Market Overview

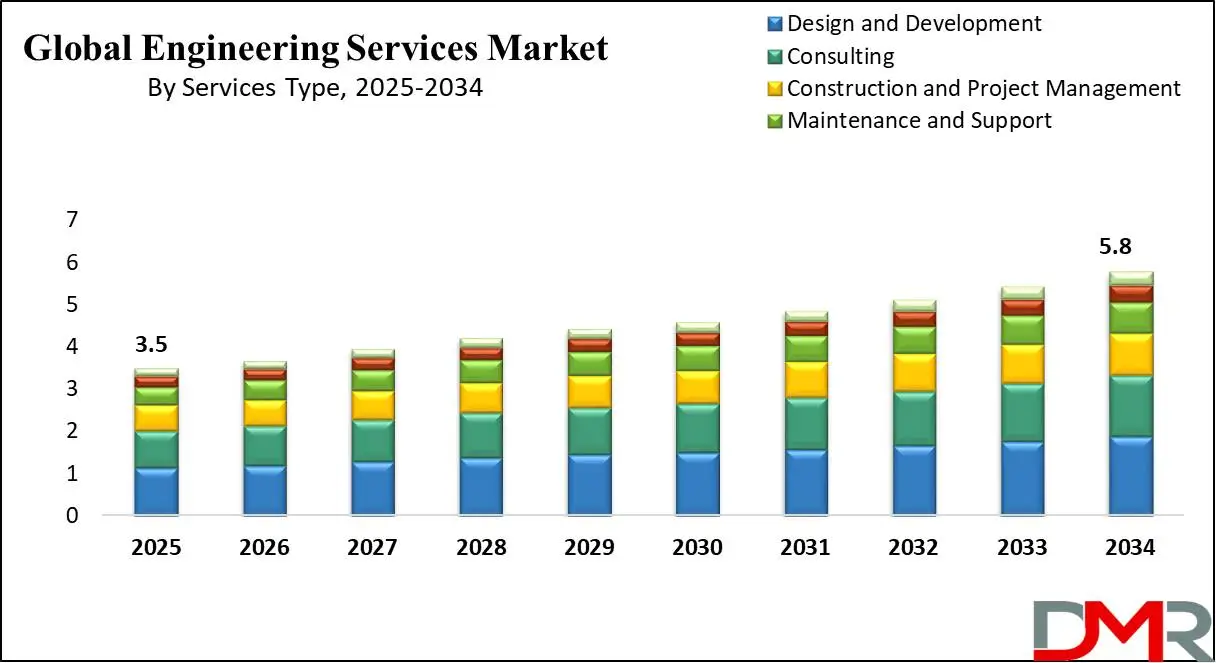

The Global Engineering Services Market is expected to be valued at USD 3.5 trillion in 2025 and is expected to grow to USD 5.8 trillion by 2034, registering a compound annual growth rate (CAGR) of 5.7% from 2025 to 2034.

Engineering services involve specialized professional tasks carried out by engineers to design, develop, analyze, and maintain systems, structures, or processes across various industries. These services include activities like conceptual design, feasibility studies, detailed engineering, project management, testing, inspection, and technical consultancy.

Engineering services span disciplines such as civil, mechanical, electrical, software, environmental, and more. They play a crucial role in construction, manufacturing, technology development, and infrastructure projects. Providers of engineering services ensure compliance with safety, quality, and environmental standards while optimizing performance and cost-efficiency. Their expertise drives innovation and supports the successful execution of complex technical and industrial projects.

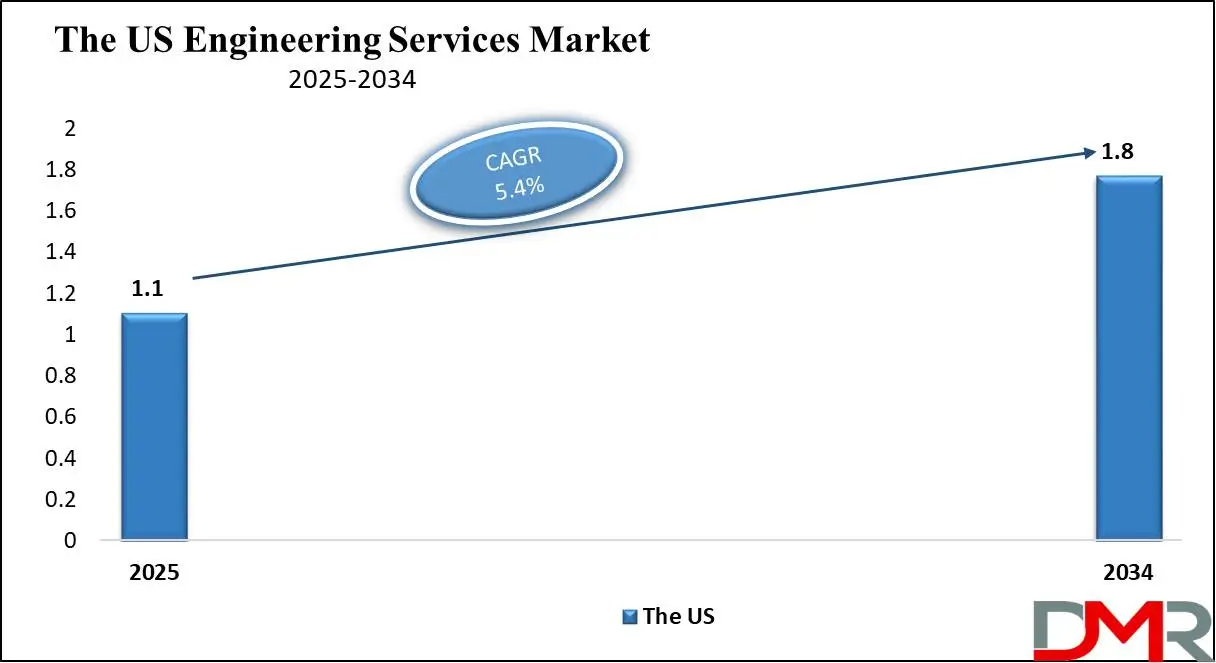

The US Engineering Services Market

The US Engineering Services market is projected to be valued at USD 1.1 trillion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.8 trillion in 2034 at a CAGR of 5.4%.

U.S. engineering services market growth is driven by infrastructure investments such as transportation, energy, and urban projects, technological innovations in telecom, renewable energy sources, and smart cities as well as sustainability initiatives such as green projects and urban planning initiatives that demand special engineering knowledge and fuel growth.

As technology and digital infrastructure continue to advance, innovation remains at the core of engineering services. They increasingly incorporate tools from IoT and automation for engineering services. Additionally, urbanization increases demand for infrastructure development projects with public-private partnerships helping facilitate large-scale initiatives.

Engineering Services Market: Key Takeaways

- Market Growth: The global Engineering Services market is anticipated to expand by USD 2.1 trillion, achieving a CAGR of 5.7% from 2025 to 2034.

- Services Type Analysis: Consulting services are predicted to dominate the engineering services market with the highest revenue share in 2025.

- Discipline Analysis: Electrical engineering services are anticipated to dominate the global market in 2025, accounting for 41.2% of global revenue.

