Market Overview

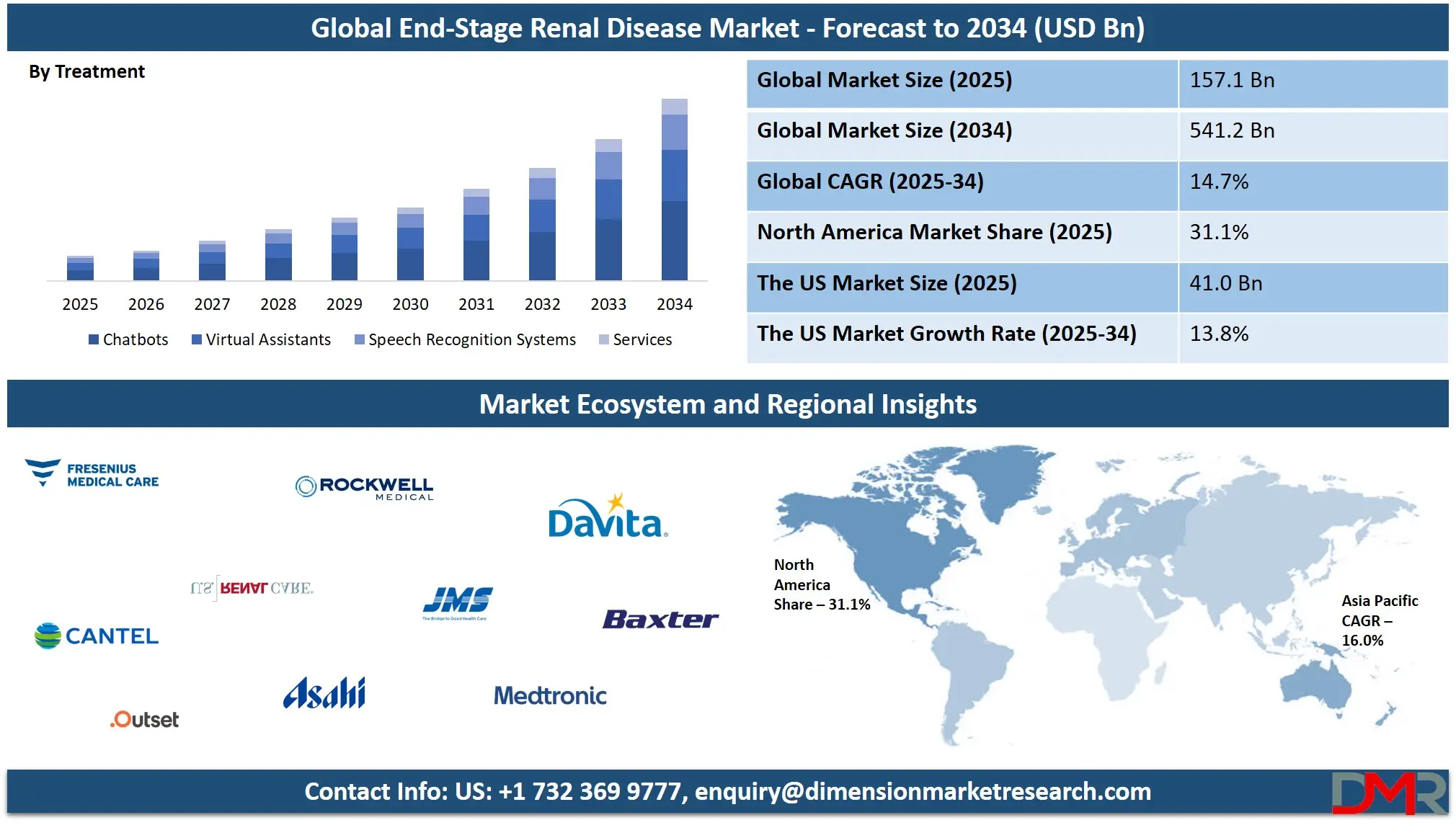

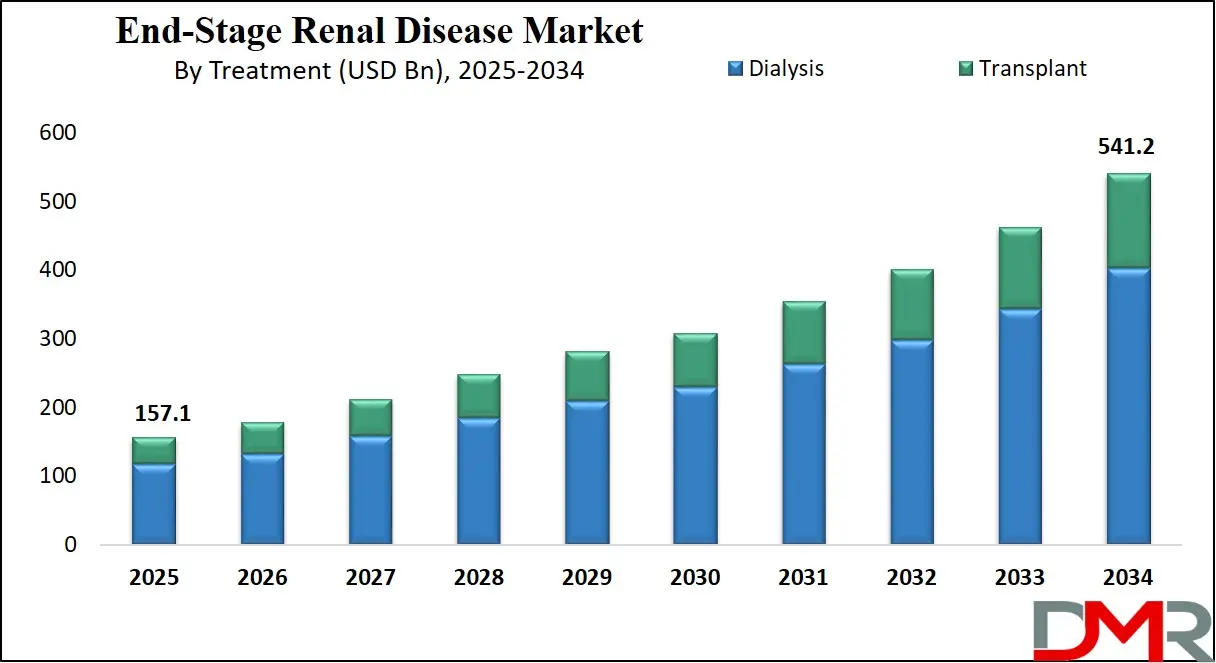

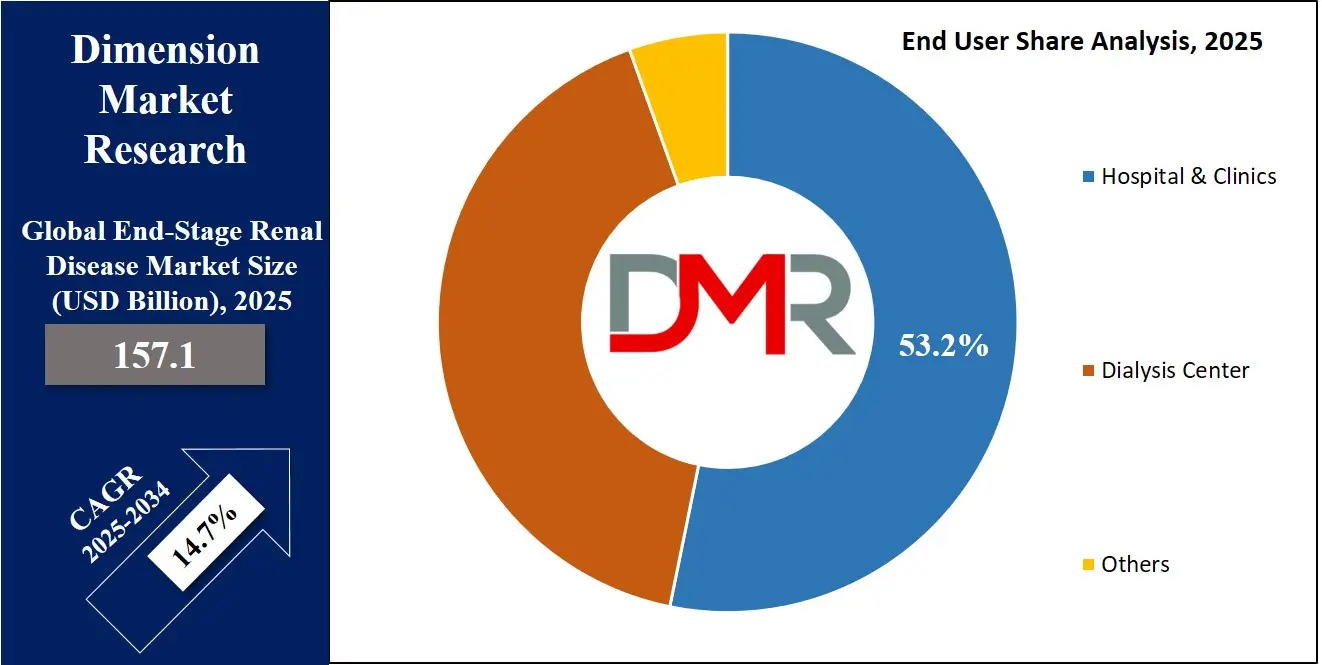

The Global End-Stage Renal Disease Market size is projected to reach USD 157.1 billion in 2025 and grow at compound annual growth rate of 14.7% from there until 2034 to reach a value of USD 541.2 billion.

End-Stage Renal Disease (ESRD), also known as kidney failure, is the final and most serious stage of chronic kidney disease. At this point, the kidneys have lost nearly all of their function and can no longer filter waste products, balance fluids, or maintain necessary electrolytes. People with ESRD need long-term treatment such as dialysis or a kidney transplant to survive. This condition can result from several causes, including diabetes, high blood pressure, and other chronic kidney issues that worsen over time.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The demand for ESRD treatment has been growing steadily. One major reason is the increase in lifestyle-related conditions such as diabetes and hypertension. As these health problems become more common around the world, more people are developing kidney damage, which can eventually lead to ESRD. Additionally, with people living longer lives, the number of older adults who are at risk of kidney disease is also increasing. This is placing more pressure on healthcare systems to provide long-term care options like dialysis centers and organ transplant services.

In recent years, technological improvements have made treatment for ESRD more accessible and efficient. Portable dialysis machines and home-based treatment options have made it easier for patients to manage their condition without frequent hospital visits. At the same time, there have been efforts to make kidney transplants more successful, including better matching systems and improved medication to prevent organ rejection. Researchers are also working on artificial kidneys, which may one day offer new hope to patients.

Several global health organizations and governments have started focusing more on kidney health due to the increasing burden of ESRD. Awareness campaigns, early screening programs, and better access to healthcare in rural and underserved areas are some of the key steps being taken. These initiatives are aimed at detecting kidney disease early before it progresses to ESRD. Despite these efforts, many patients are still diagnosed late, when the only options left are dialysis or transplant.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Another notable trend is the growing role of private healthcare companies and specialized clinics in providing ESRD care. With public health systems often overloaded, private providers are stepping in with advanced treatment facilities and faster access to care. Partnerships between governments and private companies are also helping to expand dialysis networks and reduce patient waiting times for transplants.

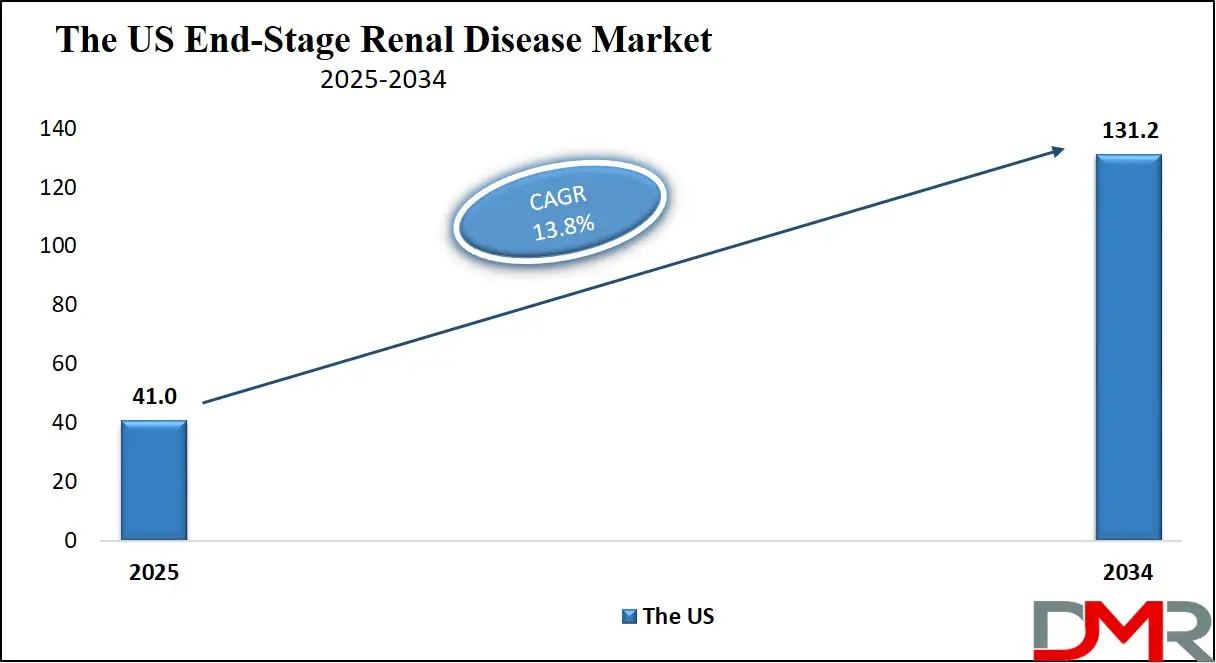

The US End-Stage Renal Disease Market

The US End-Stage Renal Disease Market size is projected to reach USD 41.0 billion in 2025 at a compound annual growth rate of 13.8% over its forecast period.

The US plays a major role in the End-Stage Renal Disease (ESRD) market due to its advanced healthcare infrastructure, large patient population, and strong focus on innovation. With a high prevalence of chronic diseases like diabetes and hypertension, the US has one of the largest ESRD patient bases globally. The country invests heavily in dialysis services, transplant programs, and research into new treatments and technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Government support, through programs like Medicare, ensures broader access to dialysis and transplant care. Additionally, the US is home to major medical companies and clinical research centers that drive advancements in ESRD management. This combination of demand, funding, and innovation places the US at the center of global ESRD market developments.

