Market Overview

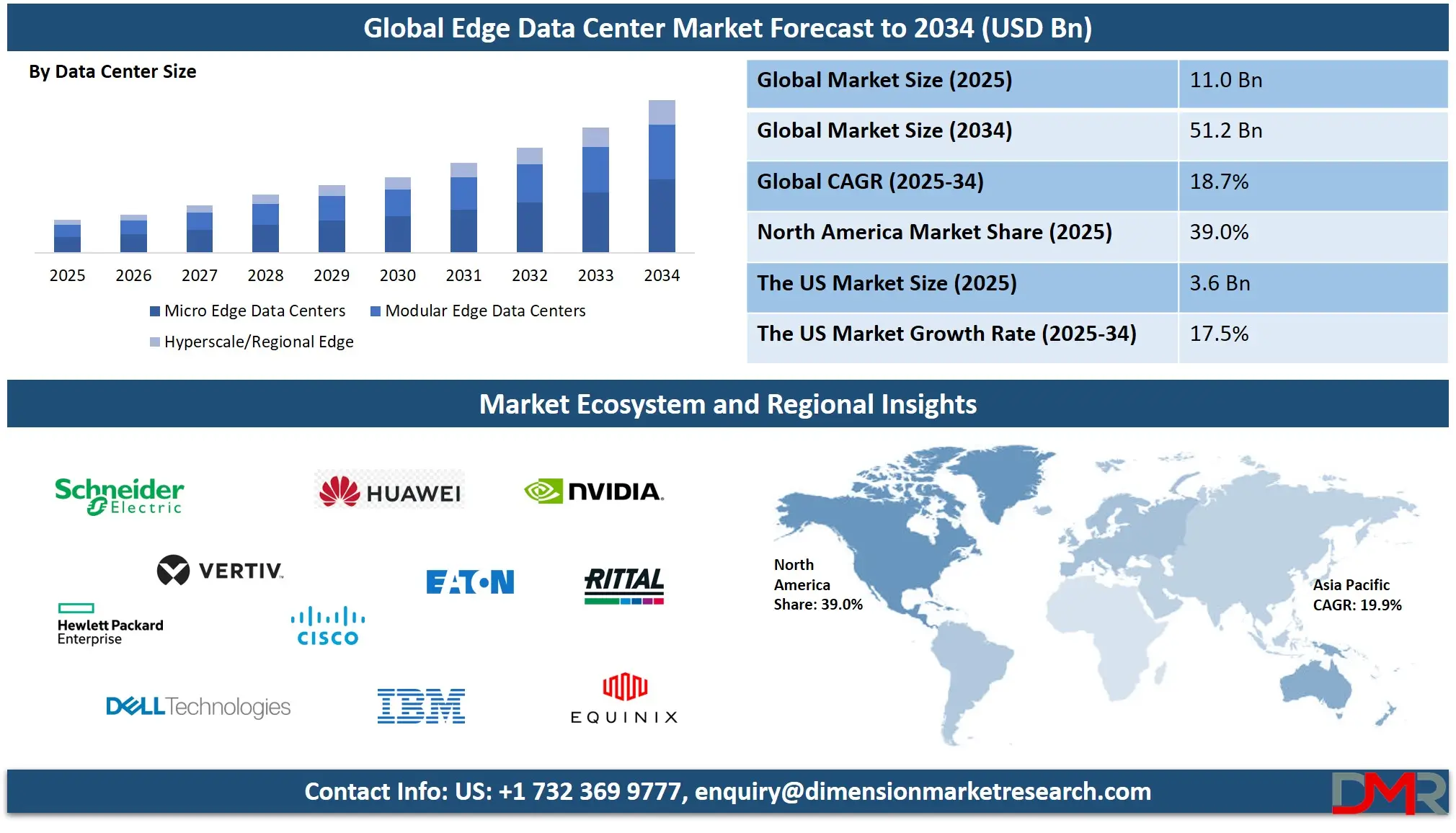

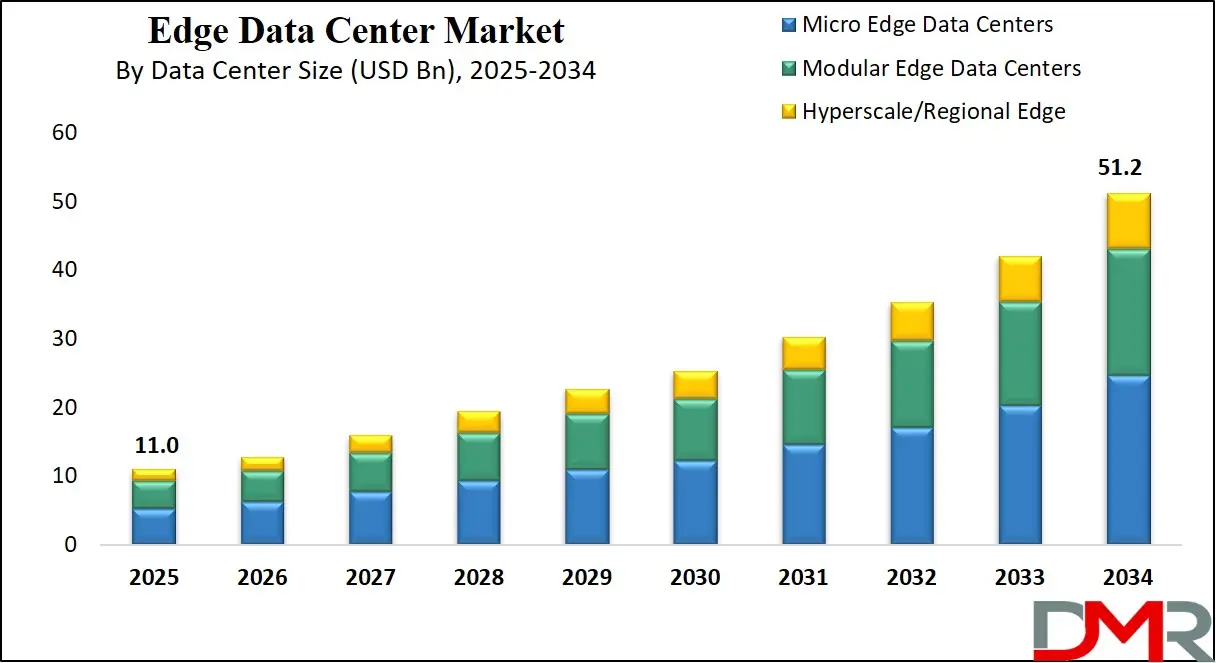

The global edge data center market is projected to reach USD 11.0 billion in 2025 and is expected to grow to USD 51.2 billion by 2034, expanding at a CAGR of 18.7%. This growth is driven by rising demand for low-latency computing, IoT data processing, and decentralized infrastructure across 5G networks, AI workloads, and real-time analytics applications.

Edge data refers to the processing, collection, and analysis of data at or near the physical location where it is generated rather than relying on centralized cloud or data center environments. This approach significantly reduces latency, enhances response times, and improves bandwidth efficiency.

Edge data systems are designed to support real-time applications by bringing computation closer to the source, whether it be sensors in a factory, autonomous vehicles, or mobile devices in remote areas. By minimizing the distance between the data source and the processing unit, edge data architecture enables faster decision-making, greater data privacy, and more resilient network infrastructure.

The global edge data center market is evolving rapidly as the demand for low-latency data processing and localized computing continues to grow. Enterprises across sectors such as telecommunications, manufacturing, healthcare, and retail are deploying edge facilities to handle massive volumes of data generated by IoT devices, AI applications, and smart systems.

These compact and decentralized centers act as regional hubs that bridge the gap between end-users and core data centers, improving service delivery and enhancing real-time analytics capabilities. Advancements in edge hardware, energy-efficient cooling systems, and software-defined networking are further fueling the adoption of edge infrastructure.

This market is witnessing strategic expansions and collaborations among technology providers, telecom operators, and infrastructure companies aiming to build scalable edge ecosystems. Regions like North America and Asia-Pacific are experiencing significant growth due to investments in 5G networks, smart city projects, and autonomous systems.

As data consumption surges and enterprises shift toward distributed computing models, the edge data center industry is positioned to play a foundational role in modern IT architecture. The integration of machine learning, containerization, and next-gen networking technologies like private 5G and Wi-Fi 6 is expected to create new use cases and drive sustained market momentum.

The US Edge Data Center Market

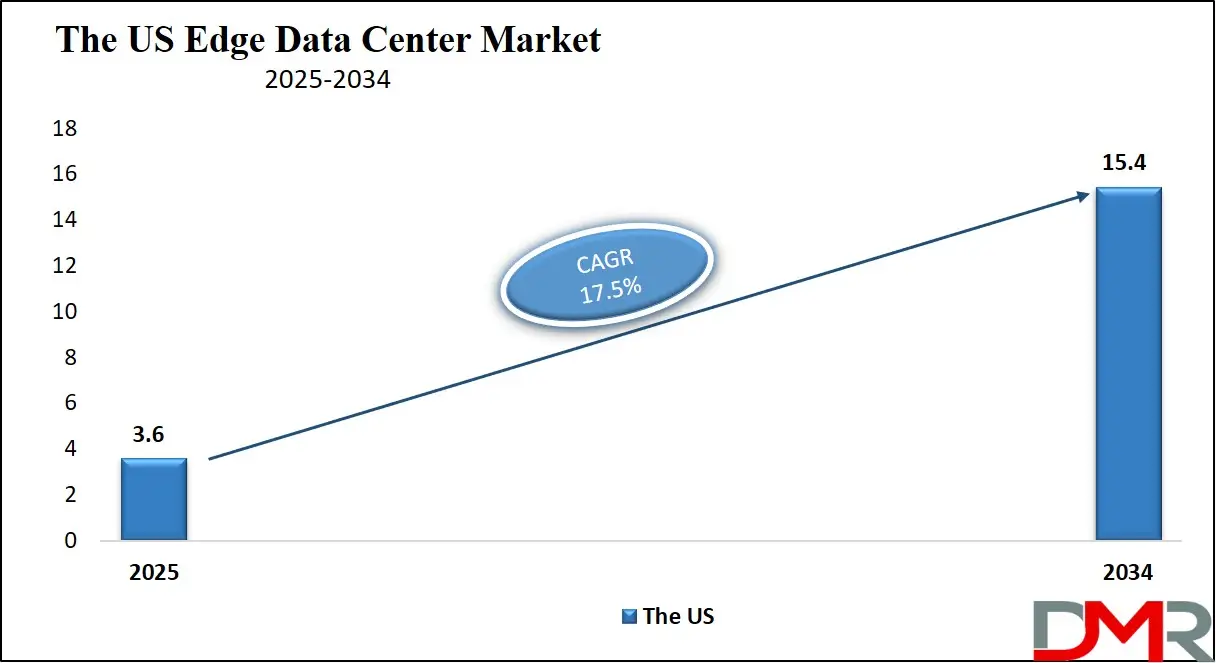

The U.S. Edge Data Center Services Market size is projected to be valued at USD 3.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 15.4 billion in 2034 at a CAGR of 17.5%.

The US edge data center market is witnessing rapid expansion driven by growing demand for low-latency data processing, 5G deployment, and real-time analytics across multiple sectors. With the proliferation of connected devices, smart infrastructure, and data-heavy applications, enterprises are moving toward decentralized IT architectures.

Edge data centers in the US are being strategically located near end users to support latency-sensitive services such as autonomous vehicles, augmented reality, and industrial IoT. Telecom providers, cloud service operators, and colocation vendors are investing heavily in micro and modular edge data center facilities to enhance content delivery and support edge computing workloads efficiently.

The rise of smart cities, remote work environments, and digital transformation initiatives is further boosting the need for edge infrastructure in the US. Key industries such as healthcare, manufacturing, and retail are leveraging edge data centers to enable faster decision-making, improve operational agility, and reduce bandwidth strain on centralized networks.

The US market benefits from a robust digital ecosystem, advanced network infrastructure, and a strong presence of technology giants who are continuously innovating edge computing solutions. With growing adoption of AI at the edge, software-defined networking, and edge-as-a-service platforms, the US edge data center market is expected to maintain its leadership and set the pace for global edge deployment trends.

Europe Edge Data Center Market

Europe’s edge data center market is estimated to reach approximately USD 2.6 billion in 2025. This strong position is driven by the region’s mature digital ecosystem, robust connectivity infrastructure, and proactive investments in next-generation technologies. Key economies such as Germany, France, the UK, and the Netherlands are leading the charge with widespread 5G rollout, growing adoption of IoT devices, and growing reliance on real-time data processing across industries.

The EU’s strict data privacy regulations, such as GDPR, are also encouraging enterprises to adopt localized edge infrastructure to ensure compliance while minimizing latency and bandwidth costs. Furthermore, the growing presence of hyperscale cloud providers and regional colocation data centers is accelerating the adoption of hybrid and edge computing models.

The market is expected to grow at a promising CAGR of 17.1% from 2025 to 2034, supported by smart city developments, industrial automation, and growing demand for low-latency digital services. European governments and private enterprises are actively investing in sustainable and modular edge data centers to support decentralized computing at scale.

Innovations in energy-efficient cooling, edge AI deployment, and containerized infrastructure are gaining momentum as the region emphasizes climate-conscious data center operations. The rise in digital services such as remote healthcare, digital banking, and immersive media is further pushing the need for edge processing capabilities across the continent. As these trends mature, Europe is likely to solidify its position as one of the most advanced and innovation-driven markets in the global edge data center landscape.

Japan Edge Data Center Market

Japan’s edge data center market is projected to reach approximately USD 515 million in 2025. This growth is supported by Japan’s highly urbanized population, advanced telecom infrastructure, and strong government focus on digital transformation under initiatives like Society 5.0.

The demand for low-latency computing is rising rapidly across sectors such as smart manufacturing, autonomous mobility, and robotics, all of which are core strengths of the Japanese economy. Major cities like Tokyo, Osaka, and Fukuoka are emerging as regional edge computing hubs due to dense connectivity, high mobile data consumption, and a growing need to process data closer to users and endpoints.

With a projected CAGR of 16.2% from 2025 to 2034, Japan’s edge data center market is expected to expand steadily, driven by the deployment of 5G networks, increased adoption of AI-powered edge devices, and the digitalization of public infrastructure. Local companies are investing in modular edge facilities to support use cases like remote diagnostics, automated factories, and real-time content delivery.

Additionally, Japan’s strict data residency policies are encouraging the development of localized and secure edge environments. As the country prepares to host international events and scales its smart city infrastructure, edge data centers will play a crucial role in managing real-time data processing demands, ensuring high-speed connectivity, and supporting digital resilience across the nation.

Global Edge Data Center Market: Key Takeaways

- Market Value: The global edge data center services market size is expected to reach a value of USD 51.2 billion by 2034 from a base value of USD 11.0 billion in 2025 at a CAGR of 18.7%.

- By Component Segment Analysis: Solutions are anticipated to dominate the component segment, capturing 63.0% of the total market share in 2025.

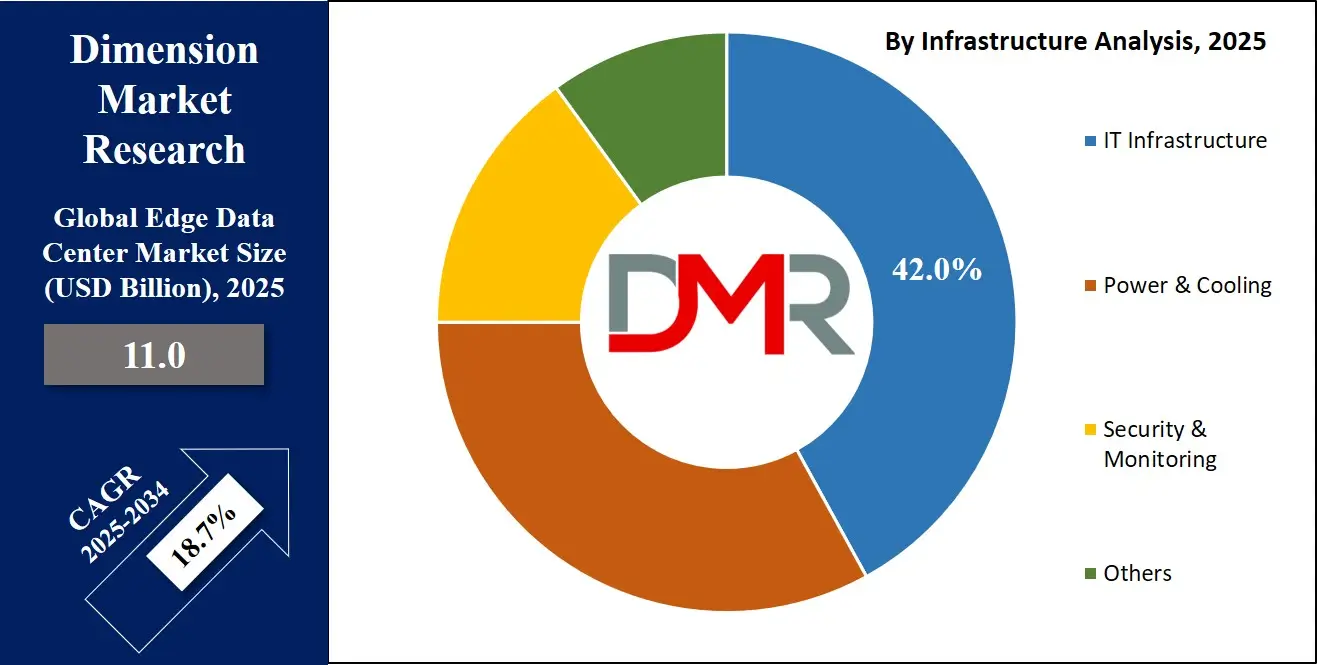

- By Infrastructure Segment Analysis: IT Infrastructures are expected to maintain their dominance in the infrastructure segment, capturing 42.0% of the total market share in 2025.

- By Data Center Size Segment Analysis: Micro Edge Data Centers are poised to consolidate their dominance in the data center size segment, capturing 48.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: On-Premise mode will dominate the deployment mode segment, capturing 44.0% of the market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises will dominate the organization size segment, capturing 61.0% of the market share in 2025.

- By Application Segment Analysis: Content Delivery & Streaming applications will account for the maximum share in the application segment, capturing 22.0% of the total market value.

- By End-User Industry Segment Analysis: The Telecommunication industry is expected to consolidate its dominance in the end-user industry segment, capturing 26.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global edge data center services market landscape with 39.0% of total global market revenue in 2025.

- Key Players: Some key players in the global edge data center services market are Schneider Electric, Vertiv, HPE, Dell Technologies, Huawei, Cisco, IBM, NVIDIA, Eaton, Rittal, Equinix, EdgeConneX, Compass Datacenters, Vapor IO, Stack Infrastructure, Cyxtera, and Others.

Global Edge Data Center Market: Use Cases

-

Autonomous Vehicles and Smart Transportation Systems: Edge data centers play a critical role in enabling autonomous driving and intelligent traffic management systems. These vehicles rely on real-time data processing from multiple sensors, cameras, and radar systems to make split-second decisions. Processing this data locally, via nearby edge facilities, drastically reduces latency and ensures road safety. In urban environments, edge computing infrastructure supports connected traffic lights, smart road signage, and vehicle-to-everything (V2X) communication. By decentralizing computational power, edge data centers reduce the load on centralized cloud networks and enable smoother operation of smart mobility solutions.

- Industrial Automation and Smart Manufacturing: In the era of Industry 4.0, manufacturing plants are integrating edge data centers to support advanced automation, robotics, and predictive maintenance. Real-time monitoring of machinery, temperature, and product quality requires continuous data collection and immediate analysis. Edge data centers enable localized data processing, allowing smart factories to respond instantly to anomalies, optimize production workflows, and reduce downtime. With the rise of industrial IoT, distributed computing frameworks powered by edge infrastructure ensure greater operational efficiency, data security, and cost-effective scalability for manufacturing ecosystems.

- Telemedicine and Remote Healthcare Monitoring: Healthcare providers are adopting edge data centers to deliver faster and more reliable services in areas such as remote diagnostics, wearable health monitoring, and connected medical devices. Edge computing helps process patient data closer to its source, allowing clinicians to access critical information with minimal delay. This is especially important in rural or underserved regions where access to centralized data centers may be limited. The combination of edge data centers, AI-based diagnostics, and electronic health records (EHR) improves patient care, supports real-time analytics, and ensures compliance with data privacy regulations like HIPAA.

- Content Delivery and Immersive Media Experiences: The growing demand for high-resolution video streaming, online gaming, and immersive technologies such as virtual reality (VR) and augmented reality (AR) is fueling the need for localized edge infrastructure. Edge data centers ensure minimal latency and faster content delivery by caching and processing data closer to end users. This reduces buffering, enhances user experience, and offloads strain from core data centers. Content providers and CDN operators leverage edge facilities to distribute workloads efficiently, scale on demand, and support bandwidth-intensive applications across regions. This use case underscores the importance of edge networks in the modern digital entertainment landscape.

Impact of Artificial Intelligence on the Edge Data Center Market

Artificial Intelligence (AI) is profoundly transforming the edge data center market by enhancing operational efficiency, enabling intelligent data processing, and accelerating the adoption of next-gen applications. As organizations deploy AI-powered workloads at the network edge, edge data centers are evolving from passive data hubs to intelligent processing units capable of real-time analytics and autonomous decision-making. AI algorithms can analyze and act upon data locally, reducing the need to send massive datasets to centralized cloud platforms and thereby improving latency, bandwidth efficiency, and system responsiveness.

AI also enhances infrastructure management within edge data centers through predictive maintenance, intelligent power management, automated cooling systems, and workload optimization. AI-driven monitoring tools can detect anomalies, anticipate hardware failures, and balance loads in real time significantly improving uptime and energy efficiency.

Additionally, AI supports advanced cybersecurity protocols by enabling edge facilities to detect and respond to threats instantaneously. The growing convergence of AI and edge computing is fostering innovation across industries such as healthcare, retail, automotive, and manufacturing, driving demand for scalable, intelligent, and decentralized edge data center solutions.

Global Edge Data Center Market: Stats & Facts

- Over 82% of the U.S. population now has access to broadband speeds of at least 100 Mbps.

- The FCC allocated USD 20.4 billion for the Rural Digital Opportunity Fund, enhancing edge infrastructure in underserved areas.

- The U.S. saw a 43% rise in data traffic at the network edge between 2021 and 2023.

- European Commission (EU Digital Economy and Society Index - DESI)

- 93% of EU households had fixed broadband access in 2023.

- The 5G coverage in populated areas reached 81% in the EU by the end of 2023.

- The EU cloud computing adoption rate among enterprises was 45% in 2023, up from 36% in 2021.

- Ministry of Internal Affairs and Communications (Japan)

- Japan recorded over 125 million mobile broadband subscriptions by the end of 2023.

- 5G base stations in Japan crossed 210,000 units by mid-2024.

- Japan’s Smart City pilot projects grew to over 50 locations, many of which include edge-enabled infrastructure.

- Department for Digital, Culture, Media and Sport (UK)

- The UK invested £200 million in edge computing and 5G testbeds as of 2023.

- Over 98% of UK households have access to at least 30 Mbps broadband, essential for edge computing use cases.

- The UK National Data Strategy includes commitments to deploy secure and decentralized edge infrastructure.

- National Institute of Standards and Technology (NIST), USA

- NIST defined reference architectures for edge computing, influencing enterprise deployments across industries.

- NIST’s edge testing framework was adopted by over 150 U.S. firms as of 2023.

- International Telecommunication Union (ITU)

- Global internet penetration reached 67% by 2023, accelerating edge data growth.

- IoT device installations worldwide surpassed 15.1 billion in 2023.

- Global 5G network coverage reached 40% of the world population by 2023.

- Latency-sensitive applications are predicted to represent 48% of mobile data traffic by 2025.

- OECD (Organisation for Economic Co-operation and Development)

- Cloud and edge computing accounted for over 35% of ICT infrastructure investments in member countries in 2023.

- The number of data center nodes at the edge increased by 19% year-over-year across OECD nations.

- Edge computing is expected to support 28% of total IoT analytics in OECD economies by 2026.

- Indian Ministry of Electronics & IT (MeitY)

- India’s National 5G Mission includes support for edge data centers in rural and urban regions.

- India had over 1.2 billion mobile subscribers in 2023, increasing pressure on localized data centers.

- The government approved over USD 1 billion in incentives for data center and edge infrastructure development in 2023.

- China’s Ministry of Industry and Information Technology (MIIT)

- China built over 2 million 5G base stations by end of 2023.

- Edge computing nodes in China reached 300,000 units deployed by Q4 2023.

- China’s "New Infrastructure" policy included edge data centers as a strategic priority by 2023.

- Australian Department of Infrastructure, Transport, Regional Development, Communications and the Arts

- Australia invested AUD 1.3 billion in the National Data Infrastructure strategy in 2023.

- Edge computing was included in government-backed R&D tax incentives in 2024.

- Over 85% of Australian enterprises deployed hybrid cloud or edge solutions by 2023.

Global Edge Data Center Market: Market Dynamics

Global Edge Data Center Market: Driving Factors

Surge in Real-Time Data Processing Demand

The exponential rise of data-intensive applications, such as IoT ecosystems, autonomous systems, and augmented reality, has led to a growing need for real-time analytics and ultra-low-latency computing. Edge data centers enable localized data processing, reducing the reliance on centralized cloud networks and enhancing performance for latency-sensitive operations. Enterprises are adopting edge architectures to support rapid data decision-making, ensuring faster responses in mission-critical environments like manufacturing lines, smart grids, and connected vehicles.

Expansion of 5G and Next-Gen Network Infrastructure

The global rollout of 5G networks is acting as a significant enabler for the edge data center market. 5G’s promise of high-speed, low-latency communication makes it ideal for distributed computing models. Telecom operators are deploying micro edge facilities to bring compute and storage closer to the network edge, improving user experience for applications such as mobile streaming, gaming, and real-time communication. This synergy between 5G and edge data centers is fueling infrastructure investments and encouraging innovation across sectors.

Global Edge Data Center Market: Restraints

High Capital Investment and Deployment Costs

Setting up edge data centers involves significant capital expenditure in physical infrastructure, power systems, cooling technologies, and localized hardware. Unlike centralized hyperscale data centers that benefit from economies of scale, edge facilities are smaller but distributed across multiple geographic locations, growing operational complexity and cost. For many small and mid-sized enterprises, the initial investment barrier remains a key constraint to large-scale edge adoption.

Limited Standardization and Interoperability

The edge computing landscape is still evolving, with varying architectures, vendor-specific solutions, and a lack of universally accepted protocols. This lack of standardization poses integration challenges, especially when managing hybrid or multi-edge environments. Ensuring seamless data flow, consistent security policies, and device interoperability across multiple edge nodes continues to be a bottleneck for edge data center scalability and long-term sustainability.

Global Edge Data Center Market: Opportunities

Rising Demand from Emerging Economies and Smart Cities

Developing regions in Asia-Pacific, Latin America, and the Middle East are rapidly investing in smart city infrastructure, connected transportation, and digital public services. These initiatives rely heavily on real-time data collection and processing, creating a strong use case for localized edge computing. Edge data centers can help manage urban data loads, improve public safety systems, and support applications like traffic optimization and waste management, offering immense growth potential in these emerging markets.

AI and Machine Learning Integration at the Edge

With advancements in edge AI chips and inference engines, there is a growing opportunity to embed artificial intelligence directly into edge data centers. This allows for instant decision-making on-site, without data needing to be transferred to centralized servers. Use cases include predictive maintenance in manufacturing, fraud detection in banking, and intelligent video analytics in surveillance. Edge AI is unlocking new business models and enhancing the value proposition of edge infrastructure across industries.

Global Edge Data Center Market: Trends

Modular and Prefabricated Edge Data Centers

To accelerate deployment and reduce on-site construction complexity, organizations are turning to modular edge data center designs. These prefabricated units are compact, easily transportable, and scalable based on demand, making them ideal for remote or space-constrained locations. This trend is driving innovation in containerized infrastructure, integrated cooling systems, and plug-and-play deployment models.

Focus on Sustainable and Energy-Efficient Infrastructure

As the edge data center footprint expands, energy consumption and environmental impact have become key concerns. Operators are adopting advanced cooling techniques, renewable power sources, and AI-based energy management systems to improve sustainability. Green edge data centers not only reduce operational costs but also align with global ESG goals, making energy efficiency a competitive differentiator in the market.

Global Edge Data Center Market: Research Scope and Analysis

By Component Analysis

In the edge data center market, the solutions segment is expected to lead the component category, accounting for approximately 63.0% of the total market share in 2025. This dominance is primarily driven by the growing demand for robust IT infrastructure, including servers, storage systems, power units, cooling solutions, and network connectivity equipment.

As organizations continue to deploy localized data centers closer to end-users, there is a strong need for high-performance, scalable, and secure hardware systems that can efficiently manage real-time workloads, support IoT integration, and handle AI-powered edge applications. The rising adoption of modular and prefabricated edge facilities is further fueling the requirement for advanced solution stacks that include both hardware and software components for optimized performance.

On the other hand, services are also playing a critical role in the growth of the edge data center ecosystem. This segment includes deployment services, consulting, integration, maintenance, and managed services. As edge deployments often involve complex, distributed infrastructures, enterprises rely on specialized service providers to ensure smooth implementation, round-the-clock support, and performance monitoring.

Managed edge services, in particular, are gaining traction among businesses lacking in-house technical expertise. These services allow organizations to outsource the operation and maintenance of edge environments while ensuring low-latency, high-availability performance. With the expansion of edge computing into new regions and industries, service providers are essential in tailoring solutions to meet diverse operational needs, compliance requirements, and local connectivity challenges.

By Infrastructure Analysis

In the infrastructure segment of the edge data center market, IT infrastructure is projected to remain the dominant category, capturing around 42.0% of the total market share in 2025. This is largely attributed to the growing need for high-performance computing, storage, and networking systems at the edge, where vast volumes of data are generated and need to be processed locally.

As more businesses adopt edge computing to support latency-sensitive applications like autonomous systems, video analytics, and industrial automation, the demand for robust and scalable IT infrastructure continues to rise. Key components such as edge-optimized servers, high-speed switches, and solid-state storage devices form the backbone of these deployments, enabling efficient data handling and real-time decision-making close to the source of data generation.

Alongside IT infrastructure, power and cooling systems form a vital part of the edge data center setup. These systems ensure uninterrupted operations and maintain optimal performance of equipment in often space-constrained and remote environments. Power infrastructure includes UPS systems, backup generators, and PDUs that provide reliable electricity and safeguard against power fluctuations.

Cooling technologies such as precision air conditioning, liquid cooling, and modular CRAC units are critical to managing the heat generated by compact and high-density edge installations. With energy efficiency becoming a priority, many edge data centers are integrating smart cooling solutions and renewable energy sources to minimize operational costs and meet sustainability goals. Together, power and cooling infrastructure play a crucial role in ensuring uptime, prolonging hardware lifespan, and supporting 24/7 availability of edge computing services.

By Data Center Size Analysis

Micro edge data centers are expected to maintain a strong lead in the data center size segment, capturing 48.0% of the total market share in 2025. These compact, containerized facilities are designed to process data close to the source, making them ideal for supporting latency-sensitive applications such as IoT deployments, smart city infrastructure, autonomous vehicles, and remote industrial operations.

Their small footprint allows them to be deployed quickly in locations with limited space or connectivity challenges, such as retail stores, telecom towers, and urban intersections. As the demand for real-time data processing increases, micro edge data centers provide a cost-effective, scalable, and decentralized solution that enables faster response times and reduces the burden on centralized cloud infrastructures.

In addition to micro edge data centers, modular edge data centers are gaining significant traction due to their flexibility, scalability, and faster deployment capabilities. These are typically larger than micro edge units but still prefabricated and designed to be quickly assembled on-site. Modular edge data centers are well-suited for use cases that require higher processing capacity, such as regional content delivery, industrial automation hubs, or localized cloud storage.

They support plug-and-play infrastructure, making it easier to expand computing power as demand grows. Enterprises favor modular setups for their ability to integrate advanced cooling, security, and monitoring systems without the delays of traditional data center construction. This segment is becoming important in edge computing strategies where agility, performance, and future-proofing are critical to success.

By Deployment Mode Analysis

On-premise deployment is set to dominate the edge data center market by deployment mode, accounting for 44.0% of the total market share in 2025. This approach allows organizations to build and manage edge data centers within their own facilities, giving them complete control over infrastructure, security, compliance, and customization.

Industries such as manufacturing, healthcare, and finance often require tight control over data handling and latency due to sensitive operations or regulatory requirements, making on-premise deployment highly favorable. With the rise of real-time data processing needs, many enterprises are investing in localized edge infrastructure to support mission-critical workloads while ensuring faster response times and improved data sovereignty.

Colocation is also playing a vital role in the growth of the edge data center ecosystem. In this model, companies lease space, power, and cooling in third-party facilities rather than building their own. Colocation providers offer scalable infrastructure, robust connectivity, and round-the-clock support, making it an attractive option for businesses looking to deploy edge services without the burden of managing physical assets.

It is particularly appealing to telecom operators, content delivery networks, and mid-sized enterprises that require proximity to end-users but lack the resources for full-scale deployments. As edge computing continues to grow, colocation is becoming a strategic choice for expanding reach and reducing latency while maintaining operational flexibility and cost efficiency.

By Organization Size Analysis

Large enterprises are expected to lead the edge data center market by organization size, capturing 61.0% of the total market share in 2025. These organizations typically have complex IT infrastructures, high data processing needs, and operations spread across multiple geographic locations, all of which drive the demand for decentralized computing solutions. Edge data centers allow large enterprises to manage latency-sensitive applications such as AI-driven analytics, real-time monitoring, and IoT networks more effectively.

Industries like automotive, finance, and manufacturing are deploying edge infrastructure to enhance agility, optimize performance, and support mission-critical workloads that require rapid data access and localized processing. The availability of substantial budgets and skilled IT teams enables large enterprises to invest in private edge networks tailored to their operational demands and compliance requirements.

Small and medium-sized enterprises (SMEs) are also adopting edge data centers, albeit at a more gradual pace. For SMEs, the key drivers include the growing reliance on digital platforms, the adoption of IoT solutions, and the need to support distributed workforces. While they may not require the scale of large enterprise deployments, SMEs benefit from edge computing by improving application responsiveness, enhancing customer experiences, and reducing dependency on centralized cloud services.

Cost remains a critical consideration for this segment, which makes modular and colocation-based edge models particularly attractive. As edge-as-a-service models and scalable edge infrastructure become more accessible, SMEs are able to tap into the benefits of edge computing without large upfront investments.

By Application Analysis

Content delivery and streaming applications are expected to hold the largest share in the edge data center market by application, accounting for 22.0% of the total market value in 2025. This dominance is driven by the growing global consumption of high-definition video, live broadcasts, cloud gaming, and immersive media experiences such as augmented and virtual reality.

Edge data centers enable content to be cached and processed closer to end users, significantly reducing latency, buffering, and bandwidth consumption. This localized data handling ensures a seamless user experience, especially in bandwidth-sensitive applications like 4K video streaming and real-time online gaming. Content providers, CDNs, and OTT platforms are relying on edge infrastructure to meet growing consumer expectations and deliver uninterrupted media services at scale.

IoT and smart devices also represent a major application area within the edge data center landscape. With billions of connected devices generating continuous streams of data, edge computing is essential to process this information efficiently and in real time. Applications range from smart homes and wearable health monitors to industrial sensors and connected vehicles.

Edge data centers support these deployments by enabling rapid data analysis and decision-making at the edge of the network, reducing latency and alleviating the need to transmit all data to a centralized cloud. This not only improves performance but also enhances data privacy and reduces bandwidth costs. As IoT ecosystems expand across sectors such as healthcare, manufacturing, energy, and transportation, the demand for edge-enabled infrastructure to support device connectivity and automation is expected to grow steadily.

By End-User Industry Analysis

The telecommunication industry is projected to maintain its dominant position in the edge data center market by end-user industry, accounting for 26.0% of the total market share in 2025. This leadership is largely driven by the ongoing global rollout of 5G networks, the exponential increase in mobile data traffic, and the need for ultra-low latency services. Telecom providers are actively deploying edge data centers at the network edge, closer to cell towers, base stations, and customer access points, to support real-time communication, mobile video streaming, and network function virtualization.

These localized facilities enhance performance, reduce latency, and improve bandwidth efficiency, which is essential for enabling next-generation telecom services like mobile AR/VR, edge caching, and autonomous communication systems. As telecom infrastructure becomes more software-defined and data-intensive, edge computing becomes critical for ensuring speed, scalability, and network reliability.

The banking, financial services, and insurance (BFSI) sector is also leveraging edge data centers to enhance its digital infrastructure. Real-time transaction processing, fraud detection, and personalized financial services require instantaneous data analytics, which edge computing facilitates by processing data close to the source. With growing customer demand for digital banking and the proliferation of mobile payment platforms, financial institutions are adopting edge data centers to reduce latency, enhance customer experience, and ensure faster response times.

Moreover, edge infrastructure supports compliance with data residency and regulatory standards by enabling localized data handling, which is particularly vital for institutions operating across multiple jurisdictions. As the BFSI sector continues to embrace AI, blockchain, and fintech innovations, the integration of edge data centers will be key to securing and optimizing these advanced financial technologies.

The Edge Data Center Market Report is segmented on the basis of the following:

By Component

By Infrastructure

- IT Infrastructure

- Power & Cooling

- Security & Monitoring

- Others

By Data Center Size

- Micro Edge Data Centers

- Modular Edge Data Centers

- Hyperscale/Regional Edge

By Deployment Mode

- On-Premise

- Colocation

- Cloud-managed Edge (Edge-as-a-Service)

By Organization Size

By Application

- Content Delivery & Streaming

- IoT & Smart Devices

- AI & Machine Learning at Edge

- AR/VR & Gaming

- Autonomous Vehicles & Traffic Systems

- Industrial Automation & Robotics

- Smart Cities

By End-User Industry

- Telecommunications

- BFSI

- Retail & E-commerce

- Healthcare

- Manufacturing & Industrial IoT

- IT & Cloud Service Providers

- Media & Entertainment

- Others

Global Edge Data Center Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global edge data center services market in 2025, capturing 39.0% of the total market revenue. This leadership position is supported by the region’s advanced digital infrastructure, early adoption of emerging technologies, and strong presence of major cloud service providers, telecom operators, and data center vendors.

The widespread deployment of 5G networks, integrated with high demand for low-latency applications such as autonomous vehicles, real-time analytics, and immersive media, is driving substantial investment in edge computing infrastructure. Additionally, North America's focus on smart cities, industrial IoT, and AI-driven services continues to fuel the expansion of distributed computing environments, positioning the region as a central hub for innovation and growth in the edge data center market.

Region with significant growth

Asia-Pacific is expected to witness the most significant growth in the edge data center market over the coming years, driven by rapid digital transformation, expanding internet penetration, and growing investments in smart city initiatives. Countries such as China, India, Japan, and South Korea are aggressively rolling out 5G infrastructure, supporting a surge in real-time applications across sectors like manufacturing, healthcare, retail, and transportation.

The region's large population base, growing adoption of IoT devices, and demand for low-latency digital services are creating strong incentives for enterprises and telecom operators to deploy localized computing infrastructure. Additionally, favorable government policies, rising cloud adoption, and the expansion of data localization regulations are accelerating the need for scalable, energy-efficient edge data centers across the Asia-Pacific landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Edge Data Center Market: Competitive Landscape

The global competitive landscape of the edge data center market is characterized by a mix of established technology giants, telecom infrastructure providers, and emerging specialized players, all vying to capture market share through innovation, strategic partnerships, and geographic expansion. Companies like Schneider Electric, Vertiv, Dell Technologies, and HPE lead the market with comprehensive infrastructure solutions, while cloud service providers such as Amazon Web Services (AWS) and Microsoft Azure are investing in edge computing capabilities to extend their service reach.

Telecom operators are also playing a crucial role by integrating edge facilities into their 5G networks to enhance data delivery and service performance. Meanwhile, niche players like EdgeConneX, Vapor IO, and Stack Infrastructure are disrupting the market with modular, location-optimized solutions tailored for latency-sensitive applications. The competitive focus is shifting toward energy-efficient systems, AI-enabled edge management, and region-specific deployments, as vendors aim to meet the evolving needs of industries embracing distributed computing models.

Some of the prominent players in the global edge data center market are:

- Schneider Electric

- Vertiv

- Hewlett-Packard Enterprise (HPE)

- Dell Technologies

- Huawei Technologies

- Cisco Systems

- IBM Corporation

- NVIDIA Corporation

- Eaton Corporation

- Rittal GmbH & Co. KG

- Equinix, Inc.

- EdgeConneX

- Compass Datacenters

- Vapor IO

- Stack Infrastructure

- Cyxtera Technologies

- Zella DC

- Iron Mountain Inc.

- AT&T Inc.

- Amazon Web Services (AWS)

- Other Key Players

Global Edge Data Center Market: Recent Developments

- June 2025: Schneider Electric launched a new range of compact, AI-integrated EcoStruxure Micro Data Centers designed for edge environments in retail and industrial settings. The product features advanced cooling, remote monitoring, and modular scalability tailored for decentralized IT operations.

- April 2025: Vertiv introduced its Vertiv Edge Lithium-Ion UPS solution globally, aimed at supporting edge applications with higher energy efficiency, longer battery life, and lower maintenance compared to traditional systems. It is specifically designed for remote, space-constrained environments.

- March 2025: Equinix completed the acquisition of a regional edge data center operator in Southeast Asia to expand its footprint in fast-growing digital markets, enhancing its ability to offer low-latency services in emerging economies.

- January 2025: Vapor IO acquired a U.S.-based edge colocation startup to enhance its Kinetic Edge platform, strengthening its network of interconnected edge sites across North America and supporting autonomous systems and 5G applications.

- May 2025: EdgeConneX secured USD 300 million in funding from existing investors to accelerate the expansion of its edge data center footprint across Europe and Latin America, targeting underserved regions with rising demand for localized data services.

- February 2025: Zella DC announced a USD 50 million Series B funding round to scale its modular micro edge data center solutions globally, focusing on remote and underserved enterprise markets, particularly in Africa and Southeast Asia.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.0 Bn |

| Forecast Value (2034) |

USD 51.2 Bn |

| CAGR (2025–2034) |

18.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Infrastructure (IT Infrastructure, Power & Cooling, Security & Monitoring, and Others), By Data Center Size (Micro Edge Data Centers, Modular Edge Data Centers, and Hyperscale/Regional Edge), By Deployment Mode (On-Premise, Colocation, and Cloud-managed Edge [Edge-as-a-Service]), By Organization Size (Large Enterprises and SMEs), By Application (Content Delivery & Streaming, IoT & Smart Devices, AI & Machine Learning at Edge, AR/VR & Gaming, Autonomous Vehicles & Traffic Systems, Industrial Automation & Robotics, and Smart Cities), and By End-User Industry (Telecommunications, BFSI, Retail & E-commerce, Healthcare, Manufacturing & Industrial IoT, IT & Cloud Service Providers, Media & Entertainment, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Schneider Electric, Vertiv, HPE, Dell Technologies, Huawei, Cisco, IBM, NVIDIA, Eaton, Rittal, Equinix, EdgeConneX, Compass Datacenters, Vapor IO, Stack Infrastructure, Cyxtera, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global edge data center services market size is estimated to have a value of USD 11.0 billion in 2025 and is expected to reach USD 51.2 billion by the end of 2034.

The US edge data center services market is projected to be valued at USD 3.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.4 billion in 2034 at a CAGR of 17.5%.

North America is expected to have the largest market share in the global edge data center services market, with a share of about 39.0% in 2025.

Some of the major key players in the global edge data center services market are Schneider Electric, Vertiv, HPE, Dell Technologies, Huawei, Cisco, IBM, NVIDIA, Eaton, Rittal, Equinix, EdgeConneX, Compass Datacenters, Vapor IO, Stack Infrastructure, Cyxtera, and Others.

The market is growing at a CAGR of 18.7 percent over the forecasted period.