Market Overview

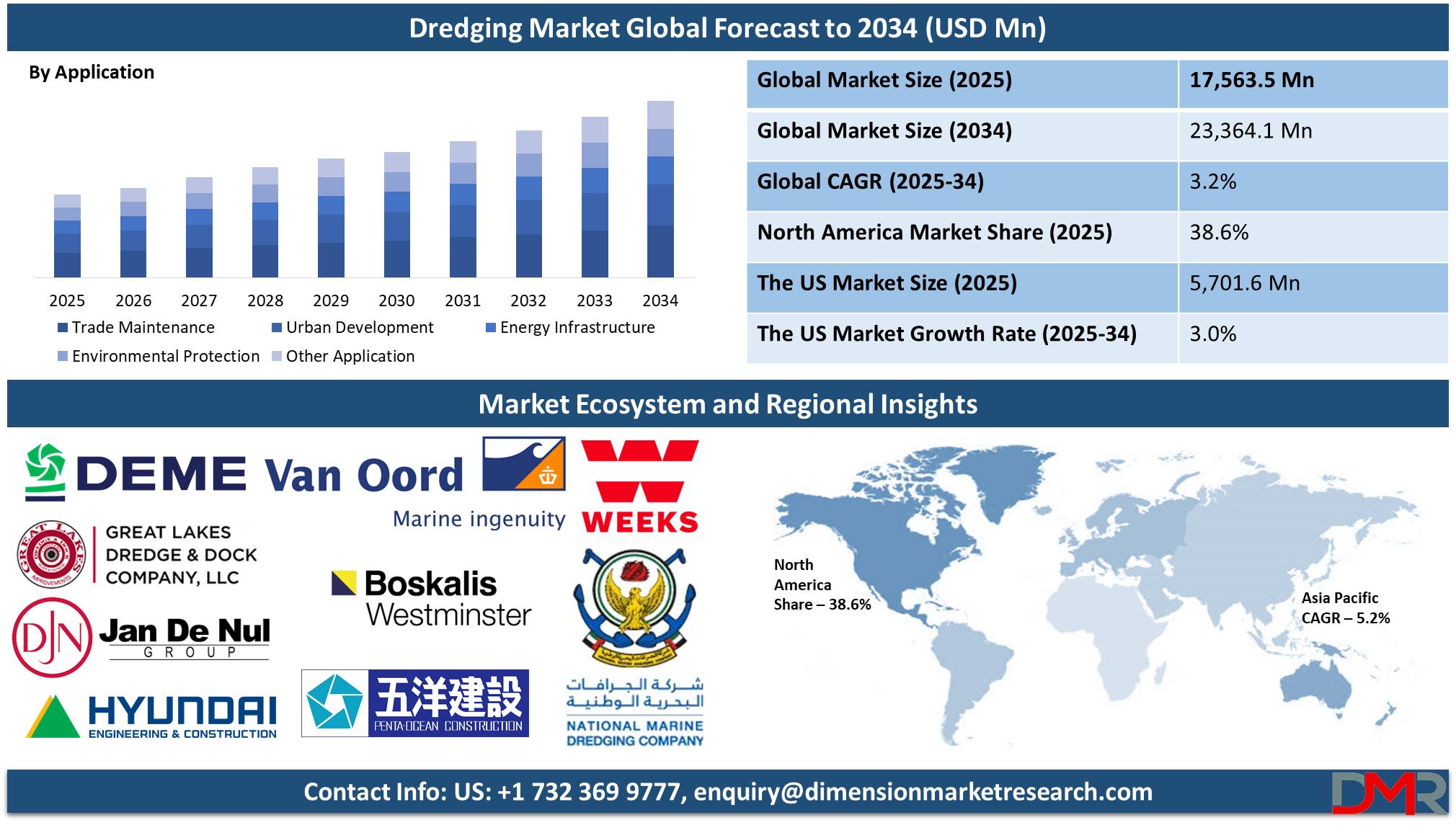

The Global

Dredging Market is projected to be

valued at USD 17,563.5 million by the end of 2025 and is further expected to reach a market

value of USD 23,364.1 million in 2034 at a

CAGR of 3.2%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global dredging market is playing a vital role in facilitating trade, urbanization, and protection of the environment. Due to the continued improvement in international trade, the requirement for expanding ports and maintenance brought explosive demand for dredging works. The condition of the navigable water in most of the international ports necessitates continuous dredging or modification to give place for gigantic vessels. Other important drivers of growth are urbanization-as land reclamation projects expand cities and offer protection to coastlines from the rise in the sea level and, more importantly, infrastructure development across the Asia-Pacific region, which continues to see unprecedented investment in developing trade hubs and major urban projects; China and India remain vital contributors in this respect.

One striking trend in the sector is an increasing adoption of eco-friendly dredging technologies, further discouraging environmental degradation. The strict regulations imposed mean that governments and companies continue to invest in technologies that minimize sediment disturbance and preserve marine ecosystems. Second, automated dredgers and real-time data monitoring systems further drive down costs and maximize operational efficiency. These technological advances will be driving the industry toward solid growth over the next decade.

Opportunities abound in regions with growing offshore energy projects, especially in offshore wind farms and oil and gas pipelines. Coastal protection projects are also in high demand, especially for areas highly susceptible to climate change. Land reclamation projects remain lucrative in highly urbanized areas, such as Singapore and the UAE, while developing nations seek to modernize their ports and waterways, further expanding the market.

However, outstanding challenges in this market include tough environmental regulations and high capital investment costs for dredgers and dredging operations. Sometimes, these strict environmental laws delay projects due to an increase in their cost of operation and difficulties in working within such law frames. Geopolitical tensions in maritime regions affect dredging works, thus stalling the growth rate of the global dredgers market. Despite that, the increasing push for environmental sustainability drives innovations in reducing ecological harm, thereby driving opportunities to arise from binding regulations.

Some statistics that depict the importance of dredging are catching, and hence support the dredging market. For example, it is estimated that the global dredging volume is more than 20 billion cubic meters annually, which underlines the magnitude of the operations at hand for trade and urban growth.

The growth prospects in the dredging industry remain high, driven by urbanization, climate resilience projects, and international trade. Land reclamation and urban waterfront development open up new possibilities as megacities grow. Coupled with that, at varying extents, different governments around the world are powering coastal defenses and flood protection, further driving demand. The integration of digital technologies and eco-friendly practices keeps the industry in step with global sustainability goals and points toward further growth.

The US Dredging Market

The U.S. Dredging Market continues to be a global leader and is projected to reach USD 5,701.6 million in 2025 at a compound annual growth rate of 3.0% over its forecast period.

The U.S. dredging market can be considered one of the cornerstones of global dredging activities because the country has a long coastline, an extensive port network, and great reliance on maritime trade. This is because U.S. ports handle about 2 billion tons annually, which contributes greatly to this country's economy and mainly relies on dredging to keep the track navigable with large vessels. The focus areas in such dredging programs are, for example, the Gulf of Mexico and the Eastern Seaboard coastal regions targeting trade maintenance urban development, and environmental restoration.

The United States enjoys a demographic advantage, with a growing coastal population that demands urban expansion and flood mitigation projects. Coastal cities such as Miami, New Orleans, and New York are increasingly investing in dredging to counter rising sea levels and improve resilience against natural disasters. The country is also at the forefront of offshore renewable energy development, with the expansion of offshore wind farms along the Atlantic Coast driving demand for seabed preparation and cable laying.

Leaders are now introducing advanced technologies like automated dredgers and eco-friendly best practices to help improve efficiency while reducing environmental impacts. Although there are still some inhibiting factors, such as strict regulations and high operational costs, the United States has the technological edge, abundant resources, and strategic location to retain its lead in dredging operations.

Key Takeaways

- Global Market Value: The Global Dredging Market was estimated to be worth USD 17,563.5 million in 2025 and is expected to reach USD 23,364.1 million by the end of 2034.

- The US Market Value: The US Dredging Market is projected to be valued at USD 5,701.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7,444.3 million in 2034 at a CAGR of 3.0%.

- Regional Analysis: North America is expected to have the largest market share in the Global Dredging Market with a share of about 38.6% in 2025.

- Key Players: Some of the major key players in the Global Dredging Market are Jan De Nul Group, Royal Boskalis Westminster N.V., DEME Group, Great Lakes Dredge & Dock Corporation, China Communications Construction Company (CCCC), Hyundai Engineering & Construction Co. Ltd., and many others.

- Global Growth Rate: The market is growing at a CAGR of 3.2 percent over the forecasted period.

Use Cases

- Port Maintenance and Expansion: Ports form a core part of international cargo transportation, while dredging keeps these facilities functioning for the bigger vessels, including the Ultra Large Container Ships (ULCS). By dredging, it keeps channels and harbor basins at their design depths minimizes shipping delays, and improves supply chain efficiency, hence giving a boost to economic activities.

- Land Reclamation Projects: Another vital use involves dredging materials to create newly reclaimed land, mostly in coastal metropolitan areas. Common examples include development projects like that of Singapore's Marina Bay and Dubai's Palm Islands, which redesign cityscapes while boosting various economies and tourism.

- Environmental Restoration: Dredging plays a very important role in the conservation of environments through the removal of contaminated sediments from rivers, lakes, and estuaries. This will restore the aquatic ecosystem by improving water quality and preventing pollutants from spreading.

- Offshore Energy Development: The growing focus on renewable energy renewable energies, particularly offshore wind farms with an integrated system of underwater pipelines. Using dredging, sea-bed preparation of such installations-from wind turbines as such to anchors and an extended cabling system-becomes critical to ensure that output is not interfered with because of an inadequately prepared seabed site.

- Flood Mitigation and Coastal Defense: Given the sea-level rise and eventual violent storms linked to climate change, dredging plays a major role in ensuring flood mitigation and coastal defense. Dredging constructs barriers, levees, and channels to protect seashore cities, infrastructure, and populations.

Market Dynamic

Driving Factors

Rising Global Trade and Port ExpansionShipping carries approximately 11 billion tons of commodities around the world every year, and maritime trade remains indispensable in the global economy. With newer and bigger ships like the Ultra Large Container Ships that have capacities of more than 20,000 TEUs, there is pressure for shipping channels to be deeper and wider, as well as for the basins where these main ports receive huge dredging projects to remain competitive amidst shipment cargo volume increases. With economic growth and industrialization driving demand, the Asia-Pacific region-which hosts major trade centers such as Shanghai, Singapore, and Mumbai-leads the way in demand. In parallel, developed regions, including North America and Europe, are refurbishing their old port facilities to modern shipping standards, ensuring steady demand for dredging services.

Urbanization and Coastal Infrastructure Development

The world's population is increasingly concentrated in urban coastal areas, with over 40% of the world's population housed in these areas. This shift brings an unprecedented demand for land reclamation projects to accommodate housing, commercial zones, and public amenities. Mega projects such as Dubai's Palm Islands and Singapore's Marina Bay exemplify dredging in its role of enabling urban expansion. Equally important are coastal protection projects, as sea level rise and extreme weather events threaten urban areas. Governments are focusing on dredging for the creation of sea walls, levees, and flood channels to protect cities, assets, and lives. This dual demand for urban growth and climate resilience cement dredging as a crucial industry.

Restraints

Stringent Environmental Regulations

The dredging industry is seriously regulated with an environmental view to reduce ecological disturbance due to its operations. It, in turn, brings regulations to enforce EIAs, compliance monitoring, and mitigation measures. Projects in sensitive areas such as coral reefs, wetlands, and estuaries would face greater scrutiny. These regulations result very frequently in delays, increase the project cost, and call for specialized equipment and practices.

Non-compliance can result in significant penalties, reputational harm, or outright cancellations of projects. While technological advances are partly an answer to the problems at hand, compliance remains complex and costly in dredging operations, especially in regions where jurisdictional regulations overlap.

High Capital and Operational Costs

Dredging is a very capital-intensive industry since the purchase price and maintenance costs of the dredger, barges, and pumping systems are high. Project costs are driven up by higher operational costs for fuel, quality labor, and logistics. Instability in the prices of fuels adds volatility to this, while shortages in skilled labor make things more difficult in some markets. Additionally, the investment needed in high-level automation and eco-friendly systems often proves to be expensive for smaller companies to achieve. These financial burdens make it difficult for smaller players to enter or expand in the market and act as barriers to growth in price-sensitive markets, especially in developing regions.

Opportunities

Expansion of Offshore Renewable Energy Projects

The momentum of offshore renewable energy is developing well in the context of countries moving toward greener sources of energy. More specifically, every offshore wind farm needs extensive preparation of the seabed given turbine installation, cable trenching, and the construction of foundations. The global push to expand renewable energy, especially in regions like Europe, with ambitious EU Green Deal targets, the U.S., and China unprecedented opportunities for dredging companies. For instance, the offshore wind capacity of Europe will reach 450 GW by 2050, further driving the demand for dredging services. Additionally, the underwater cable networks necessary for energy transmission and interconnectivity add to the need for dredging expertise in this sector.

Development of Emerging Markets

The rapid industrialization and urbanization of the emerging economies in Africa, Southeast Asia, and Latin America are driving investments in critical infrastructure. In these regions, ports like Lamu Port in Kenya and Chabahar Port in Iran are either under development or expansion to accommodate the growing trade. Inland waterways, an efficient and low-cost alternative mode of transport, are also being modernized, thereby creating opportunities for dredging projects.

Other than this, countries having a long coastline and islands also present a huge demand for dredging activities to support tourism, fisheries, and industries. The entry of international players in these markets adds to the opportunities through various collaborations and technology transfers.

Trends

Adoption of Eco-Friendly Dredging Practices

Given its environmental impacts-including sediment stirring, water quality decline, and marine organism depletion-dredging has come to be closely considered these days by all governments, mainly under constant surveillance and pressure from other environmentalist bodies and international ones as well. While these issues plague this construction market sector, the response of the business will turn out to be adopting sustainable techniques, and technologies that should keep environmental damage very minimal.

Most of the contemporary industries incorporate the use of turbidity curtains, sediment-keeping systems, as well as only low-emission dredging machines are highly urged as well as appropriate. Eco dredgers, conceived with minimal possible damage or disturbance to ecosystems, are available and in an increasing number on-site for operations. Firms are also trying to meet very strict regulations through the use of advanced sediment dispersion control techniques and real-time environmental monitoring. Initiatives such as the IMO guidelines make stakeholders begin to take in activities that coincide with global environmental objectives, therefore developing some kind of competitive advantage for companies leading in the way of sustainability innovation.

Digital Transformation and Automation

The dredging industry is well placed in a state of digital revolution, where automation and data-driven tools re-mould the efficacy of operations, thus defining them for a better tomorrow. Smart dredgers apply GPS-guided systems, real-time data acquisition, and advanced sensors towards greater accuracy, reduced fuel consumption, and optimization of time for project execution. Autonomous dredgers will do much good when it comes to weeding out any kind of error due to human interaction executing seamless operations within danger-prone terrain.

The next step includes the application of machine learning and AI in the area of equipment failure prognosis, work process optimization, and monitoring of marine conditions. Digital twins are virtual replicas of actual physical assets that enable stakeholders to simulate and test dredging projects before execution, thus minimizing risks and improving decision-making. These will keep the dredging industry competitive and aligned with modern engineering standards.

Research Scope and Analysis

By Type of Equipment

Cutter Suction Dredgers (CSDs) are projected to dominate the global dredging equipment market as they hold the highest market share in 2025. The unrivaled versatility, efficiency, and cost-effectiveness of CSDs across a wide range of applications have made them the largest segment in the global dredging equipment market. With their design features, CSDs can excavate and transport hard materials such as compacted soil, rock, and sand, which makes them indispensable in land reclamation, port deepening, and riverbed dredging projects. Equipped with a rotating cutter head, they provide for proper material removal without such high consumption of time and resources for extensive dredging operations.

Another reason for CSDs dominating the market for such a long period is the fact that they can operate both in shallow as well as deep water conditions. Unlike other dredgers, they can work perfectly in both shallow and deep water conditions without their output being adversely affected. Additionally, their ability to pump dredged material directly to the required site sometimes over a long distance reduces the need for supplementary means of transport. This helps reduce the cost of operation.

CSDs are also highly preferred in emerging economies, where large-scale infrastructure projects such as port expansions and land reclamation are on the rise. Their robust performance in challenging terrains, coupled with their ability to operate in remote areas, makes them a favored choice for governments and private stakeholders.

Advancements regarding control systems with automation and real-time monitoring, of course, have made CSDs even more attractive. These innovations result in higher returns due to better efficiency, reduced losses from downtime, and full compliance with ecological laws. While the demand for dredging gear keeps growing throughout the world, CSDs remain vital fountains of dependability and expandability to carry out a wide range of project tasks.

By Application

Trade maintenance is expected to dominate the application segment of the global dredging market, considering that it has a vital role in sustaining world commerce and maritime trade. The ports and harbors are the lifeblood of international trade, given that about 80.0% of the world's goods by volume are transported through them. Dredging makes these facilities continue working by maintaining navigable depths in channels and berths, which accommodate bigger vessels like Ultra Large Container Ships (ULCS).

Modern vessels have grown bigger and bigger, making trade maintenance a necessity. With the ever-increasing volume of global trade, all ports have to keep pace by upgrading their facilities to handle large volumes of cargo. Dredging in ports allows deepening and widening of waterways, assuring smooth access to larger vessels and avoiding congestion, thereby improving turnaround times. This directly influences the efficiency of global supply chains; hence, making trade maintenance a high-priority application.

Emerging economies are more dependent on dredging for trade maintenance, while many developing countries upgrade their port infrastructure to join the competition in the global market. For example, India, China, and Indonesia have been investing heavily in dredging to develop their trade capacity and connect to international markets.

Besides that, dredging to maintain trade is crucial in regions with sedimentation problems, which may be riverine ports or estuaries. In this regard, the removal of sediment deposits allows for continuous operation and avoids losses arising from shipping delays. While worldwide trade patterns change and sea traffic increases, trade maintenance will continue to dominate the dredging market, accompanied by growth and enabling the economic integration of global markets.

By End User

The oil and gas industry is anticipated to dominate the end-user segment of the global dredging market due to its significant dependence on dredging for infrastructure development, exploration, and operational efficiency. Offshore oil and gas projects, including platforms, pipelines, and subsea installations, require extensive seabed preparation, a task efficiently handled by dredging.

It provides stable bottoms for platforms and anchors by dredging, which helps in successfully laying submarine pipes and cables so important for carrying hydrocarbons from offshore fields to onshore processing units. This is very closely related to upstream and midstream operations; therefore, dredging becomes inevitable in the oil and gas industry.

Dredging service demands are further driven by various coastal refineries and terminals since these facilities have been using the dredged waterways to facilitate large oil tankers and LNG carriers, smoothing the import and export activities at these facilities. This is further boosted by the growing demand for liquefied natural gas and the expansion of LNG terminals, increasing dredging operations to maintain deepwater access.

Moreover, it operates in the regions with poor seabed conditions and sedimentation issues: the Arabian Gulf and the Gulf of Mexico. In this respect, dredging resolves these challenges by guaranteeing navigable depths and stable seabeds.

Dredging has gained immense popularity in the oil and gas industry due to technological advancements related to precision excavation and the development of an environmentally friendly method, hence complying with the goal of sustainability. This fact, coupled with the continuous demand for energy resources across the globe, is estimated to make the requirement for dredging services by the oil and gas industry a mainstay of the market for growth opportunities.

The Dredging Market Report is segmented on the basis of the following

By Type of Equipment

- Cutter Suction Dredger (CSD)

- Trailing Suction Hopper Dredger (TSHD)

- Backhoe Dredger

- Bucket Dredger

- Grab Dredger

- Auger Dredger

- Other Types of Equipment

By Application

- Trade Maintenance

- Port and Harbor Maintenance

- Waterway Deepening

- Urban Development

- Land Reclamation

- Coastal Protection

- Energy Infrastructure

- Oil and Gas Pipeline Installation

- Offshore Wind Farm Construction

- Environmental Protection

- Contaminated Sediment Removal

- Flood Protection Projects

- Other Application

By End User

- Government and Municipalities

- Oil and Gas Industry

- Construction Industry

- Energy Sector

- Ports and Harbors

- Mining Industry

Regional Analysis

North America is projected to dominate the global dredging market as it commands

over 38.6% of the total market revenue by the end of 2025. North America is the dominating region in the global dredging market, as it involves a long length of coastline with sea trade having an important magnitude and overall developments in infrastructure, hence making itself at the forefront. Topping this category is the U.S., with every year seeing around more than 2 billion tonnes of cargo taking place across several ports, implying that dredging is surely one indistinguishable operation involved in maintaining overall efficient trade throughput.

This is further supported by the continued development and modernization of major ports, such as the Port of Los Angeles, the Port of Houston, and the Port of New York and New Jersey, where dredging operations are necessary to accommodate larger vessels, including Ultra Large Container Ships (ULCS).

This factor, combined with its commitment to the development of offshore energy, especially in the oil, gas, and renewable energy sectors, solidifies North America's position in the dredging market. The construction of offshore wind farms along the East Coast and extensive subsea pipeline installation in the Gulf of Mexico has spurred demand for dredging services.

The advanced technological capability of the region contributes to its leading position by modern dredging equipment, with environmentally friendly technologies also being implemented in the projects. The increasingly higher investments being made in general infrastructure and coastal protection projects by the government add further thrust to market growth.

Additionally, North America presents some of the critical demographic development trends that spur growth, and have ensured the ongoing need for dredging is important to generate new land development and disaster risk management while coastal areas expand into more flood exposure ensuring the continued importance of dredging for urban expansion, land reclamation, and disaster resilience, driving the market's dominance in the region. Such elements ensure that the dominance of the dredging market remains within this geographical region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global dredging market is a very competitive arena where major players keep their leading positions in the market by being advanced in technologies, strategically partnered, and globally reached to establish their position. Key companies dominate the market with comprehensive dredging solutions and are leveraging a large portfolio of specialized equipment and strong project portfolios across the trade maintenance, offshore energy, and environmental restoration sectors. Examples include Jan De Nul Group, Royal Boskalis Westminster N.V., and DEME Group.

This can include competition based on innovation, operational efficiency, and sustainable dredging practices. Small regional players contribute to market growth by offering localized services, while large multinational corporations continue their expansion in increasing market share through mergers, acquisitions, and joint ventures. Strategic collaborations-such as those seen with government bodies for port development or an offshore project- are common in maintaining dominance.

With the industry's increasing focus on environmentally friendly dredging techniques, the competitive landscape continues to evolve, with firms adopting state-of-the-art technologies in automation, real-time monitoring, and eco-friendly dredging methods that better their bottom line while improving regulatory compliance.

Some of the prominent players in the global dredging market are

- Jan De Nul Group

- Royal Boskalis Westminster N.V.

- DEME Group

- Great Lakes Dredge & Dock Corporation

- China Communications Construction Company (CCCC)

- Hyundai Engineering & Construction Co., Ltd.

- Penta-Ocean Construction Co., Ltd.

- Van Oord

- TOA Corporation

- Weeks Marine, Inc.

- National Marine Dredging Company (NMDC)

- Boskalis Hirdes

- Gulf Cobla

- Other Key Players

Recent Developments

January 2025

- Collaboration: DEME Group and the U.S. Army Corps of Engineers announced a strategic collaboration to modernize U.S. ports, enhancing navigability for larger ships through advanced dredging techniques.

- Investment: Jan De Nul Group secured a major contract worth USD 500 million for the dredging and expansion of the Port of Miami, ensuring its ability to handle Ultra Large Container Ships (ULCS).

December 2024

- Expo: The International Dredging Conference, held in Miami, showcasing the latest technologies in dredging equipment, with a special focus on automation and sustainable practices.

- Merger: Royal Boskalis Westminster N.V. and Van Oord finalized a merger to create a joint venture aimed at expanding their presence in the offshore wind farm sector, including dredging for subsea cable installation.

November 2024

- Conference: The American Society of Civil Engineers (ASCE) hosted a seminar on sustainable dredging practices, with industry experts discussing the adoption of eco-friendly methods for sediment management.

- Investment: Penta-Ocean Construction Co., Ltd. announced a strategic investment in research and development for robotic dredging systems, aiming to reduce environmental impacts in sensitive areas.

October 2024

- Collaboration: China Communications Construction Company (CCCC) partnered with the Government of Panama to initiate the deepening of the Panama Canal, enhancing its capacity for global trade.

- Conference: A major exhibition at the International Marine Expo in San Diego highlighted the latest advancements in dredging equipment, focusing on digitalization and real-time monitoring.

September 2024

- Investment: Weeks Marine, Inc. announced plans to invest $300 million into fleet modernization, expanding its capabilities for land reclamation projects in the Caribbean.

- Merger: National Marine Dredging Company (NMDC) merged with Gulf Cobla to strengthen its foothold in the Middle East and North Africa (MENA) region, focusing on offshore energy projects.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 17,563.5 Mn |

| Forecast Value (2033) |

USD 23,364.1 Mn |

| CAGR (2024-2033) |

3.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 5,701.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type of Equipment (Cutter Suction Dredger (CSD), Trailing Suction Hopper Dredger (TSHD), Backhoe Dredger, Bucket Dredger, Grab Dredger, Auger Dredger, Other Types of Equipment), By Application (Trade Maintenance, Urban Development, Energy Infrastructure, Environmental Protection, Other Applications), By End User (Government and Municipalities, Oil and Gas Industry, Construction Industry, Energy Sector, Ports and Harbors, Mining Industry) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Jan De Nul Group, Royal Boskalis Westminster N.V., DEME Group, Great Lakes Dredge & Dock Corporation, China Communications Construction Company (CCCC), Hyundai Engineering & Construction Co. Ltd., Penta-Ocean Construction Co., Ltd., Van Oord, TOA Corporation, Weeks Marine, Inc., National Marine Dredging Company (NMDC), Boskalis Hirdes, Gulf Cobla, and Other Key Players, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Dredging Market?

▾ The Global Dredging Market size is estimated to have a value of USD 17,563.5 million in 2025 and is expected to reach USD 23,364.1 million by the end of 2034.

What is the size of the US Dredging Market?

▾ The US Dredging Market is projected to be valued at USD 5,701.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7,444.3 million in 2034 at a CAGR of 3.0%.

Which region accounted for the largest Global Dredging Market?

▾ North America is expected to have the largest market share in the Global Dredging Market with a share of about 38.6% in 2025.

Who are the key players in the Global Dredging Market?

▾ Some of the major key players in the Global Dredging Market are Jan De Nul Group, Royal Boskalis Westminster N.V., DEME Group, Great Lakes Dredge & Dock Corporation, China Communications Construction Company (CCCC), Hyundai Engineering & Construction Co. Ltd., and many others.

What is the growth rate in the Global Dredging Market?

▾ The market is growing at a CAGR of 3.2 percent over the forecasted period.