Market Overview

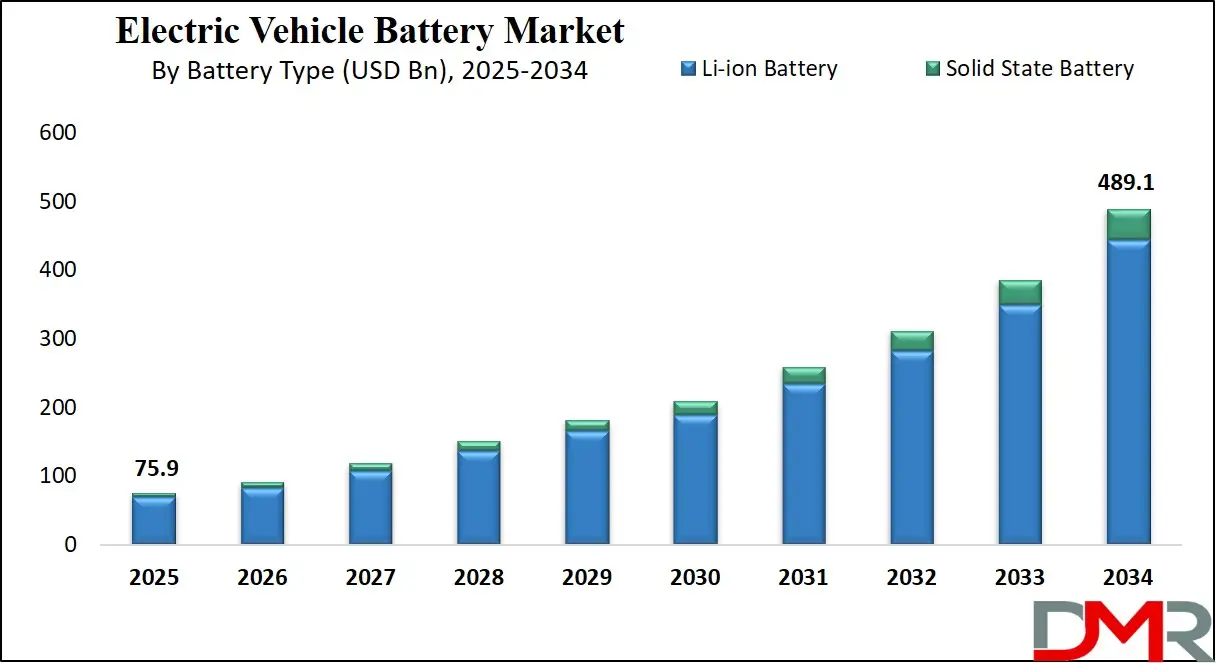

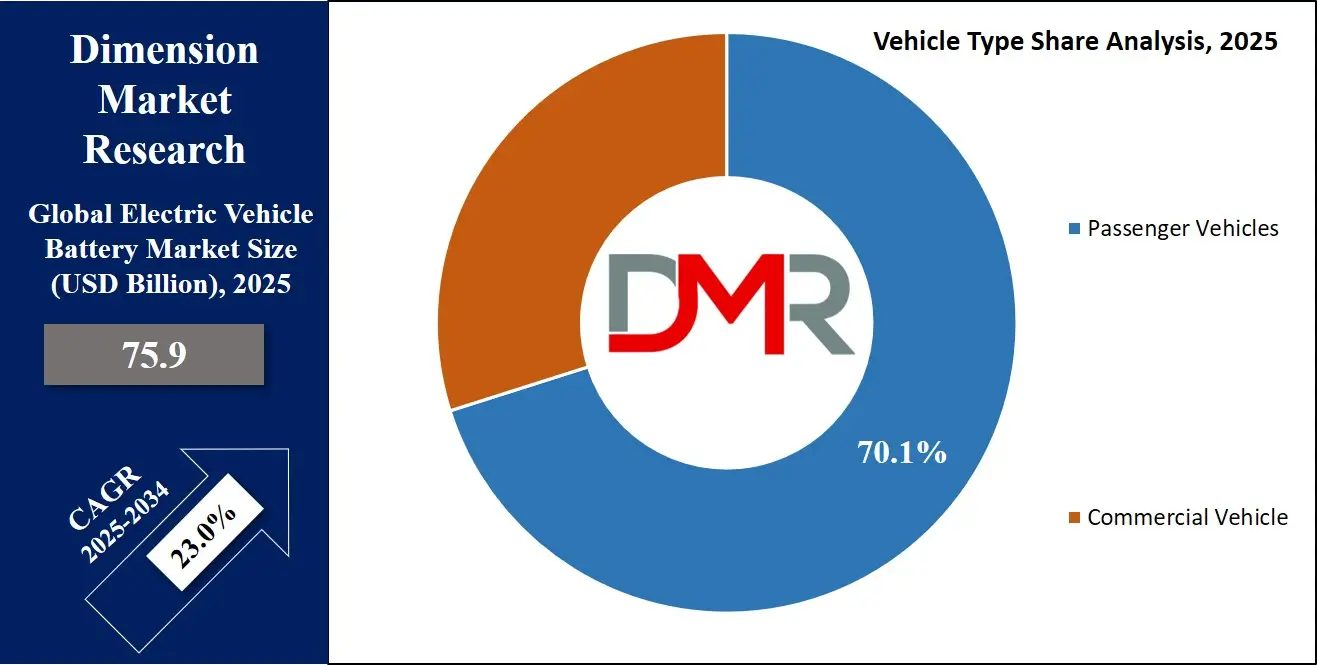

The Global Electric Vehicle Battery Market size is projected to reach USD 75.9 billion in 2025 and grow at a compound annual growth rate of 23.0% from there until 2034 to reach a value of USD 489.1 billion

Electric vehicle (EV) batteries are special rechargeable batteries used to power electric cars, buses, and other vehicles. These batteries store energy and provide it to the electric motor, replacing the need for gasoline or diesel. The most common type of battery used in EVs today is the lithium-ion battery. These are popular because they store a lot of energy for their size and can be recharged many times. EV batteries are also different from regular car batteries because they have to deliver more power and last for longer distances.

The demand for electric vehicle batteries has grown quickly in recent years. This is because more people are choosing

electric vehicles to help reduce pollution and save fuel. Many countries have announced plans to reduce or stop the sale of petrol and diesel cars, which has increased the need for better and more efficient EV batteries. As a result, battery makers are working hard to make batteries that last longer, charge faster, and cost less.

