Market Overview

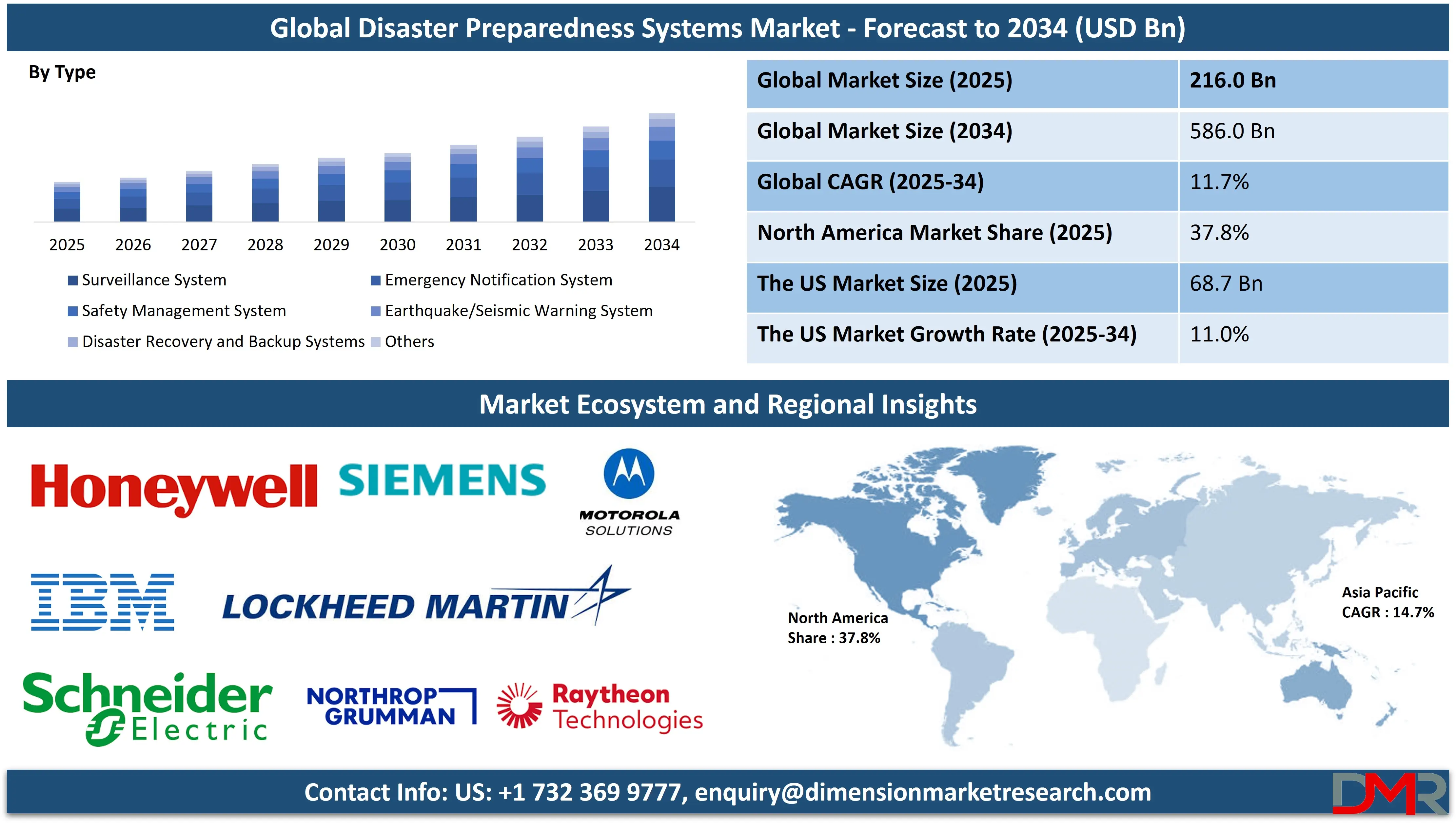

The Global Disaster Preparedness Systems Market is predicted to be valued at USD 216.0 billion in 2025 and is expected to grow to USD 586.0 billion by 2034, registering a compound annual growth rate (CAGR) of 11.7% from 2025 to 2034.

Disaster preparedness systems are comprehensive frameworks designed to anticipate, respond to, and recover from natural or man-made disasters. These systems integrate tools, technologies, policies, and procedures to enhance emergency response capabilities and minimize the impact of hazards such as earthquakes, floods, pandemics, and industrial accidents. They include early warning systems, risk assessments, resource management platforms, communication networks, and coordinated response protocols. By improving situational awareness and facilitating real-time decision-making, disaster preparedness systems help governments, organizations, and communities protect lives, infrastructure, and essential services. Their ultimate goal is to build resilience and ensure rapid recovery in the aftermath of any crisis.

