The market is further supported by a rising elderly population that requires frequent medical intervention and by government-funded initiatives promoting non-invasive diagnostic tools. Technological advancements, such as 3D imaging, AI-assisted detection, and robotics-enabled endoscopy, are being swiftly integrated into hospital settings throughout Europe. With a projected CAGR of 6.5% from 2025 to 2034, the European endoscopy devices market is expected to expand steadily, driven by both public health strategies and private sector innovation.

Japan's strong healthcare infrastructure, combined with an aging population and a high prevalence of gastrointestinal conditions such as colorectal and gastric cancers, significantly fuels the demand for advanced diagnostic and therapeutic endoscopy solutions. Regular nationwide screening programs and a cultural emphasis on early disease detection contribute to high procedural volumes and continued adoption of innovative endoscopic systems.

Moreover, Japan’s healthcare system supports rapid clinical translation of new technologies, allowing seamless integration of AI-enhanced imaging, capsule endoscopy, and minimally invasive surgical techniques into clinical practice. The country’s regulatory framework encourages research and development, creating an ecosystem that fosters continuous innovation.

Artificial Intelligence (AI) is revolutionizing the global endoscopy devices market by enhancing diagnostic precision, streamlining workflows, and reducing human error during endoscopic procedures. One of the most significant impacts of AI is in real-time image analysis, particularly in gastrointestinal (GI) endoscopy, where AI-powered software can automatically detect and classify lesions, polyps, and early-stage cancers with high sensitivity and specificity.

These systems use deep learning algorithms trained on vast datasets of endoscopic images, enabling them to support clinicians in making faster and more accurate decisions during procedures like colonoscopy, gastroscopy, and capsule endoscopy. The ability of AI to recognize subtle abnormalities not easily detected by the human eye has made it a game-changer in early cancer detection and preventative diagnostics.

Beyond diagnostics, AI also enhances procedure planning and post-procedure documentation. Machine learning algorithms can assist in mapping out endoscopic navigation paths, reducing procedure time and improving success rates in complex interventions such as bronchoscopy and endoscopic retrograde cholangiopancreatography (ERCP). AI-enabled platforms integrated into endoscopy systems also automate report generation, improving efficiency and consistency in clinical documentation.

Additionally, AI is being integrated into robotic-assisted endoscopy systems, allowing for enhanced maneuverability, stability, and precision during surgical interventions. As regulatory bodies like the FDA approve more AI-powered endoscopy solutions and healthcare institutions prioritize digital transformation, the role of artificial intelligence in the endoscopy devices market is set to expand significantly, transforming patient outcomes and redefining modern endoscopic practices.

Global Endoscopy Devices Market: Driving Factors

Rising Demand for Minimally Invasive Procedures

The global endoscopy devices market is significantly driven by the increasing preference for minimally invasive surgeries (MIS), which offer faster recovery, reduced post-operative pain, and shorter hospital stays. Endoscopic techniques such as laparoscopy, colonoscopy, and arthroscopy enable physicians to perform diagnostic and therapeutic interventions with minimal tissue disruption.

As patient awareness grows and healthcare providers shift toward cost-effective treatment options, the demand for advanced endoscopic systems like high-definition scopes, video processors, and single-use instruments continues to rise across surgical specialties.

Increasing Burden of Chronic Diseases

The growing prevalence of gastrointestinal disorders, colorectal cancer, obesity, and respiratory diseases is fueling the need for accurate and early diagnostic tools. Endoscopy devices are critical in screening and managing these conditions, particularly in aging populations.

Enhanced imaging modalities such as narrow-band imaging (NBI) and capsule endoscopy are gaining traction as physicians seek precise visualization of internal structures. The global rise in lifestyle-related illnesses further supports the widespread adoption of GI endoscopy and pulmonary endoscopy procedures.

Global Endoscopy Devices Market: Growth Opportunities

Expansion in Emerging Markets

Emerging economies such as India, China, Brazil, and Southeast Asia present a lucrative opportunity for endoscopy device manufacturers. With improving healthcare infrastructure, growing medical tourism, and rising government investment in surgical technologies, these regions are experiencing increased uptake of diagnostic endoscopy and minimally invasive treatment methods. Manufacturers are also tailoring product offerings to suit local needs, such as portable endoscopy units and cost-effective endoscopic solutions, to capture untapped market potential.

Integration of Artificial Intelligence and Robotics

The integration of artificial intelligence (AI) and robotic-assisted endoscopy systems presents significant growth prospects in enhancing procedural accuracy and reducing human error. AI-enabled software for real-time image analysis and lesion detection is improving outcomes in colonoscopy, bronchoscopy, and capsule endoscopy.

Additionally, robotic platforms are allowing for better control, precision, and access to hard-to-reach anatomical regions. These innovations open new avenues for smart surgery and next-generation diagnostics, driving future expansion.

Global Endoscopy Devices Market: Key Trends

Growing Adoption of Disposable and Single-Use Endoscopes

To mitigate infection risks and reduce reprocessing costs, healthcare institutions are increasingly adopting disposable endoscopes, especially in ICU settings and high-risk procedures. Single-use bronchoscopes and ureteroscopes are gaining popularity due to their ability to eliminate cross-contamination, reduce turnaround times, and comply with strict hygiene regulations. This trend is particularly strong in North America and parts of Europe, supported by innovations in material science and compact device engineering.

Technological Advancements in Imaging and Visualization

The endoscopy market is witnessing rapid progress in high-resolution imaging, including 4K ultra-HD video, 3D visualization, and enhanced optical systems. Techniques such as fluorescence imaging, augmented reality overlays, and AI-based tissue recognition are becoming integral to endoscopic procedures. These advancements are improving lesion localization, depth perception, and diagnostic confidence, especially in complex procedures like endoscopic submucosal dissection (ESD) and interventional endoscopy.

Global Endoscopy Devices Market: Restraining Factors

High Cost of Advanced Endoscopic Systems

Despite technological innovation, the cost of acquiring and maintaining high-end endoscopy equipment remains a major barrier, especially for smaller clinics and healthcare facilities in low- and middle-income countries.

Components such as 4K endoscopic cameras, robotic-assisted systems, and advanced video processors require significant capital investment. Additionally, expenses related to sterilization, technician training, and equipment maintenance raise the total cost of ownership, thereby limiting market penetration in cost-sensitive regions.

Risk of Cross-Contamination and Infections

The risk of infection transmission during reusable endoscope procedures is a critical restraint impacting patient safety and healthcare provider trust. Improper reprocessing and sterilization of flexible endoscopes can lead to hospital-acquired infections (HAIs), increasing scrutiny from regulatory bodies such as the FDA and CDC. This concern has intensified the demand for single-use and disposable endoscopes, yet adoption remains limited due to cost and waste management issues, particularly in large-volume hospitals.

