The US electric bicycle market has strong growth opportunities driven by growth in the demand for eco-friendly transportation, rising fuel costs, and enhanced cycling infrastructure. Government incentives and tax credits promote adoption, while e-bike sharing programs expand accessibility. Developments in battery technology, lightweight designs, and growing consumer interest in health and fitness further boost market potential across urban and suburban areas.

Further, the market is growing due to rise in environmental awareness, government incentives, and increasing urban congestion, making e-bikes a practical alternative to cars. Developments in battery technology and the popularity of e-bike-sharing programs further drive demand. However, high initial costs, limited charging infrastructure, and regulatory uncertainties in some states act as restraints. Consumer concerns about battery lifespan and safety also pose challenges to widespread adoption.

Electric Bicycle Market: Key Takeaways

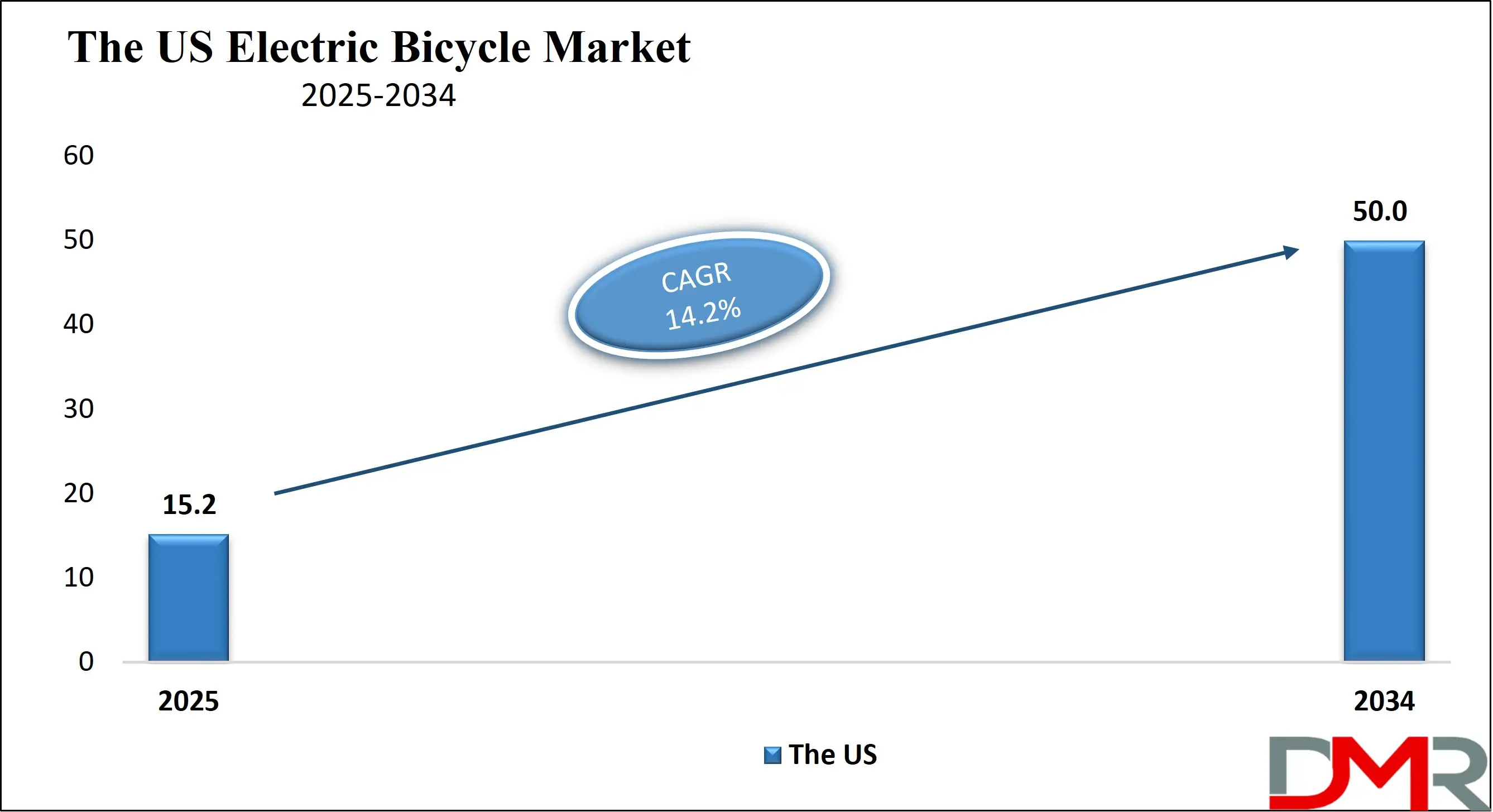

- Market Growth: The Electric Bicycle Market size is expected to grow by 140.3 billion, at a CAGR of 15.1%, during the forecasted period of 2026 to 2034.

