Market Overview

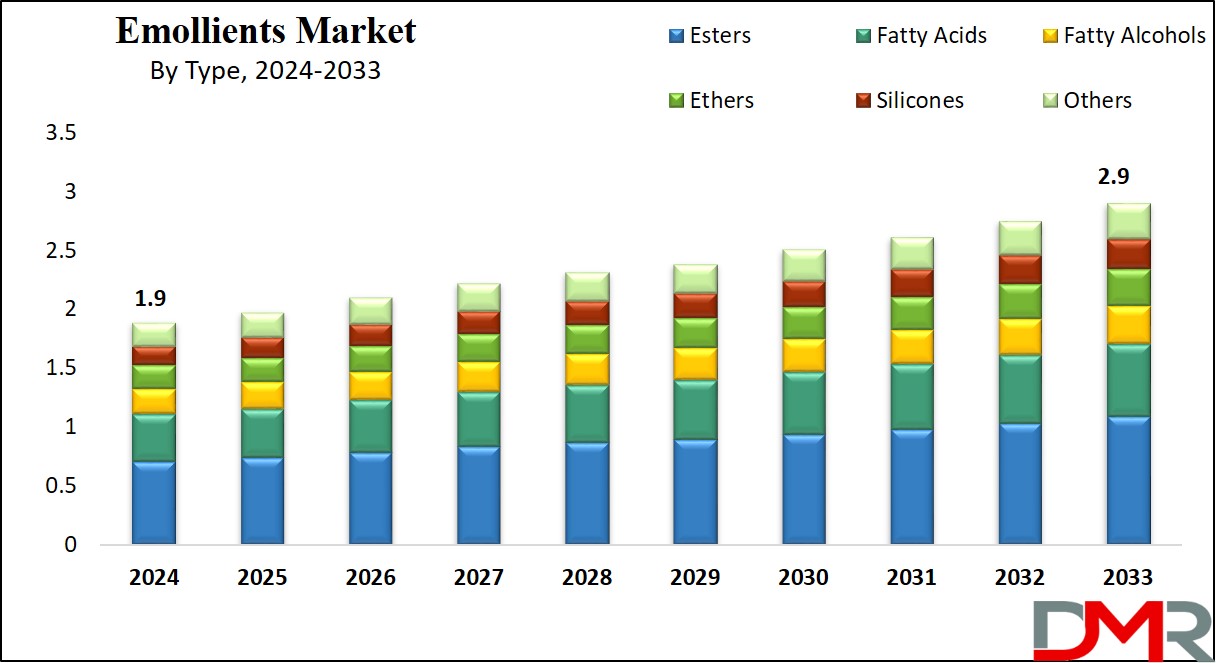

The Global Emollients Market is projected to reach

USD 1.9 billion in 2024 and grow at a compound annual growth rate of

4.9% from there until 2033 to reach a value of

USD 2.9 billion.

Emollients are substances used in skincare products to soften, hydrate, and protect the skin. They create a protective barrier that helps prevent moisture loss, making them important for people with dry, sensitive, or irritated skin. Commonly found in creams, lotions, balms, and ointments, emollients like ingredients like shea butter, cocoa butter, mineral oil, petrolatum, and natural oils including coconut or jojoba oil. Dermatists often recommend them to soothe skin conditions like eczema, psoriasis, and dermatitis.

Further, emollient demand has steadily increased due to a rise in awareness about skincare and overall wellness. People are prioritizing self-care and healthy skin; emollients have become a major component in daily skincare routines.

Also, as climate change leads to extreme weather patterns like harsh winters and hot, dry summers, more people are looking for products that can combat dryness and protect the skin. The growing number of skin-related health issues and a rise in the aging population, who need more hydration-focused products, have further fueled the demand for emollients.

Also, sustainability is a major trend influencing the emollients market in recent times. Consumers are mostly looking for eco-friendly and ethically sourced ingredients, driving brands to adopt sustainable practices. Plant-based and vegan emollients derived from renewable sources like algae, soy, or avocado oil are gaining popularity. Another major trend is innovation in multifunctional products that integrate hydration with anti-aging, sun protection, or calming properties, providing consumers more value in a single product.