Global Endoscopy Devices Market: Research Scope and Analysis

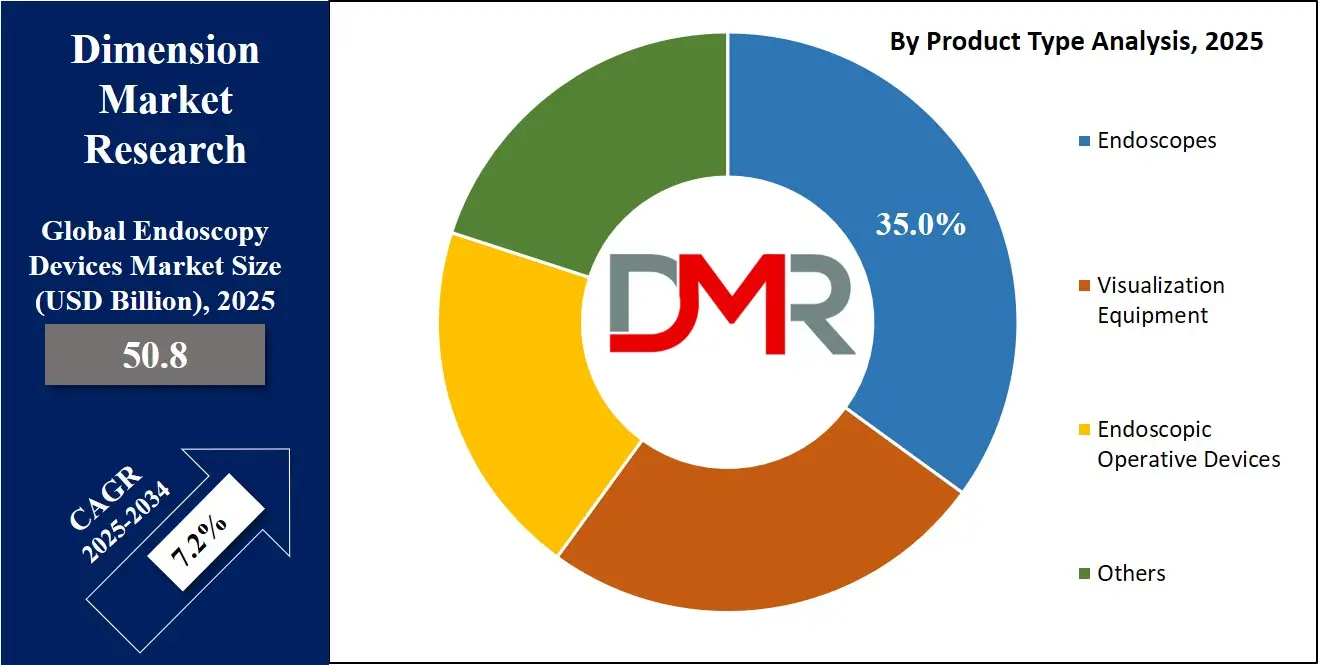

By Product Type Analysis

Endoscopes are expected to lead the product type segment in the global endoscopy devices market, accounting for an estimated 35.0% of the total market share in 2025. This dominance is attributed to their central role in both diagnostic and therapeutic procedures across various medical specialties, including gastroenterology, pulmonology, urology, and orthopedics.

The growing preference for minimally invasive surgeries, coupled with the rising incidence of chronic conditions such as colorectal cancer, inflammatory bowel disease, and obesity, has significantly increased the demand for flexible and rigid endoscopes. Technological innovations such as capsule endoscopy, disposable endoscopes, and integration with imaging systems have further strengthened the segment’s growth potential. Hospitals and surgical centers continue to invest in high-quality, durable, and versatile endoscopes that support multiple procedures, thereby contributing to higher procurement rates.

Visualization equipment also plays a crucial role in the endoscopy ecosystem, serving as the technological backbone that supports real-time imaging and enhances procedural accuracy. This segment includes components such as endoscopic cameras, light sources, video processors, and monitors that are essential for transmitting and displaying internal images during surgery.

The increasing adoption of high-definition and 4K imaging systems has significantly improved the clarity and resolution of visuals, enabling early detection of lesions and more precise surgical interventions. As AI-powered image enhancement tools and digital platforms become more integrated into endoscopy suites, the visualization equipment segment is poised for steady growth, driven by the need for better diagnostic confidence and operational efficiency in clinical settings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Endoscope Type Analysis

High-end machines are projected to retain their dominance in the endoscope type segment, capturing approximately

50.0% of the total market share in 2025. These systems are equipped with advanced features such as high-definition imaging, enhanced maneuverability, integrated AI-assisted diagnostics, and compatibility with robotic surgical platforms. Their widespread adoption across tertiary care hospitals and specialty surgical centers is driven by the increasing demand for precision, speed, and safety in minimally invasive procedures.

High-end endoscopes are particularly preferred in complex interventions where superior visualization and real-time data integration are crucial, such as in oncology, gastroenterology, and laparoscopic surgeries. The continual upgrades in optical technology, paired with supportive reimbursement frameworks in developed countries, have positioned high-end machines as the preferred choice for healthcare professionals seeking better clinical outcomes and patient satisfaction.

Rigid endoscopes, on the other hand, continue to hold a significant position within the endoscopy market due to their durability, clear imaging capabilities, and effectiveness in specific surgical disciplines. Commonly used in procedures involving orthopedics, gynecology, and urology, rigid endoscopes offer excellent visual clarity and stability, making them ideal for surgeries where straight-line access to the targeted area is possible.

Their mechanical simplicity and ease of sterilization also contribute to their ongoing use, especially in high-volume surgical settings. Despite the rise of flexible and capsule-based technologies, rigid endoscopes remain relevant due to their cost-efficiency and proven effectiveness in interventions like hysteroscopy, cystoscopy, and arthroscopy. Manufacturers continue to improve their design by integrating HD cameras and ergonomic enhancements, ensuring they remain a competitive choice in the broader endoscope category.

By Technology Analysis

High Definition (HD) visualization systems are anticipated to consolidate their leadership in the technology segment of the endoscopy devices market, capturing around 45.0% of the total market share in 2025. These systems provide superior image clarity, enhanced contrast, and finer resolution, which are essential for accurately detecting lesions, identifying anatomical structures, and performing precise interventions. The demand for HD visualization is being driven by its widespread use in procedures such as gastrointestinal endoscopy, laparoscopy, and bronchoscopy, where image quality directly impacts diagnostic accuracy and surgical outcomes.

Healthcare providers are increasingly investing in HD-compatible endoscopic platforms that support high-resolution monitors, advanced video processors, and real-time recording capabilities. Additionally, the integration of HD with other imaging technologies like narrow-band imaging, 3D visualization, and fluorescence endoscopy has further increased its appeal, especially in high-end hospitals and specialized surgical centers.

Standard Definition (SD) systems, while still present in the market, are gradually being phased out as HD and 4K technologies become more accessible and affordable. However, SD systems continue to serve a role in cost-sensitive environments such as small clinics, rural healthcare facilities, and emerging markets where budget constraints and basic diagnostic needs take precedence over advanced imaging.

These systems are typically used for routine procedures that do not require high-detail visualization and are favored for their lower upfront investment and ease of maintenance. Despite limited adoption in technologically advanced settings, SD systems offer a practical solution for facilities aiming to provide basic endoscopic services without the need for premium equipment. Nonetheless, their market share is expected to decline over time as HD technology becomes the new standard in endoscopic imaging.

By Application Analysis

Gastrointestinal (GI) endoscopy is set to account for the largest share in the application segment of the global endoscopy devices market, capturing 35.0% of the total market value in 2025. This dominance is largely driven by the rising global prevalence of GI disorders such as colorectal cancer, peptic ulcers, Crohn’s disease, and irritable bowel syndrome. GI endoscopy, which includes procedures like colonoscopy, gastroscopy, and enteroscopy, plays a vital role in both diagnosis and treatment, allowing physicians to detect abnormalities, perform biopsies, and conduct therapeutic interventions without the need for open surgery.

The growing awareness of preventive healthcare and the importance of early diagnosis, along with increased adoption of high-definition and AI-powered endoscopic systems, has led to a surge in GI screening programs worldwide. The availability of minimally invasive and capsule-based technologies has further expanded access to GI endoscopy in outpatient and ambulatory care settings, reinforcing its dominant position in this market segment.

Laparoscopy also represents a significant portion of the application segment, widely used for surgical interventions in the abdominal and pelvic regions. It is particularly prevalent in procedures such as appendectomy, hernia repair, cholecystectomy, and bariatric surgeries. The key advantage of laparoscopy lies in its minimally invasive nature, which results in shorter hospital stays, faster recovery, and reduced risk of complications.

As obesity rates continue to rise and demand for bariatric procedures increases, laparoscopy has gained substantial traction among surgeons and patients alike. Technological advancements in laparoscopic cameras, energy devices, and robotic-assisted tools have enhanced surgical precision and reduced operator fatigue, making the procedure more efficient and accessible. As more hospitals transition to minimally invasive surgery protocols, laparoscopy is expected to remain a core growth area within the endoscopy devices market.

By End-User Analysis

Hospitals are expected to solidify their leading position in the end-user segment of the global endoscopy devices market, capturing 50.0% of the total market share in 2025. This dominance is primarily due to hospitals' ability to offer a full spectrum of diagnostic and therapeutic endoscopic services under one roof, supported by advanced infrastructure, specialized medical teams, and high patient volumes.

Hospitals are typically the first adopters of new technologies such as high-definition endoscopes, robotic-assisted systems, and AI-powered imaging tools, which further enhance their capability to perform complex and high-risk procedures. Additionally, favorable reimbursement policies and the presence of dedicated departments for

gastroenterology, pulmonology, urology, and general surgery make hospitals the preferred setting for both routine and advanced endoscopic procedures. Their centralized procurement processes and integration with research institutions also allow them to stay ahead in clinical innovation and device adoption.

Ambulatory Surgical Centers (ASCs) are emerging as a strong and growing segment within the end-user landscape due to their focus on cost-efficiency, shorter procedure times, and improved patient convenience. ASCs typically handle a wide range of outpatient endoscopic procedures, such as colonoscopy, cystoscopy, and arthroscopy, in a streamlined and low-overhead environment.

The increasing number of minimally invasive procedures being shifted from hospitals to ASCs is driven by advancements in portable endoscopy systems, disposable scopes, and same-day recovery protocols. These centers are especially popular in North America, where value-based care models and patient-centric approaches are gaining momentum. As more healthcare systems prioritize efficiency and affordability, ASCs are expected to capture a larger portion of the market, particularly for elective and preventive diagnostic procedures.

Additionally, ongoing technological advancements, such as AI-integrated imaging systems and robotic-assisted endoscopy, are rapidly being adopted across hospitals and ambulatory surgical centers, further solidifying North America's leadership in the global market landscape.

The Asia-Pacific region is expected to witness the most significant growth in the global endoscopy devices market over the forecast period, driven by rapidly expanding healthcare infrastructure, rising healthcare expenditure, and increasing awareness of early disease detection. Countries like China, India, Japan, and South Korea are experiencing a surge in demand for minimally invasive diagnostic procedures due to the growing burden of gastrointestinal disorders, cancer, and lifestyle-related diseases.

Additionally, the rising adoption of advanced medical technologies, supportive government initiatives, and an expanding base of trained healthcare professionals are further accelerating market penetration. The presence of cost-effective manufacturing and increasing investments from global players looking to tap into emerging markets also contribute to the region’s robust growth potential.