- By Motor Type: The Hub motor segment is anticipated to get the majority share of the Electric Bicycle Market in 2025.

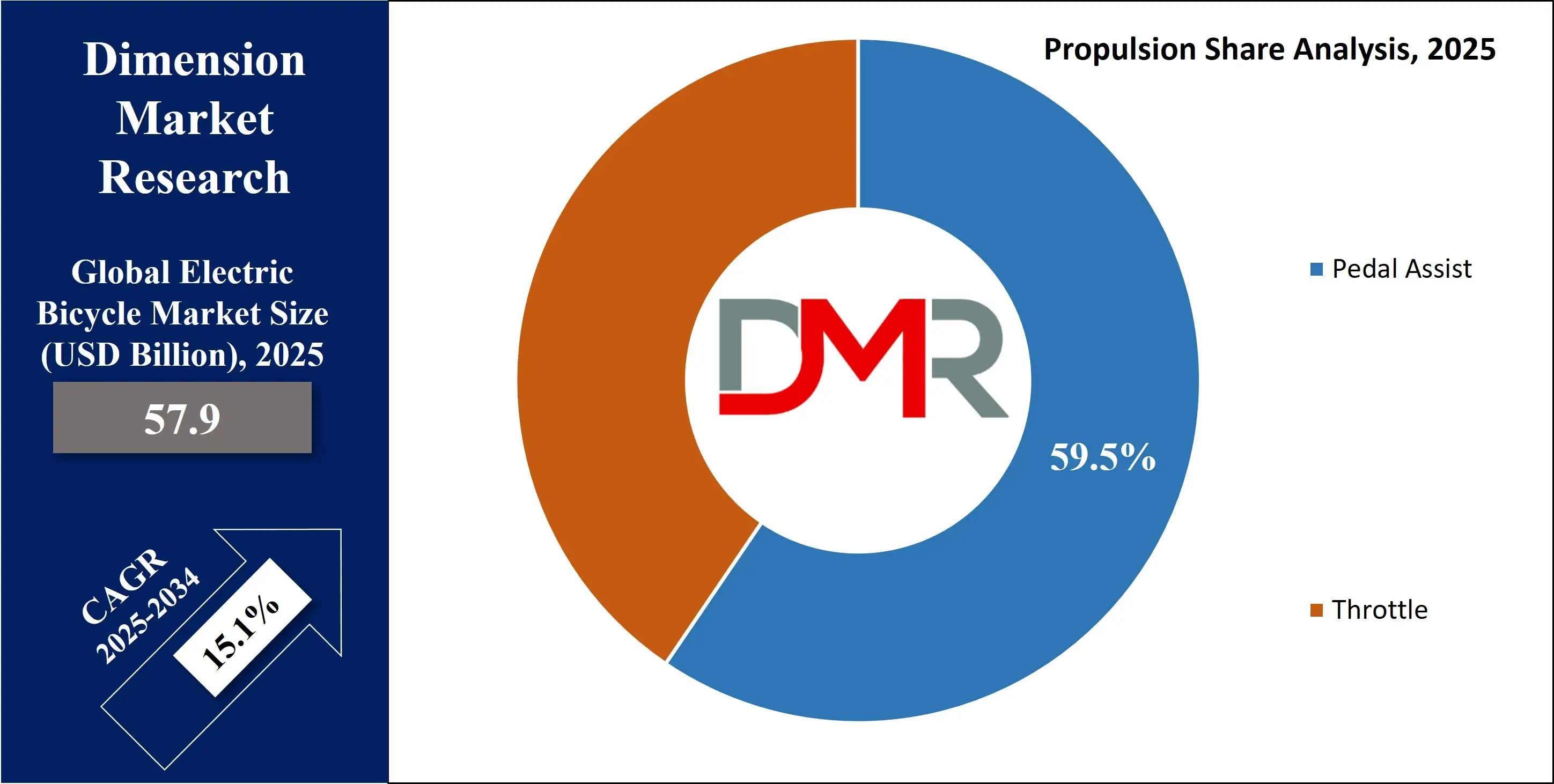

- By Propulsion: The Pedal assist segment is expected to get the largest revenue share in 2025 in the Electric Bicycle Market.

