Market Overview

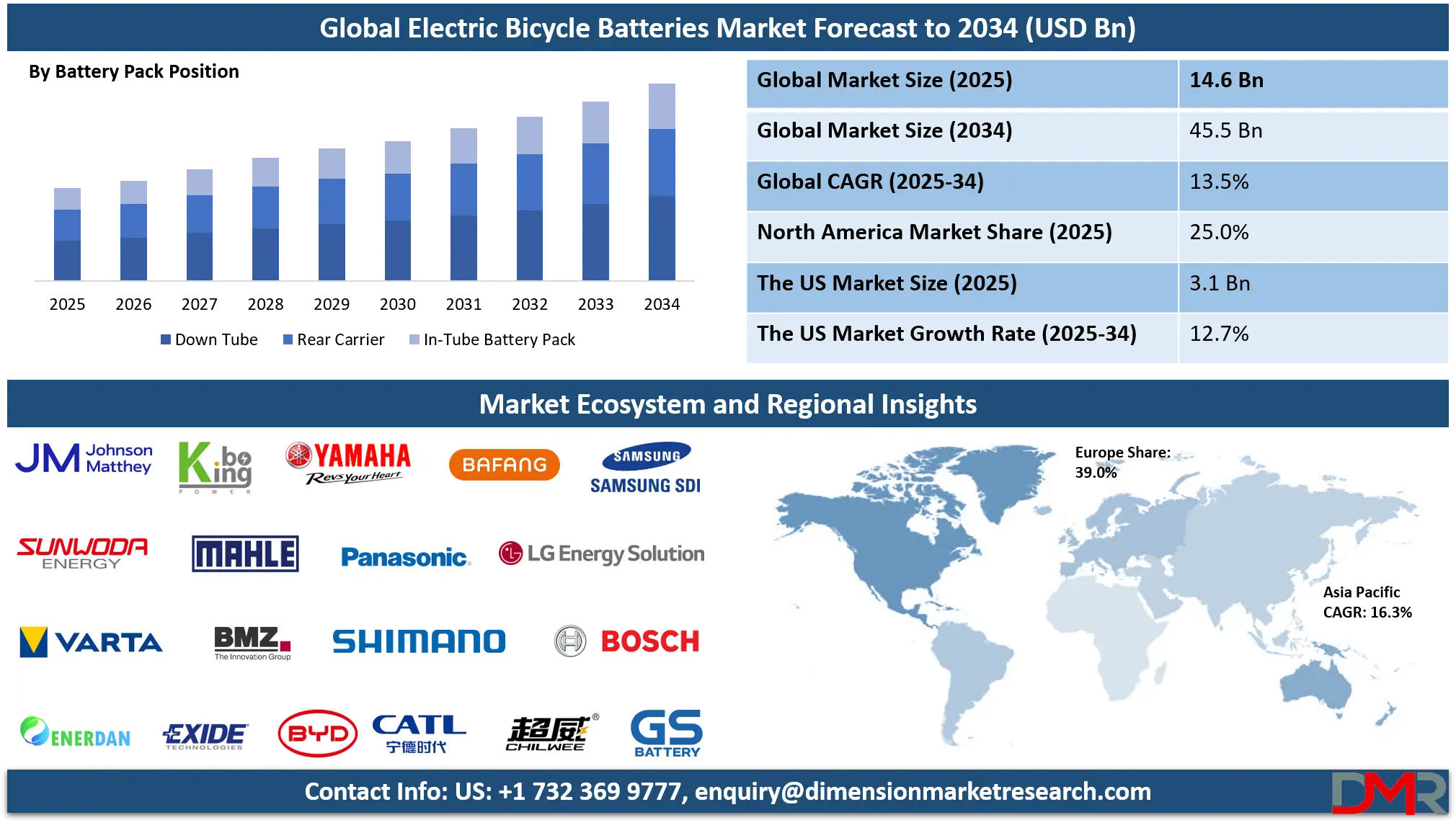

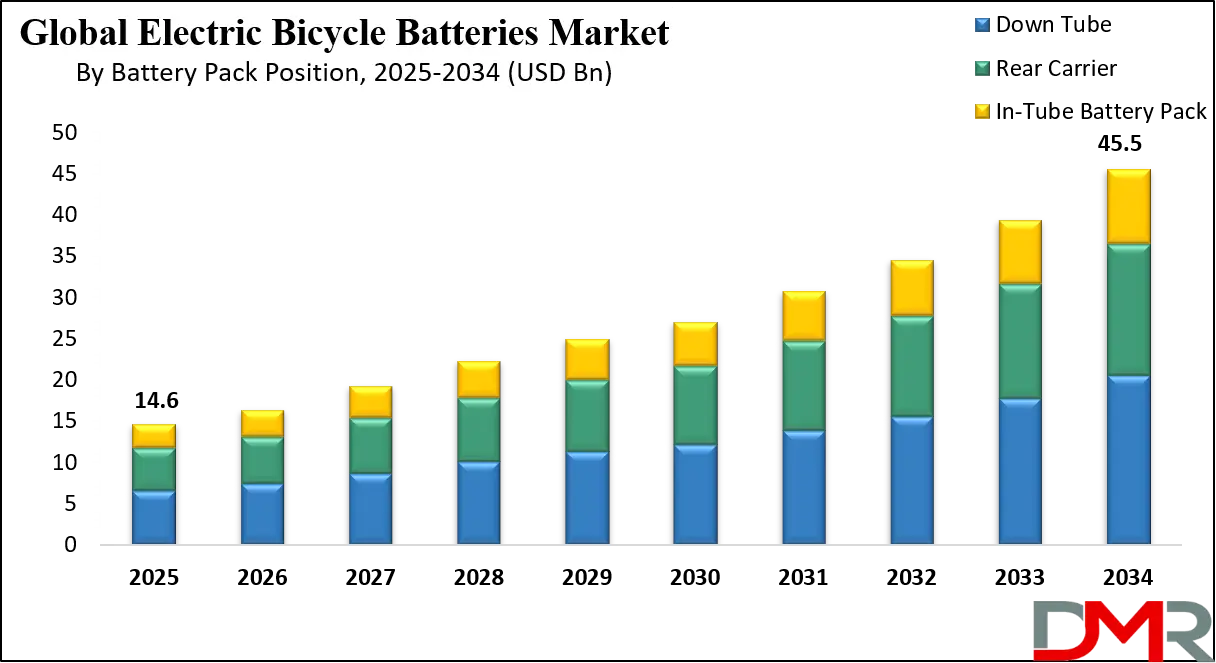

The global electric bicycle batteries market is estimated to reach USD 14.6 billion in 2025 and is forecast to expand at a robust CAGR of 13.5% during the 2025-2034 period, ultimately achieving a market value of approximately USD 45.5 billion by 2034. The market's strong growth is driven by the rising adoption of electric mobility, expanding demand for lithium-ion batteries, advancements in battery energy density, increasing urban commuting, government incentives for e-bikes, sustainable transportation initiatives, and continuous improvements in battery management systems, charging infrastructure, lifecycle performance, and cost efficiency.

Electric bicycle batteries are the core power component, enabling extended range, performance, and user convenience. Technological advancements in battery chemistry, energy density, charging speed, and battery management systems (BMS) are enhancing e-bike appeal. The shift toward lithium-ion and lithium iron phosphate (LiFePO4) chemistries, driven by their lightweight properties, longer lifespan, and declining costs, is a primary market catalyst.

Growing environmental awareness, coupled with rising fuel costs and traffic congestion in metropolitan areas, is propelling e-bike sales globally. Supportive infrastructure development, including dedicated bike lanes and public charging points, further stimulates market expansion. However, challenges such as raw material price volatility, supply chain constraints for critical minerals, recycling and safety concerns, and varying regional regulations pose potential restraints. Despite these hurdles, the convergence of green mobility trends, battery innovation, and urban transportation reforms positions the e-bike battery market as a central pillar of the future micro-mobility ecosystem through 2034.

The US Electric Bicycle Batteries Market

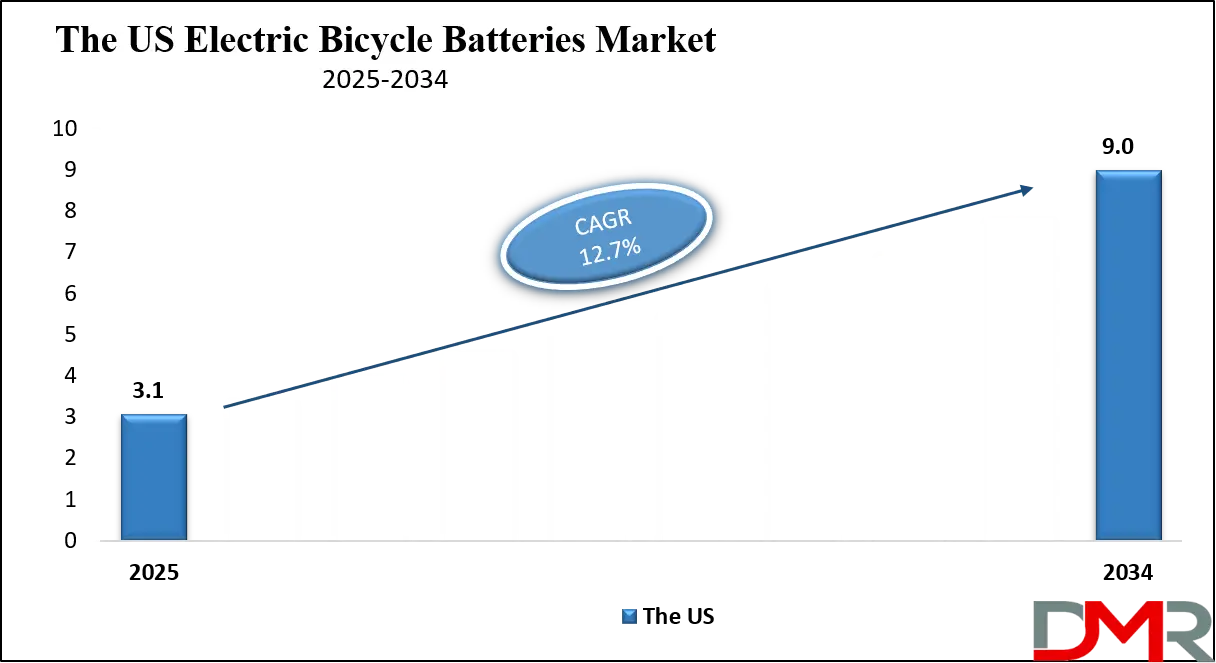

The U.S. Electric Bicycle Batteries Market is projected to reach USD 3.1 billion in 2025 and grow at a CAGR of 12.7%, reaching USD 9.0 billion by 2034. The U.S. market growth is fueled by increasing consumer interest in recreational and commuter e-bikes, supportive federal and state incentives for electric mobility, and a growing network of cycling infrastructure.

Government initiatives, such as tax credits for e-bike purchases under various proposed legislative acts and investments in urban cycling projects, are stimulating demand. The dominance of lithium-ion batteries is pronounced, driven by their performance and alignment with premium e-bike segments. Major manufacturers and brands are increasingly integrating smart BMS, fast-charging capabilities, and removable battery designs to enhance user experience and safety.

The rise of last-mile delivery services utilizing e-cargo bikes, along with bike-sharing programs incorporating swappable battery systems, presents significant growth avenues. Regulatory clarity and standardization efforts for battery safety and transportation are further shaping the market landscape, positioning the U.S. as a key innovation and adoption hub.

The Europe Electric Bicycle Batteries Market

The Europe Electric Bicycle Batteries Market is projected to be valued at approximately USD 5.5 billion in 2025 and is projected to reach around USD 17.2 billion by 2034, growing at a CAGR of about 13.5% from 2025 to 2034. Europe's leadership is anchored by strong governmental support for cycling, ambitious carbon neutrality goals, and high consumer adoption rates, particularly in countries like Germany, the Netherlands, France, and Italy.

Stringent emissions regulations and substantial investments in cycling infrastructure under the EU's sustainable mobility strategy are key drivers. The market is characterized by a high penetration of premium e-bikes, favoring advanced lithium-ion and LiFePO4 batteries with higher capacities for longer ranges. The region is also at the forefront of circular economy initiatives, with increasing focus on battery recycling, second-life applications, and standardized swappable battery systems for shared mobility.

Pan-European projects and funding for active transportation, coupled with consumer subsidies for e-bike purchases in multiple countries, ensure sustained market growth. Europe remains a global benchmark for e-bike integration into urban transit systems.

The Japan Electric Bicycle Batteries Market

The Japan Electric Bicycle Batteries Market is anticipated to be valued at approximately USD 1.1 billion in 2025 and is expected to attain nearly USD 3.6 billion by 2034, expanding at a CAGR of about 13.5% during the forecast period. Japan's market is driven by its aging population, high urbanization density, and a well-established culture of utilitarian cycling.

The demand is focused on practical, lightweight e-bikes for daily commuting and shopping, favoring compact, high-reliability battery packs. Japanese manufacturers are leaders in battery technology, focusing on safety, longevity, and fast-charging solutions. Government policies promoting "smart mobility" and support for domestic battery manufacturing under national green growth strategies provide a favorable environment.

Innovations in solid-state battery technology and smart charging infrastructure are emerging trends. Partnerships between e-bike makers, electronics companies, and energy firms to develop integrated battery ecosystems are further propelling the market.

Global Electric Bicycle Batteries Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Electric Bicycle Batteries Market is expected to be valued at USD 14.6 billion in 2025 and is projected to reach USD 45.5 billion by 2034, showcasing rapid expansion supported by the global e-bike boom and electrification of mobility.

- Steady CAGR Driven by Sustainable Mobility Shift: The market is expected to grow at a CAGR of 13.5% from 2025 to 2034, fueled by environmental regulations, rising fuel costs, technological advancements in battery packs, and growing consumer acceptance of e-bikes as a mainstream transport solution.

- Substantial Growth in the United States: The U.S. Electric Bicycle Batteries Market stands at USD 3.1 billion in 2025 and is projected to reach USD 9.0 billion by 2034, expanding at a CAGR of 12.7% due to recreational demand, urban commuting trends, and supportive incentive programs.

- Rapid Advancement in Battery Technologies: Innovations including high-energy-density lithium-ion cells, safer LiFePO4 chemistry, integrated smart BMS, fast-charging solutions, and modular/swappable battery designs are significantly enhancing e-bike performance, safety, and user convenience.

- Growing E-bike Penetration Boosts Adoption: Rising global sales of e-bikes across commuter, cargo, and mountain segments is driving sustained and parallel demand for high-quality, durable, and cost-effective battery systems.

Global Electric Bicycle Batteries Market: Use Cases

- Urban Commuting: Lightweight, high-capacity lithium-ion batteries enabling ranges of 40-100 km per charge, facilitating daily city commutes and reducing reliance on cars.

- E-Cargo Bikes: High-power and high-capacity battery packs (often LiFePO4) designed to support heavy loads and extended ranges for last-mile delivery and commercial logistics.

- Mountain/E-MTB E-Bikes: Robust, high-torque battery systems with enhanced durability and weather resistance for off-road and recreational use.

- Bike-Sharing Systems: Standardized, swappable battery packs enabling quick replacement in dockless or station-based shared e-bike fleets, ensuring constant vehicle availability.

- Retrofit Kits: Aftermarket battery packs and conversion kits allowing consumers to electrify traditional bicycles, expanding market access.

Global Electric Bicycle Batteries Market: Stats & Facts

International Energy Agency (IEA)

- Electric bicycles consume less than 2% of the energy per passenger-kilometer compared to passenger cars.

- Battery-electric two-wheelers, including e-bikes, are among the most energy-efficient electric mobility modes globally.

- Micromobility electrification reduces lifecycle CO₂ emissions by up to 90% compared with internal combustion vehicles.

United Nations Environment Programme (UNEP)

- Transport contributes approximately 25% of global energy-related CO₂ emissions, accelerating adoption of battery-powered mobility.

- Electrified non-motorized transport, including e-bikes, is classified as a key decarbonization pathway for urban transport.

- Lithium-ion battery recycling is identified as critical to reducing resource intensity in electric mobility systems.

World Health Organization (WHO)

- Active mobility solutions such as e-bikes can reduce urban air pollution exposure by over 30% compared to car travel.

- Battery-powered bicycles contribute to lower noise pollution levels, typically below 55 dB, compared with motor vehicles.

European Commission (EU Transport & Mobility Directorate)

- Europe accounts for over one-third of global e-bike usage, driving regional battery demand.

- Electric bicycles represent more than 50% of total bicycle sales in several EU member states.

- EU transport policy targets a 90% reduction in transport emissions by 2050, supporting e-bike battery deployment.

European Environment Agency (EEA)

- Road transport is responsible for over 70% of total transport greenhouse gas emissions in Europe.

- Urban mobility policies increasingly favor light electric vehicles using rechargeable batteries.

- Battery-electric bicycles are classified as low-impact mobility solutions under EU sustainability frameworks.

German Federal Ministry of Transport

- Germany has over 10 million electric bicycles in operation, requiring large-scale battery replacement and recycling.

- E-bikes account for more than 50% of bicycle kilometers traveled in urban areas.

- Federal cycling infrastructure investments exceed EUR 1 billion, indirectly boosting battery demand.

Netherlands Ministry of Infrastructure & Water Management

- More than 55% of all bicycles sold are electric, increasing lithium-ion battery consumption.

- Average e-bike battery capacity ranges between 400 Wh and 625 Wh for commuter use.

- E-bikes are used for over 25% of daily commuting trips in major cities.

U.S. Department of Transportation (USDOT)

- Electric bicycles recorded higher trip frequency than conventional bicycles in shared mobility systems.

- E-bikes are categorized as Class 1, 2, and 3, all relying on rechargeable battery systems.

- Average shared e-bike utilization exceeds 3 trips per bike per day.

U.S. Department of Energy (DOE)

- Lithium-ion batteries power over 90% of electric bicycles sold in the U.S.

- Battery energy density improvements have exceeded 5% annually in small electric mobility applications.

- Battery cost per kilowatt-hour has declined by over 80% since 2010, supporting affordability.

Ministry of Economy, Trade and Industry (Japan – METI)

- Japan is a global leader in lithium-ion battery manufacturing and safety standards.

- Electric bicycles are the most widely used electric mobility device in Japan.

- Battery safety certification is mandatory for all electric bicycles sold domestically.

International Electrotechnical Commission (IEC)

- IEC 62133 is the primary global safety standard for rechargeable e-bike batteries.

- Battery thermal runaway prevention is a mandatory design requirement for certified products.

United Nations Committee of Experts on Transport of Dangerous Goods

- All lithium-ion e-bike batteries shipped internationally must comply with UN 38.3 transport testing.

- Battery transport regulations cover shock, vibration, thermal, and overcharge testing.

Global Electric Bicycle Batteries Market: Market Dynamics

Driving Factors in the Global Electric Bicycle Batteries Market

Rising Adoption of Electric Mobility and Favorable Policies

The global push for decarbonization and sustainable urban transport is a primary driver. Governments worldwide are implementing policies such as purchase subsidies, tax benefits, and investments in cycling infrastructure to promote e-bike adoption. Rising environmental consciousness among consumers and the cost advantage of e-biking versus car ownership further stimulate demand, directly propelling the battery market.

Technological Advancements and Cost Reduction

density, lifespan, safety, and charging speeds enhance e-bike performance and appeal. The declining cost of lithium-ion cells, driven by economies of scale in EV and consumer electronics sectors, makes e-bikes more affordable. Innovations like removable batteries, smart BMS for health monitoring, and fast-charging (1-2 hours) significantly improve user convenience.