Also, it saw major innovations in the emollients market, like development in biotech-driven formulations. Companies are now using lab-grown ingredients to stimulate natural emollients, minimizing environmental impact. In addition, regulatory changes and certifications like “clean beauty” or “cruelty-free” labels have emerged as important factors in product launches. Also in 2024, new product lines are expected to focus more on inclusivity, offering solutions for diverse skin tones and types, as brands address the increase in demand for personalized skincare.

Furthermore, the market is growing, but there are challenges like high costs linked with developing sustainable and eco-friendly formulations. Also, consumer awareness about potential allergens or irritants in synthetic emollients has encouraged manufacturers to invest in safer, natural alternatives.

However, this challenge is also an opportunity for brands to build trust and loyalty by promoting transparency in their ingredient lists. Emerging markets, mainly in Asia and Latin America, also provide growth opportunities as urbanization and disposable incomes rise.

Looking ahead, the emollient market is expected to steady growth, driven by innovation, sustainability, and a transformation toward holistic skincare. Brands that prioritize clean, safe, and effective formulations while addressing specific consumer needs will thrive. Educational campaigns to inform consumers about the benefits of emollients and their role in skin health can further improve market growth. Lastly, partnerships between cosmetic brands and dermatologists may boost credibility, supporting more consumer's trust and adopt emollient-rich skincare products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

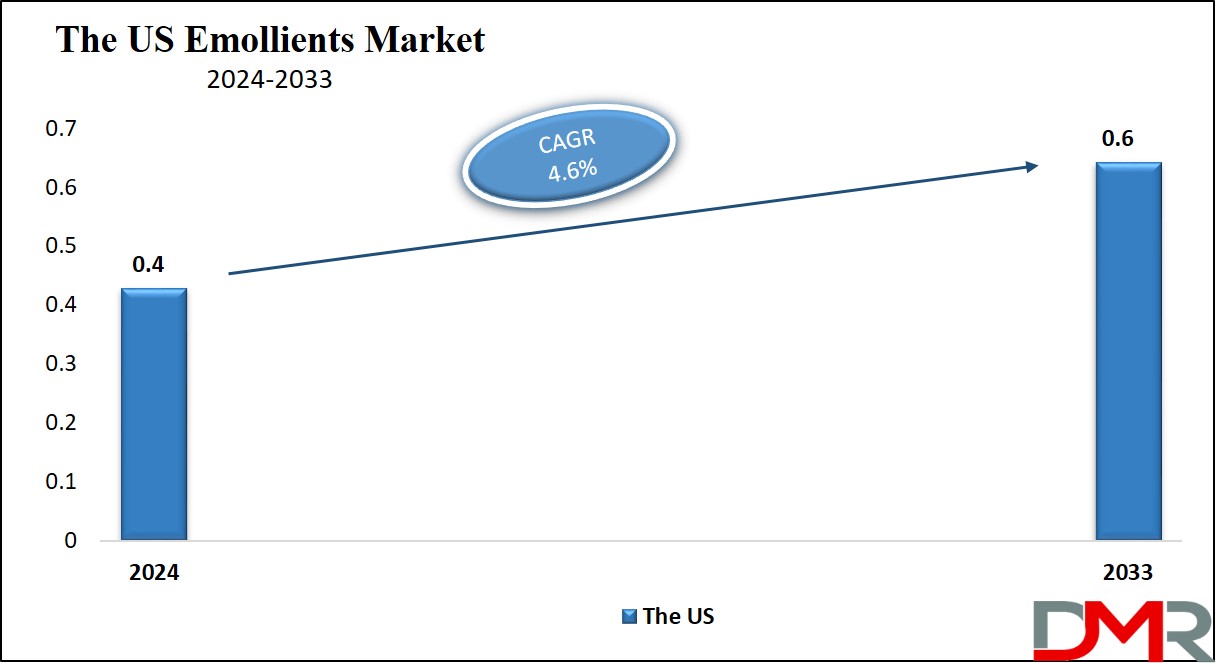

The US Emollients Market

The US Emollients Market is projected to reach

USD 0.4 billion in 2024 at a compound annual growth rate of

4.6% over its forecast period.

