Market Overview

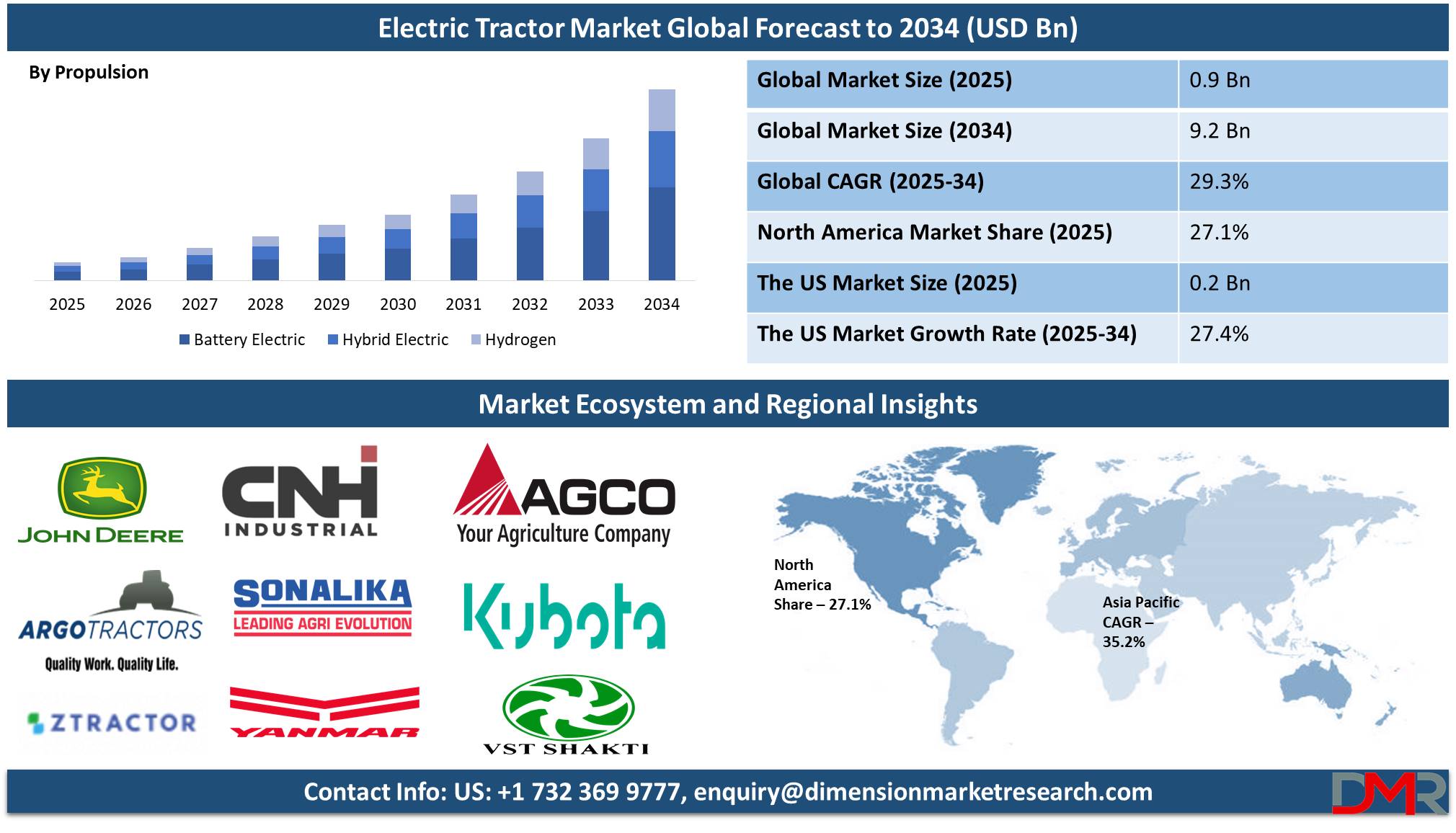

The Global Electric Tractor Market is projected to reach USD 0.9 billion in 2025 and grow at a compound annual growth rate of 29.3% from there until 2034 to reach a value of USD 9.2 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Electric tractors are agricultural vehicles that use electricity rather than traditional diesel engines, utilizing batteries to store energy that powers their motor. Electric tractors focus on making farming more sustainable by minimizing greenhouse gas emissions and dependence on fossil fuels; in addition, these noiseless electric models produce less vibration, eliminate harmful diesel fumes, improve farmers' working conditions and overall health, and require minimal maintenance costs over time as they have fewer moving parts that need servicing, saving farmers money in maintenance fees long term.

Further, in recent years there has been an increased demand for electric

tractors as governments across the work toward sustainable and environmentally friendly farming practices. Stricter emission standards and zero-emission vehicles are being promoted globally, prompting manufacturers to invest in developing electric models. Yet adoption remains slow in comparison to diesel models due to higher upfront costs, limited awareness among farmers, and inadequate charging infrastructure in rural areas.

Moreover, manufacturers are developing more efficient battery technologies to extend operational hours for these tractors, while companies look to manufacture smaller, affordable tractors designed for small and medium-sized farms. Also, precision farming technologies like GPS and automation are being integrated into these electric tractors to boost their efficiency while appealing to tech-savvy farmers; these innovations should lead to further market growth in the coming years. Similar integrations are also influencing categories like

Compact Electric Construction Equipment, offering modular and scalable power solutions across industries.

In addition, recent events demonstrate both the progress and challenges associated with the electric tractor industry. At the global level, European Union states are pushing zero emission targets creating a significant market for electric tractors as part of efforts to lower greenhouse gas emissions; China on the other hand is seeing growth of alternative power sources for tractors such as gas models which may spark similar innovations within electric tractor segments.

However, electric tractors face two key obstacles when it comes to policy and financial incentives: on-road electric vehicles often enjoy reduced taxes and insurance benefits, while electric tractors usually do not. For instance, in India, electric tractors are taxed at 12% making them less financially appealing to farmers, hence one of their major obstacles is policy and financial support from governments that encourage adoption through targeted policies or subsidies. This is particularly significant in the

Indian Tractor market, where diesel reliance remains high.

Nevertheless, electric tractors could revolutionize farming despite their challenges. Their ability to reduce emissions, lower farming costs, and enhance farmer well-being makes them an attractive alternative to traditional tractors. As battery technology improves and prices decrease, electric tractors could play an even larger role in sustainable agriculture; globally this transition could support climate goals while simultaneously encouraging rural economies by providing cleaner farming methods that create cleaner economies.

The US Electric Tractor Market

The US Electric Tractor Market is projected to reach USD 0.2 billion in 2025 at a compound annual growth rate of 27.4% over its forecast period.

The US electric tractor market provides higher growth potentials due to government support of sustainable farming practices and stricter emissions regulations. Farmers have taken advantage of eco-friendly solutions to lower operating costs and environmental impact, while advances in battery technology and growing awareness about precision farming contribute to market expansion in this country.

Further, the US electric tractor market growth is propelled by government incentives promoting sustainable agriculture, advances in battery technology, and rising consumer interest in eco-friendly solutions. However, market challenges include the initial costs of electric tractors being relatively high and limited charging infrastructure in rural areas; addressing these hurdles would unlock the full potential of electric tractors in the US agriculture sector. Integrations with technologies borrowed from

Electric and Hybrid Construction Equipment are also becoming more prominent, driving cross-industry innovation.

Electric Tractor Market: Key Takeaways

- Market Growth: The Electric Tractor Market size is expected to grow by 8.0 billion, at a CAGR of 29.3% during the forecasted period of 2026 to 2034.

- By Propulsion: The battery electric segment is anticipated to get the majority share of the Electric Tractor Market in 2025.

- By Function: The Agriculture & forestry segment is expected to be leading the market in 2025

- By Equipment Type: The electric sprayers segment is expected to get the largest revenue share in 2025 in the Electric Tractor Market.

- Regional Insight: Europe is expected to hold a 46.8% share of revenue in the Global Electric Tractor Market in 2025.

- Use Cases: Some of the use cases of Electric Tractor include sustainable farming, cost savings, and more.

Electric Tractor Market: Use Cases

- Sustainable Farming: Electric tractors reduce greenhouse gas emissions & air pollution, supporting eco-friendly agricultural practices.

- Cost Savings: With lower fuel costs & maintenance requirements in comparison to diesel tractors, electric tractors offer farmers significant cost-cutting opportunities.

- Improvement of Farmer Health: Electric tractors eliminate diesel fumes, lower noise levels, and decrease vibrations to create a healthier and more comfortable working environment for farmers.

- Precision Agriculture: Modern electric tractors can incorporate advanced technologies like GPS, automation, and real-time data collection, increasing efficiency and productivity in modern farming practices.

Stats & Facts

- According to the International Council of Clean Transportation (ICCT), India sold 1.66 million electric vehicles (EVs) in FY 2023-24. Still, only four were e-tractors, despite annual tractor sales nearing 1 million. Further, three years after launching the first e-tractor in India, adoption remains negligible, even as tractors account for 4.8% of the country's high-speed diesel consumption, comparable to buses (5.9%) and significantly higher than three-wheelers (1.2%).

- As per ICCT, Indian tractors are subject to Bharat Stage (CEV/Trem), IV emission standards until 2026, while road vehicles transitioned to stricter BS-VI standards in 2020. E-tractors, however, provide multiple advantages, like minimal emissions, lower farming costs, and better farmer health by minimizing noise, vibrations, and diesel fume exposure (ICCT). Manufacturers also highlight that e-tractors, with instant torque delivery and better control, can perform stationary tasks faster than diesel models.

- Also, in the report of ICCT, policy challenges impact the adoption of e-tractors in India. Unlike on-road EVs, which benefit from a reduced 5% GST and a 15% discount on third-party insurance premiums, e-tractors are taxed at 12% and do not enjoy similar insurance benefits. Meanwhile, the European Union imported tractors worth USD 300 million in 2022, driven by stricter emission regulations and zero-emission targets, presenting potential export opportunities for Indian manufacturers.

- According to ChinaTruck.com, tractor sales in China grew by 4% year-on-year in the first half of 2024, totaling 162,100 units, with gas-powered tractors accounting for 66% of total sales due to lower operating costs. In June 2024, sales reached 25,400 units, marking a 4% year-on-year increase but a 12% month-on-month decline. Tractor sales in this period ranked third compared to the same period in the past five years. Despite sluggish performance in construction vehicles like dump trucks and mixers, tractor sales in China outperformed the heavy-duty truck market, which faced a 6% decline.

- In addition, leading Chinese manufacturers in June 2024 included Jiefang, which sold 6,590 units (a 16% decline), SINOTRUK, which sold 5,743 units (a 31% increase), and Dongfeng, which sold 3,334 units (an 8% decline).

- Further, ChinaTruck.com also reported that gas-powered tractors experienced significant growth, with a 106% year-on-year increase in the first half of 2024, reflecting their growing popularity among end-users. Although delays in infrastructure projects and a sluggish real estate market impacted construction vehicle sales, tractors remained resilient.

- According to the International Council of Clean Transportation (IBEF), India’s automobile sector attracted USD 36.268 billion in cumulative equity FDI inflows between April 2000 and March 2024, showcasing steady growth over the years. In addition, India is on track to become the largest EV market by 2030, with a projected investment opportunity exceeding USD 200 billion over the next 8–10 years.

- According to ICCT, tractor sales in India remain a key driver and indicator of rural economic growth, emphasizing the need to promote cleaner alternatives like e-tractors. E-tractors hold significant potential to transform rural livelihoods by combining sustainability with economic efficiency, reducing dependence on diesel, and improving environmental and health outcomes.

- Further, stricter emission regulations and zero-emission targets, particularly in the European Union, create promising opportunities for Indian e-tractor manufacturers to expand their presence in export markets.

Market Dynamic

Driving Factors in the Electric Tractor Market

An Increased Focus on Sustainability

The growing environmental awareness and strict government regulations on emissions are driving demand for electric tractors worldwide. Countries around the world are setting zero-emission targets and encouraging cleaner technologies in agriculture to reduce greenhouse gas emissions, with subsidies, incentives, and tax benefits for adopting electric vehicles further encouraging farmers to switch over, which is driving the market expansion.

An Increased Focus on Sustainability

The growing environmental awareness and strict government regulations on emissions are driving demand for electric tractors worldwide. Countries around the world are setting zero-emission targets and encouraging cleaner technologies in agriculture to reduce greenhouse gas emissions, with subsidies, incentives, and tax benefits for adopting electric vehicles further encouraging farmers to switch over, which is driving the market expansion.

Restraints in the Electric Tractor Market

High Upfront Costs

Electric tractors have a higher initial purchase price in comparison to traditional diesel models, mainly due to expensive battery technology. For small and marginal farmers, this cost becomes a major barrier to adoption, mainly in developing countries where farming incomes are lower. Limited financial support or subsidies for electric tractors in many regions further worsen this issue, making them less accessible to a large audience.

