Market Overview

The global Electronics Chemicals and Materials market is predicted to be valued at

USD 85.2 billion in 2025 and is expected to grow to

USD 146.9 billion by 2034, registering a compound annual growth rate

(CAGR) of 6.2% from 2025 to 2034.

Electronics chemicals and materials are used to describe specialty chemicals of high purity used in producing and repairing semiconductors, flat panel displays, printed circuit boards, and electronic products. Wet chemicals, photoresists, gases, acids, solvents, laminates, and wafers form these chemicals and materials. All these chemicals and materials play a vital part in improving electronic device performance, efficiency, and durability.

The increased consumer electronics, automotive, and industrial applications demand is spurring market growth. Increased growth in smart technologies, IoT products, and uses in artificial intelligence (AI) has further raised premium electronic material demand. Additionally, decreased equipment prices and increased disposable incomes are spurring growth in the electronic sector rapidly in favor of the market.

The growing demand for nanotechnology in NEMS and MEMS products has created new market opportunities. As penetration in consumer homes and various industries has increased through smart devices and connected products, electronic chemicals have been in greater demand. Additionally, the expansion of the IT hardware sector and increasing corporate infrastructure have led to a surge in the consumption of computers, smartphones, and other electronic devices that rely on semiconductor technology.

Technological advancements in electronics manufacturing are expected to enhance the market scope. The demand for silicon in the solar PV industry and advancements in semiconductor fabrication will drive further growth. However, high capital investments for R&D and production setups may pose challenges for new entrants. Additionally, fluctuating silica prices due to global trade tensions may impact raw material supply. Despite these challenges, the market is set to grow with continuous innovation in semiconductor technology and increasing demand for advanced electronic devices.

The US Electronic Chemicals and Materials Market

The US Electronics Chemicals and Materials market is projected to be valued at USD 20.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 33.5 billion in 2034 at a CAGR of 5.8%.

The US electronic chemicals and materials market is fueled by rising tech growth and growing support by the US government towards locally producing semiconductors. Initiatives like the CHIPS Act encourage greater production to reduce dependence upon foreign supply channels. The demand for electronic materials is fueled by growth in 5G wireless infrastructure, electric vehicles, and renewable energy. Additionally, growth in consumer electronics, artificial intelligence, and data centers fuels market growth further by driving demand for pure chemicals and materials required to support advanced semiconductor production.

Some of the key trends in the US electronic chemicals and materials market are eco-friendly and performance materials owing to regulatory requirements in favor of protecting the environment and companies’ sustainability objectives. As EUV lithography becomes increasingly adopted in semiconductor production, this creates greater demand for ultra-pure chemicals. On top of this, accelerated growth in AI computing and quantum tech drives material development. As demand grows for electric vehicles, battery materials, and advanced packaging materials gain momentum in transforming the sector’s landscape.

Electronic Chemicals and Materials Market: Key Takeaways

- Market Growth: The global Electronics Chemicals and Materials market is anticipated to expand by USD 56.9 billion, achieving a CAGR of 6.2% from 2025 to 2034.

- Material Type Analysis: The solid materials and chemicals market is anticipated to lead with a market share of 55.6% based on material type in 2025.

- Product Analysis: Silicon wafers are expected to dominate the global market with the largest revenue share in 2025.

- End-use analysis: Semiconductors and ICs are predicted to dominate the global market with the largest market share by the end of 2025.

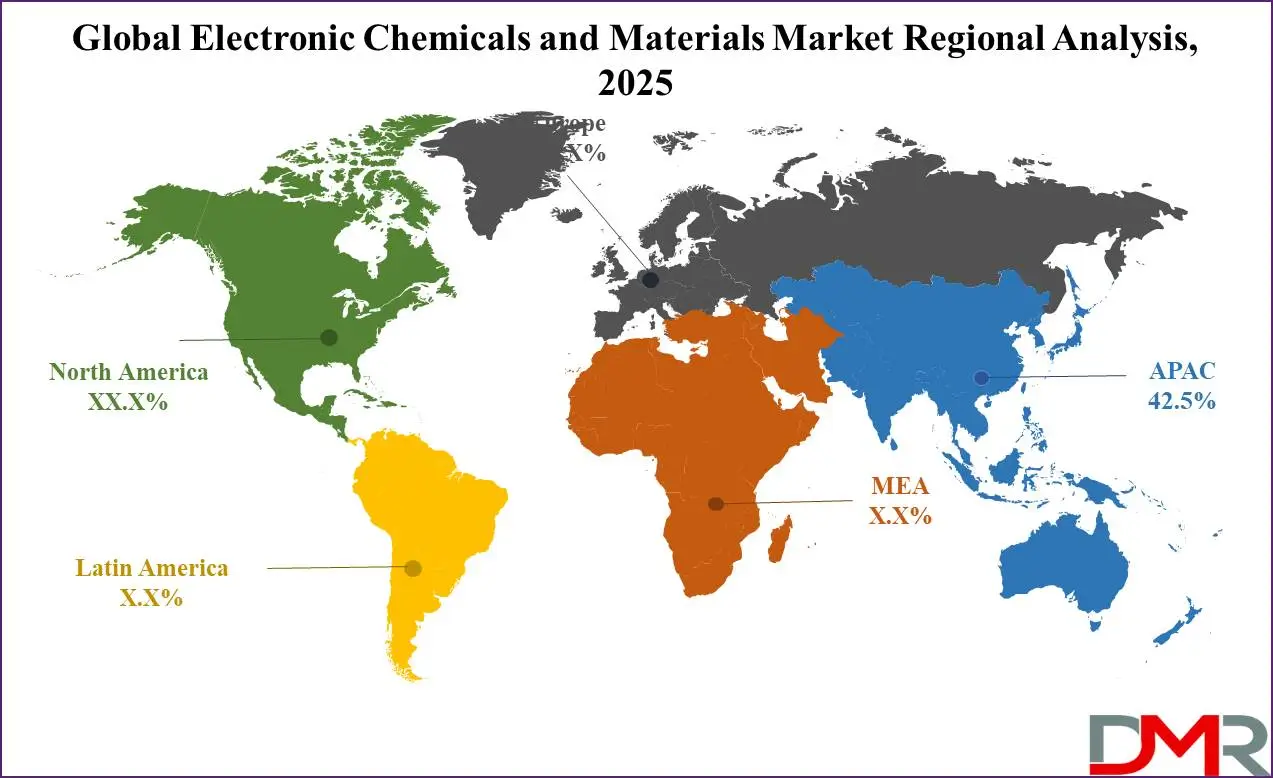

- Regional Analysis: Asia Pacific is projected to dominate the Global Electronics Chemicals and Materials Market, holding a market share of 42.5% by 2025.

- Prominent Players: Some of the major key players in the Global Electronics Chemicals and Materials Market are Air Products & Chemicals Inc., BASF SE, Dow, and many others.

Electronic Chemicals and Materials Market: Use Cases

- Semiconductor Fabrication: Electronic Materials are used in the production of integrated circuits (ICs) and microchips. Examples include photoresists, wet chemicals, and chemical mechanical planarization (CMP) slurries.

- Display Technologies: Electronic Materials are essential for manufacturing LCD, OLED, and LED displays. Materials like liquid crystals, conductive polymers, and encapsulation materials help enhance screen performance.

- Printed Circuit Boards (PCBs): Chemicals such as etchants, solder pastes, and dielectric materials are used in PCB manufacturing to create conductive pathways and protect components.

- Battery Manufacturing: Electronic Materials are critical for lithium-ion and solid-state batteries, electronic chemicals like electrolytes, cathode/anode materials, and separators to enhance battery efficiency and longevity.

Electronic Chemicals and Materials Market: Stats & Facts

- According to data from the Semiconductor Industry Association, global semiconductor sales experienced significant growth, rising from USD 139.0 billion in 2008 to USD 557.4 billion in 2022, reflecting a compound annual growth rate of approximately 6.67%.

- Fall 2022 Semiconductor Industry Forecast by the World Semiconductor Trade Statistics (WSTS) predicts a slight decline in global semiconductor sales to USD 555.6 billion in 2023, followed by a rebound to an estimated USD 602 billion in 2024.

- According to Statista, the revenue of the global Semiconductors market was US$503 billion in 2023 and is expected to reach approximately US$980 billion in 2029.

- The UK's Royal Mint has established a facility in South Wales designed to process up to 4,000 metric tons of printed circuit boards annually, extracting precious metals like gold, silver, and palladium from electronic waste.

- Semiconductors are materials with electrical conductivity between that of conductors and insulators. They play a crucial role in electronic devices, particularly in transistors and diodes.

- The most widely used semiconductor material due to its stability and abundance. It is the primary material for manufacturing integrated circuits (ICs) and microchips.

- Gallium Arsenide (GaAs) is known for its higher electron mobility compared to silicon, GaAs are commonly used in high-frequency applications such as microwave circuits and optical devices.

Electronic Chemicals and Materials Market: Market Dynamic

Driving Factors in the Electronic Chemicals and Materials Market

Rising Semiconductor Demand and Technological AdvancementsThe increasing reliance on semiconductors across various industries, including consumer electronics, automotive, and telecommunications, is a primary driver of the electronic chemicals and materials market. With the proliferation of technologies such as AI, IoT, and 5G, the need for high-performance chips has surged. These advancements require cutting-edge materials and chemicals to manufacture compact, efficient, and high-speed integrated circuits (ICs). As semiconductor companies innovate to produce smaller and more powerful chips, the demand for specialized chemicals, including photoresists, etchants, and deposition materials, continues to rise, fueling the growth of the electronic chemicals and materials market.

Expansion of Semiconductor Manufacturing Capacity

The semiconductor industry's rapid expansion is significantly driving the demand for electronic chemicals and materials. Leading semiconductor manufacturers and governments are investing billions in building new fabrication plants (fabs) and upgrading existing ones to meet the increasing demand for chips. These fabs require an extensive range of high-purity materials, such as specialty gases, wet chemicals, and CMP slurries, to ensure precise and efficient chip production. As companies continue to scale up production to support emerging technologies, the demand for advanced electronic materials is expected to rise, further accelerating market growth.

Restraints in the Electronics Chemicals and Materials Market

Environmental and Health regulations have strict standards

Electronic chemicals and materials markets face severe limitations due to stringent environmental and health regulations. Manufacturers must abide by laws concerning hazardous substances, energy efficiency, product recycling, and conflict minerals which all increase operational costs for manufacturers. Silica used in semiconductor production poses health risks to workers who must adhere to stringent health requirements that necessitate further safety precautions from regulators failing to do so could incur fines, legal liabilities, or reputational harm that affect industry profitability with regulations continually shifting companies must invest in sustainable solutions increasing production costs while hindering market expansion efforts.

Compliance and Supply Chain Costs Remain High

Compliance costs electronic manufacturers a substantial financial toll across their supply chains. Companies must ensure safe procurement, handling, and disposal of raw materials while complying with rules on packaging, energy consumption, and emissions; expenses also accrue for monitoring reporting requirements, supply chain audits, and designing environmentally-friendly product designs these rising expenses harm profit margins while hindering smaller firms from competing effectively furthermore, manufacturers face difficulties finding compliant materials which disrupt supply chains leading to extended lead times limiting market expansion potential resulting from compliance regulations.

Opportunities in the Electronics Chemicals and Materials Market

Nanoelectronics and Semiconductor Manufacturing Advancements

Nanotechnology and semiconductor production developments present an excellent opportunity for the global electronic chemicals and materials market. As companies transition from 28 nanometers to 20 nanometers, their demand for photoresists, nanomaterials, and electronic chemicals increases significantly, driving innovation within MEMS and NEMS devices by making smaller, lighter components that use less energy and reduce manufacturing waste. These innovations not only reduce fabrication costs but also open new paths for nanoelectronics. Enhancements to semiconductor performance spur wider adoption of cutting-edge technologies, leading to sustained market expansion and investment opportunities within the industry for suppliers and innovators - creating lasting profits with each successive move forward. This dynamic trend promises lasting profitability.

Expanding OLED and LED Display Technologies

OLED and LED displays offer robust growth potential to the electronic chemicals and materials market. Increased adoption of high-efficiency displays across smartphones, TVs, and consumer electronics devices has increased demand for organic semiconductors, conducting polymers, and luminescent materials. These cutting-edge materials enhance display brightness, color purity, and energy efficiency - driving innovation in transparent electrode production. When manufacturers seek superior performance and design flexibility from suppliers, the opportunity arises for investing in research and development to expand market potential as well as support the transition toward sustainable electronic devices globally driving further industry innovation.

Trends in the Electronics Chemicals and Materials Market

Advanced packaging

The rapid evolution in electronic equipment is causing an imperative demand for advanced packaging solutions to accommodate shrinking sizes and increased circuitry complexity. This is prompting specialized chemicals and material development in the form of novel photoresists, etchants, and polymers enabling high-density integration and reliability. Manufacturers are resorting to miniaturization approaches enabling next-gen semiconductors to perform efficiently in compact systems while guaranteeing thermal management, signal integrity, and overall device performance during production and over working life globally.

Sustainability and Green Chemistry Initiatives

In response to increased regulatory requirements and evolving consumer sentiment, the electronic sector is increasingly adopting green chemistry methods and eco-friendly practices. R&D investments by companies go towards developing non-hazardous, recyclable products with minimal environmental impacts. Such advanced products not only minimize hazardous waste production but also result in greater energy efficiency and material savings during production. Manufacturers incorporate eco-friendly materials and processes to extend product life cycles, achieve stricter regulatory standards, and support a better ecosystem for future generations.

Electronic Chemicals and Materials Market: Research Scope and Analysis

By Material Type

The solid materials and chemicals market is anticipated to lead with a market share of 55.6% based on material type in 2025 through increased demand for consumer electronic products in the shape of advanced electronic components in smartphones, laptops, and IoT products. Expanding growth in renewable energy products such as solar panels and electric vehicles creates additional demand for solid materials with better performance. Ongoing R&D investments in efficient and environmentally friendly materials propel increased consumption. As companies focus on minimizing sizes through miniaturization and developing better-performance products, solid electronic materials remain key factors in retaining market leadership in 2025.

The gas materials are forecast to experience the most growth in 2025 owing to increased consumption in semiconductor manufacturing, production of Printed Circuit Boards (PCBs), and advanced display technology. Increasing applications in chemical vapor deposition (CVD) and etching processes to fabricate microchips, light-emitting diodes (LEDs), and flat panel displays propel growth. Strong demand for semiconductors with better performance in

Artificial Intelligence (AI) systems, fifth generation (5G) communication systems, and autonomous vehicles drives material consumption in gases.

By Product

Silicon wafers are expected to dominate electronic chemicals and materials with the largest revenue share in 2025, owing to their foundational significance in semiconductor production. The growing demand for advanced electronic products including smartphones, tablets, and IoT products is leading to an increased demand for superior-grade silicon wafers. Trends in miniaturization and the introduction of advanced performance capabilities in electronic products further propel demand. Rapid growth in AI, 5G, and car electronics is further leading to increased consumption of silicon wafers. Their superior electrical qualities and support for high-density circuitry make them imperative in semiconductor production to secure market dominance.

Photoresists should experience growth in Compound Annual Growth Rate (CAGR) owing to increased uses in microelectronics and microsystems. Consumer electronics, automotive, and industrial applications propel demand for shrinking yet increasingly powerful semiconductor chips, thereby demanding advanced photolithography processes. Developments in EUV (Extreme Ultraviolet) lithography and other next-generation semiconductor production processes further drive photoresist demand. Constant material formulation breakthroughs and production effectiveness drive market growth.

By End Use

Semiconductors and Integrated Circuits are predicted to lead the electronic chemicals and materials market with the largest market share by the end of 2025, because of their central significance in advanced tech uses. As AI becomes increasingly significant, 5G becomes universal, and IoT (

Internet of Things) grows, demand is always increasing for chips with increased performance.

The market for semiconductors utilizes electronic chemicals to an extensive extent to etch, clean, dope, and polish to gain increased efficiency and reliability. As industries embrace increasingly powerful yet compact electronics, ICs remain central to computing, automotive, and communication markets to remain in market leadership. Constant development in making semiconductors and increased demand to possess faster yet more efficient chips continue to drive this market leadership.

Printed circuit boards (PCBs) have the second-largest market share in electronic chemicals and materials since they have a key role to play in just about every electronic device. PCBs provide support to mount and interconnect semiconductor items to realize efficient transmission of signals and functionality. Consumer electronic development, growth in telecommunications, and growth in automotive electronics have led to increased production of PCBs significantly.

The Electronic Chemicals and Materials Market Report is segmented based on the following

By Material Type

By Product

- Silicon wafers

- Photoresists

- PCB Laminates

- Specialty gases

- Wet chemicals and solvents

- Others

By End Use

- Semiconductors & Integrated Circuits

- Printed Circuit Boards

Regional Analysis

Region with the largest Share

Asia Pacific is predicted to dominate the global electronic chemicals and materials market with the highest revenue

share of 42.5% in 2025, due to its strong semiconductor and electronics manufacturing base, especially in China, Taiwan, South Korea, and Japan. The region's rapid industrialization, increasing R&D investments, and growing demand for consumer electronics drive market expansion. Government initiatives supporting domestic semiconductor production, the presence of key industry players, and a well-established supply chain further strengthen its position. Additionally, the rising adoption of advanced technologies like AI, 5G, and IoT fuels demand for high-performance electronic materials, ensuring Asia Pacific maintains its market leadership in the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

North America is expected to grow with a high CAGR in the global electronic chemicals and materials market due to increasing investments in semiconductor manufacturing and advanced technology development. The U.S. government’s push for domestic chip production, including incentives like the CHIPS Act, boosts demand for electronic chemicals. The region also benefits from strong innovation in AI, 5G, automotive electronics, and quantum computing. Additionally, the presence of leading tech companies, growing demand for sustainable and high-purity materials, and advancements in nanotechnology drive market expansion positioning North America as a rapidly growing hub for electronic chemicals and materials.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global Electronic Chemicals and Materials market is highly competitive, driven by rapid technological advancements, miniaturization trends, and increasing semiconductor demand. Key players include BASF, DuPont, Merck KGaA, Hitachi Chemical, and Showa Denko, competing on innovation, quality, and sustainability. The market is segmented into wafer fabrication and packaging chemicals, with strong demand from the semiconductor, display, and PCB industries. Asia-Pacific, led by China, Japan, and South Korea, dominates due to its robust electronics manufacturing base.

Some of the prominent players in the global Electronic Chemicals and Materials are

- Air Products & Chemicals Inc.

- Bayer AG

- Albemarle Corporation

- Ashland

- BASF SE

- Air Liquide Electronics

- Merck KGaA

- Honeywell International Inc.

- Cabot Corporation.

- Linde PLC

- Dow

- Hitachi, Ltd.

- Other Key Players

Recent Developments

- In April 2023, Resonac Corporation unveiled plans to boost the production capacity of its "Dicing Die Bonding Film" at the Goi Plant in Kamisu City, Japan, by 60%. This expansion aims to meet the rising demand for the two-in-one adhesive, which functions as both dicing tape and die-bonding film in semiconductor packaging. The new production facilities are scheduled to begin operations by 2026.

- In September 2023, Resonac Corporation, a prominent chemical company, partnered with Matmerize Inc., an AI-driven materials science startup, to drive innovation in semiconductor materials development for 6G technology. This strategic collaboration is expected to accelerate advancements in the field.

- In January 2023, Linde completed the acquisition of nexAir, LLC, a leading independent packaged gas distributor in the U.S. This move strengthened Linde’s existing operations and expanded its footprint in the Southeast. NexAir, which generated approximately USD 400 million in revenue in 2022, was previously partially owned by Linde, which held a minority stake since 2012. With this acquisition, Linde has now obtained full ownership by acquiring the remaining 77.2% stake.

- In December 2022, FUJIFILM Corporation announced plans to build a new semiconductor materials manufacturing facility in South Korea. This facility, dedicated to producing color filter materials for image sensors, is expected to commence operations in spring 2024. The project emphasizes high-quality, high-performance production using cutting-edge manufacturing techniques and advanced evaluation equipment.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 85.2 Bn |

| Forecast Value (2034) |

USD 146.9 Bn |

| CAGR (2025–2034) |

6.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 20.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material Type (Solid, Liquid, and Gas), By Product Type (Silicon wafers, Photoresists, PCB Laminates, Specialty gases, Wet chemicals and solvents, and Others), By End Use (Semiconductors & Integrated Circuits, and Printed Circuit Boards) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Air Products & Chemicals Inc., Bayer AG, Albemarle Corporation, Ashland, BASF SE, Air Liquide Electronics, Merck KGaA, Honeywell International Inc., Cabot Corporation., Linde PLC., Dow, Hitachi, Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Electronics Chemicals and Materials Market?

▾ The Global Electronics Chemicals and Materials Market size is estimated to have a value of USD 85.2

billion in 2025 and is expected to reach USD 146.9 billion by the end of 2033.

Which region accounted for the largest Global Electronics Chemicals and Materials Market?

▾ Asia-Pacific is expected to be the largest market share for the Global Electronics Chemicals and Materials

Market with a share of about 42.5% in 2025.

Who are the key players in the Global Electronics Chemicals and Materials Market?

▾ Some of the major key players in the Global Electronic Chemicals and Materials Market are Air Products & Chemicals Inc., BASF SE, Dow, and many others.

What is the growth rate in the Global Electronics Chemicals and Materials Market?

▾ The market is growing at a CAGR of 6.2 percent over the forecasted period.

How big is the US Electronics Chemicals and Materials Market?

▾ The US Electronics Chemicals and Materials Market size is estimated to have a value of USD 20.1 billion

in 2025 and is expected to reach USD 33.5 billion by the end of 2033.