Restraints in the Global Electric Bicycle Batteries Market

Raw Material Price Volatility and Supply Chain Risks

The dependence on critical raw materials like lithium, cobalt, and nickel subjects the market to price fluctuations and geopolitical supply chain risks. Securing sustainable and ethical sourcing for these materials remains a challenge, potentially impacting battery cost stability and manufacturing scalability.

Safety, Recycling, and Regulatory Hurdles

thermal runaway, necessitate stringent safety standards and testing, increasing complexity and cost. The lack of a widespread, cost-effective recycling infrastructure for end-of-life e-bike batteries poses environmental and logistical challenges. Additionally, varying international regulations regarding battery transportation, certification, and disposal create market fragmentation.

Opportunities in the Global Electric Bicycle Batteries Market

Expansion of E-Cargo and Shared Mobility Segments

The rapid growth of e-commerce and last-mile delivery is fueling demand for e-cargo bikes, which require robust, high-capacity batteries. Similarly, the expansion of e-bike sharing schemes in cities globally creates a B2B market for durable, swappable battery systems with high cycle life, presenting a major growth avenue for battery manufacturers and service providers.

Second-Life Applications and Advanced Recycling

Developing viable business models for used e-bike batteries in secondary applications, such as stationary energy storage for residential or grid support, can enhance sustainability and create new revenue streams. Investing in advanced, efficient recycling technologies to recover valuable materials will be crucial for market sustainability and regulatory compliance, representing a significant opportunity.

Trends in the Global Electric Bicycle Batteries Market

Shift Toward Lithium Iron Phosphate (LiFePO4) Chemistry

While lithium-ion dominates, there is a marked trend toward LiFePO4 batteries, especially for cargo and commuter e-bikes. LiFePO4 offers superior thermal stability, safety, and a longer cycle life, albeit with slightly lower energy density. Its cobalt-free composition also addresses ethical sourcing concerns and price volatility.

Integration of Smart Battery Management Systems (BMS)

Modern batteries are increasingly equipped with advanced BMS featuring Bluetooth/GSM connectivity. These systems allow users to monitor battery health, state of charge, location (anti-theft), and receive maintenance alerts via smartphone apps. This trend enhances safety, user experience, and enables data-driven fleet management for commercial operators.

