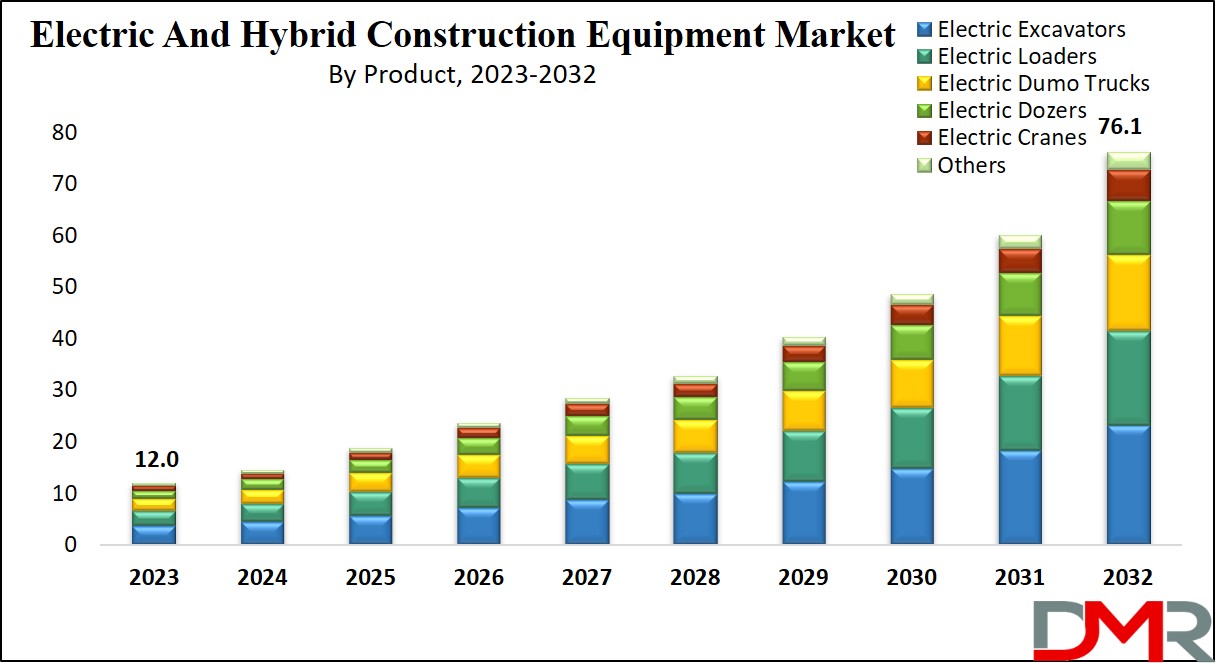

The Global Electric and Hybrid Construction Equipment Market is expected to reach a value of USD 12.0 billion in 2023, and it is further anticipated to reach a market value of USD 76.1 billion by 2032 at a CAGR of 22.8%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Electric and hybrid construction equipment is a category of machinery utilized in construction & related industries that integrates electric or hybrid power sources, often in conjunction with traditional mechanical or hydraulic systems, to improve operational efficiency, reduce environmental impact, & meet stringent emissions regulations.

This advanced equipment is gaining acceptance as they have lower emissions, lesser operating costs, and high sustainability compared to their conventional diesel-powered counterparts, making them a main choice for construction companies focused on greener & more cost-effective operations.

Further, the growing

construction equipment industry is noticing a rising demand for machinery that provides cost-effective operation while meeting with regulatory mandates for lower emissions. This shift in preference is compelling construction equipment manufacturers to favor electric & hybrid propulsion systems over traditional hydraulic and mechanical ones.

Electric and Hybrid Construction Equipment Market: Key Takeaways

- Market Growth: The global market is projected to grow from USD 12.0 billion in 2023 to USD 76.1 billion by 2032, with a strong CAGR of 22.8%.

- Sustainability Drivers: Rising emphasis on sustainability and stringent emissions regulations are prompting construction companies to adopt electric and hybrid equipment for cost-effective, eco-friendly operations.

