Market Overview

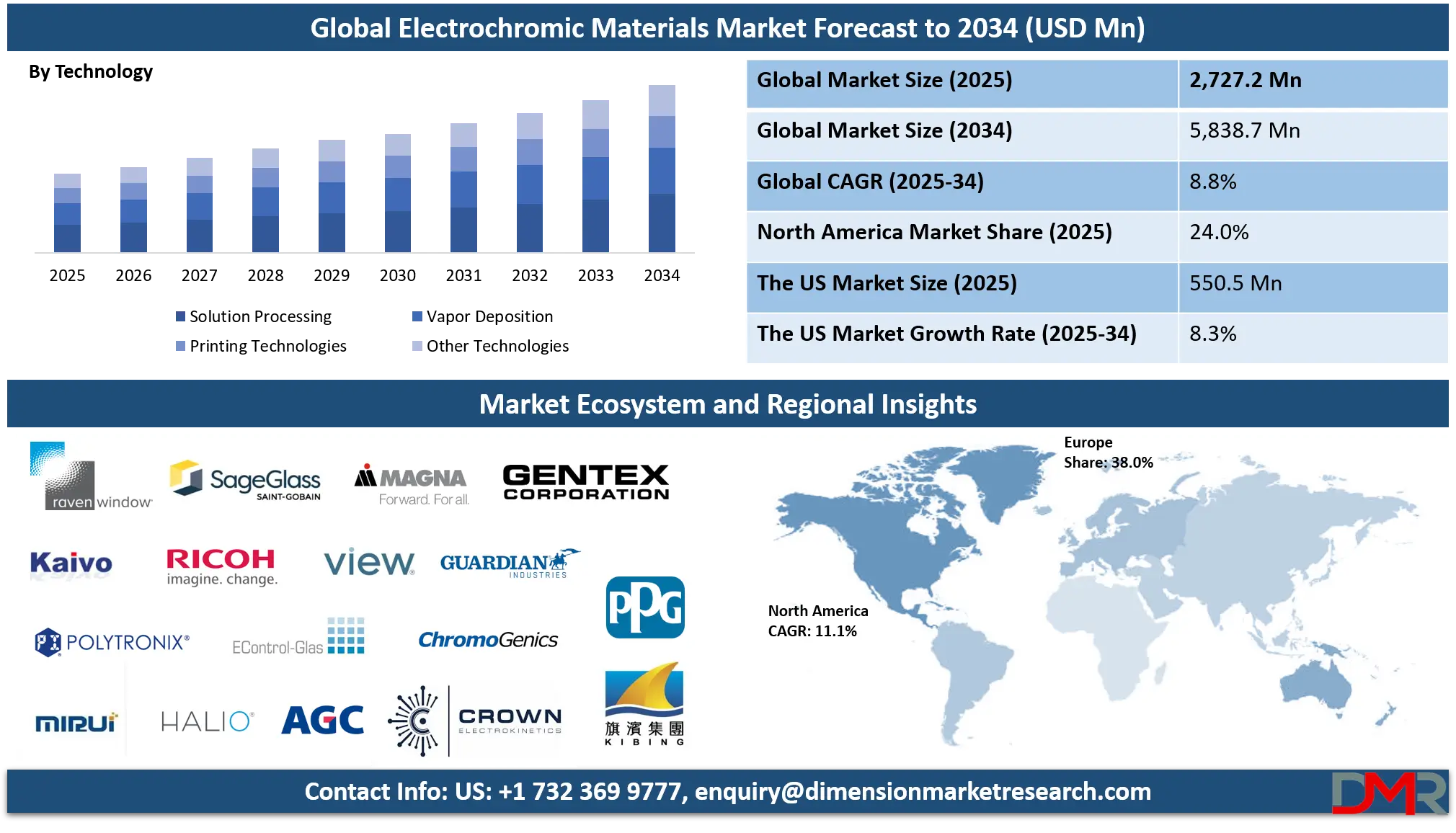

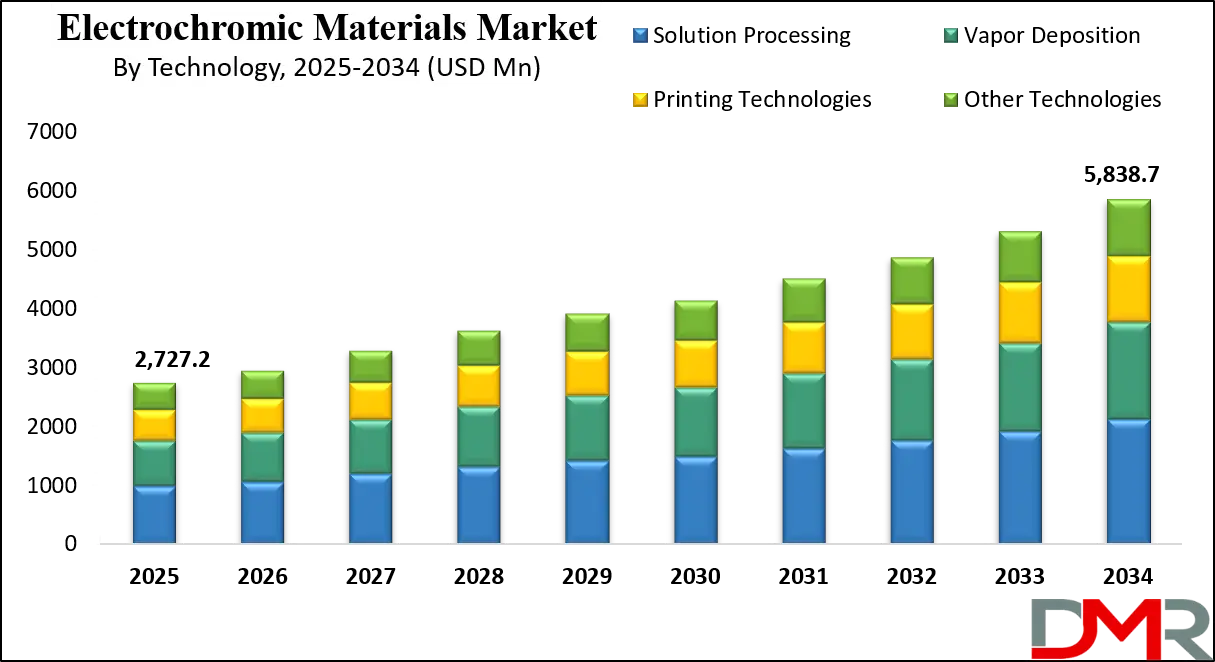

The Global Electrochromic Materials Market is projected to reach USD 2,727.2 million in 2025 and grow at a compound annual growth rate of 8.8% from there until 2034 to reach a value of USD 5,838.7 million.