The U.S. emollient market provides growth opportunities driven by a rise in consumer demand for skincare and beauty products, mainly those aimed at hydration and anti-aging. Rising awareness of natural, sustainable ingredients and plant-based emollients is driving innovation. In addition, the increased trend of wellness and self-care, along with higher disposable incomes, further contributes to the market’s expansion.

Further, the market is driven by an increase in consumer demand for skincare products, mainly those focused on hydration, anti-aging, and natural ingredients. Higher awareness of sustainable, plant-based emollients further boosts growth. However, high production costs linked with eco-friendly formulations and potential allergic reactions to certain ingredients pose challenges, limiting broader adoption among sensitive consumers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key Takeaways

- Market Growth: The Emollients Market size is expected to grow by USD 0.9 billion, at a CAGR of 4.9% during the forecasted period of 2025 to 2033.

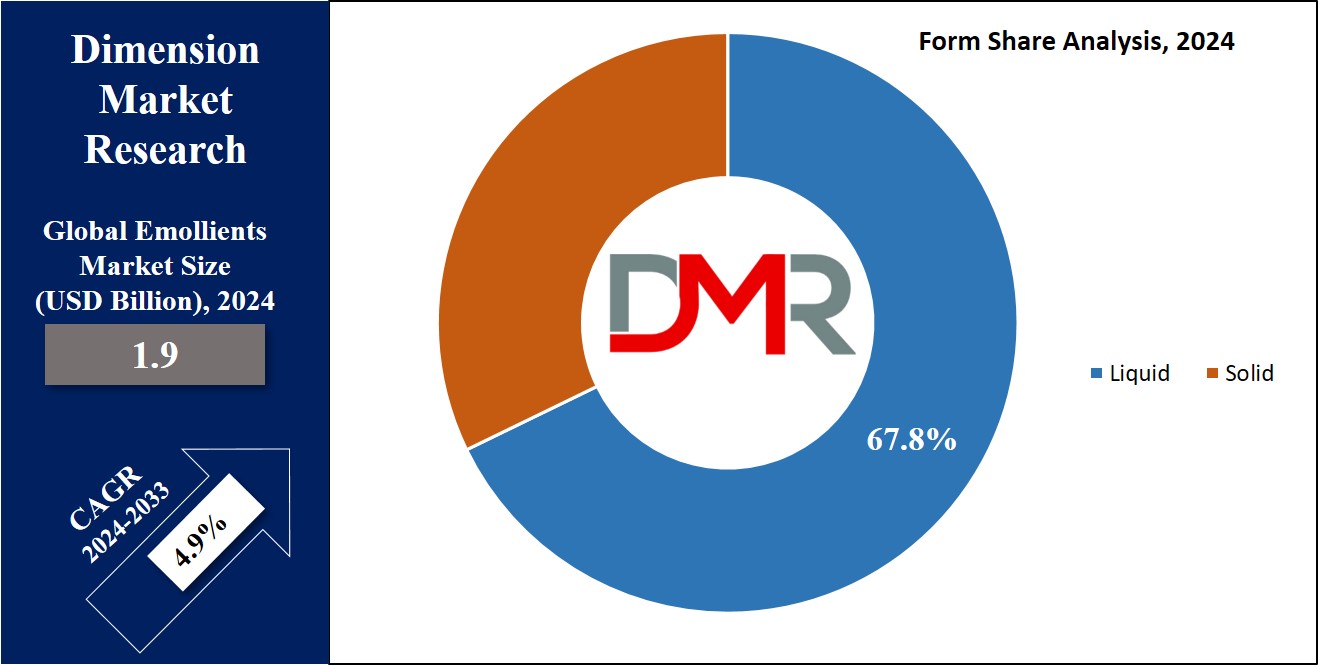

- By Form: The liquid segment is anticipated to get the majority share of the Emollients Market in 2024.