- Product Leadership: Electric excavators, with zero emissions and low noise, are leading market adoption—particularly valuable in urban construction and sustainability-focused projects.

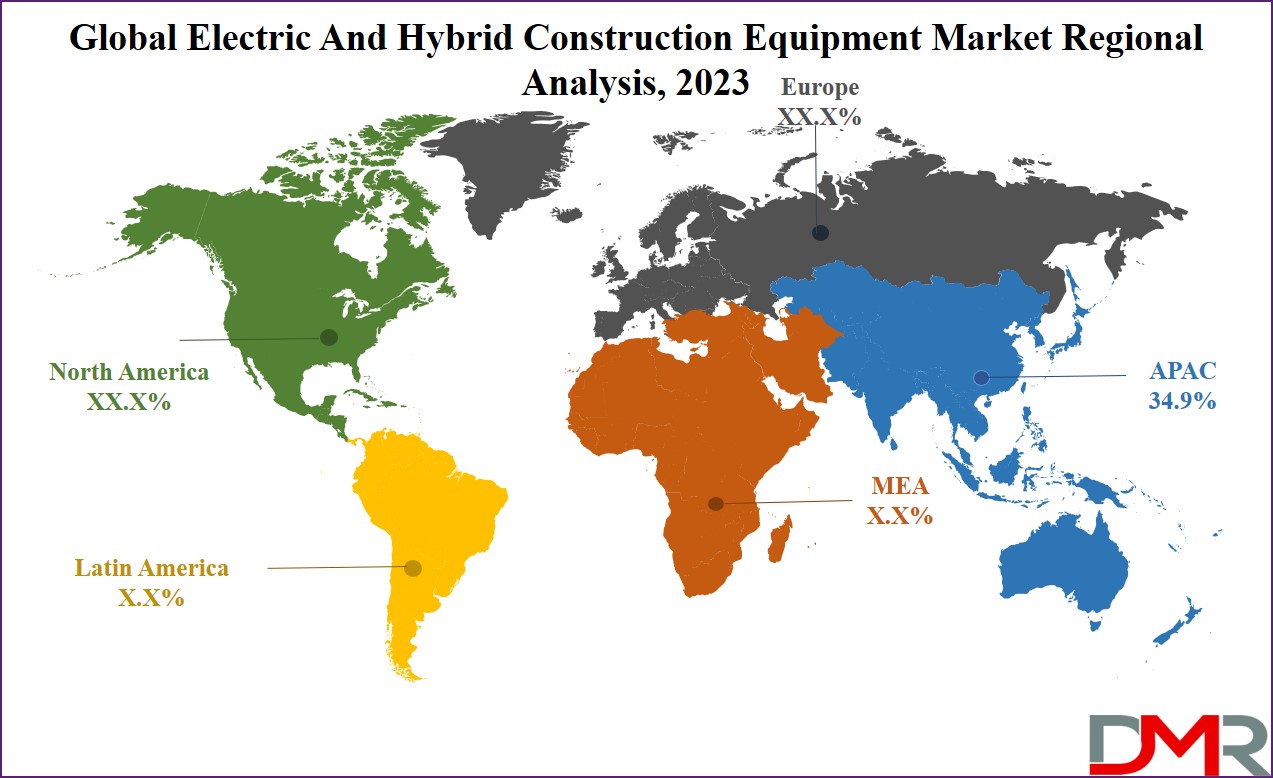

- Regional Trends: Asia Pacific commands around 34.9% of market revenue, propelled by robust infrastructure projects in China, India, and Japan, and region-wide moves toward carbon neutrality.

- Competitive Landscape: Major manufacturers like Caterpillar, Volvo CE, Komatsu, and others are rapidly innovating, introducing advanced electric equipment to meet market demands for greener solutions.

- Adoption Barriers: Initial higher costs, limited charging infrastructure, and restrictions in heavy-duty applications present adoption challenges despite long-term operational savings.