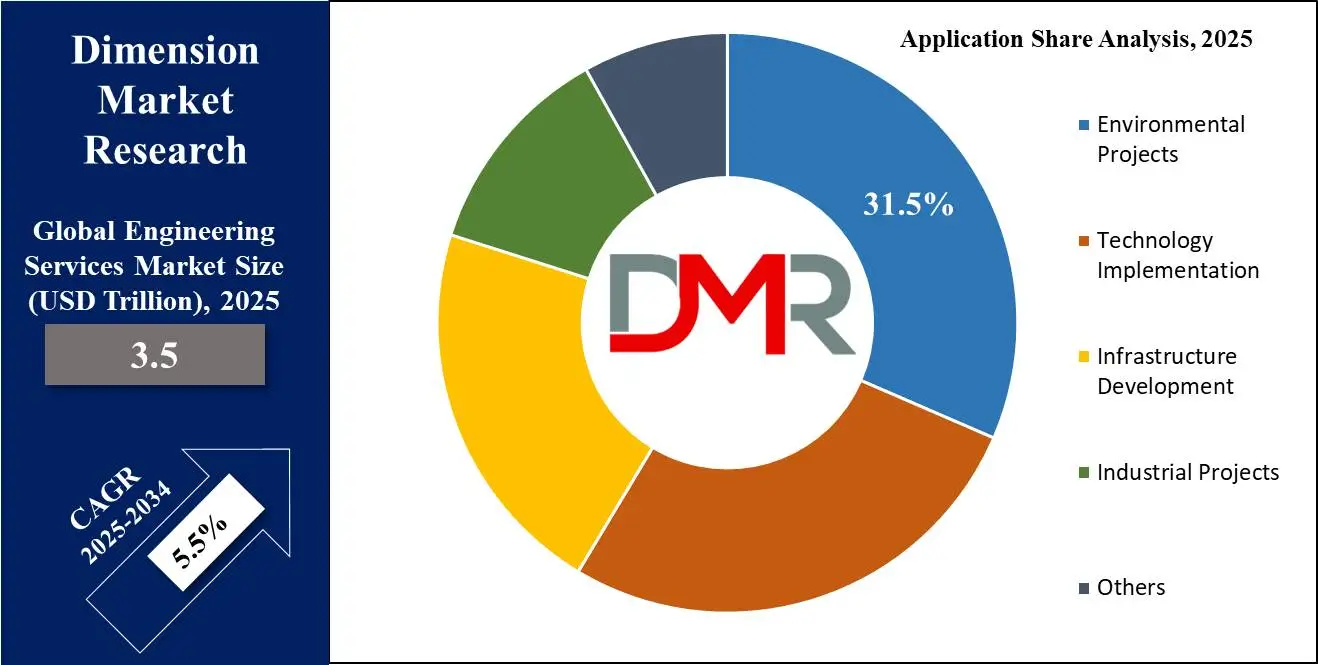

- Application Analysis: Environmental projects are predicted to dominate the engineering services market accounting for 25.6% of revenue by the end of 2025.

- End User Analysis: Telecommunication services are projected to lead the global market with the highest revenue share by 2025.

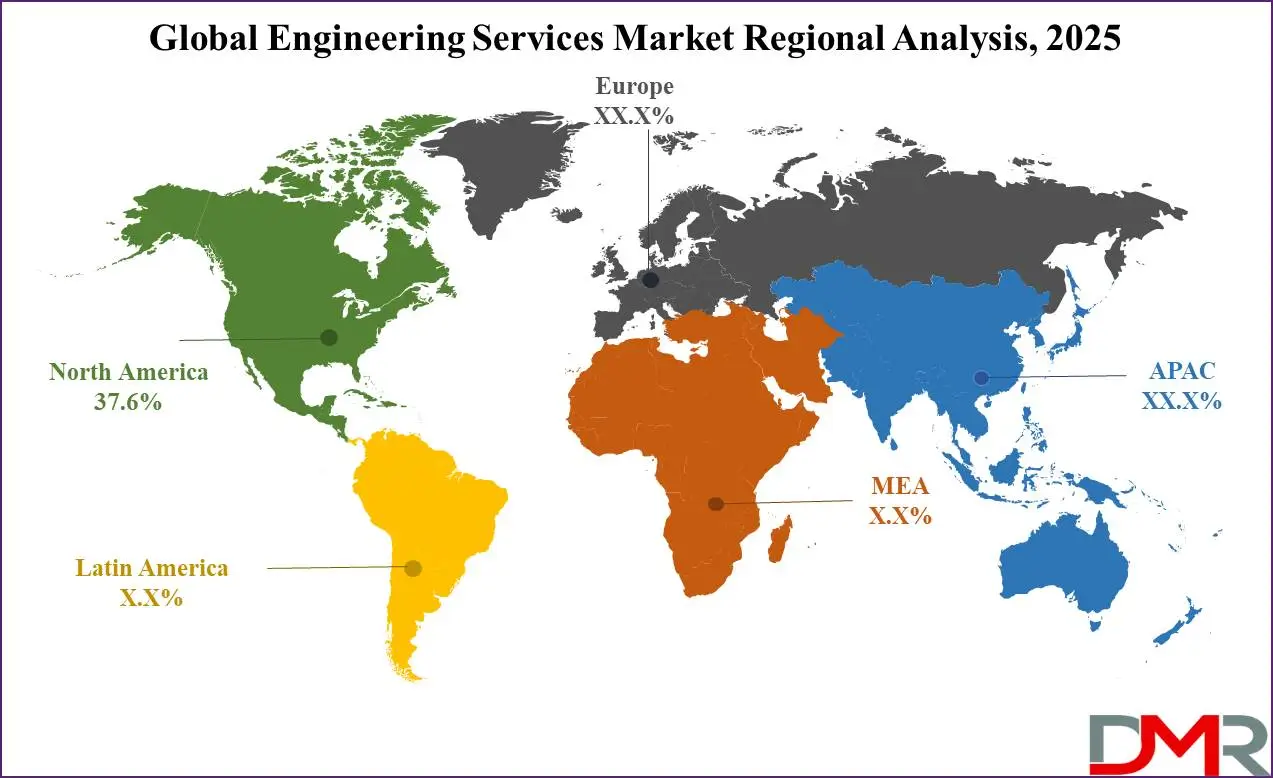

- Regional Analysis: North America is projected to dominate the global solar engineering services market, holding a market share of 37.6% by 2025.

Engineering Services Market: Use Cases

- Product Design and Development: Engineering services are often utilized in the design and development of new products. This includes everything from concept sketches to prototyping, testing, and final product realization.

- Structural Engineering for Buildings and Infrastructure: Structural engineering services are essential for the design and analysis of buildings, bridges, and other infrastructure. These services ensure that the structures are stable, durable, and able to withstand environmental and load-bearing stresses.

- Manufacturing Process Optimization: Engineering services play a critical role in improving manufacturing processes. Through process optimization, engineers help businesses streamline production lines, reduce waste, increase efficiency, and lower operational costs, leading to higher productivity and profitability.

- Energy Systems and Sustainability Solutions: Engineers provide services in the development of renewable energy systems, energy management, and sustainability initiatives.

Engineering Services Market: Stats & Facts

- Outsourcing & Economies of Scale: Engineering R&D outsourcing is rapidly expanding, anticipated to grow at a 23.9% CAGR, reaching USD 537.67 trillion in 2024, and continuing to rise to USD 1.29 trillion by 2028. This growth aligns with the concept of economies of scale, where companies increasingly outsource R&D to reduce costs and access specialized skills.

- Automation & Process Optimization: The process automation and instrumentation market is expected to increase by USD 75.47 trillion in 2024, reflecting the theory of process optimization through automation, which drives efficiency and reduces labor costs, fostering industry-wide growth.

- Innovation & Technological Advancements: The product engineering market is forecast to grow at an 8.4% CAGR, reaching USD 1,063.14 trillion by 2024, driven by continuous innovation and technological advancement in product development, aligned with the theory of technological diffusion.

- Infrastructure Growth & Capital Investment: The heavy and civil engineering market, projected to hit USD 2.04 trillion by 2024, with a consistent 4.2% CAGR, highlights the theory of capital investment, where infrastructure development is essential for economic growth and urbanization, requiring long-term investments.

Engineering Services Market Dynamic

Driving Factors in the Engineering Services Market

Urbanization and Demand for Advanced Infrastructure Solutions.

The global engineering services market is driven by urbanization and its accompanying demand for advanced infrastructure. As cities expand to accommodate growing populations, their need for smart cities, efficient transit systems, reliable utilities, and sustainable urban planning becomes ever more urgent - engineering services play a pivotal role in designing, planning, and overseeing such large-scale projects - governments, as well as private sectors alike, are investing heavily in urban living infrastructure, further increasing engineering needs for this market.

Emerging Technologies Revolutionizing Engineering Services

Emerging technologies like artificial intelligence (AI), the Internet of Things (IoT), robotics, and cloud computing are revolutionizing the engineering services market. Their innovations offer increased design accuracy, cost efficiency, and faster project execution compared to older methods such as manual project management; IoT can monitor systems more closely; robotics enhance construction processes while cloud computing offers seamless collaboration among stakeholders - not to mention opening new possibilities for complex and innovative projects. These advancements not only increase operational efficiencies but also open doors to more complex and innovative projects.

Restraints in the Engineering Services Market

Economic Dependence on Key Industries

The global engineering services market is heavily reliant on key industries like automotive, construction, and energy for its health. Recession or industry challenges affecting any of these areas have an immediate effect on demand for design development infrastructure services - like reduced construction projects or energy initiatives being funded - leading to lower levels of design development infrastructure services overall affecting market stability significantly - creating vulnerability making market performance susceptible to fluctuations causing instability while creating dependence among its stakeholders resulting in unrelenting economic reliance posing significant challenges against long term growth and stability goals.

Complex and Varying Regulatory Requirements

Engineer projects must comply with an array of complex and variable regulatory requirements that vary considerably across regions and industries, from safety regulations to environmental impacts and quality assurance requirements, requiring extensive documentation, audits, and approval processes to meet them. Compliance often increases project costs and timelines significantly while restricting market participation opportunities - especially on global platforms where differing standards and procedures create further roadblocks to successful project execution and profitability.

Opportunities in the Engineering Services Market

Expansion of IoT-Driven Engineering Services

The advent of Internet of Things technology presents global engineering services with an attractive opportunity. Companies are adopting IoT solutions in an attempt to increase operational efficiencies, ensure safety, and enable predictive maintenance services. Engineering service providers can capitalize on this trend by creating customized IoT solutions tailored specifically for industries like manufacturing, automotive, and energy.

Engineering firms that take advantage of IoT solutions to develop real-time monitoring, data analytics platforms for predictive insights, and cybersecurity measures as part of an IoT ecosystem can find new avenues of growth and profit in meeting the industry's demand for them. IoT's rising demand creates avenues for engineering firms to diversify and broaden their service portfolios to address a digital-first industrial landscape.

Strategic Partnerships and Acquisitions

As demand for IoT solutions surges, engineering service providers see an incredible opportunity for expansion through strategic acquisitions and partnerships. Recent acquisitions like Cognizant's purchase of Mobica show that firms are keen to strengthen their IoT software engineering expertise through strategic acquisitions like these. Engineers implementing such an approach are better equipped to leverage IoT knowledge and technological developments quickly to offer clients comprehensive end-to-end solutions. By forging alliances or purchasing IoT specialists outright, engineering service providers can strengthen their market position while meeting increasing global demands for sophisticated IoT-driven engineering services.

Trends in the Engineering Services Market

Adopt Digital Twin Technology Now

Digital twin technology is revolutionizing engineering services markets by creating virtual models of physical products or systems in real-time and simulating them virtually in real-time. This revolutionary approach to engineering services allows engineers to monitor, optimize, and predict product performance throughout their lifespan using sensors and IoT devices in conjunction with real-world data to reduce downtime and enhance operational efficiency as well as enhance decision-making enabling engineers to design superior products more reliably while mitigating risks for enhanced quality products and increased operational efficiencies.

Integrate Blockchain for Increased Transparency

Blockchain technology is making waves in engineering services, particularly in

Engineering, Procurement, and Construction (EPC) projects, due to its ability to increase transparency, security, and efficiency during complex processes like supply chain management and contract execution. Blockchain's decentralized ledger ensures every transaction is traceable and verifiable—greatly decreasing fraud or error risks in transactions conducted between peers. For engineering services companies, this provides more secure procurement processes while streamlining materials tracking, contract compliance reporting, and procurement tracking with reduced compliance risks for large-scale EPC projects. It also fosters collaboration among stakeholders by offering them an immutable record of their activities and a shared, transparent ledger of activities between all parties involved.

Engineering Services Market: Research Scope and Analysis

By Engineering Services Type

Consulting services are predicted to dominate the engineering services market with the highest revenue share in 2025, due to their wide-ranging applications across industries & strategic role in decision-making. Companies increasingly turn to consulting firms for help managing complex challenges like sustainability, regulatory compliance, and digital transformation. Consultants provide expert guidance for optimizing processes, improving operational efficiencies, and mitigating risks, and also provide tailored and cost-effective solutions according to specific business requirements.