Lack of Charging Infrastructure

The lack of adequate charging infrastructure in rural and agricultural areas is a major restraint for the electric tractor market. Farmers mostly work in remote locations with limited or no access to reliable electricity, which makes charging electric tractors challenging. Without a strong network of charging stations, operational reliability and convenience become concerns, discouraging farmers from transitioning to electric alternatives.

Opportunities in the Electric Tractor Market

Expansion of Government Support

Government focus across the world is increasing on sustainable agriculture, which provides significant opportunities for the electric tractor market. Policies providing subsidies, tax incentives, and reduced import duties on electric farming equipment can encourage adoption. Governments can also invest in rural charging infrastructure to address accessibility issues. Such initiatives create a favorable environment for manufacturers to expand and farmers to transition to electric tractors.

Integration of Smart Farming Technologies

The growing adoption of precision farming techniques creates an opportunity to integrate electric tractors with advanced technologies like GPS, automation, and IoT. These features enhance productivity, efficiency, and resource management, making electric tractors more appealing to tech-savvy and large-scale farmers. Combining sustainability with cutting-edge technology can position electric tractors as a key player in the future of agriculture.

Trends in the Electric Tractor Market

Advancements in Battery Technology

Recent trends show major progress in battery efficiency, like higher energy density and faster charging capabilities, making electric tractors more practical for longer operational hours. Manufacturers are mainly adopting lithium-ion and solid-state batteries to enhance performance and reduce costs. These developments address one of the major concerns of farmers is battery life and downtime, thereby driving interest in electric tractors globally.

Development of Smaller and Affordable Model

Manufacturers are launching compact and affordable electric tractors targeted at small and medium-sized farms. These models look at farmers with limited budgets while providing sufficient power for basic agricultural tasks. This trend not only expands the customer base but also aligns with the needs of markets in developing countries, where small-scale farming is prevalent.

Research Scope and Analysis

By Propulsion

Battery electric propulsion plays an integral part in driving growth for electric tractor market and is expected to lead the market in 2025, to provide a cleaner and more cost-effective alternative to traditional diesel engines. Battery technology advances are making electric tractors highly powerful and capable of taking on diverse agricultural tasks without using fossil fuels, significantly reducing fossil fuel usage while being quieter, requiring less maintenance, and having lower operational costs than their diesel counterparts. As battery efficiency is enhanced, electric tractors can operate for extended hours, making them more cost-effective for farmers, which aligns with global initiatives promoting sustainability by helping to reduce emissions while supporting eco-friendly farming practices.

Further, hydrogen as a propulsion source offers a promising alternative to battery-electric tractors for heavy-duty tasks and is expected to grow steadily in the coming years, especially on farms with multiple properties. Hydrogen fuel cells provide longer operating hours and faster refueling compared to battery models ideal for large farms that require extended power and minimal downtime contributing significantly to the market expansion of electric tractors.

By Battery Chemistry

Lithium Iron Phosphate (LFP) batteries are expected to take a prominent place in the electric tractor market in 2025 due to their superior combination of cost-efficiency, safety, and long lifespan. LFP batteries provide more stability and less overheating than traditional lithium-ion batteries, making them safer for use in agricultural machinery. Furthermore, their longer cycle life means reduced overall costs for farmers. These batteries make electric tractors more affordable, spurring higher adoption. As battery technology improves, their advantages will further propel their dominance and help promote cleaner farming practices.

Further, Lithium Nickel Manganese Cobalt Oxide (Li-NMC) batteries are expected to experience exponential growth in the electric tractor market over the forecast period due to their superior energy density and performance. Li-NMC batteries provide more power for longer-duration tasks, while their quick charging capability and long-lasting energy make them ideal for large-scale agricultural operations. With demand increasing for efficient yet durable electric tractors, these Li-NMC batteries will play an integral part in meeting these demands and spurring market expansion.

By Battery Capacity

In 2025, battery capacities with more than 100 kWh are set to dominate the electric tractor market, as they provide enough power for heavy-duty agricultural tasks. Their larger capacity allows long-running operations without frequent recharging sessions, making electric tractors more cost-efficient for large-scale farming operations than their diesel counterparts. Furthermore, these high-capacity batteries allow electric tractors to meet demanding workloads such as plowing, hauling, and harvesting operations typically handled by diesel machines while simultaneously lowering emissions and operational costs while meeting modern farming power demands while meeting current power demands simultaneously while simultaneously meeting environmental and operational cost concerns.

Further, battery capacities between 51 to 100 kWh are projected to experience substantial growth in the electric tractor market during this forecast period, providing the optimal balance of power & efficiency for medium-to-large-scale farms. These batteries deliver enough energy for various agricultural tasks without needing frequent recharging sessions, making electric tractors more accessible to farmers while supporting sustainable farming practices.

By Power Output

In terms of power output, electric tractors with 51 to 100 horsepower (HP) are expected to lead the market in 2025, as they offer an ideal balance between efficiency & performance for various farming needs. Tractors in this range will be powerful enough to carry out essential tasks like tilling, plowing, and hauling for small and medium-sized farms alike. Furthermore, with growing demands for sustainable farming solutions, these electric tractors will offer cleaner, quieter, and more cost-effective alternatives than their diesel counterparts, leading to their large adoption by agricultural sectors alike.

Further, electric tractors with power outputs under 50 horsepower are projected to experience rapid growth over the forecast period as they look into small-scale and horticultural farming needs. These compact tractors are perfect for tasks such as cultivating, mowing, and harvesting on smaller farms, offering more affordable and eco-friendly alternatives to traditional diesel models. As more farmers look for sustainable and cost-efficient solutions for farming activities, electric tractors in this power range will help promote the adoption of this equipment and thus grow the market overall.

By Function

Agriculture and forestry are two key drivers behind the expansion of the electric tractor market, as these sectors increasingly turn toward electric-powered solutions for more eco-friendly practices. Electric tractors are ideal for plowing, tilling, planting, and timber hauling tasks in these sectors, offering cleaner, quieter, and more cost-efficient alternatives than diesel machines while still satisfying traditional farming demands. As battery technology improves and eco-friendly farming becomes a priority among farmers and foresters, electric tractors may soon lead the market by 2025.

Further, utility functions, like landscaping, snow clearing, and material handling, are anticipated to drive the expansion of the electric tractor market over the forecast period. Electric tractors provide cleaner & quieter alternatives for these tasks than their diesel counterparts, making them suitable for urban settings or small properties. As businesses and local governments focus on reducing emissions while simultaneously cutting operational costs, electric tractors will increasingly be adopted for utility purposes, further propelling market expansion.

By Equipment Type

Electric sprayers will play a pivotal role in driving the growth of the electric tractor market in 2025. These innovative equipment types come with an electric system within the tractor and offer more environmentally friendly ways of applying fertilizers, pesticides, and herbicides than their traditional fuel-powered counterparts. Furthermore, as demand for precision farming increases, electric sprayers will be preferred due to their accurate delivery of controlled applications, driving further adoption of electric tractors into modern agriculture for cleaner operations overall.

Electric weeders powered by electric tractors are expected to experience significant growth over the forecast period as eco-friendly and effective solutions for weed management. Offering quiet operation with fewer emissions compared to gas-powered models, electric weeders provide quiet emission-free alternatives while offering precise performance at reduced operating costs; these factors together will drive increased adoption of electric tractors equipped with electric weeders within agriculture markets.

The Electric Tractor Market Report is segmented on the basis of the following:

By Propulsion

- Battery Electric

- Hybrid Electric

- Hydrogen

By Battery Chemistry

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt Oxide (LI-NMC)

- Others

By Battery Capacity

- Less than 50 KWH

- 51 to 100 KWH

- More than 100 KWH

By Power Output

- Less than 50 HP

- 51 to 100 HP

- More than 100 HP

By Function

- Agriculture & Forestry

- Utility

- Industrial

By Equipment Type

- Electric Sprayers

- Electric Weeders

Regional Analysis

Europe is projected to lead the electric tractor market in 2025 with an anticipated

revenue share of 46.8% due to its commitment to environmental regulations. Governments across the region are providing subsidies, tax benefits, and financial incentives to promote zero-emission farming equipment adoption. As more European nations set aggressive carbon neutrality goals, electric tractors have become a more viable solution than their diesel counterparts. Advanced infrastructure and large implementation of precision farming technologies assist in the adoption of electric tractors in this region. In addition, European farmers are switching to electric tractors as a means of cutting operating costs, improving efficiency, and meeting stringent emissions standards. Leading manufacturers' innovations and the introduction of advanced electric tractor models should help Europe maintain its position as a frontrunner in the global electric tractor market.

Further, the Asia Pacific region is anticipated to experience significant growth in the electric tractor market over the forecast period, driven by its large agricultural sector and major focus on sustainable farming practices. India and China have taken proactive steps toward supporting electric tractors with government subsidies focused on reducing carbon emissions from diesel usage as well as raising awareness about their lower operating costs and reduced pollution potential, which have further propelled demand. These elements come together to position Asia Pacific for robust expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Electric Tractor Market: Competitive Landscape

The electric tractor market has become more and more competitive as more players enter with innovative technologies to meet rising demand. Manufacturers are focusing on improving battery performance, increasing operational hours, reducing charging times, and adding advanced features like automation and precision farming integration in their tractors to make them more suitable for farmers' use. Companies also explore affordable production methods to make electric tractors more affordable; regional players meet local requirements while global competitors invest heavily in R&D, creating a dynamic competitive atmosphere that drives rapid innovation and market expansion worldwide.

Some of the prominent players in the global Electric Tractor are

- DEERE & COMPANY

- CNH INDUSTRIAL

- AGCO CORP

- AGRO TRACTORS

- SONALIKA

- KUBOTA CORP

- SOLECTRAC

- YANMAR HOLDINGS

- VST TRACTORS

- ZTRACTOR

- OTHER KEY PLAYERS

Recent Developments

- In January 2025, AutoNxt launched India’s first electric tractor called AutoNxt’s electric tractor, which will bring about a revolution in agriculture and various industrial sectors. As part of India’s ‘Make in India’ initiative, AutoNxt’s electric tractor is set to make significant steps in both agriculture and industry.

- In January 2025, John Deere launched several new autonomous machines during CES 2025 to help customers in agriculture, construction, and commercial landscaping. Building on Deere’s autonomous technology first revealed at CES 2022, the company’s second-generation autonomy kit combines advanced computer vision, AI, and cameras to help the machines navigate their environments. Automation can look into addressing the challenge; the company plans to expand its technology stack to allow more machines to operate safely and autonomously in unique and complex environments, which will not only benefit its customers but all who rely on them to provide the food, fuel, fiber, infrastructure, and landscaping care that one depends on every day.

- In December 2024, Monarch Tractor unveiled the establishment of Monarch Tractor Europe, N.V., which follows the ongoing strategic growth journey. The expansion to Europe is a logical next step with planned local manufacturing, an R&D hub, a digital center of excellence, and its EU headquarters in Flanders, Belgium

- In November 2024, Volkswagen Group Africa (VWA) announced the launch of operations of a modern farming pilot project in Gashora, Rwanda, that would see the rollout of specially developed VW-badged electric tractors for use by farmers in the area. The GenFarm Project focuses on supporting electric-powered, mechanized farming services for rural areas in Africa. Equipped with PV power and energy storage systems, the hub will provide clean energy, training, storage space, and business space to farming cooperatives in Gashora.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 0.9 Bn |

| Forecast Value (2033) |

USD 9.2 Bn |

| CAGR (2024-2033) |

29.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 0.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Propulsion (Battery Electric, Hybrid Electric, and Hydrogen), By Battery Chemistry (Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt Oxide (LI-NMC), and Others), By Battery Capacity (Less than 50 KWH, 51 to 100 KWH, and More than 100 KWH), By Power Output (Less than 50 HP, 51 to 100 HP, and More than 100 HP), By Function (Agriculture & Forestry, Utility, and Industrial), By Equipment Type (Electric Sprayers and Electric Weeders |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

DEERE & COMPANY, CNH INDUSTRIAL, AGCO CORP, AGRO TRACTORS, SONALIKA, KUBOTA CORP, SOLECTRAC, YANMAR HOLDINGS, VST TRACTORS, ZTRACTOR, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Electric Tractor Market?

▾ The Global Electric Tractor Market size is expected to reach a value of USD 0.9 billion in 2025 and is expected to reach USD 9.2 billion by the end of 2034.

Which region accounted for the largest Global Electric Tractor Market?

▾ Europe is expected to have the largest market share in the Global Electric Tractor Market with a share of about 46.8% in 2025.

How big is the Electric Tractor Market in the US?

▾ The Electric Tractor Market in the US is expected to reach USD 0.2 billion in 2025.

Who are the key players in the Global Electric Tractor Market?

▾ Some of the major key players in the Global Electric Tractor Market are DEERE & COMPANY, CNH INDUSTRIAL, AGCO CORP, and others.

What is the growth rate in the Global Electric Tractor Market?

▾ The market is growing at a CAGR of 29.3 percent over the forecasted period.