Eco Fibers Market Overview

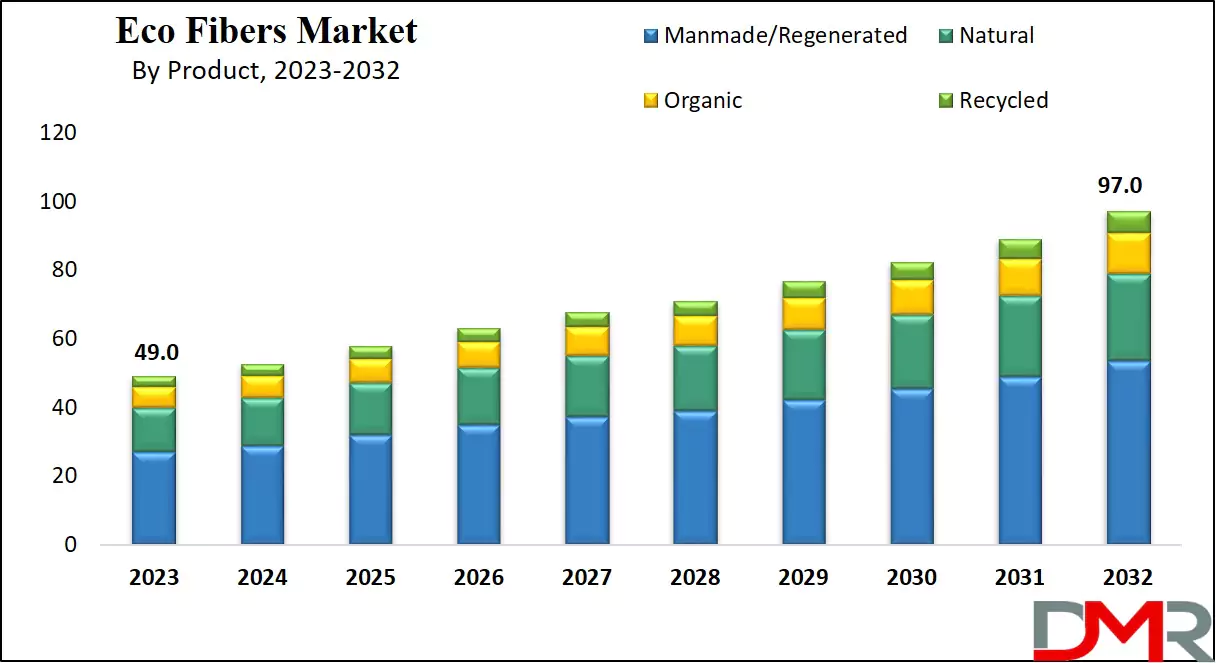

The Global Eco Fibers Market is expected to reach a value of USD 49.0 billion in 2023, and it is further anticipated to reach a market value of USD 97.0 billion by 2032 at a CAGR of 7.9%.

The global eco fiber market is experiencing significant growth, primarily fueled by the increasing demand for sustainable apparel and textiles. Growing awareness of the environmental hazards associated with synthetic fibers has prompted many clothing brands to transition toward organic and eco-friendly alternatives. Additionally, stringent government regulations worldwide promoting bio-based manufacturing have encouraged local garment producers to adopt greener raw materials, reducing pollution levels.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Eco fibers, slender & flexible threads derived from animals, plants, or minerals, offer advantages as a renewable resource. They contribute high specific strength & stiffness, creating favorable fiber aspect ratios, and are easily accessible from natural sources. Common examples of plant-based eco-fibers like bamboo, cotton, sisal, and jute.

Eco Fibers Market Key Takeaways

- By Product, Manmade/Regenerated lead in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, the Organic product is expected to have significant growth over the forecasted period.

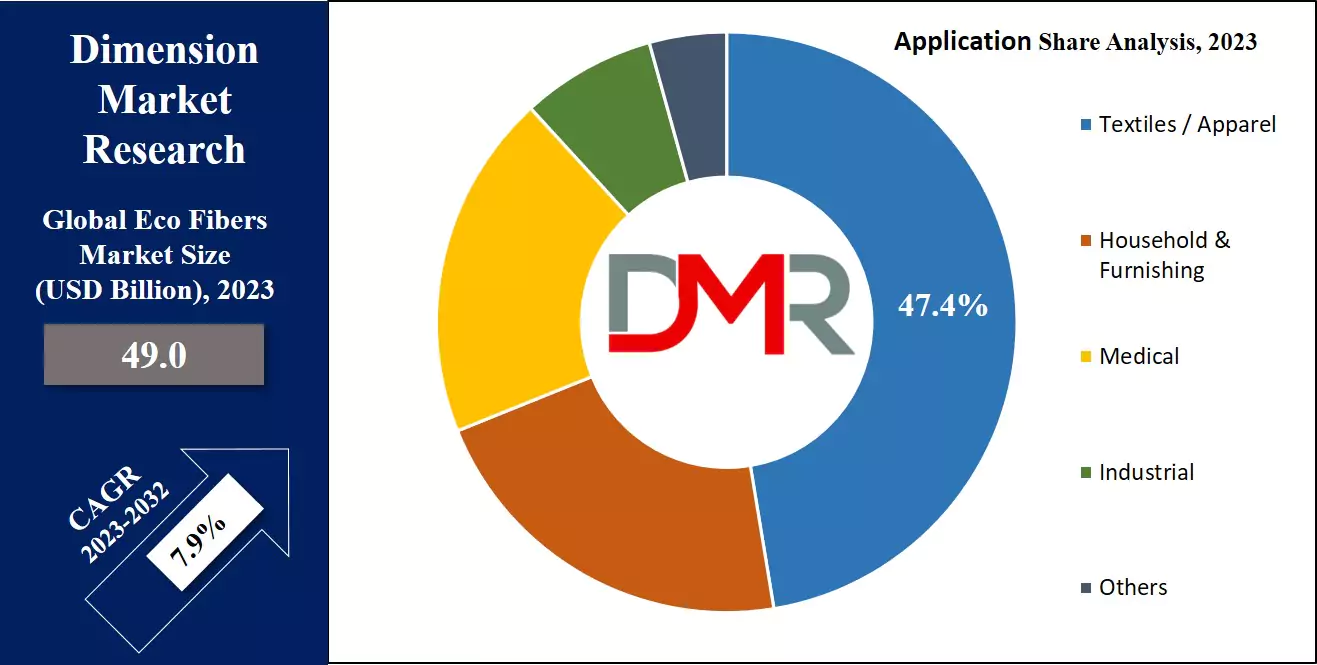

- By Application, the Textile takes the lead & drive the market in 2023

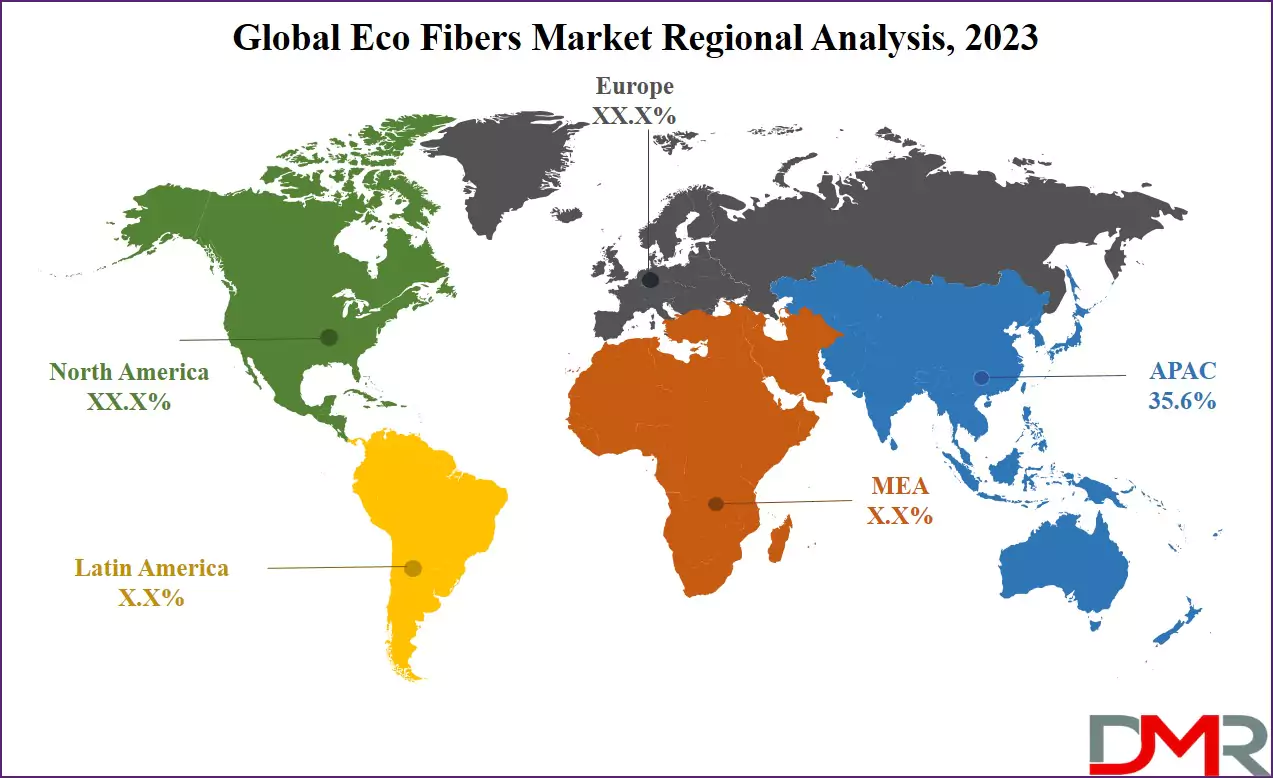

- Asia Pacific has a 35.6% share of revenue in the Global Eco Fibers Market in 2023

- Consumers and industries prefer eco-friendly alternatives over synthetic fibers due to biodegradability and lower carbon footprint.

- High production costs, limited availability of raw materials, and processing complexities hinder market expansion.

Eco Fibers Market Use Cases

- Sustainable Apparel & Fashion: Used in organic cotton, hemp, bamboo, and recycled polyester to produce eco-friendly clothing with a lower environmental impact.

- Home Textiles & Furnishings: Eco fibers like organic wool, linen, and recycled fibers are used in bedsheets, curtains, carpets, and upholstery for sustainable home décor.

- Industrial & Automotive Applications: Biodegradable and durable eco fibers are used in car interiors, seat covers, insulation materials, and industrial fabrics.

- Medical & Healthcare Textiles: Antibacterial and hypoallergenic properties of eco fibers make them ideal for hospital gowns, wound dressings, and hygiene products.

- Eco-Friendly Packaging: Recycled and plant-based fibers are used to create biodegradable packaging materials, reducing plastic waste in industries. Brands are also pairing eco fibers with Bamboo Cosmetic Packaging to extend sustainability into beauty and personal care sectors.

- Sports & Outdoor Wear: High-performance eco fibers like Tencel, merino wool, and bio-based nylon are used in activewear and outdoor gear for moisture-wicking and durability.

Eco Fibers Market Dynamic

The use of eco fibers has experienced significant expansion across various commercial & industrial applications, like automobile interiors, composite parts, building materials, partition panels, false ceilings, particle boards, insulation boards, medicine, cosmetics, & composites, which is poised to drive the eco fiber market's growth, with a main significant contribution from the need for silk-based & wool-based products. The easy accessibility of natural fiber, mainly in the medical & textile manufacturing sectors, is expected to hold a major share, boosting the overall eco-fiber market.

However, the market faces challenges such as a rise in product costs & the prevalence of low-cost substitutes, which act as restraints, potentially limiting the growth of the eco-fiber market during the forecast period. In addition, the development of affordable production techniques emerges as a major challenge in sustaining market growth.

Driver

The eco fibers market is driven by consumer preference for products with reduced environmental impacts such as water pollution and carbon emissions, leading to greater preference for biodegradable fabrics like hemp, organic cotton, bamboo and so on.

Government regulations encouraging sustainability as well as major fashion brands implementing eco-friendly practices further boost market. Recycling technologies promoting synthetic fabrics (like polyester ) contribute to market expansion by reducing waste while simultaneously offering circular fashion that caters to eco-conscious customers worldwide.

Trend

The rise of circular fashion has emerged as an influential trend in the eco fibers market. Brands are shifting towards closed-loop production processes to reduce waste and optimize resource use, and innovations like bio-based fibers and lab-grown textiles are making waves as sustainable alternatives to traditional materials.

Collaborations between fashion brands and technology companies are driving high performance eco fibers that are durable, lightweight and environmentally friendly; additionally upcycled materials and secondhand clothing bolster demand for eco fibers as consumers look for stylish, ethical yet sustainable options in response to global environmental concerns. The growing popularity of Vegan Cosmetics and Eco-Friendly Straws further highlights how sustainability is reshaping multiple industries alongside eco fibers.

Restraint

While eco fibers market can be lucrative, its growth may be hindered due to high production costs compared to conventional textiles. Organic farming and advanced recycling require significant investments that result in higher prices for eco-friendly textiles.

Limited availability of raw materials and scalability issues with sustainable fiber production prevent widespread adoption within cost-sensitive markets; consumer awareness about eco fiber benefits remains low while some companies engage in greenwashing practices which undermine consumer trust; these factors combined reduce growth for this market sector, especially regions without adequate infrastructure available to produce and recycle textile production and recycling operations.

Opportunity

Eco fibers present tremendous opportunities, particularly in developing economies with growing textile industries and an emphasis on sustainability. Government initiatives encouraging green manufacturing and renewable resources provide a favorable environment for market expansion. Athleisure and activewear segments have generated increased demand for eco-friendly fibers with performance characteristics.

Advances in biotechnology and material science, such as creating fibers from agricultural waste or algae, open new avenues for innovation. By working closely together across stakeholders such as governments, brands, and research institutions to increase awareness and drive adoption of eco fibers globally for long-term market expansion.

Eco Fibers Market Research Scope and Analysis

By Product

During the forecast period, organic eco fibers are expected for substantial growth, cultivated in controlled environments sans herbicides or chemicals, as certified agencies across the globe strictly monitor & audit the growing conditions for these fibers. Organic cotton, a highly used eco-fiber, stands out for its superior characteristics and sustainability. Rising concerns about the environmental impact of synthetic fibers have driven the demand for organic eco fibers, particularly due to their sustainable & hypoallergenic nature.

Further, the recycled product segment also holds a substantial revenue share, with the textile industry increasingly using recycled fiber, yarn, and fabric. Key clothing brands like Hanes, H&M, & Adidas adopting recycling processes in production and supply chains to address waste disposal issues, creating sustainability.

The reusing & reprocessing of used clothing gained rapid popularity, making the textile production chain more sustainable, in Asia Pacific, consumers accepted recycled fibers for their lower production costs & less strict regulations, contributing to the growing need for recycled eco fibers in the middle a shift towards closed-loop production cycles by manufacturers.

By Application

The textile application emerged as the dominant force in the eco-fiber market in 2023, and this trend is projected to grow more due to a surging global demand for clothing. Eco fibers find high use in various apparel items, ranging from shirts, jackets, & kids' wear to bed sheets, pillow covers, landfill coverings, bags, sacks, and medical textiles. Further, the textile industry anticipates growing demand for casual wear, formal wear, & fashionable clothing across all age groups in the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fabrics like denim, lycra, cotton, silk, & polyester play a vital role in crafting fashion textiles & clothing.

Furthermore, the rise in the number of luxury & trendy attire, mainly among the youth & adults, stands as a significant driving force for the market. As sustainability becomes a major point in the textile industry, the integration of eco-fibers aligns with the growing consumer consciousness towards environmentally-friendly fashion choices.

The Eco Fibers Market Report is segmented on the basis of the following

By Product

- Organic

- Manmade/Regenerated

- Recycled

- Natural

By Application

- Textiles / Apparel

- Household & Furnishing

- Industrial

- Medical

- Others

How Does Artificial Intelligence Contribute To Improve Eco Fibers Market ?

- Sustainable Fiber Production Optimization: AI enhances fiber processing by reducing waste, optimizing resource use, and improving efficiency in fiber extraction and manufacturing.

- Smart Quality Control: AI-powered computer vision and sensors detect defects in eco fibers, ensuring higher quality and reducing material waste.

- Supply Chain Efficiency: AI-driven predictive analytics optimize inventory management, demand forecasting, and logistics for eco fiber distribution.

- Eco-Friendly Textile Design: AI assists in designing sustainable fabrics by analyzing material properties, enhancing durability, and minimizing environmental impact.

- Waste Reduction & Recycling: AI-powered sorting systems improve the recycling of textiles, enabling efficient reuse of fibers like recycled cotton and polyester.

- Consumer Insights & Trend Forecasting: AI analyzes market trends and consumer preferences, helping brands develop sustainable fiber-based products aligned with demand.

- Energy Efficiency in Manufacturing: AI-driven automation and machine learning reduce energy consumption and water usage in fiber production.

- Carbon Footprint Tracking: AI helps monitor and report emissions across the eco fibers supply chain, aiding companies in achieving sustainability goals.

Eco Fibers Market Regional Analysis

In 2023, Asia Pacific commanded the eco fiber market, holding a substantial 35.6% revenue share, & is expected for the highest growth in the forecast period, with growth in demand & a higher interest in sustainable textiles are key drivers driving the market expansion in major economies like China, India, Japan, & Australia.

India stands out as the fastest-growing market due to factors such as population growth, increased per capita apparel consumption, and rising foreign investments. However, the number of uses of polyester, acrylic fibers, & viscose in various applications across the region poses a challenge to eco-fiber growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Further, North America expected significant expansion in the eco-fiber market, which is attributed to demand across industrial, textiles, medical textiles, packaging, & household industries. Factors like initiatives in superior sports apparel development, an aging population, & a growing focus on sustainable practices contribute to the regional market's expected growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Eco Fibers Market Competitive Landscape

The global eco-fibers market is experiencing strong competition as companies look to meet the growing demand for sustainable textile solutions, as many players are developing eco-friendly technologies, introducing recycled materials, & improving production processes to minimize environmental impact.

With the rise in consumer awareness about ecological concerns, the competition in the eco fibers market revolves around building environmentally conscious products while maintaining quality & affordability.

In April 2023, Lenzing Group, a key producer of specialty fibers from wood, announced the introduction of carbon-neutral VEOCEL viscose fibers for Europe & the US, which enhances Lenzing's worldwide collection of sustainable viscose fibers, showcasing their commitment to eco-friendly practices in the textile industry.

Some of the prominent players in the global Eco Fibers Market are

- US Fibers

- Teijin Ltd

- Lenzing AG

- SATERI

- Universal Fibers

- Foss Performance Materials

- Wellman Advanced Materials

- Grasim Industries Ltd

- Polyfibre Industries

- China Bambro Textile Co Ltd

- Other Key Players

Recent Developments

- In February 2023, Sudamericana de Fibras (SDF), the top dry-spun acrylic fiber producer, launched Drytex Cycle, which contains 50% post-industrial content, meeting the Recycled Blended Claim Standard. Utilizing innovative technology, SDF recovers, cleans, & transforms industrial waste into staple fiber or top in a unique process, which is ready for production, initially offered in ecru.

- In October 2023, Birla Cellulose announced a revolutionary circular fiber blend, reinforcing its position as a leading producer of eco-friendly Man-Made Cellulosic Fibers (MMCF), which boosts the use of mechanically recycled fiber to 50%, ensuring strong yarn quality along with catering to various fabric & garment needs, marking a significant step towards sustainable & versatile production in diverse categories.

- In November 2023, Champion Athleticwear introduced its latest advancement: Eco Future Reverse Weave featuring CiCLO technology, which mimics natural fibers in synthetic textiles, reducing plastic fiber's impact on the environment. Also, innovation assigns an expiration date to polyester, creating it to act more like natural fibers over time, with the collection embracing sustainability further by utilizing natural ingredient-derived dyes, like pomegranate, annatto fruit, & Terminalia chebula fruit.

Eco Fibers Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 49.0 Bn |

| Forecast Value (2032) |

USD 97.0 Bn |

| CAGR (2023-2032) |

7.9% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Organic, Manmade/Regenerated, Recycled, and Natural), By Application (Textiles / Apparel, Household & Furnishing, Industrial, Medical, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

US Fibers, Teijin Ltd, Lenzing AG, SATERI, Universal Fibers, Foss Performance Materials, Wellman Advanced Materials, Grasim Industries Ltd, Polyfibre Industries, China Bambro Textile Co Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Eco Fibers Market?

▾ The Global Eco Fibers Market size is estimated to have a value of USD 49.0 billion in 2023 and is

expected to reach USD 97.0 billion by the end of 2032.

Which region accounted for the largest Global Eco Fibers Market?

▾ Asia Pacific has the largest market share for the Global Eco Fibers Market with a share of about 35.6% in

2023.

Who are the key players in the Global Eco Fibers Market?

▾ Some of the major key players in the Global Eco Fibers Market are US Fibers, Teijin Ltd, Lenzing AG, and

many others.

What is the growth rate in the Global Eco Fibers Market?

▾ The market is growing at a CAGR of 7.9 percent over the forecasted period.