Sensors are technologically advanced electronic devices that are utilized in modern cars, as they are one of the essential parts of the electric vehicle, and can used to monitor the various parameters in the vehicles like coolant system, temperature, obstacles, faults, and alerting driver and signaling to the ECU (electronic control unit) to make informed decisions.

The Global Electric Vehicle Sensor Market is rapidly expanding with the increasing adoption of electric vehicles worldwide. As consumers move toward environmentally sustainable transportation methods, demand for advanced sensor technologies in EVs has skyrocketed; such sensors play a crucial role in optimizing vehicle performance, safety, and energy efficiency.

Recent events have demonstrated major advances in electric vehicle sensor technology, with companies employing LiDAR, radar, and cameras as primary innovations to enhance autonomous driving and driver assistance systems. Such technologies are becoming essential components for integrating semi-autonomous features in EVs.

Sensor technologies for battery management systems have seen considerable gains on the market, providing optimal energy use and longer battery life. With increasingly sophisticated electric vehicles being produced, demand for precise and reliable sensors to monitor various vehicle functions will only continue to increase, creating opportunities in sensor technologies.

Key players in the market are exploring collaborations and acquisitions as a means of expanding their sensor portfolios. Partnerships with automakers and tech companies should enable innovation in sensor solutions designed to address both safety and performance challenges present in electric vehicles, thus shaping its future development.

As per Statista reports that modern cars contain over 100 sensors which generate huge amounts of data, measuring location, performance, physical parameters and driving behavior multiple times per second. McKinsey estimates connected cars produce 25 gigabytes per hour--equivalent to nearly 30 hours of HD video or one month of music streaming!

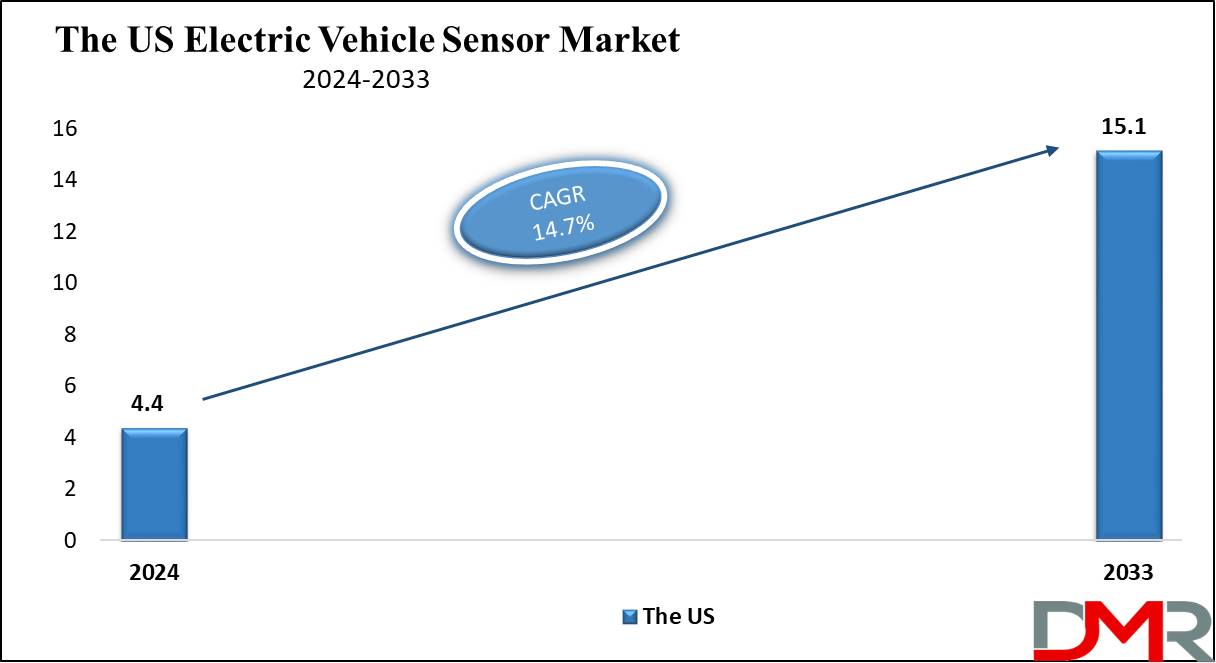

The US Electric Vehicle Sensor Market

The US Electric Vehicle Sensor Market is projected to reach

USD 4.4 billion in 2024 at a compound annual growth rate of

14.7% over its forecast period.

The electric vehicle sensor market in the US is driven by the increasing adoption of electric vehicles, development in technology, and supportive government policies. Also, the demand for specialized sensors in safety, battery management, and autonomous driving features is expanding, creating the potential for innovation and market expansion. Investment in infrastructure and technology further supports growth.

Further, drivers for the market in the US include growing demand for electric vehicles, technological development, and supportive government policies. However, the high sensor costs and supply chain challenges the market growth, along with the need for current innovation to meet safety and performance standards can be a barrier, impacting growth and adoption.

Key Takeaways

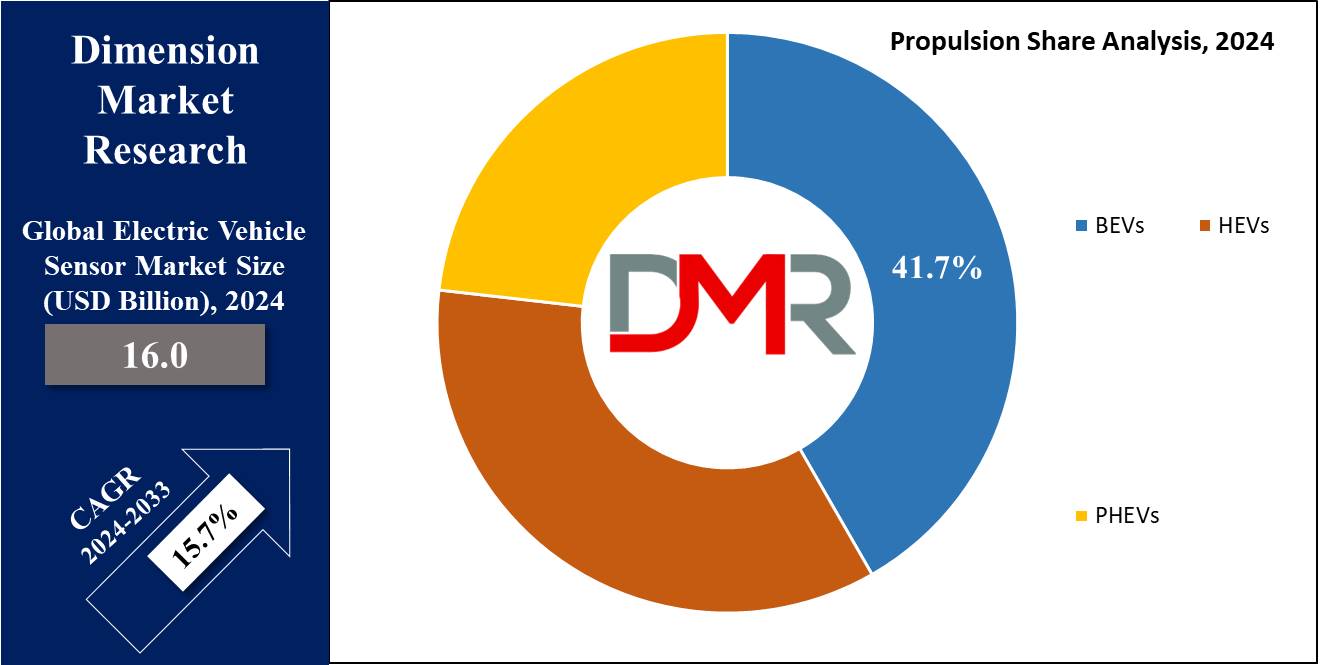

- Market Growth: The Electric Vehicle Sensor Market size is expected to grow by 41.1 billion, at a CAGR of 15.7% during the forecasted period of 2025 to 2033.

- By Product: The pressure sensors are expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Propulsion: The BEVs segment is expected to lead the Electric Vehicle Sensor market in 2024.

- By Sales Channel: The OEM segment is expected to get the largest revenue share in 2024 in the Electric Vehicle Sensor market.

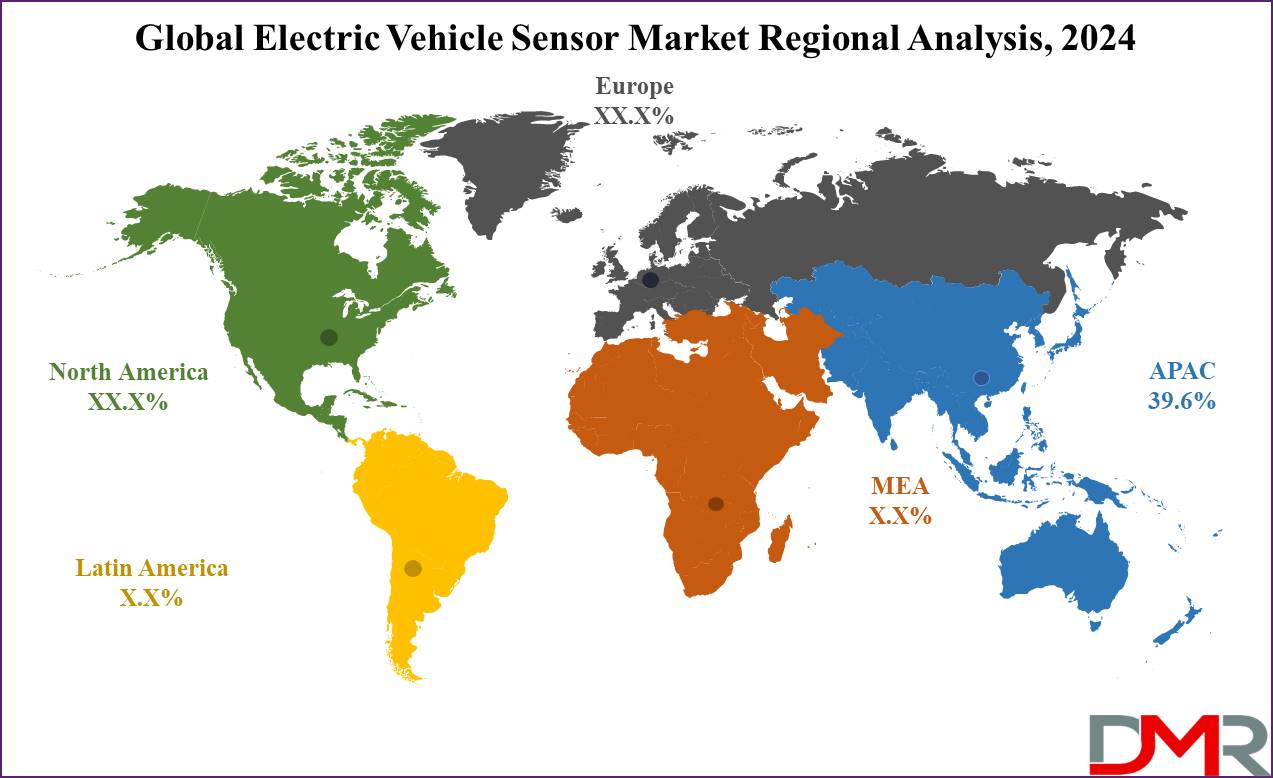

- Regional Insight: Asia Pacific is expected to hold a 39.6% share of revenue in the Global Electric Vehicle Sensor Market in 2024.

- Use Cases: Some of the use cases of Electric Vehicle Sensors include energy efficiency, autonomous driving, and more.

Use Cases

- Battery Management: Sensors monitor the state of charge, temperature, and complete health of the EV battery, ensuring efficient energy use, preventing overcharging or deep discharging, and extending battery life.

- Autonomous Driving: Sensors like LiDAR, radar, and cameras allow advanced driver-assistance systems (ADAS) by providing real-time data for obstacle detection, lane-keeping, and adaptive cruise control, contributing to autonomous driving capabilities.

- Energy Efficiency: Sensors optimize energy consumption by monitoring and adjusting the performance of critical systems like the motor, HVAC, and regenerative braking, thereby increasing range & reducing energy waste.

- Safety and Diagnostics: Sensors constantly monitor the vehicle's key systems (e.g., tire pressure, braking, and motor performance) to detect potential issues early, trigger alerts, and support predictive maintenance, improving safety and reliability.

Market Dynamic

Driving Factors

Increasing EV Adoption

The global transformation towards electric vehicles, driven by environmental regulations & consumer demand for sustainable transportation, is driving the need for advanced sensors to improve battery management, safety, and autonomous driving features.

Technological Advancements

Innovations in sensor technology, like miniaturization and enhanced accuracy, are driving their integration into EVs, supporting complex systems like ADAS & energy management, and boosting complete market growth.

Restraints

Supply Chain Constraints

The availability of vital components and raw materials for sensor manufacturing is often subject to supply chain disruptions, which can slow production and increase costs, impacting the market's overall growth.

Integration Complexity

Integrating advanced sensors into present EV architectures can be technically complex and time-consuming, demanding significant engineering efforts and potentially delaying the development & deployment of new models.

Opportunities

Growing Demand for ADAS

The higher adoption of Advanced Driver Assistance Systems (ADAS) in electric vehicles drives the need for sensors like LiDAR, radar, & cameras, creating opportunities for sensor manufacturers to innovate & expand.

Expansion in Battery Management Systems

With the growth of electric vehicles, the demand for effective battery management systems (BMS) is rising. Sensors that monitor battery health, temperature, and performance provide major opportunities in this expanding market.

Trends

Integration of AI and IoT

The integration of Artificial Intelligence (AI) & the Internet of Things (IoT) in electric vehicles is allowing smarter sensor systems, improving real-time data processing, predictive maintenance, and complete vehicle performance.

Miniaturization of Sensors

There is a trend toward the miniaturization of sensors, allowing for more compact, efficient designs in electric vehicles, which support lighter vehicles with better energy efficiency and advanced functionalities.

Research Scope and Analysis

By Product

The electric vehicle sensor market is segmented by product type into pressure sensors, temperature sensors, motion sensors, speed sensors, and gas sensors. Among these, pressure sensors are highly used in the automotive industry due to their critical role in ensuring passenger safety, particularly in systems like advanced driver assistance systems (ADAS), tire pressure monitoring (TPMS), and manifold absolute pressure sensors (MAPS), by which it is expected to lead the electric sensor market in 2024.

Further, the growing demand for electric vehicle sensors in both hybrid and fully electric vehicles is driven by their broad use in navigation systems (GPS) and ADAS. In addition, the rising adoption of custom-designed electronic devices is expected to further enhance market opportunities. As electric vehicles become more advanced, the need for these sensors is likely to grow, supporting market expansion and innovation in sensor technology.

By Propulsion

The battery electric vehicles (BEVs) segment is set to dominate the electric vehicle sensor market in 2024. BEVs, commonly known as electric vehicles, operate only on electricity, with fully rechargeable batteries providing all the power needed for vehicle operation. As consumers highly favor sustainable and eco-friendly mobility options, the need for BEVs continues to grow, which is driving the expansion of the BEV market, creating a higher demand for sensors that play a major role in monitoring vehicle safety, along with managing pressure, temperature, and other essential functions.

In addition, the rise in BEV adoption & the expansion of manufacturing facilities for electric vehicles are key factors contributing to the expansion of the electric vehicle sensor market. As BEVs become more prevalent, the demand for advanced sensors to ensure efficient and safe vehicle operation is expected to increase, further driving market expansion.

By Sales Channel

Original Equipment Manufacturers (OEMs) play an important role as a sales channel in the electric vehicle sensor market and are expected to drive the growth of the market in 2024. OEMs are responsible for incorporating sensors directly into electric vehicles during the manufacturing process, so that vehicles are equipped with the latest sensor technologies for optimal performance, safety, and efficiency.

As the need for electric vehicles rises, OEMs are highly focusing on sourcing high-quality sensors to meet the rising consumer expectations for advanced driver assistance systems (ADAS), battery management, and other important vehicle functions, which not only enhances the vehicle’s capabilities but also drives innovation in sensor technology, as OEMs collaborate with sensor manufacturers to create customized solutions that meet specific vehicle requirements. As a result, OEMs are a key driver of growth in the electric vehicle sensor market, contributing to the broad adoption of advanced sensor systems in the automotive industry.

The Electric Vehicle Sensor Market Report is segmented on the basis of the following

By Product

- Temperature Sensors

- Motion Sensors

- Pressure Sensors

- Gas Sensors

- Speed Sensors

By Propulsion

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

By Sales Channel

Regional Analysis

Asia Pacific is expected to lead the electric vehicle sensor market in 2024, holding a majority share of 39.6%, which is driven by the higher demand for electric vehicles in countries like India, China, and Japan. Issues regarding environmental pollution and strict regulations on emission standards are driving the adoption of electric vehicles. Further, the increase in population in the region is boosting the automotive industry, and expanding the growth of the electric vehicle market. The presence of big automobile manufacturers and major investments from foreign companies in the regional automotive sector are also contributing to the growth of the electric vehicle sensor market.

Moreover, Europe is also expected to see major growth in the electric vehicle sensor market during the forecast period, which is gaining momentum as consumer desires change and higher investments in automotive technology are being made. These investments are building the integration of AI, sensors, IoT, and other technologies into electric vehicles, which is driving the growth of the electric vehicle sensor market in the region. Also, the growing focus on technological development and sustainable mobility solutions is improving the market’s prospects in Europe.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the electric vehicle sensor market the competitive landscape is characterized by rapid technological development and intense competition among manufacturers. Major players are aiming on innovation, integrating advanced technologies like AI and IoT, and developing high-performance sensors to meet growing market demands. Further, companies are also investing in strategic partnerships & expanding their product offerings to capture a larger market share. The increasing focus on safety, efficiency, and sustainability in electric vehicles drives current competition and innovation in this sector.

Some of the prominent players in the Global Electric Vehicle Sensor are:

- Continental AG

- NXP Semiconductors NV

- Valeo Group

- Robert Bosch GmbH

- Denso Corporation

- Renesas Electronic Corporation

- Panasonic

- Melexis

- Amphenol Advanced Sensors

- Venture Capital GmbH

- Other Key Players

Recent Developments

- In August 2024, China's electric vehicle (EV) giant BYD launched a new version of its Seal EV, the company's first model equipped with lidar sensors, as the 2025 version of Seal will sell for prices starting at about USD 24,515.41.

- In July 2024, Infineon Technologies AG and Swoboda announced a partnership to develop and promote advanced current sensor modules specifically created for automotive applications. The collaboration merges Infineon’s top-notch current sensor integrated circuits (ICs) with Swoboda’s specialized knowledge in sensor module development and commercialization, which cater to the fast-expanding market for sensing solutions in hybrid and electric vehicles.

- In April 2024, Xiaomi, a leading technology company, has taken a major step into the electric vehicle market by launching its first mass-produced electric vehicle, the Xiaomi SU7, in Beijing, which comes along with Hesai’s cutting-edge lidar technology, setting a new standard in intelligent driving capabilities.

- In January 2024, Hyundai Mobis launched the "MOBION" electric vehicle (EV), equipped with the next-generation 'e-Corner System' motion technology, for the first time at CES 2024, where people got the first-hand opportunity to experience MOBION moving in ways they may have never seen a vehicle move before, like lateral and diagonal motion, along with stationary pivot turns.

- In January 2023, Sony and Honda’s joint mobility venture released a new EV prototype called Afeela during Sony’s presentation at CES in Las Vegas, as the brand will appear on the joint venture’s first production electric car, set to go on sale in North America in 2026, also the car would use Sony’s experience with AI, entertainment, virtual reality, and augmented reality to present a unique EV.