Market Overview

The Global

Disposable Fiber Optic Head Market is projected to reach

USD 1.4 billion in 2024 and grow at a compound annual growth rate of

8.8% from there until 2033 to reach a value of

USD 3.0 billion.

Disposable fiber optic heads are vital components in various industries, mostly used in medical devices and diagnostic equipment. These heads are part of fiber optic systems that transfer light for imaging, diagnostics, and sensing. Made for single use, they ensure safety and hygiene by preventing cross-contamination between patients or different work environments. They are mostly developed for endoscopic procedures, surgeries, or other diagnostic imaging tasks where precision and clarity are crucial.

Further, the demand for disposable fiber optic heads has grown highly due to increasing healthcare needs, mostly in minimally invasive surgeries. The growth in chronic diseases, aging populations, and the shift toward outpatient care contribute to this growth. Disposable heads provide an affordable, hygienic solution for medical facilities, as they remove the need for sterilization and reduce the risk of infection. Furthermore, their integration into diagnostic tools, like endoscopes, continues to spur demand in the medical and industrial sectors.

Further, in the healthcare sector, companies are focusing on enhancing optical clarity, durability, and ergonomic designs to meet diverse application requirements. Developments in materials, like high-quality

glass or polymers, are allowing for better light transmission and image quality. In addition, sustainability is a major trend, with some manufacturers exploring biodegradable or recyclable options to minimize environmental impact. The expansion of

telemedicine and remote diagnostics is also influencing innovation in fiber optic technologies.

Moreover, a large focus on patient safety and infection control drives the preference for disposable fiber optic heads in clinical settings. Their ability to provide high-definition imaging while removing cross-contamination risks is a major benefit. Also, their use is exceeding beyond healthcare into fields like industrial inspection and telecommunications.

However, challenges exist in terms of cost, as disposable models can be more expensive than reusable counterparts over time. Companies are addressing this by innovating in production techniques to lower costs while maintaining high standards of performance and safety.

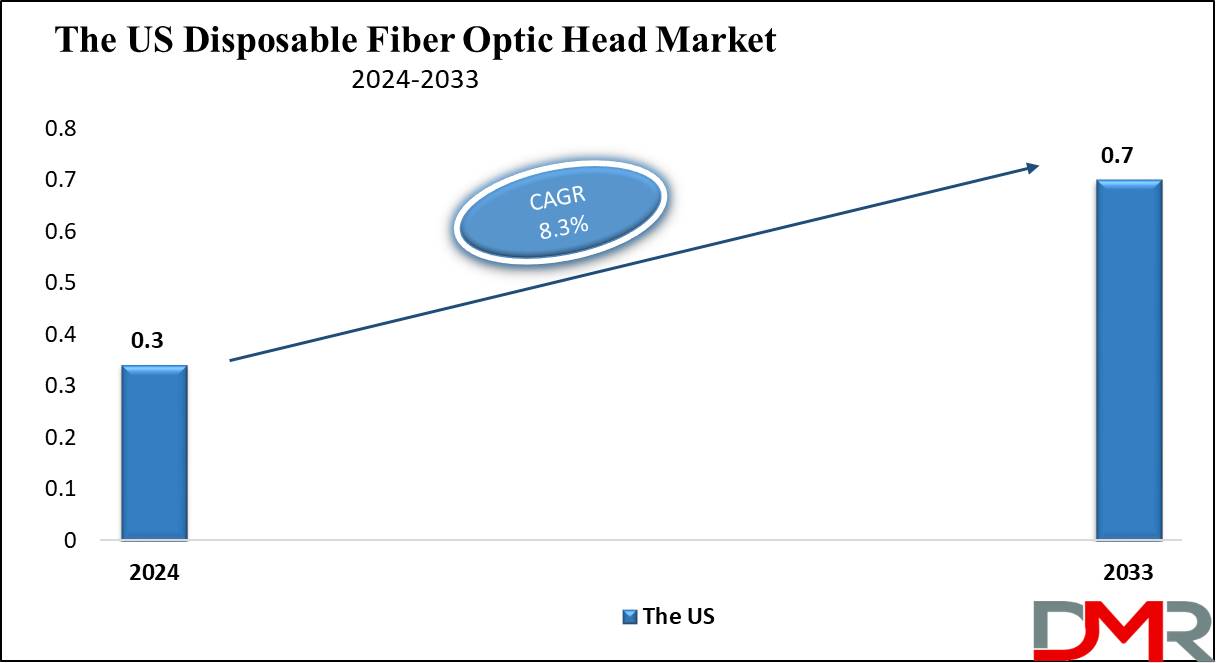

The US Disposable Fiber Optic Head Market

The US Disposable Fiber Optic Head Market is projected to reach USD 0.3 billion in 2024 at a compound annual growth rate of 8.3% over its forecast period.

The US provides significant growth opportunities in the disposable fiber optic head market due to its advanced healthcare infrastructure and increasing demand for less invasive procedures. Rising focus on infection control, along with growing adoption of innovative diagnostic tools, drives market expansion. In addition, investments in medical technology and a strong regulatory framework support the development and adoption of disposable solutions.

Further, there is an increasing demand for minimally invasive procedures and strict infection control protocols. However, a major restraint is the higher cost of disposable products in comparison to reusable alternatives, which can pose budget challenges for healthcare providers, especially in smaller hospitals and clinics.

Key Takeaways

- Market Growth: The Disposable Fiber Optic Head Market size is expected to grow by USD 1.5 billion, at a CAGR of 8.8% during the forecasted period of 2025 to 2033.

- By Type: The Diagnostic fiber optic heads segment is anticipated to get the majority share of the Disposable Fiber Optic Head Market in 2024.

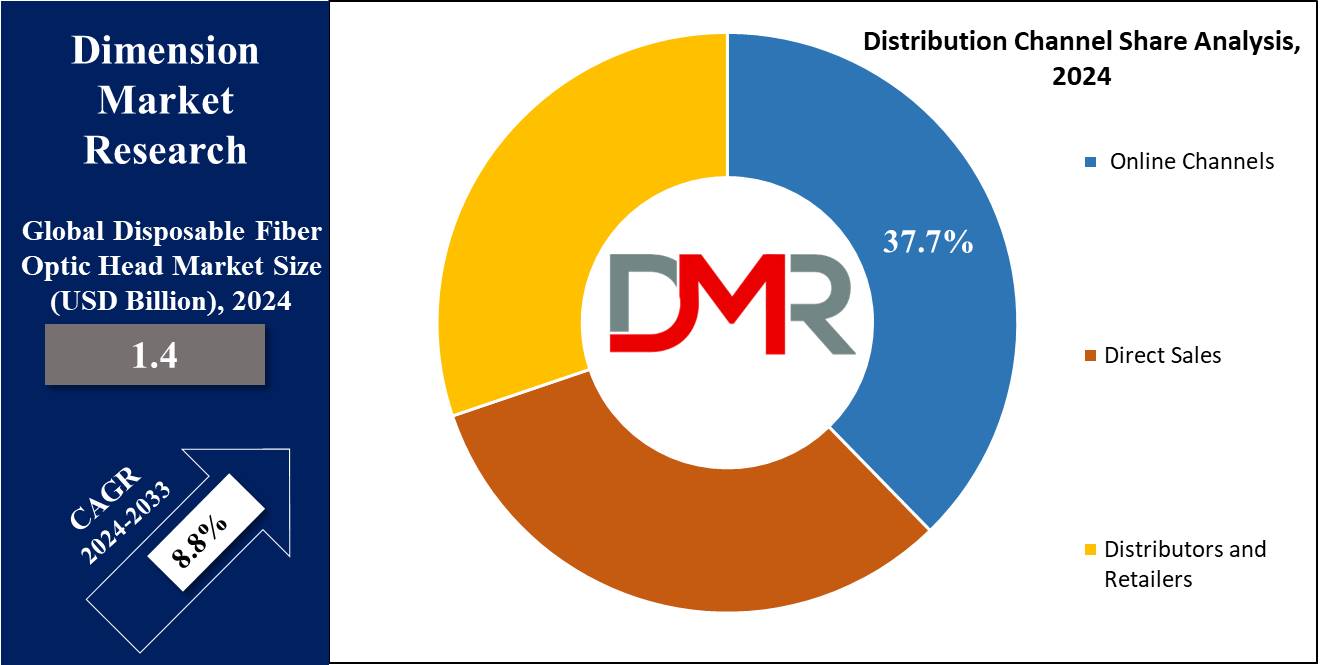

- By Distribution Channel: The online channel segment is expected to be leading the market in 2024

- By Application: The endoscopy segment is expected to get the largest revenue share in 2024 in the Disposable Fiber Optic Head Market.

