E-Health Services market is poised for significant transformational expansion due to technological innovations and an ever-increasing need for efficient healthcare solutions. Forecasts reveal a robust compound annual growth rate (CAGR) over the coming decade due to the increasing adoption of technologies like telemedicine, EHRs, mobile health applications and remote patient monitoring systems - supported by key factors like rising incidences of chronic diseases, cost-efficient healthcare delivery methods as well as smartphones with internet access - fuelling its rapid development.

Telemedicine stands at the forefront of this market, thanks to its potential to improve access, reduce travel times and enhance patient engagement - features that have gained widespread praise both among providers and patients alike. Artificial Intelligence/Machine Learning integration into E-Health platforms could further revolutionize diagnostics/personalized medicine/predictive analytics which will create market momentum.

EHRs have quickly become integral tools in healthcare operations, providing seamless data exchange and supporting clinical decision-making. Mobile health applications enable patients to take an active approach in managing their own healthcare for improved results and satisfaction; remote patient monitoring technologies play a pivotal role in lowering hospital readmission rates while assuring continuous care for chronic condition patients, ultimately driving down healthcare costs.

Key Takeaways

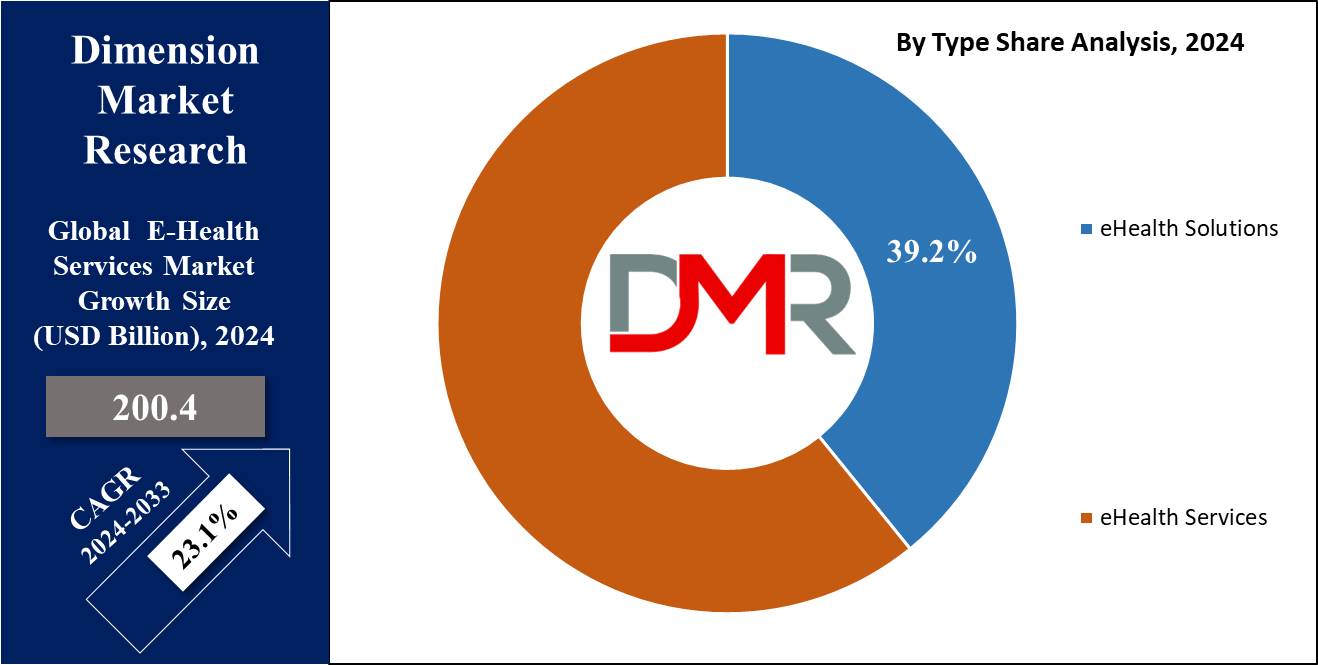

- Global E-Health Services Market reach USD 1043.39 Bn in 2033 at a CAGR of 23.1%.

- In 2024, eHealth solutions held an overwhelming market share of 39.16 within the Type segment of the E-Health Services Market.