There are several major trends in this space. One big trend is battery recycling, where used batteries are collected and reused to reduce waste. Another trend is the use of new materials like solid-state technology, which could replace the liquid used inside current lithium-ion batteries. These new batteries may be safer, charge faster, and hold more energy. Companies and researchers are also looking at ways to use less rare materials like cobalt, which is expensive and not easy to get.

In the last few years, many important events have shaped the EV battery market. Big car companies like Tesla, BYD, and Volkswagen have built their own battery factories. There have also been large partnerships between battery producers and automakers. Governments in the U.S., Europe, China, and India have announced large investments and incentives to support EV battery production and research.

Supply chain issues have also affected the battery industry. Shortages of materials like lithium and nickel have made it harder to produce batteries. This has pushed many companies to look for new sources or to recycle materials from old batteries. At the same time, countries are competing to build local battery factories and Electric Vehicle Charger production facilities to avoid relying too much on imports.

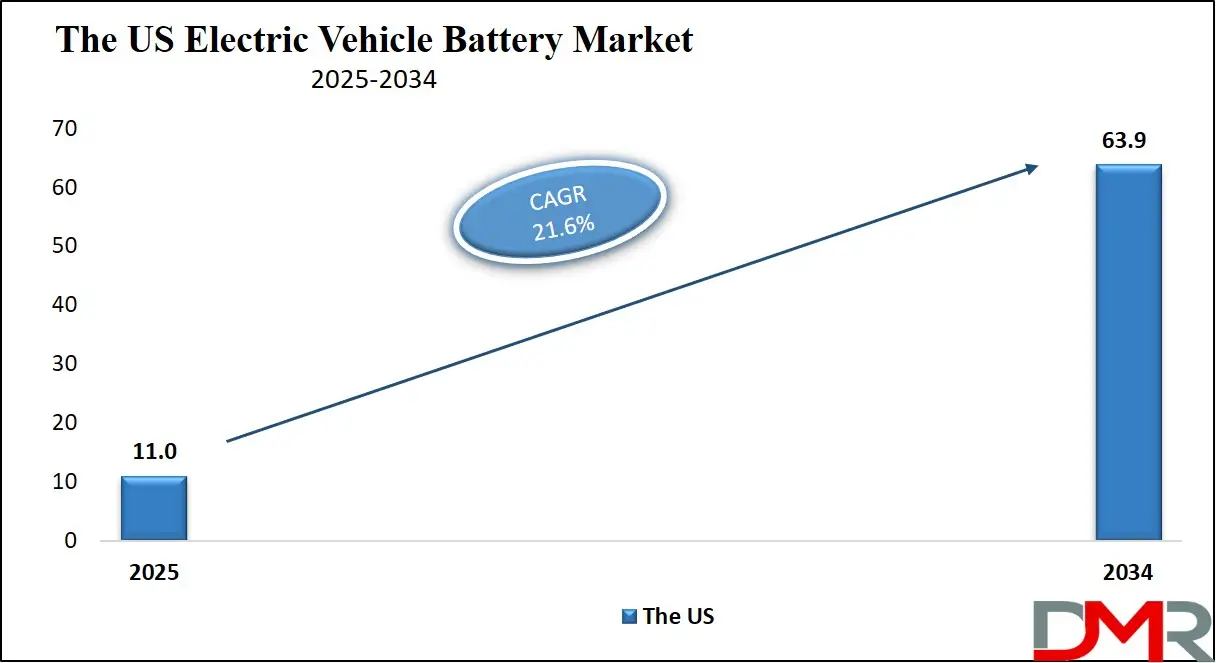

The US Electric Vehicle Battery Market

The US Electric Vehicle Battery Market size is projected to reach USD 11.0 billion in 2025 at a compound annual growth rate of 21.6 % over its forecast period.