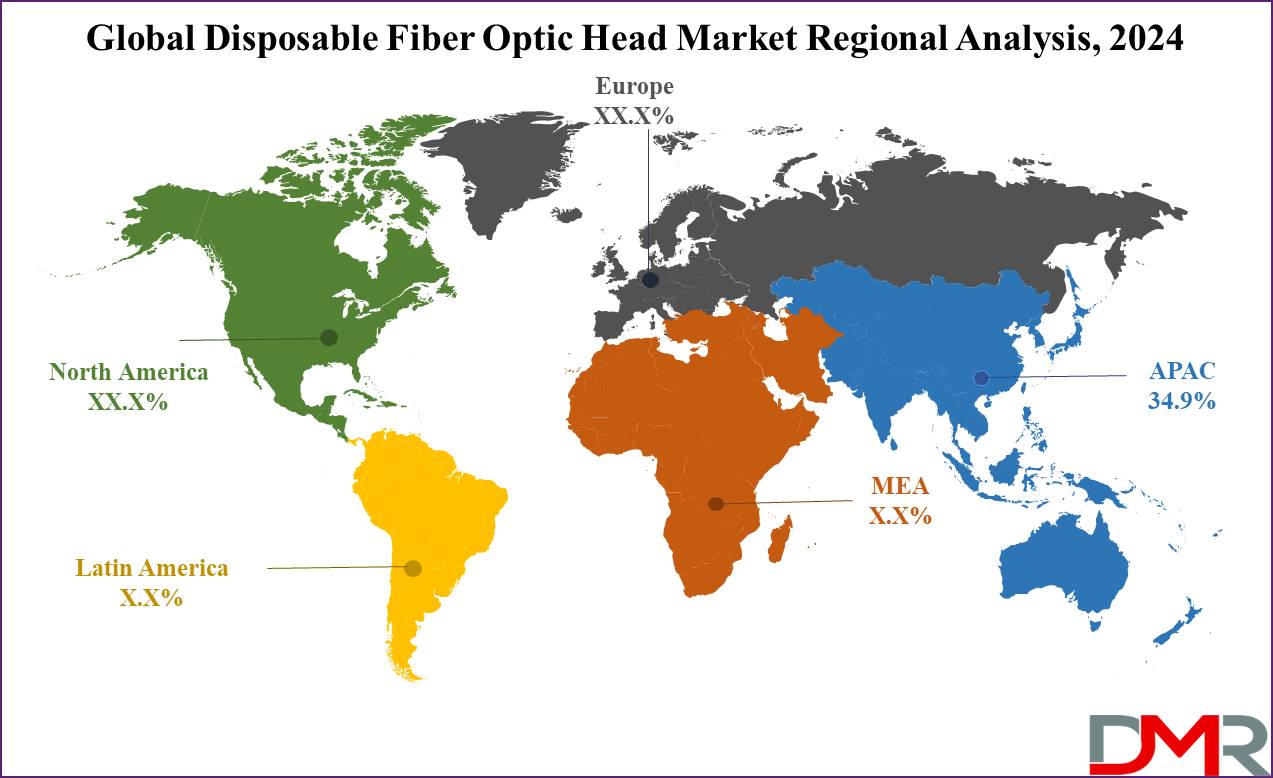

- Regional Insight: Asia Pacific is expected to hold a 34.9% share of revenue in the Global Disposable Fiber Optic Head Market in 2024.

- Use Cases: Some of the use cases of Disposable Fiber Optic Head include medical endoscopy, surgical applications, and more.

Use Cases

- Medical Endoscopy: Disposable fiber optic heads are broadly used in endoscopic procedures, allowing doctors to look into internal organs without risking cross-contamination between patients. Their single-use nature ensures hygienic conditions and improves patient safety during diagnostic and surgical procedures.

- Industrial Inspection: In industries like aerospace and manufacturing, disposable fiber optic heads are employed for inspecting hard-to-reach areas of equipment or machinery, such as engines or pipelines. They provide high-resolution imaging and are affordable for one-time use in critical inspections.

- Surgical Applications: Used in lesser invasive surgeries, disposable fiber optic heads provide high-definition imaging during procedures like laparoscopy. Their disposability reduces the risk of infection and is mainly useful in sterile environments where equipment contamination must be avoided.

- Telecommunications: In the telecommunications sector, disposable fiber optic heads can be utilized for the installation and maintenance of fiber optic networks, ensuring optimal performance by allowing for precise light transmission measurements and network diagnostics during short-term tasks.

Market Dynamic

Driving Factors

Rising Demand for Minimally Invasive Surgeries

The increase in preference for less invasive procedures is a key growth driver for the disposable fiber optic head market. These surgeries demand high-precision imaging tools that provide clear visuals with lower patient risk. Disposable fiber optic heads offer a hygienic, single-use solution, making them ideal for such applications, thus driving market growth in the medical sector.

Increasing Focus on Infection Control in Healthcare

Infection prevention remains a top priority in healthcare settings, mainly in

surgical environments. Disposable fiber optic heads eliminate the demand for sterilization and reduce the risk of cross-contamination, addressing hospitals' growing focus on patient safety, which contributes significantly to the market expansion as hospitals and clinics highly prefer disposable solutions for their ease of use and infection control benefits.

Restraints

High Cost of Disposable Models

The relatively higher cost of disposable fiber optic heads compared to reusable alternatives presents a restraint for widespread adoption, mainly in cost-sensitive healthcare environments. Hospitals and clinics may face budget constraints, limiting their ability to consistently choose disposable options despite their benefits in infection control and convenience.

Environmental Impact of Single-Use Products

The environmental concerns regarding the disposal of single-use fiber optic heads contribute to market challenges. As healthcare systems and industries look to minimize waste, the environmental footprint of disposable products is becoming a major point of contention, pushing manufacturers to explore more sustainable solutions.

Opportunities

Technological Advancements in Materials and Design

Ongoing innovations in materials, like the development of high-performance optical fibers and durable polymers, provide many opportunities for the disposable fiber optic head market. These developments can lead to better image quality, a longer lifespan, and reduced manufacturing costs, making disposable fiber optic heads more accessible and efficient for medical and industrial applications.

Expansion in Emerging Markets

The major

healthcare infrastructure in emerging economies provides many opportunities for the disposable fiber optic head market. As these regions experience enhancement in medical technology adoption and a high demand for quality healthcare, the need for affordable, hygienic diagnostic tools, like disposable fiber optic heads, is expected to rise, driving market growth.

Trends

Sustainability and Eco-friendly Innovations

A recent trend in the disposable fiber optic head market is the growing focus on sustainability. Manufacturers are exploring biodegradable materials and environmentally friendly production processes to minimize the ecological impact of single-use products, which is driven by increasing regulatory pressures and consumer demand for greener healthcare solutions.

Integration with Telemedicine and Remote Diagnostics

The growth of telemedicine and remote diagnostics is influencing the design and application of disposable fiber optic heads. These tools are becoming important in allowing high-quality, real-time imaging and diagnostics during remote consultations, which is mainly valuable in rural and underserved areas, expanding the market's reach and utilization.

Research Scope and Analysis

By Type

Diagnostic fiber optic heads play an important role in the growth of the disposable fiber optic head market and are expected to lead the market in 2024. They are highly used in medical imaging and diagnostics, mainly in procedures like endoscopy, where clear visual inspection is necessary.

As the need for precise, non-invasive diagnostic tools increases, disposable fiber optic heads provide a hygienic, affordable solution by eliminating the requirement for sterilization and reducing the risk of infections. Their use in diagnostics supports faster, safer medical procedures and allows healthcare providers to provide high-quality care, which directly drives the demand for disposable fiber optic heads across medical and industrial sectors.

Further, fiber optic bundles are also vital to the growth of the disposable fiber optic head market, as these bundles include multiple fibers working together to transmit light and images. Disposable fiber optic heads allow high-resolution visualization in procedures like endoscopy. As the need for more accurate, less invasive diagnostics rises, fiber optic bundles continue to drive market growth by providing an effective, hygienic, and affordable solution for single-use medical applications.

By Technology

LED-based fiber optic heads play a vital role in the growth of the disposable fiber optic head market by providing various advantages in terms of brightness, energy efficiency, and durability. LED technology provides consistent and high-quality light output, making better visibility during medical procedures. These fiber optic heads are highly used in surgical instruments, endoscopes, and diagnostic devices where clear and focused lighting is vital.

The introduction of LED-based fiber optic heads has also contributed to reducing operational costs, as LEDs have a longer lifespan in comparison to traditional light sources, requiring less frequent replacement. In addition, LED lights generate less heat, enhancing patient comfort during procedures.

As healthcare facilities look for disposable, affordable, and reliable lighting solutions for medical procedures, LED-based fiber optic heads are becoming increasingly popular, which is driving the growth of the disposable fiber optic head market as more healthcare providers adopt these advanced, efficient products.

By Application

Endoscopy is a key application fueling the growth of the disposable fiber optic head market. In medical procedures, endoscopes equipped with fiber optic heads allow doctors to view internal organs and tissues without making large incisions. The demand for high-quality, disposable fiber optic heads is growing as endoscopic procedures become more common, mostly for diagnostics and minimally invasive surgeries.

Disposable heads provide a hygienic, affordable solution by eliminating the risk of cross-contamination between patients. With the rise in outpatient procedures and the growth in focus on patient safety, endoscopy continues to boost demand for disposable fiber optic heads, driving market growth in the healthcare sector.

Further, in urological procedures, fiber optic heads are utilized in tools like cystoscopes to examine the urinary tract, bladder, and kidneys. As these procedures need high precision and hygiene, disposable fiber optic heads provide a safe, affordable solution by minimizing the risk of infection. With the growth in demand for minimally invasive urological treatments, disposable fiber optic heads are becoming essential, fueling market growth in this field.

By Distribution Channel

Online channels are said to be leading the disposable fiber optic head market in 2024 by making these products easily accessible to a variety of customers. Through e-commerce platforms and company websites, manufacturers and distributors can reach hospitals, clinics, and industries across different regions, like remote areas.

These platforms provide convenience, allowing buyers to in comparison prices, access detailed product information, and place orders quickly. In addition, online channels help minimize distribution costs and streamline supply chains, allowing quick delivery. As digital purchasing grows, mostly post-pandemic, online sales are becoming a key driver for market expansion in the healthcare and industrial sectors.

Further, direct sales play a major role in the growth of the disposable fiber optic head market by allowing personalized customer interactions and building strong client relationships. Through direct sales, manufacturers can better understand the specific needs of hospitals, clinics, and industries, providing customizing solutions and technical support, which helps ensure product quality and reliability, fostering trust and customer loyalty.

In addition, direct sales often result in faster transactions and delivery, which is important for time-sensitive sectors like healthcare, ultimately driving market growth by meeting client demands efficiently.

By End User

Hospitals play a major role in driving the growth of the disposable fiber optic head market and are anticipated to lead the overall market in 2024. As key end users, they depend on these products for many diagnostic and surgical procedures, like endoscopy, urology, and minimally invasive surgeries. The demand for high-quality, disposable tools in hospitals is growing due to growing patient volumes and a strong focus on infection control.

By using disposable fiber optic heads, hospitals can ensure hygienic practices, remove sterilization costs, and reduce the risk of cross-contamination. With the growing demand for advanced medical technologies, hospitals are highly contributing to the expansion of the disposable fiber optic head market.

Further, specialty clinics are also important to end users, driving the growth of the disposable fiber optic head market. These clinics mostly focus on specific medical areas, like gastroenterology or urology, where procedures like endoscopy and cystoscopy are common.

Disposable fiber optic heads are ideal for clinics due to their convenience and hygiene, assisting in preventing cross-contamination between patients. As specialty clinics focus on providing high-quality, efficient care, the demand for reliable, single-use diagnostic tools continues to rise, supporting the expansion of the disposable fiber optic head market.

The Disposable Fiber Optic Head Market Report is segmented on the basis of the following

By Type

- Diagnostic Fiber Optic Heads

- Therapeutic Fiber Optic Heads

- Fiber Optic Bundles

By Technology

- LED-based Fiber Optic Heads

- Laser-based Fiber Optic Heads

By Application

- Endoscopy

- Ophthalmology

- ENT (Ear, Nose, and Throat)

- Urology

- Gynecology

- General Surgery

By Distribution Channel

- Direct Sales

- Distributors and Retailers

- Online Channels

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Diagnostic Centers

Regional Analysis

The Asia Pacific is set to dominate the disposable fiber optic head market in 2024 with 34.9 due to its rapidly expanding healthcare sector and growing adoption of advanced medical technologies. Countries like China, India, and Japan are experiencing a rise in less invasive procedures, driven by growing patient awareness and improving healthcare infrastructure.

In addition, the region’s large population and higher occurrence prevalence of chronic diseases boost the need for diagnostic and surgical tools. Disposable fiber optic heads are gaining popularity for their role in enhancing patient safety by preventing infections. With government initiatives to enhance healthcare services and rising investments in medical technology, the Asia Pacific region is emerging as a key market for disposable fiber optic heads.

Further North America will also have substantial market share in 2024 due to its advanced healthcare system and high adoption of innovative medical technologies. The region experiences a strong demand for minimally invasive procedures, where disposable fiber optic heads are important for precise imaging and infection control.

With strict healthcare regulations focusing on patient safety and hygiene, hospitals and clinics increasingly prefer disposable tools. Additionally, rising healthcare spending and technological developments further boost the market's growth in North America.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The disposable fiber optic head market is highly competitive, with various players looking to innovate and capture market share. Companies look to develop high-quality, affordable products to meet the increase in demand in the healthcare and industrial sectors.

Innovation in materials and technology, like better light transmission and durability, is a key strategy. In addition, market players are expanding their distribution networks, like online channels, to reach a large audience.

Some of the prominent players in the Global Disposable Fiber Optic Head are

- Prysmian Group

- Fujikura Ltd

- Leoni AG

- Corning Inc

- TE Connectivity

- Amphenol Corp

- Furukawa Electric Co Ltd

- Molex LLC

- Belden Inc

- Sumitomo Electric Industries, Ltd.

- Other Key Players

Recent Developments

- In August 2024, STL launched 864-fiber micro cable and several fiber-connectivity products to the United States market, which can pack 864 fibers in a cable diameter of 11.4 mm—1.5 times more fibers than a standard micro cable of the same diameter. Using the bend-insensitive 200-micron fiber, the 864F cable can be blown up to 1500 meters in a 14-mm duct, uses 40 percent lower plastic than standard micro cable, allows tighter cable coiling during installation, and provides easy access to fiber bundles.

- In June 2024, Moldex3D and Xnovo Technology announced a partnership to offer an advanced calibration for fiber parameters based on scan experiments, empowering users to conduct reliable and accurate simulations. As simulation of fiber orientation is not a new technology, and they created a model for it, but with the input of real-life data it would be even more enhanced.

- In May 2023, Prysmian Group launched the sustainable telecommunication system Ecoslim, using Sirocco HD and Sirocco Extreme (XT) optical cables, which are available with up to 864 optical fibers, and are made with 50% less plastics and up to 25% smaller in diameter, in line with the Group’s commitment to increase the amount of recycled material in their products

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1.4 Bn |

| Forecast Value (2033) |

USD 3.0 Bn |

| CAGR (2024-2033) |

8.8% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 0.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Diagnostic Fiber Optic Heads, Therapeutic Fiber Optic Heads, and Fiber Optic Bundles)

By Technology (LED-based Fiber Optic Heads and Laser-based Fiber Optic Heads)

By Application (Endoscopy, Ophthalmology, ENT (Ear, Nose, and Throat), Urology, Gynecology, and General Surgery), By Distribution Channel (Direct Sales, Distributors and Retailers, and Online Channels), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, and Diagnostic Centers)

|

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Prysmian Group, Fujikura Ltd, Leoni AG, Corning Inc, TE Connectivity, Amphenol Corp. Furukawa Electric Co Ltd, Molex LLC, Belden Inc, Sumitomo Electric Industries, Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Disposable Fiber Optic Head Market size is expected to reach a value of USD 1.4 billion in 2024 and is expected to reach USD 3.0 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Disposable Fiber Optic Head Market with a share of about 34.9% in 2024.

The Disposable Fiber Optic Head Market in the US is expected to reach USD 0.3 billion in 2024.

Some of the major key players in the Global Disposable Fiber Optic Head Market are Prysmian Group, Fujikura Ltd, Leoni AG, and others.

The market is growing at a CAGR of 8.8 percent over the forecasted period.