The global electrochromic materials market is evolving rapidly as industries move toward adaptive glazing, dynamic mirrors, and responsive displays for both functional and aesthetic purposes. Electrochromic materials, including metal oxides, conducting polymers, viologens, and hybrid composites, are gaining recognition for their ability to modulate light, heat, and glare dynamically without mechanical shading devices.

A key global trend is the increasing focus on sustainable building design and energy efficiency, where electrochromic windows are being positioned as integral components of smart building envelopes. Opportunities arise in multifunctional applications, such as electrochromic batteries that combine storage with light modulation, as well as printed and flexible devices that allow integration into wearable electronics, e-paper displays, and consumer products.

The main restraints continue to be high installation costs, long payback periods compared with conventional low-emissivity glass, and durability challenges under extreme climates, though advancements in coatings and encapsulation are addressing these concerns. Growth prospects are significant as governments around the world set stringent building codes, net-zero commitments, and climate-neutral roadmaps.

Automotive manufacturers are adopting electrochromic materials for adaptive sunroofs, side windows, and mirrors to improve safety and comfort, while aerospace companies deploy them in cabin windows and glare-control systems to enhance passenger experience. With increasing urbanization, climate adaptation needs, and integration of electrochromics into building automation and smart mobility platforms, the global market is set to mature into a mainstream solution for energy-efficient construction and transportation, underpinned by advances in fabrication techniques such as sputtering, sol–gel processing, and inkjet printing.

The US Electrochromic Materials Market

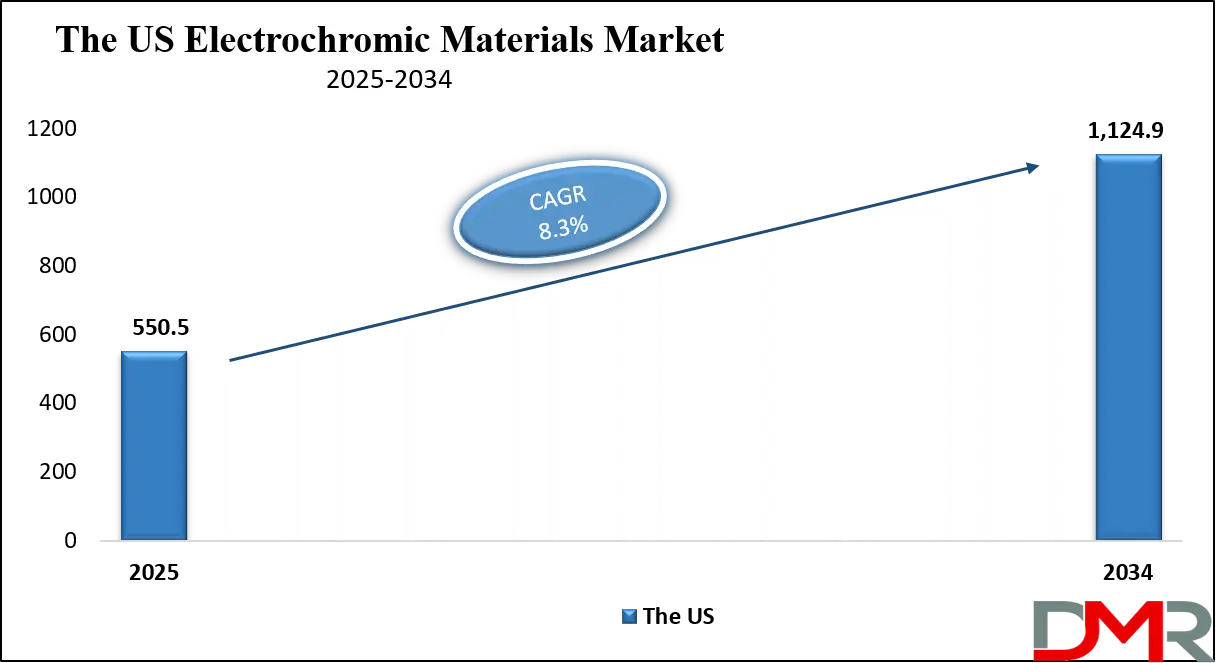

The US Electrochromic Materials Market is projected to reach USD 550.5 million in 2025 at a compound annual growth rate of 8.3% over its forecast period.

In the United States, the electrochromic materials market benefits from demographic concentration in large metropolitan areas and the nation’s extensive stock of energy-intensive commercial buildings. The U.S. Census Bureau reports that about 80% of the population resides in urban areas, driving demand for modernized glazing systems that address daylight control, energy efficiency, and occupant well-being.

Government bodies such as the Department of Energy emphasize the role of dynamic windows in reducing peak cooling loads, enhancing daylight harvesting, and improving overall grid-interactive building performance. Pilot projects under the General Services Administration’s Green Proving Ground program have demonstrated tangible reductions in HVAC energy demand and improved occupant comfort in federal facilities.

These results provide a roadmap for widespread adoption in schools, hospitals, and office towers. Demographically, growth in sunbelt cities, coupled with strong construction in residential and commercial sectors, creates favorable conditions for electrochromic window retrofits and integration into new builds. The automotive industry is also a major demand driver, with electrochromic mirrors and sunroofs enhancing both safety and passenger comfort. Federal policies supporting energy efficiency, green procurement, and net-zero building portfolios further accelerate market acceptance.

While initial cost remains a restraint compared with conventional glazing, incentives for energy-efficient retrofits, utility rebate programs, and increasing awareness of lifecycle benefits are narrowing the gap. The U.S. market is thus positioned as a leader in electrochromic adoption, with urban density, supportive government frameworks, and consumer demand for high-performance design driving long-term growth.

The Europe Electrochromic Materials Market

The Europe Electrochromic Materials Market is estimated to be valued at USD 409.0 million in 2025 and is further anticipated to reach USD 752.0 million by 2034 at a CAGR of 7.0%.

The European electrochromic materials market is strongly influenced by policy frameworks, regulatory pressure, and a dense urban population. The European Union’s Energy Performance of Buildings Directive provides the foundation for widespread retrofitting of existing structures to achieve climate neutrality by mid-century. Member States are required to establish renovation plans that prioritize energy savings, and dynamic glazing technologies such as electrochromics are increasingly recognized for their ability to reduce cooling demand, limit glare, and enhance thermal comfort without sacrificing daylight or views.

Eurostat data confirms that over 70% of Europeans live in urban areas, with high concentrations in commercial and institutional buildings that rely heavily on glazed façades. This demographic structure creates concentrated demand for advanced façade solutions in offices, hospitals, universities, and transport hubs. National programs encouraging energy-efficient retrofits and green public procurement amplify opportunities for adoption. Public sector initiatives, including hospital modernizations and school upgrades, are integrating dynamic glazing into specification requirements. However, challenges include procurement fragmentation, cost sensitivity in social housing, and differing national subsidy frameworks, which slow uniform adoption.

Nevertheless, opportunities remain strong in southern Europe, where solar gain mitigation is a priority, and northern regions, where daylight management and occupant well-being drive adoption. Corporate net-zero targets and green building certification schemes, including BREEAM and LEED Europe adaptations, reinforce market momentum. As Europe undergoes a large-scale “renovation wave,” electrochromic materials are poised to play a central role in meeting energy, comfort, and climate objectives across both public and private building sectors.

The Japan Electrochromic Materials Market

The Japan Electrochromic Materials Market is projected to be valued at USD 163.6 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 316.3 million in 2034 at a CAGR of 7.6%.

The Japanese electrochromic materials market is shaped by a combination of policy initiatives, demographic concentration, and advanced manufacturing ecosystems. The Ministry of Economy, Trade and Industry promotes technologies that support national climate goals, including energy-efficient buildings and reduced reliance on mechanical cooling. The Ministry of Land, Infrastructure, Transport and Tourism supports the diffusion of zero-energy buildings and zero-energy homes, embedding high-performance glazing in certification and labeling systems such as BELS and CASBEE.

Japan’s urban population, reported by the Statistics Bureau at over 120 million people concentrated in dense metropolitan clusters, drives demand for glazing solutions that address glare, comfort, and energy efficiency in high-rise offices, commercial centers, and transit stations. Electrochromic glazing fits well into Japan’s architectural emphasis on natural light, scenic views, and compact urban design.

Beyond construction, the country’s automotive and rail industries are global leaders in integrating electrochromic windows and partitions for enhanced passenger experience, safety, and energy efficiency. These applications align with Japan’s reputation for precision engineering, reliability, and user-centered design. Challenges include stringent durability requirements due to seismic activity, typhoon exposure, and long product life cycles expected by Japanese consumers.

However, these high standards foster innovation in coating technologies, encapsulation methods, and hybrid material systems. Financial tools such as green bonds and transition finance also support adoption, particularly for large-scale public infrastructure projects. With its alignment of policy, consumer expectations, and industrial capabilities, Japan represents one of the most advanced and demanding markets for electrochromic materials globally.

Global Electrochromic Materials Market: Key Takeaways

- Global Market Size Insights: The Global Electrochromic Materials Market size is estimated to have a value of USD 2,727.2 million in 2025 and is expected to reach USD 5,838.7 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 8.8 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Electrochromic Materials Market is projected to be valued at USD 550.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,124.9 million in 2034 at a CAGR of 8.3%.

- Regional Insights: Europe is expected to have the largest market share in the Global Electrochromic Materials Market with a share of about 38.0% in 2025.

- Key Players: Some of the major key players in the Global Electrochromic Materials Market are Gentex Corporation, Saint-Gobain S.A. (SAGE Electrochromics Inc.), View Inc., ChromoGenics AB, EControl-Glas GmbH & Co. KG, AGC Inc., PPG Industries Inc., Changzhou Yapu New Material Co., and many others.

Global Electrochromic Materials Market: Use Cases

- Smart Windows in Commercial Buildings: Electrochromic smart windows dynamically regulate light and heat, reducing HVAC loads and energy costs. They improve occupant comfort, reduce glare, and align with sustainable architecture practices, making them essential for green building certifications and energy-efficient infrastructure worldwide.

- Automotive Mirrors and Sunroofs: Electrochromic materials in rearview mirrors and panoramic sunroofs enhance driver safety by minimizing glare and improving passenger comfort. Widely adopted in luxury vehicles and electric cars, they support smart mobility, premium aesthetics, and eco-friendly automotive design trends.

- Aerospace Cabin Windows: Electrochromic aircraft windows allow passengers to adjust transparency electronically without mechanical shades. This reduces weight, improves energy efficiency, and enhances in-flight comfort. Airlines adopt these materials to achieve sustainability goals and deliver next-generation passenger experiences in modern aircraft.

- Consumer Electronics and Wearables: Adaptive electrochromic displays in smartphones, tablets, and wearable devices enable customizable visuals while reducing battery consumption. Their integration enhances user experience, supports AR/VR technologies, and aligns with the demand for energy-efficient, smart, and lightweight electronic solutions globally.

- Energy Storage and Smart Grids: Electrochromic materials are integrated into advanced batteries and supercapacitors, enabling dual functionality of charge storage and optical control. This supports renewable integration, decentralized energy systems, and sustainability goals in grid modernization, energy management, and electrification initiatives.

Global Electrochromic Materials Market: Stats & Facts

U.S. Environmental Protection Agency (EPA)

- The EPA's ENERGY STAR program estimates that air sealing walls and ceilings with appropriate sealants can save homeowners an average of 15% on heating and cooling costs.

- Through its Safer Choice program, the EPA has recognized and labeled over 30 specific elastomeric sealant and adhesive products that meet stringent human and environmental health criteria.

- The EPA's reporting on the Significant New Alternatives Policy (SNAP) lists the acceptable global warming potential (GWP) limits for blowing agents used in the manufacture of silicone and other polymer-based sealants.

U.S. Department of Energy (DOE)

- Building energy codes, which heavily influence sealant use for air sealing, have been adopted by 41 states and the District of Columbia for residential buildings, driving demand for high-performance products.

- The DOE's Building Technologies Office cites that uncontrolled air leakage through gaps and cracks accounts for between 25% and 40% of the energy used for heating and cooling in a typical building.

- DOE studies on building retrofits show that the application of elastomeric sealants is one of the most cost-effective measures for improving energy efficiency in existing structures.

U.S. International Trade Commission (USITC)

- In 2022, the United States imported over USD 450 million worth of polysulfide and polysiloxane (silicone) sealants.

- For the same year, the U.S. exported over USD 380 million worth of similar sealant products, indicating a robust international trade.

- The primary trading partners for sealant imports include Germany, China, and Canada, reflecting the global nature of the supply chain.

European Chemicals Agency (ECHA)

- Under the EU's REACH regulation, over 150 chemical substances used in the formulation of various sealants are classified as Substances of Very High Concern (SVHC), driving innovation in safer chemistries.

- ECHA's database shows that over 2,000 unique sealant and adhesive products have been registered for use within the European Economic Area, demonstrating a large and diverse market.

U.S. Census Bureau

- The value of construction put in place for residential buildings in the U.S. exceeded USD 900 billion annually, a key driver for sealant consumption in applications like windows, doors, and joints.

- The value of private non-residential construction, another major end-user for industrial-grade sealants, was over USD 500 billion for the same period.

- Data on new private construction shows that spending on manufacturing-related construction grew by over 15% year-over-year, a sector that uses significant amounts of chemical-resistant sealants.

U.S. Geological Survey (USGS)

- The annual production volume of silicone (siloxane) in the United States, a primary raw material for silicone sealants, is estimated to be over 400,000 metric tons.

- Domestic production of polyurethane raw materials (isocyanates and polyols) used in sealants exceeds 3 million metric tons annually.

- The average annual price of silicone fluids and resins, a key cost component for sealant manufacturers, fluctuates based on silicon metal prices, which are tracked quarterly.

National Institute of Standards and Technology (NIST)

- NIST's research into building failures post-hurricanes has led to updated standards requiring high-performance elastomeric sealants to withstand wind-driven rain pressures exceeding 3,000 Pascals.

- NIST's Fire Research Division has developed test protocols to evaluate the fire resistance of sealants used in expansion joints and firestop applications, which must often withstand temperatures over 1,000°C for several hours.

- Research at NIST has contributed to the development of standardized test methods (ASTM) for measuring the adhesion and cohesion properties of sealants under various environmental conditions.

Occupational Safety and Health Administration (OSHA)

- OSHA's Permissible Exposure Limit (PEL) for crystalline silica, a potential hazard during sealant surface preparation, is 50 micrograms per cubic meter of air as an 8-hour time-weighted average.

- OSHA requires specific respiratory protection and ventilation for workers exposed to isocyanates, which are found in many polyurethane sealants and can cause asthma.

- Data from OSHA's Injury Tracking Application shows that the "Sealants, Adhesives, and Gaskets" manufacturing sector has a non-fatal injury and illness rate slightly below the national average for all manufacturing.

International Energy Agency (IEA)

- The IEA's Net Zero by 2050 scenario projects that the annual rate of building energy renovations needs to double by 2030, directly increasing the market for energy-saving products like elastomeric sealants.

- The IEA estimates that improving the energy efficiency of the global building stock could contribute to over 40% of the needed reductions in energy-related greenhouse gas emissions.

U.S. Green Building Council (USGBC)

- As of the latest data, there are over 100,000 LEED-certified commercial projects globally, all of which must meet strict standards for air tightness, mandating the use of high-quality sealants.

- The Materials and Resources credit category in LEED v4 has driven a 30% increase in demand for sealants with verified Environmental Product Declarations (EPDs).

ASTM International

- ASTM International maintains over 50 active standards specifically related to the testing, application, and performance of building sealants.

- Standard C920, the Specification for Elastomeric Joint Sealants, is one of the most widely referenced standards in construction specifications across North America.

European Committee for Standardization (CEN)

- The EN 15651 series of standards provides a harmonized framework for evaluating sealants for non-structural use in buildings and pedestrian walkways across all EU member states.

- The EN 15434 standard specifies the performance characteristics of sealants and adhesives for the structural bonding of glass in Europe, a critical safety application.

International Organization for Standardization (ISO)

- ISO 11600 standard classifies sealants into classes (e.g., 25LM, 25HM) based on their modulus (low or high) and permitted movement capability (e.g., ±25%), providing a global language for performance.

- The ISO 14040 series on Life Cycle Assessment provides the framework that many manufacturers use to create Environmental Product Declarations for their sealant products.

Global Electrochromic Materials Market: Market Dynamics

Driving Factors in the Global Electrochromic Materials Market

Surge in global construction and infrastructure development projects

The rapid growth of urbanization and industrialization across developing economies has significantly boosted the demand for elastomeric sealants. Large-scale infrastructure projects, such as airports, highways, rail networks, and smart cities, require advanced sealing solutions that ensure structural integrity and long-lasting performance under environmental stress.

Elastomeric sealants are widely used in sealing expansion joints, façades, flooring systems, and glazing in both commercial and residential construction. In developed nations, government-backed renovation programs for aging infrastructure are further amplifying demand. For instance, energy-efficient retrofitting projects in Europe and the U.S. are increasingly integrating elastomeric sealants to improve insulation, waterproofing, and durability.

Their adaptability to extreme weather conditions, combined with excellent adhesion properties, makes them suitable for a wide variety of construction applications. The rise in green building certifications and strict compliance with building codes is also promoting sealants that enhance energy efficiency. These combined factors strongly position elastomeric sealants as a crucial driver in modern construction development globally.

Expanding automotive and transportation industry applications

The global automotive industry is another major growth driver for elastomeric sealants. With vehicles increasingly designed for lightweight construction and improved fuel efficiency, the demand for sealants that offer superior bonding, noise reduction, and vibration damping has grown significantly. Elastomeric sealants are extensively used in automotive glazing, body seams, weatherproofing, and bonding composite materials. Their ability to withstand extreme temperatures and provide flexibility under dynamic stress makes them essential in enhancing vehicle safety and durability.

Additionally, the transition toward electric vehicles (EVs) is generating fresh demand, as sealants are needed for battery packs, electronics protection, and noise reduction. The aerospace and marine industries are also adopting elastomeric sealants to improve structural integrity and resistance to environmental factors such as saltwater corrosion and UV exposure. With global mobility expanding and demand for durable, lightweight vehicles rising, elastomeric sealants are becoming an indispensable material in the transportation sector, further accelerating market growth worldwide.

Restraints in the Global Electrochromic Materials Market

Volatility in raw material prices is impacting profitability.

A major restraint for the elastomeric sealants market is the fluctuating cost and limited availability of raw materials such as silicone, polyurethane, and acrylic resins. These inputs are derived from petrochemicals, making their prices highly sensitive to crude oil volatility and global supply chain disruptions. For manufacturers, these fluctuations translate into inconsistent production costs, reduced profit margins, and difficulties in long-term pricing strategies.

Additionally, disruptions caused by geopolitical tensions, trade restrictions, or natural disasters often exacerbate raw material shortages. Smaller manufacturers are particularly vulnerable, as they lack the scale to absorb sudden cost increases.

The challenge is further amplified by the industry’s need to comply with strict performance and environmental standards, which restrict substitution with lower-cost alternatives. This dependence on petrochemical feedstocks not only impacts profitability but also drives companies to invest heavily in alternative bio-based raw materials, increasing R&D expenses and operational complexity.

Stringent regulatory compliance and certification requirements

Another significant restraint in the elastomeric sealants market is the increasing burden of regulatory compliance across different regions. Sealants used in construction, automotive, and aerospace applications must meet diverse safety, environmental, and performance standards, often requiring extensive testing and certification. For instance, building materials in Europe must comply with REACH regulations, while the U.S. enforces strict VOC emission standards. Meeting these requirements not only increases production costs but also prolongs the time-to-market for new formulations. Smaller companies often struggle to manage compliance across multiple regions, limiting their competitiveness.

Additionally, environmental regulations are continuously evolving, compelling manufacturers to adapt their product portfolios frequently. Non-compliance risks significant penalties, reputational damage, and exclusion from major infrastructure projects. While these regulations drive innovation toward safer, eco-friendly solutions, they also create substantial barriers to entry and operational challenges, restraining the overall growth trajectory of the elastomeric sealants market.

Opportunities in the Global Electrochromic Materials Market

Technological innovations in high-performance and specialty sealants

One of the most promising growth opportunities in the elastomeric sealants market lies in the development of advanced formulations tailored to meet specialized industry requirements. Innovations such as hybrid polymer sealants, UV-cured elastomeric sealants, and nano-enhanced materials are opening new avenues for product performance and applications.

Hybrid technologies that combine silicone, polyurethane, and acrylic offer improved adhesion, chemical resistance, and mechanical strength. For instance, aerospace and defense applications demand sealants that can endure extreme temperatures and chemical exposure, while marine industries need products resistant to prolonged saltwater contact.

Nanotechnology-infused elastomeric sealants are further enabling self-healing, anti-microbial, and energy-efficient properties that enhance long-term sustainability. These innovations provide opportunities for manufacturers to differentiate their offerings and target high-value applications beyond traditional construction. The ability to engineer customized sealants for unique end-user requirements will serve as a critical growth lever for companies focused on innovation-driven strategies.

Rising demand in renewable energy and sustainable infrastructure projects

The global transition toward renewable energy sources and sustainable infrastructure presents immense growth opportunities for elastomeric sealants. In solar energy projects, sealants are crucial for panel assembly, protecting against moisture ingress, UV degradation, and thermal cycling. Similarly, wind turbine installations require durable sealing solutions to maintain structural integrity in harsh offshore and onshore environments.

Elastomeric sealants also play a vital role in sustainable construction, where green-certified buildings demand energy-efficient insulation and airtightness to reduce carbon footprints. With governments around the world allocating significant investments in renewable energy infrastructure, the need for high-performance sealing materials is growing rapidly.

In addition, sustainable urban development projects—such as smart cities and net-zero energy housing—are increasingly reliant on elastomeric sealants to improve environmental efficiency and structural resilience. This alignment with global sustainability goals makes renewable energy and eco-infrastructure a major opportunity space for elastomeric sealant manufacturers seeking long-term expansion.

Trends in the Global Electrochromic Materials Market

Rising adoption of eco-friendly and low-VOC elastomeric sealants

One of the most notable trends in the elastomeric sealants market is the strong shift toward eco-friendly formulations that comply with stringent environmental and health safety regulations. Governments across North America, Europe, and parts of the Asia-Pacific are increasingly restricting volatile organic compounds (VOCs) in construction materials to minimize air pollution and health hazards. This has accelerated innovation in bio-based, waterborne, and solvent-free elastomeric sealants that reduce harmful emissions while maintaining durability and adhesion properties. Manufacturers are investing heavily in R&D to design high-performance sealants that meet LEED certification and other green building requirements.

Additionally, consumer awareness regarding sustainable construction and energy efficiency is fueling demand for these next-generation materials. This trend is also strongly supported by the increasing preference for sustainable building practices in both residential and commercial infrastructure projects, creating long-term market potential. Companies that can combine sustainability with strong product performance are positioned to gain a competitive edge in this evolving landscape.

Growing use of elastomeric sealants in prefabricated and modular construction

The global construction industry is increasingly embracing prefabrication and modular building techniques to address labor shortages, cost pressures, and the need for faster project completion. This trend is directly driving the demand for elastomeric sealants due to their excellent flexibility, weather resistance, and ability to accommodate structural movement.

In modular construction, where components are assembled off-site and then transported, joints and seams require high-performance sealing solutions to maintain durability during transport and installation. Elastomeric sealants deliver superior adhesion across diverse substrates such as concrete, glass, metals, and plastics, making them indispensable in prefabricated buildings.

Additionally, their resistance to UV radiation and harsh climatic conditions ensures longevity in outdoor structures, which is critical in modular housing and commercial spaces. Growing infrastructure investments, particularly in Asia-Pacific and the Middle East, are boosting modular construction adoption. Consequently, elastomeric sealants are seeing increasing integration into factory-finished panels, pre-cast concrete, and modular façade systems, reflecting a long-term trend toward industrialized construction processes.

Global Electrochromic Materials Market: Research Scope and Analysis

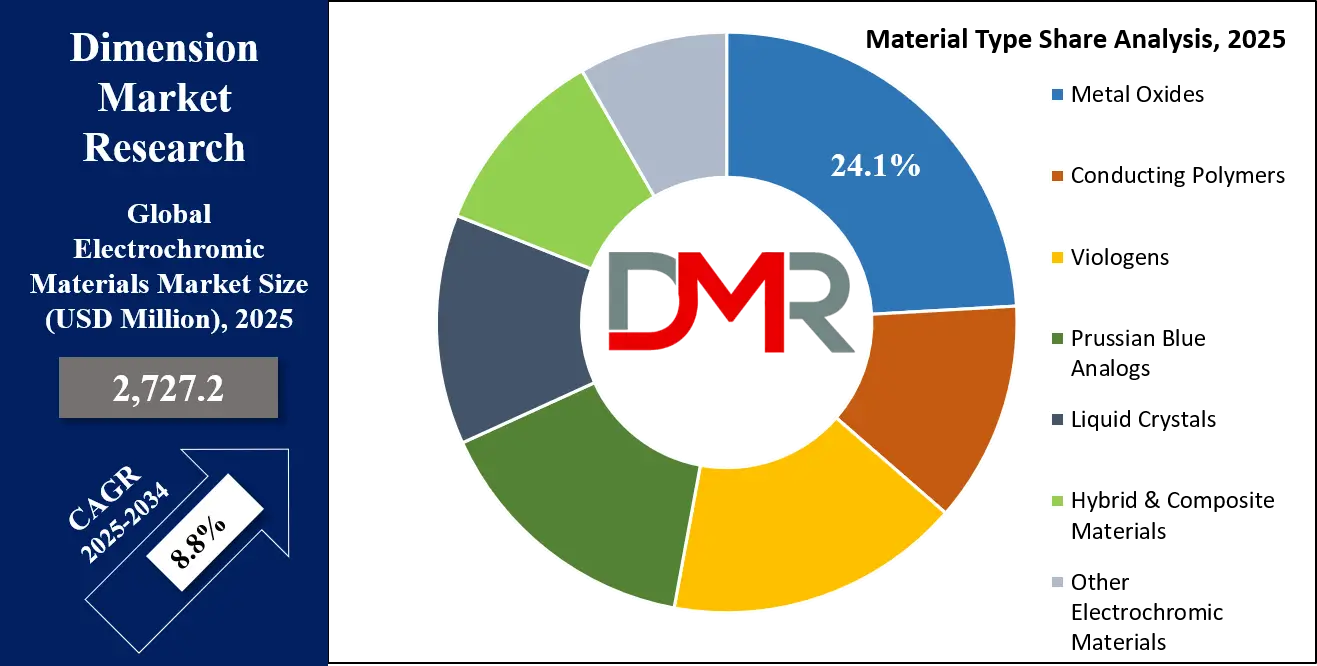

By Material Type Analysis

Metal oxides are projected to dominate the electrochromic materials market due to their exceptional durability, cost-effectiveness, and widespread compatibility with large-area applications. Tungsten oxide (WO₃) is the most established material, recognized for its excellent optical modulation, high coloration efficiency, and long-term cycling stability. These characteristics make metal oxides particularly suitable for smart windows and automotive sunroofs, where both performance consistency and lifespan are critical. Additionally, they support scalable manufacturing processes such as solution processing and vapor deposition, ensuring reliable integration into commercial and industrial products.

Metal oxides also benefit from strong research backing in the construction, aerospace, and automotive sectors, where energy-efficient technologies are prioritized. Their ability to switch between clear and tinted states with minimal energy input enhances sustainability, aligning with green building standards such as LEED and BREEAM. While conducting polymers and hybrid materials are emerging with flexible and colorful applications, they lack the proven large-scale deployment that metal oxides command.

extensive availability of tungsten, molybdenum, and nickel-based oxides further ensures steady supply chains. Their robustness against UV degradation and environmental wear adds another layer of dominance, especially in exterior applications. With rising demand for energy-efficient buildings and sustainable transportation, metal oxides remain the most commercially viable and technologically mature choice in this segment.

By Technology Analysis

Solution processing is anticipated to hold dominance in electrochromic materials technology because of its scalability, cost-efficiency, and adaptability to diverse substrates. This method supports roll-to-roll manufacturing, enabling high-throughput production of flexible and large-area electrochromic devices. Unlike vapor deposition, which demands expensive vacuum systems, solution processing minimizes infrastructure costs and enhances energy efficiency during production. This makes it particularly attractive for manufacturers targeting mass-market smart windows and displays.

Its compatibility with conducting polymers, hybrid composites, and even certain metal oxides expands material design flexibility, ensuring broader adoption. The ability to deposit uniform thin films on glass, plastic, and textiles empowers innovation across industries, from architecture to wearables. Another advantage lies in its eco-friendliness, as water-based and low-toxicity solvents can be incorporated, reducing environmental impact compared to chemical-intensive vapor techniques.

Furthermore, solution processing supports customization, enabling the production of electrochromic layers with varied colors, transparency levels, and switching speeds. This versatility accelerates adoption in sectors demanding aesthetic appeal alongside functionality, such as interior automotive design and consumer electronics.

Although vapor deposition ensures precise film quality and printing technologies enable intricate patterning, neither matches the balance of affordability, speed, and wide-area application offered by solution processing. Governments and green building initiatives further encourage this dominance, as solution-based processes align with sustainability policies and resource-efficient production standards. Its adaptability to both rigid and flexible surfaces ensures that solution processing remains the leading technology platform driving commercial scalability in the electrochromic materials industry.

By Application Analysis

Smart windows are poised to dominate the application segment of the electrochromic materials market, driven by the global push toward energy-efficient building technologies. They provide dynamic control over solar heat gain and glare, reducing reliance on artificial lighting and HVAC systems. This aligns perfectly with sustainability targets in commercial and residential construction, where energy efficiency regulations are tightening globally. The adoption of smart windows is further accelerated by their ability to improve occupant comfort, productivity, and privacy without sacrificing natural daylight.

Advanced integration with Internet of Things (IoT) systems allows for automated control, making them a cornerstone of intelligent building design. Unlike smart mirrors or displays, smart windows cover larger surface areas, amplifying the demand for electrochromic coatings, particularly in skyscrapers, airports, and corporate offices. Automotive manufacturers are also incorporating electrochromic windows and sunroofs, but architectural applications remain the largest consumer base. The ability of smart windows to cut energy consumption by up to 20–30% in buildings has positioned them as a key technology under green certifications like LEED and WELL.

Their broad appeal is not limited to new constructions; retrofit opportunities in existing structures provide another major growth avenue. In contrast, other applications such as aerospace panels, wearable displays, and energy storage devices remain niche, either due to high costs or limited awareness. With global urbanization and smart city initiatives expanding rapidly, demand for energy-saving building materials continues to prioritize smart windows as the leading application segment. Their role in reducing carbon emissions and enhancing sustainability ensures their continued market dominance.

By End-Use Industry Analysis

The construction and architecture sector is expected to dominate the electrochromic materials market due to increasing demand for sustainable and energy-efficient building solutions. Electrochromic smart windows and façades are transforming urban infrastructure by offering dynamic control over heat and light transmission, reducing cooling and heating loads, and improving indoor comfort. T

hese technologies are particularly attractive to architects and developers aiming to meet stringent building codes and sustainability benchmarks such as LEED, BREEAM, and WELL certifications. Large-scale projects, including commercial towers, educational campuses, hospitals, and government buildings, increasingly integrate electrochromic glazing to achieve operational energy savings and improved aesthetics. The sector also benefits from global initiatives promoting smart cities, where adaptive building technologies play a crucial role in reducing carbon footprints.

Electrochromic solutions add value beyond efficiency—they enhance occupant well-being by minimizing glare, improving daylight distribution, and enabling privacy without the need for physical blinds or shades. While automotive and aerospace industries leverage electrochromics for advanced sunroofs, cabin windows, and cockpit displays, their market volume remains smaller compared to construction.

Electronics and healthcare are promising niches, with displays and wearable devices showing potential, but their adoption is constrained by cost and durability issues. In contrast, construction projects demand high-volume, large-surface applications, securing the industry’s leading position. The push for net-zero energy buildings and retrofitting of older structures further strengthens this dominance. As urban populations grow and governments prioritize sustainable infrastructure, the construction and architecture industry remains the primary driver of electrochromic material demand across global markets.

The Global Electrochromic Materials Market Report is segmented on the basis of the following:

By Material Type

- Metal Oxides

- Tungsten oxide (WO3)

- Nickel oxide (NiO)

- Titanium dioxide (TiO2)

- Vanadium pentoxide (V2O5)

- Molybdenum oxide (MoO3)

- Other metal oxides

- Conducting Polymers

- Polyaniline (PANI)

- Polypyrrole (PPy)

- Poly(3,4-ethylenedioxythiophene) (PEDOT)

- Other conducting polymers

- Viologens

- Prussian Blue Analogs

- Liquid Crystals

- Hybrid & Composite Materials

- Other Electrochromic Materials

By Technology

- Solution Processing

- Sol-gel method

- Electrodeposition

- Spin coating

- Other solution processing methods

- Vapor Deposition

- Physical vapor deposition (PVD)

- Chemical vapor deposition (CVD)

- Sputtering

- Other vapor deposition methods

- Printing Technologies

- Inkjet printing

- Screen printing

- Other printing methods

- Other Technologies

By Application

- Smart Windows

- Architectural windows

- Skylights & roof windows

- Partitions & privacy glass

- Other smart window applications

- Smart Mirrors

- Automotive mirrors

- Architectural mirrors

- Other mirror applications

- Displays

- E-paper displays

- Information displays

- Other display applications

- Automotive Applications

- Sunroofs

- Rearview mirrors

- Side windows

- Other automotive applications

- Aerospace Applications

- Wearable Devices

- Energy Storage Devices

- Other Applications

By End-Use Industry

- Construction & Architecture

- Residential buildings

- Commercial buildings

- Institutional buildings

- Other building types

- Automotive & Transportation

- Passenger vehicles

- Commercial vehicles

- Other transportation

- Aerospace & Defense

- Electronics & Displays

- Marine

- Healthcare & Medical

- Other End-Use Industries

Intelligence in the Global Electrochromic Materials Market

- AI-Driven Material Discovery: Artificial intelligence accelerates the discovery of electrochromic materials by simulating molecular interactions, predicting optical properties, and identifying ideal compounds. This reduces R&D timelines while enabling the creation of advanced materials for smart windows, displays, and energy-efficient devices.

- Predictive Manufacturing Optimization: AI-powered predictive analytics optimize electrochromic material manufacturing by minimizing defects, reducing energy consumption, and enhancing process efficiency. Machine learning models ensure consistent quality while enabling scalable production for commercial applications in automotive, aerospace, and construction industries.

- Smart Product Integration: AI enables integration of electrochromic materials into adaptive systems, such as smart windows and mirrors that self-adjust based on weather, light intensity, or user preference. These intelligent products enhance comfort, reduce energy costs, and improve user experience.

- Enhanced Lifecycle Management: Artificial intelligence improves lifecycle monitoring of electrochromic devices through predictive maintenance and performance tracking. AI algorithms detect wear, material degradation, and system inefficiencies early, ensuring long-term durability, reduced replacement costs, and optimized sustainability in end-use applications.

- Market Forecasting and Customization: AI-driven big data analytics provide deep insights into consumer demand, regional trends, and industry adoption patterns. Manufacturers use these forecasts to customize electrochromic material solutions, aligning with evolving requirements in smart buildings, automotive, and advanced electronic applications.

Global Electrochromic Materials Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to dominate the global electrochromic materials market as it holds 38.0% of the total revenue by the end of 2025, due to its strong emphasis on sustainability, stringent energy-efficiency regulations, and rapid adoption of green building technologies. The European Union has established ambitious climate goals and directives such as the Energy Performance of Buildings Directive (EPBD), which encourages the integration of smart windows and dynamic glazing systems.

Electrochromic materials, being vital for reducing heating, cooling, and lighting demands in commercial and residential structures, see widespread adoption in the region. Countries such as Germany, France, and the UK have heavily invested in smart infrastructure and renewable solutions, further accelerating demand. The region’s advanced automotive sector, with brands like BMW, Mercedes-Benz, and Audi, also boosts the adoption of electrochromic mirrors and sunroofs for improved driver safety and passenger comfort.

Additionally, Europe’s aerospace industry, led by Airbus and other innovators, utilizes electrochromic technologies to improve passenger experience in next-generation aircraft cabins. Research institutes and collaborations between universities and private companies contribute to technological innovation and cost reduction, strengthening Europe’s leadership. The presence of key manufacturers and material suppliers ensures a robust supply chain network. Overall, a mix of regulatory push, mature industries, and R&D advancements cements Europe’s dominant position.

Region with the Highest CAGR

Asia Pacific is projected to witness the highest CAGR in the electrochromic materials market, fueled by rapid urbanization, infrastructure expansion, and rising investments in smart cities across China, India, Japan, and South Korea. Governments in the region are heavily promoting energy-efficient construction to combat rising energy consumption, thereby driving the use of smart windows and glazing solutions incorporating electrochromic materials. The massive construction boom in residential and commercial buildings significantly expands market potential.

The automotive industry in the Asia Pacific is another key driver, as countries like Japan, China, and South Korea lead globally in automobile production. Automakers are increasingly integrating electrochromic rear-view mirrors, sunroofs, and smart glass to differentiate their vehicles and meet consumer demand for luxury and advanced safety features.

In addition, Asia Pacific’s fast-growing electronics and display industry—particularly in China, Taiwan, and South Korea—supports demand for electrochromic materials in next-gen displays, wearable devices, and consumer electronics. The region’s governments are actively supporting R&D collaborations and incentivizing investments in advanced materials, creating fertile ground for innovation.

Furthermore, growing aerospace initiatives in Japan and India are incorporating electrochromic windows into modern aircraft fleets. The relatively low production costs, presence of emerging material suppliers, and rapidly expanding consumer base give the Asia Pacific a competitive edge in growth rate. With increasing awareness of sustainability and rising disposable incomes, the Asia Pacific stands as the most dynamic market for electrochromic material adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Electrochromic Materials Market: Competitive Landscape

The global electrochromic materials market is moderately consolidated, with competition driven by innovation, product performance, and application diversity. Leading companies such as SageGlass (a subsidiary of Saint-Gobain), ChromoGenics AB, Gentex Corporation, AGC Inc., and View Inc. dominate with established portfolios in smart windows, mirrors, and advanced glazing solutions. Their strong partnerships with construction firms, automotive manufacturers, and aerospace players ensure consistent demand channels.

European firms such as SageGlass and ChromoGenics lead the market through extensive R&D, leveraging their proximity to regulatory frameworks that favor energy-efficient solutions. Gentex Corporation plays a pivotal role in the automotive sector, offering electrochromic mirrors and smart glass products integrated across premium and mid-segment vehicles. Similarly, AGC Inc. and Saint-Gobain focus on scaling production capabilities to serve rising global demand, particularly in construction and architecture.

North American players like View Inc. are recognized for introducing innovative smart building solutions, supported by heavy investments in IoT and AI-driven integration for electrochromic windows. Meanwhile, Asian companies are increasingly entering the landscape, benefiting from lower-cost manufacturing and strong electronics sector linkages. Collaborations, mergers, and licensing agreements are common strategies to expand technological expertise and application reach.

The market also witnesses growing involvement of startups and research-driven firms introducing hybrid and polymer-based electrochromic materials that promise faster switching speeds and improved durability. Competition continues to intensify, with companies prioritizing energy efficiency, design flexibility, and customization to cater to diverse industries including construction, automotive, aerospace, and electronics.

Some of the prominent players in the Global Electrochromic Materials Market are:

- Gentex Corporation

- Saint-Gobain (SAGE Electrochromics)

- View, Inc.

- ChromoGenics

- EControl-Glas GmbH & Co. KG

- AGC Inc.

- PPG Industries

- Changzhou YAPU New Material Co., Ltd.

- Crown Electrokinetics Corp.

- KIBING Group

- Kinestral Technologies (Halio)

- Ningbo Miruo Electronic Technology Co., Ltd.

- Polytronix, Inc.

- Ricoh

- Zhuhai Kaivo Optoelectronic Technology Co., Ltd.

- RavenBrick LLC

- Guardian Industries Corporation

- Magna Glass & Window, Inc.

- Other Key Players

Recent Developments in the Global Electrochromic Materials Market

- August 2025: Gentex Corporation announced a collaboration with a European automaker to integrate electrochromic rear-view mirrors into premium EVs, focusing on enhanced driver safety, automatic glare reduction, and energy-efficient features for next-generation mobility solutions.

- July 2025: AGC Inc. unveiled a new electrochromic smart glass solution at a Tokyo expo, targeting commercial skyscrapers and smart city projects across the Asia Pacific, enhancing daylight management and reducing building cooling loads.

- June 2025: View, Inc. secured a partnership with Delta Airlines to supply electrochromic aircraft cabin windows, enhancing passenger experience through glare control, privacy, and sustainability-focused aviation technologies.

- May 2025: ChromoGenics AB expanded its electrochromic production facility in Sweden, boosting manufacturing capacity to meet increasing European demand for sustainable architectural glass solutions across residential and commercial sectors.

- April 2025: Saint-Gobain Glass introduced a next-generation electrochromic glass product in collaboration with French construction companies, aiming to accelerate green building adoption under EU carbon neutrality targets.

- March 2025: EControl-Glas GmbH & Co. KG participated in Light + Building 2025 expo in Frankfurt, showcasing advanced dynamic glazing systems and highlighting their role in sustainable urban development projects.

- February 2025: Gentex Corporation acquired a U.S.-based material technology startup specializing in hybrid electrochromic coatings, strengthening its innovation pipeline for automotive and aerospace applications.

- January 2025: AGC Inc. partnered with Panasonic to develop integrated electrochromic solutions for smart homes, including windows and consumer electronics displays, expanding applications beyond traditional architectural markets.

- December 2024: View, Inc. announced new funding from U.S. investors to scale its electrochromic smart glass solutions, aiming to accelerate adoption across airports, hospitals, and corporate buildings.

- November 2024: ChromoGenics AB launched a joint R&D program with Uppsala University to develop faster-switching electrochromic materials, enhancing product efficiency and competitiveness.

- October 2024: Saint-Gobain Glass showcased electrochromic innovations at Glasstec 2024, emphasizing applications in luxury residential projects and high-rise buildings in Europe and the Asia Pacific.

- September 2024: Gentex Corporation signed an agreement with BMW to expand the use of electrochromic glass in luxury vehicle sunroofs and interior shading systems.

- August 2024: AGC Inc. established a new R&D hub in South Korea, focusing on electrochromic material scalability for large commercial buildings and transportation applications.

- July 2024: EControl-Glas GmbH & Co. KG collaborated with a German aerospace company to supply electrochromic cockpit glass, enhancing pilot visibility and reducing glare.

- June 2024: View, Inc. participated in Smart Glass World Conference 2024, presenting advancements in cloud-connected electrochromic windows with integrated AI for adaptive lighting control.

- May 2024: ChromoGenics AB signed a supply agreement with Scandinavian construction firms for large-scale electrochromic glass integration into sustainable urban housing projects.

April 2024: Saint-Gobain Glass partnered with Schneider Electric to explore energy efficiency synergies between electrochromic glazing and smart building automation systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,727.2 Mn |

| Forecast Value (2034) |

USD 5,838.7 Mn |

| CAGR (2025–2034) |

8.8% |

| The US Market Size (2025) |

USD 550.5 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material Type (Metal Oxides, Conducting Polymers, Viologens, Prussian Blue Analogs, Liquid Crystals, Hybrid & Composite Materials, Other Electrochromic Materials), By Technology (Solution Processing, Vapor Deposition, Printing Technologies, Other Technologies), By Application (Smart Windows, Smart Mirrors, Displays, Automotive Applications, Aerospace Applications, Wearable Devices, Energy Storage Devices, Other Applications), By End-Use Industry (Construction & Architecture, Automotive & Transportation, Aerospace & Defense, Electronics & Displays, Marine, Healthcare & Medical, Other End-Use Industries) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Gentex Corporation, Saint-Gobain S.A. (SAGE Electrochromics Inc.), View Inc., ChromoGenics AB, EControl-Glas GmbH & Co. KG, AGC Inc., PPG Industries Inc., Changzhou Yapu New Material Co. Ltd., Crown Electrokinetics Corp., Kibing Group Co. Ltd., Kinestral Technologies Inc. (Halio Inc.), Ningbo Miruo Electronic Technology Co. Ltd., Polytronix Inc., Ricoh Company Ltd., Zhuhai Kaivo Optoelectronic Technology Co. Ltd., RavenBrick LLC, Asahi Glass Co. Ltd. (AGC Japan), Guardian Industries Corp., Magna Glass & Window Inc., SAGE Glass Inc., and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Electrochromic Materials Market size is estimated to have a value of USD 2,727.2 million in 2025 and is expected to reach USD 5,838.7 million by the end of 2034.

The market is growing at a CAGR of 8.8 percent over the forecasted period of 2025.

The US Electrochromic Materials Market is projected to be valued at USD 550.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,124.9 million in 2034 at a CAGR of 8.3%.

Europe is expected to have the largest market share in the Global Electrochromic Materials Market with a share of about 38.0% in 2025.

Some of the major key players in the Global Electrochromic Materials Market are Gentex Corporation, Saint-Gobain S.A. (SAGE Electrochromics Inc.), View Inc., ChromoGenics AB, EControl-Glas GmbH & Co. KG, AGC Inc., PPG Industries Inc., Changzhou Yapu New Material Co., and many others.