Market Overview

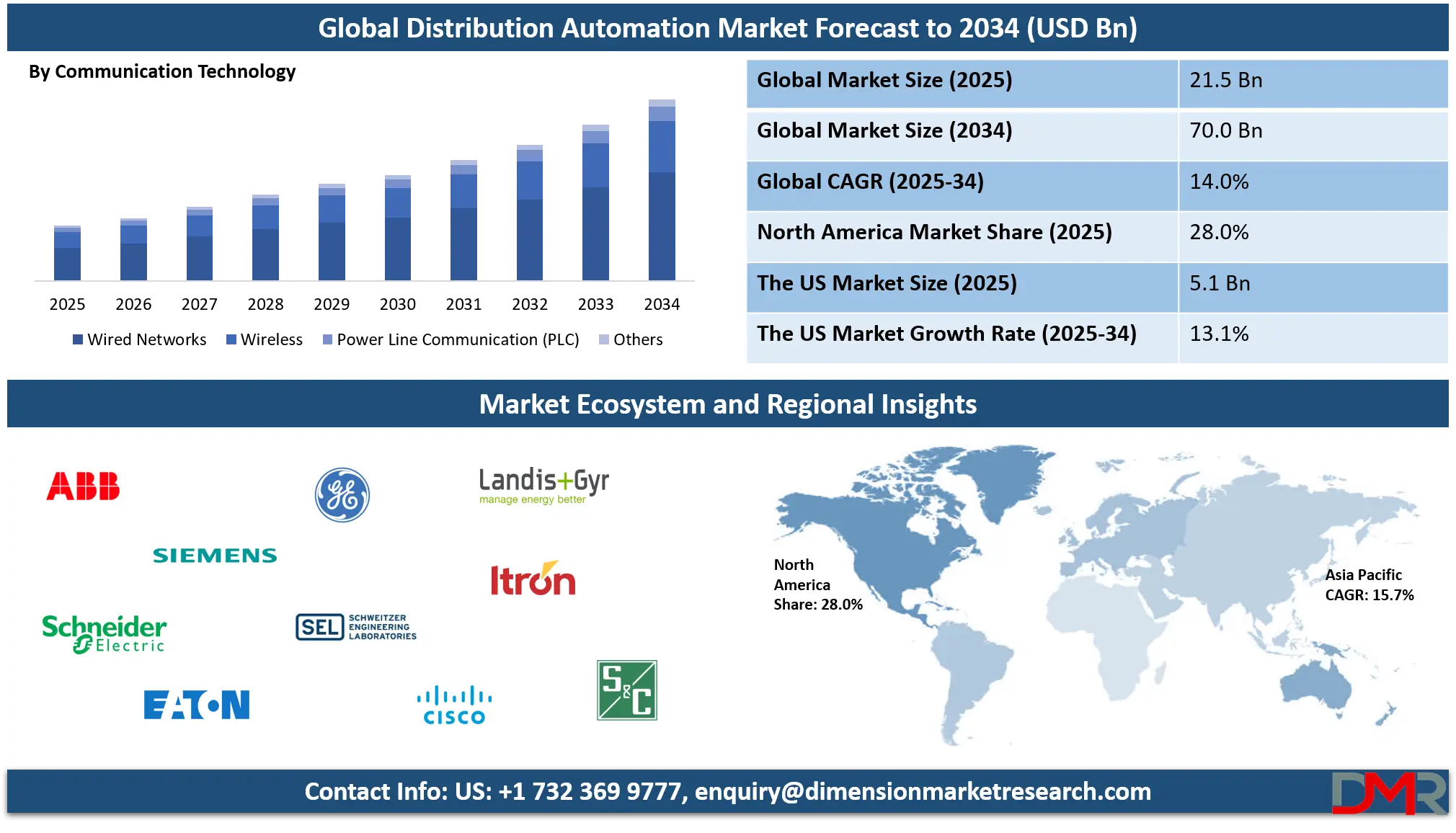

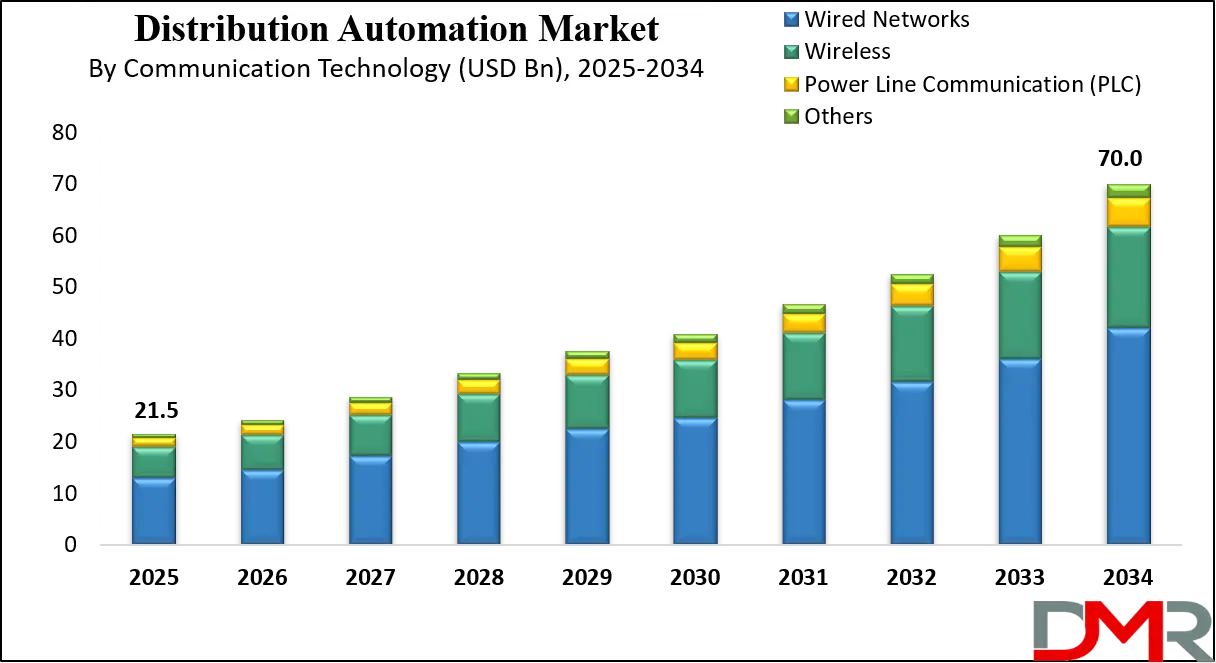

The global distribution automation market is projected to reach USD 21.5 billion in 2025 and is expected to grow to USD 70.0 billion by 2034, registering a CAGR of 14.0%. This growth is driven by growing smart grid adoption, renewable energy integration, and advancements in intelligent electronic devices, communication networks, and real-time grid management solutions.

Distribution automation refers to the application of advanced control systems, communication technologies, and intelligent devices within electrical distribution networks to monitor, manage, and optimize the flow of electricity from substations to end users. It enables real-time detection and isolation of faults, automated restoration of power, and improved voltage regulation, thereby enhancing grid reliability, operational efficiency, and power quality.

Leveraging tools such as automated feeder switches, sensors, and advanced distribution management systems, distribution automation reduces outage durations, minimizes energy losses, and supports the integration of distributed energy resources like solar and wind into the grid while meeting the growing demand for energy resilience and sustainability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global distribution automation market encompasses the technologies, solutions, and services that enable utilities and other energy providers to modernize and digitize their distribution infrastructure. This market includes hardware such as intelligent electronic devices, remote terminal units, and communication networks, as well as software platforms for real-time grid monitoring, predictive analytics, and automated control. Growth in this space is driven by rising investments in smart grid development, growing electricity demand, the push for renewable energy integration, and regulatory mandates for grid modernization across developed and emerging economies.

Market expansion is further fueled by the need to reduce operational costs, improve energy efficiency, and provide an uninterrupted power supply to consumers. Innovations in communication technologies, such as private LTE and IoT-enabled sensors, along with the adoption of artificial intelligence and machine learning for grid management, are reshaping operational capabilities.

Regions like Asia Pacific, North America, and Europe are leading adoption, with developing economies also accelerating deployment to address grid stability challenges. The competitive landscape features global technology leaders, niche solution providers, and service integrators offering tailored automation systems to utilities and industrial end users globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

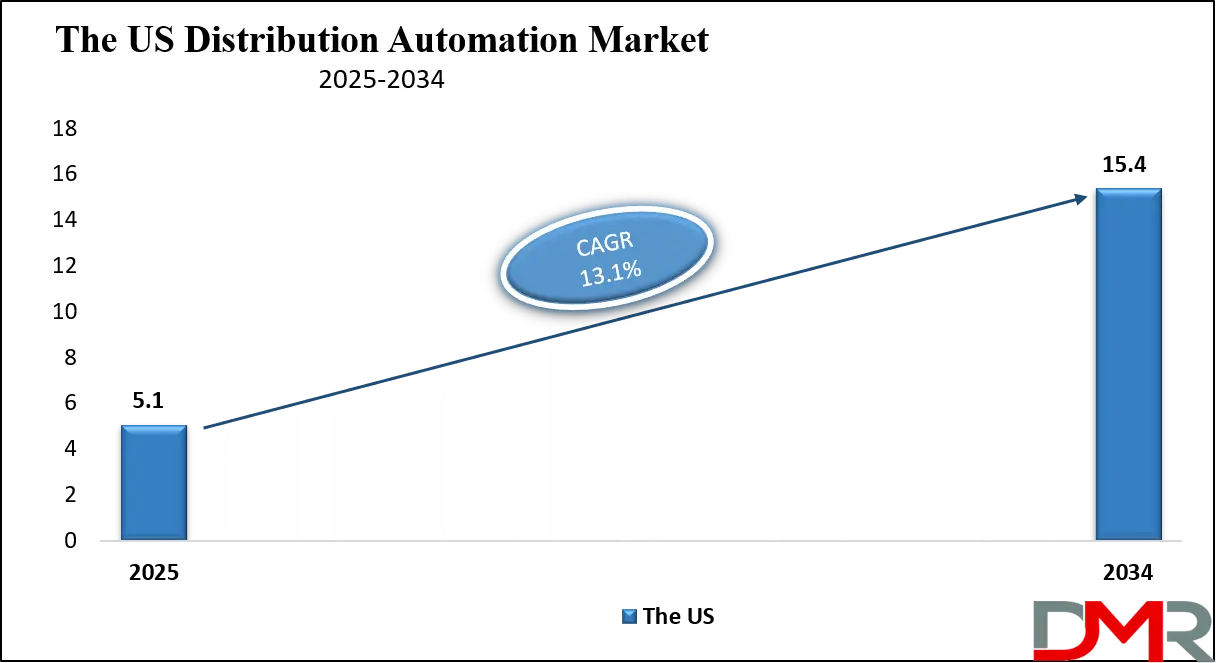

The US Distribution Automation Market

The U.S. Distribution Automation market size is projected to be valued at USD 5.1 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 15.4 billion in 2034 at a CAGR of 13.1%.

The US distribution automation market is witnessing robust growth, driven by substantial investments in smart grid infrastructure, modernization of aging power distribution networks, and the integration of distributed energy resources. Utilities across the country are deploying advanced distribution management systems, intelligent electronic devices, and real-time monitoring solutions to enhance grid reliability, improve outage management, and optimize voltage regulation.

Federal and state-level initiatives, such as funding under the Infrastructure Investment and Jobs Act, are accelerating adoption by providing incentives for utilities to implement automation technologies that support renewable energy integration, demand response programs, and predictive maintenance. The growing penetration of electric vehicles and the need to manage bidirectional power flows are further pushing utilities toward sophisticated automation solutions.

Rising concerns over grid resilience against extreme weather events and cyber threats are also influencing the US distribution automation market landscape. Utilities are investing in self-healing grid technologies, wireless communication networks like private LTE, and IoT-enabled sensors to enable faster fault detection and restoration.

Additionally, advancements in artificial intelligence and machine learning are empowering predictive analytics for asset management, enabling utilities to anticipate equipment failures and reduce downtime. With a strong presence of leading technology providers and system integrators, integrated with a clear regulatory framework for grid modernization, the United States is positioned as one of the most lucrative markets globally for distribution automation solutions, catering to both urban and rural electrification demands.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Distribution Automation Market

The Europe distribution automation market is projected to reach a valuation of approximately USD 4.3 billion in 2025, reflecting the region's growing commitment to modernizing its electrical distribution infrastructure. This growth is primarily fueled by stringent government regulations and policies aimed at enhancing grid reliability, improving energy efficiency, and accelerating the integration of renewable energy sources such as wind and solar.

Countries like Germany, France, and the United Kingdom are leading the way with substantial investments in smart grid technologies, advanced distribution management systems, and intelligent electronic devices that enable real-time monitoring, fault detection, and automated control. These initiatives support the broader European Green Deal objectives, emphasizing decarbonization and sustainability in the power sector.

Looking ahead, the European market is expected to grow at a compound annual growth rate of 12.0% through the forecast period, driven by continued technological advancements and growing adoption of digital solutions. Utilities across Europe are investing in self-healing grids, IoT-enabled sensors, and AI-powered analytics to improve operational efficiency and reduce downtime.

Additionally, the rising focus on cybersecurity within distribution networks and efforts to integrate distributed energy resources are further propelling market expansion. The combination of regulatory support, technological innovation, and growing demand for reliable and resilient power systems positions Europe as a key region in the global distribution automation landscape.

Japan Distribution Automation Market

The distribution automation market in Japan is anticipated to reach around USD 0.8 billion in 2025, reflecting the country’s ongoing efforts to enhance the reliability and efficiency of its power distribution networks. Japan’s unique geographic and climatic conditions, including frequent natural disasters such as earthquakes and typhoons, have driven a strong focus on building resilient and self-healing grids.

The government and utilities are actively investing in advanced distribution management systems, intelligent electronic devices, and real-time monitoring technologies to quickly detect faults, isolate damaged sections, and restore power with minimal downtime. These initiatives are complemented by Japan’s commitment to integrating renewable energy sources and smart technologies to meet its sustainability and energy security goals.

Looking forward, Japan’s distribution automation market is expected to grow at a compound annual growth rate of about 10.0% over the coming years. This growth is supported by advancements in communication technologies such as private LTE and 5G, which enable faster and more reliable data transmission across the grid.

Additionally, the growing adoption of artificial intelligence and machine learning for predictive maintenance and grid optimization is enhancing the operational efficiency of utilities. With continued government support, innovation in automation solutions, and a strong emphasis on grid resilience, Japan is set to maintain its position as a significant and steadily growing market within the global distribution automation landscape.

Global Distribution Automation Market: Key Takeaways

- Market Value: The global distribution automation market size is expected to reach a value of USD 70.0 billion by 2034 from a base value of USD 21.5 billion in 2025 at a CAGR of 14.0%.

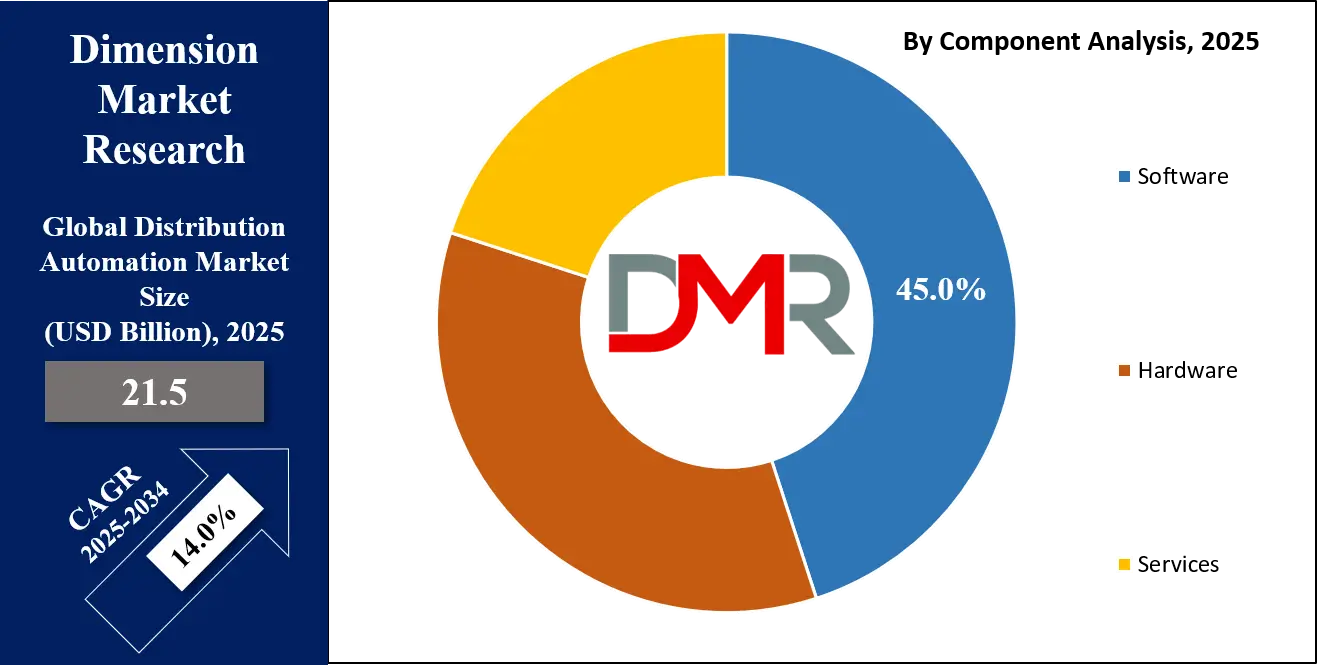

- By Component Analysis: Software components are anticipated to dominate the component segment, capturing 45.0% of the total market share in 2025.

- By Communication Technology Segment Analysis: Wired Networks are expected to maintain their dominance in the communication technology segment, capturing 60.0% of the total market share in 2025.

- By Application Segment Analysis: Fault Detection & Feeder Automation (FLISR) applications are poised to consolidate their dominance in the application segment, capturing 28.0% of the market share in 2025.

- By End User Segment Analysis: Utilities will hold the maximum market share in the end user segment, capturing 70.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global distribution automation market landscape with 39.0% of total global market revenue in 2025.

- Key Players: Some key players in the global distribution automation market are ABB, Siemens, Schneider Electric, Eaton, GE, SEL, Cisco, Landis+Gyr, Itron, S&C Electric, Toshiba, Mitsubishi Electric, Hubbell, Xylem (Sensus), Rockwell Automation, Wasion Group, and Others.

Global Distribution Automation Market: Use Cases

- Fault Location, Isolation, and Service Restoration (FLISR): FLISR is one of the most prominent applications in the global distribution automation market, enabling utilities to automatically detect faults, isolate the affected section, and restore service to unaffected areas within seconds. By using intelligent electronic devices, real-time sensors, and advanced distribution management systems, utilities significantly reduce outage durations and improve grid reliability. This self-healing grid capability enhances customer satisfaction while lowering operational costs and minimizing the economic impact of power interruptions.

- Volt/VAR Optimization and Power Quality Management: Distribution automation systems are increasingly deployed to optimize voltage profiles and manage reactive power across the grid. Volt/VAR optimization uses sensors, capacitor banks, and automation controllers to maintain voltage within regulatory limits, reduce energy losses, and improve power quality. This not only enhances operational efficiency for utilities but also supports energy conservation goals, reduces greenhouse gas emissions, and prolongs the lifespan of electrical equipment in industrial and commercial facilities.

- Distributed Energy Resource (DER) Integration: With the rise of solar, wind, and other renewable energy sources, the integration of distributed energy resources has become a critical use case. Distribution automation facilitates seamless connection and control of DERs, enabling bidirectional power flows, dynamic load balancing, and real-time monitoring. By incorporating microgrid controls and advanced communication networks, utilities can better manage intermittent renewable generation, stabilize the grid, and meet sustainability targets while complying with regulatory requirements.

- Predictive Maintenance and Asset Management: The adoption of IoT-enabled sensors and AI-driven analytics in distribution automation allows utilities to predict equipment failures before they occur. Predictive maintenance uses data from transformers, switchgear, and feeders to identify patterns of wear, thermal stress, or electrical anomalies. This proactive approach minimizes unplanned outages, reduces maintenance costs, and extends asset lifespans. By ensuring timely intervention, utilities can maintain high service reliability and optimize capital expenditure planning for grid infrastructure upgrades.

Impact of Artificial Intelligence on the Distribution Automation Market

Artificial intelligence is playing a transformative role in the distribution automation market by enabling smarter, faster, and more predictive grid management. AI algorithms process vast amounts of data from intelligent electronic devices, IoT sensors, and advanced distribution management systems to provide real-time insights into grid performance.

This allows utilities to detect anomalies, predict potential failures, and automate corrective actions without human intervention, significantly improving operational efficiency and service reliability. AI-powered fault detection and load forecasting help in minimizing outage durations, optimizing energy flows, and ensuring stable voltage levels even under fluctuating demand or intermittent renewable generation.

Another major impact of AI in distribution automation is the enhancement of decision-making through predictive analytics and adaptive control strategies. Machine learning models can analyze historical and live grid data to fine-tune maintenance schedules, forecast energy demand patterns, and dynamically manage distributed energy resources such as solar panels, battery storage, and electric vehicle charging networks.

AI also supports self-healing grid capabilities, cybersecurity threat detection, and adaptive volt/VAR optimization, all of which contribute to improved power quality, reduced operational costs, and greater integration of renewable energy. As AI technologies mature, their role in enabling autonomous, resilient, and sustainable electricity distribution networks is expected to expand rapidly, making them a key driver of future market growth.

Global Distribution Automation Market: Stats & Facts

U.S. Department of Energy (DOE) – Smart Grid and Grid Modernization Reports (2023–2025)

- The U.S. invested over USD 4 billion in grid modernization and distribution automation projects from 2023 to 2025.

- Over 60% of U.S. utilities had deployed advanced distribution management systems (ADMS) by 2025.

- Grid modernization grants supported the installation of more than 25 million smart sensors and intelligent electronic devices (IEDs) across distribution networks by 2025.

- The DOE estimates that distribution automation can reduce outage times by up to 50% through fault detection and self-healing capabilities.

- U.S. utilities integrating DERs with distribution automation increased by 35% between 2023 and 2025.

European Commission – Clean Energy Package and Smart Grid Progress (2023–2025)

- By 2025, 70% of European power distribution operators will have adopted Volt/VAR optimization technologies as part of automation initiatives.

- EU funding programs allocated €2.3 billion for smart grid projects focused on distribution automation between 2023 and 2025.

- Grid reliability improvements from automation projects reduced average outage durations by 40% across member states by 2025.

- The share of distribution grids equipped with automated fault detection systems grew from 45% in 2023 to 68% in 2025.

- Integration of renewable energy sources into automated grids increased by 25% in Europe from 2023 to 2025.

Japan Ministry of Economy, Trade and Industry (METI) – Energy White Paper (2023–2025)

- Japan’s government invested approximately ¥120 billion (about USD 900 million) in distribution automation infrastructure upgrades by 2025.

- By 2025, 50% of Japan’s distribution network transformers were equipped with sensors enabling real-time monitoring and control.

- Automation-driven grid fault detection reduced power restoration times by 30% between 2023 and 2025.

- METI reported that distributed energy resource integration would increase by 20% through automated grid management systems by 2025.

- The number of utilities implementing AI-powered predictive maintenance doubled between 2023 and 2025.

China National Energy Administration (NEA) – Power Grid Development Reports (2023–2025)

- China deployed over 150 million smart meters and IEDs within its distribution networks from 2023 to 2025.

- Grid automation projects contributed to a 35% reduction in distribution losses nationwide by 2025.

- More than 80% of urban distribution grids in China had automated fault isolation systems installed by 2025.

- NEA set a target of increasing distributed energy resource integration to 30% of grid capacity by 2030, driven by automation technologies.

- Automation-enabled Volt/VAR optimization in China’s distribution grid improved voltage stability by 25% by 2025.

India Ministry of Power – National Smart Grid Mission Reports (2023–2025)

- India installed over 70 million smart meters and associated communication devices in distribution networks by 2025.

- Distribution automation projects under the mission led to a 28% reduction in outage durations across pilot regions from 2023 to 2025.

- Automated load balancing technologies were adopted by 40% of utilities in India by 2025.

- The mission reported a 22% decrease in transmission and distribution (T&D) losses due to automation efforts.

- Integration of renewable energy assets into distribution grids increased by 18% owing to automation between 2023 and 2025.

Australian Energy Market Operator (AEMO) – Grid Technology Insights (2023–2025)

- Australia’s grid automation initiatives resulted in a 32% increase in fault detection speed in distribution networks by 2025.

- More than 55% of Australian distribution feeders were automated with self-healing technologies by 2025.

- Automation systems helped reduce peak load demand by 15% through real-time demand response management in 2025.

- The deployment of wireless communication technologies in distribution automation increased by 40% from 2023 to 2025.

- AEMO projected that grid automation would enable the integration of up to 50% renewable energy penetration in distribution grids by 2030.

Global Distribution Automation Market: Market Dynamics

Global Distribution Automation Market: Driving Factors

Rising Investments in Smart Grid Infrastructure

Governments and utilities globally are growing funding for smart grid projects to modernize aging electrical distribution networks. Distribution automation systems, equipped with advanced sensors, intelligent electronic devices, and real-time communication technologies, are at the core of these initiatives. These investments aim to improve grid reliability, reduce outage durations, and support renewable energy integration, creating a strong demand for automation solutions.

Integration of Distributed Energy Resources (DERs)

The growing adoption of solar, wind, and battery storage systems is pushing utilities to adopt sophisticated distribution automation solutions for seamless DER integration. Automation facilitates bidirectional power flows, dynamic load balancing, and voltage optimization, ensuring that variable renewable energy sources can be efficiently incorporated into the grid without compromising stability.

Global Distribution Automation Market: Restraints

High Initial Capital Expenditure

Implementing distribution automation involves substantial upfront investment in hardware, software platforms, and communication infrastructure. For utilities with limited budgets, especially in developing regions, the high initial cost remains a significant barrier to adoption despite the long-term operational savings.

Cybersecurity and Data Privacy Concerns

As distribution automation systems become increasingly digital and interconnected, they are more susceptible to cyberattacks and data breaches. Protecting critical infrastructure from malicious threats requires continuous investment in security protocols, which can slow down implementation for risk-averse utilities.

Global Distribution Automation Market: Opportunities

Advances in Artificial Intelligence and Machine Learning

The integration of AI and ML into distribution automation enables predictive maintenance, real-time fault detection, and adaptive grid control. This technological leap offers utilities opportunities to enhance efficiency, reduce downtime, and optimize energy distribution based on predictive analytics.

Expansion in Emerging Economies

Rapid urbanization, rising electricity demand, and government-backed electrification programs in Asia Pacific, Latin America, and Africa present lucrative opportunities for market players. Emerging markets are increasingly investing in modern grid infrastructure, creating significant growth potential for automation vendors.

Global Distribution Automation Market: Trends

Adoption of Self-Healing Grid Technologies

Utilities are increasingly deploying self-healing distribution networks capable of detecting faults, isolating affected sections, and restoring service automatically. This trend enhances grid resilience, reduces downtime, and improves customer satisfaction, becoming a cornerstone of modern distribution automation strategies.

Shift Toward Wireless Communication Technologies

While wired networks remain dominant, the growing deployment of private LTE, RF mesh, and 5G networks is transforming how utilities connect field devices. Wireless communication enables greater flexibility, faster deployment, and scalability, especially in remote or hard-to-reach areas.

Global Distribution Automation Market: Research Scope and Analysis

By Component Analysis

In the distribution automation market, software components are expected to lead the component segment, accounting for around 45.0% of the total market share in 2025. This dominance is largely driven by the growing demand for advanced distribution management systems, outage management systems, and analytics platforms that enable real-time monitoring, predictive maintenance, and automated control of power distribution networks.

Utilities are increasingly prioritizing software solutions to enhance operational efficiency, optimize voltage regulation, and integrate distributed energy resources such as solar and wind power into the grid. These software platforms also facilitate data-driven decision-making, improve fault detection and isolation, and support regulatory compliance for grid modernization initiatives.

Hardware components, while slightly behind software in market share, form the backbone of distribution automation systems by enabling the physical implementation of automation functions. This category includes intelligent electronic devices (IEDs), remote terminal units (RTUs), sensors, communication equipment, and automated feeder switches.

Hardware plays a critical role in collecting real-time grid data, executing control commands, and ensuring seamless connectivity between field devices and central control systems. The hardware segment is also witnessing steady growth as utilities upgrade aging infrastructure, deploy self-healing grid technologies, and adopt advanced communication protocols to enhance system reliability and resilience. Together, software and hardware components create a cohesive ecosystem that drives the efficiency, reliability, and sustainability of modern power distribution networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Communication Technology Analysis

In the communication technology segment of the distribution automation market, wired networks are projected to hold a dominant position with 60.0% of the total market share in 2025. This strong presence is attributed to their high reliability, low latency, and ability to handle large volumes of real-time data essential for grid monitoring and control.

Fiber optic cables, Ethernet, and other wired communication systems provide secure and stable connectivity, making them ideal for mission-critical applications such as fault location, isolation, and service restoration, as well as voltage regulation and load balancing. Utilities prefer wired networks for core distribution infrastructure because they offer consistent performance over long distances and are less prone to interference, ensuring dependable operation even under harsh environmental conditions.

Wireless communication technologies, while capturing a smaller share, are gaining significant traction due to their flexibility, scalability, and cost-effectiveness in deployment. Solutions such as private LTE, RF mesh, LoRaWAN, and 5G enable quick connectivity for remote or hard-to-reach locations where laying physical cables is expensive or impractical.

Wireless networks support mobile field crews, real-time asset tracking, and dynamic grid control, making them particularly valuable in distributed energy resource integration and temporary grid setups. The rapid advancement of wireless protocols and increased adoption of IoT-enabled devices are expected to drive strong growth in this segment, complementing wired networks rather than replacing them entirely. Together, wired and wireless systems form a hybrid communication infrastructure that supports the evolving needs of modern smart grids.

By Application Analysis

In the application segment of the distribution automation market, fault detection and feeder automation, commonly referred to as FLISR (Fault Location, Isolation, and Service Restoration), are set to lead with 28.0% of the market share in 2025. This dominance stems from the critical role FLISR plays in enhancing grid reliability by quickly identifying fault locations, isolating affected sections, and restoring power to unaffected areas, often within seconds.

Utilities increasingly rely on FLISR systems to minimize outage durations, reduce operational costs, and improve customer satisfaction, especially in regions prone to extreme weather events. The integration of intelligent electronic devices, advanced sensors, and automated feeder switches allows FLISR to operate seamlessly, enabling self-healing grid capabilities and supporting regulatory targets for service reliability and performance.

Real-time monitoring and control represent another vital application area, providing utilities with the ability to continuously track grid conditions and take immediate corrective actions. By leveraging SCADA systems, advanced distribution management systems, and IoT-enabled sensors, operators can monitor parameters such as voltage, current, frequency, and load in real time.

This enables proactive decision-making, early detection of anomalies, and optimized energy flow across the network. Real-time control also plays a key role in balancing supply and demand, integrating distributed energy resources, and maintaining power quality under fluctuating load conditions. As grids become more complex and decentralized, real-time monitoring and control will continue to be a cornerstone of efficient and resilient distribution automation systems.

By End User Analysis

In the end-user segment of the distribution automation market, utilities are projected to dominate with 70.0% of the market share in 2025. This strong position is driven by the growing focus on grid modernization, renewable energy integration, and the adoption of smart grid technologies by public, private, and cooperative utility providers. Utilities are implementing advanced distribution management systems, self-healing grid solutions, and real-time monitoring platforms to enhance operational efficiency, reduce outage durations, and comply with regulatory mandates for service reliability.

Large-scale investments in infrastructure upgrades, integrated with government incentives and funding programs, are further encouraging utilities to expand automation deployment across urban, suburban, and rural networks. Their scale of operations and responsibility for delivering uninterrupted power to millions of consumers position them as the primary adopters of distribution automation technologies.

The industrial segment, while smaller in comparison, represents a significant growth opportunity within the distribution automation market. Manufacturing plants, mining operations, oil and gas facilities, and large-scale processing units rely on consistent and high-quality power to maintain productivity and avoid costly downtime.

Distribution automation in industrial settings focuses on improving power quality, enabling predictive maintenance, and ensuring rapid fault detection to minimize operational disruptions. By integrating intelligent sensors, automated switches, and real-time control systems, industrial end users can optimize energy usage, reduce losses, and enhance operational safety. As industries embrace digital transformation and energy efficiency targets, the adoption of advanced automation solutions is expected to accelerate in this segment.

The Distribution Automation Market Report is segmented on the basis of the following:

By Component

- Software

- Hardware

- Services

By Communication Technology

- Wired Networks

- Wireless

- Power Line Communication (PLC)

- Others

By Application

- Fault Detection & Feeder Automation (FLISR)

- Real-Time Monitoring & Control

- Outage Management Systems (OMS)

- Volt/VAR Optimization

- Asset Monitoring & Predictive Maintenance

- DER/Renewable Integration

By End User

- Utilities

- Industrial

- Commercial

- Others

Global Distribution Automation Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global distribution automation market in 2025, capturing 39.0% of total market revenue, driven by rapid urbanization, rising electricity demand, and large-scale investments in smart grid infrastructure across countries such as China, India, Japan, and South Korea.

Government-led initiatives promoting grid modernization, renewable energy integration, and rural electrification are fueling widespread adoption of advanced distribution management systems, intelligent electronic devices, and real-time monitoring solutions. The region’s focus on reducing transmission and distribution losses, enhancing grid reliability, and supporting the integration of distributed energy resources is further accelerating market growth, positioning Asia Pacific as the fastest-growing and most influential market in the global distribution automation landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

North America is projected to witness significant growth in the distribution automation market, supported by substantial investments in modernizing aging grid infrastructure, growing adoption of renewable energy, and the rapid deployment of smart grid technologies. The region’s utilities are focusing on implementing advanced distribution management systems, self-healing grid solutions, and IoT-enabled monitoring platforms to improve service reliability and operational efficiency.

Federal and state-level funding programs, integrated with regulatory mandates for grid resilience and cybersecurity, are further driving adoption. Additionally, the growing penetration of electric vehicles and distributed energy resources is creating new demand for automation solutions, positioning North America as one of the most dynamic growth regions in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Distribution Automation Market: Competitive Landscape

The global competitive landscape of the distribution automation market is characterized by the presence of established multinational corporations, specialized solution providers, and emerging technology innovators competing to deliver integrated hardware, software, and communication solutions for modern grid management. Industry leaders such as ABB, Siemens, Schneider Electric, Eaton, and General Electric dominate through their comprehensive product portfolios, global distribution networks, and strong research and development capabilities.

These players are increasingly focusing on strategic partnerships, mergers and acquisitions, and advanced technology integration, including AI, IoT, and private LTE, to enhance their offerings. Regional players and niche companies like Schweitzer Engineering Laboratories, S&C Electric, and Landis+Gyr are leveraging their expertise in specific components or applications to gain market share, while new entrants are introducing cost-effective and modular solutions tailored for emerging markets. The competition is further intensified by the growing demand for customizable, scalable, and interoperable systems, pushing vendors to differentiate through innovation, service quality, and long-term customer engagement.

Some of the prominent players in the global distribution automation market are:

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Eaton Corporation plc

- General Electric Company (GE)

- Schweitzer Engineering Laboratories (SEL)

- Cisco Systems, Inc.

- Landis+Gyr Group AG

- Itron, Inc.

- S&C Electric Company

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Hubbell Incorporated

- Xylem Inc. (Sensus)

- Rockwell Automation, Inc.

- Wasion Group Holdings

- Larsen & Toubro Limited (L&T)

- NR Electric Co., Ltd.

- Hitachi Energy Ltd.

- CG Power and Industrial Solutions Ltd.

- Other Key Players

Global Distribution Automation Market: Recent Developments

- July 2025: Sonepar agreed to acquire a pair of authorized Rockwell Automation distributors in Brazil, strengthening its regional distribution footprint.

- June 2025: Hitachi Energy introduced a transformer‑integrated Compact Line Voltage Regulator at CIRED 2025 to enhance active voltage control capabilities for distribution utilities and industries.

- May 2025: Schneider Electric unveiled its new EcoStruxure Automation Expert platform—an open, software‑defined automation environment—showcasing advanced robotics, industrial AI, and digitalization at Automate 2025.

- April 2025: More than 60 mergers, acquisitions, and equity investments in the distribution sector have occurred over the first five months of 2025, totaling over USD 5 billion, signaling robust investment momentum in tech‑driven distribution platforms.

- January 2025: Fusion Capital Partners acquired Tavoron, a U.S. automation distributor specializing in electrical and air automation components, robotic systems, and compressed air technologies.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.5 Bn |

| Forecast Value (2034) |

USD 70.0 Bn |

| CAGR (2025–2034) |

14.0% |

| The US Market Size (2025) |

USD 5.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software, Hardware, Services), By Communication Technology (Wired Networks, Wireless, Power Line Communication, Others), By Application (Fault Detection & Feeder Automation, Real-Time Monitoring & Control, Outage Management Systems, Volt/VAR Optimization, Asset Monitoring & Predictive Maintenance, DER/Renewable Integration), and By End User (Utilities, Industrial, Commercial, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ABB, Siemens, Schneider Electric, Eaton, GE, SEL, Cisco, Landis+Gyr, Itron, S&C Electric, Toshiba, Mitsubishi Electric, Hubbell, Xylem (Sensus), Rockwell Automation, Wasion Group, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global distribution automation market?

▾ The global distribution automation market size is estimated to have a value of USD 21.5 billion in 2025 and is expected to reach USD 70.0 billion by the end of 2034.

What is the size of the US distribution automation market?

▾ The US distribution automation market is projected to be valued at USD 5.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.4 billion in 2034 at a CAGR of 13.1%.

Which region accounted for the largest global distribution automation market?

▾ Asia Pacific is expected to have the largest market share in the global distribution automation market, with a share of about 39.0% in 2025.

Who are the key players in the global distribution automation market?

▾ Some of the major key players in the global distribution automation market are ABB, Siemens, Schneider Electric, Eaton, GE, SEL, Cisco, Landis+Gyr, Itron, S&C Electric, Toshiba, Mitsubishi Electric, Hubbell, Xylem (Sensus), Rockwell Automation, Wasion Group, and Others.

What is the growth rate of the global distribution automation market?

▾ The market is growing at a CAGR of 14.0 percent over the forecasted period