- By Application: The skin care is expected to be leading the market in 2024

- By Type: The esters segment is expected to get the largest revenue share in 2024 in the Emollients Market.

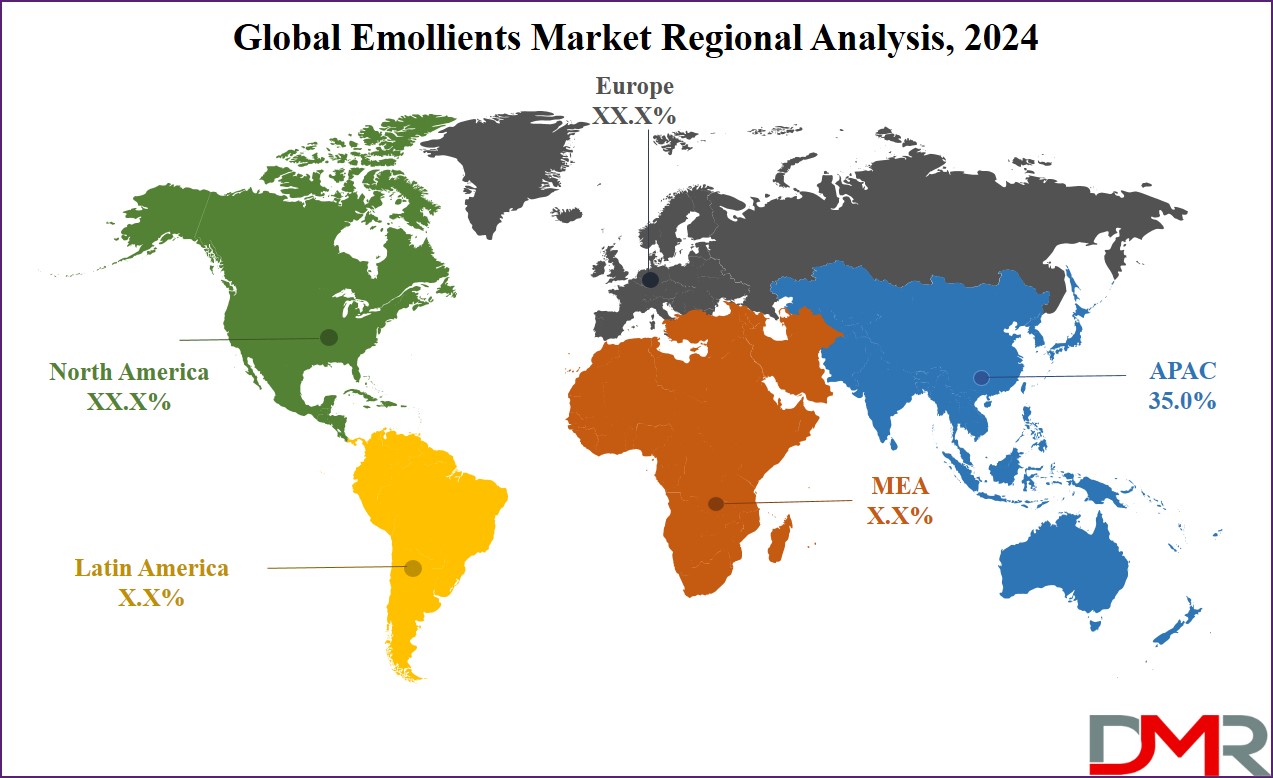

- Regional Insight: Asia Pacific is expected to hold a 35.0% share of revenue in the Global Emollients Market in 2024.

- Use Cases: Some of the use cases of Emollients include skin hydration, everyday skincare, and more.

Use Cases:

- Skin Hydration: Emollients lock in moisture and prevent water loss, making them ideal for treating dry or flaky skin and maintaining smooth, supple skin.

- Soothing Skin Conditions: They help minimize symptoms of eczema, psoriasis, dermatitis, and other irritations by forming a protective barrier and reducing inflammation.

- Post-Treatment Care: Mostly recommended after medical treatments like laser therapy or chemical peels to encourage healing and reduce irritation.

- Everyday Skincare: Used in daily routines for softening rough areas, preventing chapping, and improving complete skin health.

Market Dynamic

Driving Factors

Rising Demand for Skincare and Wellness

The rise in awareness about skin health and the vitality of hydration is a major driver of the emollients market. Consumers are integrating emollient-based products into daily routines to help dryness and maintain skin elasticity, mainly in extreme weather conditions. The rising number of skin conditions like eczema and psoriasis further boosts demand. In addition, the aging population is driving interest in anti-aging products with emollient properties. Urbanization and lifestyle transforms in emerging markets also contribute to this growth.

Sustainability and Natural Ingredients Trend

The global transformation toward eco-friendly and natural products is driving innovation in the emollients market. Consumers are looking for plant-based, renewable, and cruelty-free ingredients, creating manufacturers to develop sustainable formulations. Regulatory pressures and certifications like “clean beauty” are driving brands to adopt greener practices. Developments in biotechnology, such as lab-grown natural emollients, are gaining traction as they address sustainability concerns, which appeals to environmentally conscious buyers, driving market expansion.

Restraints

High Costs of Sustainable Ingredients

The transition to eco-friendly and natural emollients creates a cost challenge for manufacturers. Sourcing plant-based or lab-grown ingredients is mostly expensive, leading to large production costs, which can result in premium pricing, which may limit the market reach, mainly in price-sensitive regions. In addition, developing sustainable packaging further adds to costs. These factors can impact the adoption of emollient products, mainly in emerging markets.

Allergy and Sensitivity Concerns

Some emollients, especially synthetic or petroleum-based ones, can create allergic reactions or skin irritation in sensitive individuals. Consumer awareness about potential risks has increased, creating hesitancy in using products with certain ingredients. Natural emollients, while perceived as safer, can also trigger allergies (e.g., nut-derived oils). Strict regulatory scrutiny and the demand for hypoallergenic formulations add to development challenges. These concerns may limit consumer confidence in certain products.

Opportunities

Emerging Markets and Urbanization

Quick urbanization and growth in disposable incomes in developing regions like Asia-Pacific and Latin America provide major growth opportunities for the emollients market. As consumers in these regions adopt modern skincare routines, the need for moisturizing and protective products is increasing. Expanding awareness campaigns about skin health can further drive adoption. In addition, the untapped potential for customized emollient products designed for diverse skin types and climates enhances market opportunities.

Innovation in Multifunctional Products

The increase in demand for convenience is driving interest in multifunctional skincare products that integrate hydration with benefits like anti-aging, sun protection, or skin barrier repair, which opens opportunities for brands to create innovative formulations that meet these needs. Development in biotechnology and sustainable ingredients also allow the development of high-performance, eco-friendly emollients. In partnership with dermatologists, personalized skincare solutions can help brands gain a competitive edge in this evolving market.

Trends

Shift Toward Plant-Based and Vegan Emollients

Consumers are highly favoring natural, plant-based, and vegan skincare products as part of the clean beauty movement. Ingredients like shea butter, avocado oil, and algae-based emollients are gaining popularity for their eco-friendly and renewable nature. Brands are aiming for transparent sourcing and eco-certifications to align with consumer preferences, which reflects a major demand for ethical and sustainable solutions in the emollient market. As a result, plant-based innovations are driving product development and market differentiation.

Rise of Biotech and Lab-Grown Ingredients

Biotechnology is emerging as a transformative trend in the emollients market, with companies developing lab-grown or bio-identical versions of natural ingredients. These solutions minimize dependence on traditional farming, reduce environmental impact, and ensure consistent quality. Such innovations meet both sustainability goals and consumer demand for high-performance skincare. The trend is mainly appealing to eco-conscious buyers and brands looking to differentiate through advanced science, which marks a significant evolution in emollient production and formulation.

Research Scope and Analysis

By Form

The liquid segment is anticipated to hold the largest share of revenue in the emollients market in 2024 and is expected to maintain its dominance during the forecast period, as they are most commonly found in liquid form, making them versatile for use in many personal care products. Natural emollients, like fatty acids, oils, and lipids, are predominantly available in liquid form and are highly used in formulations for hydration and skin protection.