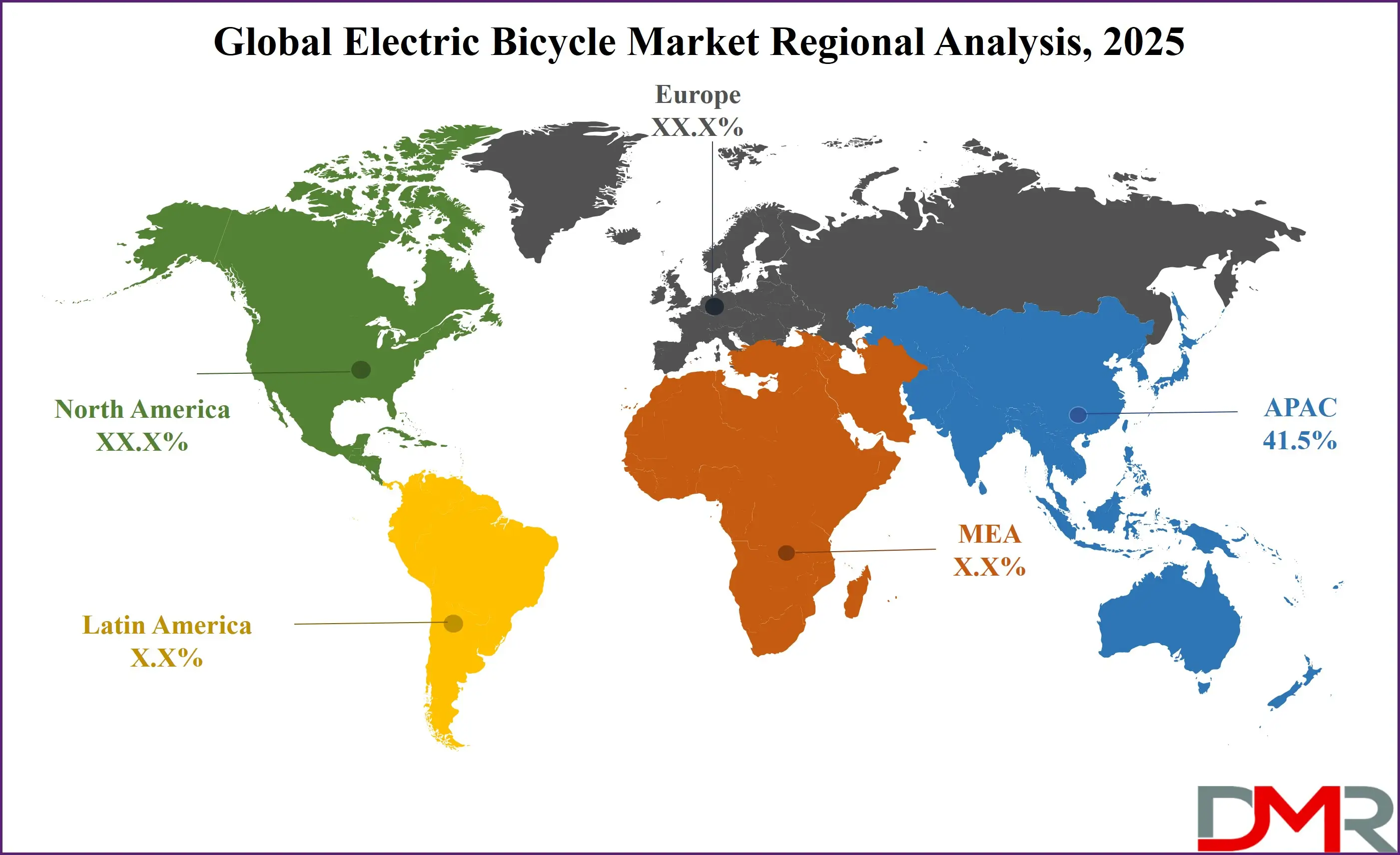

- Regional Insight: Asia Pacific is expected to hold a 41.5% share of revenue in the Global Electric Bicycle Market in 2025.

- Use Cases: Some of the use cases of Electric Bicycle include commuting, delivery services, and more.

Electric Bicycle Market: Use Cases

- Commuting: E-bikes provide an affordable and eco-friendly alternative to cars and public transport, reducing traffic congestion and travel time.

- Recreation & Fitness: Riders can enjoy long-distance cycling with motor assistance, making biking accessible to all fitness levels while still providing exercise benefits.