The US plays a growing and strategic role in the electric vehicle battery market. It is investing heavily in domestic battery production to reduce dependence on foreign supply chains. Through public funding and policy support, the US is encouraging companies to build local battery plants and secure raw materials within North America.

The country is also promoting innovation in battery technologies, including next-generation chemistries like solid-state and sodium-ion. Leading automakers and startups in the US are collaborating with battery manufacturers to scale up production. Additionally, the US government is offering incentives to boost EV adoption, which in turn drives battery demand. These combined efforts position the US as a major player in shaping the global EV battery ecosystem.

Europe Electric Vehicle Battery Market

Europe Electric Vehicle Battery Market size is projected to reach USD 16.7 billion in 2025 at a compound annual growth rate of 21.2% over its forecast period.

Europe plays a central role in the electric vehicle battery market thanks to a concerted push for self-reliance, green jobs, and industrial strength. The European Battery Alliance brings together over 120 public and private partners to build a full battery-cell value chain across the region and aims to ensure most of Europe’s battery needs are met locally. Governments and the EU offer billions in funding and subsidies, such as state aid for factories in Germany and France, to attract investment and support R&D.

Despite high ambitions, Europe still trails behind China in manufacturing scale. Recent setbacks like Northvolt's bankruptcy and paused gigafactory builds have prompted firms to partner with Asian companies for technology and capacity support. To meet targets like making 90% of its batteries at home by 2030, Europe emphasizes industrial collaboration, supply‑chain security, and green standards under plans like the Green Deal. This strategy balances competitiveness with sustainability in the evolving EV battery landscape.

Japan Electric Vehicle Battery Market

Japan Electric Vehicle Battery Market size is projected to reach USD 5.3 billion in 2025 at a compound annual growth rate of 22.9% over its forecast period.

Japan plays a strategic but challenging role in the global electric vehicle battery market. After pioneering lithium-ion battery production, Japanese firms and the government are now striving to once again lead in battery technology, from advanced solid-state types to efforts to build a full local supply chain. The government has launched substantial incentives, funding domestic factories and collaborations with automakers and material producers to strengthen the battery ecosystem.

However, financial stress among major automakers has delayed some factory plans, and strong competition especially from Chinese manufacturers has eroded Japan’s market share and slowed down its goals. Still, Japan remains focused on developing cutting-edge battery materials and next-generation cells. The nation's continued investments and partnerships may help restore its influence, but success will depend on balancing innovation, funding, and global competitive pressures.

Electric Vehicle Battery Market: Key Takeaways

- Market Growth: The Electric Vehicle Battery Market size is expected to grow by USD 397.6 billion, at a CAGR of 23.0%, during the forecasted period of 2026 to 2034.

- By Battery Type: TheLi-ion Battery segment is anticipated to get the majority share of the Electric Vehicle Battery Market in 2025.

- By Vehicle Type: The passenger vehicles segment is expected to get the largest revenue share in 2025 in the Electric Vehicle Battery Market.

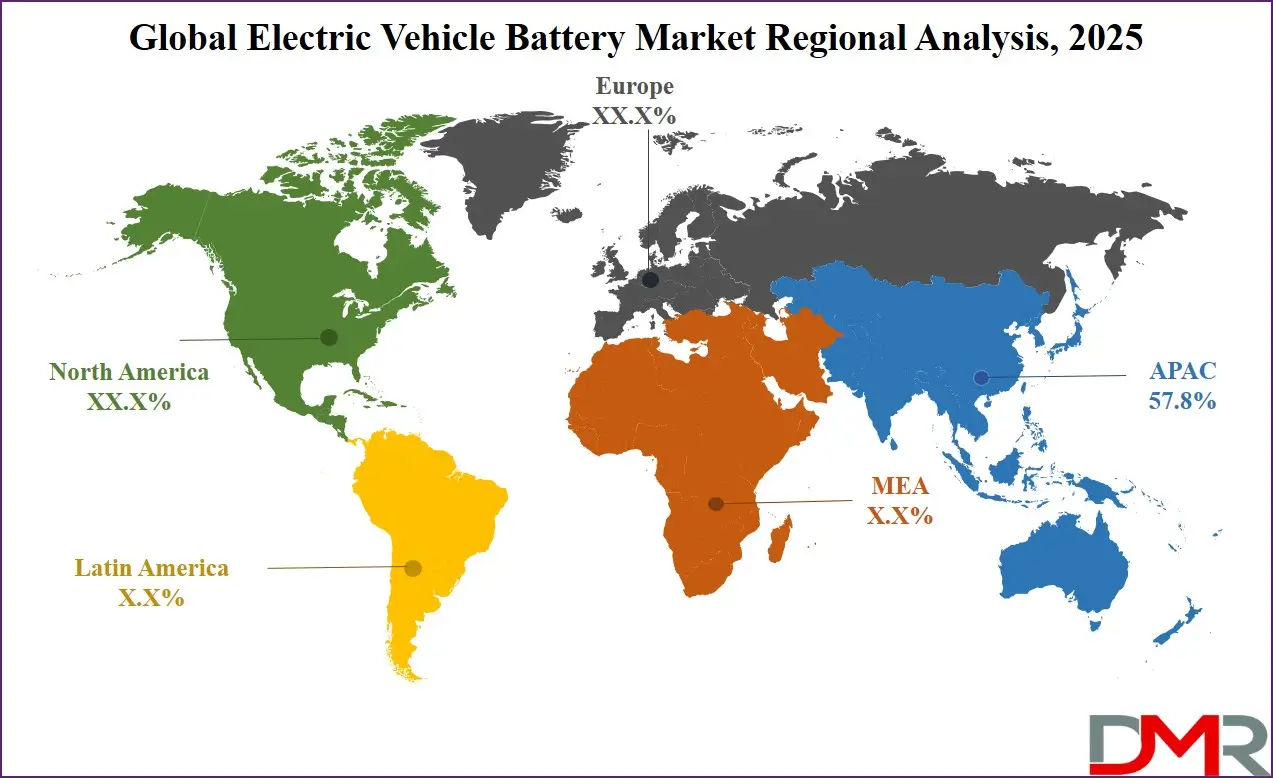

- Regional Insight: Asia Pacific is expected to hold a 57.8% share of revenue in the Global Electric Vehicle Battery Market in 2025.

- Use Cases: Some of the use cases of Electric Vehicle Battery include personal EV, public transport systems, and more.

Electric Vehicle Battery Market: Use Cases:

- Personal Electric Vehicles: Electric vehicle batteries power personal EVs like cars, scooters, and bikes. They help reduce fuel costs and emissions, making them ideal for everyday city and suburban travel. These batteries offer enough range and speed for daily commutes and errands.

- Commercial Fleets and Delivery Vans: Businesses use EV batteries in delivery vans, taxis, and service vehicles. These fleets benefit from lower operating costs and maintenance. Battery-powered fleets are also used to meet environmental rules and promote green practices.

- Public Transport Systems: Electric buses and trains rely on EV batteries to run clean public transport networks. These batteries help reduce air pollution in crowded cities. They are designed to handle frequent stops and longer operating hours.

- Energy Storage and Grid Support: Used EV batteries can be repurposed for energy storage in homes or businesses. These second-life batteries store energy from solar or wind power. They also support the electricity grid during high demand or outages.

Stats & Facts

-

According to ACEA, battery-electric car registrations fell by 10.2% in December 2024, mainly due to sharp declines in Germany and France, which led to a 5.9% decrease in total 2024 BEV market volume compared to 2023, with the full-year market share settling at 13.6%.

- As per EVBoosters, China recorded a massive 1.3 million EV sales in December 2024 alone, ending the year with 11 million units sold—a 40% year-over-year increase—driven by strong support programs, a trade-in scheme, and the continued dominance of domestic brands.

- AUTOVISTA reports that LG Energy Solution produced 108 GWh of battery cells in 2024, showing only a 1.8% increase over 2023, which caused a drop in market share by 2.4 percentage points to 12.4%, reflecting growing pressure from other cell manufacturers.

- ACEA noted that plug-in hybrid car registrations rose by 4.9% in December 2024 due to high growth in France and Germany, although the total yearly volumes still fell by 6.8% compared to 2023, holding steady at 8.3% market share.

- EVBoosters highlighted that the UK overtook Germany in BEV sales in 2024, thanks to the enforcement of the UK Zero Emission Vehicle (ZEV) mandate, even as the overall European EV market shrank by 5.9% for the year due to subsidy cuts and other shifts.

- In a strategic move reported by AUTOVISTA, LG Energy Solution and GM announced plans in December 2024 to co-develop prismatic battery cells, aiming to make LG the first global battery firm to offer all three formats: pouch, cylindrical, and prismatic.

- According to ACEA, hybrid-electric car registrations surged by 33.1% in December 2024, increasing their market share to 33.6%, overtaking petrol-powered cars for the fourth month in a row and showing strong consumer interest in non-plug alternatives.

- As per EVBoosters, the EV market in the United States and Canada grew by 9% in 2024, supported by the $7,500 federal EV tax credit and emission standards from the Environmental Protection Agency, though upcoming policy changes may affect future momentum.

- AUTOVISTA stated that BYD introduced its ‘Super e-Platform’ in late 2024, claiming the technology can deliver 400 km of range in just five minutes, with charging capacity expected to reach speeds of up to 1,000KW—setting a new benchmark in battery innovation.

- EVBoosters noted that outside major markets, EV adoption rose by 26.4% in December 2024 across emerging regions such as Asia-Pacific, Latin America, and Africa, where localized incentives and infrastructure projects are helping drive the transition to electric mobility.

- According to EVBoosters, despite Europe’s mixed performance in 2024, the December sales figure of 310,000 units marked a year-end stabilization with just a slight 0.7% increase over the previous year, reflecting both market resilience and adaptation to policy changes.

- AUTOVISTA added that since 2014, LG Energy Solution has built a total battery cell production capacity of 436.7 GWh, placing it second in the all-time global output ranking—just behind the top producer and slightly ahead of BYD.

Market Dynamic

Driving Factors in the Electric Vehicle Battery Market

Government Policies and Incentives

One of the biggest growth drivers for the electric vehicle battery market is strong support from governments around the world. Many countries are offering subsidies, tax benefits, and grants to promote electric vehicle adoption. These policies help reduce the overall cost of electric vehicles, making them more attractive to consumers. At the same time, governments are also investing in charging infrastructure and battery research to support long-term growth.

Regulations to cut carbon emissions and phase out petrol and diesel vehicles are also pushing automakers to shift toward electric mobility. Public funding for local battery production is helping reduce dependency on imports. These actions together are creating a strong foundation for the EV battery market to expand quickly and sustainably.

Rising Demand for Electric Vehicles Worldwide

The increasing demand for electric vehicles across both developed and developing countries is fueling battery market growth. Consumers are becoming more aware of environmental issues and are looking for cleaner, greener alternatives to traditional vehicles. As EV models become more affordable, with better range and features, people are more willing to switch.

Automakers are launching new electric models in every category, from compact cars to SUVs and trucks, further driving demand. Ride-sharing services and delivery companies are also turning to EVs to cut costs and meet sustainability goals. All of this creates a large and growing need for high-performance, safe, and reliable batteries. The more EVs on the road, the greater the demand for batteries, both for new production and replacement.

Restraints in the Electric Vehicle Battery Market

High Cost of Raw Materials and Batteries

One major restraint in the electric vehicle battery market is the high cost of raw materials like lithium, cobalt, and nickel. These materials are essential for battery production but are limited in supply and often sourced from specific regions, leading to price volatility. The complex extraction and refining processes also add to the overall cost. As a result, EV batteries remain expensive, which impacts the final cost of electric vehicles.

This can discourage price-sensitive consumers, especially in developing countries. In addition, securing a stable and ethical supply chain is challenging. If material costs continue to rise, it could slow down battery production and limit market growth despite increasing EV demand.

Limited Charging Infrastructure and Range Concerns

Another key restraint is the lack of widespread and reliable charging infrastructure, especially in rural and developing regions. Even with growing awareness and interest in electric vehicles, people hesitate to buy them if they worry about finding a charging station.

Range anxiety, or the fear of running out of power before reaching a charger, remains a concern for many. While battery technology is improving, some EVs, such as Electric Car and Electric Tractor models, still offer shorter driving ranges compared to traditional fuel vehicles. Long charging times further add to user inconvenience. Without enough fast and accessible charging options, the adoption of EVs and therefore batteries can be slower than expected, limiting overall market expansion.

Opportunities in the Electric Vehicle Battery Market

Advancements in Battery Technology

One of the biggest opportunities in the electric vehicle battery market lies in ongoing advancements in battery technology. Researchers and manufacturers are developing new battery types like solid-state, lithium-sulfur, and sodium-ion batteries that promise greater energy density, faster charging, and improved safety. These innovations can significantly enhance EV performance, reduce weight, and lower costs over time.

Better thermal management and longer life cycles are also being focused on to meet growing consumer expectations. As technology improves, the total cost of EV ownership will drop, encouraging wider adoption. Companies that lead in next-generation battery solutions will gain a strong competitive edge. This innovation-driven growth offers huge potential to transform the battery landscape in the coming years.

Battery Recycling and Second-Life Use

The rise of battery recycling and second-life applications presents a promising opportunity in the EV battery market. As more EVs reach the end of their battery life, recycling can recover valuable materials like lithium and cobalt, helping reduce dependence on new mining. This lowers environmental impact and improves supply chain resilience.

Additionally, used EV batteries can be repurposed for stationary energy storage, such as in solar or wind power systems. These second-life uses extend the value and life of batteries beyond vehicles. Governments and companies are increasingly investing in recycling infrastructure and reuse programs. This circular approach creates new revenue streams while supporting sustainability goals and long-term market growth.

Trends in the Electric Vehicle Battery Market

Rise of Sodium‑Ion and Alternative Chemistries

Manufacturers are increasingly exploring sodium‑ion batteries, which use more abundant materials like sodium instead of lithium. These batteries may be slightly less energy‑dense but carry big advantages in cost and sustainability. In some regions especially China they’re already powering scooters and small EVs, with plans underway to scale them into larger vehicles and even grid storage. This shift helps reduce reliance on scarce lithium supplies, opens up new uses, and offers a more environmentally friendly path forward.

Ultra‑Fast Charging & Smart Grid Integration

Another key trend sees the integration of ultra‑fast charging and vehicle‑to‑grid systems. Breakthroughs in battery design now allow EVs to recharge in just five to ten minutes, rivaling petrol fill‑ups. Meanwhile, bidirectional charging—known as V2G—enables cars to return power to the grid during peak demand, boosting overall energy efficiency. Together, these trends improve convenience for drivers, stabilize electricity systems, and support wider renewable energy adoption.

Research Scope and Analysis

By Battery Type Analysis

Li-ion battery, leading in 2025 with a share of 90.6%, is expected to remain the backbone of the electric vehicle battery market due to its high energy density, long lifecycle, and reliable performance. This battery type supports fast charging, making it ideal for modern electric vehicles across personal, commercial, and public transport applications. Its lightweight structure and ability to store more power in less space help enhance vehicle range and efficiency.

Continuous research and upgrades in lithium-ion chemistries, including lithium iron phosphate and nickel manganese cobalt, are making them safer and more affordable. As global EV adoption rises and infrastructure improves, lithium-ion batteries are expected to see steady demand, supported by large-scale production, government incentives, and strong manufacturer preference across regions.

Solid state battery, having significant growth over the forecast period, is expected to transform the electric vehicle battery market with improved safety, higher energy density, and longer lifespan. This advanced battery type replaces the liquid electrolyte found in conventional batteries with a solid material, reducing the risk of fire and leakage. Automakers and tech developers are investing in solid-state battery research to support future EV models that can travel longer distances on a single charge.

It also enables faster charging and can operate better in extreme temperatures. Though still in the development stage for mass use, solid-state batteries are gaining attention for next-generation electric vehicles. Their potential to reduce charging time and improve vehicle performance makes them a promising solution in the evolving EV battery ecosystem.

By Battery Form Analysis

Prismatic battery, leading in 2025 with a share of 45.7%, is expected to play a key role in driving the growth of the electric vehicle battery market due to its structured design and space efficiency. Its hard-shell casing offers better protection and stability, making it a preferred choice for automotive applications, especially in electric cars and buses. The rectangular shape allows easier stacking, resulting in higher packaging efficiency within battery packs.

This form supports higher energy density and is less prone to swelling compared to other types. With growing EV demand and the need for safer, more reliable energy storage, prismatic batteries are seeing increased adoption among global manufacturers. Their durability and ability to maintain performance under high pressure make them well-suited for long-term use in electric mobility, helping automakers meet performance and safety standards across regions.

Pouch battery, having significant growth over the forecast period, is gaining strong traction in the electric vehicle battery market for its lightweight, flexible, and compact design. Unlike rigid battery forms, pouch cells offer more freedom in pack configuration, allowing manufacturers to maximize space and fit custom shapes. This makes them highly suitable for electric vehicles with limited interior space or unique design requirements.

Their high power output and ability to support fast charging add further appeal, especially in high-performance EVs. As EV technologies advance and automakers look for thinner, energy-dense solutions, pouch batteries are increasingly chosen for next-gen vehicle models. Their growing role in supporting both range and efficiency places them among the most adaptable and future-ready battery formats in the market.

By Propulsion Type Analysis

BEVs, leading in 2025 with a share of 67.1%, will continue to be the primary driver for the electric vehicle battery market due to their complete reliance on battery power for mobility. As battery technology improves and prices fall, more consumers and fleets are shifting to battery electric vehicles for their zero-emission benefits and lower running costs. These vehicles require larger battery packs, which naturally boosts demand for high-capacity and long-lasting batteries.

Governments across regions are supporting BEV adoption through subsidies, stricter emission norms, and expanded charging networks. Automakers are also launching a wide range of BEVs across price points and vehicle classes. With increasing range, faster charging, and better performance, BEVs are expected to hold their lead in pushing forward battery innovation and volume production throughout the forecast period.

PHEVs, having significant growth over the forecast period, are gaining attention in the electric vehicle battery market as a flexible solution for consumers transitioning from traditional fuel vehicles. These plug-in hybrid electric vehicles combine an internal combustion engine with a rechargeable battery, allowing users to switch between electric and fuel modes based on driving needs. This dual system reduces range anxiety while still offering lower emissions and fuel savings during short trips.

Many buyers see PHEVs as a practical option, especially in areas where charging infrastructure is still developing. With growing interest in partial electrification and emission reduction, automakers are expanding their PHEV offerings. Their battery packs, though smaller than those in BEVs, are advancing in energy density and charge efficiency, helping drive consistent growth in the EV battery market.

By Vehicle Type Analysis

Passenger vehicles, leading in 2025 with a share of 70.1%, are set to play a dominant role in the electric vehicle battery market due to the rising adoption of electric cars for personal use. Increasing consumer demand for clean, affordable, and efficient transportation is driving strong growth in EV sales globally. Many automakers are focusing on electrifying their passenger car lineups with advanced battery technologies to offer longer driving ranges, quicker charging, and lower ownership costs.

Supportive government policies, urban mobility needs, and expanding charging infrastructure are also encouraging buyers to shift from fuel-based to battery-powered vehicles. As battery efficiency improves and costs decline, passenger EVs are becoming more accessible to the mass market. The high production volume of these vehicles is directly boosting demand for lithium-ion batteries and related energy storage solutions, making this segment a key force in market expansion.

Commercial vehicles, having significant growth over the forecast period, are becoming increasingly important in the electric vehicle battery market as industries aim to cut fuel costs and emissions. Delivery vans, buses, and trucks powered by batteries are being introduced to meet urban logistics and public transportation needs. As cities implement stricter emission regulations, fleet operators are investing in electric commercial vehicles for last-mile delivery and heavy-duty transport.

These vehicles demand large and durable battery packs to support longer routes and heavier loads. Government incentives and pilot programs are helping speed up the transition in this sector. The rise of e-commerce and smart city initiatives is also contributing to the greater use of electric commercial vehicles. As a result, this segment is driving new requirements in battery capacity, durability, and charging speed, supporting wider adoption and growth across the battery supply chain.

By End User Analysis

Automotive OEMs, leading in 2025 with a share of 67.6%, will be a major force in driving the growth of the electric vehicle battery market through large-scale EV production and in-house battery integration. As global carmakers shift toward electrification, they are investing heavily in battery technologies, forming partnerships, and even building their own gigafactories to secure battery supply. These original equipment manufacturers are shaping battery design, performance, and cost by setting specific requirements for range, charging speed, and safety.

Many OEMs are focusing on vertical integration to control both vehicle and battery development, helping optimize production timelines and reduce dependency on third parties. With expanding EV portfolios, aggressive emission goals, and customer demand for clean mobility, automotive OEMs are expected to continue driving bulk demand for advanced battery systems and push innovation in battery chemistry, form factor, and energy efficiency throughout the forecast period.

Battery pack manufacturers, having significant growth over the forecast period, are becoming essential contributors to the electric vehicle battery market by assembling battery cells into usable modules and packs tailored for various EV models. These manufacturers work closely with OEMs and cell producers to ensure optimal battery performance, safety, and integration with vehicle systems.

Their role includes designing thermal management systems, safety features, and ensuring regulatory compliance. With rising EV production volumes, battery pack manufacturers are scaling up operations, automating assembly lines, and adopting new battery chemistries. Their expertise in customizing packs for different propulsion types and vehicle classes makes them vital to the EV supply chain. As the demand for flexible, high-performing battery solutions rises, these manufacturers are expected to support the growing complexity and diversification of electric vehicle platforms across global markets.

The Electric Vehicle Battery Market Report is segmented on the basis of the following:

By Battery Type

- Lithium-ion Battery

- Solid-State Battery

By Battery Form

- Prismatic

- Pouch

- Cylindrical

By Propulsion Type

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By End User

- Automotive OEMs

- Battery Pack Manufacturers

- Fleet Operators

Regional Analysis

Leading Region in the Electric Vehicle Battery Market

Asia Pacific, leading in 2025 with a share of 57.8%, plays the most dominant role in the growth of the electric vehicle battery market. The region is home to several of the world’s top battery manufacturers and is a major hub for EV production, especially in countries like China, South Korea, and Japan. Strong government support, rising demand for electric vehicles, and significant investments in battery research and manufacturing are driving market expansion. China, in particular, has built a robust ecosystem for battery development, supported by local supply chains and state-led initiatives.

South Korea and Japan contribute through innovation and partnerships in next-generation battery technologies. In addition to established players, emerging economies like India and Southeast Asian countries are also increasing their focus on EV adoption, Electric Vehicle Service Equipment, and local battery production. With growing infrastructure, favorable regulations, and continuous technological advancement, the Asia Pacific region is expected to maintain its leadership position and further accelerate the global electric vehicle battery market during 2025 and beyond.

Fastest Growing Region in the Electric Vehicle Battery Market

North America shows significant growth over the forecast period in the electric vehicle battery market due to strong policy support, rising electric vehicle adoption, and increasing investment in local battery production. The region is focusing on building domestic supply chains for critical battery materials like lithium and nickel to reduce import dependence.

Major automakers and battery manufacturers are partnering to open gigafactories, especially in the U.S., to meet growing demand. Government incentives, clean energy goals, and emissions regulations are pushing faster EV deployment. With growing interest in advanced battery technologies such as solid-state and lithium-iron-phosphate, North America is estimated to become a key player in the global electric vehicle battery ecosystem.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The electric vehicle battery market is highly competitive, with many global and regional players trying to gain a strong position. Companies are focusing on improving battery performance, reducing charging time, and lowering costs to stand out from others. There is also a race to develop new battery technologies like solid-state batteries, which are seen as the next big step.

Manufacturers are forming partnerships with carmakers and governments to build large-scale battery factories near major markets. At the same time, some are working to secure raw materials and build local supply chains. The competition is intense because the market is growing fast, and everyone wants to be a leader in providing safe, efficient, and long-lasting batteries for electric vehicles.

Some of the prominent players in the global Electric Vehicle Battery are:

- CATL

- LG Energy Solution

- Panasonic Holdings Corporation

- BYD Company Ltd.

- Samsung SDI Co., Ltd.

- SK On Co., Ltd.

- Toshiba Corporation

- AESC

- Northvolt AB

- CALB

- Farasis Energy

- SVOLT Energy Technology Co., Ltd.

- Gotion High-Tech Co., Ltd.

- EVE Energy Co., Ltd.

- BAK Battery Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Hitachi Astemo, Ltd.

- Leclanché SA

- Microvast Holdings, Inc.

- Romeo Power

- Other Key Players

Recent Developments

- In May 2025, General Motors plans to introduce a new lithium manganese-rich (LMR) prismatic battery technology by 2028 for its large electric SUVs and trucks, including models like the Chevrolet Silverado and Escalade IQ. These batteries use more abundant and affordable minerals like manganese, reducing reliance on costly cobalt and nickel. GM claims this will lower EV costs while delivering premium range and performance. The company aims to be first to market, ahead of competitors like Ford, which also targets LMR battery deployment before 2030.

- In April 2025, CATL, the world’s leading EV battery maker, introduced new technologies aimed at making electric vehicles more affordable, faster to charge, better in cold climates, and longer in range—bringing them closer to competing with petrol cars. The company launched its sodium-ion battery brand, Naxtra, which is set to enter mass production by December, along with the second-generation Shenxing fast-charging battery. Sodium, being abundant and low-cost, presents a safer battery option with reduced fire risk, offering a promising alternative to traditional materials.

- In March 2025, SK On and Nissan signed a battery supply agreement to support Nissan’s EV production in North America. From 2028 to 2033, SK On will provide nearly 100 GWh of high-nickel batteries, manufactured in the U.S., for Nissan’s next-generation EVs built at its Canton, Mississippi plant. This partnership highlights both companies’ focus on electrification and sustainability. The initiative will create 1,700 U.S. jobs and includes a $661 million investment by SK On, alongside Nissan’s $500 million investment in the

- In December 2024, Stellantis N.V. and Zeta Energy Corp. entered a joint development agreement to advance lithium-sulfur battery technology for electric vehicles. This collaboration aims to achieve a high gravimetric energy density while matching the volumetric energy density of current lithium-ion cells. The result could be lighter battery packs with similar energy output, offering greater range, better handling, and improved performance. Additionally, these batteries may charge up to 50% faster and are expected to cost less than half per kWh compared to today’s lithium-ion batteries.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 75.9 Bn |

| Forecast Value (2034) |

USD 489.1 Bn |

| CAGR (2025–2034) |

23.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 11.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Battery Type (Lithium-ion Battery and Solid-State Battery), By Battery Form (Prismatic, Pouch, and Cylindrical), By Propulsion Type (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Others), By Vehicle Type (Passenger Cars and Commercial Vehicles), By End User (Automotive OEMs, Battery Pack Manufacturers, and Fleet Operators) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

CATL, LG Energy Solution, Panasonic Holdings Corporation, BYD Company Ltd., Samsung SDI Co., Ltd., SK On Co., Ltd., Toshiba Corporation, AESC, Northvolt AB, CALB, Farasis Energy, SVOLT Energy Technology Co., Ltd., Gotion High-Tech Co., Ltd., EVE Energy Co., Ltd., BAK Battery Co., Ltd., Murata Manufacturing Co., Ltd., Hitachi Astemo, Ltd., Leclanché SA, Microvast Holdings, Inc., Romeo Power, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Electric Vehicle Battery Market size is expected to reach a value of USD 75.9 billion in 2025 and is expected to reach USD 489.1 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Electric Vehicle Battery Market, with a share of about 57.8% in 2025.

The Electric Vehicle Battery Market in the US is expected to reach USD 11.0 billion in 2025.

Some of the major key players in the Global Electric Vehicle Battery Market are CATL, LG Energy Solution, Panasonic Holdings Corp, and others

The market is growing at a CAGR of 23.0 percent over the forecasted period.