Market Overview

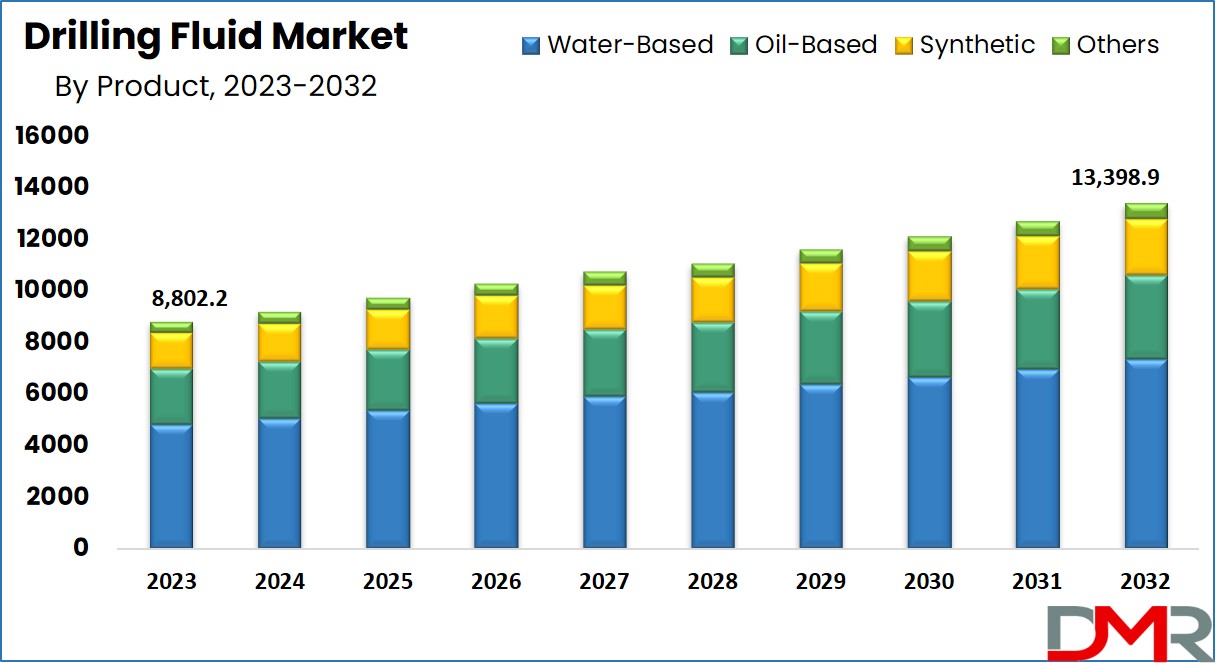

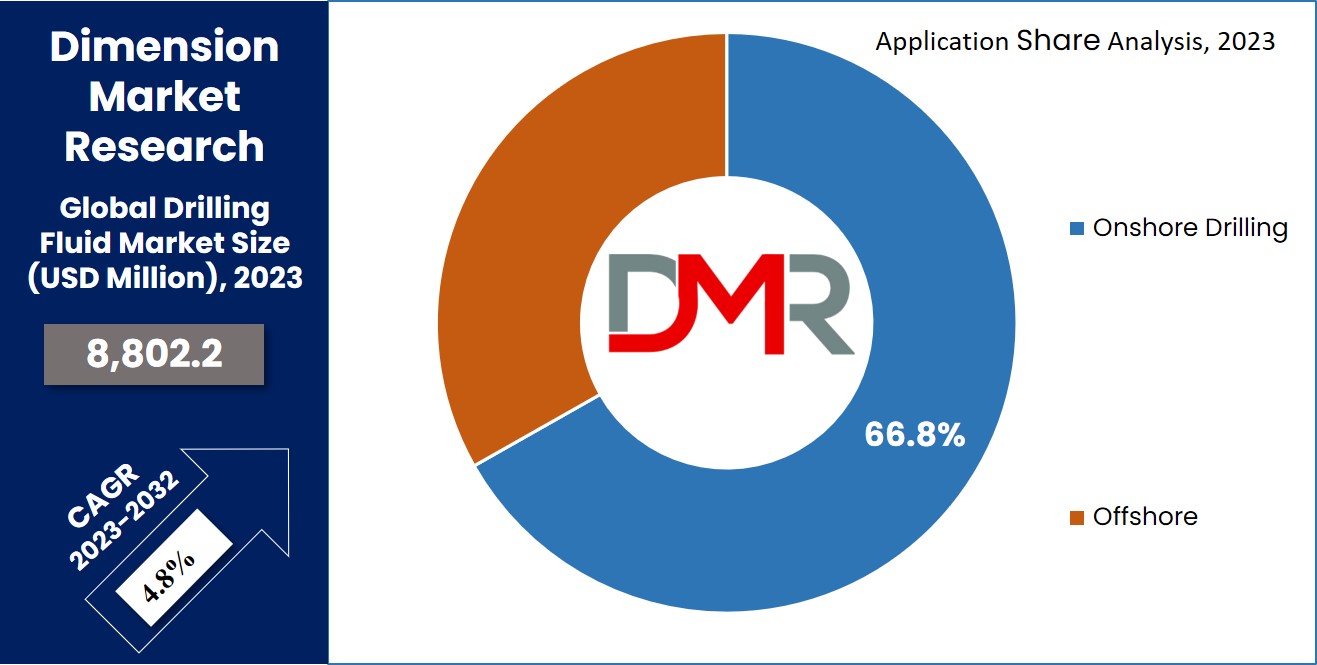

The Global Drilling Fluids Market is expected to reach a value of USD 8,802.2 million in 2023 and grow by 13,398.9 Mn with a CAGR of 4.8% for the forecasted period (2023-2032).

Drilling fluids, often referred to as drilling muds, are pivotal in the oil and gas extraction process. These specialized fluids aid the drilling operations by lubricating the drill bit, stabilizing the wellbore, and transporting the drill cuttings to the surface.

The drilling fluids market, integral to the upstream sector of the oil and gas industry, involves the production, distribution, and innovation of these fluids, catering specifically to the drilling needs across various geographies and conditions.

In 2024, the oilfield chemicals and drilling fluids market is poised for substantial growth, offering lucrative opportunities for both established industry leaders and new market entrants. For prominent players, the focus will likely be on the development of high-performance fluids with reduced environmental impacts.

For newcomers and smaller entities, the market presents chances for niche positioning and regional growth. By producing drilling fluids locally, these businesses can reduce logistical costs and adapt more swiftly to regional regulatory demands, providing them with a competitive advantage. Engaging in partnerships with local oil and gas projects could also prove beneficial, offering entry points and local expertise that might otherwise be inaccessible.

