Market Overview

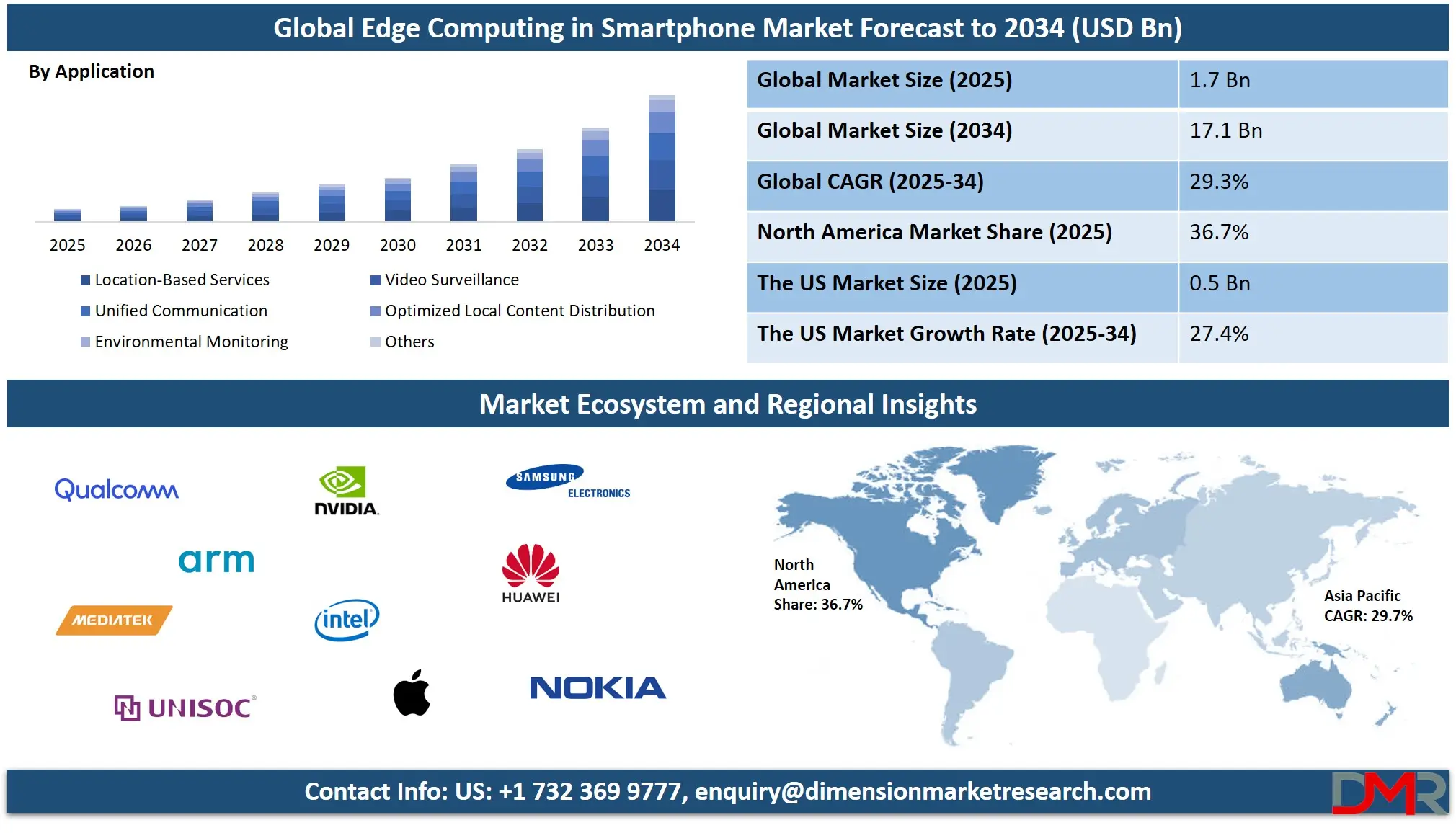

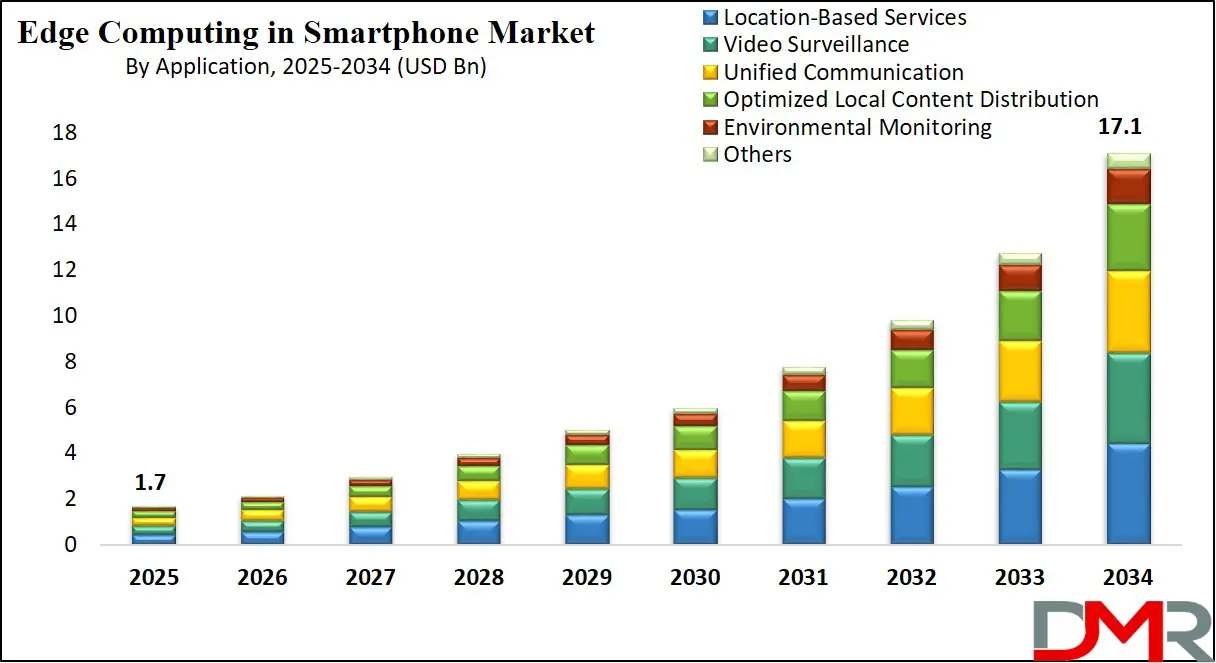

The Global Edge Computing in Smartphone Market size is projected to grow from USD 1.7 billion in 2025 to USD 17.1 billion by 2034, expanding at a robust CAGR of 29.3%, driven by rising demand for low-latency mobile applications, on-device AI processing, and 5G-enabled edge infrastructure.

Edge computing in smartphones refers to the integration of data processing capabilities directly into mobile devices, enabling real-time analysis and decision-making at the source of data generation. Unlike traditional cloud computing, where data is sent to centralized servers, edge computing reduces latency by processing information locally, often through advanced chipsets and AI accelerators embedded within the device.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This technology empowers smartphones to run applications such as augmented reality, real-time translation, facial recognition, and gaming with higher responsiveness and minimal delay. It significantly enhances user experience by minimizing reliance on network conditions while ensuring data privacy and reducing bandwidth consumption. As smartphones evolve into more intelligent, context-aware devices, edge computing becomes essential for unlocking their full potential, particularly in a 5G environment that demands ultra-low latency and high throughput for seamless mobile performance.

The global edge computing in the smartphone market is witnessing accelerated momentum as telecom infrastructure improves and next-generation mobile applications demand real-time responsiveness. The convergence of 5G deployment, artificial intelligence, and Internet of Things ecosystems is pushing mobile manufacturers and chipset developers to prioritize edge capabilities within their devices. Companies like Qualcomm, Apple, and MediaTek are at the forefront, developing SoCs (System-on-Chip) that support neural processing units and low-power AI inference engines.

These developments allow smartphones to manage intensive computational tasks locally, such as video rendering, image enhancement, and intelligent voice recognition, without relying heavily on cloud infrastructure. This shift in computational design is not only improving device performance but also reducing operational costs associated with data transmission and cloud access.

Market growth is being driven by growing consumer demand for advanced mobile applications that require instantaneous feedback and seamless connectivity. Applications such as mobile gaming, autonomous navigation, smart photography, and edge-assisted health monitoring systems are gaining popularity, especially in urbanized and tech-savvy regions. Asia-Pacific, with its massive smartphone user base and early 5G adoption in countries like South Korea, China, and Japan, is emerging as a leading contributor to edge computing deployment in mobile ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

North America and Europe are following suit, supported by strong investments in telecom infrastructure and mobile hardware innovations. Edge-enabled smartphones are also being seen as pivotal tools in bridging digital divides by offering powerful computing capabilities even in low-bandwidth or rural areas where cloud access may be limited.

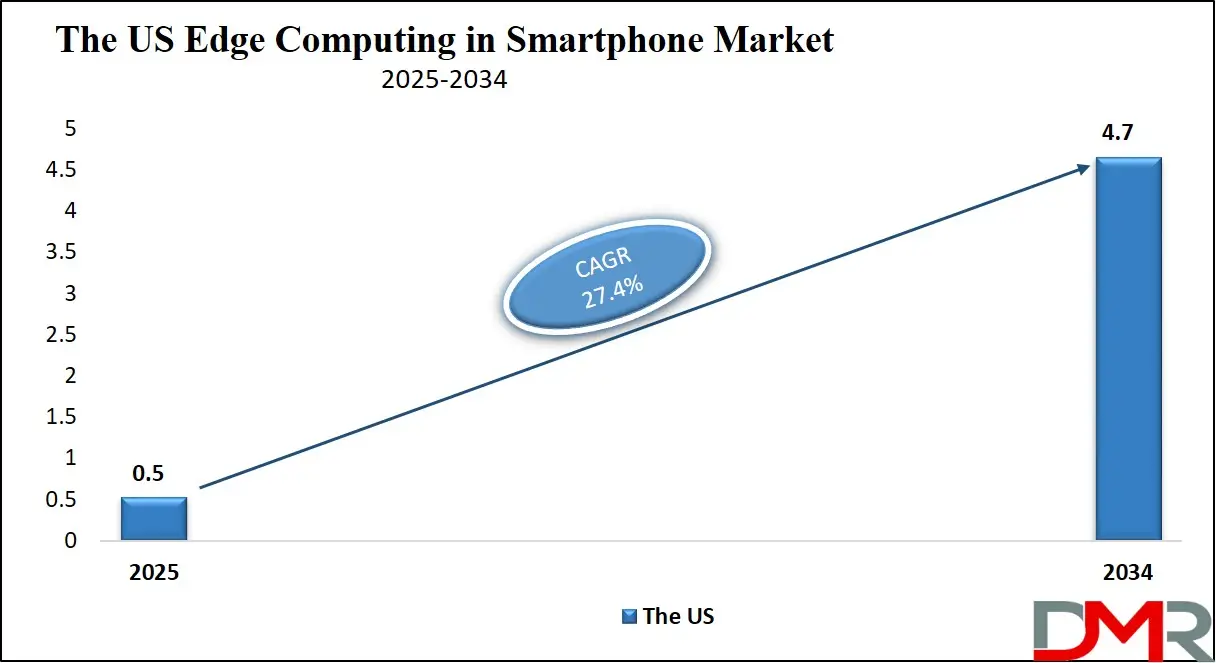

The US Edge Computing in Smartphone Market

The U.S. Edge Computing in Smartphone Market size is projected to be valued at USD 0.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4.7 billion in 2034 at a CAGR of 27.4%.

The U.S. edge computing in the smartphone market is experiencing rapid acceleration, fueled by widespread 5G rollout, growing adoption of AI-driven mobile applications, and a growing emphasis on data privacy. American consumers are leading the charge in embracing low-latency, real-time mobile services such as smart voice assistants, augmented reality, and mobile gaming, all of which benefit significantly from edge processing.

U.S.-based tech giants like Apple, Qualcomm, and Google are pioneering advancements in edge-enabled chipsets and neural processing units (NPUs), ensuring that smartphones can handle complex computational tasks locally without routing data to distant cloud servers. This not only enhances user experience through faster response times but also addresses growing concerns around data security and bandwidth optimization in a data-intensive environment.

The U.S. market also benefits from a robust ecosystem of telecom infrastructure, cloud-edge hybrid architectures, and strategic public-private investments supporting edge innovation. As more industries integrate mobile edge solutions into consumer-facing applications, ranging from telehealth to mobile banking, the smartphone becomes a powerful edge node within the broader edge computing landscape.

Government support for next-generation connectivity and AI research further strengthens the country’s leadership in this segment. With growing emphasis on domestic semiconductor production and AI regulation, the U.S. is well-positioned to remain a key player in shaping the global edge computing in the smartphone market over the next decade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Edge Computing in Smartphone Market

The European edge computing in the smartphone market is poised for significant growth, projected to reach USD 0.3 billion in 2025 with a CAGR of 27.1%.

This growth is fueled by the region's rapid 5G rollout, which enables high-speed, low-latency connections that are essential for real-time data processing on smartphones. As industries like healthcare, automotive, and manufacturing require on-device computing for applications such as real-time diagnostics, autonomous driving, and smart factories, the demand for edge-enabled mobile devices is expected to surge.

Furthermore, Europe's regulatory environment, especially with the General Data Protection Regulation (GDPR), encourages local data processing, making edge computing an attractive solution for consumers and enterprises concerned with data privacy.

Moreover, Europe’s robust technology infrastructure and innovation ecosystem play a critical role in accelerating the adoption of edge computing. Collaborations between telecom operators, mobile manufacturers, and tech firms are driving the development of edge-powered smartphones that support next-generation applications in augmented reality, mobile gaming, and video streaming.

With a growing number of businesses embracing digital transformation, the need for low-latency, high-performance mobile devices is growing, positioning Europe as a key market for edge computing solutions. This trend, integrated with the rising demand for advanced mobile applications and secure data processing, ensures that the European market will remain a strong driver of edge computing growth in the coming years.

The Japanese Edge Computing in Smartphone Market

Japan’s edge computing in smartphone market is projected to reach a market value of approximately USD 0.1 billion in 2025, with a compound annual growth rate (CAGR) of 24.8% from 2025 to 2034.

This growth is driven by Japan’s strong focus on technological advancements and its rapid adoption of 5G networks, which are essential for the seamless integration of edge computing in smartphones. The country’s commitment to innovation in sectors such as robotics, automotive, and healthcare is creating a growing demand for real-time data processing and low-latency mobile applications.

Edge computing allows Japan's industries to process data locally on smartphones, reducing reliance on centralized cloud systems and enabling faster decision-making and enhanced user experiences. Moreover, Japan’s smart city initiatives and growing demand for autonomous vehicles are pushing the need for edge-enabled smartphones that support advanced applications such as AI-powered navigation, surveillance, and remote diagnostics.

Additionally, Japan's consumer base is highly tech-savvy and demands high-performance smartphones capable of delivering sophisticated applications like augmented reality (AR), virtual reality (VR), and cloud gaming. With these trends in mind, edge computing is becoming a key enabler of mobile innovation, helping to address issues such as latency and data security.

Japan's strong partnerships between telecom operators, technology developers, and mobile manufacturers further support the growth of the edge computing market, making it a critical player in the global landscape. As Japan continues to evolve into a hub for digital transformation and cutting-edge mobile technologies, its edge computing in smartphone market is poised for rapid growth, with a CAGR of 24.8% underscoring its emerging role in this dynamic sector.

Global Edge Computing in Smartphone Market: Key Takeaways

- Market Value: The global edge computing in smartphone size is expected to reach a value of USD 17.1 billion by 2034 from a base value of USD 1.7 billion in 2025 at a CAGR of 29.3%.

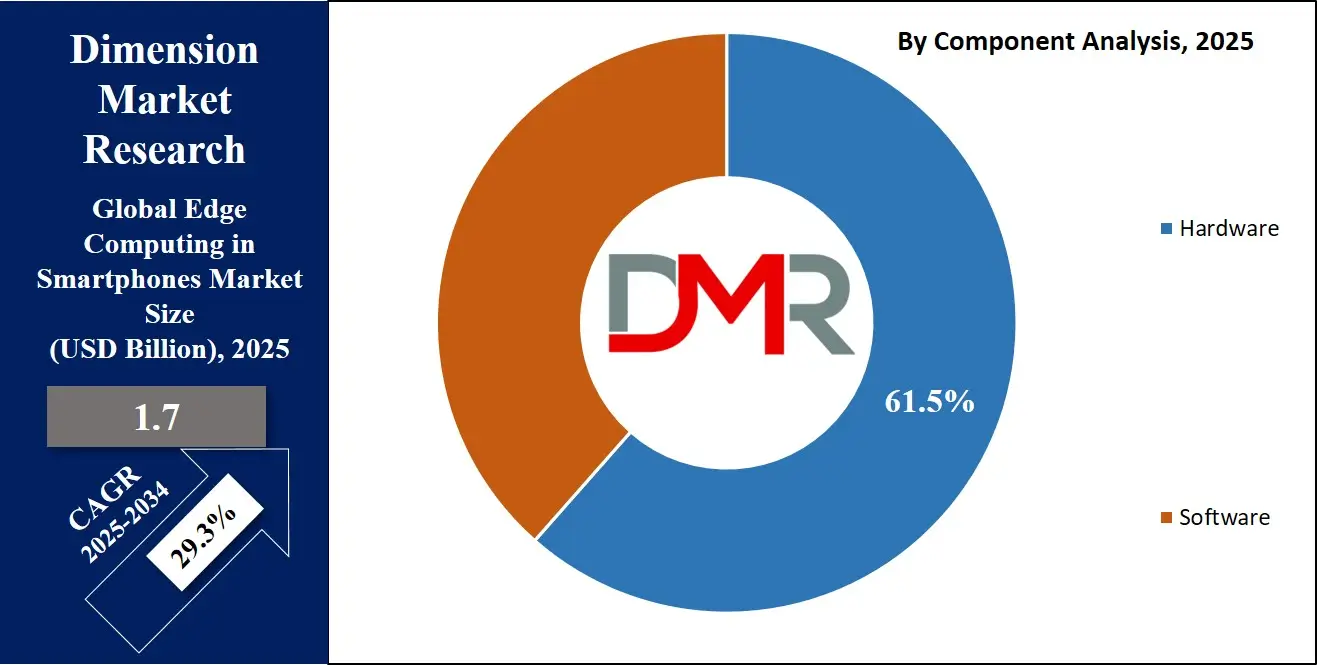

- By Component Segment Analysis: Hardware components are poised to consolidate their dominance in the component segment, capturing 61.5% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are expected to maintain their dominance in the organization size segment, capturing 67.0% of the total market share in 2025.

- By Application Segment Analysis: Location-Based Services applications are anticipated to maintain their dominance in the application type segment, capturing 25.6% of the total market share in 2025.

- By Industry Vertical Segment Analysis: The IT & Telecom industry is anticipated to maintain its dominance in the industry vertical segment, capturing 23.7% of the total market share in 2025.

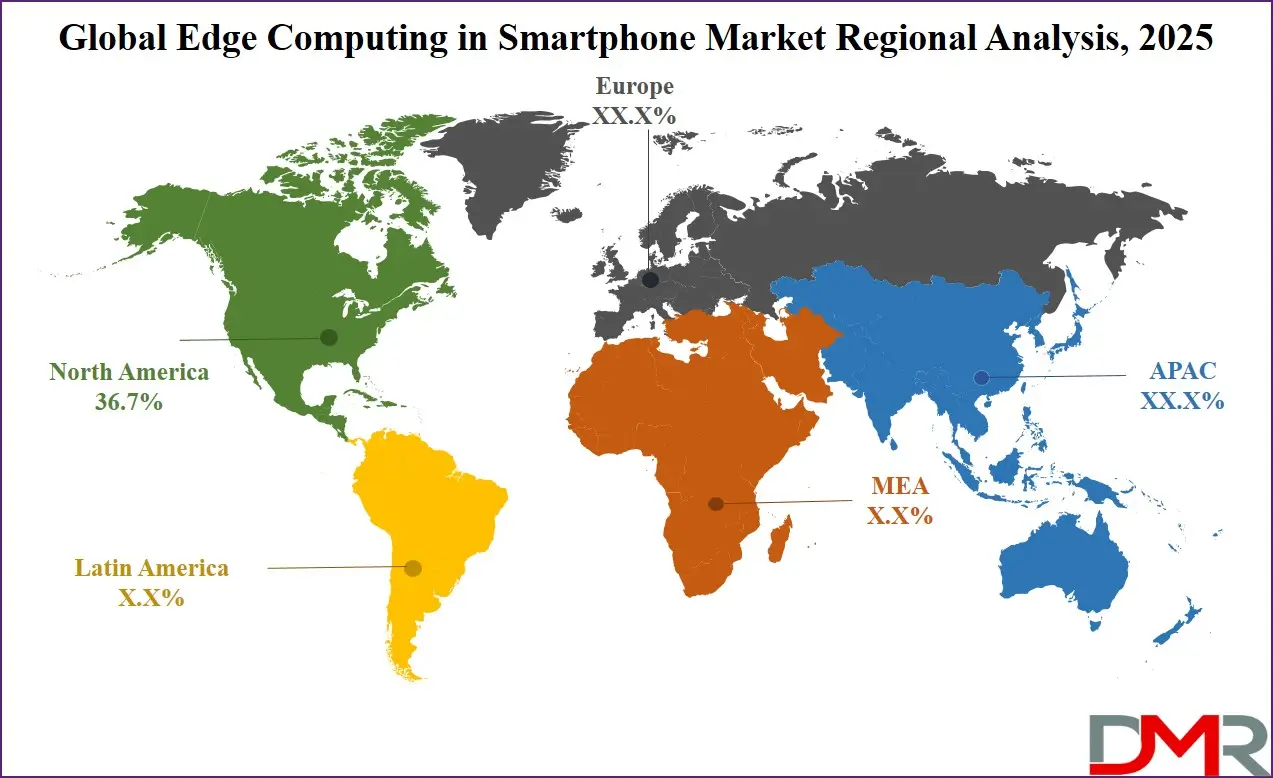

- Regional Analysis: North America is anticipated to lead the global edge computing in smartphone market landscape with 36.7% of total global market revenue in 2025.

- Key Players: Some key players in the global edge computing in smartphone market are Qualcomm, Arm Holdings, MediaTek, UNISOC, Nvidia, Intel, Apple, Samsung Electronics, Huawei Technologies, Nokia, Ericsson, ZTE Corporation, Microsoft, Google (Alphabet Inc.), Amazon Web Services (AWS), IBM, Cisco Systems, Dell Technologies, Hewlett-Packard Enterprise (HPE), Cavli Wireless, and Other key players.

Global Edge Computing in Smartphone Market: Use Cases

-

Real-Time Mobile Gaming with Ultra-Low Latency: Edge computing in smartphones enables seamless, real-time mobile gaming experiences by minimizing latency and offloading graphics-intensive computations to on-device processors. With the integration of 5G and advanced SoCs like Snapdragon and Apple Bionic chips, mobile games now offer console-level performance. Edge processing allows for faster frame rendering, enhanced graphics, and minimal lag, which are essential for competitive and cloud-based mobile gaming.

- AI-Powered On-Device Personal Assistants: Smartphones equipped with edge computing capabilities are transforming voice assistants into faster, smarter, and more context-aware tools. By performing AI inference locally, tasks like natural language processing, real-time speech recognition, and contextual recommendations are executed instantly without cloud dependency. This not only accelerates task execution but also enhances data privacy and device personalization.

- Augmented Reality for Navigation and Retail: Edge computing facilitates immersive augmented reality (AR) applications directly on smartphones, particularly in sectors like navigation, e-commerce, and retail. AR overlays in real-world environments require real-time object recognition and spatial mapping, which are achieved through edge-processed computer vision. This enables features such as AR wayfinding in smart cities and virtual product try-ons in online shopping platforms without connectivity lags.

- Mobile Health Monitoring and Diagnostics: Smartphones embedded with edge capabilities are being leveraged for real-time health diagnostics, especially for chronic disease monitoring and telehealth applications. Sensors and cameras on edge-enabled smartphones process biometric data such as heart rate, oxygen levels, and facial cues in real-time, enabling timely interventions without reliance on external servers. This use case is critical in remote healthcare scenarios where reliable connectivity may be inconsistent.

Global Edge Computing in Smartphone Market: Stats & Facts

- Teledensity Increase: India’s teledensity rose from 75.2% in March 2014 to 85.7% in March 2024.

- Wireless Connections: The number of wireless telephone connections reached 116.5 crore by the end of March 2024.

- Internet Subscribers: Internet subscribers jumped from 25.1 crore in March 2014 to 95.4 crore in March 2024, with 91.4 crore accessing the internet via wireless phones.

- 5G Launch: India launched 5G services in October 2022, positioning itself among the fastest-growing 5G networks globally.

- Mobile Broadband Speed: India improved its international ranking from 118th to 15th in mobile broadband speed by March 2024.

- 5G Test Bed: India established a 5G test bed that provides end-to-end testing facilities for R&D teams in academia and industry.

- Bharat 5G Portal: The Bharat 5G Portal fosters innovation, collaboration, and knowledge-sharing in the telecom sector.

- 6G Initiatives: The Bharat 6G Vision Document, launched in March 2023, aims to develop and deploy 6G technologies.

- United Kingdom – Mobile Ecosystems Market Study (GOV.UK)

- Mobile Internet Usage: In 2020, UK adult internet users spent an average of over 3.5 hours a day online, with nearly 3 hours spent on smartphones or tablets.

- Smartphone Ownership: 91% of UK households had access to a smartphone in 2020.

- Operating System Market Share: Between 50% to 60% of active smartphones in the UK used Apple's iOS, and between 40% to 50% used Android in 2020.

- App Store Dominance: Apple's App Store and Google Play Store are the primary gateways for app distribution on mobile devices in the UK.

- Mobile Payments Adoption: By the end of 2020, nearly a third of the UK adult population was registered to use mobile payments, an increase of 7.4 million people compared to 2019.

- 5G Contribution to GDP: Smart utilities, manufacturing, and logistics sectors are expected to add a total of £15 billion in GDP by 2035 through the adoption of 5G.

- New Zealand – Digital Strategy for Aotearoa (NZ Government)

- ICT Sector Contribution: The ICT sector contributed NZD 11.5 billion to GDP in 2019.

- ICT Employment: Over 60,000 people were employed in the ICT sector in New Zealand.

- R&D Investment: Software development firms spent NZD 924 million on research and development in 2020.

- Software Exports: New Zealand firms exported NZD 976 million of software in 2019.

- Mobile Connectivity Penetration: As of September 2023, New Zealand's mobile phone penetration rate exceeded 119%.

- Mobile Subscriptions: The number of mobile subscriptions in New Zealand climbed to approximately 6.10 million by the end of September 2023.

- 5G Penetration Forecast: New Zealand is projected to achieve 90% 5G penetration by 2029.

- 5G Economic Impact: A 10% increase in mobile penetration could correspond to a 1% uplift in GDP, potentially contributing an additional NZD 25 billion to New Zealand's GDP by 2029.

- Data-Driven Innovation: Data-driven innovation is projected to contribute over NZD 4.5 billion to New Zealand's economy by 2020.

- Digital Identity Market Potential: The digital identity market could add 3% to the UK's GDP by 2030.

- Canada – Innovation, Science and Economic Development Canada (ISED)

- 5G Infrastructure Investment: Canada invested over CAD 1.5 billion in 5G network infrastructure development from 2020 to 2024.

- Mobile Device Adoption: Approximately 90% of Canadians owned a smartphone by 2023, with usage rising across all age groups.

- 5G Connectivity Rollout: As of 2023, 5G coverage had reached 70% of Canada’s population, with a goal to reach 90% by 2026.

- Wireless Data Traffic Growth: Mobile data traffic in Canada is expected to grow by 45% annually over the next five years, driven by growing demand for edge computing and 5G.

- Economic Impact of 5G: It is estimated that the widespread adoption of 5G will add over CAD 40 billion to Canada’s economy by 2030.

Global Edge Computing in Smartphone Market: Market Dynamics

Global Edge Computing in Smartphone Market: Driving Factors

Surge in On-Device Artificial Intelligence Applications

The growing demand for intelligent smartphone functionalities is a major catalyst for edge computing integration. Consumers now expect real-time responsiveness from their mobile devices in areas such as facial authentication, live photo enhancement, voice assistant interactions, and predictive typing. These features require substantial computing power and low latency, which cloud infrastructure alone cannot deliver efficiently.

Edge computing addresses this gap by enabling devices to process data locally, ensuring immediate feedback while also conserving bandwidth. Leading chipset manufacturers are embedding AI accelerators and neural engines within mobile processors, allowing smartphones to carry out complex machine learning tasks without continuous connectivity. This shift is not only making smartphones faster and more capable but is also empowering app developers to create more personalized and secure user experiences with localized data processing.

Expansion of 5G Infrastructure Globally

The deployment of fifth-generation mobile networks is acting as a backbone for edge computing in smartphones, providing the high-speed, low-latency environment required for advanced mobile services. 5G allows data to be transferred more quickly between devices and networks, but it is the combination of 5G with edge processing that unlocks the full potential of next-gen mobile applications.

Use cases such as augmented reality navigation, cloud-based mobile gaming, and real-time video analytics benefit immensely when computing is done at the device edge rather than being routed to distant cloud servers. As telecom providers expand 5G coverage across urban and rural areas, smartphone manufacturers are integrating edge-enabled architectures to take full advantage of these capabilities. This synergy is laying the foundation for a new generation of mobile experiences that are both immersive and responsive.

Global Edge Computing in Smartphone Market: Restraints

High Hardware Costs and Power Consumption

One of the primary barriers to widespread adoption of edge computing in smartphones is the associated increase in hardware complexity and cost. Incorporating high-performance chipsets with advanced AI cores and processing units significantly raises the production cost of devices. As a result, budget-conscious consumers may find edge-enabled smartphones financially inaccessible, limiting the technology’s penetration in emerging markets.

Moreover, these powerful components often draw more energy, which can adversely affect battery life, a key concern for mobile users who rely on their devices for extended periods without access to charging. Manufacturers are now under pressure to balance performance with energy efficiency while keeping devices affordable, which presents an ongoing design and engineering challenge.

Fragmentation in Software Ecosystem and Lack of Standardization

Another critical restraint lies in the fragmented ecosystem of edge computing software, tools, and platforms. Different manufacturers and operating systems implement edge capabilities in varied ways, which leads to compatibility issues for developers and service providers. The lack of industry-wide standards for deploying and managing edge processes on mobile devices hinders the scalability of edge solutions.

For application developers, this fragmentation complicates the optimization of apps for edge environments, often requiring separate configurations for each hardware and OS variant. Without a unified framework, the market faces hurdles in accelerating innovation and ensuring seamless user experiences across devices.

Global Edge Computing in Smartphone Market: Opportunities

Rise of AR and VR Applications in Consumer and Enterprise Markets

The growing interest in augmented reality and virtual reality presents a major opportunity for edge computing in smartphones. From immersive retail experiences and virtual product try-ons to interactive learning modules and remote collaboration tools, AR and VR applications demand immediate data processing and spatial awareness.

Traditional cloud computing introduces latency that can disrupt the real-time requirements of these experiences. With edge processing, smartphones can handle visual recognition, object tracking, and environmental mapping on-device, leading to smoother and more accurate outcomes. As both consumers and enterprises explore AR and VR for productivity and entertainment, smartphones equipped with edge capabilities will become essential platforms for delivering these next-generation experiences.

Expanding Role of Smartphones in Digital Healthcare

Smartphones are being used as diagnostic and monitoring tools in the digital healthcare ecosystem, especially in remote and underserved regions. With embedded sensors and cameras, modern smartphones can measure vital signs, detect anomalies, and provide real-time health insights without requiring cloud connectivity.

Edge computing enables these tasks to be performed locally, ensuring quick response times and safeguarding patient data privacy. Applications range from chronic disease monitoring to mental health analysis, where real-time feedback is critical. As global healthcare systems look for scalable and mobile-friendly solutions, edge-enabled smartphones are poised to play a vital role in advancing telemedicine and personalized healthcare delivery.

Global Edge Computing in Smartphone Market: Trends

Integration of Federated Learning in Mobile Devices

Federated learning is emerging as a transformative trend in the edge computing space, particularly in smartphones. This approach allows machine learning models to be trained across multiple devices without centralizing user data, thus preserving privacy while enhancing the model with diverse inputs.

Smartphones equipped with edge processors can now participate in distributed learning networks, making the collective system smarter without compromising individual user data. This trend is particularly valuable for applications in personalized recommendations, predictive typing, and adaptive user interfaces. As privacy regulations tighten and users become more data-conscious, federated learning supported by edge computing will become a critical component of smartphone intelligence.

Growth of Edge-to-Cloud Hybrid Architectures

Another notable trend is the emergence of hybrid models that blend the advantages of edge and cloud computing. Instead of relying exclusively on either model, smartphones are designed to perform latency-sensitive tasks locally while sending less urgent or storage-heavy data to the cloud. This balanced approach enables better resource utilization, enhanced speed, and greater flexibility.

For instance, a smartphone might process voice commands locally for quick response, while syncing data to the cloud for analytics or backups. This architecture is becoming the blueprint for scalable mobile applications that need both immediacy and depth, supporting the growing complexity of smartphone-based workflows.

Global Edge Computing in Smartphone Market: Research Scope and Analysis

By Component Analysis

By component segment analysis, hardware components are expected to solidify their leadership in the global edge computing in smartphone market, accounting for approximately 61.5% of the total market share in 2025. This dominance is largely attributed to the rapid advancements in smartphone chipsets and integrated processors that are designed to perform complex computations directly on the device.

Key hardware elements such as neural processing units (NPUs), graphics processing units (GPUs), and system-on-chip (SoC) architectures are becoming sophisticated, enabling mobile devices to execute real-time data analysis, AI inference, image recognition, and augmented reality tasks with minimal latency.

Leading semiconductor companies like Qualcomm, Apple, and MediaTek are investing heavily in next-generation processors that enhance edge capabilities while maintaining energy efficiency. The rising demand for responsive and secure mobile applications, along with the global rollout of 5G networks, continues to fuel investments in robust edge-enabled hardware across flagship and mid-tier smartphones.

On the other hand, the software components segment plays a critical and complementary role in optimizing edge computing performance on smartphones, though it currently holds a smaller share of the market. Software solutions include edge middleware, AI models, mobile operating system enhancements, real-time data management tools, and machine learning frameworks specifically tailored for on-device execution.

These software layers are essential for enabling the hardware to function efficiently and securely, facilitating smooth communication between different edge components, and managing resource allocation on the device. Furthermore, advancements in mobile AI toolkits, such as TensorFlow Lite and Apple Core ML, are allowing developers to build and deploy lightweight, efficient models for edge inference directly within smartphone apps.

As mobile application ecosystems mature and edge computing use cases diversify, the software component is expected to witness significant growth, particularly in areas such as federated learning, AR/VR rendering, and predictive user behavior modeling.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

By organization size segment analysis, large enterprises are projected to retain a dominant share of the global edge computing in smartphone market, accounting for approximately 67.0% of the total market share in 2025. This strong foothold is primarily driven by their extensive technological infrastructure, higher budget allocations for research and development, and greater capacity to deploy edge-enabled mobile solutions at scale.

Large enterprises across industries such as telecommunications, consumer electronics, e-commerce, and healthcare are heavily investing in smartphone-based edge computing to power real-time analytics, enhance mobile user experiences, and ensure data privacy through on-device processing.

These organizations often collaborate with chipset manufacturers, cloud service providers, and software vendors to integrate custom edge solutions into their mobile platforms, facilitating advanced use cases like intelligent customer engagement, remote diagnostics, and enterprise-grade AR applications. Moreover, the widespread rollout of private 5G networks among large corporations is accelerating the adoption of edge computing frameworks within their mobile ecosystems.

In contrast, small and medium-sized enterprises (SMEs) are gradually entering the edge computing in smartphone space, though their current market share remains relatively modest. SMEs face budget constraints and limited technical expertise, which can delay the deployment of advanced edge computing infrastructures.

However, the growing availability of cost-effective edge hardware, open-source AI frameworks, and cloud-integrated mobile development tools is lowering the barrier to entry for smaller organizations. SMEs operating in sectors like retail, logistics, and digital services are beginning to leverage smartphone-based edge computing for real-time inventory tracking, mobile workforce automation, and customer-facing AR solutions.

These use cases help them improve efficiency and competitiveness while minimizing dependency on centralized data centers. As edge computing becomes more accessible and modular, SMEs are expected to emerge as a fast-growing segment, particularly in emerging markets where mobile-first strategies are becoming essential for digital transformation.

By Application Analysis

By application segment analysis, location-based services are expected to maintain their leading position in the global edge computing in smartphone market, accounting for approximately 25.6% of the total market share in 2025. This dominance is largely driven by the rising demand for real-time, context-aware applications that require immediate geospatial data processing. Location-based services, including navigation, geofencing, local search, proximity marketing, and mobility tracking, rely heavily on GPS, sensors, and real-time analytics.

Edge computing enhances these applications by enabling smartphones to process location data on-device, reducing latency, conserving bandwidth, and offering instant responses even in areas with weak connectivity. Industries such as retail, transportation, tourism, and public safety are utilizing edge-powered location services to provide personalized and time-sensitive interactions. For instance, retail brands use edge-based geofencing to deliver in-store promotions, while urban planners deploy mobile edge analytics for smart city traffic management and pedestrian flow monitoring.

In parallel, video surveillance is emerging as a fast-growing application segment within the smartphone edge computing market. While traditionally dominated by fixed cameras and cloud-based processing, mobile video surveillance is gaining traction through smartphones used by law enforcement, security personnel, and frontline workers.

Edge computing enables smartphones to process video streams locally for facial recognition, motion detection, object tracking, and behavioral analysis in real time, without depending on cloud connectivity. This is particularly crucial in time-sensitive or bandwidth-constrained environments such as remote locations, emergency zones, or high-density public spaces.

Moreover, advancements in smartphone cameras, edge AI chips, and mobile storage solutions are making it feasible to conduct high-resolution video analysis on the device itself. As security and situational awareness become integral to both enterprise operations and public safety initiatives, mobile video surveillance supported by edge computing is poised to become a critical application area with expanding use cases in smart policing, industrial monitoring, and event management.

By Industry Vertical Analysis

By industry vertical segment analysis, the IT and telecom industry is projected to retain its dominance in the global edge computing in smartphone market, capturing approximately 23.7% of the total market share in 2025. This leadership stems from the industry's foundational role in developing and deploying edge computing infrastructure, as well as its influence in shaping the mobile ecosystem.

Telecom operators are at the forefront of expanding 5G networks, which are essential enablers of edge computing, allowing ultra-low latency and high-throughput connections that empower real-time data processing directly on smartphones. At the same time, IT companies are deeply involved in the development of mobile AI frameworks, cloud-edge orchestration platforms, and security protocols that enhance the capabilities of edge-enabled devices.

These organizations leverage edge computing to improve network performance, support mobile device management, optimize content delivery, and enhance user privacy. For telecom providers, edge computing is instrumental in deploying intelligent base stations and offering value-added mobile services, while IT firms use it to support mobile-first enterprise applications, workforce mobility, and on-device analytics.

In contrast, the media and entertainment industry is rapidly emerging as a major beneficiary of edge computing in smartphones, with growing adoption driven by the demand for immersive, high-quality, and low-latency content experiences. Mobile users consume video content, play cloud-based games, and engage in augmented reality (AR) and virtual reality (VR) applications directly on their smartphones.

Edge computing allows for real-time content rendering, compression, and adaptive streaming by processing data on the device itself rather than relying entirely on centralized servers. This significantly reduces buffering times and enhances user experience, especially in bandwidth-constrained environments. In live broadcasting and interactive entertainment formats, edge processing also supports real-time editing, visual effects, and personalized content delivery.

Moreover, with the proliferation of user-generated content platforms and mobile creators, edge computing empowers smartphones to handle high-resolution video editing, effects integration, and AI-driven enhancements without offloading to the cloud. As consumer expectations for seamless mobile entertainment grow, the media and entertainment sector is set to become a vibrant and expanding segment within the broader edge computing in smartphone market.

The Edge Computing in Smartphone Market Report is segmented on the basis of the following:

By Component

By Organization Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By Application

- Location-Based Services

- Video Surveillance

- Unified Communication

- Optimized Local Content Distribution

- Data Analytics

- Environmental Monitoring

By Industry Vertical

- IT & Telecom

- Media & Entertainment

- Retail

- Healthcare

- Manufacturing

Global Edge Computing in Smartphone Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global edge computing in smartphone market in 2025, capturing approximately 36.7% of the total market revenue, driven by its advanced digital infrastructure, widespread 5G adoption, and strong ecosystem of technology innovators. The region is home to some of the world’s most prominent smartphone manufacturers, semiconductor companies, and cloud service providers, all of which are playing a pivotal role in accelerating the deployment of edge computing capabilities in mobile devices.

The United States, in particular, is at the forefront due to its early rollout of commercial 5G networks, rising consumer demand for AI-powered mobile applications, and growing enterprise investment in real-time data processing and low-latency mobile solutions.

Moreover, regulatory emphasis on data privacy and security is encouraging more on-device processing, further fueling the adoption of edge computing technologies. As consumers and enterprises alike seek faster, more secure, and personalized mobile experiences, North America is expected to remain a key driver of innovation and growth in the edge computing in smartphone landscape.

Region with significant growth

Asia Pacific is projected to witness the highest compound annual growth rate (CAGR) in the global edge computing in smartphone market through 2034, fueled by rapid technological advancements, expanding mobile user base, and aggressive 5G deployment across key economies such as China, India, Japan, and South Korea. The region’s growing demand for advanced smartphones, integrated with growing penetration of AI-driven mobile applications, is accelerating the adoption of edge computing to enhance performance, reduce latency, and enable real-time data processing on-device.

Governments and private players in the region are making substantial investments in digital infrastructure and smart city initiatives, which are further driving the need for edge-enabled mobile solutions in areas such as transportation, healthcare, and urban planning. Additionally, the presence of major smartphone manufacturers and semiconductor firms in Asia Pacific is fostering innovation in edge hardware and software ecosystems. As a result, the region is set to become a critical growth hub for edge computing in smartphones, outpacing other regions in both adoption rate and technological maturity.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Edge Computing in Smartphone Market: Competitive Landscape

The global competitive landscape for the edge computing in smartphone market is characterized by intense competition among key players from various sectors, including semiconductor manufacturers, smartphone makers, software developers, and telecom operators. Leading companies such as Qualcomm, MediaTek, Apple, Samsung, and Nvidia are driving innovation in edge computing hardware, with advancements in AI processors, system-on-chip (SoC) designs, and neural processing units (NPUs) that enable efficient, on-device data processing. These players are actively collaborating with mobile manufacturers and telecom operators to integrate edge capabilities into smartphones, leveraging the rapid expansion of 5G networks to enhance mobile performance and reduce latency.

On the software side, companies like Google, Microsoft, and IBM are developing robust AI frameworks, machine learning models, and edge computing platforms that optimize data processing at the device level. Telecom operators, including Verizon, AT&T, and China Mobile, are also key stakeholders, as they deploy private 5G networks and edge infrastructure to support low-latency applications.

The competitive dynamics are further fueled by the growing demand for real-time mobile applications, such as AR/VR, cloud gaming, and location-based services, as well as the growing emphasis on data privacy and security, which edge computing effectively addresses. As the market continues to evolve, companies are focusing on differentiating themselves through product innovation, strategic partnerships, and region-specific solutions to capture a share of the burgeoning edge computing in smartphone market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Some of the prominent players in the global edge computing in smartphones are:

- Qualcomm

- Arm Holdings

- MediaTek

- UNISOC

- Nvidia

- Intel

- Apple

- Samsung Electronics

- Huawei Technologies

- Nokia

- Ericsson

- ZTE Corporation

- Microsoft

- Google (Alphabet Inc.)

- Amazon Web Services (AWS)

- IBM

- Cisco Systems

- Dell Technologies

- Hewlett-Packard Enterprise (HPE)

- Cavli Wireless

- Other Key Players

Global Edge Computing in Smartphone Market: Recent Developments

- April 2025: Qualcomm acquired Nuvia, a leader in high-performance ARM-based chip design, to enhance its edge computing capabilities and accelerate the development of advanced AI processors for smartphones and other devices.

- January 2025: Apple acquired Intel's smartphone modem business, which was a strategic move to strengthen its in-house 5G capabilities and boost edge computing performance for its iPhone lineup.

- November 2024: MediaTek announced the acquisition of a leading AI chip startup, to enhance its edge AI processor offerings and drive growth in the smartphone market with next-generation on-device computing solutions.

- August 2024: Nvidia acquired Arm Holdings for USD 40 billion, with the intention to enhance its AI, machine learning, and edge computing capabilities across smartphones, data centers, and IoT devices.

- May 2024: Huawei Technologies acquired the majority stake in 5G edge network startup, aiming to improve its edge computing solutions and integrate faster data processing capabilities into its smartphones and telecom networks.

- March 2024: Samsung Electronics acquired the mobile edge computing division of a well-known telecom software provider, strengthening its position in delivering low-latency mobile applications and services through integrated edge computing solutions.

- February 2024: Intel acquired SiFive, a leading RISC-V processor company, to advance its edge computing strategy in smartphones, enhancing its chip development and accelerating performance capabilities for next-gen mobile devices.

- December 2023: Google acquired a prominent AI startup specializing in edge computing optimization for mobile devices, aiming to integrate powerful machine learning models and reduce the dependency on cloud processing for its Android devices.

- September 2023: Amazon Web Services (AWS) acquired a cutting-edge edge computing firm focused on optimizing mobile application performance in real-time, which will enhance AWS's mobile services and edge computing solutions for smartphone manufacturers.

- July 2023: Cisco Systems acquired a leading telecom edge infrastructure provider, expanding its portfolio of edge computing solutions to improve network performance and provide enhanced mobile services to telecom operators and smartphone manufacturers globally.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.7 Bn |

| Forecast Value (2034) |

USD 17.1 Bn |

| CAGR (2025–2034) |

29.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware and Software), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), By Application (Location-Based Services, Video Surveillance, Unified Communication, Optimized Local Content Distribution, Data Analytics, Environmental Monitoring), By Industry Vertical (IT & Telecom, Media & Entertainment, Retail, Healthcare, Manufacturing) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Qualcomm, Arm Holdings, MediaTek, UNISOC, Nvidia, Intel, Apple, Samsung Electronics, Huawei Technologies, Nokia, Ericsson, ZTE Corporation, Microsoft, Google (Alphabet Inc.), Amazon Web Services (AWS), IBM, Cisco Systems, Dell Technologies, Hewlett-Packard Enterprise (HPE), Cavli Wireless, and Other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |