Market Overview

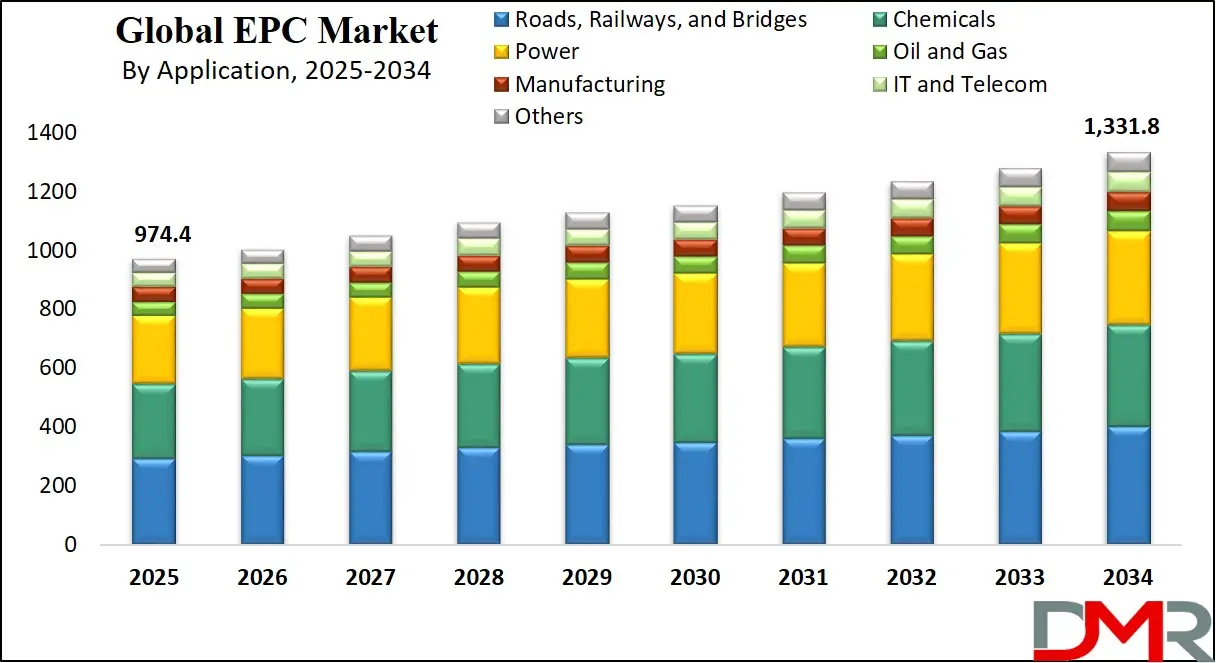

The Global Engineering, Procurement, and Construction (EPC) Market size is expected to reach a value of USD 974.4 billion in 2025, and it is further anticipated to reach a market value of USD 1,131.8 billion by 2034 at a CAGR of 3.5%.

Engineering, Procurement, and Construction, or EPC, is essential to the international infrastructure and industrial development industry. It refers to the cycle of massive undertakings like planning, designing, purchasing, constructing, and then commissioning these projects. Industries like energy, oil & gas, infrastructure, power generation, and water management widely implement EPC contracts, as these deals provide a lot of breakthrough solutions and are cost-efficient in addition to helping minimize risk factors. The market is driven by the need for sustainable and efficient infrastructure solutions, rapid urbanization, and increasing investments in renewable energy projects.

.webp)

Technological advancements like digital twin technology, Building Information Modeling (BIM), and modular construction are also reshaping the EPC landscape. Regions such as Asia-Pacific, the Middle East, and North America are significant contributors to the growth of this market, supported by burgeoning industrialization and government-led initiatives for modernization and energy transition.

The global Engineering, Procurement, and Construction (EPC) Market is currently experiencing a dynamic phase, influenced by both challenges and opportunities. On one hand, sectors like renewable energy, LNG, and public infrastructure show strong demand that benefits the market. On the other hand, disruptions in the supply chain, shortages of labor force, and increases in cost from inflation and geopolitics affect it.

Additionally, the global push for sustainability has led to green and energy-efficient project development. Therefore, renewable energy developments, such as wind, solar, and hydropower, have emerged as core focus areas. To adapt to changing customer needs and meet tougher environmental regulations, EPC companies are embracing advanced technologies and sustainable practices. This integration of technology and sustainability has positioned the Engineering, Procurement, and Construction (EPC) Market as a cornerstone for global economic development, enabling nations to achieve their infrastructure and energy goals while adapting to modern environmental challenges.

Meanwhile, digital transformation is becoming crucial for the improved efficiency of projects, better control over costs, and reduced risk. Yet, regulatory complexity and commodity price volatility are some of the ongoing challenges. Despite these factors, the market remains resilient, with significant opportunities arising from urbanization trends, smart city projects, and the need to revamp aging infrastructure.

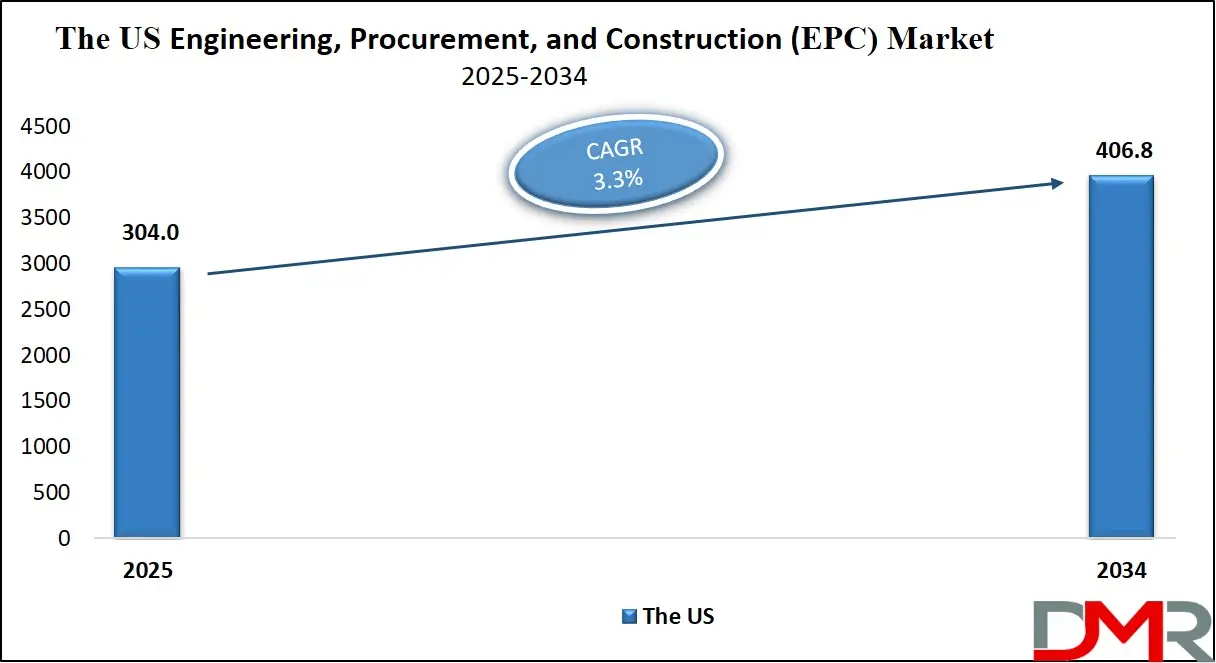

The US Engineering, Procurement, and Construction (EPC) Market

The US Engineering, Procurement, and Construction (EPC) Market is projected to be valued at USD 304.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 406.8 billion in 2034 at a CAGR of 3.3%.

The US Engineering, Procurement, and Construction (EPC) Market is one of the dynamic and quickly growing sectors, mirroring that of the country's diverse and complex infrastructure needs. One of the world's largest markets for engineering and construction is the US. It always implements modern EPC practices through industries such as energy, transportation, manufacturing, and water management. The growth in the EPC sector is primarily driven by the transition to renewable energy, as significant investments in solar, wind, and battery storage projects are aligned with federal and state-level commitments to reduce carbon emissions.

Schemes like the IRA (Inflation Reduction Act) and other clean energy schemes have promoted sustainable infrastructure which plays a vital role in the rising prominence of The US in this market which results in it emerging as a center for green energy EPC projects. Companies are utilizing tools like BIM, AI, and digital twin technology for designing, executing, and monitoring projects. The technologies reduce the risk factors while keeping efficiency and cost control on track. Hence, they are critical for large-scale projects.

On the other hand, the market faces some challenges like supply chain disruptions, material price fluctuations, and labor shortages remain some of the persistent issues requiring adaptive strategies by EPC firms. Despite these hurdles, the US Engineering, Procurement, and Construction (EPC) Market has been robust and resilient and seems to be ready for future growth as it has an excellent policy backup, private investments, and increased sustainable and technology-inclined practices.

Key Takeaways

- Market Value: The global Engineering, Procurement, and Construction (EPC) Market size is expected to reach a value of USD 1,331.8 billion by 2034 from a base value of USD 974.4 billion in 2025 at a CAGR of 3.5%.

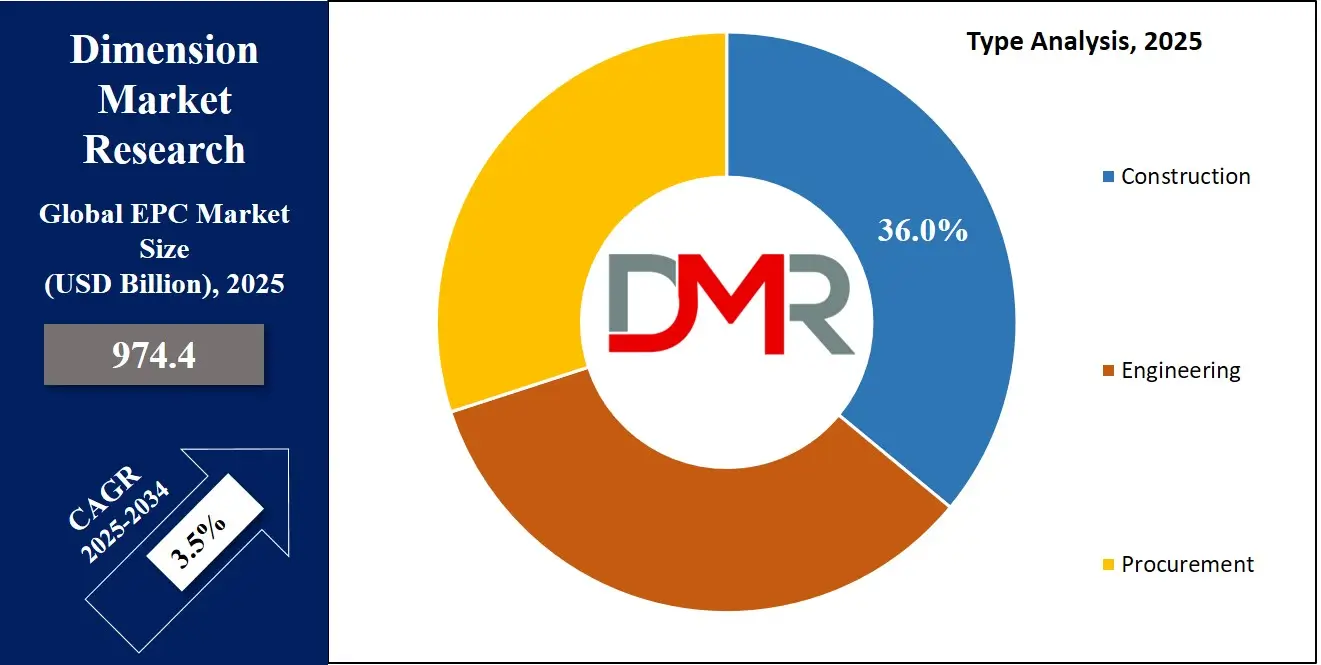

- By Type: Construction is projected to maintain its dominance in the type segment, capturing 36.0% of the market share in 2025.

- By Application: Roads, railways, and bridges are expected to dominate the application type segment in the global Engineering, Procurement, and Construction (EPC) Market, holding 30.0% of the market share in 2025.

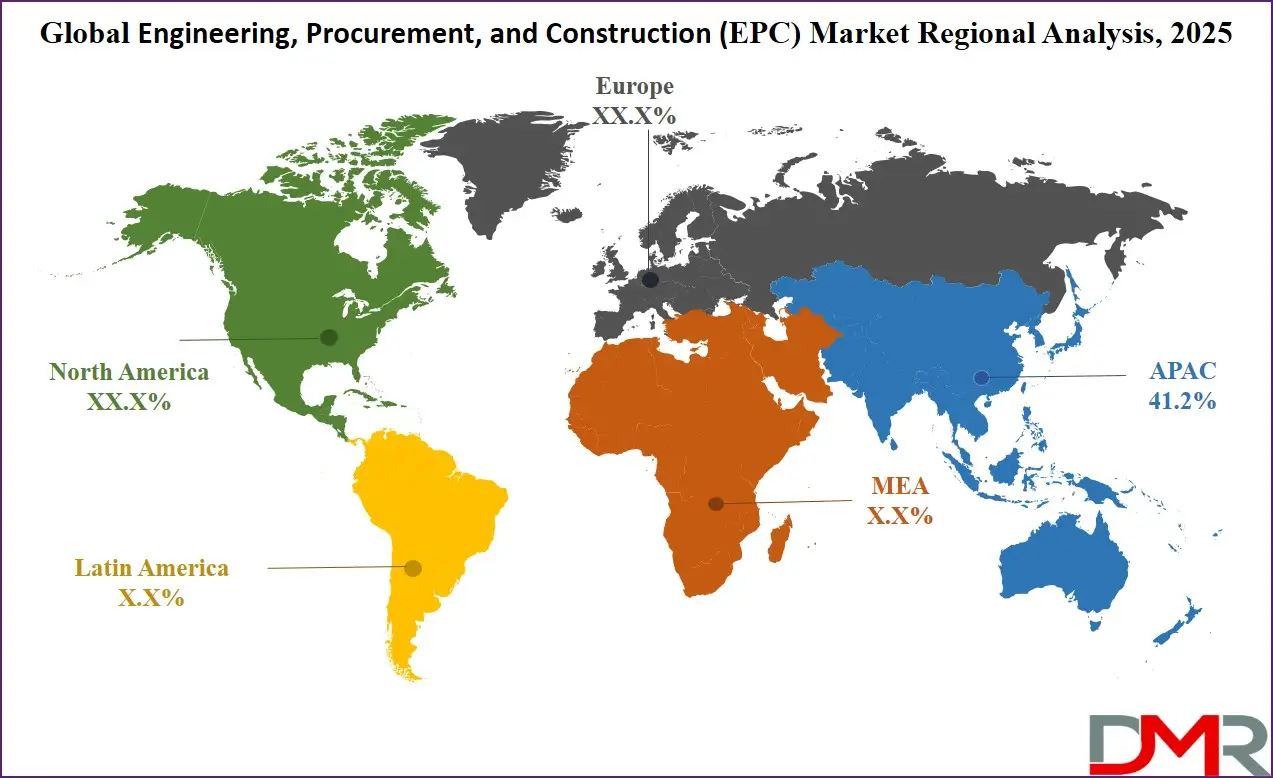

- By Region: Asia Pacific leads the global EPC landscape with 41.2% of total global market revenue and it is further anticipated to maintain its dominance by 2025.

- Key Players: Some major key players in the global Engineering, Procurement, and Construction (EPC) Market are, Mitsubishi Heavy Industries, Ltd., McDermott International Ltd., Fluor Corporation, and Other Key Players.

Use Cases

- Renewable Energy Projects: EPC firms have an important role in the design, procurement, and construction of renewable energy facilities like solar farms, wind turbines, and hydropower plants. Most of these projects require turnkey solutions because they have very tight timelines, are within very limited budgets, and need to comply with all environmental standards.

- Oil & Gas Infrastructure: Oil and gas EPC contracts are offered widely for upstream, midstream, and downstream projects involving refinery construction, LNG terminals, offshore platforms, and pipelines. An EPC firm handles project complexity with respect to design engineering, material procurement, and construction management as they execute in high-stakes situations.

- Urban Infrastructure Development: Urban infrastructure constructions that involve the bridges, highways, airports, and transit systems in place all have massive EPCs depending on such collaboration. Usually, projects will also depend on agreements between governments and private contracting bodies for purposes of such a vast undertaking.

- Industrial and Manufacturing Facilities: EPC firms support the construction of industrial plants and manufacturing facilities, such as factories, warehouses, and data centers. For example, a semiconductor fabrication plant or a gigafactory for electric vehicles requires the full area of EPC expertise to deliver on complex design requirements, precision construction, and advanced technological integration all within stringent timelines.

Market Dynamic

Driving Factors

Global Transition to Renewable Energy

Environmental concerns and commitment towards international climate goals are highly fueling the Engineering, Procurement, and Construction (EPC) Market as the world shifts towards renewable energy sources. Governments around the globe have committed to decarbonization, offering subsidies and incentives for the installation of renewable energy installations, such as solar, wind, and hydropower. Due to technological improvements, these sources are becoming increasingly viable, which has led EPC firms to engage in constructing large-scale renewable energy plants.

For example, the Inflation Reduction Act passed by the US is encouraging investments in clean energy, with several solar and wind projects undertaken in the country. These not only boost renewable energy but also other associated sectors like energy storage and grid infrastructure, for which EPC companies are very crucial in offering integrated and immediate solutions. The emphasis on sustainability and achieving net-zero emissions across the globe accelerates the demand for EPC services. Companies are now driven to innovate energy efficiency and green construction practices, and renewable energy projects will be a prime driver of the expansion of the market for EPC firms, providing them with long-term contracts that enhance market growth.

Rapid Urbanization and Infrastructure Development

Urbanization, particularly in emerging economies, has driven massive investments in infrastructure projects. As the population grows and urban areas expand, cities need better transportation systems, housing, utilities, and communication networks. The Engineering, Procurement, and Construction (EPC) Market benefits from this trend because governments and private investors look to upgrade infrastructure to meet the needs of modern cities. Smart cities, high-speed rail networks, and water treatment plants will need EPC services that require more than the construction of mere infrastructure but with the integration of advanced technology.

Asia-Pacific and other regions see rapid industrialization and urban development, which further fuels the quest for quality sustainable infrastructure. Growing and modernizing cities pose a challenge to EPC companies to adopt in dealing with huge projects. The integration of digital tools such as BIM and automation also helps in optimizing the planning and execution of these ambitious undertakings, making them more feasible and efficient. Thus, EPC companies benefit from urbanization trends, creating vast opportunities in sectors ranging from transportation to smart grid infrastructure.

Restraints

Supply Chain Disruptions

The Engineering, Procurement, and Construction (EPC) Market is heavily constrained by ongoing disruptions in global supply chains driven by geopolitical tensions and trade restrictions. Delays and price volatility in materials that are critical to construction, such as steel, cement, and specialty components, have introduced uncertainty into project timelines and budgets. For instance, the semiconductor shortage and shipping industry disruptions have delayed many infrastructure projects on a global scale. These supply chain issues complicate procurement processes for EPC companies, which forces them to look for alternative sources and manage risks related to cost overruns.

In addition, material price fluctuations and shortages increase the complexity of estimating project costs, making it harder to provide clients with accurate pricing and delivery timelines. EPC firms will have to implement risk-mitigating strategies such as supply chain diversification, higher levels of local sourcing, and closer supplier relationships. Such adjustments have proven costly and, as a result, lower the profitability of projects, halting the sector's growth. These long-term impacts might slow the growth in the Engineering, Procurement, and Construction (EPC) Market and hinder larger-scale projects, including regional development projects.

Regulatory and Environmental Compliance

The Engineering, Procurement, and Construction (EPC) Market is heavily impacted by stringent regulations that require projects to meet both environmental and safety standards. With governments in various parts of the world tightening their regulations to counter climate change and also to ensure worker safety, compliance has become a challenge for firms implementing EPC. For instance, in sectors like oil and gas, where the environmental footprint is significant, EPC companies must adhere to complex environmental protection laws and secure the necessary permits. These regulatory conditions often create additional layers of complexity in the execution of the projects which account for delay and cost overruns.

Moreover, environmental assessments, audits, and sustainable construction can become causes of a total redesign of entire projects. As governments increase the stringency of ESG standards, EPC firms are compelled to develop greener and more sustainable solutions. Compliance with these regulations may involve adopting more expensive technologies or materials that increase project costs. Furthermore, failure to comply with environmental or safety standards can result in fines, project shutdowns, or reputational damage, all of which can severely affect a firm’s viability. These regulatory constraints are very essential in environmental protection and safety but do hinder the smooth execution and profitability of the project.

Opportunities

Integration of Advanced Technologies

The integration of cutting-edge technologies presents significant growth opportunities for the Engineering, Procurement, and Construction (EPC) Market. Tools like Building Information Modeling (BIM), artificial intelligence (AI), and digital twin technology are revolutionizing the way projects are designed, constructed, and managed. With BIM, it is possible to visualize and coordinate the whole project lifecycle in a virtual space, which makes it easier to detect issues earlier and streamline decisions. On the other hand, AI enhances predictive analytics to help EPC companies optimize resource allocation and reduce risks. These technologies can automate many of the planning and monitoring tasks that were previously manual, improving overall efficiency and accuracy.

Digital twins create virtual replicas of physical assets, enabling real-time monitoring and facilitating proactive maintenance. These innovations would help EPC firms minimize delays in projects and reduce costs along with improving operations, which has a competitive edge. Moreover, automation and robotics increase the safety factor and efficiency in construction sites because of the limited use of manpower. As the demand for smarter, more efficient infrastructure increases, advanced technologies will play a more important role, providing EPC firms with an opportunity to add new services to their offerings and thus meet the changed needs of clients.

Growing Demand for Modular Construction

Modular construction is now on the rise as an option for flexible and cost-effective building, in comparison to the traditional building approach. Building components are manufactured off-site in a controlled environment, then transported and assembled on-site, saving time and waste. Industries requiring rapid deployment include healthcare, hospitality, and temporary housing. In the energy sector, offshore platforms and modular rigs can be better assembled with modular techniques, which reduces the installation time. Modular techniques also enhance cost predictability, as they are less prone to weather-related or material shortage-related delays.

Modular construction aligns well with the rising demand for sustainable and environmentally friendly construction practices because it produces less waste and often utilizes recyclable materials. Modular units are also easy to repurpose or reassemble, thus promoting the circular economy. EPC firms embracing this innovative construction method can tap into a growing market and enhance their competitive edge by offering faster, more efficient solutions to their clients.

Trends

Sustainability and Green Construction

Sustainability is now not a buzzword but has become an all-important imperative of the Engineering, Procurement, and Construction (EPC) Market. Climbing fears regarding climate change issues have brought to the forefront an immense demand for clean and green building solutions. It has seen building energy-efficient designs and low-carbon projects being favored by governments, corporations, and consumers in large numbers. The same is manifest through increased levels of green building certifications and practice in sustainable constructions. EPC firms are responding by using eco-friendly materials, reducing energy consumption, and integrating renewable energy sources into their projects. The use of technologies such as solar panels, geothermal energy, and sustainable water management systems is becoming standard practice in new infrastructure projects.

In addition, the rise in green consumers will pressure companies to adopt flexible economy principles by ensuring that construction projects either reduce waste or use recyclable or sustainable materials. All these trends are pushing the demand for EPCs delivering the direction of green solutions and providing an edge in the long term for companies that can demonstrate commitments to sustainability. With carbon-neutral buildings and renewable energy infrastructure fast becoming the new normal, the Engineering, Procurement, and Construction (EPC) Market is emerging as an important contributor to the shift towards sustainability on the global stage.

Public-Private Partnerships (PPPs)

Public-private partnerships are becoming a popular way of financing and implementing large-scale infrastructure projects. By partnering with private companies, governments can access much-needed capital and expertise to build and manage complex infrastructure systems. For EPC firms, these partnerships offer long-term project opportunities, as governments often commit to long-term contracts for the construction and operation of critical infrastructure. The development of PPPs has been most noticeable in areas like transportation, energy, and public utilities, requiring large capital expenditures.

These EPC firms then enjoy stable cash flows from such projects, usually financed by both the public and private sectors, though the latter retains control over the design, construction, and sometimes operation of the asset. The government's desire to reduce public debt and improve the quality of infrastructure is also a reason for this trend. As the popularity of PPPs continues to grow, the number of large-scale, high-value projects offering substantial returns to EPC companies will increase. With these collaborations becoming more frequent, EPC firms are perfectly placed to ride the wave of growing public-private collaboration.

Research Scope and Analysis

By Type

Construction is projected to maintain its dominance in the type segment, capturing 36.0% of the market share in 2025 driven by factors like global infrastructure modernization and development focus, along with national governments' investments in key projects. The construction sector includes residential, commercial, industrial, and public infrastructure sectors, all of these sectors have been reported to be experiencing strong growth.

Major transportation projects like roads, bridges, railways, and airports are in huge demand with the expansion of urban areas, especially in fast-developing regions. Another significant factor is the growth in the construction of smart cities, which combines technology and sustainability. Smart cities need advanced infrastructure solutions like energy-efficient buildings, intelligent transport systems, and data-driven resource management, all of which propel construction-focused EPC services.

Another reason is the increasing trend toward sustainability and sustainable construction. More construction projects are now using eco-friendly materials, energy-efficient designs, and sustainable practices. As the construction industry strives to meet global environmental standards, there is a growing need for specialized EPC services to manage these complex projects. Modular and prefabricated construction techniques are more efficient and less expensive.

Thus, this segment is growing further in the market and is gaining significant strength. The construction domain would remain the largest segment in the Engineering, Procurement, and Construction (EPC) Market as it forms the base of the main infrastructure initiatives happening around the globe.

By Application

Roads, railways, and bridges are anticipated to dominate the application type segment in the global Engineering, Procurement, and Construction (EPC) Market, holding

30.0% of the market share in 2025 due to a growing focus on sustainable and efficient transportation systems that support both urban and inter-regional mobility. As global transportation demands continue to rise due to increasing urbanization, the construction of road networks, railways, and bridges becomes critical for supporting both passenger and freight movement.

In developed regions like North America and Europe, aging infrastructure systems are being revamped or replaced, with new bridge constructions and road expansions taking priority. The demand for high-speed rail lines and more efficient, electrified railway systems is also a significant contributor to this growth. These projects, of large scale, and complex, require EPC-specialized expertise, not only to deliver technical design but also the necessary construction services for the project to be completed efficiently.

Climate resilience also plays a role in infrastructure projects because roads, railways, and bridges must be constructed to withstand the effects of extreme weather conditions or natural disasters. This thrust for climate change-resilient infrastructure provides an opportunity for the EPC sector to embrace innovative solutions that are sustainable and environmentally conscious. The European Green Deal and national infrastructure recovery plans encourage government investments in green, low-carbon transport systems, thus creating a buoyant market for the EPC sector. Given the need to continually improve infrastructures for the sake of economic development, roads, railways, and bridges will continue to remain a strong player in the market.

The Engineering, Procurement, and Construction (EPC) Market Report is segmented on the basis of the following

By Type

- Construction

- Engineering

- Procurement

By Application

- Roads, Railways, and Bridges

- Chemicals

- Power

- Oil and Gas

- Manufacturing

- IT and Telecom

- Airports and Ports

- Building Construction

- Others

Regional Analysis

Asia Pacific is projected to lead the global Engineering, Procurement, and Construction (EPC) Market landscape with 41.2% of total global market revenue by the end of 2025 which is further forecasted to exert its dominance in the upcoming period of 2025 to 2034.

This dominance is primarily driven by the rapid pace of industrialization, urbanization, and infrastructure development, which creates substantial demand for engineering, procurement, and construction services. Countries like China, India, Japan, and South Korea are at the forefront of large-scale infrastructure projects, ranging from smart cities to renewable energy plants and transportation networks. The region has become a hub for both emerging and developed economies, each contributing to the growing demand for EPC services.

Further, government-sponsored initiatives such as China's Belt and Road Initiative (BRI) and India's National Infrastructure Pipeline (NIP) are developing a solid base of projects that involve comprehensive EPC services. The BRI alone involves multi-billion-dollar investments in infrastructure projects across Asia which creates significant opportunities for EPC companies specializing in transport, energy, and telecommunications. It further is because the region's growing interest in clean and renewable energy sources like solar, wind, and hydropower drives the growth in the Engineering, Procurement, and Construction (EPC) Market.

With an increase in Asia-Pacific renewable energy investments, the modernization needs of aging infrastructures also spur demand for continued EPC service offerings. This continues to infuse foreign direct investments into those projects, with further consolidation building on the present strengths of the EPC firm role, setting up Asia-Pacific as the key market leader going through 2025.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global Engineering, Procurement, and Construction (EPC) Market is quite competitive, where a large number of established players are competing to get a share of the highly growing sectors like energy, infrastructure, industrial construction, and renewable. Major global players in this market include Bechtel, Fluor, Hyundai Engineering & Construction, and China State Construction Engineering Corporation with their global footprint, huge execution experience, and robust financial background. In addition, the leading companies use often government-backed projects through strategic partnerships to obtain long-term contracts and available financial support in the development of infrastructures.

Growing focus on sustainability, smart cities, and renewable energy has enabled regional players to diversify their offerings and compete effectively in international markets. This has reduced the gap between global leaders and regional specialists. The competitive environment has been driven by large multinational corporations and agile regional firms, both of which have to innovate continuously and adapt to meet diverse project demands and maintain market position.

Some of the prominent players in the Global Engineering, Procurement, and Construction (EPC) Market are

- Mitsubishi Heavy Industries, Ltd.

- McDermott International Ltd.

- Fluor Corporation

- Bechtel Corporation

- Saipem S.p.A.

- DEPCOM Power, Inc.

- Petrofac Limited

- Blue Ridge Power

- Blattner Energy Inc.

- John Wood Group PLC

- Quanta Services, Inc.

- Sentry Electrical Group, Inc.

- Larsen & Toubro Limited

- Sinopec Engineering Co., Ltd.

- Others

Recent Developments

- March 2024: Larsen & Toubro (L&T) entered the offshore wind energy sector with the launch of its first offshore wind farm project off the coast of India. This marks the company's expansion into renewable energy, aligning with global trends toward sustainable energy solutions.

- February 2024: Bechtel, a global leader in engineering and construction, acquired GHD Group, an Australian engineering and architecture firm, to enhance its presence in Asia-Pacific. This acquisition strengthens Bechtel's capabilities in water, environment, and infrastructure projects, particularly in the region's growing markets.

- October 2023: Saipem secured a contract worth $3 billion for the construction of a new liquefied natural gas (LNG) plant in Mozambique. The project, which is a joint venture with major international energy companies, will involve Saipem providing engineering, procurement, and construction services for the gas treatment facilities and LNG production infrastructure.

- July 2023: China National Petroleum Corporation (CNPC) announced its major expansion into the solar energy sector, committing over USD 2.0 billion to develop large-scale solar projects in Western China. CNPC aims to diversify its energy portfolio beyond traditional oil and gas, aligning with China’s green energy initiatives.

- January 2023: Fluor Corporation announced its decision to sell its government services business to a private equity firm for USD 1.5 billion. This move is part of Fluor’s strategy to refocus its operations on core industries like energy, chemicals, and infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 974.4 Bn |

| Forecast Value (2034) |

USD 1,331.8 Bn |

| CAGR (2025–2034) |

3.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 304.0 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Construction, Engineering, and Procurement) and By Application (Roads, Railways, and Bridges, Chemicals, Power, Oil and Gas, Manufacturing, IT and Telecom, Airports and Ports, Building Construction, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Mitsubishi Heavy Industries, Ltd., McDermott International Ltd., Fluor Corporation, Bechtel Corporation, Saipem S.p.A., DEPCOM Power, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Engineering, Procurement, and Construction (EPC) Market size is estimated to have a value of USD 974.4 billion in 2025 and is expected to reach USD 1,331.8 billion by the end of 2034.

The US Engineering, Procurement, and Construction (EPC) Market is projected to be valued at USD 304.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 406.8 billion in 2034 at a CAGR of 3.3%.

Asia Pacific is expected to have the largest market share in the global Engineering, Procurement, and Construction (EPC) Market with a share of about 41.2% in 2025.

Some of the major key players in the global Engineering, Procurement, and Construction (EPC) Market are Mitsubishi Heavy Industries, Ltd., McDermott International Ltd., Fluor Corporation, Bechtel Corporation, and many others.

The market is growing at a CAGR of 3.5 percent over the forecasted period.