Overview

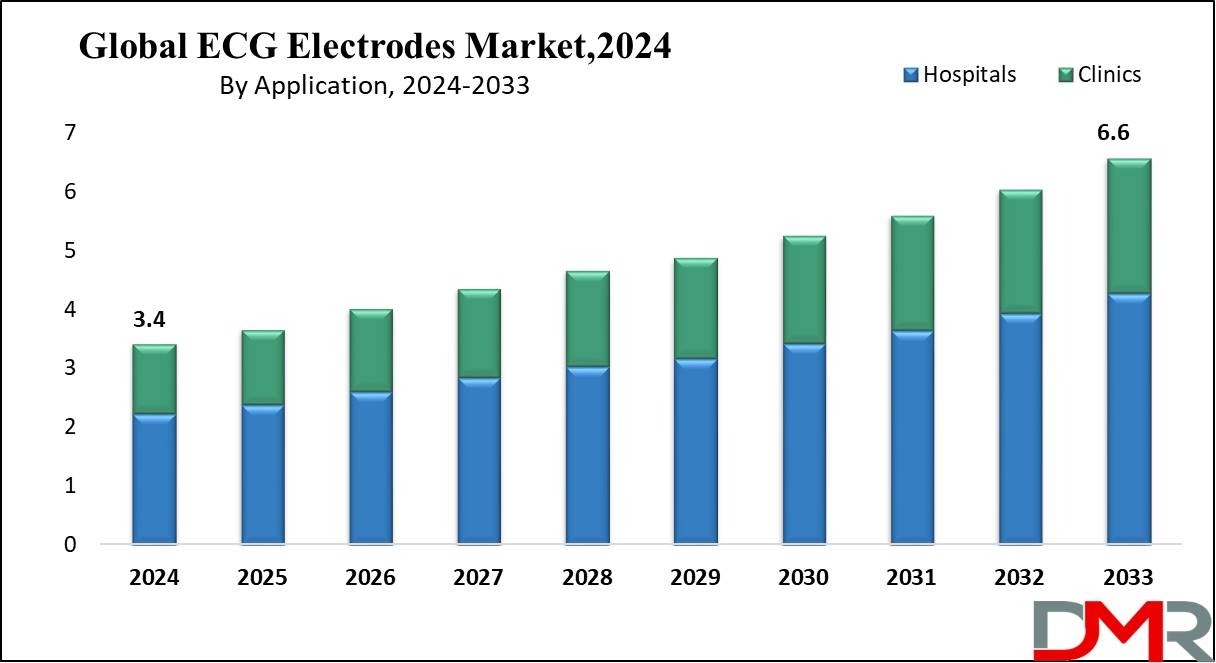

The Global ECG Electrodes Market size is expected to be worth around USD 6.6 Billion by 2033 from USD 3.4 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Electrocardiography (ECG) electrodes are medical devices designed to record and analyze the electrical activity of the heart. These small adhesive patches are placed strategically across skin areas in order to capture electrical signals coming from within the heart and transmit them back into ECG machines for analysis, providing essential details about its rhythm and electrical activity, which help physicians diagnose and monitor various cardiac conditions more accurately.

Global ECG Electrodes Market report offers an in-depth analysis of the target market, encompassing factual data like market size and shares at both regional and country levels, with CAGR and year-on-year growth rates. The report gives crystal view on market trends, opportunities, restrains and challenges along with competitive landscape analysis. Porters Five Forces, PESTLE, supply-chain analysis, Ecosystem analysis and Macro economic factors are included to cover all the target market aspects.

The research report on the global ecg electrodes market includes both qualitative as well as quantitative analysis of the market, company profiles of major market players along with complete product details and their competitive scenario. The report highly exhibits on the current and upcoming market trends and provides comprehensive analysis of all the factors that impact the global ecg electrodes market growth and size. The report will help companies to make better strategical business decisions.

Key Takeaways

- Market Value: ECG Electrodes Market size is expected to be worth around USD 8.42 Billion by 2033 from USD 3.18 Billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

- By Type Segment Analysis: In 2023, the solid-gel electrode segment dominated the market with a substantial share of 58%.

- By Application Segment Analysis: Hospital segment dominated the market, accounting for 65% of the total market share.

- By Regional Analysis: In 2023, North America emerged as the largest region in the electrocardiography (ECG) electrodes market

- Technological Advancements: Continuous innovations and technological advancements in ECG electrodes, such as the development of more accurate and user-friendly electrodes, are driving market growth.

- Growing Cardiovascular Disease Burden: The rising incidence of cardiovascular diseases globally is increasing the demand for ECG electrodes for early diagnosis and monitoring, further boosting the market.

- Key Market Players: Major companies in the market are investing heavily in research and development to introduce advanced products and expand their market presence, contributing to overall market expansion.

Use Cases

- Cardiac Diagnostics: ECG electrodes are essential for diagnosing heart arrhythmias, myocardial infarctions, and other cardiac abnormalities. By providing real-time data on heart rhythm and electrical activity, they enable healthcare providers to detect and treat heart conditions promptly.

- Post-Surgical Monitoring: After cardiac surgery, patients require close monitoring to ensure there are no complications such as arrhythmias or ischemia. ECG electrodes are used to continuously monitor the heart's electrical activity, helping to ensure patient safety and recovery.

- Emergency Response: In emergency settings, such as ambulances or emergency rooms, ECG electrodes are used to quickly assess a patient's heart function. This rapid assessment is crucial for making timely decisions about treatment in life-threatening situations.

- Routine Check-Ups: During regular health check-ups, ECG electrodes can be used to monitor heart health, especially for patients with a history of heart disease or those at risk. This helps in early detection and management of potential cardiac issues.

- Research and Clinical Trials: ECG electrodes are also widely used in medical research and clinical trials to study the efficacy of new cardiac drugs or treatments. They provide reliable data on heart function and are instrumental in advancing cardiac care.

Market Dynamics

Drivers:

The primary drivers of ECG electrodes market growth include increasing prevalence of cardiovascular diseases and an aging population. Cardiovascular diseases are one of the leading causes of death globally, fuelling demand for accurate diagnostic tools to detect them quickly. Aging populations tend to be more vulnerable to cardiovascular related ailments requiring regular cardiac monitoring. Advancements in healthcare infrastructure particularly in emerging economies is also driving market expansion as more hospitals and clinics adopt ECG technologies. Furthermore, increased awareness and proactive measures taken for cardiac health contribute to an increasing need for ECG electrodes from consumers alike.

Trends:

One significant shift in the ECG electrodes market is toward wireless and portable devices. Technological advances have led to compact yet user-friendly ECG devices with real-time monitoring and data transmission that enhance patient mobility and convenience. AI/ML advances for predictive analytics and diagnostic accuracy is also becoming increasingly common; these advances not only make ECG monitoring more efficient but also create opportunities for remote patient monitoring services which have become especially essential during COVID-19 pandemic outbreaks.

Restrictions:

While the market's growth potential is enormous, certain restraints limit its expansion. High costs associated with ECG devices and electrodes may restrict adoption in low-income regions. Furthermore, lacking qualified professionals to operate and interpret ECG results accurately presents challenges. Furthermore, stringent regulatory requirements pertaining to healthcare standards increase complexity and cost in introducing new products onto the market.

Opportunities:

The ECG electrodes market offers vast opportunities for expansion in developing nations with improved healthcare systems, especially home healthcare and remote monitoring initiatives. Collaborations and partnerships between technology firms and healthcare providers can foster innovation while driving market penetration; while materials science research could produce more comfortable electrodes that improve patient compliance while expanding the market further.

The COVID-19 Pandemic & Recession: Impact on the Global ECG Electrodes Market:

Dimension Market Research has closely monitored the impact of COVID-19 and the recession on specific business segments, along with its short and long-term implications at both the global and regional levels. The initial outbreak of the COVID-19 pandemic caused unprecedented economic damage across numerous regions. The COVID-19 pandemic severely disrupted production, sales, and supply chain activities in developed as well as developing economies. Our report comprehensively covers the pre and post-COVID-19 impacts, along with an analysis of the recession's effects on the global ecg electrodes market.

Research Scope and Analysis

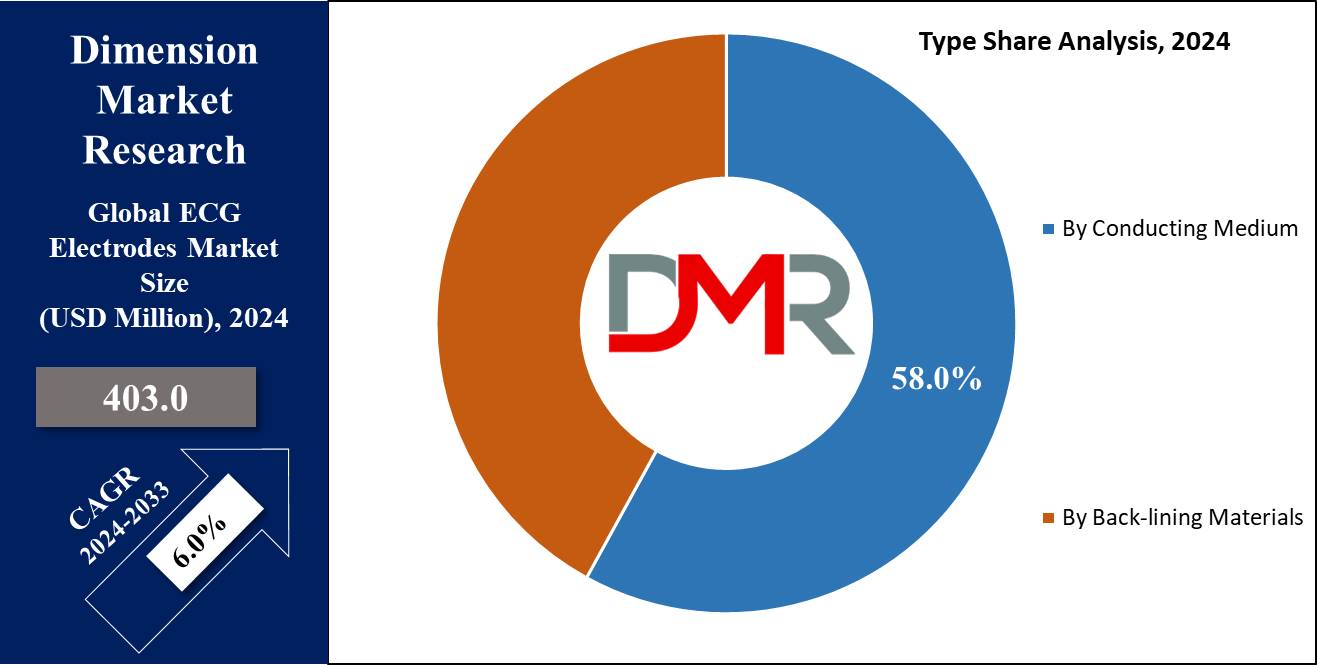

Type Analysis

The ECG electrodes market is categorized by conducting medium and back-lining materials. By conducting medium, the market segments include liquid electrodes and solid-gel electrodes. In 2023, the solid-gel electrode segment dominated the market with a substantial share of 58%. Solid-gel electrodes are preferred for their superior adhesion and stability during ECG monitoring, providing clearer and more accurate readings. They are particularly beneficial in long-term monitoring and stress tests, where consistent electrode placement and signal quality are critical.

By back-lining materials, the market is divided into sponge back-lining and non-woven back-lining segments. Non-woven back-lining materials have gained significant traction due to their cost-effectiveness and better patient comfort. These materials are lightweight, breathable, and provide excellent conformability to the skin, reducing the risk of skin irritation during prolonged use. The sponge back-lining, while offering good absorbency, is less preferred due to its bulkier nature and higher cost compared to non-woven alternatives.

Overall, the solid-gel electrodes and non-woven back-lining materials are leading the ECG electrodes market in 2023, driven by their performance benefits and patient comfort. These segments are expected to continue their dominance as healthcare providers seek reliable and efficient solutions for cardiac monitoring.

Application Analysis

The ECG electrodes market is analyzed based on its applications across various healthcare settings, primarily hospitals and clinics. In 2023, the hospital segment dominated the market, accounting for 65% of the total market share. Hospitals are the primary settings for comprehensive cardiac diagnostics and treatments, which require the extensive use of ECG electrodes for continuous patient monitoring, emergency interventions, and routine heart health assessments. The high patient influx and the need for advanced cardiac care infrastructure make hospitals the largest consumers of ECG electrodes.

Clinics, while essential for primary care and outpatient services, account for a smaller market share. However, clinics play a crucial role in early diagnosis and management of cardiac conditions, contributing significantly to the overall demand for ECG electrodes. The trend towards preventive healthcare and increasing accessibility to cardiac care services in clinics is expected to drive growth in this segment.

Overall, hospitals remain the dominant application segment in the ECG electrodes market due to their critical role in providing comprehensive cardiac care, necessitating consistent and high-volume use of ECG electrodes.

Market Analysis and Research Scope:

We provide Comprehensive insights about the ecg electrodes market along with crucial Key factors such as market size, market CAGR, market potential, recent developments, trends, opportunities, new technologies and innovations, recent product launches, restraints and market regulations. This report will help our clients immensely in getting an inside out view of the ecg electrodes market by providing them with the complete information about the ecg electrodes market and its prominent players with their competitive analysis and strategies.

The global ecg electrodes market research report provides accurate estimations for the forecast period 2024 to 2033 based on in-depth research and analysis through rigorous compilation of exhaustive primary and secondary research data. The final data will be carried out after verifying the in-house research analysis by the key opinion leaders of the global ecg electrodes market. Our triangulate research method minimizes error margin and gives holistic view on the report.

The Global ECG Electrodes Market Report is segmented on the basis of the following:

Type

By Conducting Medium

- Liquid Electrode

- Solid-gel Electrode

By Back-lining Materials

- Sponge Back-lining

- Non-woven Back-lining

Application

Geographical Segmentation of the Global ECG Electrodes Market:

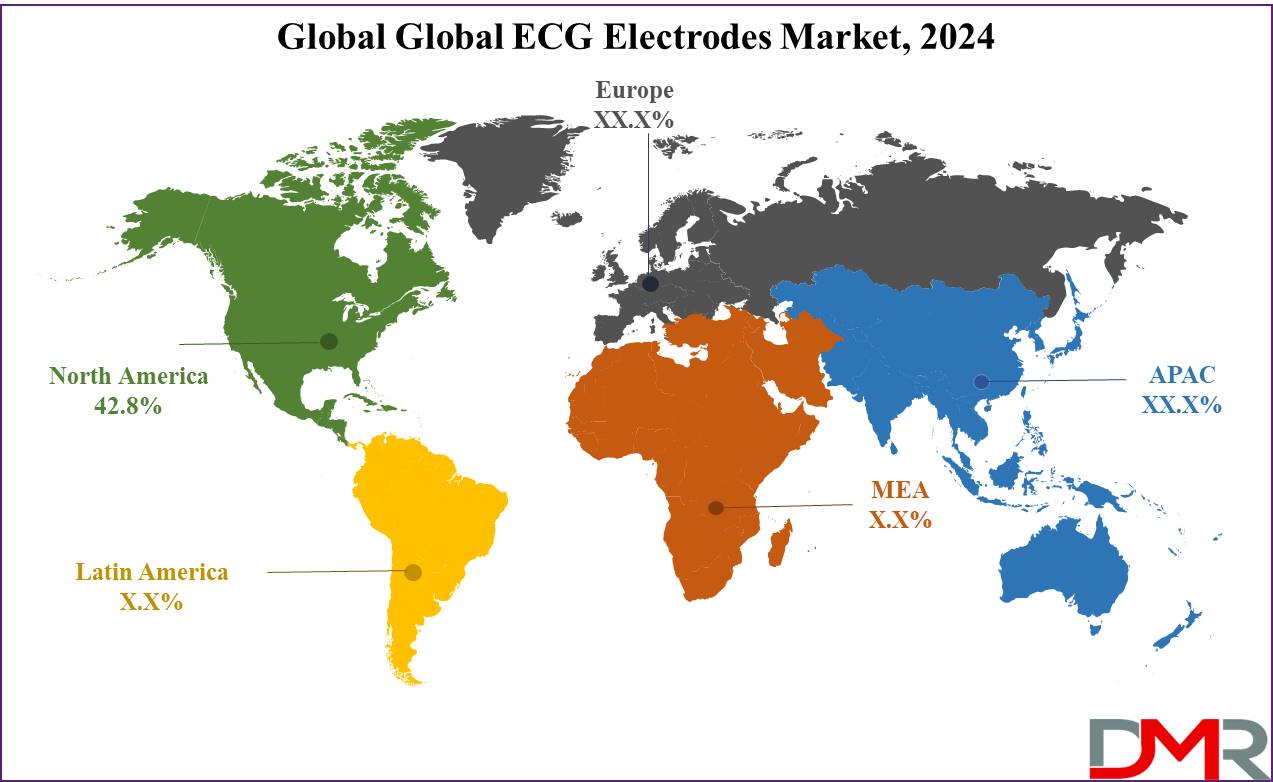

In 2023, North America emerged as the largest region in the electrocardiography (ECG) electrodes market. This dominance can be attributed to the advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and significant investment in healthcare technology within the region. The United States, in particular, has a robust market for ECG electrodes due to the widespread adoption of advanced cardiac monitoring devices and the presence of major market players.

Asia-Pacific, on the other hand, is expected to be the fastest-growing region during the forecast period. The rapid growth in this region is driven by several factors including increasing healthcare expenditure, rising awareness about cardiovascular health, and the growing burden of cardiac diseases. Countries like China, India, and Japan are experiencing significant improvements in healthcare infrastructure and an increasing demand for advanced medical devices, including ECG electrodes.

Region And Countries

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Nordic

- Benelux

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Egypt

- Rest of MEA

The global ecg electrodes market research report provides competitive examination analysis of the leading players including company description, SWOT analysis, and financial information, exhaustive product portfolio with specifications, key business areas, market share analysis, acquisitions and mergers, and key developments, etc.

Competitive Landscape:

The global ecg electrodes market is highly fragmented due to the presence of several leading players. Prominent market players of the ecg electrodes market are exhibiting a keen interest towards the emerging economies such as China, India, etc. to enhance their revenue generating opportunities. The major market players are continuously focusing on their product branding, marketing and expansion of R&D, to increase their customer base. Exhaustive key vendor analysis has been done to meet the ever-changing needs of our clients and provide them with a complete overview on the competitiveness of the global ecg electrodes market.

Global ECG Electrodes Market Key Players:

- 3M

- Ambu

- GE Healthcare

- Cardinal Health

- Conmed Corporation

- Nissha Medical

- ZOLL Medical

- Screentec Medical

- Shandong Intco Medical Products Corporation Ltd.

- Hztianyi

- Qingdao Bright

- MedLinket

- Tianrun Medical

- Mindray Medical

Recent Developments

- Technological Advancements: Companies have increasingly focused on incorporating advanced technologies into ECG electrodes, including wireless and Bluetooth-enabled models that increase patient mobility and comfort during cardiac monitoring.

- Miniaturization and Wearable Designs: There has been an explosion of efforts towards creating miniaturized ECG electrodes with improved comfort that can be worn discreetly to increase patient compliance, especially for long-term cardiac monitoring and ambulatory settings. These innovations aim to improve patient compliance.

- Improved Materials and Adhesives: New materials and adhesives are being introduced to ECG electrodes to increase durability and comfort, with an aim of reducing skin irritation while simultaneously improving signal quality, particularly for patients needing extended monitoring periods.

- Increased FDA Approvals and Certifications: Numerous new ECG electrode models have recently received FDA approval and CE marking, reflecting their compliance with stringent safety and performance standards, leading to wider adoption and use of advanced ECG electrodes in clinical practice.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 3.4 Bn |

| Forecast Value (2033) |

USD 6.6 Bn |

| CAGR (2024-2033) |

7.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type-By Conducting Medium (Liquid Electrode, Solid-gel Electrode) By Back-lining Materials (Sponge Back-lining, Non-woven Back-lining) By Application (Hospitals, Clinics) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

3M, Ambu, GE Healthcare, Cardinal Health, Conmed Corporation, Nissha Medical, ZOLL Medical, Screentec Medical, Shandong Intco Medical Products Corporation Ltd., Hztianyi, Qingdao Bright, MedLinket, Tianrun Medical, Mindray Medical |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |