Market Overview

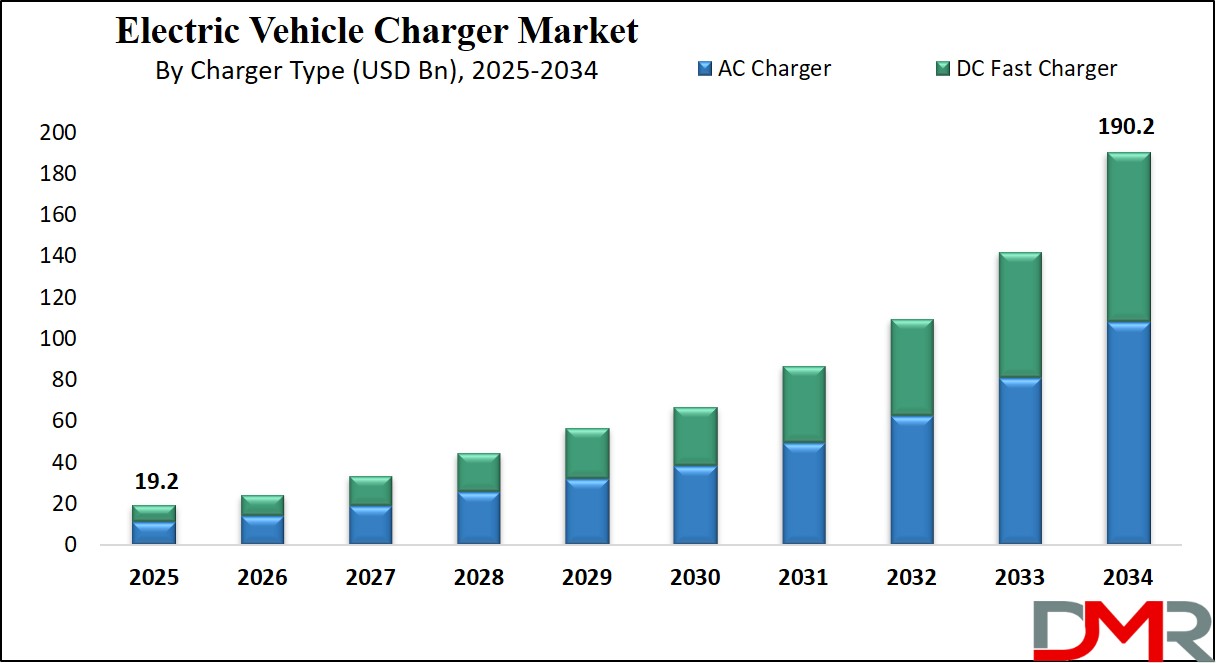

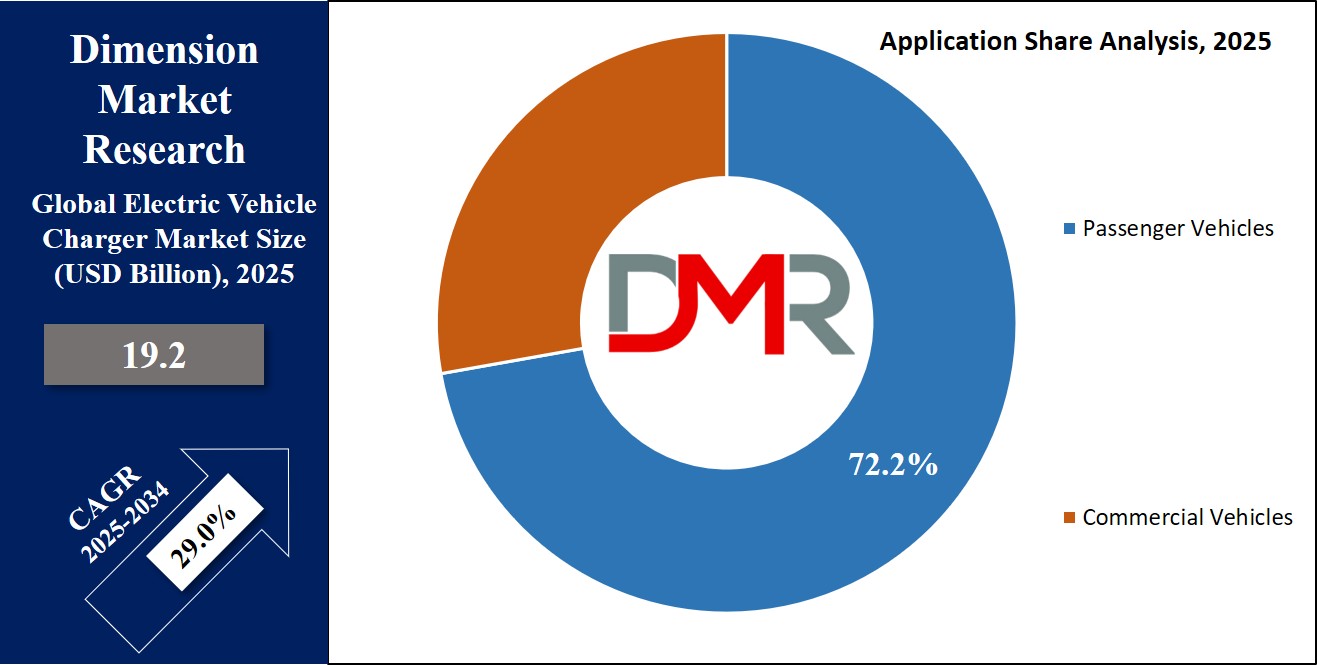

The Global Electric Vehicle Charger Market size is projected to reach USD 19.2 billion in 2025 and grow at a compound annual growth rate of 29.0% from there until 2034 to reach a value of USD 190.2 billion

Electric Vehicle (EV) chargers are devices used to recharge electric cars and other electric-powered vehicles. These chargers come in different types, such as slow chargers for home use and fast chargers for public charging stations. The main role of an EV charger is to transfer electricity from a power source to the battery of the vehicle, allowing it to run. With more people using electric vehicles today, the need for these chargers is increasing quickly.

The demand for EV chargers is growing because electric vehicles are becoming more popular around the world. Governments are encouraging people to switch to electric cars by offering benefits like lower taxes, subsidies, and stricter pollution rules. These actions help push people toward clean energy options. As a result, more charging stations are being built in cities, highways, shopping malls, and workplaces to support this transition.

In recent years, several changes have taken place in the EV charger industry. There has been a shift from traditional slow chargers to high-speed charging systems that can charge a car in less than an hour. Many companies are investing in smart charging systems that connect to apps and use data to find the best time and place to charge. Wireless charging and solar-powered stations are also being tested and introduced in some areas, showing how innovation is shaping the industry.

One important trend is the involvement of big automobile and energy companies in building their own charging networks. This allows them to offer a complete service to EV buyers. There is also a rise in partnerships between car makers and tech firms to improve the efficiency and reach of charging stations. These steps aim to reduce “range anxiety,” the fear that a vehicle will run out of charge without a nearby station.

The global push toward sustainability and lower emissions has made the EV charger market very active. Many countries are setting goals to stop selling petrol and diesel vehicles in the future. This makes building reliable and easy-to-access charging infrastructure a top priority. In addition, cities are working on building chargers in residential areas where people cannot charge at home easily, along with improving Electric Vehicle Battery technology..

In summary, electric vehicle chargers are becoming an essential part of modern transportation. The market is growing fast due to government support, new technology, and increasing use of electric vehicles. The focus now is on making charging faster, smarter, and available everywhere so that using an electric vehicle becomes simple and convenient for everyone.

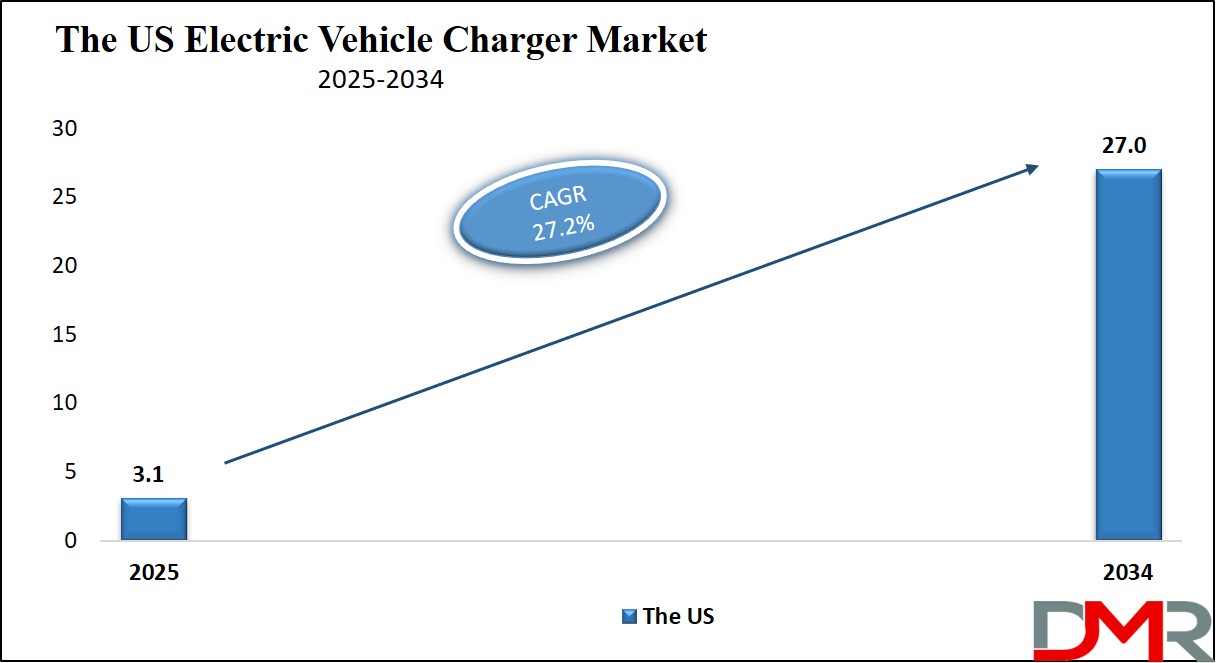

The US Electric Vehicle Charger Market

The US Electric Vehicle Charger Market size is projected to reach USD 3.1 billion in 2025 at a compound annual growth rate of 27.2 % over its forecast period.

The US plays a key role in shaping the global electric vehicle charger market through strong policy support, major investments, and technological innovation. The government is actively promoting EV adoption by funding nationwide charging networks and offering tax credits for charger installation.

Public and private sectors in the US are working together to expand both urban and highway charging infrastructure. The US is also home to many leading companies that are developing advanced fast-charging and smart-charging technologies. With a growing number of EVs on the road, the US is focusing on building a reliable, convenient, and accessible charging ecosystem. Its efforts are influencing global standards and driving market growth, especially through innovation and sustainability-focused solutions.

Europe Electric Vehicle Charger Market

Europe Electric Vehicle Charger Market size is projected to reach USD 5.8 billion in 2025 at a compound annual growth rate of 26.9% over its forecast period.

Europe holds a leading position in the electric vehicle charger market due to its strong environmental policies, early EV adoption, and coordinated regional strategies. The European Union has set ambitious climate goals, pushing countries to build dense and reliable charging networks across member states.

Governments across Europe offer incentives for both private and public charger installations, supporting fast and ultra-fast charging infrastructure. The region also encourages smart grid integration and cross-border interoperability, ensuring seamless EV travel. European companies are heavily involved in developing advanced charging solutions, such as vehicle-to-grid systems and renewable-powered chargers. With a focus on green energy and digital innovation, Europe continues to drive global progress in charging infrastructure and supports a rapid shift toward electric mobility.

Japan Electric Vehicle Charger Market

Japan Electric Vehicle Charger Market size is projected to reach USD 1.5 billion in 2025 at a compound annual growth rate of 30.7% over its forecast period.

Japan plays a distinctive role in the EV charger market, with a legacy in charging standards and a growing push for infrastructure expansion. It pioneered fast-charging technology through the CHAdeMO standard, widely deployed since 2009 and still common domestically.

The government supports this ecosystem via subsidies tied to CHAdeMO, though moves are underway to include additional standards in trade discussions. Japan’s large automakers are now collaborating such as on the Nippon Charge Service network and joint efforts on charging infrastructure software strengthening the national rollout. While EV adoption lags behind hybrids, public fast-charging stations remain convenient even in rural areas. With robust R&D, hybrid–EV transition policies, and evolving standards, Japan is shaping both its domestic system and contributing to global charging norms.

Electric Vehicle Charger Market: Key Takeaways

- Market Growth: The Electric Vehicle Charger Market size is expected to grow by USD 166.0 billion, at a CAGR of 3.9%, during the forecasted period of 2026 to 2034.

- By Charger Type: TheAC Charger segment is anticipated to get the majority share of the Electric Vehicle Charger Market in 2025.

- By Application: The passenger vehicles segment is expected to get the largest revenue share in 2025 in the Electric Vehicle Charger Market.

