Market Overview

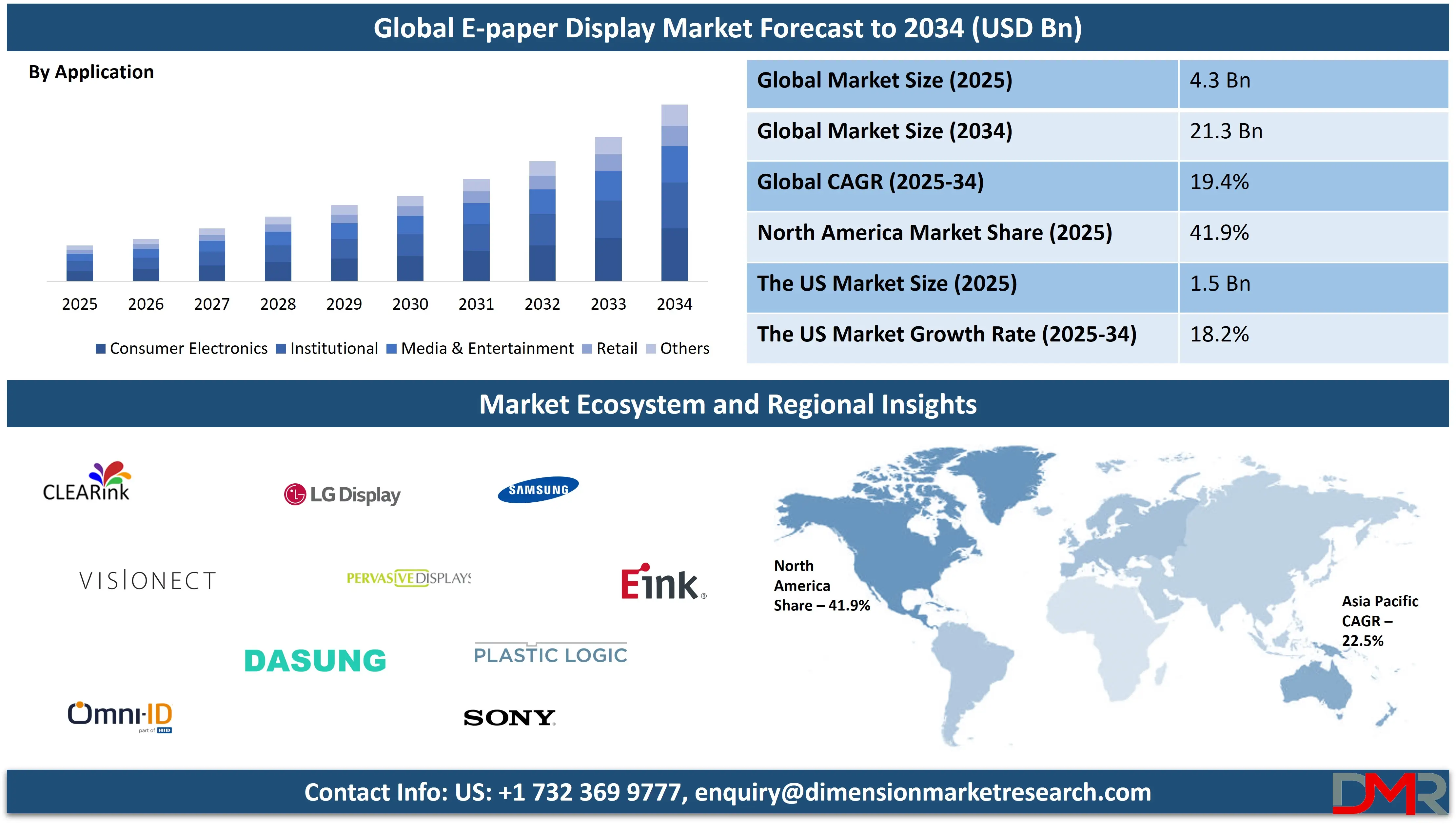

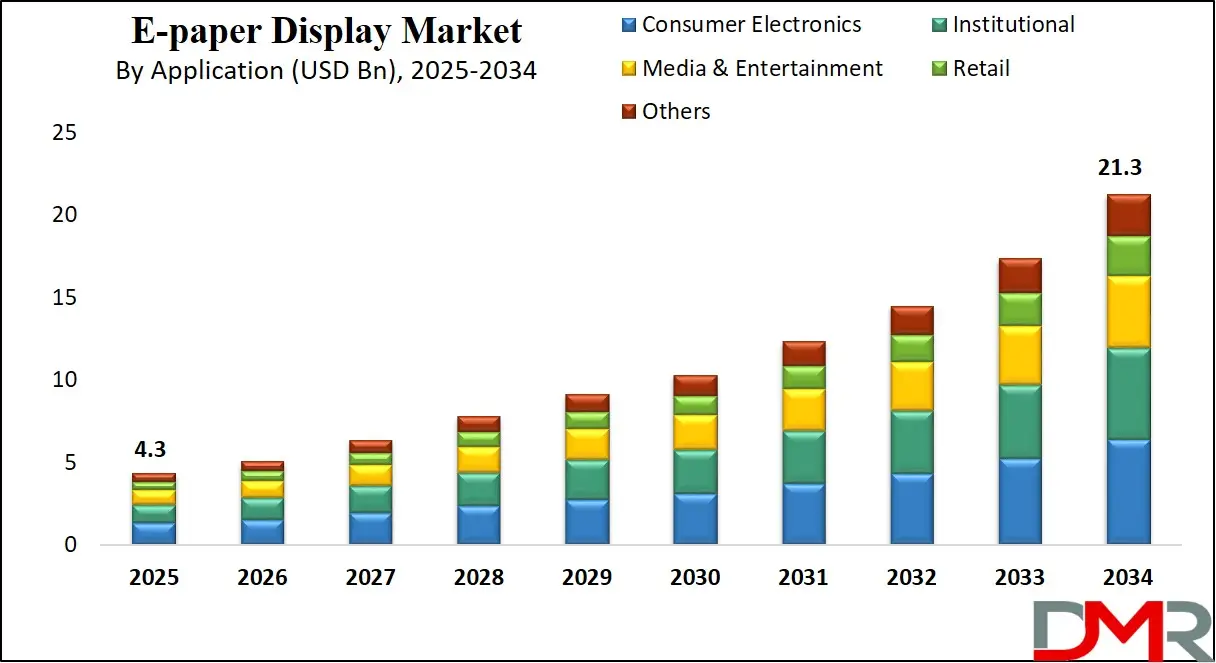

The Global E-paper Display Market size is projected to reach USD 4.3 billion in 2025 and grow at a compound annual growth rate of 19.4% from there until 2034 to reach a value of USD 21.3 billion.

E-paper (electronic paper) display is a type of screen technology that mimics the appearance of regular ink on paper. It works by using tiny particles that move to display text or images without the need for a backlight. Because it only uses power when the screen content changes, it is highly energy-efficient. This technology is often used in devices like e-readers, digital price tags, electronic shelf labels, and signage. The biggest benefit of e-paper is its readability in direct sunlight and low power use, making it ideal for long-term, always-on displays.

The demand for e-paper displays has grown in recent years due to the rise in smart retail and the need for sustainable, energy-saving solutions. Retailers are adopting electronic shelf labels to quickly update product prices without printing new labels. Similarly, transportation systems are using e-paper for smart signage due to its visibility outdoors. The rise of e-readers and electronic notebooks is also driving growth, especially as more people prefer digital reading experiences that feel like paper. The need for battery-powered, low-energy solutions in wearable and IoT devices is another reason behind the demand.

A key trend in the e-paper market is the growing use of color e-paper technology. Earlier displays were limited to black and white, but new models offer improved color quality while maintaining low power use. Another trend is the development of flexible and foldable e-paper displays, which can be used in smart cards, ID badges, and packaging. There is also increasing integration of e-paper in smart city projects for outdoor signage and public information boards. E-paper is also being tested in the fashion and textile industries for dynamic clothing displays.

Recent years have seen significant improvements in e-paper speed, resolution, and color range. Companies are working on reducing refresh rates, which means quicker updates of screen content. This makes the technology more usable for applications like dynamic signs and low-power tablets. New forms of reflective display materials are being researched to enhance viewing angles and clarity. Developers are also combining e-paper with touch input and wireless updates, helping users interact with the display in new ways.

In recent years, major companies in the e-paper field have announced partnerships and product launches that signal market expansion. E Ink, a pioneer in the space, has unveiled new color displays and flexible materials. Global electronics shows have featured smart luggage tags, folding phones, and other devices using e-paper. Some transportation authorities in Europe and Asia have replaced traditional signs with e-paper displays for better energy savings. These examples reflect broader industry interest in adopting the technology beyond just e-readers.

The US E-paper Display Market

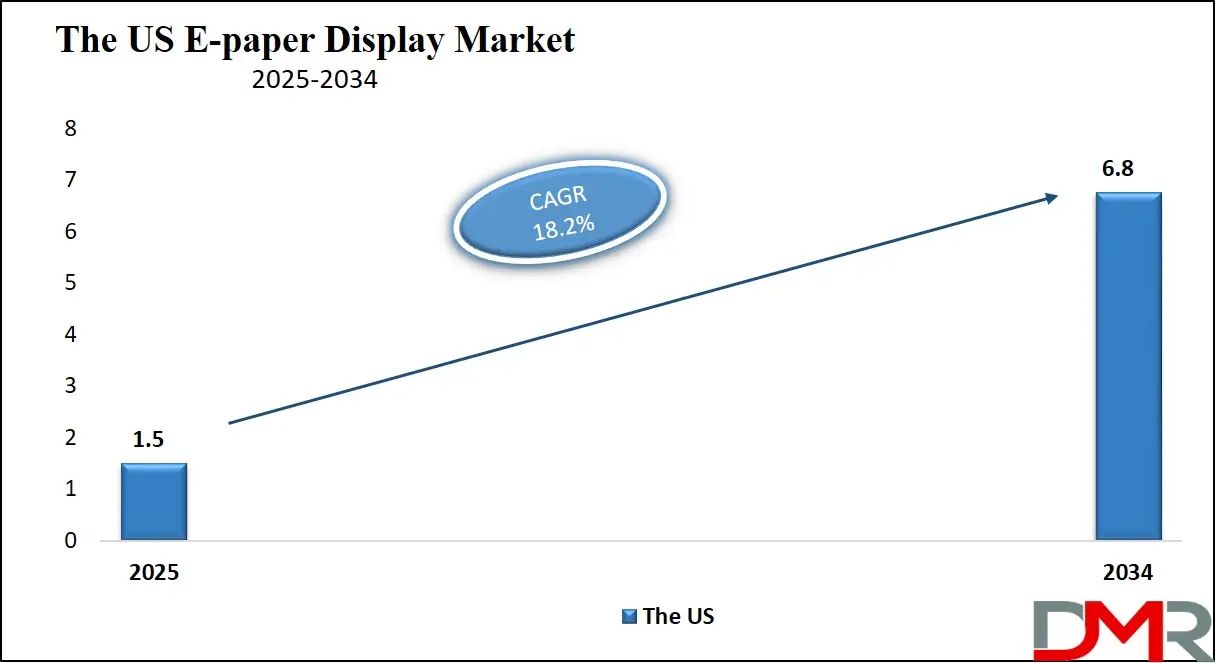

The US E-paper Display Market size is projected to reach USD 1.5 billion in 2025 at a compound annual growth rate of 18.2% over its forecast period.

The US plays a key role in the global e-paper display market through technological innovation, strong demand from advanced retail and logistics sectors, and active research and development. US-based companies and research institutions are contributing to advancements in e-paper materials, color technology, and flexible display formats. The country’s focus on sustainability and energy-efficient solutions is also driving adoption in smart cities, public signage, and transportation systems. Additionally, the US retail industry is increasingly using electronic shelf labels and digital signage to enhance store operations, boosting market growth. The presence of leading tech companies, a strong consumer electronics market, and investment in next-gen display technologies positions the US as a critical hub for e-paper development, commercialization, and application.

Europe E-paper Display Market

Europe E-paper Display Market size is projected to reach USD 940 million in 2025 at a compound annual growth rate of 18.8% over its forecast period.

Europe holds a significant position in the e-paper display market due to its strong focus on sustainability, smart infrastructure, and digital innovation. Many European countries are adopting e-paper technology in public transportation systems, including bus stop signs, train schedules, and airport information boards, driven by energy efficiency goals. Retailers across Europe are also leading in the adoption of electronic shelf labels to support dynamic pricing and reduce paper waste. The region’s support for smart city projects and low-power technologies has encouraged the use of e-paper in urban signage and public services. Europe’s emphasis on eco-friendly solutions, combined with supportive regulations and strong demand in logistics, education, and healthcare, makes it a key driver of e-paper market growth and innovation.

Japan E-paper Display Market

Japan E-paper Display Market size is projected to reach USD 250 million in 2025 at a compound annual growth rate of 19.9% over its forecast period.

Japan plays a key role in the e-paper display market through its focus on advanced technology, sustainability, and efficient infrastructure. The country has adopted e-paper in areas like public transportation, retail signage, and smart city projects due to its low power usage and clear visibility in various lighting conditions. Japanese companies often collaborate with global partners to develop flexible and color e-paper solutions for innovative applications. The retail sector in Japan also supports digital transformation through the use of electronic shelf labels and dynamic signage. In addition, e-paper is being used in education and healthcare tools, supporting paperless communication. Japan’s commitment to eco-friendly solutions and technological innovation makes it a strong contributor to both development and adoption in the e-paper market.

E-paper Display Market: Key Takeaways

- Market Growth: The E-paper Display Market size is expected to grow by USD 16.2 billion, at a CAGR of 19.4%, during the forecasted period of 2026 to 2034.

- By Application: The consumer electronics segment is anticipated to get the majority share of the E-paper Display Market in 2025.

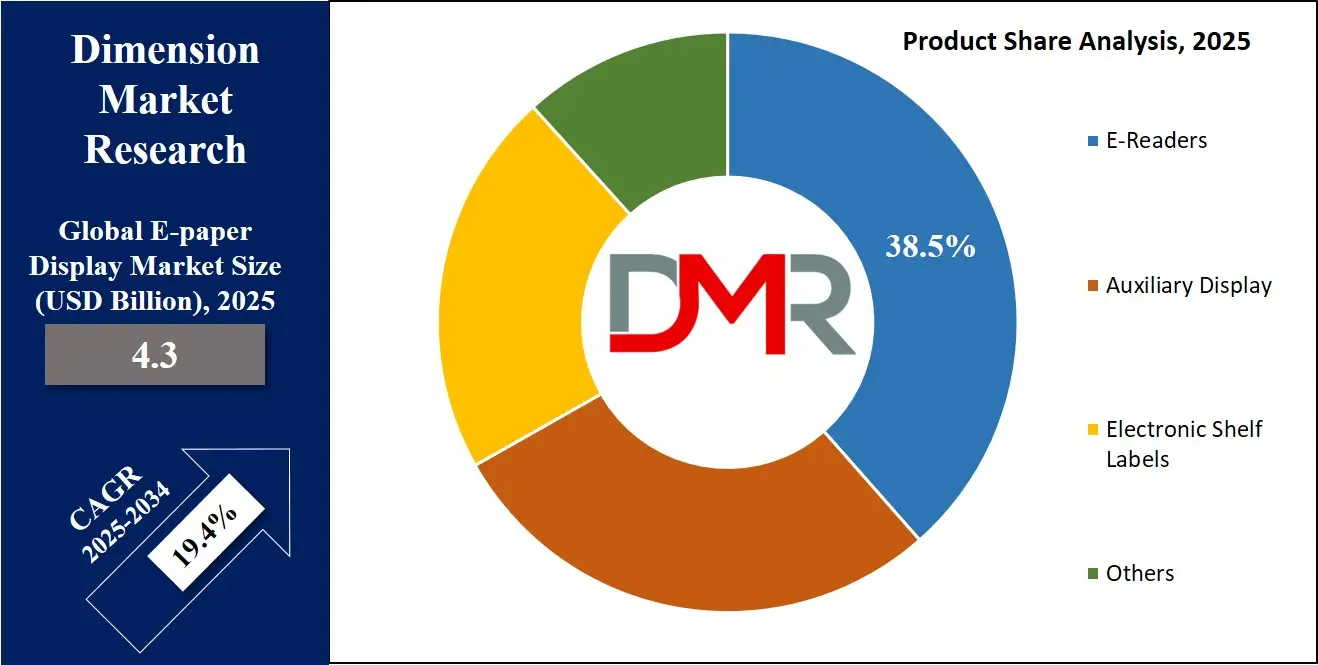

- By Color Display: The E-readers segment is expected to get the largest revenue share in 2025 in the E-paper Display Market.

- Regional Insight: North America is expected to hold a 41.9% share of revenue in the Global E-paper Display Market in 2025.

- Use Cases: Some of the use cases of E-paper Display include retail shelf labels, e-readers & digital notebooks, and more.

E-paper Display Market: Use Cases

- Retail Shelf Labels: E-paper displays are widely used in electronic shelf labels in supermarkets and stores. They allow real-time price updates without printing paper, saving time and reducing waste. Their clear visibility under bright store lighting makes them ideal for retail environments.

- E-Readers and Digital Notebooks: E-paper is the core technology behind e-readers and writing tablets, offering a paper-like reading experience. It reduces eye strain and works well in sunlight, making it perfect for long reading or writing sessions. Its low power use means longer battery life for users.

- Public Signage and Transport Info Boards: E-paper displays are used in bus stops, train stations, and public notice boards. They show real-time schedules, alerts, and maps with excellent visibility outdoors. Their power efficiency supports solar-powered setups in remote or off-grid areas.

- Smart Wearables and ID Badges: E-paper is used in smartwatches, fitness bands, and ID cards where low power use and readability are key. These displays can show names, health stats, or messages without draining battery quickly. They are also thin and flexible, ideal for compact designs.

Stats & Facts

- As per Exploding Topics

- Approximately 402.74 million terabytes of data are created each day, showing the overwhelming scale at which global users, systems, and services are producing digital information across all sectors and devices.

- Around 147 zettabytes of data are set to be generated in 2024 alone, reflecting the explosive growth in cloud storage, internet activity, and digital communication happening worldwide.

- Global data creation is expected to surge to 181 zettabytes in 2025, marking a more than 150% increase from the 120 zettabytes produced in 2023, as more users stream content, share media, and adopt connected technologies.

- Over 90% of the world’s data has been generated in just the past two years, revealing how the current pace of digital content creation has rapidly outstripped all previous eras of data development combined.

- The annual amount of data generated has consistently grown each year since 2010, emphasizing a long-term pattern of rising digital dependency and information exchange.

- From only 2 zettabytes created in 2010, data output has multiplied approximately 74 times in the past 13 years, illustrating a steep and ongoing climb in global data volume.

- Video content alone now accounts for more than half of all internet data traffic, thanks to increased video sharing, streaming, and short-form content creation across social and entertainment platforms.

- Facebook’s transformation into a video-heavy platform is clear, with 51% of its shared content now being video-based, reflecting the broader trend of users preferring visual, engaging formats over static posts.

- Watching YouTube at 480p uses over 500 MB of data per hour, while 4K video streams consume up to 30 times more—highlighting how resolution directly impacts the amount of bandwidth required.

- Streaming Netflix in standard definition uses about 1GB per hour, which totals 24GB in a full day; high-definition uses 3GB per hour (72GB/day), and Ultra HD can reach 7GB per hour, or 168GB in a day.

- Internet traffic is largely driven by video (over 50%), social media (12.69%), and gaming (9.86%), with these three categories together making up more than 76.27% of all global data movement online.

- The U.S. hosts over 2,700 data centers, underscoring its role as a major hub for cloud computing, internet infrastructure, and data processing power supporting both domestic and international digital systems.

- Nearly 250 million emails are sent every minute worldwide, and this volume adds up to a staggering 333.22 billion emails every 24 hours—signaling the continued relevance of email despite newer communication tools.

- Each snap sent via Snapchat uses around 1MB of data, much of which is video content, contributing quietly but steadily to the massive pool of daily mobile data generated by social media users.

Market Dynamic

Driving Factors in the E-paper Display Market

Rising Demand for Energy-Efficient Display Solutions

One of the major growth drivers of the e-paper display market is the increasing global focus on energy conservation and sustainable technology. E-paper consumes power only when the screen content changes, making it highly energy-efficient compared to traditional LCD or LED screens. This unique feature has made it a preferred choice in sectors like retail, transportation, and public signage where displays remain static for long periods. As businesses and governments aim to reduce energy usage and carbon footprints, the adoption of low-power technologies like e-paper is rising. Solar-powered applications, especially in outdoor signage, are further boosting demand. The combination of power savings and improved visibility under natural light strengthens e-paper’s value proposition. These factors are driving both adoption and innovation across industries.

Expansion of Smart Retail and Digital Labeling

The rapid digital transformation in the retail sector is another strong growth driver for the e-paper display market. Retailers are increasingly shifting from traditional paper labels to electronic shelf labels (ESLs) to enable dynamic pricing, reduce labor costs, and improve operational efficiency. E-paper displays offer excellent visibility, even under store lighting, and can display prices, product names, and promotions clearly. The ability to update thousands of shelf labels wirelessly in real time gives retailers flexibility and speed in responding to market changes. As e-commerce merges with physical retail through omni-channel strategies, smart in-store technologies like e-paper displays are becoming vital. This trend is especially strong in supermarkets, pharmacies, and convenience stores where frequent price changes are common.

Restraints in the E-paper Display Market

High Production Costs and Limited Color Display Capabilities

One of the major restraints in the e-paper display market is the high production cost compared to conventional display technologies. Manufacturing e-paper involves complex materials and processes that can drive up the cost, especially for large or color displays. While prices are gradually falling, they still remain a barrier for widespread use in cost-sensitive applications. Additionally, the color rendering capabilities of e-paper are still limited and not as vibrant or fast as LCD or OLED displays. This restricts their use in media-rich or advertisement-heavy environments where visual impact is crucial. The need for specialized components and limited supplier options also adds to the cost burden. As a result, many potential users hesitate to adopt e-paper over cheaper alternatives.

Slow Refresh Rates and Limited Multimedia Support

Another significant restraint is the slow refresh rate of e-paper displays, which affects their ability to show moving images or support video playback. Unlike LCDs, e-paper screens are not suited for applications that require fast transitions or animations. This technical limitation reduces their use to mostly static content like text or simple graphics. As digital interfaces become more interactive and multimedia-driven, e-paper lags behind in offering real-time user experiences. The lack of touch responsiveness in some versions and slower screen updates can also limit usability in modern smart devices. These drawbacks make e-paper unsuitable for many commercial and consumer electronics applications that demand high responsiveness and dynamic content.

Opportunities in the E-paper Display Market

Integration in Smart Cities and Public Infrastructure

E-paper displays present a strong opportunity for integration into smart city projects and public infrastructure. Their ability to operate with minimal power makes them ideal for outdoor environments where solar-powered systems are preferred. Applications such as digital bus stop signs, public information boards, and traffic guidance displays can benefit from e-paper’s readability in sunlight and low maintenance needs. As governments across the world invest in building smarter, greener urban spaces, e-paper can play a key role in improving communication and efficiency. Its durability and resistance to glare or overheating add to its appeal for long-term outdoor use. Additionally, real-time updates via wireless networks make it suitable for dynamic urban communication. These factors create potential for large-scale public sector adoption.

Expansion in Healthcare and Logistics Applications

The healthcare and logistics sectors are emerging as promising areas for e-paper display applications. In hospitals, e-paper can be used for patient wristbands, room signage, medication labels, and digital charts, helping improve accuracy and reduce paper use. Their easy readability and low power demand are especially helpful in environments that need round-the-clock monitoring without frequent charging or screen maintenance. In logistics, e-paper tags can be attached to packages and containers to show real-time tracking data, instructions, or product information. Since these displays are lightweight and consume minimal power, they are well-suited for mobile and battery-operated systems. As the demand for efficient, traceable, and sustainable operations grows in these sectors, e-paper displays offer a smart, long-term solution.

Trends in the E-paper Display Market

Color E‑Paper Displays Going Mainstream

A major recent trend is the rapid improvement and rollout of full‑color e‑paper displays. Where earlier e‑ink screens showed only shades of gray, newer versions deliver thousands of color hues—perfect for digital signage, education materials, and color e‑readers. For instance, desktop monitors using Kaleido 3 color tech and digital posters featuring Spectra 6 can now present vibrant artwork with minimal power consumption and almost no refresh energy. This rise in color capability is driving demand because it blends the energy savings of e‑paper with the visual attractiveness of modern screens.

Flexible, Foldable, and Large‑Scale Formats

Another growing trend is the development of bendable, rollable, and foldable e‑paper panels, along with large‑format signage for outdoor use. Flex panels are appearing in prototypes of smart clothing, packaging, and foldable e‑readers—like one device tested to survive over 200,000 bends. Alongside this, large color e‑paper displays and billboards using Spectra 6 are being tested for public spaces like transit hubs and shopping malls, benefiting from their sunlight readability and ultra‑low power needs. These innovations are creating new form factors and use cases—ranging from flexible wearable displays to solar‑powered outdoor signage—that were not possible with traditional screen types.

Impact of Artificial Intelligence in E-Paper Display Market

Artificial Intelligence is playing a vital role in advancing the E-Paper Display market by enhancing functionality, user interaction, and energy efficiency. E-Paper technology, known for its low power consumption and readability in bright light, is being further optimized with AI-driven solutions. AI algorithms can now analyze user behavior and environmental conditions to adjust display settings like brightness, contrast, and content layout in real time, which ensures a more personalized and efficient viewing experience while conserving battery life. In applications such as e-readers, digital signage, smart labels, and electronic shelf tags, AI helps manage content dynamically, automating updates based on inventory, usage patterns, or user preferences.

Moreover, AI integration is pushing the boundaries of E-Paper displays in areas like smart cities, education, and healthcare. For instance, in digital signage, AI can analyze foot traffic or demographics to display targeted content. In education, AI-powered E-Paper tablets can enhance learning by adapting content delivery to student performance or reading habits. Similarly, in medical settings, E-Paper devices equipped with AI can streamline patient information management and improve data visibility without straining power resources. While challenges such as limited color range and refresh rates still exist, AI is enabling smarter use of these displays by making them context-aware and more interactive. As a result, AI is not only increasing the efficiency and functionality of E-Paper technologies but also expanding their scope of application across multiple industries, driving greater demand and innovation in the market.

Research Scope and Analysis

By Product Analysis

E-readers will be leading in 2025 with a share of 38.5%, playing a major role in the growth of the e-paper display market. These devices use e-paper screens to give users a paper-like reading experience that’s easy on the eyes and readable even in bright sunlight. As more people shift to digital reading for convenience and sustainability, demand for e-readers continues to rise. The long battery life and low power consumption of e-paper make it perfect for these devices, especially for students, professionals, and frequent readers. Publishers and educational institutions are also adopting e-readers to reduce paper use and lower costs. With rising interest in eco-friendly electronics and lightweight digital tools, e-readers are expected to remain a key driver for market expansion. Their popularity is growing across regions due to portability, eye comfort, and advanced e-ink technologies that improve screen clarity and support interactive functions like note-taking and dictionary access.

Electronic shelf labels are expected to witness significant growth over the forecast period, becoming one of the most widely used products in the e-paper display market. These digital tags help retailers update pricing and product details instantly without printing or manual labor, saving time and reducing waste. The clear visibility of e-paper, even under store lighting, makes it ideal for supermarkets, pharmacies, and department stores. As stores aim to improve efficiency and keep up with frequent price changes, demand for these smart labels is rising fast. Retailers across regions are also integrating electronic shelf labels with inventory and sales systems for real-time updates and better stock management. The low energy use and long life of e-paper displays help reduce operating costs. Combined with the push for digital transformation in the retail sector, electronic shelf labels are set to play a vital role in market expansion and smarter in-store operations.

By Application Analysis

Consumer electronics will be dominating in 2025 with a share of 29.8%, playing a key role in the growth of the e-paper display market. Devices like e-readers, smartwatches, digital notepads, and mobile accessories are increasingly using e-paper technology due to its low power use, light weight, and clear readability. As users look for gadgets with longer battery life and better outdoor visibility, e-paper is becoming a preferred display option. Tech companies are also exploring flexible and foldable e-paper screens to create innovative product designs that are thin, durable, and energy-efficient. From fitness bands showing health data to remote controls with always-on displays, e-paper is supporting the trend toward minimalist and smart design. Its benefits in reducing glare and eye strain further boost its use in daily-use consumer tech. With rising interest in portable, user-friendly, and sustainable electronics, this segment is expected to remain a strong growth driver for the market.

Retail is showing significant growth over the forecast period as a major application area for e-paper displays. Stores are adopting electronic shelf labels, smart signage, and digital price tags to enhance efficiency and minimize paper waste. E-paper’s ability to clearly show text and prices, even under strong store lights, makes it ideal for busy retail environments. Retailers benefit from quick price updates, lower labor costs, and better inventory management. E-paper displays also help enhance customer experience by showing accurate product information and dynamic promotions in real time. As digital transformation accelerates across supermarkets, department stores, and pharmacies, the use of e-paper technology is expanding rapidly. Its energy efficiency and support for wireless updates make it a practical solution for modern retail operations. Combined with the push for sustainability and smart store automation, retail is expected to remain a strong growth area for the e-paper display market.

The E-paper Display Market Report is segmented on the basis of the following:

By Product

- E-readers

- Auxiliary Display

- Electronic Shelf Labels

- Others

By Application

- Consumer Electronics

- Wearable

- E-readers

- Smartphones

- Institutional

- Media and Entertainment

- Retail

- Others

Regional Analysis

Leading Region in the E-paper Display Market

North America, leading in 2025 with a share of 41.9%, plays a major role in the growth of the e-paper display market due to strong demand from retail, logistics, education, and public information systems. The region is seeing widespread use of electronic shelf labels in stores, helping businesses manage real-time pricing while reducing printing costs and waste. E-paper displays are also being used in public transit systems, outdoor signage, and smart city projects thanks to their low power use and high visibility in sunlight.

North America's focus on energy-efficient technologies and digital transformation supports the growth of e-paper in multiple industries. In addition, rising adoption in healthcare for patient monitoring and in logistics for tracking and labeling is expanding its use. Backed by strong research, innovation, and early adoption, the region continues to push development forward. With key players based in this region and ongoing investment in advanced display solutions, North America remains a central hub in the global e-paper display market.

Fastest Growing Region in the E-paper Display Market

Asia Pacific is showing significant growth over the forecast period in the e-paper display market due to rapid advancements in smart retail, public infrastructure, and low-power digital signage. Countries like China, Japan, and South Korea are actively using electronic shelf labels, e-readers, and e-paper-based transport signs to support digital transformation and energy efficiency. The growing focus on eco-friendly display solutions, combined with rising demand in education, logistics, and healthcare sectors, is boosting regional adoption. With strong manufacturing capabilities, increasing urbanization, and investments in flexible and color e-paper technologies, Asia Pacific is estimated to become one of the fastest-growing regions, supporting innovation and large-scale deployments across various applications.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The e-paper display market is growing fast and becoming more competitive as more companies enter with new ideas and products. This market includes both well-known tech providers and smaller firms focusing on smart and energy-saving display solutions. Companies are competing by improving screen quality, adding color options, making displays flexible, and lowering power use. Some focus on large-scale signage and public displays, while others target consumer gadgets like e-readers or shelf labels in retail stores. New partnerships and research investments are helping firms create better and more affordable products. As demand rises across retail, education, transport, and smart devices, companies are racing to offer the most reliable, clear, and long-lasting e-paper solutions in different sizes and forms.

Some of the prominent players in the global E-paper Display are:

- E Ink Holdings Inc.

- CLEARink Displays Inc.

- Sony Corporation

- LG Display Co. Ltd.

- Samsung Display Co. Ltd.

- Plastic Logic GmbH

- Pervasive Displays Inc.

- Visionect

- Amazon (Liquavista B.V.)

- BOE Technology Group

- Guangzhou OED Technologies Co., Ltd.

- Kent Displays Inc.

- Dasung Tech Co., Ltd.

- Displaydata Ltd.

- Toppan Printing Co. Ltd.

- GDS Holding S.r.l.

- Waveshare Electronics

- Good Display

- Omni-ID

- Motion Display

- Other Key Players

Recent Developments

- In June 2025, Samsung Electronics launched its 32-inch Color E-Paper display (EM32DX model), expanding its range of energy-efficient digital signage solutions. Using advanced digital ink technology, the new model offers ultra-low power consumption, high visibility, and a lightweight design, making it an eco-friendly and versatile option for businesses. Hoon Chung, EVP of Samsung’s Visual Display Business, emphasized the company’s focus on innovation that balances performance and sustainability, enabling businesses to deploy efficient, customizable signage with minimal environmental impact.

- In April 2025, E Ink unveiled its largest E Ink Spectra™ 6 display to date—a 75” full-color ePaper module. This launch follows the earlier debut of the Kaleido™ 3 75” and reflects E Ink’s focus on expanding its large-format offerings. Sample modules will be available in Q4 2025 for Touch Taiwan 2025 partners. CEO Johnson Lee highlighted the display’s rich color, energy efficiency, and potential to revolutionize indoor digital signage with sustainable, impactful advertising solutions.

- In March 2025, E Ink announced a major advancement in its E Ink Spectra™ product line. The update introduces E Ink Ripple, a wave-like transition effect that reduces screen flashing and ensures smoother display refreshes. In addition, the company has developed a new waveform driving architecture that improves color performance. This innovation enhances color mixing by utilizing existing color particles to generate new color variations, offering a more vibrant and visually appealing experience for E Ink Spectra displays.

- In April 2024, E Ink announced a strategic partnership and memorandum of understanding with AUO, a top supplier of display and smart application solutions, to co-develop large-size color ePaper displays. E Ink will supply full-color ePaper modules, while AUO will contribute integrated hardware and software technologies, including TFT backplane components. Highlighting ePaper's ultra-low power use and poster-like display quality, E Ink’s President, Dr. FY Gan, emphasized its suitability for retail and public displays and expressed enthusiasm for expanding its applications through this collaboration.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.3 Bn |

| Forecast Value (2034) |

USD 21.3 Bn |

| CAGR (2025–2034) |

19.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (E-readers, Auxiliary Display, Electronic Shelf Labels, and Others), By Application (Consumer Electronics, Institutional, Media and Entertainment, Retail, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

E Ink Holdings Inc., CLEARink Displays Inc., Sony Corporation, LG Display Co. Ltd., Samsung Display Co. Ltd., Plastic Logic GmbH, Pervasive Displays Inc., Visionect, Amazon (Liquavista B.V.), BOE Technology Group, Guangzhou OED Technologies Co., Ltd., Kent Displays Inc., Dasung Tech Co., Ltd., Displaydata Ltd., Toppan Printing Co. Ltd., GDS Holding S.r.l., Waveshare Electronics, Good Display, Omni-ID, Motion Display, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global E-paper Display Market size is expected to reach a value of USD 4.3 billion in 2025 and is expected to reach USD 21.3 billion by the end of 2034.

North America is expected to have the largest market share in the Global E-paper Display Market, with a share of about 41.9% in 2025.

The E-paper Display Market in the US is expected to reach USD 1.5 billion in 2025.

Some of the major key players in the Global E-paper Display Market are Sony, LG Display, Samsung Display, and others

The market is growing at a CAGR of 19.4 percent over the forecasted period.