The global disaster preparedness systems market is witnessing significant growth due to the increasing frequency and severity of natural and man-made disasters. Governments and private organizations are investing heavily in emergency response systems, crisis management platforms, and predictive analytics to enhance resilience and safeguard critical infrastructure.

Technological advancements in early warning systems, geospatial tools, and communication infrastructure are driving the adoption of disaster preparedness technologies. Integration of artificial intelligence, IoT, and cloud-based platforms allows real-time data analysis, remote monitoring, and effective resource allocation during emergencies, improving overall emergency management solutions (LSI keyword).

Growing public awareness and stringent regulatory frameworks have further accelerated the deployment of disaster recovery solutions and emergency operation centers across sectors like healthcare, manufacturing, and energy. These systems help ensure business continuity, reduce economic losses, and support rapid post-disaster recovery. In healthcare, the integration of medical devices with emergency platforms ensures continuity of patient care during crises.

Moreover, the market is being shaped by the increasing demand for scalable and customizable disaster preparedness software. Organizations are prioritizing the implementation of business continuity planning, automated alert systems, and real-time communication tools. The rising importance of community resilience, sustainability, and risk mitigation strategies (LSI keyword) continues to influence market trends.

The global disaster preparedness systems market is characterized by innovation and strategic partnerships. Major vendors are focusing on offering end-to-end solutions that combine hardware components such as sensors and drones with advanced software for situational awareness and decision support. Enhanced interoperability between public and private agencies, data-driven decision-making, and proactive planning supported by IoT Microcontroller technology are becoming essential components of modern emergency preparedness frameworks. This shift is reshaping emergency planning and disaster response operations worldwide.

The US Disaster Preparedness Systems Market

The US Disaster Preparedness Systems Market is projected to be valued at USD 68.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 175.4 billion in 2034 at a CAGR of 11.0%.

The increasing frequency and severity of natural disasters such as hurricanes, wildfires, and floods is a key driver for disaster preparedness systems in the US. Government agencies are investing in early warning systems, communication platforms, and emergency management tools to mitigate disaster impact. Public awareness campaigns and community-based preparedness programs further enhance system adoption. Technological advancements in predictive analytics and AI-driven response coordination tools support a proactive approach to disaster management.

Additionally, growing concerns over infrastructure resilience and continuity of operations in critical sectors like healthcare and energy have amplified the need for robust disaster preparedness frameworks across the country.

The US market is witnessing a surge in the integration of cloud-based emergency management solutions that offer real-time data access and scalability. There’s a growing shift towards AI and machine learning applications for predictive modeling and automated response systems. The rise of mobile-based emergency alert systems and public communication platforms is also notable. Partnerships between government agencies and private tech firms are driving innovation in disaster management infrastructure. Cybersecurity preparedness is increasingly being incorporated into traditional disaster readiness frameworks. Moreover, there is a trend toward community-centered solutions that enable localized and faster response during crises, supported by technologies such as Data Center Liquid Immersion Cooling that ensure IT resilience during emergencies.

The Japan Disaster Preparedness Systems Market

The Japan Disaster Preparedness Systems Market is projected to be valued at USD 15.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 39.1 billion in 2034 at a CAGR of 10.3%.

Japan’s vulnerability to earthquakes, tsunamis, typhoons, and volcanic activity remains a critical driver for advanced disaster preparedness systems. The government’s longstanding focus on disaster risk reduction has led to significant investments in early warning systems, structural reinforcement, and public education programs. Technological innovation plays a central role, with smart infrastructure and real-time monitoring networks being widely implemented. The integration of seismic and meteorological data allows for timely alerts and evacuation procedures. Additionally, the country’s proactive disaster culture and regulatory mandates compel industries and municipalities to adopt and maintain high-level preparedness systems and response capabilities.

Japan is leading the way in the use of robotics and automation for disaster response and recovery. Drones and unmanned vehicles are increasingly deployed for damage assessment and rescue operations. Smart city developments now incorporate resilient design standards and emergency communication infrastructure. There is growing integration of AI and big data analytics in emergency decision-making systems. Public engagement is being enhanced through mobile applications offering real-time alerts and safety instructions. The government is also focusing on improving the resilience of aging infrastructure and ensuring data continuity during crises through decentralized, cloud-based platforms and backup systems.

The Europe Disaster Preparedness Systems Market

The Europe Disaster Preparedness Systems Market is projected to be valued at USD 37.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 101.7 billion in 2034 at a CAGR of 11.2%.

Stricter regulatory frameworks across the European Union regarding disaster risk reduction and public safety are major drivers in this market. Climate change has increased the occurrence of floods, heatwaves, and storms, prompting nations to bolster preparedness measures. The region’s commitment to sustainability and resilience drives investment in intelligent systems that ensure early detection and efficient coordination. Cross-border cooperation and centralized data platforms enhance regional preparedness. EU-funded initiatives and national policies prioritize risk assessments, resilient infrastructure, and efficient response mechanisms. The integration of disaster risk management into urban planning and critical sectors like transportation and energy also accelerates adoption.

Europe is experiencing a trend toward harmonized, multi-country disaster response systems using integrated digital platforms. The use of GIS mapping and satellite monitoring for risk assessment and damage estimation is increasing. Countries are adopting AI-enhanced early warning systems and IoT devices for real-time disaster tracking. Remote training and simulation-based preparedness programs are gaining traction among emergency service providers. Public-private partnerships are fostering the development of advanced technologies for faster disaster recovery. There is also a rise in community-based disaster preparedness initiatives aligned with regional and national response frameworks, creating more inclusive and scalable disaster mitigation strategies.

Disaster Preparedness Systems Market: Key Takeaways

- Market Overview: The global disaster preparedness systems market is projected to reach a valuation of USD 216.0 billion in 2025 and is anticipated to expand significantly, hitting USD 586.0 billion by 2034. This growth will occur at a compound annual growth rate (CAGR) of 11.7% over the forecast period.

- By Type: Surveillance systems are expected to lead the market in 2025, accounting for 31.2% of the total revenue share.

- By Solution: Disaster recovery solutions are forecasted to be the most dominant segment in 2025, contributing 45.6% of the global market share.

- By Services: Design and integration services are likely to command the largest portion of the market by 2025, comprising 38.7% of the share.

- By Communication Technology: Satellite phones are anticipated to hold the leading position in the communication technology segment by 2025, representing 34.1% of the market.

- By End User: The public sector is set to emerge as the primary end user in 2025, capturing 36.4% of the overall market.

- Regional Insights: North America is projected to be the leading region in the global disaster preparedness systems market by the end of 2025, with a market share of 37.8%.

Disaster Preparedness Systems Market: Use Cases

- Early Warning and Evacuation Planning: Disaster preparedness systems help monitor natural hazards like hurricanes, floods, and earthquakes in real-time. They issue timely alerts to emergency services and the public, enabling structured evacuation procedures, minimizing panic, and ensuring communities relocate to safety zones before catastrophic impacts occur.

- Emergency Response Coordination: These systems support efficient communication between fire departments, police, medical teams, and government agencies during a disaster. They centralize situational data, resource availability, and response protocols, allowing faster deployment, reduced duplication of efforts, and streamlined decision-making for life-saving interventions.

- Resource Management and Logistics: Disaster preparedness systems track and manage critical supplies such as food, water, medical kits, and fuel during emergencies. They assist in optimal inventory distribution based on real-time demand and accessibility, reducing shortages and ensuring aid reaches the most affected zones without delay.

- Continuity of Operations in Enterprises: Businesses use these systems to create and test disaster recovery plans, ensuring data protection, employee safety, and service continuity. This minimizes operational disruptions from cyberattacks, power outages, or natural disasters, enabling companies to resume critical functions swiftly after an event.

- Public Health Crisis Management: In pandemics or chemical spills, preparedness systems monitor infection spread, manage quarantine protocols, and track healthcare capacity. By integrating data from hospitals, labs, and field teams, they enable timely public health decisions and ensure medical resources are allocated efficiently.

Disaster Preparedness Systems Market: Stats & Facts

- FEMA: According to the Federal Emergency Management Agency, as of 2023, only 44% of Americans have developed and discussed an emergency plan with their household.

- UNDRR: The United Nations Office for Disaster Risk Reduction reported that between 2000 and 2019, over 7,000 major disaster events were recorded globally, emphasizing the urgent need for robust preparedness systems.

- CDC: The Centers for Disease Control and Prevention found that only 51% of U.S. adults had emergency supplies at home as of 2022, such as water, flashlights, or food, indicating gaps in public readiness.

- World Bank: The World Bank estimates that investing USD 1 in disaster risk reduction can save up to USD 6 in post-disaster recovery and reconstruction costs, highlighting the economic efficiency of preparedness systems.

- NOAA: The National Oceanic and Atmospheric Administration reported that the U.S. experienced 28 weather and climate disasters in 2023, each causing over $1 billion in damages, underscoring the growing frequency and cost of unpreparedness.

- Red Cross: The American Red Cross states that nearly 60% of Americans are unprepared for a natural disaster and lack a go-bag or emergency evacuation plan.

- UNICEF: In 2022, UNICEF noted that 1 in 3 children worldwide lived in areas highly exposed to climate disasters, demanding stronger disaster education and early warning systems in schools and communities.

- IFRC: The International Federation of Red Cross and Red Crescent Societies estimates that only 20% of countries have comprehensive early warning systems that reach populations at risk in time.

- National Fire Protection Association (NFPA): In 2022, U.S. fire departments responded to over 1.5 million fire incidents, with only 25% of households having practiced a home fire drill within the last year.

- U.S. Department of Energy: During extreme weather events in 2021, nearly 3.4 million Americans experienced power outages lasting more than 48 hours, revealing vulnerabilities in grid preparedness and resilience systems.

- U.S. Geological Survey (USGS): The U.S. has 16 states at high risk for earthquakes, yet fewer than 30% of buildings in seismic zones are retrofitted with earthquake-resistant systems.

- National Center for Disaster Preparedness (NCDP): A 2023 survey found that only 39% of small businesses had a formal continuity or disaster recovery plan in place.

- U.S. Department of Homeland Security (DHS): In 2022, over 2,000 cybersecurity incidents were reported that impacted critical infrastructure, pushing FEMA to expand digital disaster preparedness protocols.

- National Oceanic and Atmospheric Administration (NOAA): In 2023, hurricane early warning systems gave an average 72-hour advance notice, up from 48 hours a decade ago, due to advances in disaster communication technologies.

- American Public Health Association (APHA): Roughly 60% of U.S. hospitals have conducted full-scale emergency preparedness drills in the past year, focusing on bioterrorism and pandemic response scenarios.

Disaster Preparedness Systems Market: Market Dynamics

Driving Factors in the Disaster Preparedness Systems Market

Increasing Frequency and Severity of Natural Disasters

The growing occurrence of natural disasters such as hurricanes, wildfires, earthquakes, and floods has significantly accelerated the demand for disaster preparedness systems. Climate change continues to intensify weather-related events, making early warning systems, risk assessment platforms, and crisis communication technologies vital for minimizing loss. Governments and private institutions are investing in advanced emergency response systems to enhance real-time decision-making and ensure public safety.

Integration of AI and GIS in natural disaster management further supports precise risk mapping and response coordination. This factor is propelling the adoption of resilient infrastructure, mobile alert networks, and predictive analytics across multiple sectors, including healthcare, energy, and defense, thereby boosting the disaster preparedness systems market growth globally.

Government Initiatives and Regulatory Mandates

Global regulatory bodies and governments are increasingly enforcing policies for mandatory risk mitigation tools and public safety technologies. National and international disaster management frameworks now require standardized emergency communication systems, crisis management platforms, and evacuation planning solutions. The FEMA guidelines in the U.S. and similar frameworks in Europe and Asia drive funding and implementation of integrated disaster recovery solutions.

These initiatives emphasize inter-agency collaboration, efficient resource allocation, and digital simulation-based training. Smart cities are embedding disaster preparedness software into urban infrastructure, enhancing community resilience. This regulatory momentum is fueling technological innovation in emergency notification systems and pushing organizations toward adopting comprehensive disaster preparedness protocols.

Restraints in the Disaster Preparedness Systems Market

High Initial Implementation and Maintenance Costs

Deploying disaster preparedness systems often involves high capital expenditure, especially for small to mid-sized enterprises and developing nations. Sophisticated technologies like real-time monitoring, geospatial mapping, and cloud-based emergency response platforms demand significant investment in infrastructure, personnel training, and integration with legacy systems.

Additionally, maintenance and periodic upgrades of early warning networks, satellite communication tools, and command-and-control systems add recurring costs. These financial constraints slow down adoption rates of critical disaster management software in budget-sensitive environments. This acts as a significant barrier despite the increasing awareness of the importance of proactive emergency response planning and public safety enhancement.

Interoperability and Data Silos between Systems

One of the major technical challenges in the disaster preparedness systems market is the lack of interoperability between various platforms and agencies. Emergency alert systems, sensor-based detection platforms, and crisis communication tools often operate in silos, leading to fragmented response efforts. This incompatibility impedes real-time data exchange and coordinated response, particularly during large-scale emergencies.

Differences in data formats, communication protocols, and infrastructure between federal, state, and local agencies exacerbate inefficiencies. As a result, even with robust disaster recovery systems in place, the failure to create unified communication and data-sharing mechanisms continues to hinder effective implementation and response accuracy.

Opportunities in the Disaster Preparedness Systems Market

Integration of AI and IoT in Emergency Management

The convergence of artificial intelligence (AI), machine learning, and Internet of Things (IoT) offers transformative opportunities in the disaster preparedness systems market. Smart sensors, drones, and wearable devices collect real-time data that can be analyzed by AI-driven platforms for faster and more accurate decision-making. Predictive analytics enables early warnings, situational awareness, and risk forecasting, improving public safety outcomes.

IoT-based alert systems also support automated evacuation guidance and remote monitoring. These innovations enhance the efficiency of emergency management systems in sectors like healthcare, transportation, and critical infrastructure. As AI and IoT adoption increases, vendors have a lucrative opportunity to offer intelligent disaster risk reduction solutions globally.

Growing Demand in Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and Africa present vast untapped potential for disaster preparedness systems. As urbanization accelerates and climate vulnerability increases in these regions, the demand for early warning systems, mass notification systems, and emergency evacuation planning tools is rising. Governments and humanitarian organizations are launching disaster risk reduction programs and investing in public awareness campaigns.

International funding from agencies such as the World Bank and UNDP supports the development of national crisis management frameworks. This creates a favorable environment for market players to expand their offerings, establish local partnerships, and introduce cost-effective and scalable disaster preparedness solutions in developing countries.

Trends in the Disaster Preparedness Systems Market

Rise of Cloud-Based Disaster Management Solutions

Cloud-based platforms are revolutionizing how organizations manage disaster preparedness. These solutions offer real-time access, scalability, and centralized coordination during emergencies. Cloud-enabled disaster recovery systems, GIS platforms, and mobile crisis communication tools allow seamless updates, cross-agency collaboration, and data redundancy. They eliminate the need for heavy infrastructure while providing secure, scalable, and customizable tools for emergency response planning.

Organizations are increasingly favoring cloud adoption due to lower costs, improved resilience, and flexibility in disaster operations. This trend is particularly significant among government agencies, healthcare systems, and educational institutions aiming for agile and unified disaster response management architectures.

Increased Adoption of Simulation and Training Software

Simulation-based preparedness and virtual training tools are becoming a cornerstone of modern emergency planning strategies. Advanced modeling software enables realistic disaster scenario rehearsals for personnel across healthcare, energy, manufacturing, and public administration sectors. These platforms help users understand decision-making under stress, resource allocation, and inter-agency coordination during crises.

Augmented reality (AR) and virtual reality (VR) are also being integrated for immersive disaster readiness drills. The shift from manual training to digital simulation ensures better preparedness without real-world consequences. This growing focus on experiential learning and operational readiness is driving demand for innovative training modules within the disaster preparedness systems market.

Disaster Preparedness Systems Market: Research Scope and Analysis

By Type Analysis

Surveillance systems are projected to dominate the global disaster preparedness systems market by the end of 2025, capturing a 31.2% share. The rising demand for real-time monitoring, threat detection, and secure communication infrastructure is driving this dominance. Governments and municipal authorities are increasingly investing in video surveillance infrastructure to ensure continuous situational awareness during emergencies. This segment supports remote access, AI-based video analytics, and integration with early-warning systems, making it essential for proactive disaster risk reduction.

Additionally, increasing urbanization and the need for enhanced public safety are propelling the adoption of advanced surveillance technologies in both developed and emerging economies, reinforcing their importance in modern emergency response frameworks and disaster readiness planning.

The emergency notification system segment is expected to grow at the highest CAGR in the global disaster preparedness systems market by the end of 2025. This growth is driven by the increasing need for instant communication during crises, ensuring rapid information dissemination across public and private sectors. These systems enable multi-channel alerts through SMS, emails, mobile applications, and public address systems. Their ability to integrate with IoT-based sensors and geolocation tracking enhances accuracy in targeting affected populations. Furthermore, rising awareness of the importance of mass alert systems during natural disasters, pandemics, and industrial accidents is accelerating their deployment across smart city infrastructure, transportation networks, and enterprise continuity planning.

By Solution Analysis

Disaster recovery solutions are expected to dominate the global disaster preparedness systems market by the end of 2025, with a market share of 45.6%. These solutions offer critical infrastructure protection and ensure the continuity of essential services following emergencies. The increasing frequency of cyber-attacks, system outages, and natural calamities has prompted both public and private sectors to invest in resilient IT recovery frameworks.

Disaster recovery tools enable quick data restoration, business continuity operations, and remote backup capabilities, which are vital for minimizing economic losses and downtime. This segment’s prominence is further reinforced by the growing adoption of cloud-based platforms and compliance requirements related to organizational risk management and digital resilience planning.

Situational awareness solutions are projected to witness the highest CAGR in the disaster preparedness systems market by the end of 2025. These solutions provide real-time insights and decision-making support by integrating sensor data, field communications, and predictive analytics. Their application in emergency response coordination, incident command systems, and tactical planning is rapidly expanding, especially within defense, transportation, and urban infrastructure.

The rise in unpredictable climatic events and security threats has accelerated the demand for intelligent platforms that visualize unfolding scenarios. Integration with geographic information systems and AI-driven analytics further enhances operational readiness. As smart infrastructure evolves, these solutions are becoming vital in reducing reaction time and strengthening proactive emergency strategies.

By Services Analysis

Design & integration services are anticipated to dominate the global disaster preparedness systems market by the end of 2025, accounting for 38.7% of the overall share. These services are critical in tailoring disaster response infrastructures to specific operational needs, ensuring seamless interoperability among surveillance systems, communication tools, and command platforms. With increasing investment in resilient infrastructure and customized emergency management frameworks, organizations seek expert integration to unify diverse technological components.

This segment supports efficient deployment of disaster resilience systems across sectors such as transportation, healthcare, and utilities. As the complexity of multi-hazard risk environments rises, the demand for scalable, adaptable, and fully integrated preparedness solutions continues to drive this segment’s strong market positioning.

Training & education services are projected to experience the highest CAGR in the disaster preparedness systems market by the end of 2025. Growing awareness about the importance of preparedness drills, simulation exercises, and real-time crisis response has led to increased adoption of structured training programs.

These services equip personnel with the skills needed to manage emergencies efficiently and reduce response time. Governments, corporations, and humanitarian agencies are prioritizing workforce readiness to improve disaster mitigation strategies. This segment’s growth is also driven by the integration of virtual reality-based training modules, scenario planning tools, and e-learning platforms. As global risk landscapes evolve, proactive education remains essential for strengthening emergency preparedness and building a culture of safety.

By Communication Technology Analysis

Satellite phones are projected to dominate the global disaster preparedness systems market by the end of 2025, capturing a 34.1% market share. Their ability to maintain uninterrupted communication during natural disasters, infrastructure failures, or remote field operations makes them indispensable. Unlike terrestrial networks, satellite communication ensures connectivity even in areas with limited or no cellular coverage, supporting coordination in disaster zones.

Emergency management agencies, humanitarian organizations, and military forces increasingly rely on satellite phones for voice, text, and data communication during crisis response. As extreme weather events and geopolitical instability rise, the demand for secure, reliable, and globally accessible communication channels is fueling the growth of satellite-based disaster communication systems in preparedness frameworks.

Vehicle-ready gateways are expected to grow at the highest CAGR in the disaster preparedness systems market by the end of 2025. These mobile communication hubs offer flexible, on-the-move connectivity for emergency response teams, integrating Wi-Fi, LTE, and satellite links within vehicles.

Their ability to connect command centers, drones, sensors, and field operatives in real time is revolutionizing mobile disaster response capabilities. Governments and rescue agencies are deploying these gateways in fire trucks, ambulances, and mobile command units to ensure field operability under dynamic conditions. With increasing demand for mobile incident management, rapid deployment units, and resilient field networks, vehicle-ready communication platforms are gaining traction as critical assets in modern emergency preparedness ecosystems.

By End User Analysis

The public sector is projected to dominate the global disaster preparedness systems market by the end of 2025, holding a 36.4% market share. Government agencies at the national, regional, and municipal levels are significantly investing in comprehensive emergency response infrastructure. Their role in safeguarding communities from natural disasters, pandemics, and industrial accidents drives heavy deployment of early-warning systems, emergency operations centers, and real-time surveillance.

Public safety mandates and national resilience programs further accelerate implementation. Moreover, the integration of smart city initiatives with disaster readiness technologies enhances situational responsiveness. As threats to public welfare grow more complex, public sector bodies continue to lead the adoption of coordinated disaster management strategies through large-scale, policy-driven initiatives.

The healthcare segment is anticipated to register the highest CAGR in the disaster preparedness systems market by the end of 2025. Hospitals and healthcare networks are increasingly focusing on continuity planning, emergency notification, and infrastructure protection to maintain critical care services during crises.

The COVID-19 pandemic underscored the urgent need for integrated preparedness frameworks within medical facilities. Demand for real-time alert systems, mobile field units, and backup power systems is rising. Furthermore, compliance with health safety standards and accreditation requirements is pushing providers to adopt robust disaster response technologies. As climate events, epidemics, and cyber threats intensify, healthcare systems are prioritizing resilience and operational agility through advanced preparedness tools.

The Disaster Preparedness Systems Market Report is segmented on the basis of the following:

By Type

- Surveillance System

- Emergency Notification System

- Safety Management System

- Earthquake/Seismic Warning System

- Disaster Recovery and Backup Systems

- Others

By Solution

- Disaster Recovery Solutions

- Geospatial Solutions

- Situational Awareness Solutions

By Services

- Consulting Services

- Training & Education Services

- Design & Integration Services

- Support & Maintenance Services

By Communication Technology

- Emergency Response Radars

- First Responder Tools

- Satellite Phones

- Vehicle-Ready Gateways

- Others

By End User

- Public Sector

- Healthcare

- BFSI

- Energy and Utilities

- Aerospace and Defence

- Manufacturing

- Others

Regional Analysis

Region with the largest Share

North America is expected to hold the largest share in the global disaster preparedness systems market by the end of 2025, accounting for 37.8%. The region’s leadership is driven by strong government policies, advanced infrastructure, and high public safety awareness. The U.S. and Canada heavily invest in emergency response technologies, cybersecurity resilience, and integrated communication networks.

Federal agencies like FEMA and Homeland Security allocate substantial budgets for disaster mitigation and recovery systems. Additionally, the presence of leading tech firms and defense contractors supports innovation in early warning, backup, and monitoring platforms. Frequent occurrences of wildfires, hurricanes, and cyber incidents further drive adoption of comprehensive preparedness frameworks across public institutions and critical sectors like healthcare and utilities.

Region with Highest CAGR

Asia Pacific is anticipated to witness the highest CAGR in the global disaster preparedness systems market by the end of 2025. The region faces increasing vulnerability to natural disasters such as typhoons, earthquakes, floods, and tsunamis, prompting countries to upgrade emergency management infrastructures rapidly.

Nations like Japan, India, China, and Indonesia are heavily investing in geospatial intelligence, satellite communication, and public alerting technologies. Urbanization, growing population density, and climate change risks are pushing local governments to implement scalable and technology-driven disaster readiness strategies. Moreover, the integration of smart city initiatives and real-time situational awareness platforms across the region enhances response efficiency. This surge in infrastructure development and policy reform positions Asia Pacific as a key growth hub for the market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in Disaster Preparedness Systems Market

- Enhanced Predictive Analytics: Artificial Intelligence (AI) significantly improves predictive capabilities in disaster preparedness systems by analyzing vast datasets from weather forecasts, satellite imagery, and historical incidents. Machine learning algorithms can detect patterns, helping authorities forecast events like hurricanes, floods, or wildfires with greater accuracy. These insights allow for timely alerts and proactive mitigation strategies.

- Real-Time Decision Support: AI-powered systems enable real-time decision-making during emergencies by processing live data from IoT sensors, drones, and communication networks. This allows emergency responders to assess evolving situations and deploy resources efficiently. AI-driven dashboards can prioritize high-risk zones, reducing response time and increasing operational efficiency in crisis management.

- Automation of Emergency Responses: Through intelligent automation, AI enhances disaster recovery systems by activating safety protocols such as lockdowns, alarms, or evacuation routes without human intervention. AI chatbots and virtual assistants are also being used to disseminate information and guide civilians during emergencies, ensuring clear communication across diverse populations.

- Post-Disaster Recovery and Analysis: AI aids in post-disaster assessment by analyzing structural damage using computer vision and drone footage. It also supports resource allocation and logistics for recovery operations. Long-term, AI helps in refining future disaster preparedness plans by learning from past data, improving resilience, and reducing economic and human losses.

Competitive Landscape

The competitive landscape of the global disaster preparedness systems market is marked by a mix of established technology providers, government contractors, and specialized emergency management firms. Leading players are focusing on innovation, strategic partnerships, and public-private collaborations to strengthen their market positions. Companies such as Honeywell International, Lockheed Martin, Siemens, Motorola Solutions, and Everbridge are investing in advanced situational awareness platforms, emergency communication networks, and resilient infrastructure solutions. These firms are integrating AI-powered analytics, IoT-based sensors, and satellite-enabled communication into their product portfolios to address rising global threats.

Additionally, vendors are aligning with national security agencies and urban planners to provide tailored disaster recovery services and design-integrated safety systems. Startups are also entering the market with niche offerings such as real-time geospatial mapping, mobile command units, and cloud-based continuity platforms. The demand for customized training modules, intelligent emergency response tools, and secure communication technology is intensifying competition. Regional players are focusing on local compliance standards, while global corporations are scaling operations through mergers, acquisitions, and R&D investments. As risks from climate change, cyberattacks, and biological hazards increase, the market is witnessing a dynamic shift toward agile, interoperable, and multi-layered preparedness systems across critical sectors.

Some of the prominent players in the Global Disaster Preparedness Systems Market are

- Honeywell International Inc.

- Siemens AG

- Motorola Solutions, Inc.

- Lockheed Martin Corporation

- IBM Corporation

- Schneider Electric SE

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Everbridge, Inc.

- Collins Aerospace

- AtHoc (a division of BlackBerry Limited)

- Johnson Controls International plc

- Esri

- FLIR Systems (now part of Teledyne Technologies)

- NEC Corporation

- Airbus S.A.S.

- Intergraph Corporation (a Hexagon company)

- BAE Systems plc

- ICF International, Inc.

- Rave Mobile Safety

- Other Key Players

Recent Developments

- In March 2025, IBM collaborates with FEMA to implement AI-powered simulation models predicting disaster impacts, enabling faster resource deployment and improving real-time decision-making across critical U.S. infrastructure and public service networks.

- In January 2025, Siemens introduces a modular emergency power grid solution for disaster zones, integrating smart microgrids with satellite communications to maintain energy resilience and connectivity during extreme weather and geophysical events.

- In February 2025, Microsoft launches the "Disaster Insights Hub" on Azure, using real-time analytics, geospatial data, and AI to support governments and NGOs in proactive disaster planning and climate risk management.

- In May 2024, Panasonic unveils a portable disaster-response energy kit combining solar power, energy storage, and communication devices aimed at supporting emergency responders and relief operations in remote and post-disaster regions.

- In August 2024, Amazon Web Services (AWS) partners with the International Red Cross to expand its cloud-based disaster response infrastructure, enhancing data sharing, supply chain logistics, and crisis communications across global hotspots.

- In October 2024, Schneider Electric announces a new initiative to retrofit critical infrastructure in flood-prone regions with smart sensors and adaptive control systems, improving early warning mechanisms and operational continuity during natural disasters.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 216.0 Bn |

| Forecast Value (2034) |

USD 586.0 Bn |

| CAGR (2025–2034) |

11.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 68.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Surveillance System, Emergency Notification System, Safety Management System, Earthquake/Seismic Warning System, Disaster Recovery and Backup Systems, Others), By Solution (Disaster Recovery Solutions, Geospatial Solutions, Situational Awareness Solutions), By Services (Consulting Services, Training & Education Services, Design & Integration Services, Support & Maintenance Services), By Communication Technology (Emergency Response Radars, First Responder Tools, Satellite Phones, Vehicle-Ready Gateways, Others), By End User (Public Sector, Healthcare, BFSI, Energy and Utilities, Aerospace and Defence, Manufacturing, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Honeywell International Inc., Siemens AG, Motorola Solutions, Inc., Lockheed Martin Corporation, IBM Corporation, Schneider Electric SE, Northrop Grumman Corporation, Raytheon Technologies Corporation, Everbridge, Inc., Collins Aerospace, AtHoc, Johnson Controls International plc, Esri, FLIR Systems, NEC Corporation, Airbus S.A.S., Intergraph Corporation, BAE Systems plc, ICF International, Inc., Rave Mobile Safety, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Disaster Preparedness Systems Market size is estimated to have a value of USD 216.0 billion in 2025 and is expected to reach USD 586.0 billion by the end of 2034.

North America is expected to be the largest market share for the Global Disaster Preparedness Systems Market with a share of about 37.8 % in 2025.

Some of the major key players in the Global Disaster Preparedness Systems Market are Honeywell International Inc., Siemens AG, Motorola Solutions Inc., and many others.

The market is growing at a CAGR of 11.0% over the forecasted period.

The US Disaster Preparedness Systems Market size is estimated to have a value of USD 68.7 billion in 2025 and is expected to reach USD 175.4 billion by the end of 2034.