An increasing need for advanced drug delivery systems has catalyzed rapid expansion in the global drug-device combination products market. Combination products combine drugs and

medical devices into one single unit, increasing therapeutic efficacy while increasing patient convenience and compliance some major products are infusion pumps, orthopedic combinations, transdermal patches, drug-eluting stents, inhalers, and antimicrobial catheters major examples of combination products that combine drugs and devices together into single pieces.

These trends have clearly demonstrated their efficacy through increasing rates of adoption of combination products for chronic disease management, cardiovascular, diabetes, and cancer treatments. Market growth is further propelled by cutting-edge technologies being integrated into these products such as smart pumps or wearable drug delivery devices; demand has also grown due to an aging global population and chronic illnesses becoming more commonplace.

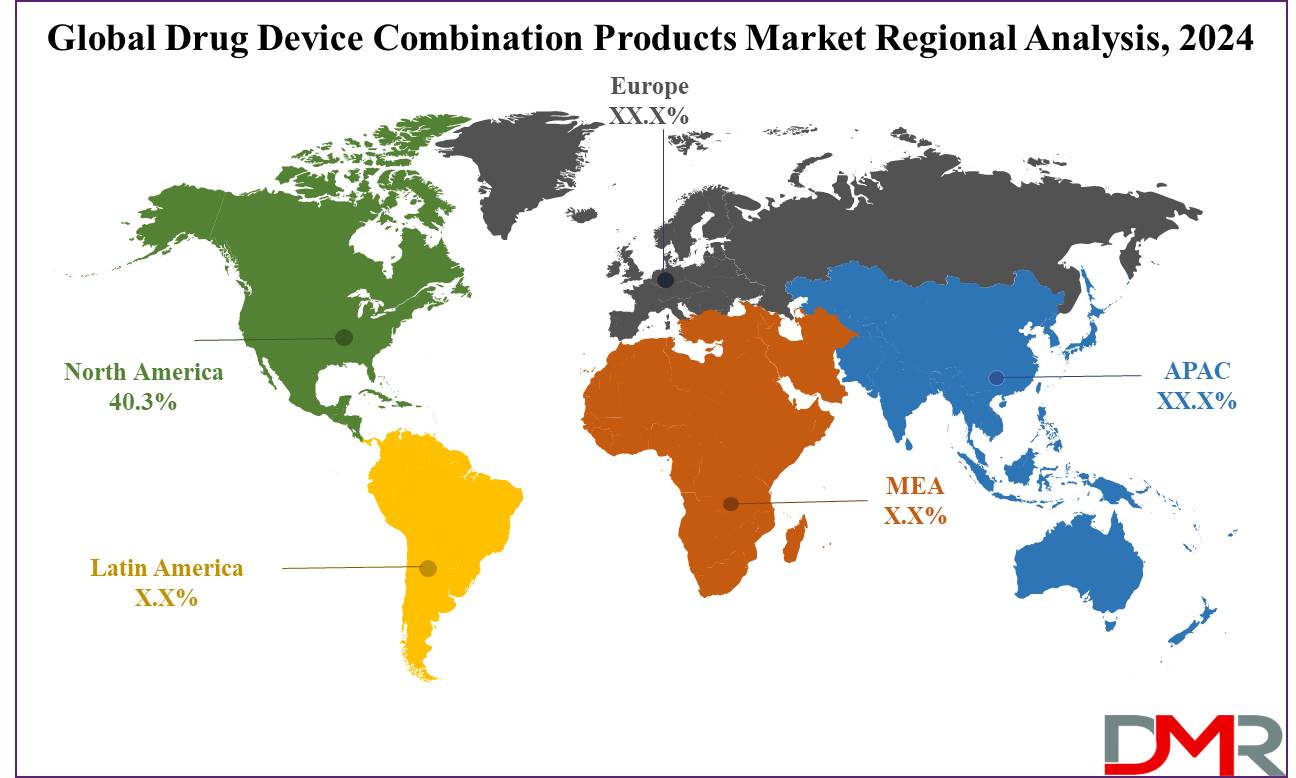

North America is projected to dominate in terms of market size due to a well-developed healthcare infrastructure and increasing healthcare spending as well as activities of leading market players.

North America's market is projected for sustained healthy growth during its projected lifespan due to new product innovations as well as regulatory framework support from regulatory authorities; overall the global combination products market appears promising for expanding players looking for high revenue returns in this market segment.

The Global Drug-Device Combination Products Market is experiencing rapid expansion due to growing consumer interest for integrated solutions that combine the benefits of drugs and medical devices. Such solutions enable more effective treatments by offering simpler application methods, improved patient compliance, and enhanced therapeutic outcomes, driving their adoption across various healthcare sectors.

Technological advances in drug-device combination products are revolutionizing healthcare delivery. Products like auto-injectors,

wearable medical devices, and

smart inhaler technology are improving the precision of drug administration while simultaneously increasing effectiveness while decreasing side effects, all which help drive market expansion.

As regulatory frameworks adapt to support product approval and commercialization of these medical device technologies, opportunities in the market are broadening as more governments streamline approval procedures and encourage innovation within medical device technologies. Companies are taking advantage of this favorable environment to develop cutting-edge products and meet unmet healthcare needs more effectively. This represents an exciting opportunity for players in this sector.

Drug-device combination products market is experiencing explosive growth with over 500 million units sold annually, including devices like insulin pens, auto-injectors and inhalers. Over 80% of these products are used to manage chronic conditions such as diabetes or asthma; by 2022 alone approximately 30 million people worldwide had utilized combination therapies for managing their condition.

The US Drug-Device Combination Products Market

The US Drug-Device Combination Products market is projected to be valued at USD 59.1 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 125.6 billion in 2033 at a CAGR of 8.7%.

The market for US combination products remains growing prevalently well on account of technological advances and the rising prevalence of chronic diseases. Technology advances and rising chronic disease prevalence are driving steady market expansion for US combination products, particularly among geriatric populations.

Notable categories within this market include

infusion pumps, transdermal patches and drug-eluting stents as they all provide efficient yet convenient drug delivery systems aimed at managing conditions associated with diabetes and cardiovascular disorders. Demand drivers for such systems come largely from this need for efficient drug administration systems that support long-term care services for chronic illnesses like diabetes and cardiovascular conditions.

Innovative smart infusion pumps and wearable drug delivery devices in the US market recently were recently developed to support increased patient compliance and therapeutic results, along with personalized medicine adoption - which necessitated personalized combination product adoption practices.

Key players in the US market have prioritized strategic alliances, mergers, and portfolio acquisitions to expand their market presence. Furthermore, regulatory approval by the FDA as well as substantial investments in research and development is further driving market expansion. Furthermore, its strong culture of innovation with regard to patient care ensures it continues to provide new entrants opportunities for expansion over time.

Key Takeaways

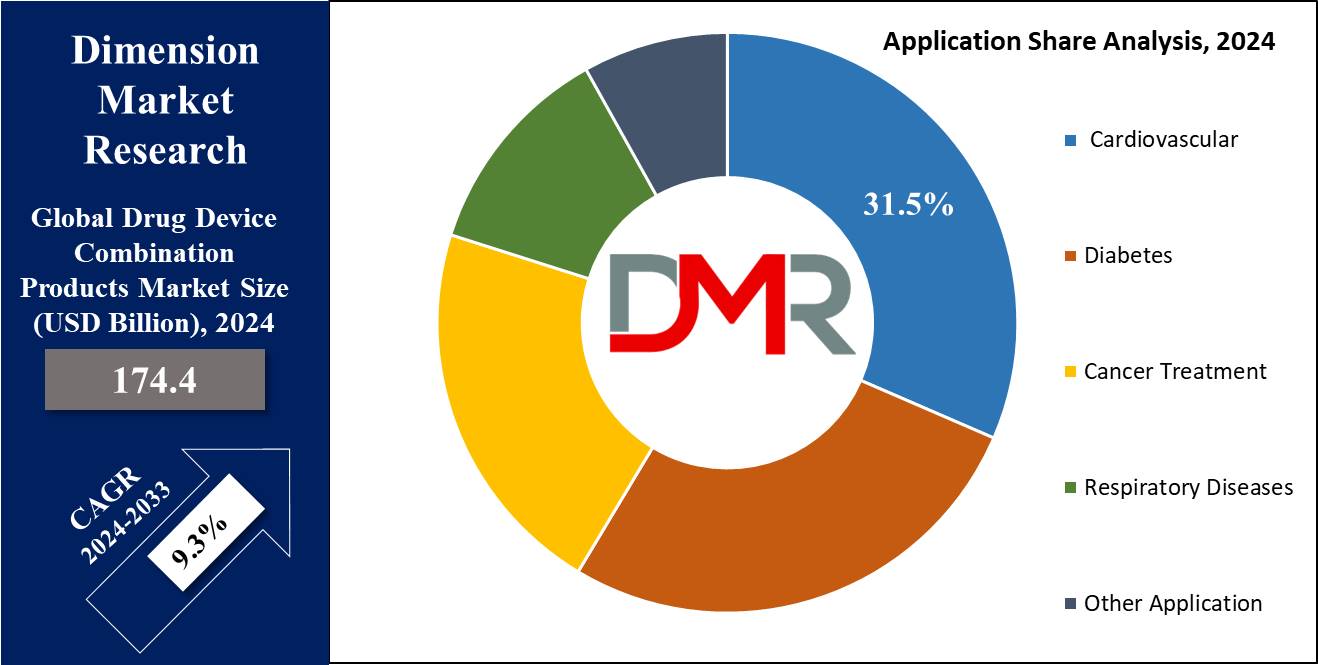

- Market Value: The Global Drug Device Combination Products Market size is estimated to have a value of USD 174.4 billion in 2024 and is expected to reach USD 389.7 billion in 2033.

- The US Market Value: The US Drug-Device Combination Products market is projected to be valued at USD 59.1 billion in 2024 which is further projected to grow up to USD 125.6 billion in 2033 at a CAGR of 8.7%.

- By Product Segment Analysis: The infusion pumps are projected to lead the drug-device combination products market as they hold the highest market share in 2024

- By Application Segment Analysis: Cardiovascular applications are projected to dominate the drug-device combination products market in terms of application as they hold 31.5% of the market share in 2024.

- By End User Segment Analysis: Hospitals are anticipated to dominate the global drug-device combination products market as they are projected to hold 41.1% of the market share in 2024.

- Regional Analysis: North America is expected to have the largest market share in the Global Drug Device Combination Products Market with a share of about 40.3% in 2024.

- Global Market Value: The market is growing at a CAGR of 9.3% over the forecasted period.

Use Cases

- Diabetes Management: Insulin pumps, in combination with continuous glucose monitoring (CGM) systems, facilitate real-time blood sugar levels and the delivery of insulin with precision, thereby improving glycemic control and reducing the complications arising from it.

- Cardiovascular Care: Drug-eluting stents are capable of eliciting a directing effect in the delivery of medication into the coronary artery, preventing restenosis and improving patient outcomes in the management of coronary artery disease.

- Pain Management: The transdermal patch allows a continuous and steadier drug release, thus, the pain relief source remains constant at all times without the requirement of repeated dosing so that patient comfort remains optimal with the highest compliance likely.

- Cancer Therapy: Photodynamic therapy devices contain light-sensitive drugs and aim at the selective treatment, targeting, and elimination of cancer cells non-invasively in treating certain cancers.

Market Dynamic

Market Trends

Technological Advancements

The drug-device combination products market is fast changing with technological innovations. Smart medication delivery systems are an example, which will improve patient care with highly sophisticated and technically enhanced infusion pumps that have the functions of wireless connectivity, real-time monitoring, and facilitating automation of dosing adjustments. Such innovations not only offer significant treatment efficacy enhancement but also substantial patient safety through minimized medication errors and facilitated remote monitoring.

Personalized Medicine

Trends in personalized medicine are drastically influencing the market for drug-device combination products. The combination products are bloc being tailored to diversifying patient requirements. For example, sugar control through customized insulin pumps or continuous glucose monitoring systems is used to deliver the drug with great accuracy and hence high patient specificity, resulting in good health outcomes. This has been catalyzed by enhancements in diagnostic technologies and an increasing understanding of genetic and molecular profiles affording opportunities for developing targeted therapies.

Growth Drivers

Rising Prevalence of Chronic Diseases

In the forecast period, the expansion in the incidences of chronic diseases such as diabetes, cardiovascular diseases, and cancer is expected to further drive demand for drug-device combination products markets. These diseases require long-term treatment processes that are, to a large extent, complex in nature, and which combination products efficiently manage. For example, coronary artery disease is treated with the help of essential drug-eluting stents while insulin pumps have been in pronounced demand for insulin delivery management.

Rise in Older Population

One of the major driving forces in combination drug-device products expansion is that the world population is rapidly aging. As people age, there is a higher risk of suffering from chronic conditions that may need advanced and persistent treatment. Combination products, such as infusion pumps for pain management and antimicrobial catheters for infection control, are especially handy for elderly patients; hence, demand is going to increase with a growing aging population.

Growth Opportunities

Emerging Markets

This therefore opens up more growth opportunities for the drug-device combination products market in emerging markets, particularly in Asia-Pacific and Latin America. Improvement in healthcare infrastructure, rising expenditure on healthcare, and consciousness about advanced therapeutic options are burgeoning in these regions.

Firms within this market will thrive in such regions through strategic partnerships, product launches, and investments in local R&D or manufacturing facilities. In addition, an increase in the population of the middle class and rising cases of chronic diseases within those regions maximize the potential.

Regulatory Support

It creates growth opportunities for market players through favorable regulatory frameworks and fast-track approval processes for combination products. Regulatory agencies such as the FDA and EMA are smoothing out the approval pathways by bringing more clarity on the development and commercialization of combination products. This kind of regulatory support will foster innovation and aid in bringing newer products into the marketplace within a short period.

Restraints

High Developmental Costs

Development and commercialization in the field of drug-device combination products use huge investments in research,

clinical trials, and regulatory compliance. High costs for these activities can easily create a barrier to market entry, especially for small companies.

Furthermore, it is complex work to place drugs and devices together, with lengthy testing required for safety and efficacy, also raising development costs. This financial difficulty can make it hard for a company to innovate better and bring new products forward.

Regulatory Complexity

For manufacturers, one of the major tasks is handling the complicated and fragmented regulatory environment surrounding drug-device combination products. Having different requirements for regulatory compliance across geographies demands numerous approvals, which are nearly always long-drawn-out and expensive processes, thereby adding to the problem's complexity. The issue gets further complicated by stringent regulations for both the drug and the device component. Delays in regulatory approvals delay product launch and thus affect market entry time, ultimately affecting overall market growth.

Research Scope and Analysis

By Product

The infusion pumps are projected to lead the drug-device combination products market as they hold the highest market share in 2024 since these play a critical role in delivering controlled and inflexible doses of medication over an extended duration. These devices are crucial in various therapeutic areas, including pain management, chemotherapy, diabetes, and critical care, where precise and consistent delivery of drugs is of importance.

Some of the key drivers that have led to the dominance of infusion pumps on the market include their flexibility and their wide field of application. They find usability in most settings, including hospitals, ambulatory surgical centers, and home care settings, making them an indispensable part of the different healthcare settings. Varieties include volumetric pumps, disposable pumps, syringe pumps, ambulatory pumps, implantable pumps, and insulin pumps.

Technological advancements have further put the position of infusion pumps well in the marketplace. Features such as advanced versions of infusion pumps, from basic models to smart ones integrated with wireless communication, real-time monitoring, and automatic alarming, have made improvements in patient safety and treatment outcomes.

Such facilities help health care providers in a more effective management and monitoring of the treatments. Besides, rising cases of chronic diseases such as diabetes and cancer treatable through administered drugs for a long period or even constantly, and treatment needs are efficiently availed through infusion pumps.

Another driver is the rising aging population where older individuals may have complicated drug delivery systems to treat multiple conditions, thus fueling the demand for infusion pumps. Overall, the infusion pump is a dominant segment considering drug-device combination products; it combines versatility, technological innovation, and a growing need for precise drug delivery.

By Application

Cardiovascular applications are projected to dominate the drug-device combination products market in terms of application as they hold 31.5% of the market share in 2024, which becomes self-explanatory because CVDs present one of the highest run rates worldwide and, therefore, a critical need for effective and advanced therapies. Some of the leading causes of morbidity and mortality are hypertension, heart failure, coronary artery disease, and arrhythmias.

The age of the so-called drug-device combinations, specifically the drug-eluting stents, brought with it open chances concerning the treatment of coronary artery disease. These are stents that offer mechanical support to keep the arteries open and emit drugs to stop restenosis, hence opening up enormous strides in treatment outcomes for patients.

It is this dual functionality that places the drug-eluting stents on higher visibility on the platform of health providers. The increasing prevalence of cardiovascular diseases has been further driven by a growing geriatric population, which is more prone to such disorders. Moreover, increasing usage of minimally invasive treatments in cardiology boosts the combination products market, as these treatments generally involve devices such as stents and catheters with drug-delivery components.

Similarly, innovative technologies enabling bioresorbable stents and advanced cardiac monitoring devices are being designed for the advancement of the growth of cardiovascular combination products, which have much better safety profiles, patient compliance, and therapeutic efficacy within the medical scenario, strengthening the grounds for their dominance in this sector. In conclusion, the high burden of cardiovascular diseases and continued innovation and effectiveness of combination products are contributing factors to cardiovascular applications remaining the leading segment in the drug-device combination products market.

By End-User

Hospitals are anticipated to dominate the global drug-device combination products market as they are projected to hold 41.1% of the market share in 2024. This growth is driven by the drug-device combination products market, being a central facility for providing comprehensive health services and a site in which complex medical procedures can be performed.

Hospitals are fully endowed with well-developed medical infrastructure and professional healthcare workers; hence, they pose the most crucial place for administering drug-device combination products, especially those to be used in critical and chronic conditions.

Combination products are highly pervasive in hospital environments, with really strong applications in cardiology, oncology, orthopedic, and intensive care relaxation units. Of common use are drug-eluting stents to many sections of cardiology patients needing percutaneous coronary interventions, and intensive care relaxation units to send for infusion pumps for an accurate administration of the medication.

The main strength of hospitals as an end-user lies in their capability to handle a wider range of patient needs, from acute care to chronic disease management. Often, in their breadth, they require the use of comparatively sophisticated drug-device combinations. This versatility makes hospitals the largest end-user segment in the market.

With increasing chronic patients and aging populations, the rate of admissions to hospitals is increasing gaining momentum, and in turn, the demand for sophisticated drug delivery systems. Hospitals offering constant monitoring and care are now being complemented by the increased utilization of combination products.

Furthermore, hospitals are often involved to a significant extent in clinical trial developmental processes and are usually the earliest adopters of new medical technologies within the market; integration of new innovative combination products in their treatment line is therefore fast-tracked. By adopting such a proactive position, hospitals can ensure they always come first and foremost in using newly engineered therapeutic options prior to their competitors, thereby maintaining market leadership.

The Drug-Device Combination Products Market Report is segmented based on the following

By Product

- Infusion Pumps

- Volumetric Pumps

- Disposables Pumps

- Syringes

- Ambulatory Pumps

- Implantable Pumps

- Insulin Pumps

- Orthopedic Combination Products

- Bone Graft Implants

- Antibiotic Bone Cement

- Transdermal Patches

- Nicotine Patches

- Hormone Patches

- Pain Relief Patches

- Cardiovascular Patches

- Drug Eluting Stents

- Coronary Stents

- Peripheral Vascular Stents

- Inhalers

- Dry Powder

- Nebulizers

- Metered Dose

- Wound Care Products

- Antimicrobial Catheters

- Urological

- Cardiovascular

- Others

- Other Products

By Application

- Cardiovascular

- Hypertension Management

- Heart Failure

- Coronary Artery Disease

- Arrhythmias

- Diabetes

- Blood Glucose Monitoring

- Insulin Delivery

- Continuous Glucose Monitoring (CGM)

- Cancer Treatment

- Chemotherapy Delivery

- Photodynamic Therapy

- Targeted Drug Delivery

- Respiratory Diseases

- Asthma Management

- Chronic Obstructive Pulmonary Disease (COPD)

- Cystic Fibrosis

- Other Application

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Home Care Setting

- Other End User

Regional Analysis

The North American market for drug-device combination products is projected to dominate as it holds

40.3% of the total market revenue in 2024. Some of the key factors such as well-developed healthcare infrastructure, high healthcare spending, and a strong presence of leading market players. The better-developed North American healthcare systems specifically that of the United States and Canada have aided the adaptation and integration of innovative combination products into daily clinical practice.

Besides, what drives a drug-device combination market to such a great level of prevalence in North America is the very high occurrence of chronic diseases like cardiovascular diseases, diabetes, and cancer. It is in these niche markets that further improvement is being demanded in drug delivery systems. Furthermore, the high aging population in North America relates to important growth in such products, because in later years of age, proper and complex medical care becomes crucial.

Besides this, the technological advancement and strong research and development in this field support the position of North America's top in the market. There are major numbers of medical device and pharmaceutical companies within this region that stand on the leading edge in combining new drugs and products and bringing them to the market. Strong prospection about these R&D activities and adequate scientific collaborations between the players and different academic institutions keep the pace of innovation and product development.

Regulatory support, such as the FDA, has a big role as one of the major factors leading to market dominance among North American countries. The best approval norms set by the FDA partnered with clear-cut examples of regulatory direction related to combination products, motivate firms to launch newer and more efficacious products into the market in the least possible time.

In addition, North America has been reported to give a lot of attention to personalized medicine and patient-centered care, which acts in line with the emerging trend of customized drug-device combinations for improved treatment outcomes and patient satisfaction. These factors altogether guarantee North America's position as the front-runner in the global drug-device combination products market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the drug-device combination product players is fostering innovation and market development with a strategic initiative. Some of the major companies in this business are Johnson & Johnson, Medtronic, Abbott Laboratories, Boston Scientific Corporation, and Becton, Dickinson and Company which use their understanding of invasive devices and pharmaceuticals to develop advanced combination products.

Key players in the market are thus engaged in new product development and innovation to retain their competitive position. These companies are making huge investments in research and development to innovate new drug-device combinations that have better therapeutic outcomes and better patient compliance.

Strategic collaborations and partnerships with other pharma companies, academic institutions, and research organizations are common practices for expediting new product development and market entry. Acquisitions and mergers also play a critical role in shaping the competitive landscape.

Companies are acquiring small firms with innovative technologies or complementary product portfolios to increase their market footprint and improve product offerings. Besides, geographically expanding into emerging markets is a strategic focus for a majority of such players to garner growing demand for advanced drug delivery systems in these regions.

Some of the prominent players in the Global Drug-Device Combination Products Market are:

- Abbott

- Terumo Medical Corporation

- Stryker

- Viatris Inc.

- Medtronic

- Boston Scientific Corporation

- Novartis AG

- Becton, Dickinson and Company.

- Teleflex Incorporated

- W. L. Gore & Associates, Inc.

- Sensely, Inc.

- Other Key Players

Recent Developments

- July 2024: Johnson & Johnson launched a new drug eluting stent with enhanced drug delivery technology, aimed at improving patient outcomes in coronary artery disease. This stent features a novel polymer coating that provides more controlled and sustained drug release, reducing the risk of restenosis and improving long-term efficacy.

- June 2024: Medtronic announced FDA approval of its latest smart insulin pump, designed to offer real-time glucose monitoring and automated insulin delivery. This next-generation pump integrates with continuous glucose monitoring (CGM) systems, providing precise insulin dosing adjustments based on real-time glucose levels, thereby enhancing diabetes management.

- May 2024: Abbott Laboratories introduced a next-generation transdermal patch for pain management, incorporating advanced materials for better drug absorption and patient comfort. The new patch utilizes micro-needles for enhanced drug delivery, ensuring more effective pain relief and improved patient adherence.

- April 2024: Boston Scientific Corporation completed the acquisition of a leading orthopedic combination products company, expanding its product portfolio in bone graft implants, antibiotic bone cement, and entering the Dental Bone Graft Substitute Market. This strategic acquisition enhances Boston Scientific's capabilities in orthopedic applications and strengthens its market position.

- March 2024: Becton, Dickinson, and Company received CE marking for its new antimicrobial catheter, designed to reduce infection rates in urological and cardiovascular applications. The catheter features a novel antimicrobial coating that prevents bacterial colonization, significantly reducing the risk of catheter-associated infections.

- February 2024: Pfizer collaborated with a biotech startup to develop a novel photodynamic therapy device for targeted cancer treatment. This device combines a photosensitizing drug with light exposure to selectively destroy cancer cells, offering a non-invasive and effective treatment option for certain types of cancer.

- January 2024: The FDA approved a new inhaler by GlaxoSmithKline for COPD management, featuring an innovative drug formulation and delivery mechanism. The inhaler delivers a combination of long-acting bronchodilators and anti-inflammatory agents, providing improved symptom control and reducing exacerbations in COPD patients.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 174.4 Bn |

| Forecast Value (2033) |

USD 389.7 Bn |

| CAGR (2024-2033) |

9.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 59.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Greenhouse Films, Grow Bags, Windbreaks, Shelterbelts, Greenhouse Coverings, Greenhouse Accessories, and Other Products), By Material Types (Glass, Plastic Film Greenhouse, and Rigid Panel Greenhouse), By Crop Types (Fruits and Vegetables, Flowers and Ornamentals, Nursery Crops, and Other Crop Type), By Technology (Heating System, Cooling System, Lighting System, Climate Control Systems, and Other Technology), By Shape (Venlo, Flat arch, Raised dome, Sawtooth, Tunnel, and Modified Quonset), By End-User (Commercial Growers, Research and Educational Institutes, Retail Gardens, and Others ) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Abbott, Terumo Medical Corporation, Stryker, Viatris Inc., Medtronic, Boston Scientific Corporation, Novartis AG, Becton, Dickinson and Company., Teleflex Incorporated, W. L. Gore & Associates Inc. Sensely Inc., and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Drug Device Combination Products Market size is estimated to have a value of USD 174.4 billion in 2024 and is expected to reach USD 389.7 billion by the end of 2033.

The US Drug-Device Combination Products market is projected to be valued at USD 59.1 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 125.6 billion in 2033 at a CAGR of 8.7%.

North America is expected to have the largest market share in the Global Drug Device Combination Products Market with a share of about 40.3% in 2024.

Some of the major key players in the Global Drug Device Combination Products Market are Smith & Nephew plc, Becton, Dickinson and Company, Novartis International AG, Abbott Laboratories, Bayer AG, Boston Scientific Corporation, GlaxoSmithKline plc, Baxter International Inc., Medtronic plc, Johnson & Johnson, and many others.

The market is growing at a CAGR of 9.3 percent over the forecasted period.