- Delivery Services: Businesses use e-bikes for food and package deliveries, cutting costs, minimizing emissions, and improving efficiency in urban areas.

- Tourism & Rentals: Tourists can explore cities and scenic routes effortlessly with e-bike rentals, making sightseeing more accessible and enjoyable.

Stats & Facts

- According to the VAHAN Portal, Ola Electric led the electric two-wheeler market in FY 23-24 with a 35% market share, selling 3,26,443 units. This marks a significant rise from its 21% share in FY22, solidifying its position as the top EV maker. The company’s aggressive expansion, strong brand presence, and competitive pricing have contributed to its rapid growth. Ola’s increasing dominance highlights the growing consumer preference for its models in India’s evolving EV market.

- In addition, TVS ranked second in the electric two-wheeler market with a 19% share, selling 1,82,959 units in FY 23-24. This is a notable increase from its 11% market share in FY 22, demonstrating strong momentum in the sector. TVS’s steady growth is attributed to its well-established dealership network and consistent product innovation. The company has effectively captured the attention of both urban and semi-urban customers looking for reliable electric mobility options.

- VAHAN Portal data shows that Bajaj experienced significant growth, expanding its market share from 5% in FY 22 to 11% in FY 23, with total sales reaching 1,06,990 units. The company’s electric models have gained traction due to their brand legacy and robust performance. Bajaj’s surge in sales indicates a rising consumer shift toward established two-wheeler brands entering the EV space. With a focus on technological advancements, Bajaj is strengthening its presence in the rapidly evolving electric vehicle market.

- As per VAHAN Portal records, Okinawa saw a drastic decline in market share, falling from 19% in FY 22 to just 2% in FY 23. The company, which once held a strong position in India’s electric two-wheeler market, recorded a significant drop in sales, reflecting changing consumer preferences. The decline could be attributed to increased competition from new-age EV brands offering better performance, range, and technology. This shift highlights the challenges faced by early EV players in sustaining long-term growth.

- Moreover, VAHAN Portal data indicates that Hero Electric’s market share plummeted from 27% in FY 22 to just 1% in FY 23, marking a steep fall. Once one of India’s leading EV brands, Hero Electric struggled to maintain its dominance amid rising competition. The company faced stiff challenges from new entrants offering superior products and aggressive pricing strategies. This decline emphasizes the need for traditional electric players to innovate and enhance their product offerings to stay relevant.

- According to the VAHAN Portal, the total sales of electric two-wheelers in FY 23-24 reached 12,67,280 units, highlighting the sector’s rapid expansion. This marks a substantial increase in demand, showing that electric mobility is gaining strong traction in India. Government incentives, rising fuel prices, and improved charging infrastructure have contributed to this growth. The increasing adoption of EVs signals a long-term shift toward sustainable transportation in the country.

- As per VAHAN Portal reports, Ampere’s market share declined from 12% in FY 22 to 6% in FY 23, with total sales of 75,576 units. The company, once a strong contender in the electric two-wheeler segment, saw a drop in its ranking as newer brands gained popularity. Ampere’s declining numbers suggest the growing competition in the EV space, where innovation and strong after-sales service play a crucial role. To regain market position, Ampere may need to focus on launching new models with better features and performance.

- Further, the Portal data reveals that Revolt managed to maintain a stable presence in the market, selling 12,934 units in FY 23-24. Despite being a niche player focusing on electric motorcycles, the company has carved out a loyal customer base. Revolt’s emphasis on battery swapping and smart connectivity features has helped it differentiate itself from traditional scooter-dominated EV brands. Its steady performance indicates that the electric motorcycle segment is gradually gaining traction among Indian consumers.

- As per the VAHAN Portal, smaller EV brands like Okaya EV, BGauss, and Battre Electric collectively accounted for a minor market share in FY 23-24. These brands contributed to a small but growing segment of the industry, catering to niche customers. Their market presence suggests that while leading players dominate the industry, there is still space for emerging brands to grow. Future growth for these companies will likely depend on technological advancements, better range, and competitive pricing.

- Furthermore, the VAHAN Portal reports that the 'Others' category, which includes various smaller EV manufacturers, accounted for a significant 28% of total electric two-wheeler sales. This highlights the fragmented nature of the industry, where many small players contribute to overall market growth. While big brands capture a majority share, the presence of multiple smaller companies indicates a diverse and dynamic EV ecosystem. As consumer interest in electric mobility continues to rise, these emerging players have the potential to scale up and capture more market share.

Market Dynamic

Driving Factors in the Electric Bicycle Market

Rising Environmental Awareness & Government Support

The growth in concerns about air pollution and climate change has encouraged people to adopt eco-friendly transportation options like electric bicycles. Many governments around the world are promoting e-bike usage through subsidies, tax incentives, and dedicated cycling infrastructure. Cities are also investing in bike lanes and charging stations, making e-bikes a more convenient and sustainable choice. These efforts have mainly boosted demand for e-bikes as a cleaner alternative to cars and motorcycles.

Technological Advancements & Consumer Demand

Enhancements in battery technology, like longer ranges and faster charging, have made e-bikes more efficient and practical. Lightweight materials and smart features like GPS tracking, mobile apps, and automatic gear shifting enhance the user experience. As urbanization grows, more people look for cost-effective and convenient commute solutions, further driving market growth. The rise of e-bike-sharing programs and rental services has also contributed to widespread adoption across different consumer groups.

Restraints in the Electric Bicycle Market

High Initial Cost & Battery Concerns

Electric bicycles are more expensive than traditional bicycles due to the cost of batteries, motors, and advanced features. While long-term savings on fuel and maintenance exist, the upfront price can be a barrier for many consumers. In addition, battery lifespan and recycling remain challenges, as improper disposal can lead to environmental issues. The cost of replacing batteries after a few years adds to ownership expenses, making some buyers hesitant to invest in e-bikes.

Regulatory Challenges & Infrastructure Limitations

Different countries and cities have varying regulations regarding e-bike speed limits, classifications, and road access, creating confusion for consumers and manufacturers. In many regions, cycling infrastructure is underdeveloped, making it unsafe or inconvenient for e-bike riders. Lack of dedicated bike lanes, charging stations, and parking spaces limits their usability, mainly in densely populated urban areas. These factors slow down the widespread adoption of e-bikes despite growing interest.

Opportunities in the Electric Bicycle Market

Expansion of E-Bike Sharing & Rental Services

The growth of shared mobility services provides a huge opportunity for the electric bicycle market. Many cities are integrating e-bike rental programs, allowing users to access affordable and convenient transportation without ownership costs. Tourists & daily commuters benefit from these services, promoting wider e-bike adoption. With development in mobile apps and smart locks, managing e-bike fleets has become easier. Expanding these services in urban and suburban areas can significantly boost market growth.

Advancements in Battery Technology & Smart Features

Constant improvements in lithium-ion batteries are leading to longer ranges, quick charging, and reduced weight, making e-bikes more appealing. Integration of smart technologies, such as GPS navigation, theft protection, and AI-powered riding assistance, enhances the user experience. These innovations attract tech-savvy consumers and improve the overall convenience of using e-bikes. As battery recycling solutions improve, concerns about sustainability will decrease, further driving demand in the market.

Trends in the Electric Bicycle Market

Growth of High-Performance & Off-Road E-Bikes

The demand for electric mountain bikes (e-MTBs) and high-performance e-bikes is rising among adventure enthusiasts and professional cyclists. These bikes come with powerful motors, durable frames, and improved suspension systems, making them ideal for rough terrain. Manufacturers are focusing on lightweight materials and better battery efficiency to improve riding experiences. The popularity of outdoor activities and adventure tourism has fueled this trend. More riders are switching to e-MTBs for long-distance trails and challenging routes without exhausting themselves.

Integration of IoT & Smart Connectivity

Modern e-bikes are becoming smarter with the integration of IoT (Internet of Things) and AI-based features. Many models now integrate GPS tracking, theft alarms, automatic gear shifting, and mobile app connectivity for real-time performance monitoring. These developments make e-bikes more user-friendly and secure, attracting tech-savvy customers. Some manufacturers are also experimenting with self-charging solar panels to improve battery life. The shift toward connected mobility is making e-bikes a more attractive and efficient mode of transport.

Research Scope and Analysis

By Propulsion Analysis

Based on propulsion, the pedal assist segment will lead the electric bicycle market with a 59.5% share in 2025, playing a key role in its expansion. Pedal-assisted e-bikes, also known as pedelecs, combine manual pedaling with motor support, providing a natural riding experience while minimizing rider fatigue. These bikes appeal to commuters, fitness enthusiasts, and eco-conscious consumers looking for an efficient yet active mode of transport.

They provide better battery efficiency since the motor only activates when pedaling, allowing for longer rides on a single charge. Many governments promote pedal-assist e-bikes by providing incentives and allowing them in bicycle lanes without special licenses. With growing interest in health, sustainability, and cost-effective commuting, pedelecs are becoming a preferred choice for urban mobility. As technology advances, lightweight frames and improved motors will make pedal-assisted e-bikes even more practical and popular worldwide.

The throttle segment will see the highest growth over the forecast period, driven by its convenience and ease of use. Throttle-powered electric bicycles enable riders to accelerate without pedaling, making them ideal for those looking for effortless transportation. These e-bikes are mainly popular among delivery riders, older adults, and individuals with mobility issues. They provide instant power, making urban commuting faster and lowering rider fatigue on long trips. Developments in throttle technology are improving responsiveness and battery efficiency, improving overall performance. As cities expand e-bike-friendly infrastructure and more people look for low-effort mobility options, the demand for throttle-based e-bikes will continue to rise.

By Motor Type Analysis

The hub motor segment is set to dominate the electric bicycle market with a 64.1% share in 2025, playing a major role in its growth. Hub motors are popular because they are affordable, easy to install, and need less maintenance compared to mid-drive motors. They provide a smooth and quiet ride, making them ideal for city commuting and recreational use. Many e-bike manufacturers prefer hub motors due to their simpler design and lightweight structure, which enhances overall efficiency. These motors are also mainly used in affordable e-bike models, making electric bicycles accessible to a larger audience. Advancements in hub motor technology have better power output and battery efficiency, allowing riders to travel longer distances with better performance. As urban mobility continues to grow, hub motors will remain a key driver in expanding the e-bike market, supporting both daily commuters and casual riders.

The mid-drive motor is expected to see growth over the forecast period, driven by its superior performance and efficiency. Placed at the bike’s crankset, these motors provide better weight distribution, enhancing balance and handling. They provide higher torque, making them ideal for steep terrains, long-distance rides, and high-performance e-bikes. Mid-drive motors work easily with the bike’s gears, ensuring smoother acceleration and greater energy efficiency. As the need for premium e-bikes grows, manufacturers are focusing on lightweight and powerful mid-drive motor systems. With developments in battery technology and smart features, mid-drive motors will continue to gain popularity among commuters, adventure riders, and delivery services.

By Battery Type Analysis

The lithium-ion segment will lead the electric bicycle market with a 56.4% share in 2025, driving its growth. Lithium-ion batteries are the preferred choice for e-bikes due to their lightweight design, high energy efficiency, and long lifespan. They provide better performance in comparison to traditional lead-acid or nickel-based batteries, allowing riders to travel longer distances on a single charge. Rapid charging capabilities and less maintenance make them ideal for daily commuters and long-distance travelers.

As battery technology constantly improves, lithium-ion batteries are becoming more affordable and environmentally friendly, further boosting their demand. Manufacturers are focusing on enhancing safety features, like overheating protection, to increase reliability. With the global push for cleaner transportation, lithium-ion batteries will remain a key factor in making e-bikes more efficient, practical, and widely accessible for different types of riders.

Further, the lead-acid battery segment will see major growth over the forecast period due to its affordability and widespread availability. Many budget-friendly electric bicycles use lead-acid batteries, making them accessible to cost-conscious consumers. These batteries are durable and easy to recycle, which appeals to users in regions where lithium-ion options are more costly. While heavier and slower to charge, enhancements in battery technology are enhancing their efficiency and lifespan. Lead-acid batteries remain popular in entry-level e-bikes and cargo models used for short-distance travel. As demand for low-cost electric bicycles increases, this battery type will continue to play a role in market expansion, especially in developing regions.

By Component Analysis

In 2025, the battery segment is set to be at the forefront in the electric bicycle market in 205 with a 31.7% share, playing a major role in driving growth. Batteries determine an e-bike’s range, speed, and overall performance, making them one of the most important components. Developments in lithium-ion technology have enhanced battery efficiency, allowing for longer rides and faster charging times. Lightweight and high-capacity batteries are growing in the appeal of e-bikes for daily commuters, adventure riders, and delivery services. Manufacturers are aiming for safer, more durable, and eco-friendly battery solutions to meet rising demand. The push for sustainable transport has also promoted better recycling programs, reducing environmental concerns. As cities expand cycling infrastructure and consumers look for cost-effective mobility options, battery innovations will continue to shape the future of the e-bike market, making them more reliable and practical for a wide range of users.