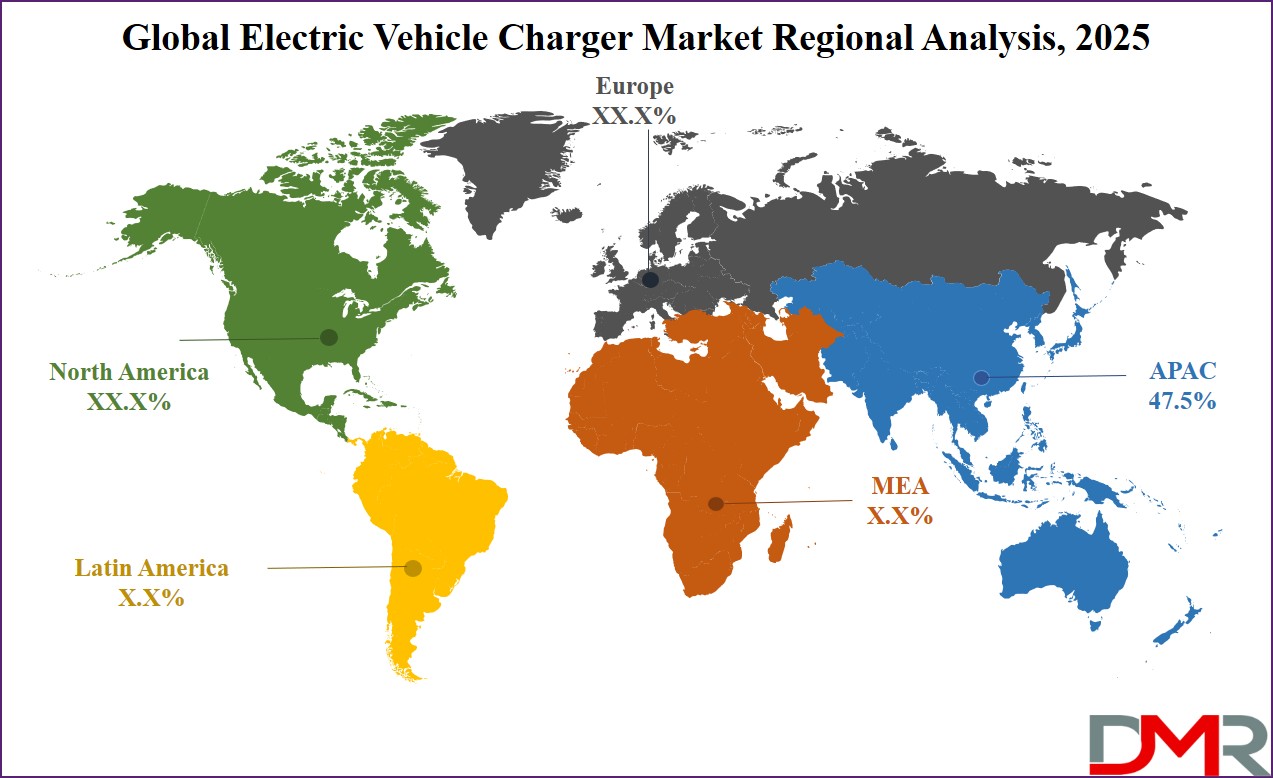

- Regional Insight: Asia Pacific is expected to hold a 47.5% share of revenue in the Global Electric Vehicle Charger Market in 2025.

- Use Cases: Some of the use cases of Electric Vehicle Charger include home charging, workplace charging, and more.

Electric Vehicle Charger Market: Use Cases

Stats & Facts

-

According to ACEA, battery-electric car registrations fell by 10.2% in December 2024, mainly due to sharp declines in Germany and France, which led to a 5.9% decrease in total 2024 BEV market volume compared to 2023, with the full-year market share settling at 13.6%.

- As per EVBoosters, China recorded a massive 1.3 million EV sales in December 2024 alone, ending the year with 11 million units sold—a 40% year-over-year increase—driven by strong support programs, a trade-in scheme, and the continued dominance of domestic brands.

- AUTOVISTA reports that LG Energy Solution produced 108 GWh of battery cells in 2024, showing only a 1.8% increase over 2023, which caused a drop in market share by 2.4 percentage points to 12.4%, reflecting growing pressure from other cell manufacturers.

- ACEA noted that plug-in hybrid car registrations rose by 4.9% in December 2024 due to high growth in France and Germany, although the total yearly volumes still fell by 6.8% compared to 2023, holding steady at 8.3% market share.

- EVBoosters highlighted that the UK overtook Germany in BEV sales in 2024, thanks to the enforcement of the UK Zero Emission Vehicle (ZEV) mandate, even as the overall European EV market shrank by 5.9% for the year due to subsidy cuts and other shifts.

- In a strategic move reported by AUTOVISTA, LG Energy Solution and GM announced plans in December 2024 to co-develop prismatic battery cells, aiming to make LG the first global battery firm to offer all three formats: pouch, cylindrical, and prismatic.

- According to ACEA, hybrid-electric car registrations surged by 33.1% in December 2024, increasing their market share to 33.6%, overtaking petrol-powered cars for the fourth month in a row and showing strong consumer interest in non-plug alternatives.

- As per EVBoosters, the EV market in the United States and Canada grew by 9% in 2024, supported by the $7,500 federal EV tax credit and emission standards from the Environmental Protection Agency, though upcoming policy changes may affect future momentum.

- AUTOVISTA stated that BYD introduced its ‘Super e-Platform’ in late 2024, claiming the technology can deliver 400 km of range in just five minutes, with charging capacity expected to reach speeds of up to 1,000KW—setting a new benchmark in battery innovation.

- EVBoosters noted that outside major markets, EV adoption rose by 26.4% in December 2024 across emerging regions such as Asia-Pacific, Latin America, and Africa, where localized incentives and infrastructure projects are helping drive the transition to electric mobility.

- According to EVBoosters, despite Europe’s mixed performance in 2024, the December sales figure of 310,000 units marked a year-end stabilization with just a slight 0.7% increase over the previous year, reflecting both market resilience and adaptation to policy changes.

- AUTOVISTA added that since 2014, LG Energy Solution has built a total battery cell production capacity of 436.7 GWh, placing it second in the all-time global output ranking—just behind the top producer and slightly ahead of BYD.

Market Dynamic

Driving Factors in the Electric Vehicle Charger Market

Government Policies and Incentives

One of the biggest growth drivers for the electric vehicle charger market is strong government support through policies and financial incentives. Many countries are offering subsidies for installing EV chargers, both for public and private use. In addition, strict regulations on vehicle emissions are pushing automakers and consumers toward electric alternatives.

Governments are also investing in nationwide charging infrastructure as part of their clean energy goals. These actions are creating a favorable environment for rapid market expansion. Public funding programs, tax benefits, and grants for charger installation are helping reduce costs and speed up deployment. As more countries commit to phasing out petrol and diesel vehicles, the demand for accessible and widespread charging networks continues to grow rapidly.

Rising Electric Vehicle Adoption and Technology Innovation

The increasing number of electric vehicles on the road is directly driving demand for more charging stations. As consumers switch from fuel-powered to electric vehicles, they need reliable and fast charging options at home, work, and on the go. This shift is encouraging companies to invest in building charging networks with smarter and quicker solutions.

Innovations like ultra-fast chargers, wireless charging, and app-based charger location services are making the experience easier and more appealing for users. In addition, battery technologies are improving, allowing for faster charging and longer ranges, which further increases the usefulness of advanced chargers. The combination of growing EV sales and constant technological progress is creating strong momentum in the charger market.

Restraints in the Electric Vehicle Charger Market

High Installation and Infrastructure Costs

One major restraint in the electric vehicle charger market is the high cost of installation, especially for fast-charging stations. Setting up these stations requires expensive equipment, strong electrical infrastructure, and sometimes upgrades to the local power grid. For rural or remote areas, the cost is even higher due to limited grid access.

Businesses and property owners may hesitate to invest without government support or clear return on investment. Even for home users, installing Level 2 chargers may involve electrical panel upgrades and professional installation. These financial barriers slow down the pace of charger deployment and limit accessibility. Until costs come down or incentives increase, expansion in some regions may remain slow.

Limited Grid Capacity and Energy Demand Issues

Another challenge is the pressure that EV chargers place on local power grids, especially when many vehicles charge at the same time. Fast chargers consume large amounts of electricity in a short period, which can strain the energy system during peak hours. In areas with outdated or weak grid infrastructure, this may cause power outages or require costly upgrades.

Utilities and planners must carefully manage load distribution to prevent instability. Without smart charging solutions or energy storage integration, the grid may not be ready for widespread EV adoption. These limitations create concerns about long-term scalability and reliability of the charging network.

Opportunities in the Electric Vehicle Charger Market

Expansion into Emerging Markets

A major opportunity for the electric vehicle charger market lies in expanding into emerging markets where EV adoption is just beginning. Countries in Asia, Africa, and Latin America are starting to embrace electric mobility due to growing environmental concerns and rising fuel costs. These regions often lack proper charging infrastructure, creating a large gap that companies can fill. By entering early, charger providers can establish strong market positions and long-term partnerships.

Governments in these regions are also introducing policies to support clean transportation, including charger installations. Affordable charging solutions tailored for local needs can drive quick adoption. As urbanization and economic growth continue, the demand for sustainable transport and charging networks will increase significantly.

Integration with Renewable Energy and Smart Grids

The growing focus on sustainability presents a key opportunity to integrate EV chargers with renewable energy sources like solar and wind. This helps reduce the carbon footprint of electric vehicles even further and supports cleaner charging. Solar-powered charging stations are gaining attention in sunny regions and can operate off-grid, reducing dependency on traditional electricity.

Additionally, pairing chargers with energy storage systems and smart grids allows for better energy use and load balancing. This opens up possibilities for bidirectional charging, where EVs can send power back to the grid. Such smart energy solutions not only improve grid efficiency but also create new revenue models for users and providers.

Trends in the Electric Vehicle Charger Market

Ultra‑Fast and High‑Power Charging

One major trend is the rapid expansion of ultra‑fast charging stations that offer high-power output. These chargers are built to provide quick energy boosts, making long-distance travel more convenient. They reduce the waiting time for drivers, making EV journeys feel more like filling up at a gas station.

This trend is supported by investments from both public and private sectors to ensure coverage along highways and urban routes. As battery technology improves, vehicles are better able to accept these faster charges. Overall, ultra-fast charging is helping to reduce “range anxiety” and make electric driving more practical for everyone.

Smart, Connected, and Wireless Charging

The charger market is also embracing smarter systems that connect to apps and power grids. These smart chargers can shift the charge to off-peak hours, adjust speeds based on grid needs, and send alerts when maintenance is needed. They support newer standards that let a car plug in and start charging automatically without extra steps. Wireless charging is also gaining attention, letting users simply park over a pad to recharge. These trends aim to make charging easy, flexible, and integrated with renewable energy systems, helping both users and the grid to work more efficiently.

Research Scope and Analysis

By Charger Type Analysis

AC charger, leading in 2025 with a share of 56.9%, is expected to remain the most widely used charging type in the electric vehicle charger market due to its affordability, easy installation, and compatibility with home and workplace settings. Most electric vehicles support AC charging through onboard converters, making it suitable for daily use. Residential users prefer AC chargers for overnight charging, which fits naturally into their routines without requiring expensive upgrades.

The growth of electric vehicle ownership in urban areas and multi-dwelling units further supports the demand for AC chargers. As the EV market expands, especially in emerging economies, AC chargers continue to be a cost-effective solution for both private and semi-public spaces. With consistent advancements in charging technology and growing support from local authorities, AC chargers are expected to play a major role in building a widespread, accessible charging network that supports everyday mobility and electric vehicle adoption across the globe.

Fast charger, having significant growth over the forecast period, is gaining strong momentum in the electric vehicle charger market due to its ability to deliver quick energy boosts and reduce charging time. These chargers are mainly used along highways, commercial zones, and busy urban routes to support long-distance travel and high-usage fleets. Fast charging technology helps reduce range anxiety and makes electric vehicles more practical for users who need faster turnaround times.

As more electric vehicles support high-voltage charging, demand for fast chargers continues to rise. Governments and private companies are investing in expanding public fast charging networks to improve access and convenience. The segment is also seeing innovation in ultra-fast and high-power systems, enabling charging in under an hour. With increasing electric vehicle sales, especially in commercial and transit applications, fast chargers are expected to become a critical part of the charging infrastructure supporting modern electric mobility.

By Connector Type Analysis

CCS connector, leading in 2025 with a share of 37.7%, is expected to drive major growth in the electric vehicle charger market due to its flexibility and fast-charging capability. Used widely across Europe and North America, the Combined Charging System supports both AC and DC charging in one plug, making it highly convenient for users. Its growing compatibility with many electric vehicle models has helped it become a preferred standard among automakers. The expansion of public fast-charging infrastructure further boosts the demand for CCS connectors, especially on highways and in commercial areas.

As more EVs support higher power levels, CCS enables faster, efficient energy transfer, reducing charging time. The connector's role in supporting high-voltage DC charging also aligns well with the rising need for ultra-fast chargers. With ongoing standardization and growing global acceptance, CCS is set to remain a key connector type in the evolving EV charging ecosystem.

Type 2 connector, having significant growth over the forecast period, is gaining wide acceptance in the electric vehicle charger market due to its established presence in residential and public charging setups across Europe and other regions. Known for its reliability and safe design, Type 2 is the standard for AC charging and is commonly used in home, workplace, and semi-public charging stations.

Its compatibility with various EV brands and support for three-phase charging makes it suitable for both slow and faster AC applications. With growing EV adoption and a rising focus on accessible infrastructure, Type 2 connectors are becoming a go-to option for convenient everyday charging. Their use in smart charging solutions, integration with solar power, and ease of installation further strengthen their role. As governments push for more residential and city charging options, the Type 2 segment is positioned to see steady and meaningful growth globally.

By Charging Site Analysis

Residential charging, leading in 2025 with a share of 47.1%, will continue to be a major driver of growth in the electric vehicle charger market due to its convenience and cost-effectiveness for everyday EV users. Home-based charging allows vehicle owners to plug in overnight without needing to visit public stations, making it the most practical and preferred option. As electric vehicle adoption rises among individual consumers, especially in urban and suburban areas, the demand for residential AC chargers is also growing.

Government subsidies and incentives for home charger installation are further encouraging adoption. In multi-unit buildings, shared residential charging systems are being installed to support the needs of multiple EV owners. With more people switching to electric mobility and spending more time at home, residential charging will remain a core part of the charging network, offering flexibility, lower charging costs, and ease of use for daily commuting and local travel.

Highway charging hub, having significant growth over the forecast period, is becoming increasingly important in the electric vehicle charger market as it supports long-distance travel and fast-charging needs. These hubs are strategically built along major routes to reduce range anxiety and enable EV drivers to recharge quickly during long trips. As fast-charging technology continues to advance, highway stations are being equipped with high-power chargers that minimize wait times and improve convenience.

Their development is often supported by public-private partnerships aiming to build an interconnected national charging network. In addition, highway charging hubs are designed to serve not only private vehicles but also commercial fleets, buses, and logistics vehicles. As more people choose electric vehicles for intercity travel and road transport systems shift toward cleaner options, the highway charging segment is set to expand rapidly and play a key role in building a reliable, fast, and wide-reaching EV infrastructure.

By Application Analysis

Passenger vehicle segment, leading in 2025 with a share of 72.2%, will continue to drive the expansion of the electric vehicle charger market due to rising consumer adoption and strong support for personal electric mobility. With more individuals choosing electric cars for daily commuting, there is a growing demand for accessible and convenient charging solutions at home, work, and in public spaces. Automakers are launching a wider range of affordable and efficient electric passenger vehicles, making EVs more attractive to mass-market users.

Governments across various regions are also offering incentives, tax benefits, and infrastructure development to support the shift toward cleaner transportation. The increase in city-based charging points and integration of smart charging systems further boosts the practicality of passenger EVs. As this segment grows, it will continue to shape the need for both AC and DC charging infrastructure, contributing heavily to the overall development of the EV charging ecosystem.

Commercial vehicle segment, having significant growth over the forecast period, is emerging as a powerful force in the electric vehicle charger market as logistics companies, public transport fleets, and delivery services move toward electrification. These vehicles operate on fixed routes and require reliable, fast, and high-capacity charging options to maintain operational efficiency. The rise in e-commerce and urban freight delivery is pushing demand for dedicated commercial EV chargers in fleet depots and urban centers.

Many governments are encouraging the use of electric buses and trucks by providing infrastructure funding and regulatory support. Fast-charging technology and smart energy management are becoming essential for keeping commercial fleets running smoothly. As businesses focus on reducing carbon emissions and fuel costs, the commercial vehicle segment is set to expand its presence in the EV charging space, helping to build more robust and large-scale charging networks suited for heavy-duty and high-usage vehicles.

By End User Analysis

Private end user segment, leading in 2025 with a share of 54.1%, will continue to be a major contributor to the growth of the electric vehicle charger market as more individuals invest in electric cars for personal use. The growing availability of home charging solutions makes it easier and more convenient for people to power their vehicles overnight. Governments are also offering subsidies and tax incentives that reduce the cost of installing home chargers, making EV ownership more appealing.

As cities become more EV-friendly, the demand for residential and semi-private charging points in apartments and gated communities is rising. With lifestyle shifts focusing on sustainability and energy savings, private users are embracing smart charging features and renewable integration. This widespread individual adoption is helping to build a stable foundation for charging infrastructure and is encouraging continued investment in user-friendly, accessible EV charging options across regions.

Fleet operator end user segment, having significant growth over the forecast period, is quickly becoming a strong driver in the electric vehicle charger market as businesses transition their vehicle fleets to electric. Delivery companies, ride-hailing services, and public transportation providers are increasingly adopting electric vehicles to reduce fuel costs and meet emission goals. These operators need reliable, fast, and scalable charging infrastructure to keep their fleets moving efficiently.

Centralized charging stations, depot-based systems, and scheduled charging management are all essential for high-utilization fleet models. Many fleet operators are working with energy providers and technology partners to install tailored charging setups that meet their operational needs. This growing demand for commercial-grade solutions is driving innovation in load management, energy storage, and grid optimization. As fleet electrification expands, especially in urban logistics and mobility services, this segment is playing a key role in building high-performance EV charging networks.

The Electric Vehicle Charger Market Report is segmented on the basis of the following:

By Charge Type

- AC Charger

- DC Fast Charger

By Connector Type

By Charging Site

- Residential

- Public Charging Stations

- Highway Charging Hubs

By Application

- Passenger Vehicles

- Commercial Vehicles

By End User

- Private

- Fleet Operators

- Government Bodies

Regional Analysis

Leading Region in the Electric Vehicle Charger Market

Asia Pacific, leading the electric vehicle charger market in 2025 with a share of 47.5%, continues to play a major role in shaping global industry growth. The region is witnessing strong support from governments promoting electric mobility, along with rapid urbanization and rising environmental awareness. Countries like China, Japan, South Korea, and India are heavily investing in public and private EV charging infrastructure to meet the growing number of electric vehicles on the road.

Many regional players are focusing on advanced technologies such as ultra-fast charging, wireless systems, and smart grid integration. In addition, favorable policies, manufacturing strength, and the presence of key electric vehicle manufacturers contribute to the growing demand for reliable and efficient EV charging solutions. The rising adoption of electric public transport and fleet vehicles further boosts market expansion. With continuous innovation, strong local production capabilities, and supportive regulations, the Asia Pacific region remains central to the global development of electric vehicle charger infrastructure.

Fastest Growing Region in the Electric Vehicle Charger Market

Europe is showing significant growth over the forecast period in the electric vehicle charger market due to strong government policies, rising demand for zero-emission transport, and strict carbon emission regulations. The region supports electric vehicle adoption through incentives and funding for public charging infrastructure. Countries across Europe are expanding fast charging networks along highways, cities, and residential zones to meet the rising number of EVs.

Leading automakers and energy firms in the region are working together on smart charging solutions, renewable energy integration, and cross-border interoperability. This regional push is estimated to further boost electric mobility, improve access to charging stations, and strengthen Europe’s position in sustainable transportation development.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The electric vehicle charger market is highly competitive, with many players working to expand their presence as demand for EVs grows. Companies are focusing on developing fast and smart charging solutions to attract more users. Some are building large charging networks, while others are creating home charging systems with advanced features. New players are also entering the market, offering fresh ideas and technologies.

There is a strong push toward partnerships between energy firms, automakers, and tech providers to improve coverage and service quality. The race to offer affordable, reliable, and user-friendly charging solutions is driving rapid innovation. As the market grows, competition is expected to become even more intense, with a focus on speed, convenience, and clean energy integration.

Some of the prominent players in the global Electric Vehicle Charger are:

- Tesla, Inc.

- ABB Ltd.

- ChargePoint Holdings, Inc.

- Schneider Electric SE

- Siemens AG

- EVBox Group

- Wallbox N.V.

- BYD Company Ltd.

- Webasto Group

- Blink Charging Co.

- Delta Electronics, Inc.

- Tritium DCFC Limited

- BP Pulse

- Shell Recharge Solutions

- Volta Inc.

- Eaton Corporation plc

- Leviton Manufacturing Co., Inc.

- ENEL X

- Pod Point

- Alfen N.V.

- Other Key Players

Recent Developments

- In June 2025, Kitu Systems, a leading clean energy solutions provider, and EV charger maker FractalEV have successfully integrated Kitu’s Expedition Charge Management System (CMS) with FractalEV’s charging hardware. This collaboration, validated through extensive joint testing, delivers a fully interoperable, end-to-end electric vehicle (EV) charging solution. Built on recognized industry standards, the system enables smart and adaptable charging operations. The partnership highlights a shared commitment to advancing efficient EV infrastructure with reliable technology for flexible energy management and seamless user experience.

- In May 2025, India has taken major steps to boost electric vehicle (EV) adoption, with over 45 lakh EVs already registered, as per government data. The Centre is now focused on expanding charging infrastructure and advancing technology. In a significant move, C-DAC (T) and VNIT Nagpur have developed an indigenous wireless charger that can charge up to 90% of an EV battery in around three hours. This technology has been transferred to an Indian company for commercial development and broader market use.

- In March 2025, BYD has unveiled its new “super e-platform,” capable of delivering peak charging speeds of 1,000 kW—enough to add 400 km of range in just five minutes. Initially available in the Han L sedan and Tang L SUV, this system charges twice as fast as Tesla’s latest superchargers. It requires 1000V architecture along with specially designed batteries, motors, and thermal systems. BYD aims to eliminate charging anxiety by making EV charging times comparable to traditional fuel refueling.

- In February 2025, Tata Motors has launched the Tata.ev Mega Charger network to offer high-speed electric vehicle charging across India. The network is being developed in collaboration with four charging point operators—Tata Power, Zeon, Charge Zone, and Statiq—with plans to set up 500 outlets within 12 months. Each site will offer a total output of 120kW, either through one four-gun charger or two 60kW units. While open to all EVs, Tata EVs will receive priority access and enjoy up to 25% lower tariffs.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.2 Bn |

| Forecast Value (2034) |

USD 190.2 Bn |

| CAGR (2025–2034) |

29.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Charge Type (AC Charger and DC Fast Charger), By Connector Type (CCS, CHAdeMO, Type 2, and Tesla), By Charging Site (Residential, Public Charging Stations, and Highway Charging Hubs), By Application (Passenger Vehicles and Commercial Vehicles), By End User (Private, Fleet Operators, and Government Bodies) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Tesla, Inc., ABB Ltd., ChargePoint Holdings, Inc., Schneider Electric SE, Siemens AG, EVBox Group, Wallbox N.V., BYD Company Ltd., Webasto Group, Blink Charging Co., Delta Electronics, Inc., Tritium DCFC Limited, BP Pulse, Shell Recharge Solutions, Volta Inc., Eaton Corporation plc, Leviton Manufacturing Co., Inc., ENEL X, Pod Point, Alfen N.V, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Electric Vehicle Charger Market size is expected to reach a value of USD 19.1 billion in 2025 and is expected to reach USD 190.2 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Electric Vehicle Charger Market, with a share of about 47.5% in 2025.

The Electric Vehicle Charger Market in the US is expected to reach USD 3.1 billion in 2025.

Some of the major key players in the Global Electric Vehicle Charger Market are Tesla, Inc., ABB Ltd., ChargePoint Holdings, Inc , and others

The market is growing at a CAGR of 29.0 percent over the forecasted period.