Electric and Hybrid Construction Equipment Market: Use Cases

- Urban project compliance: Electric and hybrid equipment enable contractors to meet stricter emission and noise regulations in city construction zones, supporting sustainable urban infrastructure projects.

- Mine site sustainability: Mining operations can deploy electric machinery underground to reduce carbon emissions, minimize ventilation needs, and improve worker safety through quieter and cleaner operation.

- Renewable energy builds: Electric equipment is ideal for wind, solar, and hydro construction sites, ensuring low environmental impact and aligning with the sustainability goals of clean energy companies.

- Green fleet procurement: Construction firms can modernize equipment fleets with hybrid models to access tax incentives, meet government tender requirements, and control operating costs through fuel savings.

- Indoor facility construction: Electric machinery is particularly suitable for enclosed building projects such as factories, warehouses, and sports arenas that require low emissions and minimal noise.

- Remote monitoring solutions: Advanced hybrid machines offer telematics integration, enabling remote diagnostics, efficient scheduling, and predictive maintenance for large-scale infrastructure developments.

Market Dynamic

The major driver for the adoption of electric and hybrid construction equipment depends on the industry's growing emphasis on sustainability & environmental responsibility. With strong regulations regarding emissions in place & a global push towards carbon neutrality, construction companies are constantly turning to electric and hybrid solutions to lower their carbon footprint, reduce operating costs, and benefit from noise-free & more efficient machinery, aligning their operations with both regulatory requirements & market demands for eco-friendly construction practices.

However, a major restraint for electric and hybrid construction equipment is the higher initial cost associated with these advanced technologies in comparison to traditional diesel-powered machinery. While electric and hybrid equipment offers long-term operational cost savings & environmental benefits, the upfront investment can be a challenge for construction companies, mainly smaller ones with limited budgets. Additionally, concerns about the availability of charging infrastructure & potential limitations in heavy-duty applications can further hinder the adoption of electric and hybrid construction equipment.

Research Scope and Analysis

By Product

Electric excavators drive the global electric & hybrid construction equipment market in 2023 & are anticipated to do the same during the coming future as well, as they are revolutionizing the construction industry as a key product in the field of electric and hybrid construction equipment. These machines deliver a range of advantages that are evolving construction practices. Like, electric excavators are environmentally friendly, emitting zero tailpipe emissions, which aligns perfectly with the growing importance of sustainability in construction, reacting to the industry's role in lowering carbon footprints.

Moreover, electric excavators are less noisy during operation in comparison to their diesel counterparts, making them ideal for urban construction projects where noise control is essential. Additionally, they mostly come with lower operating costs due to the affordability of electricity compared to diesel fuel, which not only leads to financial savings for construction companies but also contributes to a cleaner & more effective construction sector. With their lower environmental impact, noise benefits, & cost-effectiveness, electric

excavators are a major factor driving the shift towards greener & more sustainable construction practices, along with the adoption of electric and hybrid construction equipment.

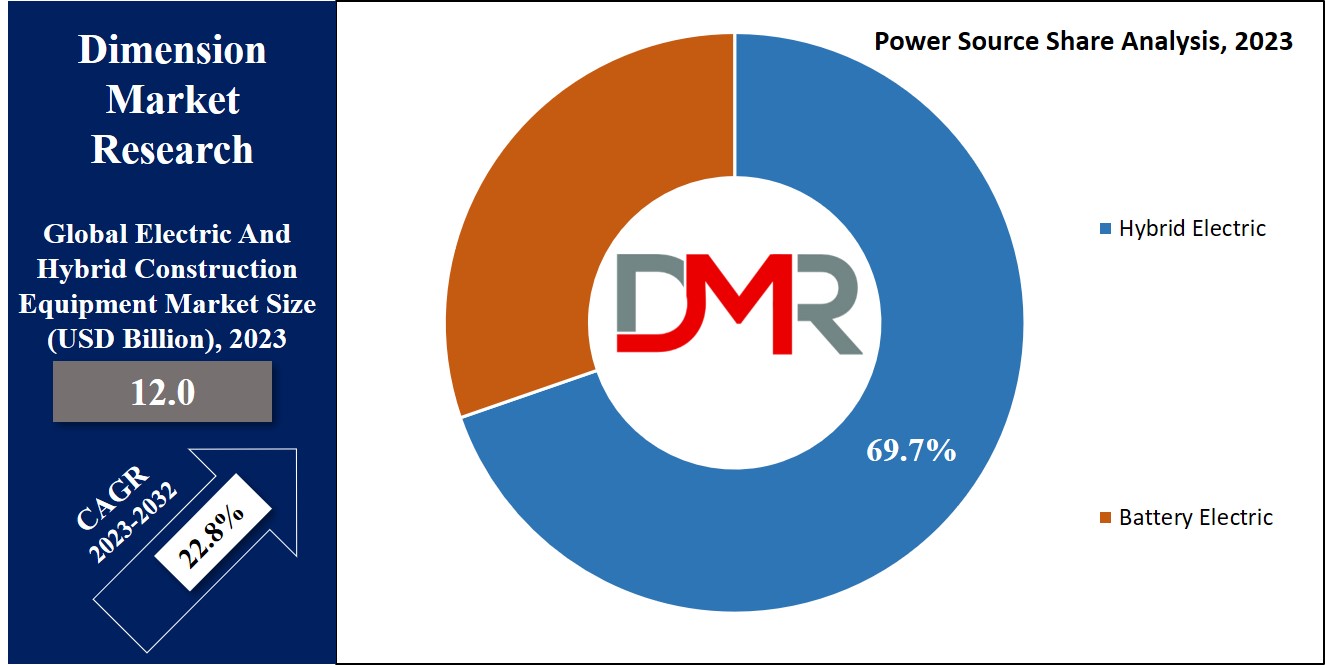

By Power Source

In 2023, the hybrid-electric vehicle market holds a significant share of the automotive industry's power source landscape. Within this market, many propulsion options are available, including Natural Gas Vehicles (NGVs), Hybrid Electric Vehicles (HEVs), & Plug-in Hybrid Electric Cars (PHEVs). Mainly, PHEVs have gained popularity owing to their distinctive charging capabilities, which include both the engine mechanism & external power sources.

NGVs, on the other hand, depend on compressed natural gas (CNG) to power their engines, along with driving generators to initiate the electric motor in hybrid vehicles. The market's growth was fueled by strong environmental regulations & government initiatives focused on promoting electric & hybrid vehicle adoption, driven by growing public awareness of emissions.

Furthermore, vehicles integrating gasoline & diesel fuels emit fewer pollutants compared to traditional hybrids, inspiring policymakers in the United States & Europe to gradually ease emissions regulations, which can be aimed at minimizing the impact of ozone-depleting substances and enhancing vehicle eco-friendliness. As a result, Original Equipment Manufacturers (OEMs) are constantly motivated to invest in the development of hybrid and electric vehicles to align with evolving regulatory requirements and consumer preferences for eco-friendly transportation solutions.

By End User

Construction companies are one of the major factors driving the global electric & hybrid construction equipment in 2023. Construction companies are progressively turning to electric & hybrid construction equipment to address both environmental issues & operational efficiency. These innovative machines have established acceptance in the industry for several reasons. Mainly, electric & hybrid construction equipment highly reduces emissions in comparison to their traditional diesel counterparts, which aligns with the construction sector's rising commitment to sustainability & environmental responsibility, meeting severe emission standards and reducing the industry's carbon footprint.

Further, these equipment options deliver operational benefits. Electric and hybrid construction equipment tend to be silent during operation, making them more valuable for urban construction projects where noise control is important. Additionally, they often come with better fuel efficiency & lower operating costs due to the usage of electricity or hybrid technology, which not only contributes to long-term cost savings for construction companies but also enhances complete job site performance. As construction companies look to balance profitability & environmental responsibility, the adoption of electric and hybrid construction equipment continues to gain momentum, changing industry practices for a more sustainable future.

The Global Electric and Hybrid Construction Equipment Market Report is segmented on the basis of the following:

By Product

- Electric Excavators

- Electric Loaders

- Electric Dump Trucks

- Electric Dozers

- Electric Cranes

- Others

By Power Source

- Battery Electric

- Hybrid Electric

By End User

- Construction Companies

- Government & Municipalities

- Others

Regional Analysis

Asia Pacific region secures a significant market share, contributing about 34.9% of the total revenue in the Global Electric and Hybrid Construction Equipment Market in 2023. Countries like China, India, & Japan collectively hold a large share of the market in the Asia-Pacific region, establishing the region as a global leader in construction equipment sales.

The need for construction machinery is anticipated to notice steady growth over the next few decades, largely driven by China's ambitious South-North water transfer plant project, lined up for completion by 2050. This big initiative will necessitate the installment of numerous types of construction equipment, either through rentals or acquisitions.

Further, various key factors are fueling the strong growth of the construction machinery market in the APAC region. These factors include the growing number of dam construction projects, the growing real estate sector including commercial & residential complexes, and the growth of rail & road infrastructure.

In response to these opportunities, organizations are customizing their manufacturing efforts to specifically meet the unique demands of the Asian market. Moreover, as governments across Asia set higher goals for achieving carbon neutrality by 2040, construction equipment manufacturers are actively working to lower their dependency on traditional gasoline & diesel-powered machinery.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global Electric and Hybrid Construction Equipment Market experiences fierce competition among numerous industry players. These companies are looking to innovate & introduce advanced electric and hybrid equipment solutions to meet the rising demand for more rational construction practices. As regulatory pressures for reduced emissions intensify & construction companies seek affordable and environmentally friendly alternatives, the market's competitive landscape keeps on evolving, marked by aiming at technology development, strategic collaborations, & market expansion efforts.

Like,

In October 2022, Komatsu announced the PC210E, an advanced 20-tonne all-electric hydraulic excavator, at Bauma 2022 in Munich. Set to hit the Japanese & European markets in 2023, this excavator strengthens Komatsu's proprietary coordinating technology & incorporates Proterra's proven

lithium-ion battery technology, well known for its reliability in heavy-duty & commercial vehicles. With integrated components such as the hydraulic pump, controller, & electric motor for work equipment operation, the PC210E signifies a major advancement in electric construction equipment.

Some of the prominent players in the Global Electric and Hybrid Construction Equipment Market are:

- Caterpillar

- Volvo CE

- Terex

- Komatsu

- Deere & Company

- Hitachi Construction Machinery

- Zoomlion

- Shantui

- Liebherr

- Other Key Players

Recent Developments

- In January 2025, Tata Hitachi launched the EX 210LC Electric excavator and next-generation machines at BAUMA Conexpo India, focusing on lower operational costs and reduced carbon footprint.

- In December 2024, Mahindra Construction Equipment unveiled its new CEV5 range at BAUMA CONEXPO 2024, including upgraded electric EarthMaster and RoadMaster models targeting eco-friendly infrastructure projects.

- In December 2024, SANY India showcased next-generation hybrid cranes and piling rigs at Bauma Conexpo 2024, highlighting advancements in hybrid and electric-powered construction equipment.

- In September 2024, Volvo Construction Equipment launched hybrid versions of the EC400 and EC500 excavators, boosting fuel efficiency and cutting CO2 emissions for large-scale earthmoving.

- In July 2024, Wacker Neuson launched the EZ17E electric mini excavator, expanding its portfolio of compact, battery-powered machines.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 12.0 Bn |

| Forecast Value (2032) |

USD 76.1 Bn |

| CAGR (2023-2032) |

22.8% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Electric Excavators, Electric Loaders, Electric Dump Trucks, Electric Dozers, Electric Cranes and Others), By Power Source (Battery Electric and Hybrid Electric), By End-user (Construction Companies, Government & Municipalities and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Caterpillar, Volvo CE, Terex, Komatsu, Deere & Company, Hitachi Construction Machinery, Zoomlion, Shantui, Liebherr, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |