Market Overview

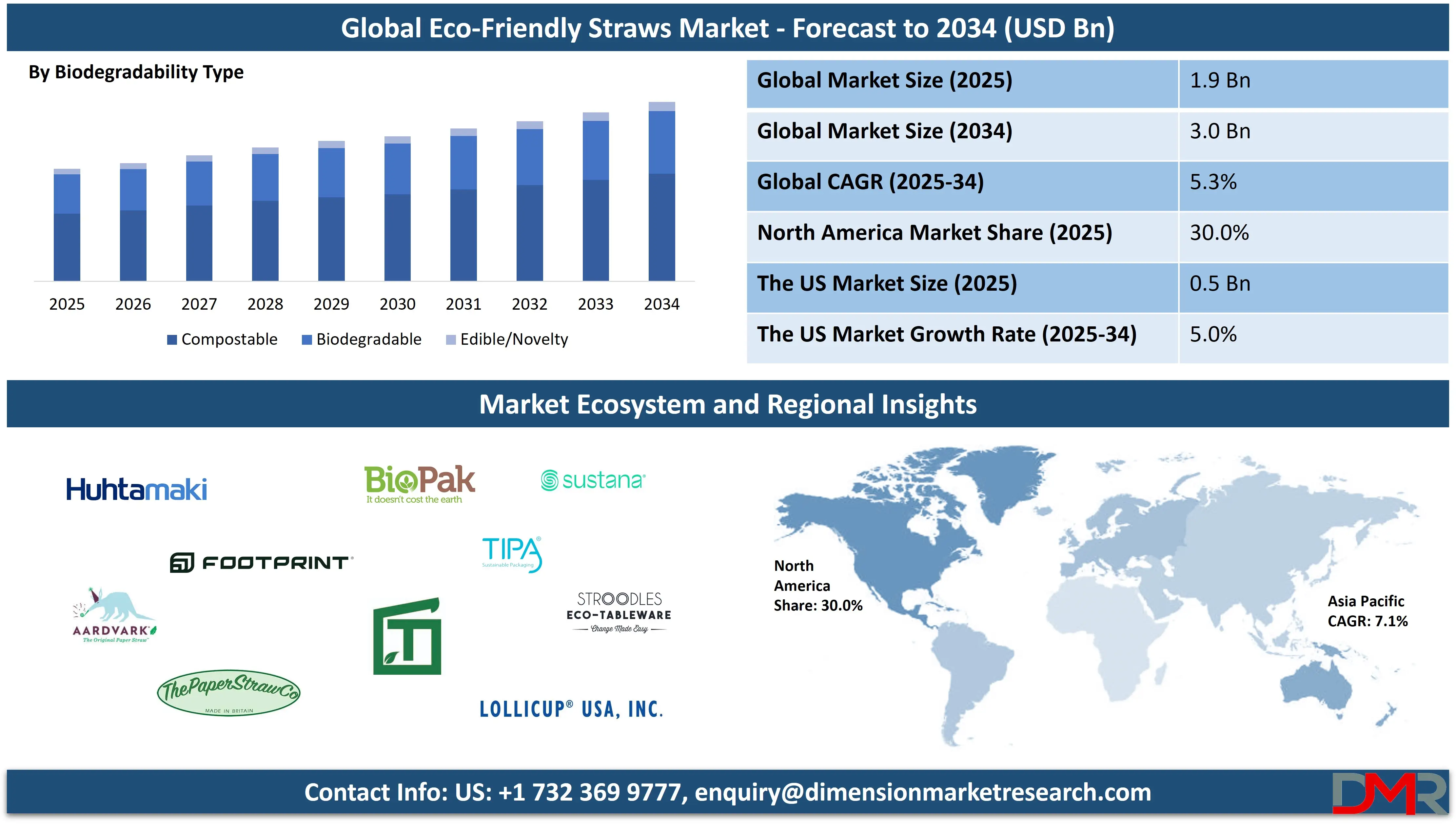

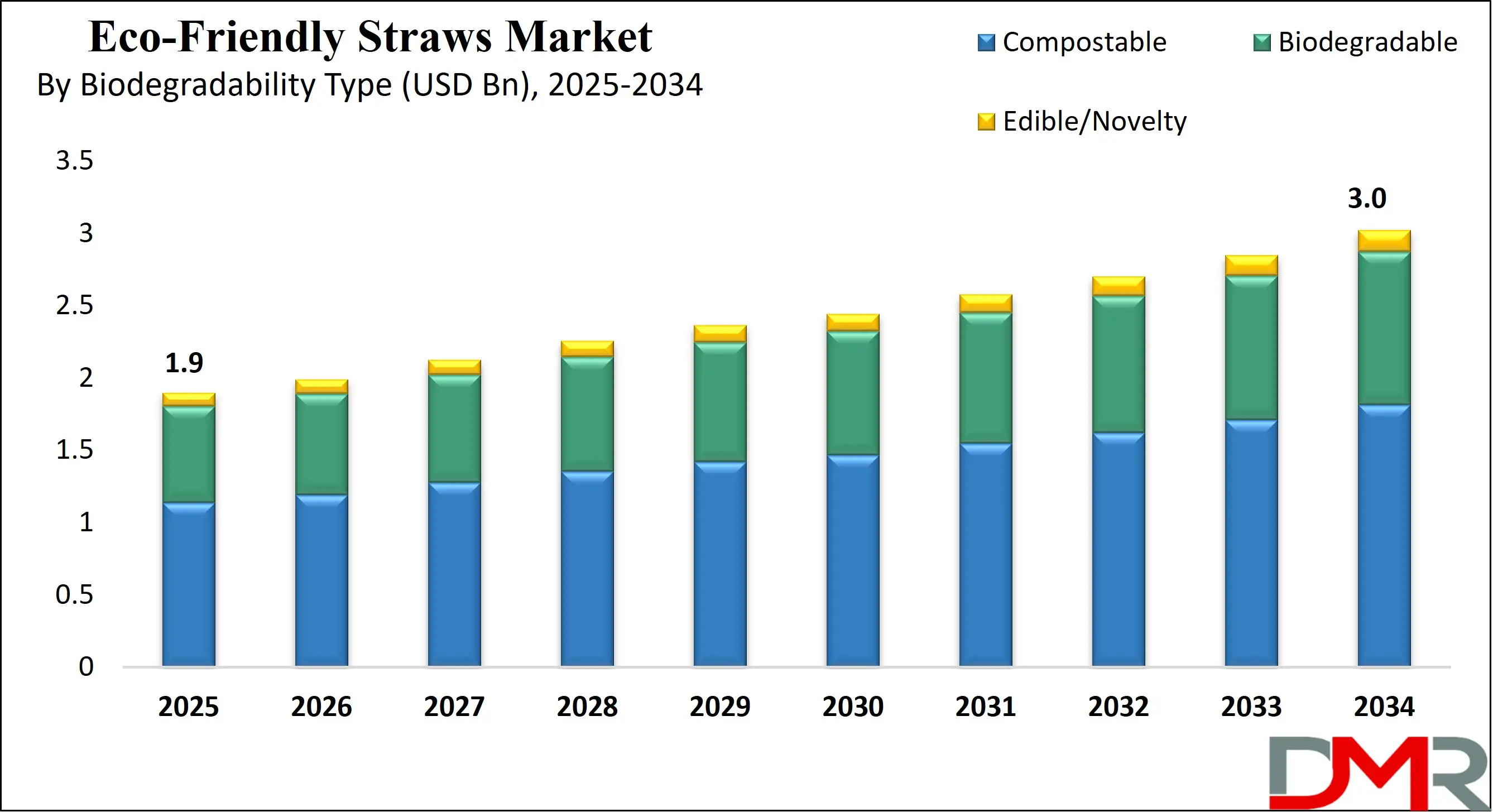

The Global Eco-Friendly Straws Market is projected to reach USD 1.9 billion in 2025 and is expected to grow at a CAGR of 5.3%, hitting approximately USD 3.0 billion by 2034. The market growth is driven by growing bans on single-use plastic, rising demand for sustainable packaging, and the adoption of biodegradable straws and reusable drinking alternatives across the foodservice, retail, and hospitality sectors.

Eco-friendly straws are sustainable alternatives to conventional plastic straws, designed to minimize environmental impact and promote responsible consumption. These straws are made from biodegradable plastics, compostable, or reusable materials, including paper, bamboo, metal, glass, silicone, polylactic acid (PLA), and even edible substances such as rice or pasta.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Unlike plastic straws that can persist in ecosystems for hundreds of years, eco-friendly variants decompose naturally or can be reused multiple times, making them a preferred choice for environmentally conscious consumers and businesses. Their rise in popularity is largely driven by growing public awareness of marine pollution, government regulations banning single-use plastics, and growing demand for zero-waste and sustainable drinking products.

The global Eco-Friendly Straws Market is evolving rapidly as sustainability becomes a critical component of consumer behavior and corporate responsibility. Businesses in the hospitality, food service, and retail sectors are actively switching to green alternatives in response to environmental regulations and shifting customer preferences.

The growing number of plastic bans across North America, Europe, and parts of Asia Pacific has significantly accelerated the demand for biodegradable straws and reusable straws. Public campaigns around ocean conservation and microplastic pollution have amplified the adoption of paper straws, bamboo straws, and other compostable options, especially among millennials and Gen Z consumers who value eco-conscious brands.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This market is also benefiting from technological advancements in food packaging and sustainable packaging materials, allowing manufacturers to offer straws that mimic the durability and functionality of plastic without the ecological harm. The rise of e-commerce and private-label green brands has expanded product accessibility, while strategic partnerships between foodservice giants and packaging machinery firms continue to foster innovation. As demand grows in emerging economies alongside urbanization and increased environmental awareness, the eco-friendly straws industry is poised to become an integral part of the global sustainable packaging and single-use alternative solutions landscape.

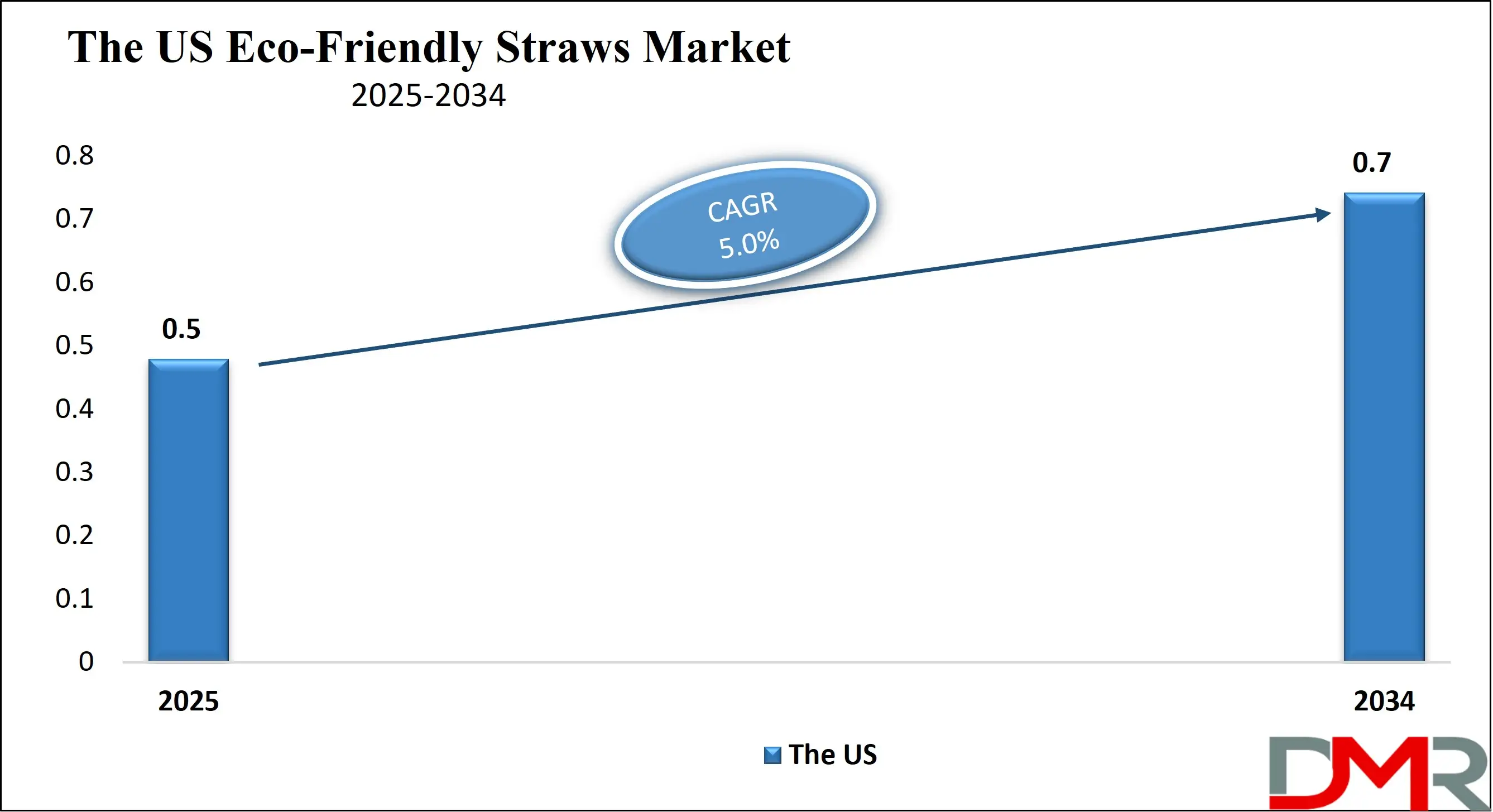

The US Eco-Friendly Straws Market

The U.S. Eco-Friendly Straws Market size is projected to be valued at USD 500 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 700 million in 2034 at a CAGR of 5.0%.

The U.S. market is witnessing robust growth, driven by stringent federal and state-level regulations banning single-use plastic drinking straws. With growing consumer awareness of ocean pollution and microplastics, demand for biodegradable straws, compostable paper straws, and reusable alternatives like metal and silicone has surged across the country. States such as California, New York, and Washington have implemented laws restricting plastic straw use, prompting foodservice chains, cafes, and QSRs (Quick Service Restaurants) to adopt sustainable drinking straw solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is further bolstered by the expanding presence of eco-packaging companies and green startups that specialize in innovative straw materials such as PLA (polylactic acid), bamboo, edible rice, and even recyclable silicone. Consumer preferences in the U.S. are rapidly shifting toward plant-based and non-toxic straw alternatives, especially among millennials and Gen Z. E-commerce platforms like Amazon and sustainable D2C brands have made these products more accessible, while national chains such as Starbucks, McDonald’s, and Whole Foods have already transitioned to eco-friendly options. With growing corporate sustainability mandates and ESG goals, the U.S. is set to remain a dominant contributor to the global eco-friendly straws market over the next decade.

Europe Eco-Friendly Straws Market

Europe is projected to hold a substantial share in the global eco-friendly straws market, with an estimated market value of approximately USD 494 million in 2025. This strong market presence is largely driven by strict environmental regulations across the European Union, particularly the implementation of the Single-Use Plastics Directive, which mandates the reduction and eventual elimination of plastic straw usage.

These regulations have prompted widespread adoption of biodegradable and compostable straw alternatives across the foodservice, hospitality, and retail sectors. European consumers are also among the most environmentally conscious globally, consistently choosing sustainable and plastic-free alternatives, which has encouraged brands and retailers to align their offerings with these values.

The region is expected to continue its upward trajectory with a projected CAGR of 5.8% from 2025 to 2034. This growth will be supported by growing investments in circular economy initiatives, expansion of composting infrastructure, and rising demand for certified sustainable products. Additionally, innovation in materials, such as seaweed-based or edible straws, integrated with strong government and private-sector collaboration on sustainability targets, will fuel market expansion. The presence of several regional eco-packaging leaders and favorable consumer habits make Europe not only a mature market but also an innovation hub for next-generation eco-friendly straw solutions.

Japan Eco-Friendly Straws Market

Japan is estimated to capture a market share of approximately USD 114 million in the global eco-friendly straws market by 2025. This growth is driven by Japan's strong government-led initiatives aimed at reducing plastic waste and promoting sustainable alternatives.

In response to the Plastic Resource Circulation Act and similar national policies, businesses across the country, from convenience stores to major beverage chains, have begun replacing plastic straws with biodegradable and plant-based options. Consumer awareness around environmental impact is also growing, especially among younger populations and urban consumers, which is further encouraging the shift toward eco-friendly consumption.

With a projected CAGR of 6.2% from 2025 to 2034, Japan is poised for steady growth in this segment. This momentum will be fueled by technological innovation in bio-based materials, high product quality standards, and strong participation from both domestic manufacturers and international brands.

Moreover, companies such as Starbucks Japan and other foodservice players are already leading the transition to compostable alternatives, setting industry benchmarks. As sustainability becomes a core part of Japan’s corporate and consumer culture, demand for eco-friendly straws is expected to grow not only in foodservice but also in retail and institutional applications, making Japan an important growth region in the global market landscape.

Global Eco-Friendly Straws Market: Key Takeaways

- Market Value: The global eco-friendly market size is expected to reach a value of USD 3.0 billion by 2034 from a base value of USD 1.9 billion in 2025 at a CAGR of 5.3%.

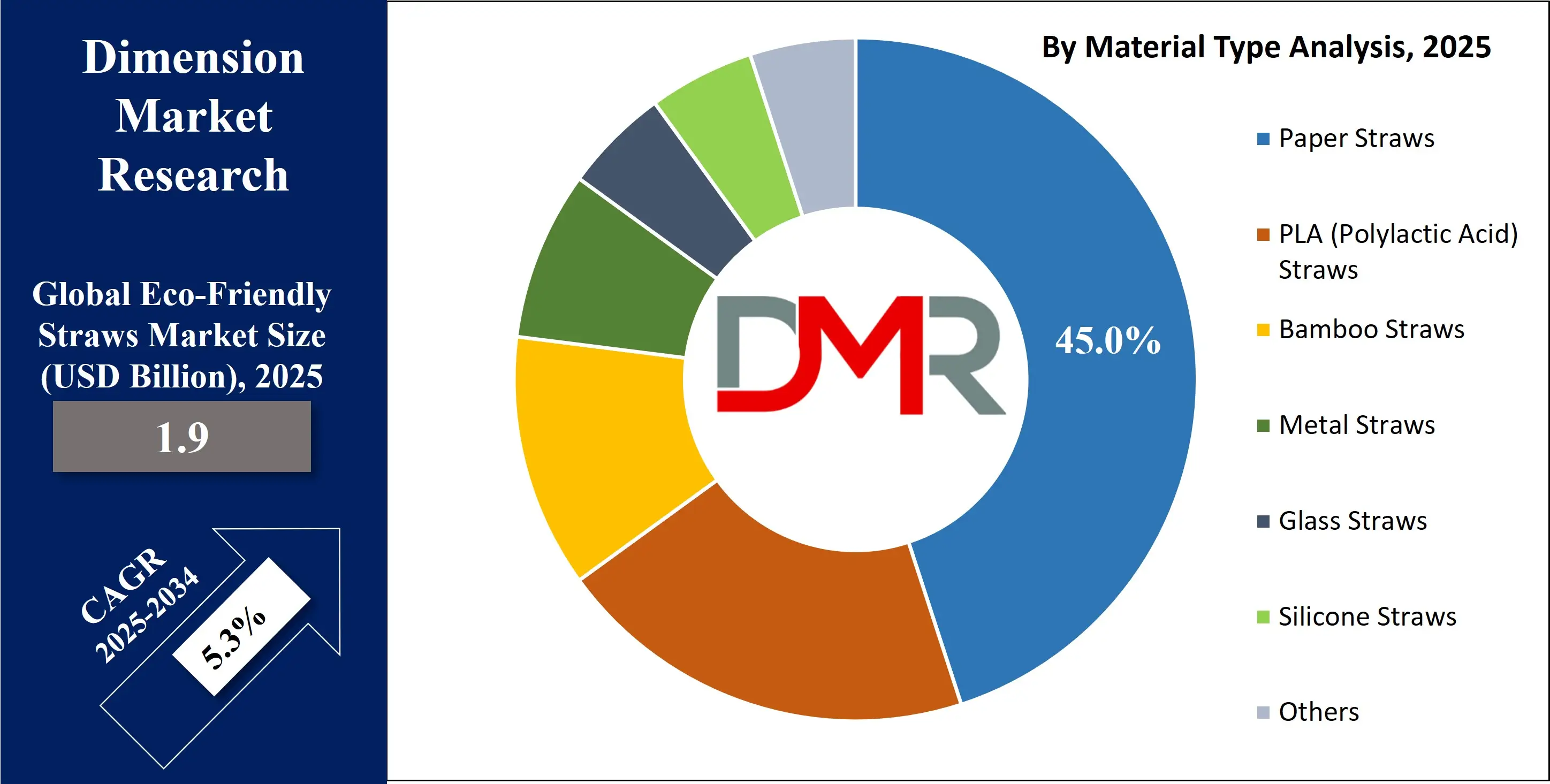

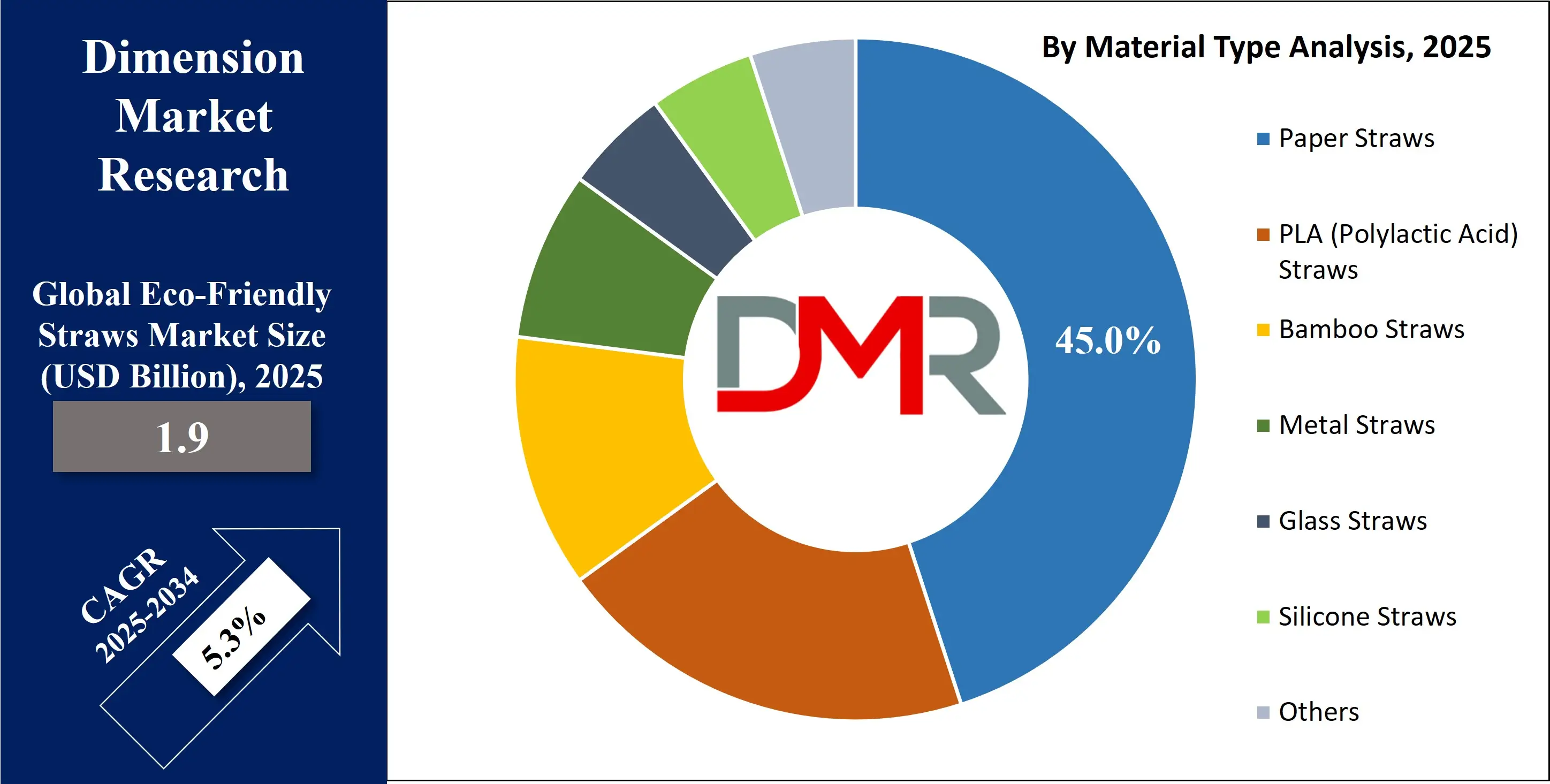

- By Material Type Segment Analysis: Paper Straws are anticipated to dominate the material type segment, capturing 45.0% of the total market share in 2025.

- By Biodegradability Type Segment Analysis: Compostable straws are poised to consolidate their dominance in the biodegradability type segment, capturing 60.0% of the total market share in 2025.

- By Straw Length Segment Analysis: Standard Size (7-8 inch) straws are expected to maintain their dominance in the straw length segment, capturing 65.0% of the total market share in 2025.

- By User Type Segment Analysis: Single-Use type will lead in the user type segment, capturing 70.0% of the market share in 2025.

- By End-Use Segment Analysis: Foodservice (HoReCa) will lead the end-use segment, capturing 50.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global eco-friendly market landscape with 30.0% of total global market revenue in 2025.

- Key Players: Some key players in the global eco-friendly market are Eco-Friendly Straws Market are Huhtamaki Oyj, Footprint LLC, Aardvark Straws (Hoffmaster Group Inc.), The Paper Straw Co., U.S. Paper Straw, Biopak, Transcend Packaging, Lollicup USA, Inc., Sustana Group, TIPA Corp Ltd., Soton Daily Necessities Co., Ltd., Stroodles, Vegware, and Others.

Global Eco-Friendly Straws Market: Use Cases

- Foodservice Industry Adoption: The foodservice sector, including cafes, fast-food chains, and restaurants, is one of the largest users of eco-friendly straws. Growing pressure from governments and environmentally aware customers has led businesses to shift away from single-use plastic straws. Paper, PLA, and bamboo straws are now commonly used in dine-in and takeaway operations. Major chains like Starbucks and McDonald’s have rolled out sustainable straw options globally, not only to meet regulatory demands but also to reinforce their commitment to environmental responsibility.

- Retail & Household Usage: Consumers are purchasing eco-friendly straws for home use, especially reusable options like metal, silicone, and glass straws. These products are commonly packaged in multi-use kits and sold through supermarkets, lifestyle stores, and online platforms. The rise of zero-waste living and sustainable consumer behavior has made these straws popular in everyday household settings, especially among families and younger, eco-conscious buyers. Many brands now offer compostable and BPA-free variants to cater to growing health and environmental concerns.

- Hospitality & Tourism Sector Compliance: Hotels, resorts, and cruise operators are moving toward plastic-free alternatives as part of broader sustainability goals and regional compliance with plastic ban laws. Eco-friendly straws, made from wheat, paper, or edible materials, are being adopted across in-room dining, bars, and event services. These changes not only reduce the environmental impact in fragile ecosystems like beaches and coastal areas but also enhance brand value by appealing to eco-tourists and sustainability-minded travelers.

- Institutional Implementation: Eco-friendly straws are being adopted by schools, hospitals, and corporate campuses, aiming to align with sustainability goals and responsible procurement practices. In educational institutions, they are often used to promote environmental awareness among students. In healthcare, biodegradable and flexible straws offer safe and eco-conscious alternatives for patient care. Corporations and tech campuses are incorporating such products into their dining services as part of their ESG strategy, aiming to reduce plastic waste and promote green operations internally.

Impact of Artificial Intelligence in the Eco-Friendly Straws Market

- Smart Manufacturing and Process Optimization: AI-powered systems are transforming production lines by optimizing manufacturing processes for eco-friendly straws. From material selection to molding precision, AI algorithms help reduce waste, monitor energy consumption, and enhance product consistency. Machine learning models predict the optimal mix of biodegradable compounds, ensuring stronger, more durable straws while minimizing material usage. This leads to cost savings and increased production efficiency, especially in large-scale operations.

- Predictive Demand and Inventory Management: AI-driven demand forecasting tools analyze real-time data on consumer trends, regulations, and environmental campaigns to accurately predict shifts in market demand. Manufacturers can leverage this to align their production volumes and inventory levels with regional preferences, such as compostable straws in Europe or reusable bamboo straws in Asia, reducing overproduction and supply chain inefficiencies.

- Customization and Product Innovation: AI enables rapid prototyping and customization of straws based on consumer feedback and design trends. By analyzing customer reviews, sales patterns, and social media insights, AI tools guide companies in developing novel straw types, like edible or color-changing straws, that appeal to niche markets. This promotes innovation while aligning with sustainability goals.

- Quality Control and Sustainability Compliance: Computer vision and AI-powered inspection systems are used for quality assurance during the production of eco-friendly straws. These systems can detect defects, contamination, or structural weaknesses more accurately than manual inspections. Moreover, AI helps companies stay compliant with global environmental standards by tracking material sources, recyclability, and carbon footprint in real time.

- Marketing and Consumer Engagement: AI-driven analytics tools segment eco-conscious consumer groups and personalize marketing strategies. Brands use AI to create targeted campaigns that highlight sustainability certifications, composting benefits, or reusable features, thus improving brand visibility and consumer trust. Chatbots and AI assistants also enhance user experience across e-commerce platforms selling eco-friendly straws.

- Supply Chain Transparency: AI and blockchain integration help ensure transparent sourcing and logistics for eco-friendly raw materials like PLA, bamboo, or paper pulp. With growing consumer scrutiny over greenwashing, AI helps trace the product journey, from raw material origin to end-use, enhancing authenticity and consumer confidence.

Global Eco-Friendly Straws Market: Stats & Facts

-

White House (Biden‑Harris Administration)

- Federal goal to phase out single-use plastics in food service by 2027 and across all operations by 2035.

- Over 90% of plastic is derived from fossil fuels.

- Federal agencies must divert at least 50% of non‑hazardous solid waste, including plastics, from landfills by FY 2025.

- The diversion goal increases to 75% by FY 2030.

- The EPA’s Trash Free Waters program is investing in reusable foodware pilot projects in four U.S. cities.

- The federal sustainability plan under Executive Order 14057 aims for net-zero procurement by 2050.

-

White House (Trump Administration, 2025)

- Federal procurement of paper straws was ended by executive order in February 2025.

- Studies cited by the administration showed paper straws contained PFAS chemicals, while plastic straws did not.

- Producing paper straws has a higher carbon footprint and water usage compared to plastic straws.

-

U.S. Government Accountability Office (GAO) & Department of Defense (2024)

- Military commissaries in Washington, D.C. transitioned to reusable or paper straws due to local bans.

- DOD Instruction 4715.23 mandates integrated recycling and solid waste management across military bases.

- Most plastic recycling in the U.S. results in downcycling, which degrades the quality of the material.

- The U.S. recycling system was heavily reliant on exports before China’s 2018 ban on contaminated plastic waste.

-

U.S. Congress (Break Free From Plastic Pollution Act, 2023)

- Legislation was introduced to amend the Solid Waste Disposal Act, targeting single-use plastics.

- The act aims to hold manufacturers accountable for the end-of-life impact of plastic products.

Global Eco-Friendly Straws Market: Market Dynamics

Global Eco-Friendly Straws Market: Driving Factors

Global Plastic Bans and Regulatory Pressure

A growing number of countries have implemented strict regulations on single-use plastics, including plastic straws, to combat environmental degradation and marine pollution. These government-led initiatives are compelling businesses to transition to eco-friendly alternatives across the foodservice, hospitality, and retail sectors. Regulatory pressure has accelerated innovation in sustainable packaging and positioned biodegradable straws as a preferred substitute.

Rise in Eco-Conscious Consumer Behavior

There is a significant shift in consumer preference toward environmentally responsible products. Consumers are choosing reusable and compostable straws over plastic counterparts as part of broader zero-waste and sustainable living movements. This growing eco-awareness, especially among younger demographics, is influencing purchasing decisions and driving market demand across both online and offline retail channels.

Global Eco-Friendly Straws Market: Restraints

High Production Costs and Price Sensitivity

Eco-friendly straws, particularly those made from bamboo, PLA, or metal, are often more expensive to produce than conventional plastic straws. The higher cost can be a deterrent for small businesses, especially in developing markets where price sensitivity remains high. Additionally, fluctuating raw material availability can affect profitability and large-scale adoption.

Performance and Durability Limitations

Some biodegradable and paper-based straws have durability issues, becoming soggy or collapsing when used with hot or thick beverages. These performance concerns affect user satisfaction and can limit acceptance in certain foodservice environments, particularly those that prioritize convenience and speed.

Global Eco-Friendly Straws Market: Opportunities

Expansion in Emerging Markets

As urbanization and sustainability awareness rise in regions like Asia Pacific, Latin America, and the Middle East, the demand for eco-friendly straws is gaining traction. Government-backed environmental campaigns and growing middle-class consumer bases present untapped growth opportunities for manufacturers offering affordable and scalable green alternatives.

Innovation in Materials and Customization

Ongoing R&D efforts are creating opportunities to develop next-gen straws using novel, sustainable materials like edible rice, seaweed, or sugarcane fiber. Additionally, brands are exploring customization and branding options for eco-straws, offering businesses a way to align sustainability with marketing strategies and enhance brand value.

Global Eco-Friendly Straws Market: Trends

Rise of Reusable Straw Kits in Consumer Retail

The popularity of reusable straw kits, featuring metal, silicone, or glass straws with cleaning tools, is growing in the consumer retail segment. These kits are positioned as lifestyle products and often come with eco-friendly packaging, aligning with the broader shift toward plastic-free living and zero-waste home habits.

Private Label and E-commerce Growth

The rise of private label brands and the growth of e-commerce platforms have made eco-friendly straws more accessible to consumers globally. Online marketplaces are driving visibility and variety, while D2C brands are leveraging subscription models and influencer marketing to build loyal customer bases focused on sustainability.

Global Eco-Friendly Straws Market: Research Scope and Analysis

By Material Type Analysis

Paper straws are expected to lead the material type segment in the global eco-friendly straws market, accounting for around 45.0% of the total market share in 2025. Their dominance is largely driven by their affordability, widespread availability, and ease of adoption across the foodservice and hospitality sectors. As regulatory bans on plastic straws continue to tighten globally, businesses are seeking cost-effective, biodegradable alternatives that can be quickly integrated into daily operations without significantly growing expenses.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Paper straws fulfill this need effectively. They are also highly customizable, allowing brands to print logos or promotional messages, which adds marketing value. Despite some concerns over their durability, improvements in water-resistant coatings and multi-ply designs are enhancing product quality, making paper straws suitable for a broader range of beverage types.

Alongside paper, PLA (polylactic acid) straws are also gaining traction in the eco-friendly straws market. Made from renewable resources like corn starch or sugarcane, PLA straws offer the appearance and functionality of plastic but are compostable under industrial conditions. They are especially popular in settings where customers expect the strength and performance of conventional plastic straws, such as fast-food chains, movie theaters, and cafes.

However, one of the challenges with PLA straws is the need for specific composting environments to break down properly, something not readily available in all regions. Despite this, growing investments in composting infrastructure and rising consumer demand for plant-based packaging alternatives are helping to support the steady growth of PLA straws in the overall market.

By Biodegradability Type Analysis

Compostable straws are set to maintain a dominant position in the biodegradability type segment of the global eco-friendly straws market, projected to account for 60.0% of the total market share in 2025. This stronghold is largely attributed to growing regulatory support for compostable materials and the growing demand from both businesses and consumers for packaging solutions that leave minimal environmental impact. Compostable straws, often made from materials like PLA, bagasse, or wheat, break down into natural elements under composting conditions, typically within a few months.

Their ability to decompose without leaving toxic residues makes them an attractive option for foodservice providers, especially in regions with industrial composting facilities. Many governments and municipalities also encourage the use of certified compostable products, adding further momentum to their market expansion. Moreover, these straws align well with corporate sustainability goals and consumer expectations for zero-waste and plastic-free alternatives.

On the other hand, biodegradable straws, while also eco-friendly, differ in how and where they decompose. These straws can be made from similar plant-based materials, but they generally take longer to break down and may require specific environmental conditions such as heat, moisture, and microbial activity.

Although they are more sustainable than plastic, biodegradable straws are often seen as a transitional option, particularly in areas lacking access to composting facilities. They are commonly used in regions with moderate environmental regulations or where cost efficiency is a concern. Despite these limitations, the biodegradable segment continues to grow, supported by advancements in material science and growing awareness about reducing single-use plastic waste.

By Straw Length Analysis

Standard size straws, typically ranging from 7 to 8 inches in length, are projected to hold the largest share in the straw length segment, accounting for approximately 65.0% of the global eco-friendly straws market in 2025. Their widespread dominance is driven by their compatibility with a broad variety of beverages and standard cup sizes used across the foodservice, hospitality, and retail sectors.

These straws are commonly found in fast-food outlets, cafes, and restaurants serving water, soft drinks, iced teas, and juices. Their ease of production, cost-effectiveness, and consumer familiarity contribute significantly to their continued preference. Additionally, they are available in a wide range of biodegradable and compostable materials, making them the go-to choice for businesses transitioning away from single-use plastic.

In comparison, jumbo or long straws, typically between 9 and 10 inches, are designed for specialty beverages like smoothies, milkshakes, and bubble tea, which require a wider and longer straw for ease of consumption. While they serve a more niche purpose, their demand is growing steadily due to the rising popularity of thick beverages in quick-service and specialty drink outlets.

These straws are often made from more durable eco-materials to maintain structural integrity during use, especially with denser liquids. Although they represent a smaller portion of the overall market, the jumbo/long straw segment is gaining traction in urban areas and among premium beverage brands seeking sustainable yet functional solutions. Their adoption is likely to rise as consumer interest in specialty drinks continues to grow.

By User Type Analysis

Single-use straws are projected to lead the user type segment of the global eco-friendly straws market, capturing around 70.0% of the total market share in 2025. Their dominance is primarily driven by the high demand from fast-paced foodservice operations, including quick-service restaurants, cafes, takeout chains, and events where convenience and hygiene are key priorities. These straws are designed for one-time use and are typically made from biodegradable materials such as paper, PLA, or wheat. With growing regulatory pressure to eliminate plastic straws, businesses are opting for single-use eco-friendly alternatives that can be easily integrated into existing service models without requiring cleaning or reuse.

Their low cost, mass availability, and disposability make them the preferred choice for high-volume consumption environments, especially in regions with strong environmental compliance requirements.

In contrast, multi-use straws, which include those made from materials like stainless steel, glass, silicone, or bamboo, are geared toward long-term use and are primarily targeted at individual consumers or niche hospitality segments. These straws are often sold in kits with cleaning brushes and travel pouches, catering to zero-waste households, eco-conscious consumers, and health-conscious buyers who prefer durable, non-toxic options.

Although their market share is smaller, multi-use straws are gaining popularity due to growing awareness about sustainability and the long-term cost savings they offer. They are particularly popular in retail, e-commerce platforms, and specialty stores, and are also used in select premium cafes and environmentally focused establishments that promote reusable product practices.

By End-Use Analysis

The foodservice sector, encompassing hotels, restaurants, and catering services (HoReCa), is expected to dominate the end-use segment of the global eco-friendly straws market, accounting for approximately 50.0% of the total market share in 2025. This leadership is fueled by the industry's large-scale consumption of straws and the urgent need to comply with regional plastic bans and sustainability mandates.

Establishments across the HoReCa sector are switching to compostable and biodegradable straw options to align with environmental standards, reduce waste, and enhance brand reputation. The use of eco-friendly straws has become a standard practice in cafes, fast-food outlets, and fine-dining restaurants, especially in urban markets where consumers actively support businesses with sustainable practices. High turnover of disposable items and the demand for hygienic, single-use products make this sector the largest consumer of eco-friendly straws.

On the other hand, the household segment, while smaller in market share, is steadily growing due to growing consumer awareness of plastic waste and the rise of sustainable living habits. Households are adopting both single-use compostable straws and reusable options like metal, silicone, and bamboo for everyday use.

These products are typically sold in sets through retail and online platforms, appealing to families and individuals aiming to reduce their environmental footprint. The household segment is also benefiting from lifestyle trends such as zero-waste living and health-conscious consumption, where consumers are seeking non-toxic and reusable alternatives for home beverages, smoothies, and children's drinks. As more people seek to bring sustainability into their personal routines, this segment is expected to grow steadily over the coming years.

The Eco-Friendly Straws Market Report is segmented on the basis of the following

By Material Type

- Paper Straws

- PLA Straws

- Bamboo Straws

- Metal Straws

- Glass Straws

- Silicone Straws

- Others

By Biodegradability Type

- Compostable

- Biodegradable

- Edible/Novelty

By Straw Length

- Standard Size (7-8 inch)

- Jumbo/Long (9-10 inch)

- Mini (<6 inch)

By User Type

By End-Use

- Foodservice (HoReCa)

- Household

- Institutional

- Commercial/Industrial

- Retail

Global Eco-Friendly Straws Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global eco-friendly straws market in 2025, capturing around 30.0% of the total market revenue. This dominance is largely driven by stringent government regulations against single-use plastics, strong environmental advocacy, and widespread consumer awareness about sustainability.

The United States and Canada have implemented various state and federal-level bans and restrictions on plastic straws, prompting rapid adoption of biodegradable and compostable alternatives across the foodservice, hospitality, and retail sectors. Additionally, the presence of key market players, early adoption of sustainable practices by major restaurant chains, and a well-established distribution network contribute to North America's leading position in the global eco-friendly straws industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is projected to experience significant growth in the eco-friendly straws market over the coming years, driven by rapid urbanization, growing environmental awareness, and rising government initiatives to reduce plastic waste. Countries like China, India, Japan, and Australia are witnessing a surge in demand for sustainable alternatives due to growing consumer consciousness and expanding foodservice sectors.

Local regulations banning or restricting single-use plastics are also pushing businesses to adopt biodegradable and compostable straw options. Furthermore, the presence of a large manufacturing base, growing adoption of eco-friendly products among millennials, and the rise of local green startups are expected to accelerate the region’s market expansion, making Asia Pacific a key growth contributor globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Eco-Friendly Straws Market: Competitive Landscape

The global competitive landscape of the eco-friendly straws market is characterized by the presence of both established packaging giants and emerging sustainable startups, all striving to gain a foothold in a rapidly evolving industry. Key players such as Huhtamaki Oyj, Footprint LLC, and Hoffmaster Group (Aardvark Straws) lead the market through large-scale production capabilities, strong distribution networks, and a focus on innovation in compostable and biodegradable materials.

At the same time, niche brands and regional manufacturers are gaining traction by offering customizable, locally sourced, and cost-effective solutions tailored to specific consumer and regulatory needs. Strategic partnerships with foodservice chains, product diversification (e.g., edible or reusable straws), and investments in R&D are central to maintaining competitive advantage. With growing demand and regulatory pressure, companies are also emphasizing certifications, sustainable sourcing, and environmentally responsible branding to differentiate themselves in a highly competitive global market.

Some of the prominent players in the global eco-friendly straws market are

- Huhtamaki Oyj

- Footprint LLC

- Aardvark Straws (Hoffmaster Group Inc.)

- The Paper Straw Co.

- U.S. Paper Straw

- Biopak

- Transcend Packaging

- Lollicup USA, Inc.

- Sustana Group

- TIPA Corp Ltd.

- Soton Daily Necessities Co., Ltd.

- Stroodles

- Vegware

- Eco-Products, Inc.

- Hello Straw

- The Blue Straw

- Bambu Home

- Simply Straws

- Greenmunch

- ALBayrak Paper Industries

- Other Key Players

Global Eco-Friendly Straws Market: Recent Developments

- July 2025: Corn Next introduced non-toxic, biodegradable straws made from cornstarch, water, and natural enzymes. These straws are PFAS-free, durable in cold drinks for up to two hours, and priced competitively, offering a safer and eco-friendly alternative to traditional options.

- June 2025: Teknor Apex acquired Danimer Scientific, a major player in bioplastics, to expand its offerings in compostable materials. The deal strengthens Teknor Apex’s position in the sustainable packaging sector by integrating Danimer’s PHA-based solutions.

- December 2024: Starbucks began offering Green Planet™ straws across its stores in Japan. These plant-based biodegradable straws are designed to decompose naturally in both soil and seawater, reinforcing the company’s sustainability efforts in the Asia-Pacific region.

- January 2024: Hoffmaster Group, backed by Wellspring Capital, completed the acquisition of Aardvark Straws, a leading U.S. paper straw manufacturer. This move was aimed at expanding Hoffmaster’s eco-friendly product portfolio and growing production capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.9 Bn |

| Forecast Value (2034) |

USD 3.0 Bn |

| CAGR (2025–2034) |

5.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material Type (Paper Straws, PLA Straws, Bamboo Straws, Metal Straws, Glass Straws, Silicone Straws, Others), By Biodegradability Type (Compostable, Biodegradable, Edible/Novelty), By Straw Length (Standard Size (7–8 inch), Jumbo/Long (9–10 inch), Mini (<6 inch)), By User Type (Single-Use, Multi-Use), and By End-Use (Foodservice (HoReCa), Household, Institutional, Commercial/Industrial, Retail) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Huhtamaki Oyj, Footprint LLC, Aardvark Straws (Hoffmaster Group Inc.), The Paper Straw Co., U.S. Paper Straw, Biopak, Transcend Packaging, Lollicup USA, Inc., Sustana Group, TIPA Corp Ltd., Soton Daily Necessities Co., Ltd., Stroodles, Vegware, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global eco-friendly market?

▾ The global eco-friendly market size is estimated to have a value of USD 1.9 billion in 2025 and is expected to reach USD 3.0 billion by the end of 2034.

What is the size of the US eco-friendly market?

▾ The US eco-friendly market is projected to be valued at USD 0.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 0.7 billion in 2034 at a CAGR of 5.0%.

Which region accounted for the largest global eco-friendly market?

▾ North America is expected to have the largest market share in the global eco-friendly market, with a share of about 30.0% in 2025.

Who are the key players in the global eco-friendly market?

▾ Some of the major key players in the global eco-friendly market are Huhtamaki Oyj, Footprint LLC, Aardvark Straws (Hoffmaster Group Inc.), The Paper Straw Co., U.S. Paper Straw, Biopak, Transcend Packaging, Lollicup USA, Inc., Sustana Group, TIPA Corp Ltd., Soton Daily Necessities Co., Ltd., Stroodles, Vegware, and Others.

What is the growth rate of the global eco-friendly market?

▾ The market is growing at a CAGR of 5.3 percent over the forecasted period.