Market Overview

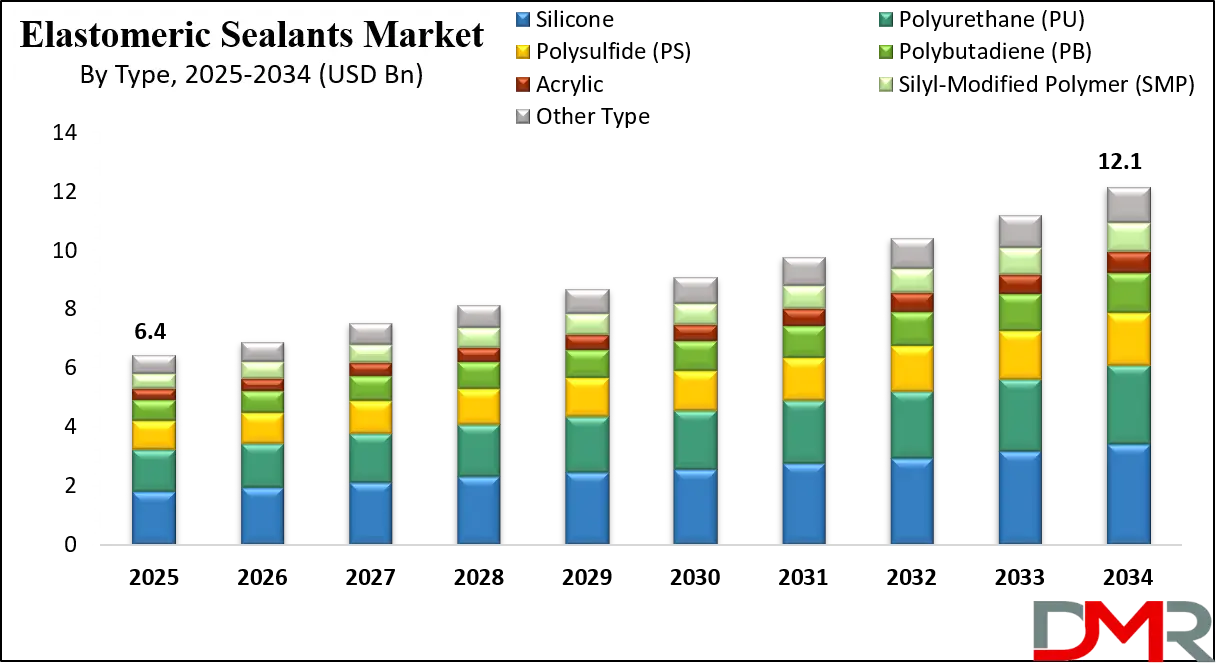

The Global Elastomeric Sealants Market is projected to witness significant growth, reaching USD 6.4 billion by 2025 and expanding at a CAGR of 7.3% throughout the forecast period. By 2034, the market is expected to attain an estimated value of USD 12.1 billion. Growth is being driven by increasing demand across construction, automotive, aerospace, marine, and industrial applications, where elastomeric sealants provide superior flexibility, durability, and weather resistance.

Rising investments in infrastructure development, along with the growing need for eco-friendly, low-VOC sealants, are further boosting adoption. Additionally, advancements in polyurethane, silicone, and polysulfide-based elastomeric formulations are expanding performance capabilities, catering to both structural bonding and waterproofing solutions, and solidifying market expansion globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global elastomeric sealants market is expanding as building envelope performance, lightweight automotive assemblies, and miniaturized electronics drive demand for flexible, high-performance sealing and bonding chemistries. Growth is supported by rising retrofit activity in mature markets and accelerated construction and infrastructure spending in emerging regions; manufacturers are responding with low-VOC, hybrid SMP and silane-modified systems that combine silicone weatherability with polyurethane toughness.

Manufacturers are innovating toward faster-curing, single-component (1K) formulations and tailored two-component (2K) structural adhesives to meet OEM bonding requirements in transportation and renewable-energy installations. This technical shift is increasing average selling prices in value-dense end-uses such as automotive glazing and electronics encapsulation, while volume growth remains anchored in construction joint sealing and weatherproofing.

Sustainability and regulatory pressure—low VOC limits, recyclability requirements, and fire-performance standards—are reshaping R&D priorities and supply chains, creating opportunities for bio-based additives and solvent-free chemistries but also raising raw-material sourcing and compliance costs for producers. Market constraints include feedstock volatility, cyclic construction activity, and substitution risk from competing adhesives in some applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Statistically, a mid-single to high-single digit global CAGR underpins forecasts driven by infrastructure renovation cycles, electrification of transport (which raises demand for specialized sealants), and growth in consumer electronics requiring potting and gap-fill solutions. Global opportunities include aftermarket repair/retrofit segments, modular construction, and integration with passive fire and acoustic systems, while risks focus on regional policy shifts and commodity price shocks. Overall, the outlook favors suppliers who can combine formulation agility, regulatory compliance, and regional distribution to capture both volume and higher-margin specialty applications.

The US Elastomeric Sealants Market

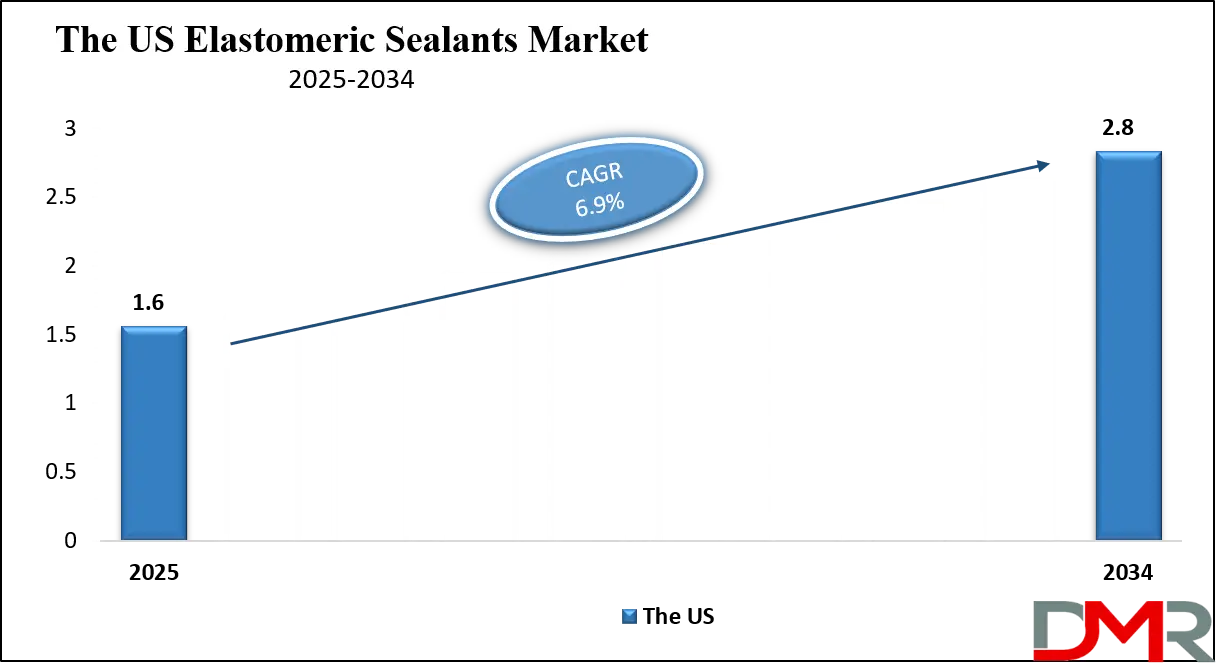

The US Elastomeric Sealants Market is projected to reach USD 1.6 billion in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The U.S. market benefits from sustained demand across residential and non-residential construction, large renovation pipelines, and a robust automotive and electronics manufacturing base; the U.S. Census Bureau’s construction spending and housing-starts data show ongoing project activity that underpins sealant consumption in joint sealing, glazing, and structural bonding. The demographic advantage includes a growing and geographically mobile population—with metro expansion in Sun Belt regions—and an aging housing stock that fuels retrofit and weatherproofing work, while Census population estimates and construction surveys provide the empirical basis for projecting product demand.

Industrial dynamics favor one-component, low-VOC formulations for commercial and residential construction and high-performance polyurethanes and structural SMPs for automotive assembly and repair. End-users in HVACR, fenestration, and civil infrastructure require proven service life and compatibility with diverse substrates—concrete, aluminium, glass, and polymer composites—so suppliers emphasize primerless adhesion, UV stability, and movement accommodation.

Labor market trends and regional permitting processes influence installation rates; meanwhile, federal and state energy-efficiency programs and building codes (insulation, air-tightness) indirectly push uptake of advanced sealants. The combination of construction project pipelines, demographic shifts toward rental and multifamily housing, and regulatory emphasis on indoor-air quality positions the U.S. as a high-value market for both commodity and specialty elastomeric sealants.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Elastomeric Sealants Market

The Europe Elastomeric Sealants Market is estimated to be valued at USD 960.0 million in 2025 and is further anticipated to reach USD 1,764.0 million by 2034 at a CAGR of 7.0%.

Europe’s elastomeric sealants market is shaped by an aging building stock, stringent energy-efficiency regulations, and a strong industrial base for automotive and high-value electronics manufacturing. Eurostat construction production and demographic publications highlight slower structural growth but elevated retrofitting and renovation activity driven by decarbonization and building-efficiency directives, which favor sealants that improve airtightness, thermal bridging mitigation, and long-term durability. The median age and ageing population trends in the EU also influence demand patterns for retrofit accessibility and healthcare infrastructure projects.

Regulatory and market forces push the adoption of low-emission, fire-resistant, and recyclable formulations; suppliers increasingly promote SMP hybrids and solvent-free technologies for compliance with VOC limits and circular-economy goals. Automotive trends—electrification and lightweighting—are altering OEM sealing needs for battery enclosures, sensor housings, and multi-material joints, delivering opportunities for structural adhesives and potting compounds.

Meanwhile, variability across EU member states in construction cycles and incentives creates a mosaic of demand: Northern and Western Europe emphasize high-performance, specification-driven products, while Eastern and Southern markets show stronger volume growth in basic joint-sealant categories. Success in Europe requires localized formulation approvals, strong distribution partnerships, and alignment with green-building certification standards.

The Japan Elastomeric Sealants Market

The Japan Elastomeric Sealants Market is projected to be valued at USD 384.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 736.0 million in 2034 at a CAGR of 7.6%.

Japan’s market is characterized by advanced manufacturing, dense electronics and automotive value chains, and a demographic profile dominated by an aging population—factors that together shape sealant demand toward high-precision, long-service-life, and low-maintenance solutions. National statistical publications and the Statistical Handbook of Japan document an increasingly older population and stable urban infrastructure investment patterns; these demographic realities drive renovation of existing housing and public facilities, as well as demand for sealing solutions in healthcare and assisted-living construction.

Industrial demand is pronounced in electronics encapsulation, automotive structural bonding, and marine/defense applications where tight tolerances and material compatibility are critical. Suppliers in Japan emphasize silicones for weather resistance, specialty polyurethanes for structural joining, and SMPs for primerless adhesion on diverse substrates.

Market opportunities include seismic-resilient sealing systems for infrastructure retrofits, modular prefabrication in urban infill projects, and specialty formulations for high-reliability electronics used in automotive ADAS and battery systems. Given demographic headwinds that constrain labor availability, there is growing interest in sealants that enable faster installation, longer maintenance intervals, and compatibility with automated dispensing in manufacturing lines.

Global Elastomeric Sealants Market: Key Takeaways

- Global Market Size Insights: The Global Elastomeric Sealants Market size is estimated to have a value of USD 6.4 billion in 2025 and is expected to reach USD 12.1 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Elastomeric Sealants Market is projected to be valued at USD 1.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.8 billion in 2034 at a CAGR of 6.9%.

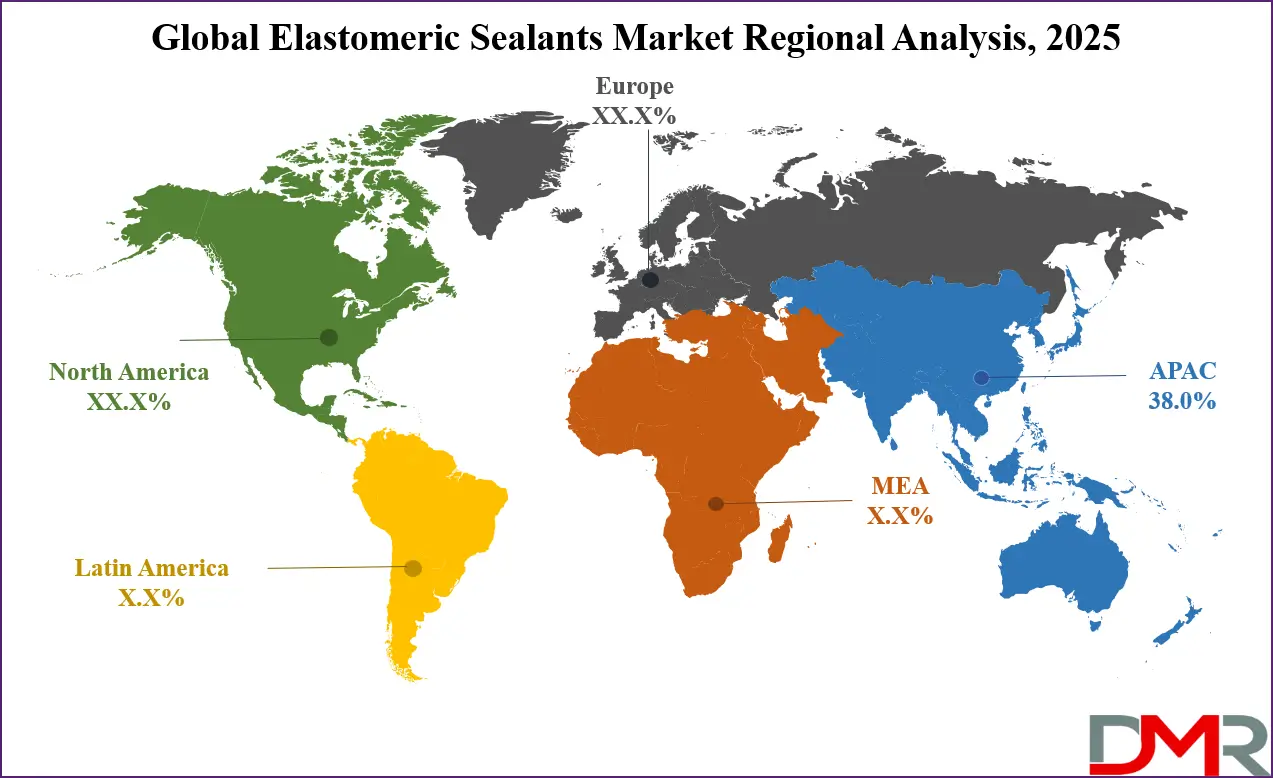

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Elastomeric Sealants Market with a share of about 38.0% in 2025.

- Key Players: Some of the major key players in the Global Elastomeric Sealants Market are 3M Company, Henkel AG & Co. KGaA, Sika AG, BASF SE, Dow Inc., Wacker Chemie AG, and many others.

Global Elastomeric Sealants Market: Use Cases

- Façade & Window Glazing Sealing: Modern façades rely on silicone and SMP sealants to maintain airtightness, manage thermal expansion, and resist UV-induced degradation; high-movement joints in curtain walls and insulated glazing units require low-modulus, permanently elastic products that prevent water ingress, improve energy performance, and meet fire and acoustic continuity requirements in commercial buildings.

- Automotive Body & Glazing Bonding: Polyurethane and structural hybrid sealants are used for windshield bonding, seam sealing, and multi-material joints in electric and conventional vehicles; these chemistries provide crash-relevant adhesion, vibration damping, and corrosion protection while enabling lightweight designs and automated dispensing on production lines.

- Electronics Potting & Encapsulation: Low-outgassing silicone and specialty polyurethane potting compounds protect PCBs, sensors, and connectors from moisture, thermal stress, and vibration; elastomeric formulations provide dielectric insulation, thermal management, and mechanical strain relief in consumer devices, industrial controls, and automotive electronic modules.

- Marine & Fuel-Resistant Joint Sealing: Polysulfide and specialty polyurethane sealants deliver chemical resistance and long-term flexibility needed in shipbuilding, fuel-system assemblies, and offshore equipment; these sealants tolerate salt spray, hydrocarbons, and cyclic movement, ensuring watertight joints and compliance with marine safety standards.

- HVACR & Industrial Equipment Gasketing: Elastomeric sealants serve as gasketing and vibration-damping materials in HVAC ductwork, refrigeration systems, and machinery assembly; formulations focus on temperature stability, low compressive set, and compatibility with metals and plastics to prevent leaks, improve energy efficiency, and reduce maintenance downtime.

Global Elastomeric Sealants Market: Stats & Facts

U.S. Census Bureau (U.S. Department of Commerce)

- Construction spending during the first six months of 2025 amounted to USD 1,036.1 billion.

- Privately-owned housing starts (seasonally adjusted annual rate) in July 2025 were 1,428,000 units.

- Private construction spending was reported at an annual rate of about USD 1,621.9 billion (most recent monthly rate referenced).

U.S. Bureau of Labor Statistics (BLS)

- Overall employment in construction and extraction occupations is projected to produce about 649,300 job openings per year on average from 2024–2034 (growth + replacements).

- The BLS projects construction and extraction occupations to grow faster than the average for all occupations over 2024–2034 (supporting sustained demand for installation labor).

- BLS industry employment table shows ~8.21 million people employed in the construction sector (2024 data; projected ~8.57 million by 2034).

U.S. Environmental Protection Agency (EPA) / Federal Register

- The EPA has active regulatory action on volatile organic compound (VOC) emissions for consumer and coating products; an interim final rule revising national VOC emission standards was published in the Federal Register in 2025.

- The EPA identifies paints, adhesives, sealants, and consumer products among primary indoor/outdoor VOC sources — regulatory pressure on these product categories drives formulation change (low-VOC and solvent-free sealants).

U.S. Energy Information Administration (EIA) & NREL

- In 2023, the combined U.S. residential and commercial sectors accounted for about 27.6% of U.S. end-use energy consumption.

- The EIA’s CBECS estimated ~5.9 million U.S. commercial buildings consumed ~6.8 quadrillion Btu of energy (2018 CBECS estimate).

- National Renewable Energy Laboratory (NREL) notes buildings are responsible for roughly 40% of U.S. total energy use and about 35% of U.S. carbon emissions (building operations + electricity).

Eurostat / European Commission (EU)

- The European Commission’s Renovation Wave aims to renovate 35 million buildings by 2030 (doubling annual energy renovation rates).

- The revised EU Energy Performance of Buildings Directive (EPBD) targets an 11.7% reduction in EU building energy consumption by 2030 as part of energy-efficiency goals.

- Eurostat reported the construction production index (volume) for the EU showed a –0.9% annual average change in 2024 (compared with 2023).

International Energy Agency (IEA) / UNEP (Buildings & Construction)

- Buildings and construction together account for roughly 27% (operational) of global CO₂ emissions (with additional emissions from materials/manufacturing).

- Global buildings energy demand reached about 135 exajoules (EJ) in 2021 — one of the largest recent increases in a decade.

- The UNEP / Buildings-GSR notes buildings’ operational emissions are just under ~10 GtCO₂ (2022 scale).

United Nations / World Bank (urbanization & demographics)

- Today > over 4 billion people (over 50% of the world’s population) live in cities; the UN projects urban share rising to ~68% by 2050 (major long-term demand driver for buildings and infrastructure).

Government of Japan — Cabinet Office / METI / Ministry of Health

- Japan’s total population was 124.35 million (as of Oct 1, 2023; Annual Report on the Ageing Society).

- The population aged 65 and over was ~29.1% of the total population (2023 Annual Report on the Ageing Society).

- Japan recorded ~720,988 births in 2024 (preliminary ministry data), the lowest annual births on record — a demographic trend affecting housing and retrofit demand.

ACEA / European Environment Agency (automotive & EV trends in Europe)

- Eurostat reports the number of registered passenger cars in the EU exceeded ~259 million in 2024.

- The EEA / ACEA reported ~2.4 million new electric cars registered in 2023 (rising share of electrified vehicle production affects specialized sealant demand for battery enclosures).

U.S. National Institute of Standards & Technology (NIST) / UNCTAD

- NIST (synthesizing BEA data) reports U.S. manufacturing value added in 2022 was ~$2.3 trillion, roughly 11.4% of U.S. GDP (manufacturing scale supports industrial sealant demand).

- UNCTAD/related data note that manufacturing value-added per capita in developed economies was roughly USD 5,379 (constant 2015 prices) in 2023 — indicating high industrial intensity in advanced markets (higher ASP sealant opportunities.

REN21 (renewables & buildings)

- REN21 reports ~75% of the final energy consumed in buildings is used for space heating and hot water (global buildings energy profile).

- REN21 also notes that electricity met ~35% of buildings’ energy needs in 2021, with electricity demand for cooling rising rapidly—drivers for improved building envelopes and sealants that improve efficiency.

Global Elastomeric Sealants Market: Market Dynamics

Driving Factors in the Global Elastomeric Sealants Market

Infrastructure expansion and urbanization worldwide

Urbanization and infrastructure spending are among the most powerful growth drivers in the elastomeric sealants market. According to the United Nations, nearly 68% of the world’s population will live in cities by 2050, creating intense demand for residential, commercial, and civil infrastructure projects. Countries such as India, China, and Indonesia are witnessing extensive construction of urban transport systems, high-rise buildings, airports, and smart cities, all requiring high-performance sealing solutions for glazing, expansion joints, and waterproofing.

Mature economies in Europe and North America are focused on large-scale retrofitting and renovation programs driven by energy-efficiency directives and decarbonization goals. Sealants play a pivotal role in airtightness, fire safety, and vibration damping in these projects. Simultaneously, emerging economies are investing heavily in public housing and industrial facilities, further boosting consumption. Elastomeric sealants’ versatility, ability to bond multiple substrates, and durability under environmental stress position them as indispensable materials in long-term infrastructure development.

Automotive electrification and lightweighting initiatives

The transition to electric vehicles (EVs) and lightweight automotive design significantly drives demand for elastomeric sealants. EV battery packs require advanced adhesives and sealants that provide vibration resistance, fire retardancy, and moisture protection while maintaining structural integrity under harsh operating conditions. Elastomeric sealants are integral to bonding battery housings, gaskets, and cooling systems.

Lightweighting efforts, aimed at improving fuel efficiency and reducing emissions, encourage the use of mixed materials such as aluminum, composites, and polymers, which require versatile sealants to ensure secure joints. Sealants also enhance NVH (noise, vibration, harshness) performance, contributing to passenger comfort.

Globally, vehicle production remains high, with Asia-Pacific leading automotive manufacturing output. The rapid adoption of EVs in Europe, North America, and China further magnifies demand. OEMs are increasingly specifying hybrid SMP and polyurethane formulations compatible with automated robotic dispensing, reducing cycle times and boosting productivity. This convergence of electrification and material innovation ensures sustained sealant market growth in the automotive sector.

Restraints in the Global Elastomeric Sealants Market

Raw material price volatility and supply chain risks

One of the key restraints in the elastomeric sealants market is the volatility of raw material prices and the fragility of global supply chains. Base polymers, specialty additives, and curing agents often depend on petrochemical derivatives, leaving producers exposed to oil price fluctuations and geopolitical uncertainties.

Recent disruptions in global logistics—ranging from pandemic-driven port congestion to energy supply shocks in Europe—have amplified cost structures for manufacturers. For smaller regional producers, the inability to secure long-term raw material contracts creates competitive disadvantages compared to integrated chemical giants. Price volatility reduces predictability in margins, complicates planning, and forces downstream price adjustments that contractors and OEMs resist.

Additionally, environmental regulations affecting chemical production facilities, particularly in China and Europe, have occasionally restricted supply. Unless producers diversify sourcing and adopt more sustainable feedstocks, this restraint will continue to hamper long-term profitability and market stability.

Regulatory compliance and substitution pressures

Stringent regulations governing VOC emissions, chemical safety, and recyclability impose compliance costs on elastomeric sealant manufacturers. In regions such as the EU, REACH and CLP regulations demand extensive documentation and reformulation, while in North America, the EPA enforces emissions standards for construction and consumer products. These compliance requirements increase R&D expenditures, lengthen product approval timelines, and sometimes restrict the use of cost-effective ingredients.

In parallel, there is rising substitution pressure from alternative bonding technologies such as tapes, structural adhesives, and preformed gaskets, which compete in specific industrial applications. Contractors and OEMs are also pushing for solutions that integrate faster application and lower labor dependency, occasionally favoring alternative materials.

Opportunities in the Global Elastomeric Sealants Market

Green buildings and energy efficiency retrofits

The global focus on decarbonization and sustainable construction creates vast opportunities for elastomeric sealants. Green building certification programs, including LEED in the U.S., BREEAM in Europe, and CASBEE in Japan, emphasize airtightness, moisture resistance, and durability—performance factors directly influenced by sealant technologies. Retrofitting existing structures for energy efficiency, especially in Europe, where over 75% of buildings are energy-inefficient, represents a multi-billion-dollar opportunity.

Sealants play a critical role in minimizing air leakage, improving insulation performance, and supporting passive house standards. National renovation waves, such as the EU’s plan to double annual energy renovation rates, ensure consistent market pull. In North America, federal tax credits and state-level incentives for weatherization stimulate demand. In Asia, rapid urbanization coincides with sustainability mandates, further accelerating adoption. The opportunity lies not only in volume growth but also in high-margin, specialized formulations engineered for fire resistance, acoustic performance, and long-term service in demanding climatic conditions.

Expansion into electronics and high-tech industries

The elastomeric sealants market is also poised to capture opportunities in the electronics and advanced manufacturing sectors. Miniaturization of electronic devices, proliferation of 5G infrastructure, and growth in semiconductor manufacturing require potting, encapsulation, and vibration-damping solutions.

Elastomeric sealants, particularly silicones and polyurethane derivatives, provide electrical insulation, thermal stability, and protection against moisture and dust ingress in sensitive electronic assemblies. With global electronics production concentrated in East Asia, suppliers have opportunities to integrate deeper into high-growth clusters in Japan, South Korea, and China.

Beyond consumer devices, industrial automation, aerospace electronics, and renewable energy systems—such as wind turbine control units and solar panel junction boxes—rely heavily on elastomeric sealing to ensure long service life. As demand for high-reliability electronics increases in automotive ADAS and medical devices, sealants with low outgassing, high dielectric strength, and compatibility with automated dispensing are becoming mission-critical, creating lucrative opportunities for suppliers with specialized formulations.

Trends in the Global Elastomeric Sealants Market

Shift toward hybrid formulations and sustainable chemistries.

The market is witnessing a strong shift from traditional polyurethane and silicone products toward hybrid systems such as silyl-modified polymers (SMPs). These chemistries combine high UV resistance, primerless adhesion, and elasticity without the VOC-related drawbacks of solvent-based technologies.

Governments in North America, Europe, and Asia are tightening regulations on emissions and chemical content, prompting R&D teams to prioritize low-VOC, solvent-free, and even bio-based sealants. Sustainable construction programs, circular economy policies in Europe, and green building certification systems such as LEED and BREEAM accelerate this transition.

Automotive OEMs and electronics manufacturers are also adopting SMPs because of their compatibility with multi-material assemblies, ease of processing, and long-term reliability under thermal stress. In marine and aerospace applications, hybrid systems provide corrosion resistance and weight-saving advantages. This trend reflects not only regulatory compliance but also growing demand for performance, lifecycle durability, and sustainability in critical bonding and sealing applications.

Digitalization of application methods and automated dispensing

Another notable trend in the elastomeric sealants market is the integration of advanced dispensing and digital application technologies. Robotics and automated systems in automotive production, aerospace assembly, and electronics manufacturing increasingly rely on programmable sealant dispensing units that deliver high precision and reduce material waste.

Building construction is also adopting mechanized caulking and preformed sealing systems to mitigate skilled-labor shortages, particularly in Europe and Japan, where the aging workforce is constraining manual application capacity. Automated solutions improve consistency, reduce defects, and ensure compliance with stringent energy-efficiency codes by guaranteeing airtight joints.

Digital monitoring of curing cycles, bonding strength, and moisture ingress prevention through IoT-enabled tools is gaining traction, offering real-time quality assurance and predictive maintenance in industrial production lines. These trends represent a convergence of materials science and Industry 4.0 manufacturing practices, allowing sealant suppliers to embed themselves deeper into OEM supply chains and construction contractors’ digital workflow ecosystems.

Global Elastomeric Sealants Market: Research Scope and Analysis

By Type Analysis

Silicone-based elastomeric sealants are projected to dominate the global market in terms of both value and volume, largely due to their unparalleled performance in weatherproofing, structural glazing, and façade applications. Their inherent flexibility, UV resistance, and wide service temperature range make them indispensable in high-performance infrastructure projects, particularly in urban centers with rising demand for energy-efficient and sustainable buildings.

Silicone formulations also comply with stringent international standards for fire safety, VOC emissions, and green building certifications, positioning them as the preferred choice for architects, façade engineers, and contractors. The dominance of silicone sealants is reinforced by the control of production capacity and advanced formulations by global specialty chemical leaders such as Dow Inc., Wacker Chemie AG, 3M Company, and Henkel AG.

Additionally, specification-driven suppliers like Sika AG leverage strong brand equity in construction and industrial applications, ensuring repeat use across projects. The ability of silicone sealants to bond dissimilar substrates such as glass, metal, and stone further supports their leadership in modern architectural designs, particularly curtainwall glazing and insulated glass units.

Their extended lifespan compared to polyurethane or acrylic alternatives reduces replacement cycles, appealing to stakeholders seeking lifecycle cost savings. As urbanization accelerates across Asia-Pacific and the Middle East, silicone’s role as the premium sealant chemistry is expected to strengthen, supported by technology innovations such as low-VOC formulations, self-healing chemistries, and enhanced adhesion technologies. This cements silicone’s position as the chemistry leader in the elastomeric sealants market.

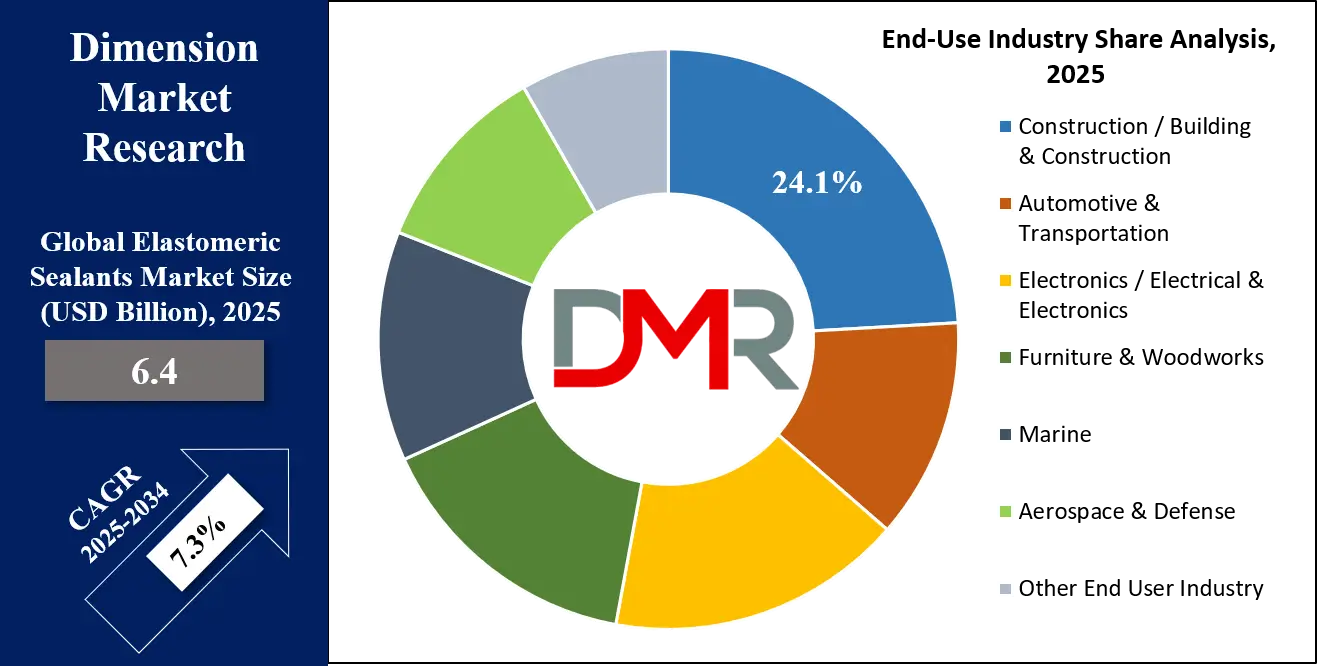

By End-Use Industry Analysis

The construction and building industry is poised to be the single largest consumer of elastomeric sealants, accounting for the highest volume demand globally. This dominance is driven by the extensive use of sealants in applications such as façade glazing, expansion joints, roofing, flooring, and interior finishing. Sealants provide critical performance in structural stability, energy efficiency, moisture resistance, and air sealing, making them integral to both residential and commercial projects. With the global construction sector expanding due to urbanization, infrastructure upgrades, and government-led housing initiatives, the demand from this segment consistently outpaces automotive, electronics, or marine applications.

Key suppliers in this space include Sika AG, MAPEI S.p.A., Tremco Incorporated, Pidilite Industries, Soudal Group, and RPM International, each offering tailored sealant systems optimized for specific building applications. These companies dominate by combining chemical expertise with system integration—providing adhesives, waterproofing membranes, coatings, and sealants as part of bundled solutions.

Moreover, compliance with building codes, LEED certifications, and sustainability mandates drives the adoption of low-VOC, eco-friendly elastomeric sealants, further strengthening the construction sector’s lead. High-rise developments, smart city initiatives, and investments in green infrastructure across Asia-Pacific, the U.S., and Europe are expanding the usage of high-performance sealants, particularly silicone and polyurethane types.

Renovation and retrofitting projects in developed markets also sustain recurring demand. As construction increasingly embraces modular and prefabricated systems, elastomeric sealants remain central to ensuring airtightness and durability. The industry’s scale, coupled with continuous technological evolution and supplier consolidation, ensures that the construction and building sector will remain the dominant end-use driver for elastomeric sealants globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Elastomeric Sealants Market Report is segmented on the basis of the following:

By Type

- Silicone

- Polyurethane (PU)

- Polysulfide (PS)

- Polybutadiene (PB)

- Acrylic

- Silyl-Modified Polymer (SMP)

- Other Type

By End-Use Industry

- Construction / Building & Construction

- Automotive & Transportation

- Electronics / Electrical & Electronics

- Furniture & Woodworks

- Marine

- Aerospace & Defense

- Other End User Industry

Impact of Artificial Intelligence in the Global Elastomeric Sealants Market

- Smart Manufacturing and Process Optimization: AI-driven predictive analytics optimize elastomeric sealant production by reducing waste, enhancing energy efficiency, ensuring precise formulations, and automating mixing and curing stages, enabling manufacturers to achieve consistent quality with lower operational costs.

- Advanced Quality Control Systems: AI-enabled vision systems and machine learning models detect micro-defects, viscosity inconsistencies, and bonding irregularities in elastomeric sealants, ensuring higher durability and compliance with international building, automotive, and aerospace quality standards.

- Predictive Maintenance of Equipment: Artificial intelligence in elastomeric sealant plants enables predictive maintenance, monitoring machinery performance, preventing downtime, and extending equipment life cycles, thereby reducing production interruptions and ensuring continuous supply chain stability.

- AI-Driven R&D for Formulation Innovation: Machine learning accelerates elastomeric sealant research by analyzing molecular structures, chemical interactions, and performance simulations, enabling faster development of eco-friendly, durable, and application-specific sealants for industries like construction, marine, and automotive.

- Enhanced Supply Chain and Market Forecasting: AI algorithms strengthen logistics by forecasting raw material demands, predicting regional sealant consumption, and optimizing distribution, allowing suppliers to reduce costs, minimize delays, and align production with market demand fluctuations.4

Global Elastomeric Sealants Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to dominate the global elastomeric sealants market with 38.0% of the market share by the end of 2025, due to its strong construction, automotive, and electronics industries, supported by rapid urbanization and industrialization. Countries such as China, India, Japan, and South Korea serve as both production and consumption hubs for sealants, with extensive demand in infrastructure development, residential housing, high-rise projects, and industrial facilities. The surge in government-backed smart city initiatives and urban infrastructure expansion projects across India and China is a major driver for silicone and polyurethane-based sealants used in weatherproofing, glazing, and structural bonding.

Automotive manufacturing in Japan, China, and South Korea further drives consumption, as elastomeric sealants are crucial in bonding, vibration-damping, and corrosion resistance applications. The electronics sector in Taiwan, Japan, and South Korea adds another layer of demand for specialty sealants with high precision and reliability. The region also benefits from a strong raw material supply chain, relatively lower labor costs, and increasing adoption of eco-friendly formulations due to tightening environmental regulations.

Additionally, leading global players are expanding operations or establishing joint ventures in the Asia Pacific to leverage its massive growth potential. Domestic companies, particularly in China and India, are also strengthening their positions through cost-effective production. This combination of large-scale demand, supportive policies, and competitive manufacturing advantages positions the Asia Pacific as the undisputed leader in the elastomeric sealants market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America is expected to record the highest CAGR in the elastomeric sealants market, primarily due to advanced technological integration, sustainability focus, and growing renovation activities in the construction sector. The United States, supported by robust infrastructure investments and stringent building codes, is driving higher adoption of high-performance sealants, particularly silicone and SMP chemistries, that ensure durability, energy efficiency, and compliance with green building certifications.

The automotive and aerospace industries in the U.S. and Canada are critical growth drivers, with elastomeric sealants extensively used for structural bonding, insulation, and weatherproofing in lightweight and fuel-efficient designs. Additionally, the booming electric vehicle (EV) market in North America requires advanced sealant solutions for battery packs, safety enclosures, and thermal management, accelerating demand for innovative chemistries.

North America also leads in R&D investments and adoption of smart manufacturing powered by AI, robotics, and automation, which enhances product consistency, performance monitoring, and supply chain optimization. The shift toward bio-based, low-VOC, and sustainable sealants aligns with rising environmental awareness and evolving regulatory frameworks, further boosting market attractiveness.

Another contributing factor is the high prevalence of renovation and retrofitting activities across commercial and residential infrastructure, driving continuous consumption. Strategic mergers, acquisitions, and technological innovations by regional players strengthen the supply base and expand product portfolios. Collectively, these factors make North America a dynamic growth hub, offering the fastest CAGR among global regions in the elastomeric sealants market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Elastomeric Sealants Market: Competitive Landscape

The global elastomeric sealants market is highly competitive, with a mix of multinational corporations and regional players competing on innovation, quality, price, and distribution reach. Leading companies such as Dow Inc., Wacker Chemie AG, Henkel AG & Co. KGaA, Sika AG, 3M Company, and RPM International Inc. hold significant market shares due to their diversified product portfolios, strong R&D capabilities, and global distribution networks. These companies dominate high-value applications in construction, automotive, and aerospace with advanced silicone, polyurethane, and silyl-modified polymer-based sealants.

Sika AG and MAPEI S.p.A. have established strong footholds in construction-focused segments, leveraging their system integration expertise. Meanwhile, Tremco Incorporated, Pidilite Industries, and Soudal Group are recognized as strong regional competitors, particularly in building and construction sealants. 3M Company and Henkel AG are also actively expanding their automotive and electronics-oriented offerings.

Innovation is a central theme, with key players increasingly focusing on eco-friendly, bio-based, and low-VOC formulations to comply with tightening environmental regulations. Mergers and acquisitions remain strategic tools, such as Sika’s acquisitions of regional sealant specialists to strengthen its product portfolio. Companies are also investing in AI-driven manufacturing and predictive analytics to optimize production, ensure consistency, and reduce costs.

In addition, strategic partnerships with construction firms, automotive OEMs, and aerospace manufacturers are enabling closer integration into end-user applications. This competitive intensity, combined with rising demand across diverse industries, continues to push market leaders toward technological innovation and sustainable product development.

Some of the prominent players in the Global Elastomeric Sealants Market are:

- 3M Company

- Henkel AG & Co. KGaA

- Sika AG

- BASF SE

- Dow Inc.

- Wacker Chemie AG

- H.B. Fuller Company

- Arkema S.A.

- RPM International Inc.

- MAPEI S.p.A.

- Tremco Incorporated

- Pidilite Industries Ltd.

- Bostik (Arkema Group)

- Illinois Tool Works Inc. (ITW)

- Asian Paints Ltd.

- Franklin International

- Pecora Corporation

- Master Bond Inc.

- Soudal Group

- Konishi Co., Ltd.

- Other Key Players

Recent Developments in the Global Elastomeric Sealants Market

- July 2024: Dow Inc. expanded its elastomeric sealants portfolio through sustainable silicone innovations, targeting construction and automotive applications, enhancing weather resistance and energy efficiency, while reinforcing its leadership in eco-friendly materials for global sealant demand.

- May 2024: Sika AG announced new elastomeric sealant manufacturing expansion in Asia-Pacific, aimed at strengthening supply chains and addressing surging construction demand, emphasizing innovation in high-performance, weatherproofing, and energy-efficient sealant solutions.

- March 2024: Henkel AG introduced advanced polyurethane-based elastomeric sealants focused on automotive lightweighting and durability, aligning with EV trends, while showcasing the innovations at global mobility conferences to attract OEM collaborations.

- January 2024: Wacker Chemie AG launched climate-neutral silicone elastomeric sealants, leveraging renewable raw materials, strengthening its sustainability leadership, and responding to tightening environmental regulations in Europe and North America.

- October 2023: Tremco Incorporated expanded elastomeric sealant capacity in North America, supporting construction industry needs for high-performance sealing solutions, while investing in advanced R&D to enhance durability in façade and roofing applications.

- August 2023: MAPEI S.p.A. showcased innovative elastomeric sealant solutions at an international construction expo, emphasizing adhesion versatility, low VOC content, and green building certifications for sustainable urban infrastructure.

- May 2023: Soudal Group acquired a regional sealant player in Eastern Europe, strengthening its elastomeric sealant distribution network and expanding its construction and industrial adhesive portfolio.

- February 2023: RPM International Inc., through Tremco, invested in elastomeric sealant technology upgrades, focusing on smart sealants with better moisture detection and lifecycle monitoring capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.4 Bn |

| Forecast Value (2034) |

USD 12.1 Bn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 1.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Silicone, Polyurethane (PU), Polysulfide (PS), Polybutadiene (PB), Acrylic, Silyl-Modified Polymer (SMP), and Other Type), By End-Use Industry (Construction/Building & Construction, Automotive & Transportation, Electronics/Electrical & Electronics, Furniture & Woodworks, Marine, Aerospace & Defense, and Other End User Industry) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

3M Company, Henkel AG & Co. KGaA, Sika AG, BASF SE, Dow Inc., Wacker Chemie AG, H.B. Fuller Company, Arkema S.A., RPM International Inc., MAPEI S.p.A., Tremco Incorporated, Pidilite Industries Ltd., Bostik (Arkema Group), Illinois Tool Works Inc. (ITW), Asian Paints Ltd., Franklin International, Pecora Corporation, Master Bond Inc., Soudal Group, Konishi Co., Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Elastomeric Sealants Market?

▾ The Global Elastomeric Sealants Market size is estimated to have a value of USD 6.4 billion in 2025 and is expected to reach USD 12.1 billion by the end of 2034.

What is the growth rate in the Global Elastomeric Sealants Market in 2025?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

What is the size of the US Elastomeric Sealants Market?

▾ The US Elastomeric Sealants Market is projected to be valued at USD 1.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.8 billion in 2034 at a CAGR of 6.9%.

Which region accounted for the largest Global Elastomeric Sealants Market?

▾ Asia Pacific is expected to have the largest market share in the Global Elastomeric Sealants Market with a share of about 38.0% in 2025.

Who are the key players in the Global Elastomeric Sealants Market?

▾ Some of the major key players in the Global Elastomeric Sealants Market are 3M Company, Henkel AG & Co. KGaA, Sika AG, BASF SE, Dow Inc., Wacker Chemie AG, and many others.