Market Overview

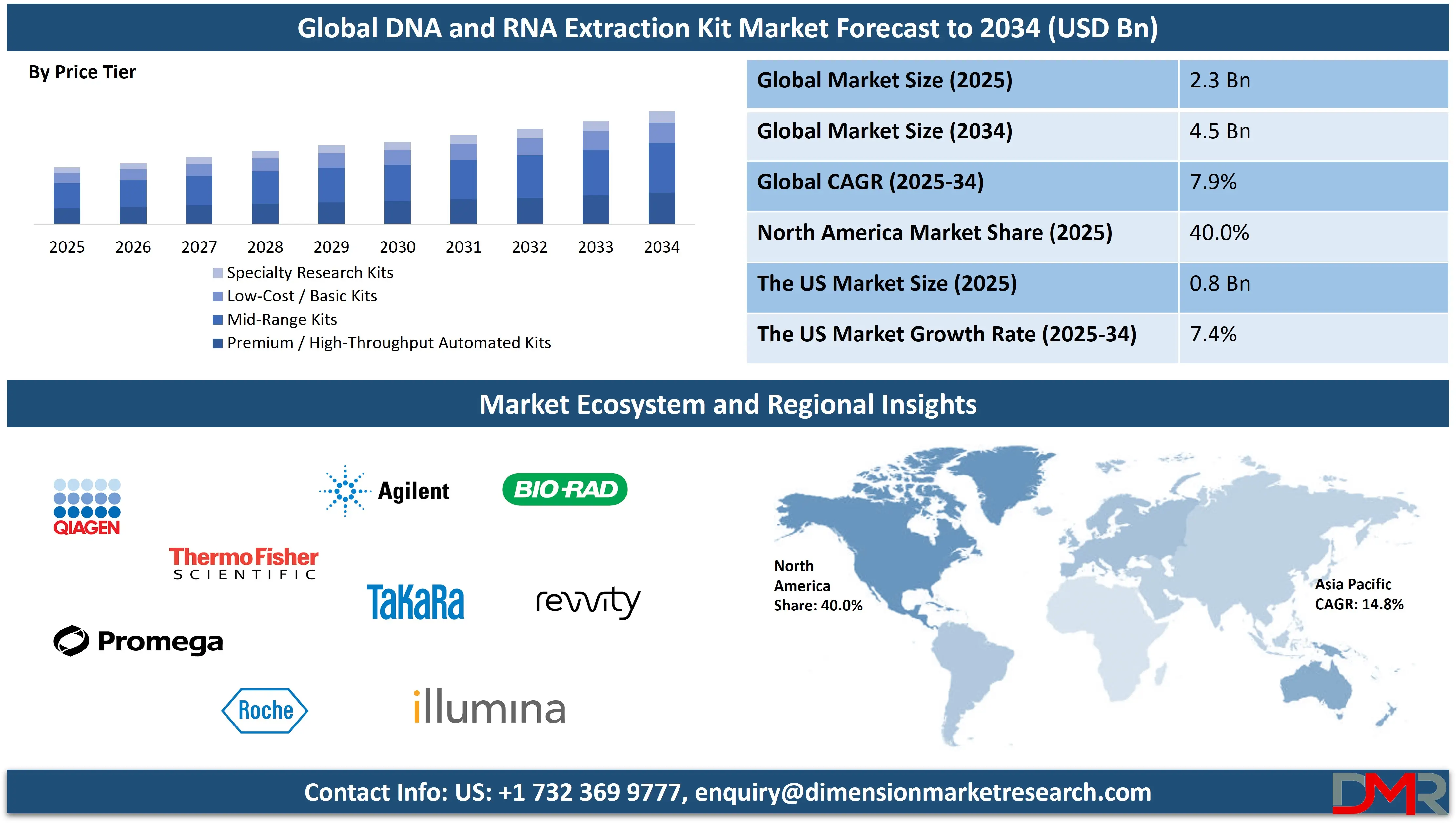

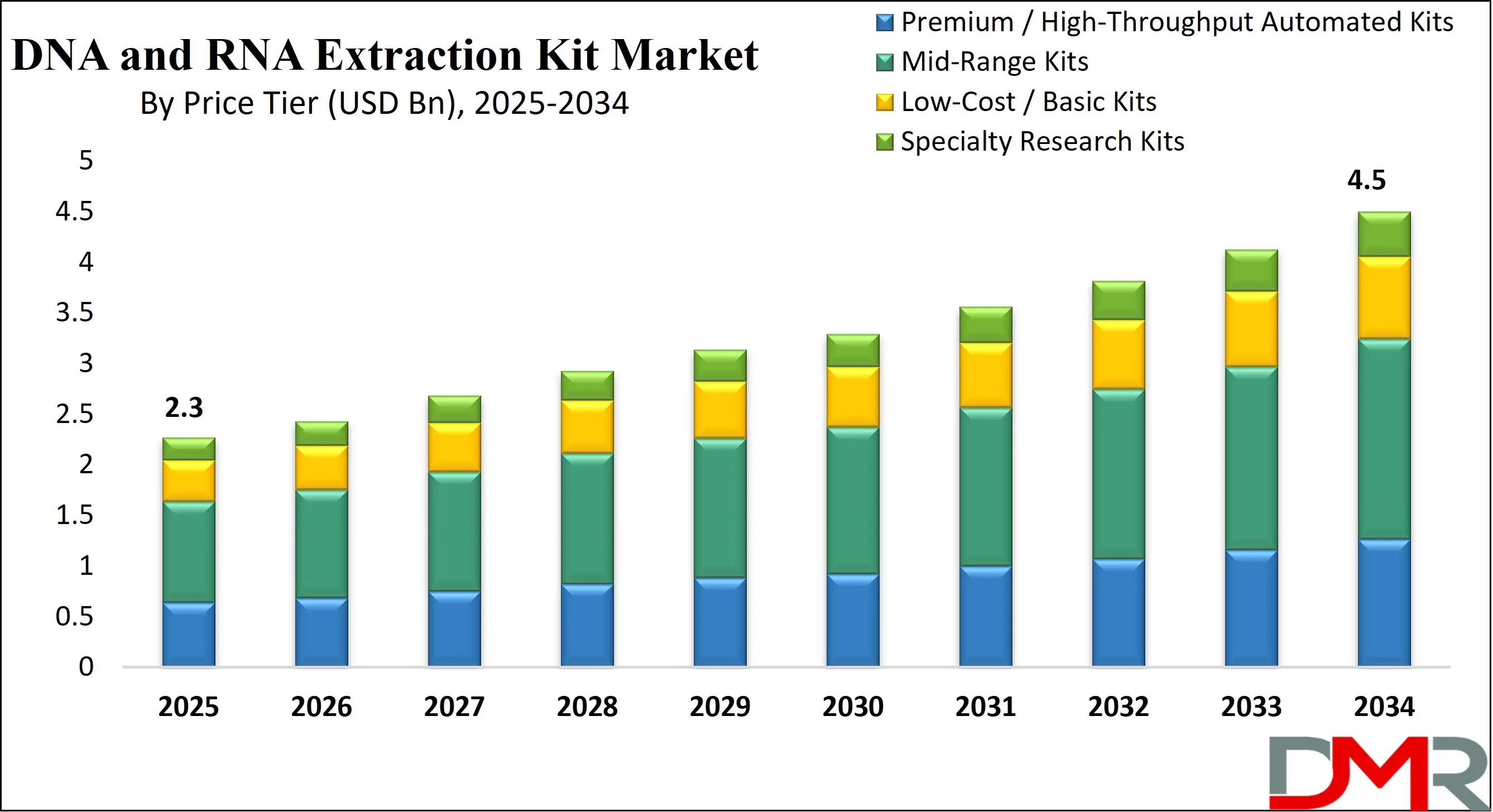

The Global DNA and RNA Extraction Kit Market size is projected to reach USD 2.3 billion in 2025 and is expected to grow to USD 4.5 billion by 2034, registering a CAGR of 7.9%. This growth is driven by rising demand for molecular diagnostics, next-generation sequencing (NGS), and genomic research across clinical, pharmaceutical, and biotechnology sectors.

A DNA and RNA extraction kit is a laboratory solution designed to isolate and purify nucleic acids from a wide range of biological samples such as blood, tissue, cells, or microorganisms. These kits streamline the process of separating high-quality genetic material by combining optimized reagents, buffers, and purification columns or magnetic beads, ensuring reproducibility and minimizing contamination. They are fundamental tools in genomics, molecular diagnostics, drug discovery, and clinical research, enabling accurate downstream applications such as PCR amplification, sequencing, cloning, and gene expression analysis.

The global DNA and RNA extraction kit market represents a rapidly expanding segment of the life sciences industry driven by the growing adoption of molecular diagnostics, infectious disease testing, and precision medicine. Increasing demand for efficient sample preparation solutions across hospitals, biotechnology firms, and research institutions is accelerating the development of advanced extraction technologies such as automated and magnetic bead-based systems. The rise in genomic research initiatives, integrated with large-scale sequencing projects and personalized healthcare programs, continues to strengthen market growth globally.

The market is further influenced by technological innovations that enhance yield, speed, and purity of nucleic acid isolation processes while reducing manual intervention. Companies are focusing on integrated extraction platforms compatible with next-generation sequencing and PCR workflows, supporting applications in oncology, virology, forensic science, and agricultural genomics. Expanding R&D funding, rising awareness of molecular testing, and the growing presence of biotechnology firms in emerging economies are expected to sustain steady growth in the coming years across North America, Europe, and the Asia-Pacific.

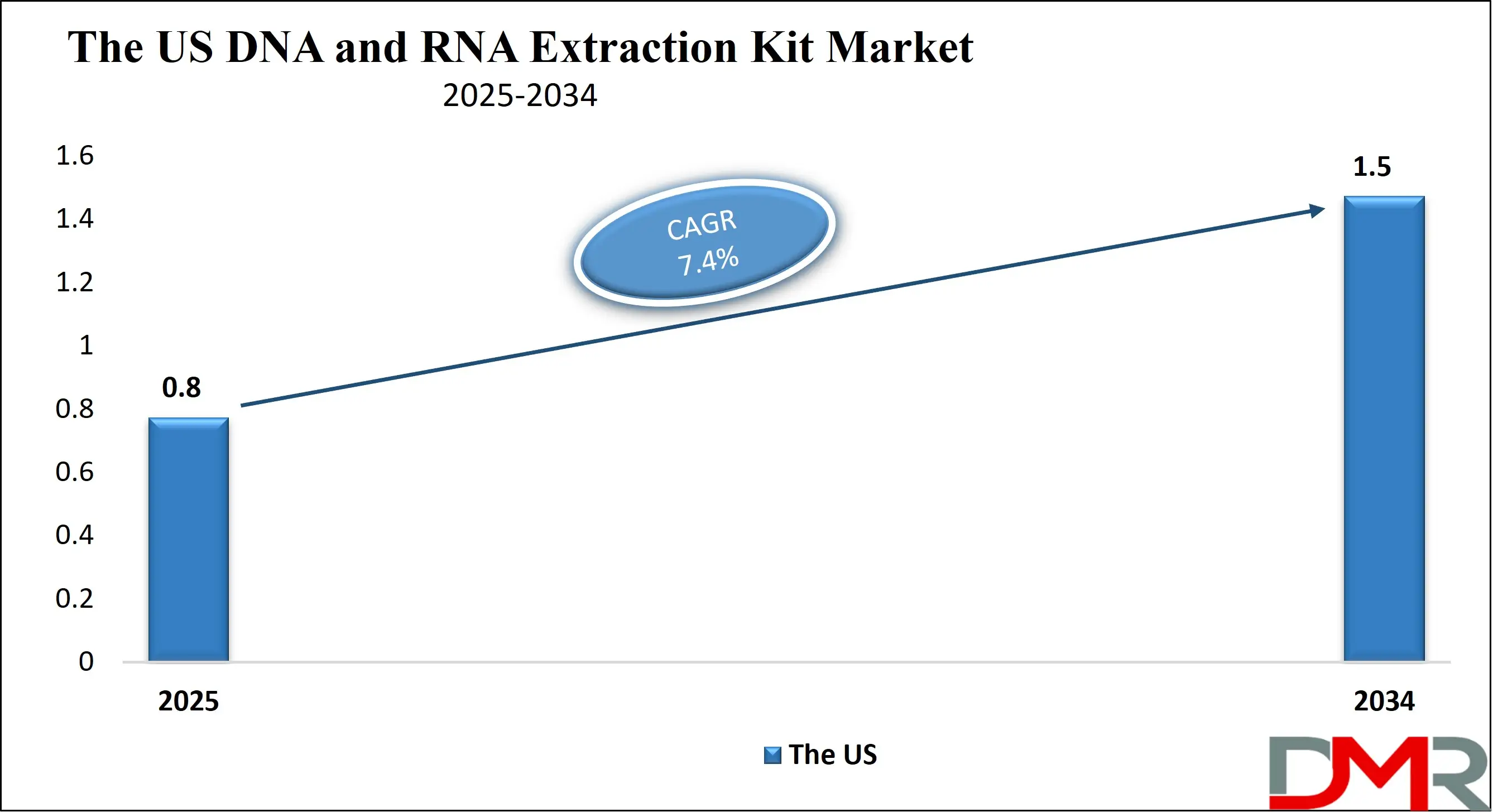

The US DNA and RNA Extraction Kit Market

The U.S. DNA & RNA Extraction Kit Market size is projected to be valued at USD 0.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.5 billion in 2034 at a CAGR of 7.4%.

The US DNA and RNA extraction kit market is witnessing strong growth driven by the expanding adoption of molecular diagnostics, genetic testing, and precision medicine. With the United States being a hub for biotechnology and genomic research, there is growing demand for high-throughput and automated nucleic acid isolation systems across clinical laboratories, research institutes, and pharmaceutical companies.

The rise in infectious disease testing, oncology screening, and personalized healthcare initiatives has amplified the need for efficient sample preparation technologies that deliver high-quality DNA and RNA for downstream applications such as PCR, qPCR, and next-generation sequencing. Moreover, government-backed genomic programs and NIH-funded projects are fueling innovation and accelerating the development of advanced extraction platforms tailored for clinical and research workflows.

In addition, the market is benefiting from the growing presence of major players such as Thermo Fisher Scientific, Qiagen, and Promega Corporation, who continue to expand their product portfolios with magnetic bead-based and automation-ready extraction kits. The growing integration of AI-driven sample tracking, cloud-based data management, and robotics in laboratory automation is also transforming the nucleic acid extraction landscape in the US.

Furthermore, the surge in biopharmaceutical R&D, integrated with a growing focus on early disease detection and liquid biopsy testing, is enhancing the adoption of high-purity extraction kits that support complex molecular assays. With rising investments in genomic infrastructure and growing collaborations between diagnostic companies and research organizations, the US DNA and RNA extraction kit market is poised for sustained expansion in the coming years.

Europe DNA and RNA Extraction Kit Market

The Europe DNA and RNA extraction kit market is projected to reach approximately USD 500 million in 2025, reflecting steady growth driven by rising adoption of molecular diagnostics and genomic research across the region. The strong presence of advanced healthcare infrastructure, well-established clinical laboratories, and leading biotechnology companies in countries such as Germany, the United Kingdom, and France is supporting robust demand for high-quality nucleic acid extraction kits.

Increasing investments in precision medicine, cancer genomics, and infectious disease testing are further contributing to market expansion, as laboratories require reliable DNA and RNA isolation solutions for PCR, next-generation sequencing, and gene expression studies. Additionally, regulatory support and government-funded genomic programs are enabling the rapid integration of automated and high-throughput extraction systems across clinical and research institutions.

Technological advancements in extraction methodologies, including magnetic bead-based systems, silica column kits, and semi-automated workflows, are enhancing efficiency, reproducibility, and sample purity in European laboratories. These innovations are particularly relevant for high-throughput molecular testing, liquid biopsy applications, and complex research studies.

The market is also benefiting from collaborations between biotechnology firms, research institutes, and hospitals to develop specialized kits for diverse sample types, ranging from blood and plasma to tissue and swab specimens. With an adjusted CAGR of 7.2%, the Europe market is expected to sustain consistent growth over the coming years, driven by growing molecular testing volumes, adoption of advanced technologies, and a strong focus on personalized medicine initiatives.

Japan DNA and RNA Extraction Kit Market

The Japan DNA and RNA extraction kit market is projected to reach approximately USD 110 million in 2025, supported by growing demand for molecular diagnostics, genomic research, and clinical testing. The country’s well-established healthcare infrastructure, advanced research institutions, and growing focus on precision medicine are driving the adoption of high-quality extraction kits.

Clinical laboratories and hospitals in Japan are increasingly using these kits for applications such as PCR, RT-PCR, next-generation sequencing, and liquid biopsy testing. Rising awareness of genetic disorders, oncology screening, and infectious disease monitoring has further fueled the need for reliable nucleic acid isolation solutions that ensure high purity and consistent yield across various sample types.

Technological innovations in automated extraction systems, magnetic bead-based kits, and silica column methodologies are enhancing workflow efficiency, throughput, and reproducibility in Japanese laboratories. The market is also witnessing collaborations between biotech companies, academic research institutes, and healthcare providers to develop specialized extraction kits tailored for diverse sample types, including blood, plasma, tissue, and swab specimens. With an adjusted CAGR of 6.5%, the Japan market is expected to grow steadily, driven by growing investment in molecular research, the adoption of advanced laboratory automation, and the expanding role of nucleic acid testing in diagnostics and translational medicine.

Global DNA and RNA Extraction Kit Market: Key Takeaways

- Market Value: The global DNA and RNA Extraction Kit market size is expected to reach a value of USD 4.5 billion by 2034 from a base value of USD 2.3 billion in 2025 at a CAGR of 7.9%.

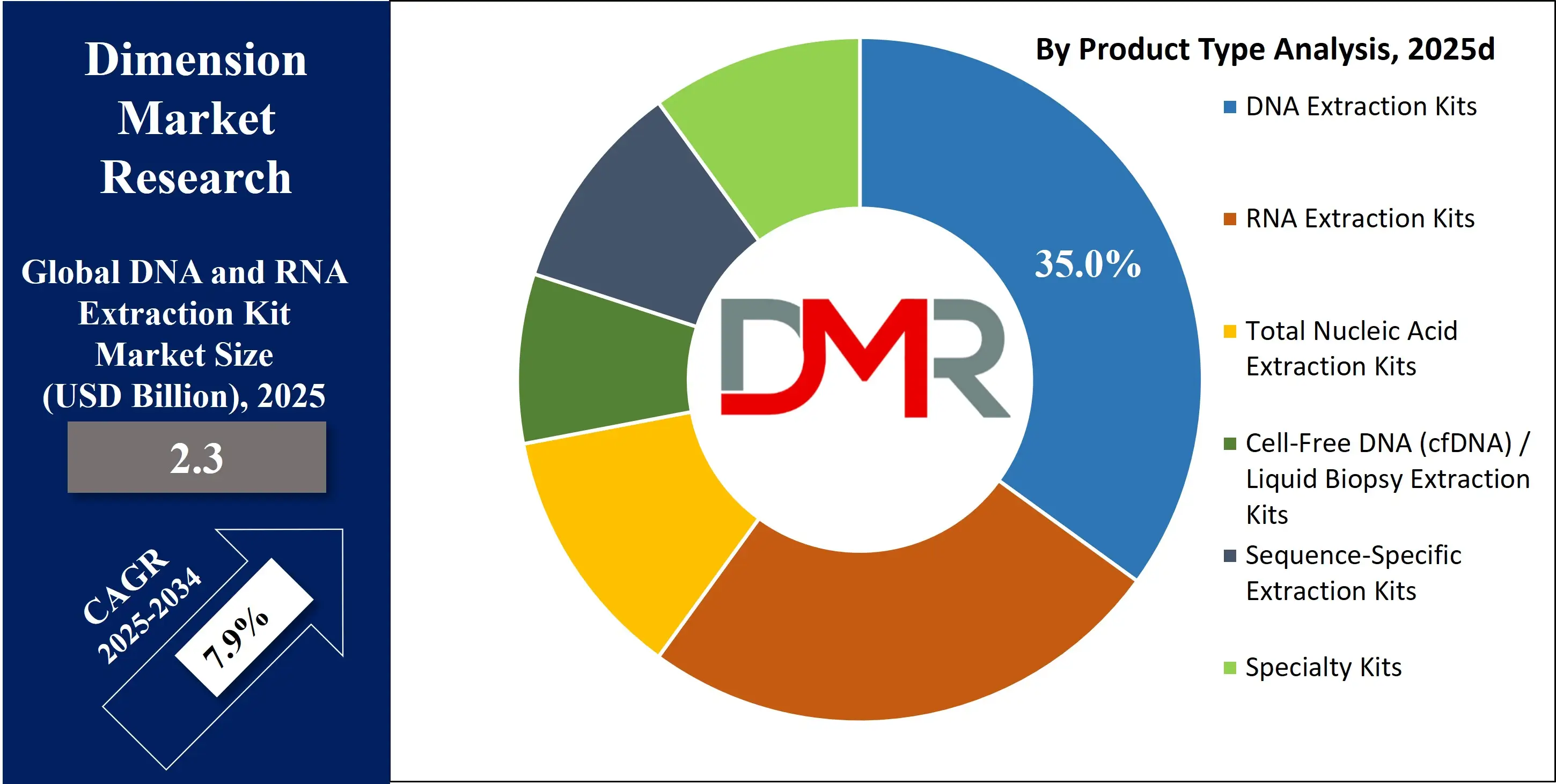

- By Product Type Segment Analysis: DNA Extraction Kits are expected to maintain their dominance in the product type segment, capturing 35.0% of the total market share in 2025.

- By Format Segment Analysis: Manual Kits and Reagents will dominate the format segment, capturing 60.0% of the market share in 2025.

- By Sample Type Segment Analysis: Blood / Plasma / Serum Samples are anticipated to dominate the sample type segment, capturing 30.0% of the total market share in 2025.

- By Technology Segment Analysis: Magnetic Bead-Based Extraction will dominate the technology segment, capturing 32.0% of the market share in 2025.

- By Price Tier Segment Analysis: Mid-Range Kits will account for the maximum share in the price tier segment, capturing 44.0% of the market share in 2025.

- By Application Segment Analysis: Clinical Diagnostics applications will account for the maximum share in the Application segment, with a market share of 36.0% in 2025.

- By End User Segment Analysis: Hospitals and Clinical Laboratories will dominate the end user segment, capturing 34.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global DNA and RNA Extraction Kit market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global DNA and RNA Extraction Kit market include Qiagen N.V., Thermo Fisher Scientific Inc., Promega Corporation, Roche Diagnostics, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Takara Bio Inc., Illumina Inc., PerkinElmer Inc. (Revvity), Norgen Biotek Corp., Zymo Research Corporation, and Others.

Global DNA and RNA Extraction Kit Market: Use Cases

- Clinical Diagnostics and Infectious Disease Testing: DNA and RNA extraction kits are essential in molecular diagnostics for detecting pathogens, genetic mutations, and viral infections. Used across hospitals and diagnostic labs, they isolate nucleic acids from blood, swabs, or tissue for PCR and RT-PCR assays. Growing use in infectious disease testing and cancer diagnostics is driving demand for automated and magnetic bead-based systems that offer faster processing, high purity, and consistent results.

- Genomic Research and Drug Discovery: In genomic and biopharmaceutical research, extraction kits provide high-quality DNA and RNA for sequencing, gene expression, and biomarker discovery. They support workflows in next-generation sequencing and precision medicine studies. As genomic research and personalized drug development expand, demand for efficient, contamination-free extraction methods continues to rise across academic and pharmaceutical laboratories.

- Forensic Science and Human Identification: Forensic labs depend on DNA extraction kits for human identification, criminal investigations, and paternity testing. These kits recover genetic material from degraded or limited samples such as hair, saliva, or trace blood. Their high sensitivity and reliability enable accurate STR profiling and genetic fingerprinting, making them indispensable tools in forensic analysis.

- Agricultural and Environmental Genomics: In agriculture and environmental biotechnology, extraction kits are used to analyze plant genetics, soil microbes, and pathogen resistance. They help monitor crop health, detect GMOs, and study biodiversity. Advanced nucleic acid isolation supports precision agriculture and environmental genomics, enabling better understanding of microbial ecosystems and sustainable crop management.

Impact of Artificial Intelligence on the global DNA and RNA Extraction Kit market

Artificial intelligence (AI) is transforming the DNA and RNA extraction kit market by enhancing automation, accuracy, and efficiency across molecular workflows. AI-powered algorithms are increasingly being integrated into sample preparation systems to optimize extraction protocols, predict reagent performance, and reduce manual errors. Machine learning models enable laboratories to analyze extraction parameters in real time, ensuring consistent nucleic acid yield and purity across diverse sample types. This technological integration not only improves reproducibility but also minimizes time-intensive manual handling, accelerating molecular diagnostics and research processes.

AI is also driving innovation in smart laboratory automation platforms that combine robotics, data analytics, and predictive maintenance to streamline nucleic acid extraction. These systems are capable of adapting extraction workflows based on sample quality and experimental needs, reducing reagent waste and operational costs. Furthermore, AI-driven data management enhances traceability and compliance in clinical and research environments, particularly in next-generation sequencing and precision medicine applications. As biotechnology and diagnostic companies continue to integrate AI with automated extraction systems, the global market is expected to see significant gains in productivity, scalability, and quality control, reinforcing its role in advancing molecular biology and genomics research.

Global DNA and RNA Extraction Kit Market: Stats & Facts

-

Centers for Disease Control and Prevention (CDC)

- In 2023, genotyping surveillance coverage for culture‑positive tuberculosis (TB) cases in the United States was 96.0%.

- In 2023, the United States reported 9,633 TB cases, representing a 15.6% increase in case count and a 15.0% increase in incidence rate compared with 2022.

- FY2025 proposal: Approximately USD 175 million requested for the Advanced Molecular Detection program under U.S. genetic surveillance and viral sequencing efforts.

- National Institutes of Health (NIH) / U.S. Government Research Funding

- FY2023: NIH and ARPA‑H program level funding was approximately USD 47.311 billion.

- FY2024 enacted: Slight decrease of approximately 0.7% versus FY2023.

- FY2025 request: USD 50.174 billion, an increase of 2.8% over FY2024 enacted.

- FY2023–FY2024: Total NIH program level funding remained largely flat (‑0.8% in FY2024) despite broader biomedical research demands.

- European Union / Genomics Infrastructure

- “1+ Million Genomes” initiative: At least 100,000 citizens per national cohort will be sequenced as part of the Genome of Europe project under a joint European genomics data infrastructure starting in 2024.

- A pan‑European biodiversity genomics project includes 33 partners across 20 countries to scale up DNA‑barcoding and reference genome generation under Horizon Europe.

- Japan / Genomics Strategy

- In July 2024: The Tohoku Medical Megabank Organization completed whole genome analysis of 100,000 people, providing a large Japanese reference dataset for genomic medicine.

- June 2024: The Japanese government introduced a genomic strategic action covering six groups of rare diseases, enabling reimbursement for comprehensive genomic testing for those groups.

Global DNA and RNA Extraction Kit Market: Market Dynamics

Global DNA and RNA Extraction Kit Market: Driving Factors

Rising Adoption of Molecular Diagnostics and Genomic Testing

The growing use of molecular diagnostics and genomic testing in clinical and research settings is a major driver of the global DNA and RNA extraction kit market. The growing prevalence of infectious diseases, cancer, and genetic disorders has accelerated demand for accurate nucleic acid isolation solutions. Hospitals, diagnostic labs, and biotechnology companies rely on high-quality extraction kits to prepare samples for PCR, RT-PCR, and next-generation sequencing (NGS). The expansion of personalized medicine and rapid diagnostic platforms is further strengthening the market, as laboratories seek fast, reliable, and automation-ready extraction systems.

Technological Advancements and Automation in Sample Preparation

Continuous innovation in extraction technologies, including magnetic bead-based systems, microfluidic platforms, and automated extraction instruments, is driving market growth. Automation reduces human error, enhances throughput, and ensures consistent nucleic acid purity. Integration of AI and robotics in laboratory workflows is enabling real-time monitoring, efficient reagent utilization, and data-driven optimization. These advancements cater to high-volume molecular testing and large-scale genomic research, making extraction kits indispensable across pharmaceutical, clinical, and academic laboratories.

Global DNA and RNA Extraction Kit Market: Restraints

High Equipment and Reagent Costs

Despite growing demand, the high cost of automated extraction systems and specialized reagents remains a key restraint. Many small and mid-sized laboratories, particularly in developing regions, struggle to invest in advanced extraction platforms due to budget limitations. Additionally, recurring expenses associated with consumables and proprietary kits add to operational costs. This cost barrier often leads to limited adoption in low-resource settings, slowing market penetration in emerging economies.

Regulatory and Standardization Challenges

DNA and RNA extraction kits used in clinical diagnostics are subject to strict regulatory approvals and validation processes. Variations in compliance requirements across regions such as the FDA, CE-IVD, and CFDA create delays in product commercialization. Lack of standardized protocols for different sample types and workflows can lead to inconsistencies in nucleic acid quality, impacting downstream molecular analysis. These regulatory complexities often slow innovation and limit global scalability for manufacturers.

Global DNA and RNA Extraction Kit Market: Opportunities

Expansion of Genomic Research and Precision Medicine Initiatives

Global investment in genomic research, biobanking, and personalized medicine is creating new growth opportunities. Governments and research organizations are funding large-scale genome sequencing projects that require reliable DNA and RNA extraction solutions. The growing collaboration between biotech companies and academic institutions is promoting innovation in sample preparation methods. Extraction kits that integrate with NGS and high-throughput sequencing workflows are particularly well-positioned to benefit from this expanding research ecosystem.

Emerging Demand in Developing Regions

The growing establishment of molecular diagnostics laboratories and research centers in Asia-Pacific, Latin America, and the Middle East is opening new market opportunities. Rising healthcare investments, expanding infectious disease surveillance, and growing awareness of genetic testing are driving adoption of extraction technologies. Manufacturers focusing on cost-effective and user-friendly extraction kits can capture significant market share in these emerging economies.

Global DNA and RNA Extraction Kit Market: Trends

Shift Toward Automation and AI-Integrated Extraction Systems

Laboratories are increasingly adopting automated and AI-enabled extraction platforms to enhance precision, reduce processing time, and improve scalability. These systems use intelligent algorithms for sample tracking, workflow optimization, and real-time quality assessment. The combination of robotics and cloud-based data management is revolutionizing nucleic acid extraction efficiency, aligning with the broader trend of digital transformation in laboratory automation.

Growing Focus on Liquid Biopsy and cfDNA Extraction

The rising use of liquid biopsy for cancer diagnostics and prenatal testing is driving innovation in cell-free DNA (cfDNA) and RNA extraction technologies. Manufacturers are developing specialized kits that enable high-sensitivity isolation from plasma and other low-yield samples. This trend reflects the shift toward non-invasive diagnostics, personalized oncology, and early disease detection, positioning cfDNA extraction as a crucial frontier in molecular testing advancements.

Global DNA and RNA Extraction Kit Market: Research Scope and Analysis

By Product Type Analysis

In the product type segment, DNA extraction kits are expected to maintain their dominance, capturing around 35.0% of the total market share in 2025. This leadership is driven by their extensive use in molecular diagnostics, genetic testing, and biomedical research. DNA extraction kits are widely utilized in hospitals, research laboratories, and biopharmaceutical companies to isolate high-quality genomic DNA for applications such as PCR amplification, sequencing, and cloning. The growing adoption of precision medicine, cancer genomics, and forensic testing has further reinforced their demand. Additionally, advancements in magnetic bead-based and automated extraction technologies have improved efficiency and yield, allowing laboratories to process large sample volumes with enhanced accuracy and consistency.

RNA extraction kits are also gaining significant traction due to the growing importance of RNA-based research in infectious disease testing, transcriptomics, and vaccine development. These kits are crucial for isolating high-integrity RNA from complex biological samples, supporting downstream applications like RT-PCR and gene expression analysis. The surge in viral RNA detection, especially after global pandemics, has boosted their utilization across clinical and research facilities. As mRNA therapeutics and vaccine research continue to expand, RNA extraction kits are expected to experience steady growth, complementing the overall dominance of DNA extraction kits in the global nucleic acid extraction market.

By Format Analysis

In the format segment, manual kits and reagents are projected to dominate, accounting for nearly 60.0% of the total market share in 2025. Their strong presence is attributed to their widespread use in academic research, small- to mid-scale laboratories, and diagnostic facilities where cost efficiency and flexibility are critical. Manual extraction kits offer easy-to-use protocols, require minimal equipment, and are compatible with various sample types, making them ideal for low-throughput applications.

They continue to be the preferred choice for laboratories seeking reliable nucleic acid isolation without the need for complex automation systems. Additionally, their affordability, adaptability, and suitability for field and point-of-care testing further enhance their market dominance. Manufacturers are also improving manual kits with advanced reagents that enhance purity, reduce contamination risk, and streamline workflow efficiency.

Automated extraction systems and consumables, on the other hand, are witnessing growing adoption as laboratories strive for higher throughput, consistency, and faster turnaround times. These systems use robotics and magnetic bead-based technologies to process multiple samples simultaneously with minimal human intervention.

Their demand is particularly strong in clinical diagnostics, biopharmaceutical manufacturing, and high-volume genomic research facilities where precision and scalability are essential. The integration of artificial intelligence, cloud-based monitoring, and workflow automation is further boosting the efficiency of automated systems. Although they currently represent a smaller market share compared to manual kits, automated extraction systems are expected to grow rapidly in the coming years as molecular testing and high-throughput sequencing continue to expand globally.

By Sample Type Analysis

In the sample type segment, blood, plasma, and serum samples are anticipated to dominate, capturing around 30.0% of the total market share in 2025. This dominance is primarily driven by their extensive use in molecular diagnostics, oncology testing, and genetic analysis. Blood and plasma samples are rich sources of genomic and cell-free DNA, making them essential for applications such as liquid biopsy, infectious disease detection, and prenatal genetic testing.

The growing use of minimally invasive diagnostic procedures and the expansion of precision medicine programs have further boosted the adoption of extraction kits optimized for blood and plasma processing. These kits are designed to deliver high-quality nucleic acids suitable for PCR, sequencing, and biomarker identification, supporting both clinical and research needs. Moreover, advancements in cfDNA isolation and plasma RNA extraction technologies are enhancing sensitivity and accuracy in molecular assays, strengthening their role in personalized healthcare.

Swab and respiratory samples are also playing an increasingly important role in the DNA and RNA extraction kit market, especially after the global rise in infectious disease surveillance. Nasal, throat, and buccal swabs are widely used for detecting viral RNA and bacterial DNA in clinical diagnostics and epidemiological testing. The COVID-19 pandemic accelerated the demand for efficient extraction kits that can rapidly isolate nucleic acids from respiratory specimens, setting a new benchmark for scalability and turnaround time.

These sample types remain crucial for molecular testing in virology, respiratory disease research, and point-of-care diagnostics. As molecular testing expands into decentralized healthcare settings, swab-based sample collection continues to drive innovation in extraction reagents and automated workflows designed for fast and reliable results.

By Technology Analysis

Magnetic bead-based extraction is projected to dominate the technology segment, capturing around 32.0% of the total market share in 2025. This method is preferred for its high efficiency, scalability, and automation compatibility. Magnetic beads coated with nucleic acid–binding materials allow for rapid and clean isolation of DNA and RNA from a wide range of biological samples such as blood, tissues, and swabs.

The technology minimizes manual handling, reduces contamination risks, and is suitable for both low- and high-throughput applications. It is extensively used in clinical diagnostics, genomics research, and forensic analysis due to its ability to deliver high-purity nucleic acids ideal for PCR, RT-PCR, and sequencing workflows. The growing demand for automation in molecular laboratories and the integration of magnetic bead-based platforms in next-generation sequencing workflows are further accelerating its adoption across research and clinical environments.

Silica membrane or column-based extraction continues to hold a significant share of the global DNA and RNA extraction kit market due to its cost-effectiveness and reliability. This traditional method relies on nucleic acid binding to silica under chaotropic conditions, followed by washing and elution to produce purified genetic material. It remains widely used in academic research, diagnostic laboratories, and biotechnology companies for small- to medium-scale applications.

Silica column kits are especially valued for their simplicity, reproducibility, and ability to produce consistent yields across diverse sample types. Although they are more labor-intensive compared to magnetic bead systems, ongoing improvements in spin column chemistry and miniaturized formats are maintaining their relevance. Their affordability and ease of integration into routine workflows ensure steady demand, especially in settings where automation is not yet fully implemented.

By Price Tier Analysis

Mid-range kits are expected to lead the price tier segment, accounting for nearly 44.0% of the total market share in 2025. Their dominance is driven by a balanced combination of performance, affordability, and compatibility with various applications in clinical, research, and diagnostic settings. These kits offer consistent yield and purity levels suitable for PCR, sequencing, and molecular diagnostic assays, making them a preferred choice among medium- to high-volume laboratories.

They cater to institutions that demand reliable results but are conscious of budget constraints, particularly in developing economies where high-end kits may not be economically viable. The growing adoption of mid-range kits by academic research institutes, biotechnology firms, and contract research organizations further strengthens their market presence. Additionally, the growing availability of mid-range kits with advanced formulations and shorter processing times continues to enhance their demand in both manual and semi-automated workflows.

High-end kits, although more expensive, are designed for specialized applications requiring ultra-high purity and precision, such as next-generation sequencing (NGS), gene expression profiling, and clinical-grade diagnostics. These premium kits feature advanced purification chemistries, faster turnaround times, and higher sample throughput, catering mainly to large research centers, hospitals, and genomic laboratories with advanced infrastructure.

While their adoption is expanding in developed markets like the US, Germany, and Japan, their high cost limits widespread use in emerging economies. Nonetheless, continuous innovation and technological integration, such as automation-ready formats and improved reagent stability, are gradually bridging the gap between high-end and mid-range products, making premium solutions more accessible in the global DNA and RNA extraction kit market.

By Application Analysis

Clinical diagnostics applications are projected to hold the largest share of the global DNA and RNA extraction kit market, accounting for approximately 36.0% in 2025. This dominance is primarily driven by the rising prevalence of infectious diseases, cancer, and genetic disorders, which have increased the demand for molecular testing and personalized medicine. DNA and RNA extraction kits are critical in diagnostic workflows such as PCR, RT-PCR, and next-generation sequencing, enabling accurate detection of pathogens, mutations, and biomarkers.

The widespread integration of molecular diagnostics in hospitals, clinical laboratories, and point-of-care facilities further fuels market growth. The COVID-19 pandemic significantly accelerated adoption, leading to sustained investments in diagnostic infrastructure and automation. Moreover, the growing need for rapid, reliable nucleic acid isolation in liquid biopsy and companion diagnostics continues to strengthen the clinical diagnostics segment. Advancements in extraction technologies are also improving workflow efficiency, yield quality, and compatibility with automated instruments, enhancing diagnostic throughput and accuracy.

Research and academic use remains another vital segment in the global DNA and RNA extraction kit market, as these kits are essential tools for genomics, transcriptomics, and molecular biology studies. Universities, research institutes, and biotechnology startups utilize these kits for fundamental research, drug discovery, and gene expression analysis.

Their affordability and ease of use make them ideal for educational and experimental purposes, where sample variety and manual handling are common. Increasing government funding for genomics research and academic collaborations with industry players are further driving adoption. Additionally, innovations in reagent stability, sample flexibility, and simplified workflows are helping researchers obtain high-quality nucleic acids suitable for diverse downstream applications. As research on precision medicine, gene editing, and synthetic biology expands, demand for cost-effective and efficient extraction kits within academic and R&D environments continues to grow steadily.

By End User Analysis

Hospitals and clinical laboratories are projected to dominate the end-user segment, accounting for about 34.0% of the global DNA and RNA extraction kit market in 2025. Their leadership is attributed to the rising adoption of molecular diagnostics for disease detection, genetic testing, and personalized treatment planning. These facilities increasingly rely on high-quality extraction kits to ensure accurate and rapid results in applications such as oncology testing, infectious disease screening, and hereditary disorder analysis.

The integration of automated extraction systems within hospital laboratories has enhanced testing efficiency and reduced human error, enabling faster diagnosis and improved patient outcomes. Moreover, the growing emphasis on precision medicine and the expansion of molecular testing capabilities in hospital networks have significantly driven the demand for reliable nucleic acid extraction solutions. Continuous government initiatives to improve healthcare infrastructure and diagnostic accuracy further strengthen this segment’s market dominance.

Diagnostic and reference laboratories also represent a crucial end-user segment, serving as key centers for advanced molecular testing and validation. These laboratories typically handle large sample volumes from hospitals, clinics, and research institutions, requiring high-throughput extraction kits and automated systems for consistent performance.

Their role in confirming complex diagnoses, conducting specialized genetic and pathogen testing, and supporting clinical trials has led to an growing demand for scalable, efficient DNA and RNA extraction technologies. Many reference labs have adopted robotic extraction platforms integrated with AI-driven analytics to improve turnaround times and reduce operational costs. Additionally, the growing trend of outsourcing diagnostic services by smaller healthcare providers and the expansion of private laboratory networks are further contributing to the growth of this segment. As personalized and genomic medicine continues to expand globally, diagnostic and reference laboratories are expected to remain vital to the market’s long-term evolution.

The DNA and RNA Extraction Kit Market Report is segmented on the basis of the following

By Product Type

- DNA Extraction Kits

- RNA Extraction Kits

- Total Nucleic Acid Extraction Kits

- Cell-Free DNA (cfDNA) / Liquid Biopsy Extraction Kits

- Sequence-Specific Extraction Kits

- Specialty Kits

By Format

- Manual Kits and Reagents

- Automated Extraction Systems and Consumables

- Service-Based Extraction (CRO / Outsourcing)

- OEM or Integrated Extraction Modules

By Sample Type

- Blood / Plasma / Serum Samples

- Swab and Respiratory Samples

- Tissue / Biopsy / FFPE Samples

- Urine / Stool / Other Body Fluids

- Cell Culture, Microbial, or Environmental Samples

- Saliva / Buccal Samples

By Technology

- Magnetic Bead-Based Extraction

- Silica Membrane / Column-Based Extraction

- Spin-Column / Precipitation / Chemical Lysis

- Enzymatic / Proprietary Chemistry-Based Extraction

- Automated Cartridge-Based Extraction

- Hybrid or Other Emerging Methods

By Price Tier

- Premium / High-Throughput Automated Kits

- Mid-Range Kits

- Low-Cost / Basic Kits

- Specialty Research Kits

By Application

- Clinical Diagnostics (Molecular & Infectious Disease Testing)

- Research and Academic Use

- Biopharmaceutical and Drug Discovery

- Next-Generation Sequencing (NGS) Sample Preparation

- Forensic and Paternity Testing

- Veterinary, Agricultural, and Environmental Testing

- Other Applications

By End User

- Hospitals and Clinical Laboratories

- Diagnostic and Reference Laboratories

- Academic and Government Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research and Testing Organizations (CROs)

- Other End Users

Global DNA and RNA Extraction Kit Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global DNA and RNA extraction kit market, accounting for around 40.0% of total revenue in 2025. The region’s dominance is driven by the strong presence of leading biotechnology and pharmaceutical companies, advanced healthcare infrastructure, and high adoption of molecular diagnostic technologies. The growing demand for genomic research, precision medicine, and clinical testing in the United States and Canada has significantly boosted market growth.

Additionally, substantial government funding for life sciences research, integrated with rising investments in next-generation sequencing and automated extraction platforms, supports continuous technological advancement. The expansion of diagnostic testing capacities post-COVID-19 and the growing focus on personalized healthcare further reinforce North America’s position as a key hub for innovation and commercialization in the global DNA and RNA extraction kit market.

Region with significant growth

The Asia-Pacific region is projected to witness significant growth in the global DNA and RNA extraction kit market over the coming years. This expansion is fueled by the rapid development of healthcare infrastructure, growing government investment in genomics and biotechnology, and a growing focus on early disease detection.

Countries such as China, India, Japan, and South Korea are driving demand through rising research activities, expanding clinical diagnostic capabilities, and the establishment of molecular biology laboratories. The growing prevalence of infectious and chronic diseases, integrated with the adoption of automation and next-generation sequencing technologies, is further accelerating market growth. Additionally, the surge in academic collaborations, local manufacturing initiatives, and cost-effective research programs are positioning the Asia-Pacific region as a high-potential growth hub in the DNA and RNA extraction kit industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global DNA and RNA Extraction Kit Market: Competitive Landscape

The global DNA and RNA extraction kit market is characterized by intense competition, with numerous established and emerging players striving to enhance their technological capabilities and expand their product portfolios. Companies are increasingly focusing on developing high-throughput, automation-compatible, and AI-integrated extraction solutions to meet the growing demand from clinical diagnostics, research institutions, and biotechnology firms. Strategic collaborations, mergers, and partnerships are common as manufacturers aim to strengthen global distribution networks and improve accessibility in emerging regions.

Continuous innovation in reagent chemistry, magnetic bead technology, and silica-based purification methods is driving differentiation among competitors. Additionally, the trend toward customizable kits, miniaturized formats, and environmentally sustainable reagents is reshaping market strategies. As precision medicine, molecular diagnostics, and genomic research continue to evolve, competition within the DNA and RNA extraction kit industry is expected to intensify, emphasizing quality, efficiency, and automation.

Some of the prominent players in the global DNA and RNA Extraction Kit market are:

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

- Promega Corporation

- Roche Diagnostics

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Takara Bio Inc.

- Illumina Inc.

- PerkinElmer Inc. (now Revvity)

- Norgen Biotek Corp.

- Zymo Research Corporation

- New England Biolabs (NEB)

- Beckman Coulter Life Sciences

- Merck KGaA (Sigma-Aldrich)

- GenScript Biotech Corporation

- Analytik Jena AG

- Omega Bio-tek Inc.

- MP Biomedicals LLC

- Cytiva (Danaher Corporation)

- AutoGen Inc.

- Other Key Players

Global DNA and RNA Extraction Kit Market: Recent Developments

- September 2025: Xpedite Diagnostics GmbH launched the SwiftX™ Virus one‑step DNA/RNA extraction kit, CE‑IVD certified and designed for rapid isolation of viral DNA and RNA from serum and plasma in just six minutes, targeting tropical and vector‑borne disease diagnostics.

- April 2025: QIAGEN N.V. announced its acquisition of Parse Biosciences, Inc., a provider of scalable, instrument‑free single‑cell sample preparation solutions, thereby broadening QIAGEN’s sample technologies portfolio and strengthening its footprint in high‑throughput nucleic acid workflows.

- March 2025: iGeneTech Co., Ltd. unveiled a series of new extraction kits—including plasma, pathogen, universal and FFPE formats—and announced accompanying investment into its reagent development and automation‑compatible workflows for nucleic acid isolation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.3 Bn |

| Forecast Value (2034) |

USD 4.5 Bn |

| CAGR (2025–2034) |

7.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (DNA Extraction Kits, RNA Extraction Kits, Total Nucleic Acid Extraction Kits, Cell-Free DNA / Liquid Biopsy Extraction Kits, Sequence-Specific Extraction Kits, Specialty Kits), By Format (Manual Kits and Reagents, Automated Extraction Systems and Consumables, Service-Based Extraction, OEM or Integrated Extraction Modules), By Sample Type (Blood / Plasma / Serum Samples, Swab and Respiratory Samples, Tissue / Biopsy / FFPE Samples, Urine / Stool / Other Body Fluids, Cell Culture / Microbial / Environmental Samples, Saliva / Buccal Samples), By Technology (Magnetic Bead-Based Extraction, Silica Membrane / Column-Based Extraction, Spin-Column / Precipitation / Chemical Lysis, Enzymatic / Proprietary Chemistry-Based Extraction, Automated Cartridge-Based Extraction, Hybrid or Other Emerging Methods), By Price Tier (Premium / High-Throughput Automated Kits, Mid-Range Kits, Low-Cost / Basic Kits, Specialty Research Kits), By Application (Clinical Diagnostics, Research and Academic Use, Biopharmaceutical and Drug Discovery, Next-Generation Sequencing Sample Preparation, Forensic and Paternity Testing, Veterinary / Agricultural / Environmental Testing, Other Applications), and By End User (Hospitals and Clinical Laboratories, Diagnostic and Reference Laboratories, Academic and Government Research Institutes, Pharmaceutical and Biotechnology Companies, Contract Research and Testing Organizations, Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Qiagen N.V., Thermo Fisher Scientific Inc., Promega Corporation, Roche Diagnostics, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Takara Bio Inc., Illumina Inc., PerkinElmer Inc. (Revvity), Norgen Biotek Corp., Zymo Research Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global DNA and RNA Extraction Kit market size is estimated to have a value of USD 2.3 billion in 2025 and is expected to reach USD 4.5 billion by the end of 2034.

The US DNA and RNA Extraction Kit market is projected to be valued at USD 0.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.5 billion in 2034 at a CAGR of 7.4%.

North America is expected to have the largest market share in the global DNA and RNA Extraction Kit market, with a share of about 40.0% in 2025.

Some of the major key players in the global DNA and RNA Extraction Kit market are Qiagen N.V., Thermo Fisher Scientific Inc., Promega Corporation, Roche Diagnostics, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Takara Bio Inc., Illumina Inc., PerkinElmer Inc. (Revvity), Norgen Biotek Corp., Zymo Research Corporation, and Others.

The market is growing at a CAGR of 7.9 percent over the forecasted period.