In addition, motor controller segment will experience higher growth over the forecast period, as it plays a major role in managing the power and performance of electric bicycles, which regulates the flow of electricity from the battery to the motor, ensuring smooth acceleration, efficient energy use, and better riding control. With the growth of smart e-bikes, advanced motor controllers are integrating features like regenerative braking, torque sensing, and connectivity with mobile apps. These innovations enhance rider experience and battery efficiency. As the need for high-performance and long-range e-bikes increases, manufacturers are focusing on developing more efficient and responsive motor controllers, driving further expansion in the e-bike market.

By Battery Capacity Analysis

In terms of battery capacity, the 451W to 650W battery capacity segment is set to lead the electric bicycle market with a 41.5% share, as it provides a strong balance between power and efficiency, making e-bikes suitable for longer distances and challenging terrains. Riders benefit from higher speeds and better performance, mainly in hilly areas or for heavy-duty use like cargo transportation. These batteries also help with advanced features like smart connectivity and fast charging, which is enhancing convenience for daily commuters and adventure cyclists. With the growth demand for high-performance e-bikes, manufacturers are focusing on improving battery life and reducing charging time.

Governments supporting e-bike adoption with incentives and better infrastructure are further driving the market. As urban travel and eco-friendly transport gain popularity, the 451W to 650W segment plays a crucial role in making e-bikes more practical and widely accepted across different user groups.

The above 650W battery capacity segment will see major growth over the forecast period, driven by the growth in the demand for high-performance electric bicycles. These powerful batteries are ideal for off-road biking, cargo transportation, and long-distance travel, providing greater speed and torque.

Adventure riders and delivery services prefer e-bikes with higher wattage for better performance on steep terrains and heavy loads. Developments in battery technology are improving efficiency, allowing for longer rides with shorter charging times. As consumer interest in powerful e-bikes increases, manufacturers are focusing on developing lightweight, durable, and high-capacity battery solutions, further driving market expansion in this segment.

By Application Analysis

In 2025, the city/urban segment will lead the electric bicycle market with a 39.2% share, driving its expansion. Urban e-bikes are a practical solution for daily commuting, providing a faster and more eco-friendly alternative to cars and public transport. With rising traffic congestion and fuel costs, more people are choosing e-bikes for short-distance travel. Many cities are enhancing cycling infrastructure, adding bike lanes, and supporting e-bike-sharing programs to promote sustainable transportation.

These bikes are lightweight, easy to maneuver, and designed for comfort, making them ideal for city riders. The need for affordable and efficient mobility solutions constantly grows, pushing manufacturers to develop better battery performance and smart features like GPS tracking and anti-theft systems. As urban populations increase, electric bicycles will remain a key part of modern city transport, reducing pollution and improving everyday commute experiences.

Moreover, the cargo/luggage segment will experience significant growth over the forecast period, driven by the growth in the demand for eco-friendly and cost-effective transportation solutions. Businesses and delivery services are mainly using electric cargo bikes for last-mile logistics, minimizing fuel costs and emissions. These e-bikes provide high load capacity, making them ideal for transporting goods, groceries, and even passengers. Urban areas are supporting their adoption by improving cycling infrastructure and allowing access to restricted zones. Families are also embracing cargo e-bikes for daily errands and school runs. With advancements in battery power and motor efficiency, cargo e-bikes are becoming a reliable alternative to traditional delivery vehicles.

The Electric Bicycle Market Report is segmented on the basis of the following:

By Propulsion

By Motor Type

- Hub Motor

- Mid-driver Motor

By Battery Type

- Lead Acid

- Lithium-ion

- Nickel Metal Hydride

- Others

By Component

- Battery

- Electric Motors

- Motor Controller

- Frame with Forks

- Others

By Battery Capacity

- Below 250W

- 251W to 450W

- 451W to 650W

- Above 650W

By Application

- City/Urban

- Mountain/Trekking

- Cargo/Luggage

Regional Analysis

Leading Region in the Electric Bicycle Market

In 2025, the Asia Pacific region will lead the electric bicycle market with a 41.5% share, playing a major role in its expansion. Countries like China, Japan, and India are driving demand due to growth in urbanization, rising traffic congestion, and the requirement for affordable transportation. China, the largest e-bike market, benefits from strong government support, advanced manufacturing, and a well-developed supply chain. In India and Southeast Asia, e-bikes are gaining popularity as an affordable and eco-friendly alternative to traditional motorcycles and scooters.

Many cities are enhancing cycling infrastructure, making electric bicycles a practical choice for daily commuting. Growing environmental awareness and strict emission regulations are pushing people towards sustainable mobility solutions. Developments in battery technology and local production are also making e-bikes more affordable in the region. With rising demand and continuous innovation, Asia Pacific will remain the key driver of global e-bike market growth.

Fastest Growing Region in the Electric Bicycle Market

Europe will see significant growth in the electric bicycle market over the forecast period, driven by strong government support and a rising focus on sustainable transportation. Many countries provide subsidies and tax incentives to encourage e-bike adoption, making them more affordable for consumers. Well-developed cycling infrastructure, including dedicated bike lanes and charging stations, further boosts demand. Cities are promoting e-bikes as an alternative to cars to lower traffic congestion and pollution. The rise in the popularity of e-bike sharing programs and increasing health awareness among people are also key factors. With advancements in battery technology and high-performance models, Europe will remain a major player in the global e-bike market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The electric bicycle market is highly competitive, with many global and regional players focusing on innovation, performance, and affordability. Major companies like Giant Bicycles and more are leading the market with advanced designs and smart features. Many manufacturers are enhancing the battery technology, motor efficiency, and lightweight frames to attract more customers.

Startups and local brands are also entering the market, providing budget-friendly and customized e-bike solutions. Partnerships with ride-sharing services and online retailers are expanding market reach. Governments supporting e-mobility through subsidies & infrastructure development are further intensifying competition. As demand grows, companies continue to invest in research and development to stay ahead in this fast-evolving market.

Some of the prominent players in the Global Electric Bicycle are:

- Giant Bicycles

- Riese & Muller

- Dahon

- Yuba Bicycles

- Yedea

- Gocycle

- Hero

- Aventon Bikes

- Bianchi

- Bulls Bikes

- Cube Bikes

- Haibike

- Luna Cycle

- Magnum Bikes

- NCM Bikes

- Propella

- Raleigh Electric

- Serial 1

- Super 73

- Surly Bikes

- Other Key Players

Recent Developments

- In December 2024, Segway has assembled a dedicated electric bike (e-bike) division in the United States to support the upcoming launch of its first two e-bikes as well as future cycling products. First previewed at CES 2024, the Xyber and Xafari will be available in Q1 2025. Further, the company is also implementing a new sales model for its e-bikes supporting independent dealers rather than selling direct-to-consumer or through major retail chains and websites as it does with its other product offerings.

- In October 2024, ZADD bikes unveiled its first electric cargo bicycle in India. Named ‘Utility Hauler,’ the electric bicycle is engineered for last-mile delivery and has wide use cases.

- In September 2024, Stryder Cycle introduced two new models, Voltic X and Voltic GO. These e-bikes are being offered at an introductory price of INR 32,495 and INR 31,495, respectively, which contains a discount of up to 16% off the original price. The launch is part of Stryder’s effort to encourage e-bikes as a sustainable mobility option amid concerns about air pollution and traffic congestion.

- In May 2024, EMotorad announced world’s largest integrated electric cycle gigafactory, as the gigafactory will focus on producing essential components like batteries, motors, displays, and chargers, with an initial capacity of 5,00,000 electric cycles annually.

- In April 2024, OKAI launched its highly anticipated 2024 lineup of e-bikes, as the company is focusing on personal ownership by unveiling innovative designs and advanced features. With an impressive track record of shipping over 2 million units and featuring a portfolio of 200+ patents, OKAI repeats its commitment to excellence by designing and manufacturing its own frames, battery packs, and core components. Introducing the OKAI LyteCycle EB60, OKAI E-Kargo EB70, and OKAI TraVRS EB80 is a major milestone in their mission to shape the future of electric biking.

| Report Characteristics |

| Market Size (2025) |

USD 57.9 Bn |

| Forecast Value (2034) |

USD 206.1 Bn |

| CAGR (2025-2034) |

15.1% |

| Historical Data |

2019 – 2023 |

| The US Market Size (2025) |

USD 15.2 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Propulsion (Pedal Assist and Throttle), By Motor Type (Hub Motor and Mid-driver Motor), By Battery Type (Lead Acid, Lithium-ion, Nickel Metal Hydride, and Others), By Component (Battery, Electric Motors, Motor Controller, Frame with Forks, and Others), By Battery Capacity (Below 250W, 251W to 450W, 451W to 650W, and Above 650W), By Application (City/Urban, Mountain/Trekking, and Cargo/Luggage) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Giant Bicycles, Riese & Muller, Dahon, Yuba Bicycles, Yedea, Gocycle, Hero, Aventon Bikes, Bianchi, Bulls Bikes, Cube Bikes, Haibike, Luna Cycle, Magnum Bikes, NCM Bikes, Pro pella, Raleigh Electric,Series 1, Super 73, Surly Bikes, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |