KTM, and Kawasaki have strong distribution and marketing operations in North America.

North America's strong aftermarket ecosystem, including parts, gear, and customization services, further supports market dominance. Financing options and a vibrant used bike market make ownership accessible to a broad demographic.

Region with the Highest CAGR

Asia-Pacific holds the highest CAGR and is poised to achieve a significant market share in the dirt bike market due to its growing middle class, increasing interest in motorsports, and rising adventure tourism. The region accounts for a large youth population enthusiastic about outdoor activities and motorsports.

Asia-Pacific faces growing demand for affordable recreational vehicles. Countries like India, Thailand, and Indonesia are seeing rising sales of entry-level and mid-range dirt bikes. Government initiatives to develop motorsports infrastructure and tourism trails are accelerating adoption.

Local manufacturing and assembly are reducing costs, while international brands are expanding their presence through partnerships and dealerships. The cultural shift toward adventure lifestyles and disposable income growth positions APAC as the fastest-growing region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Dirt Bike Market: Competitive Landscape

The Global Dirt Bike Market is moderately fragmented, driven by a mix of established motorcycle manufacturers and specialized off-road brands. Leading companies Honda, Yamaha, KTM, Kawasaki, and Suzuki dominate the market with comprehensive model lineups, strong brand loyalty, and global distribution networks. These companies invest heavily in R&D for performance, durability, and emerging electric technologies.

Electric-focused innovators such as Zero Motorcycles, Cake, and Stark Future are gaining influence by offering high-performance electric dirt bikes that challenge traditional gasoline models. Their solutions appeal to environmentally conscious riders and those seeking new technology experiences.

Aftermarket and accessory providers like Fox Racing, Alpinestars, and Pro Circuit support the ecosystem with gear, parts, and performance upgrades. Meanwhile, regional players and new entrants in Asia and Latin America are expanding market reach with affordable models.

Some of the prominent players in the Global Dirt Bike Market are:

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- KTM AG

- Kawasaki Heavy Industries, Ltd.

- Suzuki Motor Corporation

- Zero Motorcycles, Inc.

- Beta Motorcycles

- Sherco

- TM Racing

- Stark Future SL

- Bultaco

- Husqvarna Motorcycles

- GasGas

- Other Key Players

Recent Developments in the Global Dirt Bike Market

- November 2025: KTM introduced its latest electric enduro bike, featuring enhanced battery range, advanced traction control, and a lightweight chassis design. The model targets both competitive enduro riders and recreational adventurers, strengthening KTM's position in the electric off-road segment.

- October 2025: Yamaha presented a hybrid adventure dirt bike concept at EICMA 2025, combining electric assist with a conventional engine for improved efficiency and torque. Demonstrations emphasized versatility for long-distance touring and technical off-road use.

- October 2025: The Fédération Internationale de Motocyclisme unveiled plans for a world electric motocross championship starting in 2026, aiming to promote sustainable motorsports and accelerate electric dirt bike adoption across professional racing.

- September 2025: Zero Motorcycles expanded its European dealership and service network, improving accessibility for electric dirt bike customers in key markets like Germany, France, and the U.K.

- August 2025: Honda acquired a minority stake in an electric powertrain technology startup to accelerate development of next-generation electric off-road motorcycles, focusing on battery efficiency and charging solutions.

- July 2025: Kawasaki partnered with a global adventure tourism platform to offer guided dirt bike tours in emerging destinations, combining bike rentals with curated off-road experiences to attract new riders.

- June 2025: India hosted its inaugural national electric dirt bike championship, supported by government clean mobility initiatives, highlighting growing interest in electric off-road sports in Asia-Pacific.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.9 Bn |

| Forecast Value (2034) |

USD 29.0 Bn |

| CAGR (2025–2034) |

8.5% |

| The US Market Size (2025) |

USD 4.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Motocross, Enduro, Trail, Dual-Sport, Electric, and Others), By Application (Recreational Riding, Motocross Racing, Enduro Competition, Adventure Touring, Training & Skill Development, and Others), By End User (Individual Consumers, Rental Services, Sports Clubs & Teams, Tourism & Adventure Companies, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., KTM AG, Kawasaki Heavy Industries, Ltd., Suzuki Motor Corporation, Zero Motorcycles, Inc., Beta Motorcycles, Sherco, TM Racing, Stark Future SL, Cake, Bultaco, Husqvarna Motorcycles, GasGas, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Dirt Bike Market size is estimated to have a value of USD 13.9 billion in 2025 and is expected to reach USD 29.0 billion by the end of 2034.

The market is growing at a CAGR of 8.5 percent over the forecasted period of 2025.

The US Dirt Bike Market is projected to be valued at USD 4.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.9 billion in 2034 at a CAGR of 8.0%.

North America is expected to have the largest market share in the Global Dirt Bike Market with a share of about 34.0% in 2025.

Some of the major key players in the Global Dirt Bike Market are Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., KTM AG, Kawasaki Heavy Industries, Ltd., Suzuki Motor Corporation, and many others.