Drone taxis, also known as aerial taxis or urban air mobility (UAM) vehicles, are a transformative development in urban transportation, using drone technology to support quick, sustainable transit in congested urban areas through the use of

Autonomous Vehicles.

These electrically powered vehicles are designed for short- to medium-range trips, focusing on decreasing traffic congestion on city roads, reducing travel times, and lowering environmental impact through low-emission operations.

The Drone Taxi Market is rapidly evolving as companies investigate urban air mobility solutions. Recent innovations in electric vertical takeoff and landing (eVTOL) technology are paving the way for autonomous drone taxis — promising reduced traffic congestion while offering faster, more cost-efficient urban transport options to passengers, reinforcing the momentum of the growing air taxi industry.

Governments and regulatory bodies are actively creating frameworks that will support the growth of the drone taxi market. Cities around the globe are conducting trials and pilot programs with these technologies in terms of airspace management, safety protocols, passenger experience testing. Such efforts should speed up commercialization of drone taxis in urban environments.

Demand for drone taxis has grown out of an increasing need for sustainable and efficient transport solutions, particularly within urban settings with their dense populations and traffic congestion. Drone taxis offer eco-friendly alternatives to traditional cars while simultaneously increasing mobility while decreasing carbon emissions, aligning with the global shift toward advanced air mobility (AAM) ecosystems.

Opportunities in the market include partnerships among technology companies, aerospace manufacturers, and city planners. As drone taxi services gain popularity, new prospects are emerging for infrastructure development such as vertiports and advancements in autonomous flight systems. Additionally, the growing need for

Drone Insurance to support safe and compliant commercial drone operations further strengthens this ecosystem. Together, these developments are set to shape the future of urban transport making drone taxis an attractive and innovative mobility solution for cities worldwide.

As per dronebrands Drones can reach altitudes of up to 400 feet, but it's crucial to adhere to local regulations and airspace restrictions. The average drone costs around $540, though prices can vary significantly based on features and quality. DJI is a dominant player in the market, holding 54% of the global share and 80% of the U.S. market.

The global drone market is forecast to grow at a compound annual growth rate (CAGR) of 21.5%, expected to generate $43 billion in revenue by 2024. In the U.S., 8% of people own drones, with the 45-54 age group being the largest demographic. The U.S. leads the global market with a 34.6% share, followed by China at 23.4%.

Commercial drone pilots operate in various industries, from real estate photography to infrastructure inspections and precision agriculture. With a median annual salary between $60,000 and $120,000+, the role offers exciting opportunities. As a drone pilot, you will be at the forefront of transforming industries through innovative aerial technology.

The US Drone Taxi Market

The US Drone Taxi Market is projected to reach USD 40.0 million in 2024 at a compound annual growth rate of 13.1% over its forecast period.

The US drone taxi market provides major growth opportunities driven by development in autonomous flight technology, strong government assistance for urban air mobility, and increasing investment from tech and aerospace companies. The country's look into reducing traffic congestion, developing sustainable transport solutions, and using its strong aviation infrastructure positions it as a key player in the global drone taxi industry.

Further, the major growth driver for the U.S. drone taxi market is driving for sustainable urban mobility and the reduction of traffic congestion, assisted by technological development and government initiatives. However, a key restraint is the complex regulatory landscape, like airspace management and safety concerns, which could delay large-scale deployment and public acceptance of

drone taxis.

Key Takeaways

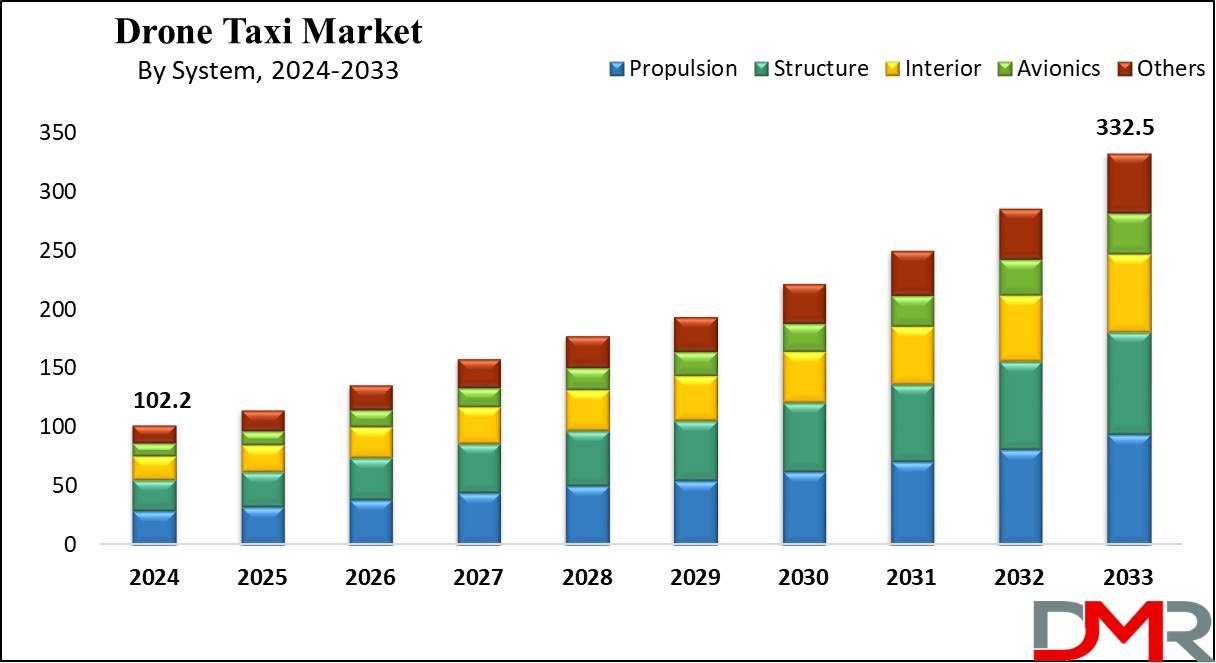

- Market Growth: The Drone Taxi Market size is expected to grow by 217.5 million, at a CAGR of 14.0% during the forecasted period of 2025 to 2033.

- By System: The propulsion segment is anticipated to get the majority share of the military wearable market in 2024.

- Range: The intracity segment is expected to be leading the market in 2024

- By End Use: The ride-sharing companies is expected to get the largest revenue share in 2024 in the Drone Taxi Market.

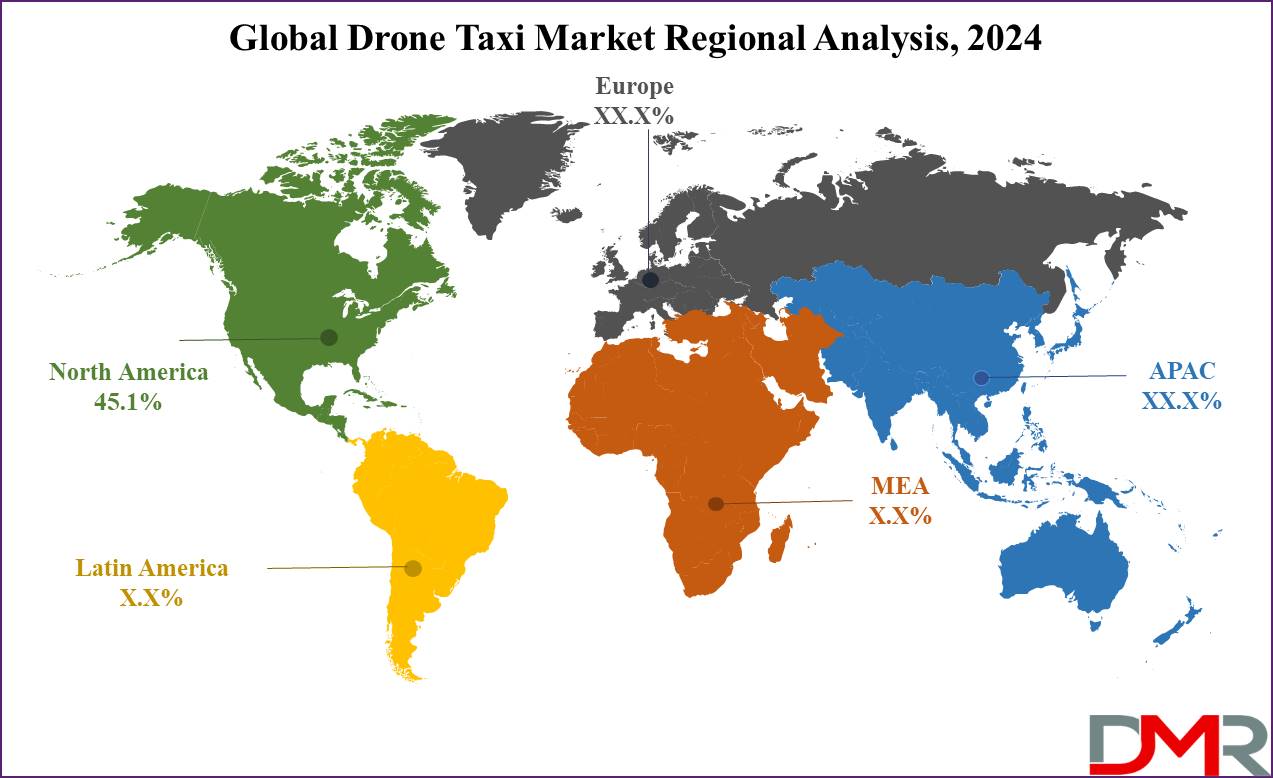

- Regional Insight: North America is expected to hold a 45.1% share of revenue in the Global Drone Taxi Market in 2024.

- Use Cases: Some of the use cases of Drone Taxi include urban air mobility, airport transfer, and more.

Use Cases

- Urban Air Mobility: Drone taxis can help reduce road traffic in densely populated urban areas by providing an aerial alternative for short- to medium-distance commuting.

- Airport Transfers: Quick and efficient transfers between airports & city centers minimize travel time highly and bypass traffic bottlenecks.

- Tourism and Sightseeing: Providing scenic aerial tours over cities, landmarks, or natural attractions, providing tourists with a distinctive perspective.

- Emergency Transport: Drone taxis could serve as fast-response transport for emergencies, delivering patients or medical supplies across congested or remote areas.

Market Dynamic

Driving Factors

Advancements in Autonomous Flight Technology

Enhancements in AI, autonomous navigation, and drone safety systems are making drone taxis a viable and reliable option for transportation, driving market adoption.

Rising Urbanization and Traffic Congestion

The rise in city population density and growing traffic congestion are driving the need for alternative, efficient, and faster transportation solutions, driving the demand for aerial mobility like drone taxis.

Restraints

Regulatory Challenges

Strict aviation regulations, air traffic control integration, and safety standards for unmanned aerial vehicles (UAVs) can delay the broader deployment of drone taxis.

High Initial Costs and Infrastructure

The cost of developing drone taxi technology and establishing supporting infrastructure (e.g., vertiports, charging stations) is high, limiting early adoption and scalability in the market.

Opportunities

Eco-friendly Transportation Solutions

The rise in demand for sustainable and eco-friendly transportation options develops an opportunity for electric-powered drone taxis to contribute to minimizing urban carbon emissions.

Partnerships with Urban Planning and Smart Cities

Partnerships & collaboration with governments and smart city initiatives can expand the integration of drone taxis into future urban mobility systems, using public infrastructure and funding to support growth.

Trends

Shift Toward Electric Vertical Takeoff and Landing (eVTOL) Aircraft

The development and adoption of eVTOL technology are essential and a central trend, with companies aiming to build quieter, more effective, and environmentally friendly drone taxis that can operate in urban environments.

Increased Investment and Partnerships

Key players in the aerospace, automotive, and technology sectors, along with venture capitalists, are investing heavily in drone taxi startups, creating strategic partnerships for developing and testing prototypes, and pushing the commercialization of drone taxis closer to reality.

Research Scope and Analysis

By System

The propulsion segment is projected to hold the largest market share in the drone taxi market by 2024, which is further categorized into fully electric, hybrid, and electric hydrogen systems. Among these, the fully electric segment is predicted to dominate in terms of market size during the forecast period. The growing use of fully electric propulsion systems can be said due to the higher demand for vehicles that provide low emissions, high performance, and enhanced fuel efficiency.

These systems also provide better endurance, enabling drone taxis to fly for longer durations in comparison to other propulsion technologies. As cities and countries prioritize eco-friendly and sustainable transportation options, completely electric drone taxis are likely to gain major traction, driving the overall growth of this segment.

Further, the avionics segment is anticipated to exhibit a steady growth rate in the coming years. Avionics refers to the electronic systems and equipment particularly designed for aviation use, playing a major role in both traditional aircraft and drones. The growth in demand for better fuel efficiency, along with the demand for better safety and stability, is driving the growth of the avionics segment.

These systems contribute to the complete performance of drone taxis by providing critical functions like navigation, communication, and flight control. As the drone taxi market transforms, advanced avionics technology will be essential for ensuring the safety, efficiency, and reliability of these aerial vehicles, further driving demand in this segment.

By Autonomy

The remotely piloted segment is predicted to hold a dominant position in the drone taxi market by 2024, capturing a major share, which is primarily due to the current regulatory environment and the public's greater trust in human oversight in comparison to complete autonomous systems.

Remotely piloted drone taxis provide a vital transitional technology that combines traditional aviation practices with modern drone capabilities, providing better safety through human control, which benefits from established aviation regulations that prioritize human oversight, which supports its adoption and integration into urban transportation networks.

Moreover, the strength of the remotely piloted segment is further assisted by the familiarity with current technologies and the gradual adaptation it provides both regulatory authorities and the public. Ensuring that a pilot can intervene during unexpected situations or system failures, minimizes some concerns related to completely autonomous vehicles, thereby improving safety perceptions among potential users.

In addition, ongoing investments in remote piloting technology and infrastructure like secure communication systems and comprehensive pilot training programs show higher confidence in this model. As technology progresses and societal acceptance of drone taxis increases, the remotely piloted segment is well-positioned to maintain its lead, acting as an essential stepping stone toward more advanced autonomous urban air mobility solutions.

By Range

The intracity segment is set to dominate the drone taxi market by 2024, accounting for the largest revenue share, which is driven by the increase in the demand for air transportation within core urban areas, around city centers, and suburban residential areas. As traffic congestion & commuting times with constant challenges in densely populated cities grow, the demand for efficient and rapid transportation alternatives is growing.

Major manufacturers are already making major investments in developing advanced and reliable intracity drone taxi services to meet this demand, as they offer a practical solution for minimizing travel times within cities, making intracity drone taxis a key player in future urban mobility.

Further, the intercity segment is projected to experience healthy growth in the coming years, which is fueled by the growth in demand for alternative transportation methods to bypass traffic congestion between cities.

With a rise in the focus on environmental sustainability, intercity drone taxis provide a cleaner, more energy-efficient mode of travel in comparison to traditional ground transportation.

As people become more conscious of their environmental impact, the switch towards greener, eco-friendly transportation options is likely to boost the adoption of intercity drone taxis, which is expected to contribute to the strong growth of the intercity segment as it becomes a popular choice for longer-distance travel.

By Passenger Capacity

Drone taxis with a passenger capacity of 3 to 5 are anticipated to experience the highest growth during the forecast period and are also set to dominate the market in 2024 due to their cost-efficiency, making them an attractive option for regular commuting.

With more seats available, these drone taxis can optimize per-passenger costs, making them more affordable for users in comparison to smaller alternatives. In addition, they provide a practical balance between size and capacity, which supports reducing air traffic congestion, mainly in densely populated urban areas.

As cities grow and there is an increase in the need for transportation, drone taxis with a 3 to 5-passenger capacity provide an ideal solution for short-to-medium distance travel, serving both individual commuters and small groups. Their efficiency and potential for lower ground traffic will likely make them a popular choice for both personal and shared urban air mobility services, driving major growth in this segment of the market.

By End Use

In 2024, ride-sharing companies as end users are expected to dominate the drone taxi market, securing a significant share, which is largely due to the natural fit between established ride-sharing platforms and the new drone taxi services, enabling these companies to capitalize on their large customer bases and advanced dispatch systems.

By combining drone taxis into their current offerings, ride-sharing companies can improve their urban mobility solutions, providing faster travel options and assisting in easing traffic congestion, especially in densely populated cities.

Their well-established logistical and operational frameworks make it easier to incorporate new technologies like drone taxis, giving these companies a clear advantage in the emerging market.

Further, the ride-sharing companies are well-positioned to pioneer the commercial rollout of drone taxis because of their expertise in scalable, on-demand transportation services. Their existing infrastructure, such as customer service, booking systems, and route optimization, can be easily adapted to help aerial transport, making the transition smoother for consumers.

In addition, these companies are actively forming strategic partnerships with urban planners, technology developers, and regulatory bodies, driving innovation and tackling the challenges linked with urban air mobility.

By leading pilot programs and advocating for supportive regulations, ride-sharing companies are not only boosting their market share but also creating the way for large acceptance and adoption of drone taxis. Their ongoing investment in drone taxi technology solidifies their leadership and promotes the growth of this futuristic transport solution.

The Drone Taxi Market Report is segmented on the basis of the following

By System

- Propulsion

- Fully Electric

- Hybrid

- Electric Hydrogen

- Structure

- Interior

- Avionics

- Others

By Autonomy

- Fully Autonomous

- Remotely Piloted

By Range

By Passenger Capacity

- Up to 2

- 3 to 5

- More than 5

By End Use

- Ride Sharing Companies

- Scheduled Operators

- Hospital & Medical Agencies

- Private Operators

Regional Analysis

The North American region is expected to dominate the drone taxi market in 2024, accounting for

45.1% of the market revenue, which is largely due to North America's position as one of the most technologically advanced regions globally. The region's well-developed infrastructure and its status as an early adopter of flying drone technology contribute significantly to this leadership.

Additionally, the increase in traffic congestion in both the U.S. and Canada has grown the demand for alternative transportation solutions, like flying taxis, to assist in reducing road congestion. The presence of many key players in the global flying taxi market across the region also accelerates market growth.

Moreover, the European market is anticipated to experience the highest growth during the coming years, which can be attributed to the development of telecommunication technologies like

5G services, which are important for operating flying taxis, and the growth of startup funding dedicated to this emerging industry.

In addition, European aviation companies are actively developing and preparing to commercialize flying taxis, further driving expansion. As these companies advance their projects, Europe is positioning itself as a leader in the global flying taxi market, spurring significant growth across the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The drone taxi market is highly competitive, with many companies looking to develop innovative solutions for urban air mobility. Startups and established players from the aerospace, automotive, and technology sectors are competing to develop safe, effective, and autonomous drone taxi systems.

Key areas of competition like development in electric vertical takeoff and landing (eVTOL) technology, autonomy, battery efficiency, and regulatory approval. Collaboration with governments and urban planners is also important, as companies work to secure testing rights and commercial licenses in major cities worldwide.

Some of the prominent players in the Global Drone Taxi are

- Boeing

- Airbus

- Lift Aircraft

- Lilium

- Volocopter

- Joby Aviation

- Ehang

- Aloft Aviation

- Airspace Experience Technology

- Micor Technology LLC

- Other Key Players

Recent Developments

- In August 2024, Indian startup Vjaitra Air Mobility, a division of the drone manufacturer Darsh Dronobotics Systems, announced its plans on aiming to develop air taxis capable of covering distances of up to 600 km and addressing the demand for travel between crowded metropolitan cities across states.

- In June 2024, Saudi Arabia launched a self-driving aerial taxi service for pilgrims during this year’s Hajj season. The electric flying taxi is created to transport pilgrims across holy sites, supporting the quick transfer of medical emergencies and supplies, and delivering goods. It’s the first service of its kind in any market around the world.

- In February 2024, Joby Aviation, Inc. announced that the company signed a definitive agreement with Dubai’s Road and Transport Authority (RTA) to launch air taxi services in the Emirate by early 2026, with Joby targeting initial operations as early as 2025, which provides Joby with the exclusive right to operate air taxis in Dubai for six years and will position Dubai as a world leader in delivering the fast, clean, and better air travel through Joby’s revolutionary technology.

- In November 2023, InterGlobe Enterprises, the parent company of IndiGo, announced its intention to launch an all-electric air taxi service in India by 2026, with its plans to operate the air taxi service, IndiGo has signed a Memorandum of Understanding (MoU) with Archer Aviation, a company that deals in electric aircraft, air taxis, and the like.

- In October 2023, Ehang has received the world's first airworthiness "type certificate" for its EH216-S AAV, a complete autonomous drone created to carry two passengers has declared itself the first to hold this certificate, enabling it to operate autonomous electric vertical take-off and landing (eVTOL) aircraft for passenger transport in China.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 102.2 Mn |

| Forecast Value (2033) |

USD 332.5 Mn |

| CAGR (2024–2033) |

14.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 40.0 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By System (Propulsion, Structure, Interior, Avionics, and Others), By Autonomy (Fully Autonomous and Remotely Piloted), By Range (Intercity and Intracity), By Passenger Capacity (Up to 2, 3 to 5, and More than 5), By End Use (Ride Sharing Companies, Scheduled Operators, Hospital & Medical Agencies, and Private Operators) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Boeing, Airbus, Lift Aircraft, Lilium, Volocopter, Joby Aviation, Ehang, Aloft Aviation, Airspace Experience Technology, Micor Technology LLC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analyst working days and 5 analyst working days respectively. |