Global Electric Bicycle Batteries Market: Research Scope and Analysis

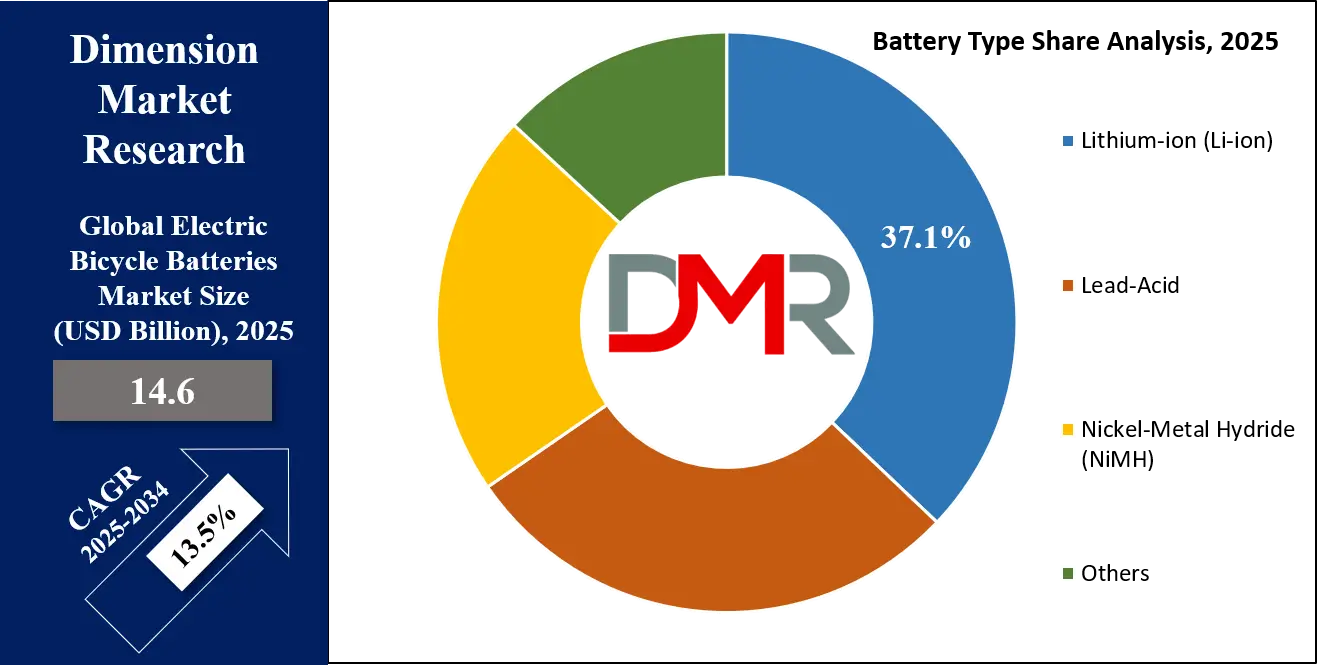

By Battery Type Analysis

Lithium-Ion (Li-ion) batteries decisively dominate the global e-bicycle battery market by type, capturing the overwhelming majority of market share. This dominance is driven by their superior energy density, which provides longer range per unit weight, a critical factor for e-bikes where minimizing weight is paramount. Compared to alternatives like heavy lead-acid or lower-density Nickel-Metal Hydride (NiMH), Li-ion batteries offer a lighter, more compact, and more efficient power source, directly enhancing bike performance and user experience. Their longer cycle life, typically 500-1000 full charges before significant degradation, translates to better long-term value, reducing the total cost of ownership despite a higher initial price.

The broader electric vehicle (EV) revolution has fueled massive R&D and economies of scale in Li-ion production, continuously driving down costs and improving technology. Within this category, Lithium Iron Phosphate (LiFePO4) chemistry is increasingly leading for premium applications due to its exceptional safety profile, thermal stability, and extended lifespan, making it the preferred choice for high-end and commercial e-bikes. While lead-acid retains a minor foothold in the ultra-low-cost segment in some developing regions, and NiMH is nearly obsolete, the global industry standard for new mid-to-high-end e-bikes is unequivocally Li-ion. Regulatory trends pushing for performance and safety, alongside consumer demand for reliability and range, solidify Li-ion's undisputed leadership, with its market share expected to grow further as costs continue to decline.

By Battery Capacity Analysis

The 400-700 Wh capacity segment is the dominant force in the global e-bicycle battery market. This range represents the "sweet spot" that optimally balances performance, range, cost, and practicality for the vast majority of e-bike users. Batteries within this bracket typically power e-bikes with a range of 40-120 kilometers on a single charge, effectively addressing "range anxiety" for daily commuters, recreational riders, and most utility users without incurring the excessive weight, size, and cost of higher-capacity packs. This segment aligns perfectly with the most popular e-bike categories: city/urban and hybrid/trekking bikes. Manufacturers widely adopt this capacity as it allows them to offer compelling, market-ready products that meet consumer expectations for sufficient daily range while maintaining competitive pricing.

The 48V battery architecture, which is the industry standard for mid-drive and performance hub motors, most commonly delivers energy within this 400-700 Wh range (e.g., a 48V 14Ah pack equals 672Wh). While the "Below 400 Wh" segment serves lighter, lower-range, or more budget-conscious models, and "Above 700 Wh" is essential for premium e-MTBs and cargo bikes, it is the broad 400-700 Wh category that drives the highest sales volumes. Its dominance is underpinned by its perfect alignment with the core use case of e-biking: reliable, all-purpose electric assist for everyday journeys.

By Battery Pack Position Analysis

The Down Tube battery position is the dominant and most prevalent configuration in the modern e-bicycle market. Mounting the battery pack within or on the main down tube of the bicycle frame offers critical advantages that define current e-bike design. First, it centralizes mass low and near the bike's center of gravity, significantly improving handling, stability, and ride feel compared to rear-carrier mounts, which can make the bike feel tail-heavy and less agile. This integrated placement also provides superior protection for the battery from impacts, weather, and theft, while contributing to a sleek, streamlined aesthetic that mimics traditional bicycle geometry. Frame-integrated "in-tube" designs, a subset of down tube mounting, represent the premium standard, offering the cleanest look and best protection.

While Rear Carrier mounts are common on retrofit kits and some utility/cargo-focused models for easier swappability and capacity expansion, they compromise handling. The In-Tube design, though growing, often carries a cost premium and can complicate removal for charging. Therefore, the down tube position, balancing optimal weight distribution, design integration, manufacturing feasibility, and cost-effectiveness, has become the default choice for the vast majority of OEMs across city, mountain, and hybrid e-bikes, cementing its dominant market share.

By Application Analysis

The City/Urban E-Bikes segment is the dominant application for e-bicycle batteries, representing the largest and most volume-driven market. This dominance is fueled by the core value proposition of e-bikes: serving as a practical, efficient, and sustainable solution for daily urban mobility. City e-bikes are designed for commuting, running errands, and navigating traffic-congested environments, which constitutes the primary use case for the majority of global e-bike consumers. The batteries for this segment, typically in the 400-700 Wh capacity range, are optimized for a balance of range, weight, and cost, perfectly aligning with the dominant market capacity.

Massive growth in urbanization, supportive infrastructure like bike lanes, and government incentives aimed at reducing traffic and pollution directly propel this segment. While Mountain E-Bikes (e-MTBs) drive demand for high-performance, high-capacity (>700Wh) batteries and Cargo E-Bikes require ultra-durable, high-energy packs, their volumes, though growing rapidly, remain a fraction of the mainstream urban market. The sheer scale of urban adoption, from shared micromobility fleets to individual commuters, makes the City/Urban segment the primary engine of battery demand, setting the trends for technology, pricing, and manufacturing scale that influence the entire industry.

By Sales Channel Analysis

The OEM (Original Equipment Manufacturer) sales channel overwhelmingly dominates the e-bicycle battery market. The vast majority of batteries are sold not as standalone products, but as integrated, proprietary components within a complete new e-bicycle. This dominance is structural: leading e-bike brands partner closely with battery cell and pack manufacturers (like Panasonic, LG, or BMZ) to co-develop customized battery systems that are seamlessly integrated into the bike's frame, electronics, and design. These OEM batteries are essential for ensuring optimal performance, safety, warranty coverage, and brand-specific functionality. The booming global sales of new e-bikes directly fuel this channel's leadership.

In contrast, the Aftermarket channel, while significant and growing, is inherently smaller. It serves two main needs: replacement batteries for aging e-bikes (typically after 3-5 years) and upgrades/conversions. However, the aftermarket faces challenges like compatibility issues, warranty complexities, and the frequent use of proprietary connectors and BMS software by OEMs to lock in customers. Therefore, while the aftermarket presents a crucial long-term opportunity, the initial sale of a battery within a new bicycle via the OEM channel captures the predominant share of the market's revenue and volume, establishing its dominant position.

The Global Electric Bicycle Batteries Market Report is segmented on the basis of the following:

By Battery Type

- Lithium-ion (Li-ion)

- Lead-Acid

- Nickel-Metal Hydride (NiMH)

- Others

By Battery Capacity

- 400-700 Wh

- Below 400 Wh

- Above 700 Wh

By Battery Pack Position

- Down Tube

- Rear Carrier

- In-Tube Battery Pack

By Application

- City/Urban E-Bikes

- Mountain E-Bikes

- Cargo E-Bikes

By Sales Channel

Impact of Artificial Intelligence in the Global Electric Bicycle Batteries Market

- Solid-State Battery Development: Promises revolutionary increases in energy density and safety by replacing liquid electrolytes with solid materials. This will enable lighter, longer-range e-bike batteries with significantly reduced fire risk, though commercialization remains mid-term.

- Advanced Battery Management Systems (BMS): Smart BMS with AI algorithms optimize charging/discharging, predict cell failure, manage thermal conditions, and enable accurate state-of-charge and health monitoring, extending pack life and enhancing safety.

- Fast-Charging Technology: Innovations in cell design and charging protocols are reducing full charge times to under one hour, improving convenience for commercial fleets and reducing downtime for shared mobility services.

- Battery Swapping Standardization: Industry efforts to create universal swappable battery standards (e.g., by the Japanese JAS4P consortium or EU initiatives) could revolutionize ownership models, reduce upfront costs, and streamline logistics for fleets.

- IoT and Connectivity Integration: Cellular-enabled batteries allow for remote diagnostics, anti-theft tracking, usage analytics for fleet operators, and integration with smart grid for optimized charging, creating new service-based business models.

Global Electric Bicycle Batteries Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to dominate the global market in terms of revenue share as it holds 39.0% of market share in 2025. This leadership is anchored in its mature, high-value e-bike ecosystem. The region boasts exceptional consumer purchasing power, a deeply ingrained cycling culture, and unparalleled infrastructure, from dedicated lanes to secure parking. Stringent EU-wide regulations, particularly the new Battery Regulation, mandate high standards for sustainability, safety, and transparency, pushing the market toward premium, innovative products.

Countries like Germany, the Netherlands, and France are not only massive markets but also home to leading premium e-bike manufacturers (e.g., Bosch, Brose, Specialized, Accell Group) whose advanced, integrated battery systems command higher average selling prices. This focus on quality, performance, and regulatory compliance, rather than just volume, ensures Europe captures the largest portion of global revenue, solidifying its position as the market's value leader.

Region with the Highest CAGR

The Asia-Pacific region is poised to exhibit the highest Compound Annual Growth Rate (CAGR), signaling its role as the market's primary growth engine. This explosive potential is driven by a confluence of massive scale and rapid transformation. China is the undisputed global production hub and the world's largest single market, while burgeoning economies like India and Vietnam are experiencing a surge in e-bike adoption fueled by urbanization, rising incomes, and government policies combating pollution and congestion.

The region's focus is on scalable, cost-competitive solutions for vast populations, driving innovation in affordable lithium-ion technology and pioneering battery-swapping infrastructure for shared mobility and delivery fleets. With a massive addressable population, supportive national policies, and a strategic shift from lead-acid to lithium-ion batteries, Asia-Pacific's growth trajectory will significantly outpace other regions, rapidly expanding its overall market share.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Electric Bicycle Batteries Market: Competitive Landscape

The Global Electric Bicycle Batteries Market is moderately consolidated yet competitive, featuring a mix of large battery cell manufacturers, specialized e-bike battery pack assemblers, and integrated e-bike brands. Leading cell suppliers like Panasonic, LG Chem, Samsung SDI, and Contemporary Amperex Technology Co. Limited (CATL) provide the core technology for many premium packs. Specialized battery pack makers such as BMZ Group, FTH Power, and Sinexcel design and assemble integrated battery systems for OEMs.

Major e-bike manufacturers like Giant, Trek, Specialized, and Accell Group increasingly develop proprietary or co-branded battery solutions to differentiate their products. Meanwhile, startups are innovating in areas like swappable battery networks (e.g., Swobbee, Gogoro) and advanced BMS technology. The competitive landscape is characterized by partnerships across the value chain, vertical integration efforts, and a strong focus on sustainability and circular economy principles.

Some of the prominent players in the Global Electric Bicycle Batteries Market are:

- Samsung SDI

- Panasonic Industry

- LG Energy Solution

- CATL (Contemporary Amperex Technology Co., Limited)

- Robert Bosch GmbH

- Shimano Inc.

- BYD Company Ltd.

- Yamaha Motor Co., Ltd.

- BMZ Group (BMZ GmbH)

- Bafang Electric (Suzhou) Co., Ltd.

- ChaoWei (Chilwee Group)

- GS Battery

- Exide Technologies

- Mahle GmbH

- Kingbo Power Technology Co., Ltd.

- Yoku Energy (Zhangzhou) Co., Ltd.

- EnerDan GmbH

- Varta AG

- Sunwoda Electronic Co., Ltd.

- Johnson Matthey

- Other Key Players

Recent Developments in the Global Electric Bicycle Batteries Market

- November 2025: CATL introduced its new 'Kirin' battery platform designed specifically for light electric vehicles, including e-bikes. The platform offers enhanced energy density and integrated cell-to-pack (CTP) technology, promising longer range and improved safety for next-generation e-bikes.

- October 2025: Bosch eBike Systems unveiled its updated Battery Management System with predictive analytics and enhanced thermal management. The system communicates with smartphone apps to provide detailed health reports and optimize charging patterns for extended battery life.

- September 2025: The European Union launched a pilot program for digital battery passports applied to e-bike batteries. This initiative, part of the EU Battery Regulation, aims to ensure transparency on carbon footprint, material provenance, and recycling instructions.

- August 2025: Giant Manufacturing announced a strategic partnership with a solid-state battery developer to co-research next-generation e-bike batteries. The collaboration aims to integrate solid-state technology into future high-performance e-bike models.

- July 2025: Swobbee secured significant funding to expand its swappable battery station network for e-cargo bikes across major German and French cities, targeting last-mile delivery fleets.

- June 2025: LG Chem committed to a new production line dedicated to Lithium Iron Phosphate (LiFePO4) cells, citing soaring demand from the e-bike sector due to their safety and longevity advantages.

- May 2025: Underwriters Laboratories (UL) published an updated safety standard (UL 2849) focusing specifically on electrical systems and batteries for e-bikes, influencing product design and certification requirements in North America.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.6 Bn |

| Forecast Value (2034) |

USD 45.5 Bn |

| CAGR (2025–2034) |

13.5% |

| The US Market Size (2025) |

USD 3.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Battery Type (Lithium-ion (Li-ion), Lead-Acid, Nickel-Metal Hydride (NiMH), Others), By Battery Capacity (400-700 Wh, Below 400 Wh, Above 700 Wh), By Battery Pack Position (Down Tube, Rear Carrier, In-Tube Battery Pack), By Application (City/Urban E-Bikes, Mountain E-Bikes, Cargo E-Bikes), By Sales Channel (OEM, Aftermarket) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Samsung SDI, Panasonic Industry, LG Energy Solution, CATL (Contemporary Amperex Technology Co., Limited), Robert Bosch GmbH, Shimano Inc., BYD Company Ltd., Yamaha Motor Co., Ltd., BMZ Group (BMZ GmbH), Bafang Electric (Suzhou) Co., Ltd., ChaoWei (Chilwee Group), GS Battery, Exide Technologies, Mahle GmbH, Kingbo Power Technology Co., Ltd., Yoku Energy (Zhangzhou) Co., Ltd., EnerDan GmbH, Varta AG, Sunwoda Electronic Co., Ltd., Johnson Matthey, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Electric Bicycle Batteries Market size is estimated to have a value of USD 14.6 billion in 2025 and is expected to reach USD 45.5 billion by the end of 2034.

The market is growing at a CAGR of 13.5 percent over the forecasted period of 2025 to 2034.

The US Electric Bicycle Batteries Market is projected to be valued at USD 2.1 billion in 2025. It is expected to reach USD 6.9 billion in 2034, growing at a CAGR of 12.7%.

Europe is expected to have the largest market share in the Global Electric Bicycle Batteries Market, driven by high e-bike adoption rates and supportive policies.

Some of the major key players in the Global Electric Bicycle Batteries Market are Panasonic Corporation, LG Chem, Samsung SDI, Contemporary Amperex Technology Co. Limited (CATL), BMZ Group GmbH, and many others.