- Healthcare Providers held an impressive 51.9% market share among End User segments for e-Health services market in 2024.

- North America held the dominates the E-Health Services Market with 39.1% market share.

- Healthcare services geared towards elderly care will be in greater demand as the global population of 65-year-olds and older reaches 1,5 billion by 2050.

- Mobile Health (mHealth), applications, has emerged as a major trend in the E-Health Services Market by 2024.

Use Cases

- Artificial Intelligence (AI) holds immense promise to improve diagnostic accuracy, support tailored treatment plans and maximize resource allocation through large datasets which leverage AI algorithms.

- Telemedicine allows healthcare providers to consult remotely using secure messaging and videoconferencing, expanding access to care in rural and underserved communities while decreasing time spent receiving care at distance and travel expenses.

- Remote patient monitoring systems offer early intervention opportunities, reduce hospital readmission rates, and help those managing chronic conditions more efficiently by providing continuous tracking of key health metrics like blood pressure and glucose.

- Mobile health applications (mHealth apps) contain virtual health coaching capabilities, medication alerts and fitness tracking features designed to foster increased patient engagement and lifestyle changes.

- EHR systems allow healthcare professionals to quickly retrieve patient data such as treatment plans, lab results and coordination needs with ease through EHR access points, which leads to enhanced coordination, reduced medical errors and informed decision-making processes.

Driving Factors

Rising demand for digital healthcare solutions

Demand for digital healthcare products and services among hospitals and patients worldwide is fuelling expansion in the E-Health Services Market. As healthcare systems look to maximize efficiency, digital solutions such as telemedicine, EHRs and mobile health apps have increasingly taken on an essential role in hospital operations and improved diagnostic accuracy while offering enhanced patient care. Hospitals are taking full advantage of such innovations by adopting modern technologies for increased efficiency as they transform how care is delivered and patient safety improves. Patients meanwhile seek digital health services' convenience in managing chronic conditions or accessing remote consultations remotely; their widespread adoption shows how increasingly reliant people have become upon digital tools for meeting modern healthcare requirements, thus leading to market expansion.

Investment in Telecommunications and IT Infrastructure

Investment in telecom and IT infrastructure has become essential to the expansion of E-Health Services Market, thanks to smartphones becoming more prevalent worldwide and an ever-increasing internet user base. More users gain access to digital health solutions. According to recent statistics, smartphone penetration will reach an all-time high by 2021 and smartphone use should reach 3.8 billion globally by then; internet use continues to expand globally as internet penetration rises further - particularly among developing regions. Telecommunications and IT infrastructure advances provide the backbone for e-health service deployment, guaranteeing reliable connectivity and real-time data exchange - increasing reach, effectiveness, adoption rates and market expansion of platforms like those of e-health platforms.

Healthcare Providers Embark On E-Health Platforms

E-health platforms used by healthcare providers for consultations and services mark an impressive change in healthcare delivery, representing an essential distribution channel offering services ranging from remote consultations to chronic disease management. Healthcare providers have begun using e-health solutions more and more often as part of their strategy for expanding reach, improving patient engagement and decreasing operational costs. This trend can be traced to COVID-19 pandemic's surge in adoption of telehealth services; their incorporation into daily healthcare practices not only enhances service delivery but also positions them as integral elements in modern health systems for greater market expansion.

Growth Opportunities

An Aging Population Drives the Need for Geriatric Care Solutions

As global population aged 65 or over reaches 1.5 billion by 2050, healthcare services tailored to senior care will become ever more in demand. E-health solutions offer continuous monitoring with timely interventions to decrease hospital admissions while increasing quality of life - further contributing to market expansion. Telemedicine solutions that specifically cater for senior care provide mobility issues as well as comprehensive medical attention that benefits senior populations worldwide thereby driving market expansion.

Expansion into Emerging Markets

Emerging markets present enormous potential as there is a rising need for affordable healthcare services as internet penetration increases. These opportunities exist on two fronts - affordability of accessing such healthcare services as well as greater internet penetration. Countries across Asia-Pacific, Latin America, and Africa are currently witnessing rapid digital transformation as they upgrade their telecom infrastructure. International Telecommunication Union reports that internet penetration reached 51% among developing nations by 2021, offering substantial opportunity for e-health providers. By expanding into these markets, providers are able to tap into new customer segments by offering cost-effective healthcare solutions tailored specifically for these regions, thus leading to significant market expansion and success.

AI and Machine Learning to Revolutionize E-Health Services

Integrating artificial intelligence (AI) and machine learning (ML) for predictive analytics, personalized medicine and automated diagnostics can open up significant growth prospects in the E-Health Services Market. AI/ML technology can improve diagnostic accuracy, personalize treatment plans and facilitate maintenance plans with greater predictability - including disease outbreak prediction or patient risk analysis using large datasets analyzed with AI algorithms analyzed to create proactive healthcare management. Integrating these technologies into E-health platforms not only enhance patient care while simultaneously drawing investment dollars into this sector - further propelling market expansion beyond 2024.

Key Trends

Telehealth as an Expanding Healthcare Delivery Model

Global E-Health Services market is witnessing an explosive expansion of TeleHealth as an indispensable healthcare delivery model. Telehealth's increasing acceptance and usage for medical consultations and treatments have quickly proliferated its use, further expanding adoption. Telehealth played an instrumental role in maintaining healthcare continuity during and post-Pavid-19 pandemic; its importance has only increased. Telehealth can bring many advantages, from increased access for remote and underserved populations, reduced healthcare costs and enhanced patient convenience, all the way through to regulatory changes allowing reimbursement models that expand significantly - opening the way for widespread market expansion of telehealth solutions.

Assimilate Patient-Centric Care Models

E-Health Services Market is currently experiencing an important transformation towards patient-centric models of care, which encompass personalized treatment plans, engagement strategies and self-management solutions. Patient centric models emphasize meeting patients' preferences and needs while employing inclusive, collaborative, participatory healthcare delivery techniques like mobile apps, wearables or patient portals that empower individuals to actively manage their health - not only improving satisfaction and outcomes; but also aligning more broadly with larger goals related to chronic disease management or prevention - thus increasing overall service efficacy.

Mobile Health (mHealth) Applications have seen rapid development

Mobile Health (mHealth) applications have emerged as one of the major trends in 2024 E-Health Services market. Offering various functions like fitness tracking and wellness monitoring all the way up to chronic disease management and telehealth consultation, these applications represent an emerging sector within E-Health services. MHealth apps have quickly gained widespread adoption due to their accessibility and convenience for users, leading to widespread uptake by industry reports. According to projections by industry bodies, industry estimates project the global mHealth market will experience compound annual growth at 29.1% from 2021-2028. This market expansion can be attributed to factors like increasing smartphone penetration, advancements in mobile technology and an emphasis on personalized healthcare. Furthermore, continued innovation of mHealth apps should fuel market expansion beyond 2024.

Restraining Factors

Usability Barriers Reducing Adoption Rate

Usability issues present one of the primary obstacles for E-Health Services Market growth. Many healthcare providers find e-health systems complex and time consuming to implement, thus leading them to adopt these technologies with hesitation. Integration of electronic health records (EHRs), telemedicine platforms and mobile health applications often requires extensive alterations to current workflows as well as extensive training with an associated learning curve. An American Medical Association survey reported that 44% of physicians experienced burnout due to EHR administration burden. Implementation time may prevent healthcare providers from fully adopting E-health solutions and therefore slow market expansion.

Fraud Compromises Trust

E-health sector exposure to fraudster activities is another critical impediment to its expansion. Insurance fraud, identity theft and scams pose an existential threat to both providers and patients, making online health services less enticing to use. One such example was reported by the Federal Bureau of Investigations during the COVID-19 pandemic: there was an upsurge in cases related to telehealth fraud resulting in financial losses but also damaging consumer confidence in these platforms and market expansion efforts; fraudulent activities can hinder adoption rates significantly as perceived integrity breaches undermine market expansion plans for these platforms.

By Type

In 2024,

eHealth solutions held an overwhelming market share within the Type segment of the E-Health Services Market with a

39.20% market share. This success can be linked to various key trends that shaped digital health's development landscape.