Europe End-Stage Renal Disease Market

Europe End-Stage Renal Disease Market size is projected to reach USD 36.1 billion in 2025 at a compound annual growth rate of 14.2% over its forecast period.

Europe holds a significant role in the End-Stage Renal Disease (ESRD) market due to its well-established healthcare systems, strong regulatory frameworks, and focus on patient-centered care. Many European countries provide universal healthcare, making dialysis and transplant services more accessible to a wide population. The region also emphasizes early detection and prevention through national screening programs and chronic disease management. Europe is known for its adoption of advanced medical technologies and support for home-based dialysis, helping reduce pressure on hospital resources. Collaborative research across countries and funding from public health bodies further drive innovation in ESRD treatment. Europe’s balanced approach to accessibility, technology, and public health policy makes it a key contributor to the global ESRD market landscape.

Japan End-Stage Renal Disease Market

Japan End-Stage Renal Disease Market size is projected to reach USD 10.2 billion in 2025 at a compound annual growth rate of 14.8% over its forecast period.

Japan plays a vital role in the End-Stage Renal Disease (ESRD) market due to its advanced medical infrastructure, high standard of care, and aging population. The country has a well-developed dialysis network, with a strong focus on in-center hemodialysis supported by trained professionals and modern equipment. Japan is known for its innovation in dialysis technology and commitment to patient safety and comfort. Preventive healthcare is also a key focus, with regular check-ups and early intervention practices helping to manage chronic kidney conditions. Additionally, Japan’s healthcare system supports long-term treatment and research into improved therapies. Its contributions in technology, clinical care, and patient management position Japan as a major player in shaping the ESRD market across Asia and beyond.

End-Stage Renal Disease Market: Key Takeaways

- Market Growth: The End-Stage Renal Disease Market size is expected to grow by USD 363.3 billion, at a CAGR of 14.7%, during the forecasted period of 2026 to 2034.

- By Treatment: The dialysis is anticipated to get the majority share of the End-Stage Renal Disease Market in 2025.

- By End User: The hospitals & clinics segment is expected to get the largest revenue share in 2025 in the End-Stage Renal Disease Market.

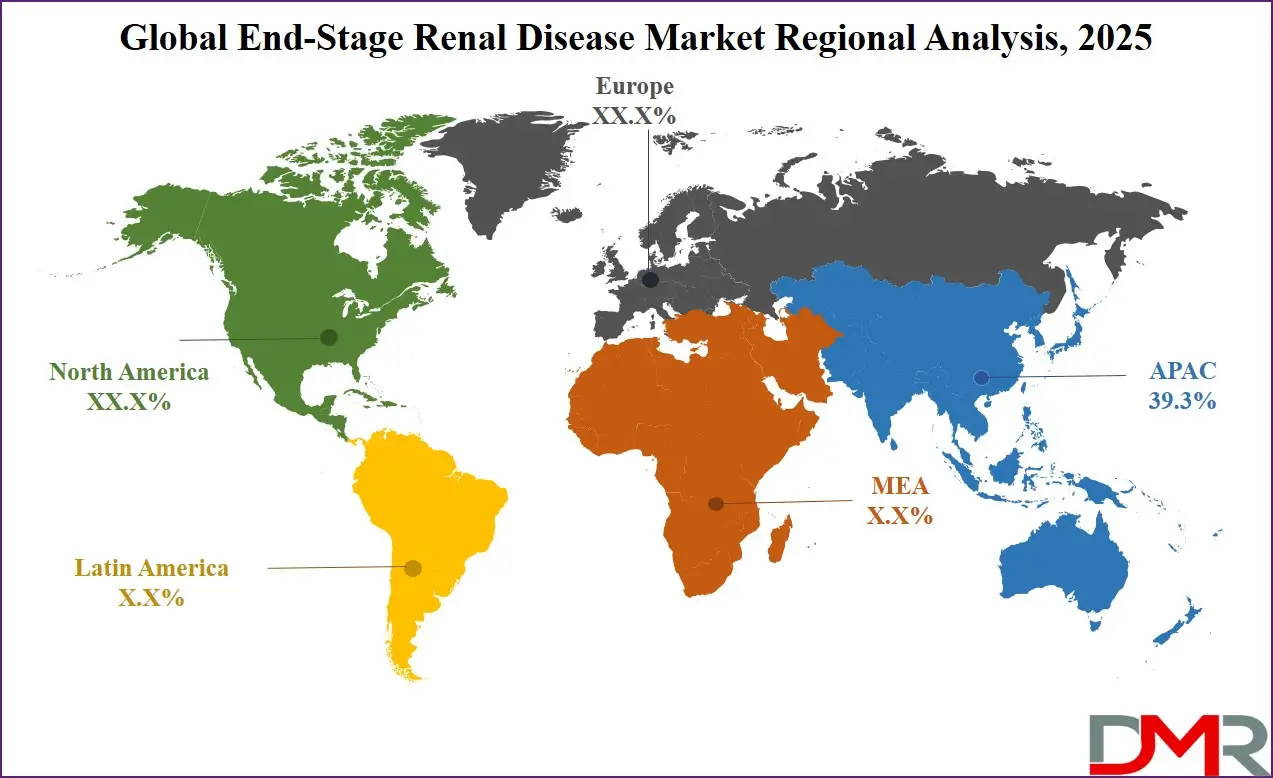

- Regional Insight: Asia Pacific is expected to hold a 39.3% share of revenue in the Global End-Stage Renal Disease Market in 2025.

- Use Cases: Some of the use cases of End-Stage Renal Disease include kidney transplant programs, remote patient monitoring, and more.

End-Stage Renal Disease Market: Use Cases

- Dialysis Treatment Management: Dialysis is a key use case in managing ESRD, helping remove waste and excess fluids when kidneys can no longer function. Both in-center and at-home dialysis options are used based on patient needs and condition. Regular dialysis treatments are essential for maintaining life in patients who are not eligible for immediate transplants.

- Kidney Transplant Programs: Kidney transplantation offers a more long-term solution for ESRD patients. Hospitals and transplant centers use advanced screening and matching systems to identify suitable donors. Ongoing care and medication are critical after the transplant to ensure the new kidney functions properly.

- Remote Patient Monitoring: Digital tools and wearable devices are now being used to track patient vitals and treatment responses. This helps doctors make better decisions without frequent clinic visits. It also improves patient comfort and supports early detection of complications.

- Chronic Disease Management Support: Many ESRD patients suffer from diabetes or hypertension, which also need constant care. Integrated care plans help manage these conditions alongside kidney failure. This coordinated approach improves quality of life and slows disease progression.

Market Dynamic

Driving Factors in the End-Stage Renal Disease Market

Rising Prevalence of Chronic Conditions

One of the main growth drivers for the End-Stage Renal Disease market is the increasing number of people living with chronic conditions like diabetes and hypertension. These diseases are leading causes of long-term kidney damage and are becoming more widespread due to unhealthy lifestyles, poor diets, and lack of physical activity. As these conditions continue to grow globally, especially in aging populations, more individuals are developing chronic kidney disease that progresses to ESRD. This drives demand for dialysis, kidney transplants, and long-term renal care services. In both developed and developing regions, healthcare systems are being pushed to invest in infrastructure and technology to meet the growing needs of ESRD patients. This upward trend is expected to continue, fueling market growth.

Technological Advancements in Treatment

Ongoing innovation in ESRD treatment technologies is another powerful driver of market growth. New and improved dialysis machines, home-based treatment options, and wearable monitoring tools are making care more effective and convenient. These advancements not only improve patient outcomes but also help reduce the burden on hospitals and care providers. Telemedicine and digital health platforms are enabling remote consultations and better tracking of patient health, which supports early intervention and fewer complications. Additionally, research into bioartificial kidneys and stem-cell therapy is opening up promising new treatment possibilities. As these technologies become more widely available, they are likely to attract more investment and expand access to care, further supporting the market’s growth trajectory.

Restraints in the End-Stage Renal Disease Market

High Cost of Treatment and Limited Accessibility

One of the major restraints in the End-Stage Renal Disease market is the high cost associated with long-term care such as dialysis and kidney transplantation. These treatments require expensive equipment, skilled medical staff, and regular monitoring, which can place a heavy financial burden on both patients and healthcare systems. In many low- and middle-income countries, access to quality renal care is limited due to lack of infrastructure and funding. Even in advanced economies, the out-of-pocket expenses for patients can be significant, especially when insurance coverage is inadequate. This financial barrier often leads to delayed or inconsistent treatment, worsening patient outcomes. As a result, market growth is slowed by affordability challenges and unequal access to care.

Shortage of Donors and Skilled Professionals

Another key restraint is the shortage of organ donors and trained medical professionals in the ESRD space. Kidney transplantation, while a preferred long-term solution, depends heavily on the availability of compatible donors, which remains limited worldwide. Long waiting lists and strict eligibility criteria further reduce access to this option. At the same time, there is a growing demand for specialized nephrologists, dialysis technicians, and transplant surgeons, but the supply of trained personnel has not kept pace. This gap leads to delays in treatment, increased workload for existing staff, and compromised care quality in many regions. These human resource and supply chain limitations significantly hinder the scalability of ESRD treatment solutions.

Opportunities in the End-Stage Renal Disease Market

Expansion of Home-Based Dialysis Solutions

A growing opportunity in the End-Stage Renal Disease market lies in the expansion of home-based dialysis treatments. As healthcare systems aim to reduce hospital congestion and lower treatment costs, home dialysis is gaining popularity for its convenience and patient-centered approach. It allows individuals to manage their condition more flexibly, improving quality of life and treatment adherence. Technological improvements, such as compact and user-friendly dialysis machines, are making at-home care more practical and effective. Training programs for patients and caregivers are also supporting this transition. With rising demand for personalized and remote care options, companies that develop and deliver home dialysis solutions are well-positioned for growth. This shift could also reduce healthcare costs and resource pressure in the long term.