The market is also witnessing several transformative trends that are likely to shape its future. There is an increasing shift towards sustainable practices within the industry, with a focus on minimizing environmental footprint. This shift is driving the demand for eco-friendly drilling fluids that adhere to strict environmental regulations and align with industries like

Biodegradable Packaging.

Additionally, technological advancements such as the incorporation of

nanotechnology in fluid compositions are improving the adaptability and efficiency of drilling operations in complex geological settings. The onshore drilling fluids market is particularly benefiting from these innovations, as operators seek enhanced performance in diverse terrains. Regulatory pressures are further influencing market dynamics, as companies strive to align with new global standards to avoid penalties and operational disruptions.

This evolving market landscape is underpinned by significant data points that highlight the scale and scope of potential growth. For instance, MSI forecasts that by 2025, offshore oil production will represent about 28% of the global total, while onshore production will continue to dominate at 72%. Moreover, the United States' record issuance of 758 oil and gas drilling licenses in 2023 signals a robust expansion in drilling activities that necessitate advanced fluid solutions.

To capitalize on these opportunities, it is essential for companies in the drilling fluids market to engage actively with potential clients, demonstrating how advanced solutions can meet their specific needs. Implementing client-centric strategies such as personalized consultations, tailored service offerings, and educational webinars can help in illustrating the operational and regulatory benefits of innovative drilling fluids.

By focusing on innovation, sustainability, and comprehensive client support, businesses can establish themselves as indispensable partners in the dynamic oil and gas sector, driving both industry progress and their own market success.

Key Takeaways

- The Global Drilling Fluids Market is projected to grow from USD 8,802.2 million in 2023 to USD 13,398.9 million by 2032, at a CAGR of 4.8%.

- Water-based drilling fluids, including types like freshwater and brine, hold the largest market share in 2023.

- Onshore drilling processes command the majority of market share in the drilling segments in 2023.

- The U.S. holds over 26% of the market share in 2023, leading the drilling fluids market in North America.

Use Cases

- Onshore Drilling Operations: Drilling fluids are essential for stabilizing wellbores, cooling and lubricating drill bits, and transporting cuttings to the surface. Water-based and synthetic fluids dominate onshore applications due to cost efficiency, performance, and compliance with environmental regulations.

- Offshore Drilling Projects: Synthetic and low-toxicity oil-based muds (LTOBM) are increasingly used in offshore drilling to reduce environmental impacts while providing enhanced lubricity and thermal resistance. These fluids are crucial for deepwater operations in regions like the North Sea, Persian Gulf, and South China Sea.

- Environmental & Regulatory Compliance: Eco-friendly drilling fluids minimize the environmental footprint by reducing toxic residues and contamination of soil and groundwater. Biodegradable and low-toxicity formulations help companies meet strict governmental and industry regulations.

- Enhanced Oil Recovery (EOR) & Complex Formations: Specialized drilling fluids incorporating additives such as nanomaterials, polymers, and weighting agents optimize drilling in challenging formations, improving wellbore stability, reducing fluid loss, and increasing overall operational efficiency.

- Customized Fluids for Regional Needs: Local production of drilling fluids allows smaller market entrants to tailor formulations for regional geological conditions, operational requirements, and regulatory standards, reducing logistical costs and improving market penetration.

Market Dynamic

The expanding oil & gas sectors, driven by the growing demand for energy, are fueling the growth of the Global Drilling Fluids Market. With the rise in power plants & transportation, infrastructure is helping meet the increasing global energy requirements. However, with a growing population & rapid urbanization, the demand for energy continues to rise. To meet this energy demand, the drilling of borewells for gas & oil extraction has become a necessity.

Drilling operations make use of drilling fluids that consist of additive chemicals pumped through the drill string. Unfortunately, the interaction between these fluids & the cuttings from the drilling process leads to the creation of residues. When these residues are discharged, they have detrimental effects on the surrounding ecosystem.

Contaminants from these residues can mix with groundwater, making it toxic. This contamination leads to pollution of water and soil, disturbing the natural habitat of various organisms. The limited usage of

biodegradable chemicals in this context is majorly due to their higher cost. Several regulations have also been introduced by different governments, keeping in mind the pollution caused by such practices.

Research Scope and Analysis

By Product

The Water-based drilling fluid segment contributes to the largest market share in 2023. Water-based drilling fluid is used to drill wells mostly. These water-based fluids can be either freshwater, seawater, formate brine, or saturated brine. The fluid used, depends upon the condition of the well. Some commercial additives like bentonite may also be added to the fluid to increase the effectiveness of the hole cleaning. Water-based oil is getting prominence in the upcoming days.

Oil-based fluid is also referred to as oil-based mud. These fluids are in fact petroleum based such as diesel fuel. It’s less viscous & has better cleaning capabilities. These oil-based muds have increased lubricity properties & are also resistant to higher temperatures.

However, oil-based fuel interferes with the geochemical analysis of cuttings and core as it becomes difficult to distinguish base fluid from the oil that is returned from the formation. Its market size is expected to grow in the near future However, keeping in view the environmental impacts, the government has introduced strict policies for its use.

The base fluid in synthetic fluids is synthetic oil. This oil can be an ester, linear paraffin, or poly alpha- olefins. Synthetic fluids are also referred to as LTOBM (Low Toxicity Oil Based Mud). It’s similar to oil-based mud but with low viscosity.

These fluids are mostly utilized in offshore drilling & are considered more environmentally friendly than oil-based fluids. The cost is higher than other fluids that are used in drilling. Synthetic fluids are expected to be used more frequently because of their environmentally acceptable ability.

By Application

The Onshore drilling segment dominates the segment with a maximum share of the market in 2023. Onshore drilling is the drilling process that takes place from below the earth’s surface. Due to an increase in urbanization, global energy demand is rising, and therefore to meet the demand, various research activities & projects are on the rise, which further boost the onshore drilling activities.

With an increase in gas exploration & onshore oil extraction, countries such as the United States, Saudi Arabia, & Russia, are expected to increase their demand for this market in the upcoming days. With the increasing projects in the Middle East & African region, demand for offshore drilling fluids is expected to rise. Offshore drilling happens beneath the seabed. The development of existing wells in deep waters, mostly in regions of the North Sea, South China Sea, Persian Gulf, etc. is expected to drive the market growth.

The Global Drilling Fluids Market Report is segmented on the basis of the following:

By Product

- Water-Based

- Oil-Based

- Synthetic

- Others

By Application

- Onshore Drilling

- Offshore Drilling

Regional analysis

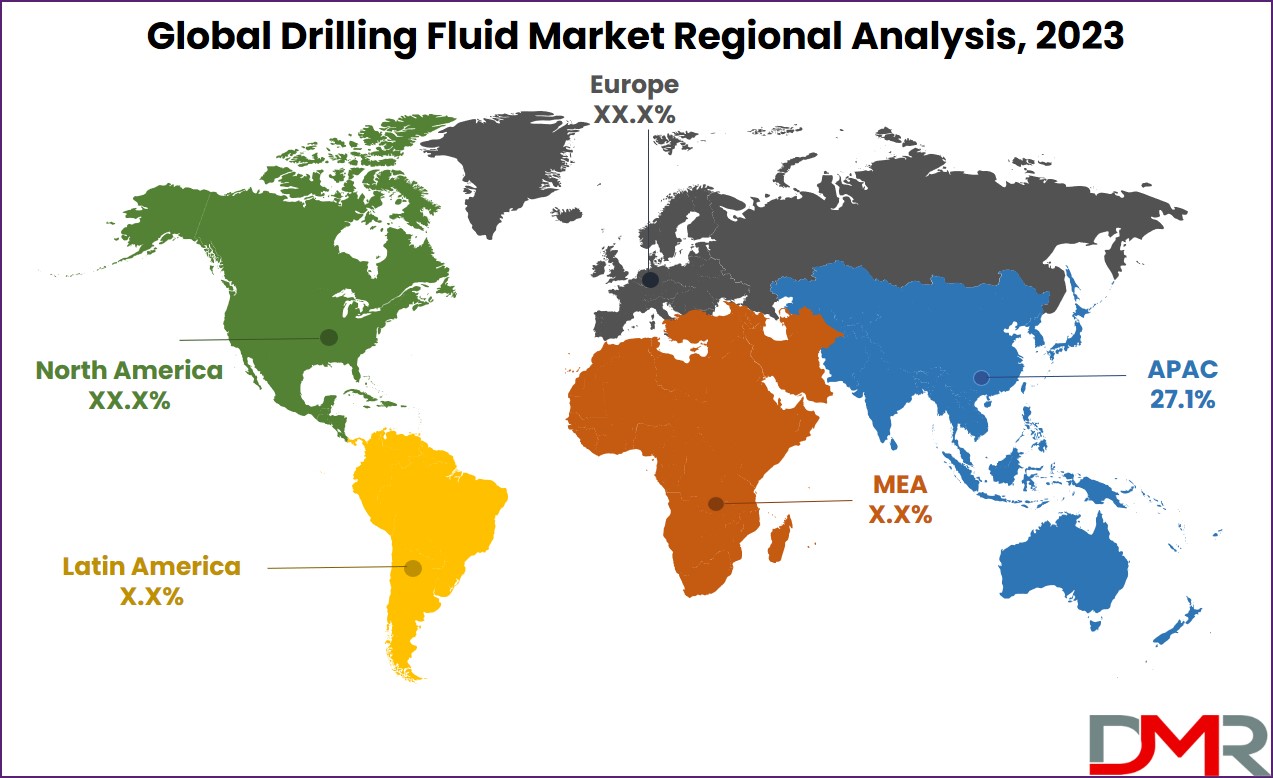

With a maximum share of more than 26% in 2023, the U.S. dominates the market. The following factors in North America are responsible for fueling the demand. First, Rapid development of infrastructure and increasing oil & gas production in the U.S. Second, a large number of oil & gas reserves are present in Canada. And being the fifth largest producer of crude oil & natural gas.

Europe is expected to show an increase in demand, especially in Italy, Norway, & Denmark, with the rise in drilling requirements in horizontal wells, over the years.

Asia Pacific is also expected to show growth with the rising exploration in deep waters & oil reserves. With several technological developments & implementations, the growth in this market is expected to rise even further in the upcoming years.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major industry leaders are actively engaged in research and development investments to drive product innovation, particularly in the development of multi-functional fluid additives. This enables them to gain a competitive advantage over other players in the market. These top market players distinguish themselves by effectively catering to diverse industry demands. Additionally, market participants are implementing strategic initiatives such as new product development, partnerships, acquisitions, and more, in order to strengthen their competitive position.

For example, in January 2023, Paragon ISG acquired the Cinco Mud Solutions team and associated assets, which is anticipated to significantly enhance Paragon ISG's drilling fluids services and contribute to its overall growth.

Some of the prominent players in the Global Drilling Fluids Market are:

- Scomi Group Bhd

- Schlumberger limited

- New Park Resource, Incorporation

- Weatherford International

- Halliburton, Inc.

- Baker Hughes, Inc.

- CES Energy Solution corporation

- Petrochemical Performance Chemical Limited LLC

- Other Key Players

Recent Developments

- August 2025: Drilling Fluids Market is Projected to Reach USD 8,802.2 mn in 2023 and Grow at a CAGR of 4.8% from There Until 2032 to Reach a value of USD 13,398.9 Mn by 2032

- July 2025: SLB completed its acquisition of ChampionX Corporation, enhancing its capabilities in drilling fluids and production chemicals.

- July 2025: Nabors Industries acquired Parker Wellbore, a leading provider of downhole tubulars, in an all-stock transaction valued at approximately $1.2 billion.

- June 2025: SCF Partners acquired Newpark Fluids Systems, a global provider of oil and gas drilling fluids, expanding its portfolio in the drilling fluids sector.

- May 2025: Impact Fluid Solutions joined Dorf Ketal, a global specialty chemicals manufacturer, enhancing its offerings in drilling and cementing applications.

| Report Characteristics |

|

Market Size (2023)

|

USD 8,802.2 Mn

|

|

Forecast Value (2032)

|

USD 13,398.9 Mn

|

|

CAGR (2023-2032)

|

4.8%

|

|

Historical Data

|

2017 - 2022

|

|

Forecast Data

|

2023 - 2032

|

|

Base Year

|

2022

|

|

Estimate Year

|

2023

|

|

Report Coverage

|

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc.

|

|

Segments Covered

|

By Product (Water-Based, Oil-Based, Synthetic, and Others), By Application (Onshore Drilling, and Offshore Drilling).

|

|

Regional Coverage

|

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

|

Prominent Players

|

Scomi Group Bhd, Schlumberger Limited, New Park Resource, Incorporation, Weatherford International, Halliburton, Inc., Baker Hughes, Inc., CES Energy Solution Corporation, Petrochemical Performance Chemical Limited LLC, and Other Key Players.

|

|

Purchase Options

|

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Drilling Fluids Market is anticipated to reach a value of USD 8,802.2 million in 2023.

The Global Drilling Fluids Market is projected to grow at a compound annual growth rate of 4.8% from 2023 to 2032.

Some of the prominent players include; Scomi Group Bhd, Schlumberger Limited, New Park Resource, Incorporation, Weatherford International, etc.

The Water-Based drilling fluid segment contributes to the largest share in the Global Drilling Fluids Market.