Further, synthetic emollients like butylene glycol and capric/caprylic triglyceride are also provided in liquid form due to their adaptability in developing liquid-based personal care products. These include creams, lotions, moisturizers, and shampoos, which are important staples in the beauty and skincare industry. The popularity of liquid emollients is driven by their ease of formulation and wide-ranging applications.

Further, the solid segment is expected to experience the fastest growth over the forecast period. Industry players are mostly offering semi-solid, powdered, and waxy-solid emollients to meet the transforming needs of personal care and cosmetics manufacturers.

Solid emollients are gaining traction due to their longer shelf life and enhanced stability, making them more convenient for storage and handling. Companies are constantly developing solid personal care products, like solid moisturizers and balms, to meet consumer demand for innovative and sustainable options, which highlights a shift toward diversifying product formats in the emollients market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Type

The emollients market is segmented by type into esters, fatty alcohols, ethers, fatty acids, and silicones. Among these, the esters segment is expected to dominate the market in terms of revenue in 2024 and maintain its dominant position during the forecast period. Esters, like isopropyl myristate, C12-15 alkyl benzoate, cetyl palmitate, and myristyl myristate, are broadly used in personal care formulations due to their versatility and beneficial properties.

These compounds are vital in creating smooth, lightweight textures in products like creams, lotions, and moisturizers, making them highly popular in the beauty and skincare industry. The large use of esters in many emollient formulations highlights their importance in meeting consumer demand for effective and comfortable skincare products.

Further, the fatty acid segment is expected to grow significantly during the forecast period. Fatty acids are valued for their unique emollient properties, mainly their ability to hydrate the skin by locking in moisture and preventing water loss. They also help minimize evaporation from the skin’s surface, improving its barrier function. Common fatty acids are used as emollients like glycerides, phospholipids, and sterols, which are broadly utilized in skincare products for their nourishing and protective qualities, which reflects increasing consumer interest in natural and effective skin-conditioning ingredients.

By Application

The skincare segment is anticipated to hold the largest share of revenue in the emollients market in 2024 and is expected to maintain its dominant position throughout the forecast period. This is primarily due to the widespread use of skin care products like moisturizers, creams, and lotions by consumers looking for effective solutions for hydration and skin protection. In addition, the growing demand for plant-based emollients is contributing to market growth.

Many personal care manufacturers are aiming to develop new products that incorporate plant-based oils, providing consumers with natural and effective options. As consumers are highly looking for products that align with their wellness and sustainability values, the use of plant-based emollients is constantly growing, fueling the overall growth of the skincare segment.

Further, the hair care segment is projected to grow at the fastest rate during the forecast period. As consumer awareness of beauty and personal care constantly grows, the need for hair care products like shampoos, conditioners, hair masks, and gels is expanding.

Emollients are broadly used in these products to help hydrate and nourish the hair, ensuring it stays smooth and healthy-looking. With more people prioritizing their hair care routines and looking for products that provide both hydration and protection, the use of emollients in the hair care market is set to increase, driving major growth in this segment, which reflects broader trends in personal care and wellness, where consumers are highly invested in improving both skin and hair health.

The Emollients Market Report is segmented on the basis of the following

By Form

By Type

- Esters

- Fatty Acids

- Fatty Alcohols

- Ethers

- Silicones

- Others

By Application

- Skin Care

- Hair Care

- Deodorants

- Oral Care

- Others

Regional Analysis

The Asia-Pacific region is expected to lead the global emollients market in 2024, holding an estimated

35% of the total revenue share, which is expected to continue in the coming years, driven by transforming fashion preferences and a growing focus on improving personal appearance across Asian countries.

Further, the rise in awareness about skincare routines and products, along with a rising middle class with higher disposable income, has driven the demand for emollient-based cosmetics. Moreover, the region benefits from being home to major manufacturers and suppliers, ensuring steady product availability and innovation. These factors together make Asia-Pacific a major player in shaping global market trends.

Further, North America is expected to see rapid growth in the emollients market during the forecast period, which is primarily driven by the rising popularity of cosmetics and personal care products in the US. Changing consumer lifestyles, with a stronger focus on self-care and beauty, are driving the need for skincare solutions.

In addition, a large interest in wellness and anti-aging products, along with a rise in willingness to invest in premium cosmeceuticals, is driving market growth in the region. As consumers highly prioritize high-quality skincare and beauty products, North America’s emollients market is set for significant development in the years ahead.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The emollients market is highly competitive, with various global and regional players looking to meet different consumer needs. Companies are aiming for innovation, providing sustainable, plant-based, and multifunctional products to stay ahead. The market is also influenced by growth in consumer awareness about clean beauty, encouraging brands to adopt eco-friendly practices and transparent labeling.

Further, regional players often meet local preferences, while global brands invest in advanced formulations and marketing strategies. With the rise in demand, partnerships, product differentiation, and sustainability initiatives are key factors shaping the competitive landscape.

Some of the prominent players in the Global Emollients are:

- BASF SE

- Eastman Chemical Company

- Evonik Industries AG

- Solvay

- Covestro AG

- The Lubrizol Corporation

- Clariant

- Hallstar

- The Lubrizol Corporation

- Cargill

- Other Key Players

Recent Developments

- In December 2024, Azelis announced a new distribution agreement with AAK, a leading supplier of sustainably sourced, technologically advanced plant-based ingredients for the beauty and personal care industry. Following a successful commercial relationship between Azelis and AAK for Food & Nutrition in the Americas region, this is the first partnership with AAK in Asia Pacific. Its complete range of emollients, renowned for their high oxidative stability, is broadly used in skin care, hair care, and cosmetic applications.

- In September 2024, P2 Science launched two innovative products: Citropol® DE-4 and Citropol® V6 for cosmetics and personal care. Citropol® is a rising family of natural-based ingredients that is redefining the beauty industry. Made from upcycled forest-derived terpenes, consciously sourced materials, and a transforming clean process, Citropol products are biodegradable for sustainability from start to finish, which marks a major milestone in beauty industry innovation as the first new liquid polymeric emollients launched since silicones.

- In September 2024, Evonik inaugurated its new production plant for cosmetic emollients at its site in Steinau, Germany. These esters are manufactured using an enzymatic process. The double-digit million-euro plant will mostly increase Evonik’s production capacity, which will meet the rising customer demand for sustainable cosmetic emollients, and will help reduce the climate footprint of Evonik and the cosmetic formulations of its customers.

- In August 2024, Oleon Health & Beauty launched Radiastar 1436, a vegetable-based multibranched Guerbet alcohol, which offers remarkable performance across a broad range of applications in the beauty and cosmetics industry, providing great film-forming properties, a sensational sensorial profile, and a soft, cushioning touch with fantastic gloss.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1.9 Bn |

| Forecast Value (2033) |

USD 2.9 Bn |

| CAGR (2024-2033) |

4.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 0.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Form (Liquid and Solid), By Type (Esters, Fatty Acids, Fatty Alcohols, Ethers, Silicones, and Others), By Application (Skin Care, Hair Care, Deodorants, Oral Care, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BASF SE, Eastman Chemical Company, Evonik Industries AG, Solvay, Covestro AG, The Lubrizol Corporation, Clariant, Hallstar, The Lubrizol Corporation, Cargill, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Emollients Market?

▾ The Global Emollients Market size is expected to reach a value of USD 1.9 billion in 2024 and is expected to reach USD 2.9 billion by the end of 2033.

Which region accounted for the largest Global Emollients Market?

▾ Asia Pacific is expected to have the largest market share in the Global Emollients Market with a share of about 35.0% in 2024.

How big is the Emollients Market in the US?

▾ The Emollients Market in the US is expected to reach USD 0.4 billion in 2024.

Who are the key players in the Global Emollients Market?

▾ Some of the major key players in the Global Emollients Market are BASF SE, Eastman Chemical Company, Evonik Industries AG, and others

What is the growth rate in the Global Emollients Market?

▾ The market is growing at a CAGR of 4.9 percent over the forecasted period.