Telehealth services have rapidly evolved into an integral component of modern healthcare delivery models, substantially contributing to the development of the eHealth services market. Telehealth's acceptance and use for medical consultations and treatments has played a critical role. Telehealth's ability to increase access to care in underserved regions while simultaneously cutting costs has cemented its position within healthcare ecosystem. With projected CAGR at 23.5% between 2022-2029 for global telehealth market alone alone it remains an influential force within it sector.

The shift towards patient-centric care models has only solidified eHealth services as market contenders. This trend emphasizes personalized treatment plans, patient engagement and self-management to drive tailored e-health solutions - such as mobile health apps, wearable devices and patient portals that empower patients in collaborative healthcare environments. As such, patient centricity not only improves satisfaction and outcomes for individual patients, but it has also aligned well with preventive health management goals while simultaneously strengthening market standing of eHealth services.

Mobile health (mHealth) applications represent one key trend fuelling the success of the eHealth services market. Offering features ranging from fitness tracking and chronic disease management, as well as telehealth consultation, these apps have grown increasingly popular over time - evidenced by projected CAGR of 29.1% from 2021-2028 in terms of global market size growth; increasing smartphone use combined with technological developments have furthered this exponential expansion, making mHealth an integral component of today's eHealth ecosystem!

By End-Use

Healthcare Providers held an impressive 51.9% market share among End User segments for e-Health services market in 2024, due to several key trends that emphasize their increasing reliance on digital healthcare solutions.

Payers such as insurance companies and government health agencies have increasingly turned to digital solutions in order to streamline operations, reduce costs, and enhance patient outcomes. EHealth platforms enable payers to better manage patient data efficiently while improving claims processing speed and offering more preventative programs - this shift towards digital supports the expansion of the eHealth services market overall.

Healthcare consumers have increasingly taken an active approach to managing their health through electronic health services (eHealth services). Telemedicine, mobile health apps and wearable devices have increased in use as consumers seek personalized and convenient health solutions; consequently adoption of eHealth services continues to rise, contributing significantly to market expansion.

Pharmacies play an essential part in driving market growth through adopting digital solutions to optimize medication management, patient engagement and compliance to treatment plans. E-prescriptions, online consultations and digital health records all play a part in improving pharmacy services while simultaneously streamlining operations - driving market expansion with every integration.

The E-Health Services Market Report is segmented based on the following:

By Type

- eHealth Solutions

- EHR/EMR Solutions

- Picture Archiving and Communication Systems & Vendor Neutral Archive

- Radiology Information Systems

- Laboratory Information Systems

- Cardiovascular Information Systems

- Pharmacy Information Systems

- Other Specialty Information Systems

- Telehealth Solutions

- E-Prescribing Solutions

- PHR & Patient Portals

- Clinical Decision Support Systems

- Health Information Exchange Solutions

- Chronic Care Management Apps

- Medical Apps

- eHealth Services

- Remote Monitoring Services

- Diagnosis & Consultation Services

- Healthcare Systems Strengthening Services

- Treatment Services

- Database Management Services

By Deployment

By End User

- Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Home Healthcare Agencies, Nursing Homes, and Assisted Living Centers

- Payers

- Healthcare Consumers

- Pharmacies

- Other End Users

Regional Analysis

North America held the dominates the E-Health Services Market with 39.1% market share. North American's dominance can be explained by advanced healthcare infrastructure, high internet penetration rates, strong government support for digital health initiatives as well as extensive investments made into telehealth, electronic health records (EHRs), tech-savvy populations as well as favorable regulatory frameworks in place there.

Europe represents an expanding segment, supported by robust healthcare systems and digital transformation initiatives. Germany, United Kingdom and France have led in adopting electronic health solutions due to aging populations requiring effective chronic disease management solutions and data privacy requirements imposed by European Union regulators - an environment that fosters significant market expansion of electronic health solutions in this region.

Asia Pacific region shows great promise, driven by increasing internet use and smartphone penetration as well as significant government investments into healthcare modernization projects. China, Japan and India all make significant contributions, with large populations seeking accessible healthcare solutions at reasonable costs. Market growth in this region is further reinforced by innovative startups and public-private partnerships designed to expand telehealth and mobile health applications. Middle East/Africa and Latin America are making steady strides forward with digital health initiatives and improvements to healthcare infrastructure, with countries like Saudi Arabia, South Africa, Brazil and Mexico adopting electronic healthcare services due to accessibility challenges and improve overall health outcomes.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

CVS Health, Teladoc Health Inc and American Well are key players influencing the global E-Health Services Market in 2024. CVS has taken advantage of its vast pharmacy network to integrate telehealth services, creating a seamless patient experience while improving accessibility and convenience for its members. Teladoc and American Well have spearheaded this telehealth revolution with comprehensive virtual care platforms offering services which address numerous medical requirements while simultaneously cutting healthcare costs, making these companies central players in this e-health landscape.

Companies such as iCliniq and Veradigm LLC have also made notable advances with their telemedicine services and electronic health record (EHR) solutions, providing expert medical consultations globally through its global network of specialists while Veradigm integrates EHR systems and uses data analytics to streamline clinical workflows and enhance patient care. Meanwhile Koninklijke Philips N.V. and Medtronic lead in medical device production as well as remote patient monitoring sectors - with cutting-edge healthcare technologies and connected care solutions vital for managing chronic disease management as well as continuous patient monitoring capabilities that drive significant advancements within EHR services overall.

Some of the prominent players in the Global E-Health Services Market are:

- CVS Health

- Teladoc Health, Inc.

- American Well

- iCliniq

- Veradigm LLC

- Koninklijke Philips N.V

- UNITEDHEALTH GROUP

- Medtronic

- Epocrates

- Telecare Corporation

- Medisafe

- Set Point Medical

- IBM

- Doximity, Inc.

- LiftLabs

Recent developments

- Eli Lilly unveiled LillyDirect in January 2024 - a digital platform intended to streamline purchasing specific medications for specific conditions like diabetes, obesity and migraine. LillyDirect connects patients directly with independent teleHealth providers who offer direct access to medications while offering resources for disease management - eliminating traditional steps required in getting prescription from physicians.

- ZS, an international management consultancy and technology firm, introduced their ZAIDYN Connected Health solution as part of its ZAIDYN by ZS platform in October 2024. This artificial intelligence (AI)-powered tool aims to assist pharmaceutical firms, healthcare providers, insurers in innovating to identify unaddressed needs, enhance patient engagement and boost health outcomes for better healthcare services and outcomes.

- At its Developer Conference 2024 (SDC23), Samsung Electronics Co. Ltd. announced an open initiative at Tulane University School of Medicine, MIT Media Lab, Brigham & Women's Hospital and Samsung Medical Center to explore enhancements of digital health ecosystem and wellness approaches.

- Fujitsu unveiled in March 2024 a cloud-based platform designed to securely collect and utilize health data, supporting digital transformation initiatives within healthcare sectors. Fujitsu's Healthy Living vision aligns with this goal under Fujitsu Uvance; specifically its automated data conversion from electronic medical records from healthcare institutions that conform with HL7 FHIR standards framework thereby streamlining integration and management processes for health data-related integration/managing projects.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 200.4 Bn |

| Forecast Value (2033) |

USD 1383.1 Bn |

| CAGR (2024-2033) |

23.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type(eHealth Solutions[EHR/EMR Solutions, Picture Archiving and Communication Systems & Vendor Neutral Archive, Radiology Information Systems, Laboratory Information Systems, Cardiovascular Information Systems, Pharmacy Information Systems, Other Specialty Information Systems, Telehealth Solutions, E-Prescribing Solutions, PHR & Patient Portals, Clinical Decision Support Systems, Health Information Exchange Solutions, Chronic Care Management Apps, Medical Apps], eHealth Services[Remote Monitoring Services, Diagnosis & Consultation Services, Healthcare Systems Strengthening Services, Treatment Services, Database Management Services]), By Deployment(On-premise, Cloud-based), By End User(Healthcare Providers[Hospitals, Ambulatory Care Centers, Home Healthcare Agencies, Nursing Homes, and Assisted Living Centers], Payers, Healthcare Consumers, Pharmacies, Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

CVS Health, Teladoc Health, Inc., American Well, iCliniq, Veradigm LLC, Koninklijke Philips N.V, UNITEDHEALTH GROUP, Medtronic, Epocrates, Telecare Corporation, Medisafe, Set Point Medical, IBM, Doximity, Inc., LiftLabs, |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |