Market Overview

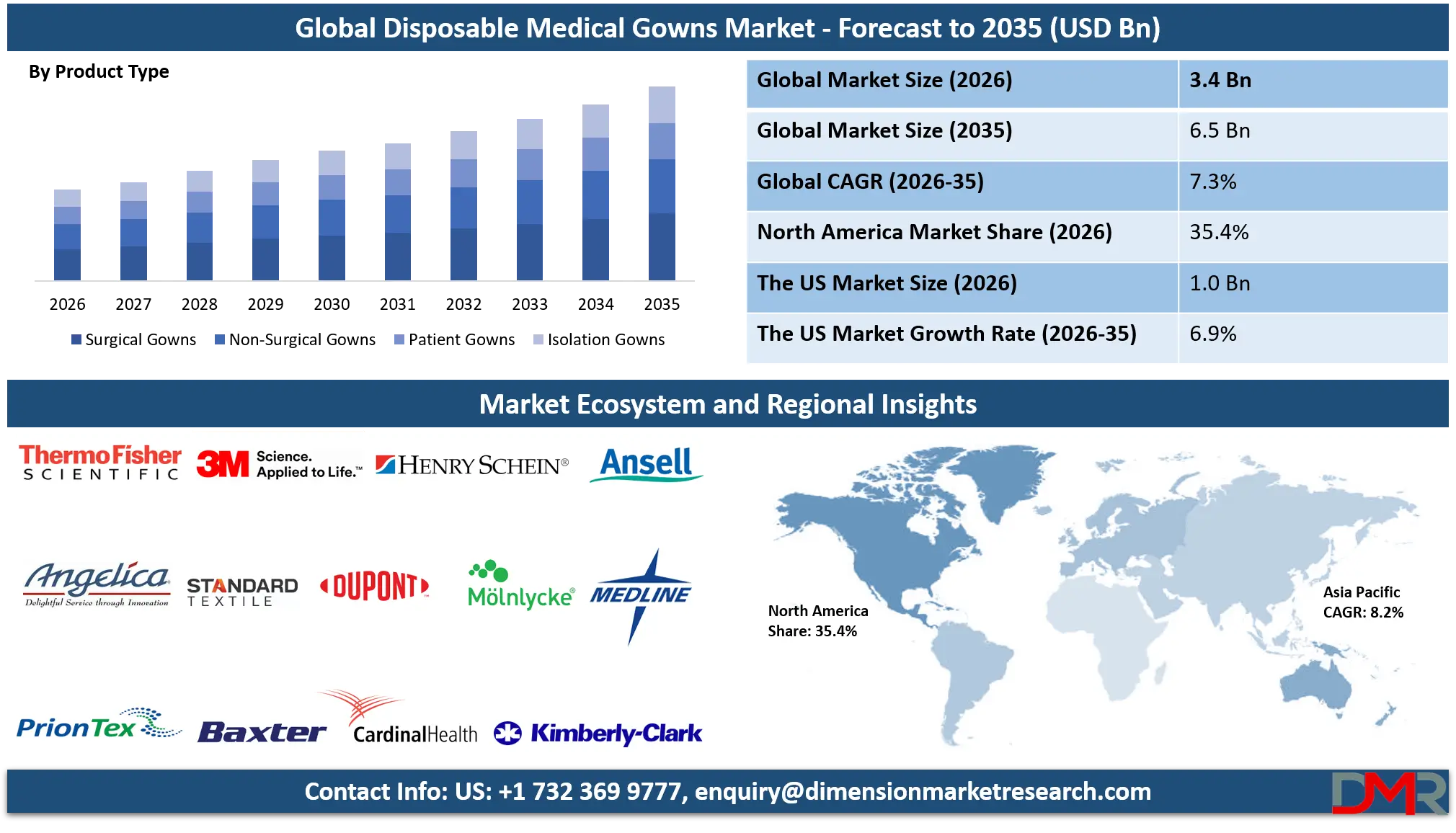

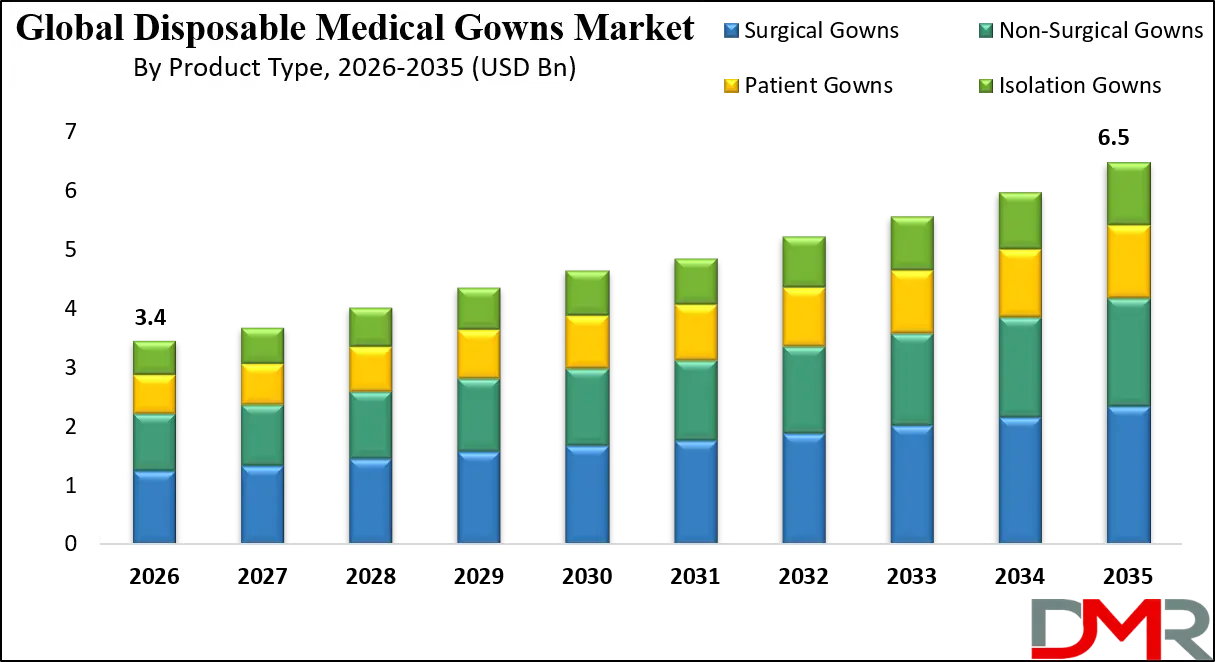

The Global Disposable Medical Gowns market is projected to reach USD 1.8 billion in 2026 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2026 to 2035, reaching an estimated USD 6.5 billion by 2035. This steady growth trajectory is fueled by the persistent global emphasis on infection prevention and control (IPC), heightened regulatory standards for healthcare worker safety, and the rising volume of surgical procedures worldwide. Disposable medical gowns represent a critical component in the frontline defense against healthcare-associated infections (HAIs), providing a barrier against fluid, microbial, and particulate transmission.

Unlike reusable gowns, disposable medical gowns are single-use products designed for consistent performance and sterility, eliminating risks associated with inadequate reprocessing. This single-use function ensures standardized protection, reduces cross-contamination potential, and enhances operational efficiency in fast-paced clinical settings. The market's expansion is underpinned by a powerful confluence of drivers: stringent regulations from bodies like the FDA and EU MDR, rising incidence of chronic diseases requiring surgical intervention, growing awareness of occupational safety, and the lasting impact of pandemic preparedness initiatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The evolution of disposable medical gowns is characterized by material and design innovation. Advancements such as enhanced breathable yet impermeable fabrics, sustainable bio-based materials, and gowns with integrated

sensor technology for wear-time monitoring are improving user comfort and functionality. Concurrently, digitalization through supply chain tracking and inventory management integration is streamlining procurement and ensuring availability.

While the market faces headwinds from environmental concerns regarding plastic waste, price volatility of raw materials, and competitive pressure from reusable gown systems, the long-term demand proposition is solid. Total cost of ownership (TCO) analyses increasingly factor in laundry, water, and labor costs of reusables, supporting the disposable value model. Supported by robust regulatory frameworks like the FDA's Premarket Notification [510(k)] for surgical gowns and AAMI PB70 standards, disposable medical gowns remain a fundamental component of modern healthcare safety protocols, positioning themselves as an essential market within the broader medical supplies sector through 2035.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Disposable Medical Gowns Market

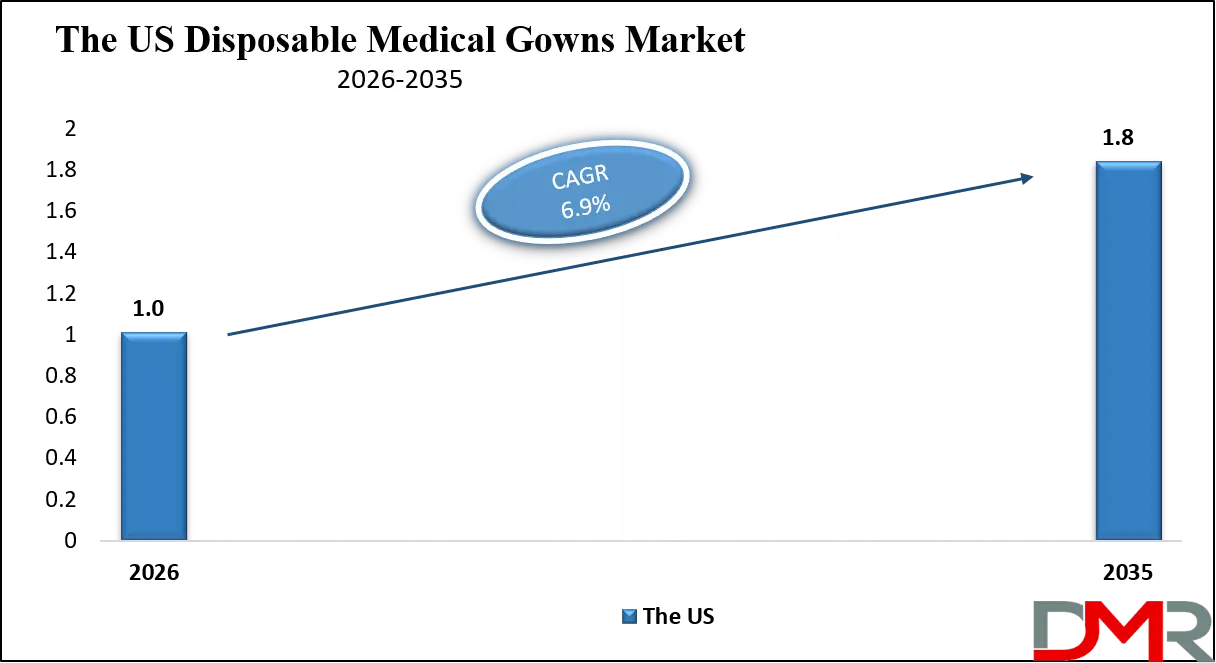

The U.S. Disposable Medical Gowns Market is projected to reach USD 1.0 billion in 2026 and grow at a CAGR of 6.9%, reaching USD 1.8 billion by 2035. The United States market is a dynamic engine of consumption and innovation, driven by a potent mix of stringent regulatory oversight, high healthcare expenditure, and a strong focus on medico-legal risk mitigation. The Food and Drug Administration (FDA) classification of surgical gowns as Class II medical devices necessitates rigorous premarket review, ensuring high safety standards. Furthermore, guidelines from the Centers for Disease Control and Prevention (CDC) and Occupational Safety and Health Administration (OSHA) on bloodborne pathogens create a compliance-driven demand.

Large integrated healthcare networks and group purchasing organizations (GPOs) wield significant purchasing power, fostering competitive landscapes and driving product standardization. Beyond regulation, a powerful driver is the high surgical procedure volume and the growing outpatient surgery trend in Ambulatory Surgical Centers (ASCs). The innovation landscape is responsive, with manufacturers focusing on improved comfort for long procedures, antimicrobial coatings, and color-coding systems for easy protection level identification. This blend of strict regulation, high clinical volume, and focus on healthcare worker safety solidifies the U.S. as a global leader in both market size and product specification standards.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Disposable Medical Gowns Market

The Europe Disposable Medical Gowns Market is projected to be valued at approximately USD 540 million in 2026 and is projected to reach around USD 1,950 million by 2035, growing at a CAGR of about 7.3% from 2026 to 2035. Europe is an established region with mature regulatory and procurement practices, guided by the European Medical Device Regulation (MDR) and harmonized standards like EN 13795 for surgical drapes and gowns. The region's strong public healthcare systems and national tenders create a stable, albeit price-sensitive, demand environment.

National frameworks and sustainability directives are increasingly influential. The EU's Circular Economy Action Plan pressures the market to develop more eco-friendly disposable options, such as gowns made from recycled materials or designed for compostability under specific conditions. Europe's strength lies in its high-quality manufacturing standards and focus on evidence-based infection control. The region also sees growth driven by the aging population and associated increase in surgical interventions for age-related conditions. This combination of enforced regulation, centralized procurement, and a growing emphasis on sustainable healthcare ensures Europe's sustained position as a major and value-oriented market.

The Japan Disposable Medical Gowns Market

The Japan Disposable Medical Gowns Market is anticipated to be valued at approximately USD 180 million in 2026 and is expected to attain nearly USD 650 million by 2035, expanding at a CAGR of about 7.3% during the forecast period. Japan's market is uniquely shaped by its rapidly aging society, world-class healthcare infrastructure, and meticulous attention to hygiene and quality. The government's healthcare policies and robust universal health insurance system support consistent demand for high-quality medical supplies.

Japan's technological precision extends to its medical apparel, with demand for high-performance, comfortable gowns suitable for long-duration, complex surgeries common in an elderly patient population. The concept of "infection control as a priority" is deeply ingrained, supporting the use of single-use barrier protection.

Furthermore, Japan is a leader in automation and robotics in healthcare, which may influence future gown designs for compatibility with automated dispensing and donning systems. Social trends, including a highly trained nursing workforce that advocates for optimal protective equipment, fuel growth. Japan thus represents a stable, quality-focused market where clinical need and high standards drive sophisticated adoption.

Global Disposable Medical Gowns Market: Key Takeaways

- Market Growth from Healthcare Fundamentals: The market is set to expand from USD 3.4 billion in 2026 to USD 6.5 billion by 2035 (CAGR 7.3%), primarily driven by the non-cyclical need for infection control, rising surgical volumes, and stringent global safety regulations.

- Asia-Pacific as the Volume & Growth Frontier: The APAC region will exhibit the highest CAGR, fueled by rapidly improving healthcare infrastructure, increasing medical tourism, growing health awareness, and government initiatives to enhance hospital hygiene standards in countries like China and India.

- Material Innovation Beyond Traditional Polypropylene: While polypropylene remains dominant for its cost-effectiveness and performance, innovations in spunbond-meltblown-spunbond (SMS) fabrics, biodegradable polymers, and soft non-woven blends are expanding material choices for better protection and comfort.

- From Commodity to Differentiated Product: The competitive edge is shifting from selling basic gowns to providing value-added features such as fluid-repellent enhancements, improved breathability, sizing inclusivity, and sustainability credentials, creating brand loyalty.

- The Rise of Sustainable Procurement: Leading healthcare providers and GPOs are increasingly incorporating environmental criteria into tenders, responding to institutional sustainability goals and driving manufacturers to design for reduced environmental impact across the product lifecycle.

Global Disposable Medical Gowns Market: Use Cases

- High-Risk Surgical Procedures: In operating rooms for cardiothoracic or orthopedic surgeries, AAMI Level 4 surgical gowns provide critical liquid barrier protection against blood and other potentially infectious fluids, safeguarding both patient and surgical team.

- Isolation Precautions in Hospital Wards: Isolation gowns are used extensively in contact precautions for patients with multi-drug resistant organisms (MDROs) like MRSA or C. diff, preventing pathogen transmission to healthcare workers and other patients.

- Outpatient and Clinic Settings: Procedure gowns are used for routine examinations, minor procedures, and imaging, providing necessary patient dignity and a basic barrier during low-fluid exposure risks.

- Emergency and Pandemic Response Stockpiles: Governments and hospitals maintain strategic reserves of disposable gowns as part of pandemic preparedness plans, ensuring rapid deployment during outbreaks of infectious diseases like influenza or novel pathogens.

- Long-Term Care Facilities: Disposable gowns are used during patient handling and hygiene care for residents, protecting caregivers from exposure to bodily fluids and helping to control infection spread in communal living environments.

Global Disposable Medical Gowns Market: Stats & Facts

U.S. Centers for Disease Control and Prevention (CDC) – Healthcare-Associated Infections (HAIs)

- On any given day, approximately 1 in 31 hospital patients in the U.S. has at least one healthcare-associated infection (HAI).

- Around 3% of hospitalized patients experience one or more HAIs.

- U.S. acute care hospitals recorded about 687,000 HAIs in a single year.

- Approximately 72,000 patients with HAIs died during hospitalization.

- CDC surveillance covers more than 38,000 healthcare facilities nationwide.

- HAIs are defined as infections acquired during or shortly after healthcare delivery.

- HAIs remain a major public health and patient safety concern.

CDC / National Institute for Occupational Safety and Health (NIOSH) – PPE & Gown Usage

- Isolation gowns are the second most commonly used PPE in hospitals after gloves.

- ANSI/AAMI PB70 is the primary U.S. standard for medical gown barrier performance.

- The standard defines four protection levels (Level 1–Level 4).

- Level 4 gowns are the only gowns tested for viral penetration resistance.

- Gown selection is based on anticipated exposure risk and procedure type.

World Health Organization (WHO) – Infection Prevention & Control (IPC)

- Up to 70% of healthcare-associated infections are preventable through effective IPC measures.

- Out of every 100 hospitalized patients, 7 in high-income countries acquire at least one HAI.

- In low- and middle-income countries, 15 out of 100 hospitalized patients acquire an HAI.

- IPC implementation capacity is eight times higher in high-income countries than in low-income countries.

- Only about 3.8% of reviewed countries fully met all WHO IPC requirements.

- More than 24% of patients with healthcare-associated sepsis die globally.

- Over 50% of ICU patients with healthcare-associated sepsis do not survive.

- WHO identifies PPE as critical for protecting healthcare workers from biological hazards.

U.S. Food and Drug Administration (FDA) – Medical Gown Regulation

- Medical gowns are regulated as personal protective equipment (PPE).

- Surgical gowns are classified as Class II medical devices.

- Surgical gowns require 510(k) premarket clearance.

- Non-surgical isolation gowns are classified as Class I medical devices.

- The FDA uses ANSI/AAMI PB70 standards to guide gown selection.

- The entire front of a surgical gown must meet at least Level 1 protection requirements.

Public Health & Healthcare Safety Statistics

- Approximately 1.7 million HAIs occur annually in U.S. hospitals.

- HAIs are associated with nearly 99,000 deaths per year in the U.S.

- Healthcare-associated infections are among the leading causes of mortality in hospital settings.

- Methicillin-resistant Staphylococcus aureus (MRSA) causes over 80,000 invasive infections annually in the U.S.

- MRSA is responsible for more than 11,000 deaths annually.

- Insufficient PPE availability has been documented in over half of health facilities in some low- and middle-income regions.

- Even where PPE is available, only about 60% of healthcare workers consistently use all recommended protective equipment.

Global Disposable Medical Gowns Market: Market Dynamics

Driving Factors in the Global Disposable Medical Gowns Market

Stringent Infection Control Regulations and Standards

Global and national mandates for patient and healthcare worker safety, enforced by bodies like the FDA, EU MDR, and CDC, are primary drivers. Healthcare accreditation standards (e.g., Joint Commission) require proven IPC measures, directly mandating the use of appropriate barrier protection like medical gowns. These regulations create a non-negotiable compliance-driven market.

Rising Surgical Procedure Volumes and Aging Populations

The increasing global prevalence of chronic diseases (cancer, cardiovascular) requiring surgery, coupled with demographic shifts towards older populations needing more medical interventions, is steadily increasing the consumption of surgical and procedure gowns. The growth of outpatient surgery centers further amplifies this demand.

Restraints in the Global Disposable Medical Gowns Market

Environmental Concerns and Waste Management Issues

The single-use nature of disposable gowns, often made from plastics, generates significant medical waste, leading to landfill use and incineration concerns. This has sparked regulatory scrutiny and a push towards reusable alternatives or more sustainable disposables, potentially restraining growth in environmentally conscious markets.

Price Sensitivity and Raw Material Volatility

In cost-containment healthcare systems, price is a major factor. Fluctuations in the cost of key raw materials like polypropylene resin directly impact manufacturing costs and profit margins. This price sensitivity drives intense competition and pressure on manufacturers, particularly in markets with tender-based procurement.

Opportunities in the Global Disposable Medical Gowns Market

Innovation in Sustainable Materials and Circular Design

There is a significant opportunity to develop and commercialize biodegradable, compostable, or recyclable materials for disposable gowns that meet performance standards. Products with a reduced environmental footprint can command premium pricing and win tenders with green criteria, tapping into the growing sustainability trend in healthcare.

Expansion in Emerging Markets with Improving Healthcare Access

Rapidly developing economies in Asia-Pacific, Latin America, and Africa present vast opportunities as they expand hospital infrastructure, increase surgical capacities, and formalize infection control protocols. Rising health awareness and government spending on public health create new demand pools for basic and advanced disposable gowns.

Trends in the Global Disposable Medical Gowns Market

Differentiation through Enhanced User Experience

The trend is moving beyond basic barrier protection to gowns that offer improved breathability, moisture vapor transmission, and ergonomic designs for greater comfort during long shifts. Features like softer linings, raglan sleeves for mobility, and color-coded protection levels are becoming key differentiators.

Smart Integration and Supply Chain Digitization

The use of RFID tags and barcodes on gown packaging is growing for automated inventory tracking, restocking, and usage analytics. Integration with hospital materials management systems helps optimize stock levels, reduce waste from expiry, and ensure the right gown is available at the point of care.

Global Disposable Medical Gowns Market: Research Scope and Analysis

By Product Type Analysis

Within the Surgical Gowns category, AAMI Level 3 and Level 4 surgical gowns form the dominant revenue sub-segment. These high-barrier gowns are essential for invasive procedures such as orthopedic, cardiovascular, and trauma surgeries where significant fluid exposure is expected. Their dominance stems from strict regulatory mandates, high unit cost, and non-negotiable clinical necessity in operating rooms globally. Level 3 gowns, offering moderate to high barrier protection, see the broadest use in general surgery, while Level 4 gowns are critical for high-risk fluid-intensive environments.

In the Non-Surgical Gowns category, Procedure/Examination Gowns dominate in terms of unit volume. These are ubiquitously used in outpatient clinics, emergency departments, and during routine physical exams, balancing adequate protection with cost-efficiency. For Patient Gowns, the open-back tie or snap-closure gowns dominate due to their practicality, ease of use, and high consumption in inpatient settings for daily care, diagnostic imaging, and patient mobility.

In the Isolation Gowns segment, AAMI Level 1 and Level 2 disposable gowns dominate, driven by massive utilization across hospital wards, long-term care facilities, and during outbreak management for contact and standard precautions. Their high-volume, single-use nature in non-sterile environments ensures steady demand, making this sub-segment the volume leader within isolation wear.

By Protection Level / Risk Category Analysis

The Moderate Risk (Level 3) is projected to dominate the protection level category in terms of revenue and utilization frequency. It serves as the clinical and economic cornerstone for surgical and procedural safety, required in the vast majority of operating rooms and interventional suites. Its dominance is due to its optimal performance-to-cost ratio, providing a proven liquid barrier against blood and bodily fluids during procedures with moderate fluid exposure, such as cesarean sections, laparoscopy, and vascular access.

This level is routinely integrated into standard surgical packs and custom procedure kits, ensuring consistent and high-volume procurement. While High Risk (Level 4) gowns are vital for specific high-exposure surgeries, their use is more selective. Conversely, the Low Risk (Level 2) sub-segment dominates in sheer unit volume across healthcare settings for tasks like phlebotomy, patient bathing, and wound care in non-surgical environments. The universal applicability and regulatory compliance requirements for Level 3 protection in core clinical activities cement its market leadership across both value and strategic importance.

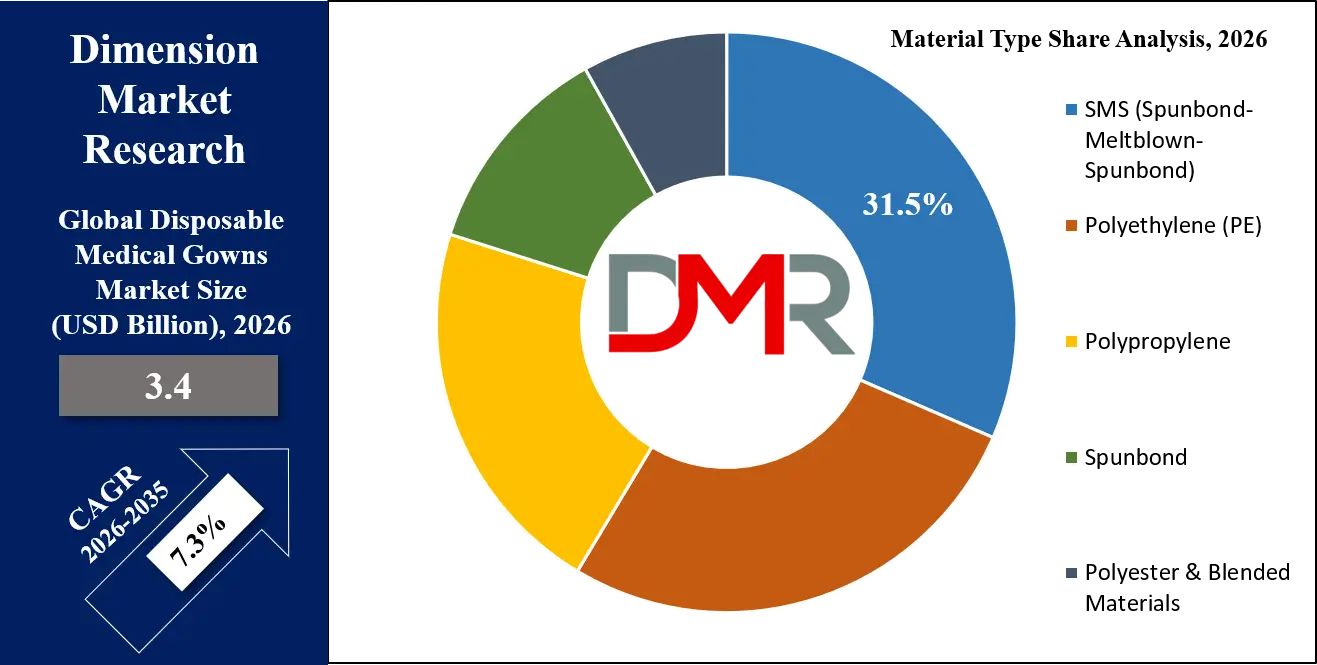

By Material Type Analysis

The SMS (Spunbond-Meltblown-Spunbond) is poised to dominate the material category, especially for moderate and high-protection gowns. Its three-layer laminate structure, a meltblown polymer sandwiched between two spunbond layers, delivers superior fluid resistance, breathability, tensile strength, and lint-free properties, making it the gold standard for surgical and critical isolation gowns. SMS dominates because it meets AAMI Level 3 and 4 performance standards while maintaining wearer comfort during long procedures, a balance that single-layer materials cannot achieve.

While Polypropylene (PP) Spunbond fabric dominates in terms of total raw material volume used across all gown types, particularly for low-risk isolation and procedure gowns, due to its low cost and lightweight nature, it does not match SMS in performance-critical applications. Polyethylene (PE) is dominant in the niche of minimal-risk aprons and low-cost disposable covers but lacks breathability for extended wear. Emerging biodegradable polymers are gaining traction in green procurement programs but remain a small niche. Thus, SMS holds dominance in the high-value, specification-driven segment that defines market revenue and innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Distribution Channel Analysis

The Direct Institutional Sales channel dominates in terms of revenue share and market influence. This sub-segment involves contractual agreements directly between large manufacturers or master distributors and major healthcare institutions, including hospital networks, Group Purchasing Organizations (GPOs), and government health systems. It dominates because it facilitates the bulk procurement of high-value surgical gowns (Level 3/4) and governs long-term supply agreements that ensure volume stability and pricing advantages.

This channel controls access to the largest end-user segment, hospitals, and often includes value-added services like consigned inventory, logistics integration, and compliance tracking. While Medical Distributors & Wholesalers handle a greater number of transactions and SKU varieties to serve smaller clinics, ASCs, and dental offices, and the Online/E-commerce channel is growing for spot purchases and small facilities, the direct channel’s command over strategic, high-margin contracts with centralized buyers ensures its premier position in shaping market dynamics and revenue flow.

By End User Analysis

Hospitals are anticipated to constitute the dominant end-user, commanding the largest share of global market revenue. This dominance is structural and multifaceted: hospitals are the primary venues for surgical procedures, emergency care, intensive care, and inpatient treatment for infectious diseases, all scenarios requiring high volumes of both premium surgical gowns and basic isolation gowns. Their large, centralized procurement functions, often managed through GPOs, drive bulk purchases of high-value AAMI Level 3 and 4 gowns.

Additionally, stringent accreditation standards (e.g., Joint Commission) and infection control protocols mandate consistent, compliant usage, creating inelastic demand. While Ambulatory Surgical Centers (ASCs) represent the fastest-growing segment due to the shift of outpatient surgery, and Clinics & Outpatient Centers consume high volumes of low-risk gowns, neither matches the hospital sector’s combined scale, procedural complexity, and expenditure on premium protective apparel. The hospital segment’s critical role as the frontline for acute and surgical care ensures its continued revenue dominance.

The Global Disposable Medical Gowns Market Report is segmented on the basis of the following:

By Product Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Isolation Gowns

By Protection Level / Risk Category

- Minimal Risk (Level 1)

- Low Risk (Level 2)

- Moderate Risk (Level 3)

- High Risk (Level 4)

By Material Type

- SMS (Spunbond-Meltblown-Spunbond)

- Polyethylene (PE)

- Polypropylene

- Spunbond

- Polyester & Blended Materials

By Distribution Channel

- Direct Institutional Sales

- Medical Distributors & Wholesalers

- Online / E-Commerce

By End User

- Hospitals

- Clinics & Outpatient Centers

- Ambulatory Surgical Centers

- Diagnostic & Research Laboratories

- Other End Users

Impact of Artificial Intelligence in the Global Disposable Medical Gowns Market

- Predictive Demand Forecasting: AI algorithms analyze historical usage data, seasonal infection rates, and scheduled surgical volumes to predict future gown demand at the hospital or regional level, optimizing inventory and reducing both shortages and overstock waste.

- Quality Control Automation: Computer vision systems powered by AI are used on production lines to automatically detect defects in gown fabric, seams, or packaging with higher speed and accuracy than human inspectors, ensuring consistent product quality.

- Smart Inventory Management: AI-powered software in hospital supply rooms uses sensor data and usage patterns to automate restocking orders for gowns and other PPE, integrating directly with supplier systems to maintain par levels efficiently.

- Optimized Logistics and Distribution: AI models plan the most efficient delivery routes and schedules for gown distributors, factoring in traffic, hospital demand urgency, and storage capacities, ensuring timely supply to healthcare facilities.

- Sustainability Analytics: AI tools can analyze the full lifecycle environmental impact of different gown materials and supply chain choices, helping manufacturers and providers make data-driven decisions to reduce their carbon footprint.

Global Disposable Medical Gowns Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate this market, holding the 35.4% market share in 2026. This leadership is driven by its high per capita healthcare expenditure, the largest and most advanced hospital sector globally, and the most stringent regulatory enforcement for medical devices and worker safety. The presence of major GPOs and a culture of rigorous infection control protocols creates a high-volume, compliance-driven market. The region also has a high surgical procedure rate and a strong focus on minimizing medico-legal risks, which supports the adoption of high-quality, certified disposable gowns. While price competition exists, the emphasis on proven performance and liability protection allows for significant revenue generation from premium product segments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific achieves the highest CAGR because it represents a massive, underpenetrated market undergoing rapid healthcare modernization. Factors include burgeoning hospital construction, rising medical tourism, growing health insurance coverage, and increasing government focus on improving basic hygiene standards. Countries like China and India are not only large domestic markets but also major manufacturing hubs, influencing global supply chains. The growth is fueled by rising patient volumes, increasing surgical capabilities, and a growing awareness of HAIs. While the average selling price may be lower than in mature markets, the sheer volume growth from a large baseline population drives the highest CAGR, representing the frontier for new demand.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Disposable Medical Gowns Market: Competitive Landscape

The competitive landscape is fragmented and highly competitive, characterized by the presence of large multinational conglomerates and numerous regional manufacturers. Large Diversified Healthcare/PPE Conglomerates Companies like Cardinal Health, Medline Industries, Inc., and 3M leverage their extensive distribution networks, broad product portfolios, and strong relationships with GPOs. Their strategy is to provide a one-stop shop for healthcare supplies, including gowns, often as part of larger bundled contracts.

Specialist Medical Apparel Manufacturers Companies like Halyard Health (now part of Owens & Minor), Ansell Ltd., and Molnlycke Health Care compete on deep expertise in surgical and infection prevention products, strong R&D in materials, and focus on high-performance segments. They often lead in product innovation and clinical education.

The competitive battleground is based on cost, quality/reliability, supply chain dependability, and increasingly, sustainability features. Winning requires robust regulatory compliance, scalable manufacturing, efficient logistics, and the ability to offer product differentiation through comfort or eco-design. Mergers, acquisitions, and partnerships are common as companies seek to expand geographic reach or product portfolios.

Some of the prominent players in the Global Disposable Medical Gowns Market are:

- Cardinal Health

- Medline Industries, Inc.

- Owens & Minor (including Halyard Health products)

- 3M Company

- Ansell Ltd.

- Molnlycke Health Care AB

- Kimberly-Clark Corporation

- Baxter International Inc.

- Henry Schein, Inc.

- DuPont de Nemours, Inc.

- Standard Textile Co., Inc.

- Priontex

- Angelica Corporation

- Thermo Fisher Scientific Inc.

- Medicom Group

- Winner Medical Co., Ltd.

- Tronex International (A Division of Oak Hill Capital)

- Sara Health Care

- Superior Group of Companies

- Aramark (Healthcare Division)

- Other Key Players

Recent Developments in the Global Disposable Medical Gowns Market

- February 2025: Medline Launches New Line of Compostable Isolation Gowns. The gowns, made from a plant-based polymer blend, are designed to meet ASTM standards for industrial compostability, addressing hospital waste stream concerns.

- January 2025: FDA Issues Updated Guidance on Surgical Gown Standards. The new guidance clarifies testing expectations for liquid barrier performance and seam strength for AAMI Level 3 and 4 gowns, aiming to enhance product consistency and safety.

- December 2024: A Large U.S. Hospital System Signs Exclusive Contract with Cardinal Health. The multi-year agreement standardizes disposable gowns across all facilities, highlighting the trend towards system-wide standardization for cost and quality control.

- November 2024: Ansell and a Leading Biotech Firm Partner on Antimicrobial Gown Coating. The partnership aims to develop a durable antimicrobial treatment for surgical gowns intended to reduce microbial migration in case of barrier breach.

- October 2024: European Committee for Standardization (CEN) Reviews EN 13795. The review process begins to potentially update the surgical gown and drape standard, with expected greater emphasis on comfort testing methodologies and environmental aspects.

- September 2024: New Manufacturing Facility Opens in Vietnam. A major joint venture opens a state-of-the-art non-woven fabric and gown manufacturing plant in Vietnam, aiming to serve the growing APAC market with localized production.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.4 Bn |

| Forecast Value (2034) |

USD 6.5 Bn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 1.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Surgical, Non-Surgical, Patient, And Isolation Gowns), By Protection Level (Level 1–Minimal Risk To Level 4–High Risk), By Material Type (SMS, Polyethylene, Polypropylene Spunbond, Polyester & Blends), By Distribution Channel (Direct Institutional Sales, Medical Distributors & Wholesalers, Online/E-Commerce), And By End User (Hospitals, Clinics & Outpatient Centers, Ambulatory Surgical Centers, Diagnostic & Research Laboratories, And Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cardinal Health, Medline Industries, Inc., Owens & Minor (including Halyard Health products), 3M Company, Ansell Ltd., Mölnlycke Health Care AB, Kimberly-Clark Corporation, Baxter International Inc., Henry Schein, Inc., DuPont de Nemours, Inc., Standard Textile Co., Inc., Priontex, Angelica Corporation, Thermo Fisher Scientific Inc., Medicom Group, Winner Medical Co., Ltd., Tronex International (a division of Oak Hill Capital), Sara Health Care, Superior Group of Companies, and Aramark (Healthcare Division), and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Disposable Medical Gowns Market?

▾ The Global Disposable Medical Gowns Market size is estimated to have a value of USD 3.4 billion in 2026 and is expected to reach USD 6.5 billion by the end of 2035

What is the growth rate in the Global Disposable Medical Gowns Market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2026 to 2035.

What is the size of the US Disposable Medical Gowns Market?

▾ The US Disposable Medical Gowns Market is projected to be valued at USD 1.0 billion in 2026. It is expected to reach USD 1.8 billion in 2035, growing at a CAGR of 6.9%.

Which region accounted for the largest Global Disposable Medical Gowns Market?

▾ North America is expected to have the largest market share in the Global Disposable Medical Gowns Market, driven by its high healthcare spending, stringent regulatory environment, and advanced hospital infrastructure.

Who are the key players in the Global Disposable Medical Gowns Market?

▾ Some of the major key players in the Global Disposable Medical Gowns Market are Cardinal Health, Medline Industries, Inc., 3M Company, Owens & Minor, Ansell Ltd., and Molnlycke Health Care AB, among others.