Adoption of Digital Health and AI Tools

The increasing use of digital health technologies and artificial intelligence offers a major opportunity to transform ESRD management. Smart monitoring devices, telehealth platforms, and AI-driven data analytics can improve early detection, personalize treatment plans, and enhance patient monitoring. These tools support better decision-making by healthcare providers and help identify issues before they become serious. Digital platforms also improve communication between patients and doctors, leading to more responsive care. In regions with limited access to nephrology specialists, telemedicine can bridge the gap and extend quality care to remote areas. As the healthcare sector continues to digitalize, the integration of AI and digital tools into ESRD care is expected to open new pathways for innovation and improved outcomes.

Trends in the End-Stage Renal Disease Market

Growing Shift to Personalized Care Models

A key recent trend in the ESRD market is the move toward more personalized care plans tailored to each patient’s needs. Instead of relying solely on traditional in-center dialysis schedules, healthcare providers are offering flexible treatment regimens that consider a patient’s lifestyle, health condition, and preferences. This includes options like home dialysis, nocturnal therapy, and incremental treatment schedules. Patients now receive more education and hands-on training, empowering them to take charge of their own treatment. Personalized approaches help improve treatment adherence, overall health outcomes, and patient satisfaction, while supporting a more sustainable use of healthcare resources.

Increased Emphasis on Preventive and Early Intervention Programs

Another emerging trend involves a stronger focus on preventing ESRD before it progresses to its most severe stage. Healthcare systems are implementing early intervention programs that screen at-risk populations—such as people with diabetes, hypertension, or a family history of kidney disease—for early signs of reduced kidney function. Educational efforts and community outreach are also being used to promote healthy lifestyle changes, medication adherence, and routine check-ups. These initiatives aim to slow disease progression and cut down on the need for costly dialysis or transplants. By focusing on prevention and early care, the market is adapting to deliver more holistic and proactive patient care.

Impact of Artificial Intelligence in End-Stage Renal Disease Market

Artificial Intelligence (AI) is making a strong impact on the End-Stage Renal Disease (ESRD) market by transforming how patients are diagnosed, monitored, and treated. AI algorithms can analyze large volumes of patient data to identify early signs of kidney decline, helping doctors detect chronic kidney disease before it reaches the end stage. These tools are also assisting in risk prediction, allowing healthcare professionals to develop personalized care plans based on a patient's medical history, lifestyle, and genetic factors. By using machine learning, AI helps improve accuracy in interpreting lab results, imaging scans, and real-time health metrics, reducing the chances of missed or delayed diagnoses. This is especially important in ESRD, where early intervention can slow disease progression and improve patient outcomes.

Beyond diagnosis, AI is also improving treatment planning and patient management in ESRD care. In dialysis, AI tools can adjust treatment settings in real-time, based on patient vitals, to increase safety and comfort. Remote monitoring systems powered by AI allow healthcare providers to track patients at home, reducing the need for hospital visits and improving long-term care. AI is also supporting kidney transplant processes by improving donor-recipient matching, predicting organ acceptance, and optimizing post-transplant care. With growing integration into hospital systems and dialysis centers, AI is enhancing efficiency, reducing costs, and allowing care teams to focus more on patients. As technology continues to evolve, AI is set to play an even bigger role in reshaping the ESRD landscape and supporting better care delivery across all stages of kidney failure.

Research Scope and Analysis

By Treatment Analysis

Dialysis is expected to lead the End-Stage Renal Disease market in 2025 with a projected share of 74.4%, driven by its widespread use and essential role in managing kidney failure. It remains the most accessible and commonly used treatment option, especially for patients waiting for transplants or those not eligible for surgery. Both hemodialysis and peritoneal dialysis are helping patients remove waste and excess fluid from the blood, offering a life-sustaining solution. The growing number of dialysis centers, rising acceptance of home dialysis, and improvements in dialysis machines are all supporting market expansion. As chronic kidney disease cases continue to increase, especially among aging and diabetic populations, dialysis will remain a key pillar in ESRD care across both developed and developing regions.

Transplant treatment is set to witness significant growth over the forecast period due to rising awareness and advancements in organ donation and surgical techniques. Kidney transplants offer a more permanent solution compared to dialysis and can greatly improve a patient’s quality of life. As healthcare systems invest in transplant infrastructure and improve donor matching technologies, more patients are gaining access to this life-saving procedure. Immunosuppressive therapies are also evolving, making post-transplant care more effective and reducing rejection risks. In many regions, efforts to reduce transplant wait times and promote organ donation are gaining momentum. With continued support from government policies and growing patient preference, transplant treatment is becoming a vital component in the overall growth of the End-Stage Renal Disease market.

By Diagnosis Analysis

Blood test will be the leading diagnostic segment in the End-Stage Renal Disease market in 2025, with an estimated share of 38.7%, due to its accuracy and ability to detect kidney function early. These tests measure levels of creatinine, urea, and glomerular filtration rate (GFR), helping doctors understand how well the kidneys are working. Since ESRD develops gradually, routine blood tests are essential for early detection and monitoring disease progression. Healthcare providers rely on these simple yet powerful tools to guide treatment decisions, track response, and adjust medication. The ease, affordability, and speed of blood testing make it a preferred choice in both primary care and specialist clinics. As awareness about chronic kidney disease grows, more people are undergoing routine screening, supporting the strong role of blood tests in market growth.

Imaging test is showing significant growth over the forecast period as a valuable tool in the diagnosis and evaluation of End-Stage Renal Disease. These tests, including ultrasound, CT scans, and MRI, help visualize the size, shape, and structure of the kidneys. They are essential in detecting abnormalities such as blockages, scarring, or shrinkage that can lead to or result from chronic kidney disease. Imaging is especially useful in planning treatment approaches like dialysis access placement or evaluating a patient for transplant eligibility. With advances in imaging technologies and greater availability in healthcare settings, the accuracy and usefulness of these tests have increased. As the need for detailed kidney assessment rises, imaging tests continue to support better clinical outcomes and contribute to the overall expansion of the ESRD diagnostic segment.

By End User Analysis

Hospital & clinics will be leading the End-Stage Renal Disease market in 2025 with a projected share of 53.2%, mainly due to their ability to offer comprehensive care under one roof. These healthcare facilities provide a full range of services, from early diagnosis and lab testing to advanced dialysis treatment and transplant procedures.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hospitals are also equipped with emergency services, critical care units, and experienced nephrologists, making them the primary choice for managing serious kidney-related complications. Clinics, especially those linked to larger hospitals, offer outpatient care and regular monitoring for ESRD patients. The growth of public and private hospitals, better healthcare access, and the expansion of specialized nephrology departments are all helping increase patient volume. Their integrated care models and wide availability play a vital role in supporting ESRD treatment and improving patient outcomes across regions.

Dialysis center is showing significant growth over the forecast period as a dedicated end-user segment for treating End-Stage Renal Disease. These centers focus specifically on providing regular dialysis treatments, making them a convenient and efficient option for patients requiring ongoing care. With the rising burden of kidney failure and limited transplant availability, more patients are relying on dialysis centers for routine, life-sustaining treatment.

Many of these facilities are expanding into smaller cities and rural areas, helping to close the care gap. Their ability to offer specialized services, trained staff, and flexible scheduling, including home dialysis support, makes them increasingly popular. As demand for dialysis grows, these centers are becoming a vital part of the ESRD treatment network, supporting both accessibility and consistent care delivery.

The End-Stage Renal Disease Market Report is segmented on the basis of the following:

By Treatment

- Dialysis

- Hemodialysis

- Peritoneal Dialysis

- Transplant

By Diagnosis

- Blood Test

- Urine Test

- Imaging Test

- Others

By End User

- Hospitals & Clinics

- Dialysis Centers

- Others

Regional Analysis

Leading Region in the End-Stage Renal Disease Market

Asia Pacific, leading the End-Stage Renal Disease market in 2025 with a share of 39.3%, continues to show strong growth due to rising cases of diabetes, hypertension, and other lifestyle-related diseases. The region's growing population, especially the aging group, is contributing to a higher number of ESRD cases. Countries like China, India, and Japan are witnessing a sharp increase in demand for dialysis services and kidney care due to changing lifestyles and limited early screening.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Improvements in healthcare access, expansion of dialysis centers, and rising awareness about kidney health are further driving market growth. Governments across the region are also supporting initiatives for affordable treatment and preventive care. In addition, the growing use of home dialysis, better medical technologies, and increased private sector involvement are helping meet the rising demand. With ongoing healthcare investments, the Asia Pacific region is becoming a crucial driver in the global End-Stage Renal Disease market through both care delivery and innovation..

Fastest Growing Region in the End-Stage Renal Disease Market

Latin America is showing significant growth in the End-Stage Renal Disease market over the forecast period due to rising cases of chronic kidney disease, diabetes, and high blood pressure. The region is seeing more demand for dialysis treatment, kidney transplants, and renal care services, especially in urban areas. Improved healthcare access, public awareness, and government programs are helping more patients get diagnosed and treated earlier. As more people suffer from lifestyle-related health issues, the need for renal replacement therapy is increasing. Growing investments in medical infrastructure and the adoption of new treatment technologies are also supporting the market. This growth highlights Latin America’s expanding role in the global ESRD landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the End-Stage Renal Disease (ESRD) market is shaped by a mix of specialized healthcare providers, medical device makers, and pharmaceutical companies. These players compete to offer better dialysis machines, improved treatment drugs, and more advanced transplant services. Many focus on creating home-based dialysis solutions and digital tools to monitor patient health remotely. Partnerships between hospitals, private clinics, and research centers are also growing, aiming to improve care quality and access. Competition is strong in both developed and developing regions, with companies racing to meet the rising demand for cost-effective, patient-friendly solutions. Innovation, affordability, and reliability are key factors that shape success in this fast-growing and life-saving healthcare market.

Some of the prominent players in the global End-Stage Renal Disease are

- Fresenius Medical Care

- Baxter International

- DaVita Inc.

- B. Braun Melsungen AG

- Nipro Corporation

- Asahi Kasei Medical

- Nikkiso Co., Ltd.

- Medtronic

- Cantel Medical

- Rockwell Medical

- Toray Medical Co., Ltd.

- Dialife SA

- JMS Co., Ltd.

- Satellite Healthcare

- Outset Medical

- AWAK Technologies

- Quanta Dialysis Technologies

- SWS Hemodialysis Care

- Kibow Biotech

- U.S. Renal Care

- Other Key Players

Recent Developments

- In June 2025, Vantive, formerly Baxter’s kidney care unit, announced an investment of USD 1 billion over five years to advance its kidney care and vital organ support offerings. The move follows its 2024 spin-out through a USD 3.5 billion divestment deal with global investment firm Carlyle. The investment will focus on enhancing R&D and expanding manufacturing capabilities. Vantive emphasizes the urgency of accelerating innovation to address the growing demand driven by rising cases of chronic kidney disease (CKD) and end-stage renal disease (ESRD), which cost Europe approximately USD 140 billion annually in healthcare expenses.

- In June 2025, Renalyx Health Systems unveiled India’s first indigenously developed AI-powered smart hemodialysis machine, RxT21, aimed at making renal care more affordable and accessible for End-Stage Renal Disease (ESRD) patients. Priced at INR 6.7 lakh, it is 20–25% cheaper than imported alternatives and features cloud-enabled real-time remote monitoring and clinical connectivity. The launch supports Renalyx’s mission to enhance India’s kidney care infrastructure.

- In April 2025, Seoul National University College of Engineering, in collaboration with several institutions, has developed a compact peritoneal dialysis device that could serve as a portable artificial kidney. The innovation addresses the rise in the need for dialysis solutions as kidney failure cases rise. Current hemodialysis methods are time-consuming and hospital-dependent. While global efforts have aimed at portable solutions, technological hurdles in miniaturizing dialyzers have so far prevented successful commercialization—until now.

- In October 2024, Otsuka Pharmaceutical Development & Commercialization, Inc. and Otsuka Pharmaceutical Co., Ltd. have announced positive topline interim results from the ongoing Phase 3 trial of sibeprenlimab for treating immunoglobulin A nephropathy (IgA nephropathy) in adults. Sibeprenlimab is an investigational anti-APRIL monoclonal antibody that targets a key trigger in the disease’s immune pathway by reducing Gd-IgA1 production and immune complex formation. IgA nephropathy is a chronic autoimmune kidney condition that can progress to end-stage kidney disease. The therapy previously received Breakthrough Therapy designation after promising Phase 2 results.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 157.1 Bn |

| Forecast Value (2034) |

USD 541.2 Bn |

| CAGR (2025–2034) |

14.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 41.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Treatment (Dialysis and Transplant), By Diagnosis (Blood Test, Urine Test, Imaging Test, and Others), By End User (Hospitals & Clinics, Dialysis Centers, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Fresenius Medical Care, Baxter International, DaVita Inc., B. Braun Melsungen AG, Nipro Corporation, Asahi Kasei Medical, Nikkiso Co., Ltd., Medtronic, Cantel Medical, Rockwell Medical, Toray Medical Co., Ltd., Dialife SA, JMS Co., Ltd., Satellite Healthcare, Outset Medical, AWAK Technologies, Quanta Dialysis Technologies, SWS Hemodialysis Care, Kibow Biotech, U.S. Renal Care, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global End-Stage Renal Disease Market?

▾ The Global End-Stage Renal Disease Market size is expected to reach a value of USD 157.1 billion in 2025 and is expected to reach USD 541.2 billion by the end of 2034.

Which region accounted for the largest Global End-Stage Renal Disease Market?

▾ Asia Pacific is expected to have the largest market share in the Global End-Stage Renal Disease Market, with a share of about 39.3% in 2025.

How big is the End-Stage Renal Disease Market in the US?

▾ The End-Stage Renal Disease Market in the US is expected to reach USD 41.0 billion in 2025.

Who are the key End-Stage Renal Disease Market?

▾ Some of the major key players in the Global End-Stage Renal Disease Market are Fresenius Medical Care, Baxter International, DaVita Inc., and others

What is the growth rate in the Global End-Stage Renal Disease Market?

▾ The market is growing at a CAGR of 14.7 percent over the forecasted period.