Consultancy firms provide essential insight during the early project phases, with feasibility studies, market analyses, and technical assessments helping shape investment decisions. Furthermore, with rapid technological developments and market demands evolving rapidly over time, consulting firms also play a vital role in helping organizations adopt emerging technologies to foster innovation while maintaining a competitive edge.

Specialized Engineering Services take second place due to their essential role in meeting niche technical needs like aerospace engineering, biomedical device design, or renewable energy solutions. These specialized services require exceptional expertise as they serve industries where precision safety and innovation are of the utmost importance; making them essential in driving forward cutting-edge projects.

By Engineering Discipline

Electrical engineering services are anticipated to dominate the engineering services market in 2025, accounting for 41.2% of global revenue due to its key role in digital integration, renewable energy solutions, and smart infrastructure development. The expertise in IoT, AI, & automation continues to drive its expansion as these technologies optimize industrial processes while strengthening connectivity. As more countries move toward renewable sources like solar & wind power, there has been an exponential surge in the need for electrical engineers capable of designing efficient energy systems that fit seamlessly into existing grids. Electric transportation includes electric cars and infrastructure which contributes significantly to sector expansion due to advances in battery technology and power electronics.

Leading firms such as Siemens, ABB, and Tesla are leading innovation in smart grid solutions and digital automation. Civil engineering continues to experience the fastest revenue share due to urbanization, infrastructure expansion, and environmental sustainability initiatives.

By Application

Environmental projects are predicted to dominate the engineering services market accounting for 25.6% of revenue by the end of 2025, due to rising awareness about sustainability and stringent regulatory frameworks. These projects address numerous environmental challenges, from pollution prevention and resource conservation, to habitat restoration which aligns with global efforts toward sustainable development. The demand for these projects has skyrocketed due to compliance requirements with emission control and waste management standards as well as increasing interest in environmental impact assessments.

Corporate Social Responsibility (CSR) initiatives, innovations in clean energy technologies and waste recycling methods as well as public awareness all strengthen this sector. Engineering firms specializing in environmental consultancy and sustainable design play an instrumental part in leading this transformation process.

Technology Implementation is the second most dominant segment, which excels in driving digital transformation using cutting-edge technologies like AI, IoT, and blockchain that help organizations enhance operational efficiencies and innovation. Meanwhile, industry 4.0 cloud computing data analytics 5G quantum computing drives its expansion transforming industries such as healthcare and finance.

By End User

Telecommunication services are likely to lead the engineering services market with the highest revenue share in 2025, due to their central role in global connectivity through voice calls, data transfer, and internet services. Telecommunication services thrive thanks to continued technological innovations such as 5G networks, IoT integration, and satellite transmission capabilities. Telecommunications companies depend on engineering services for network optimization and expansion to meet evolving consumer needs, increasing reliability, speed, coverage, and speed while meeting time-critical timeliness demands.

At the same time, digital transformation across industries heightens the need for robust telecommunications infrastructure to support cloud computing, remote work environments, and digital services. Requirements set forth by government regulations and stiff competition demand innovative engineering solutions to keep pace. Engineering firms play an essential part in designing, implementing, and maintaining these complex networks which improves efficiency while increasing customer experience.

Construction sector engineering services rank second due to their widespread usage in infrastructure design, project management, and sustainable development projects. Urbanization trends like smart cities or green buildings demand engineering expertise for infrastructure planning purposes.

The Engineering Services Market Report is segmented based on the following:

By Services Type

- Design and Development

- Consulting

- Construction and Project Management

- Maintenance and Support

- Specialized Engineering Services

- Technology Integration

By Discipline

- Civil

- Mechanical

- Electrical

- Piping and Structural

By Application

- Environmental Projects

- Technology Implementation

- Infrastructure Development

- Industrial Projects

- Others

By End User

- Construction

- Manufacturing

- Energy and Utilities

- Transportation

- Healthcare

- Telecommunications

- Others

Regional Analysis

North America is likely to dominate the global engineering services market with a revenue

share of 37.6% by the end of 2025, due to a combination of advanced infrastructure, technological leadership, and strong industrial capabilities. Significant investments to modernize critical infrastructure like roads, bridges, public transportation systems, and energy grids have driven an upsurge in engineering expertise demand. Focusing on safety, efficiency, and sustainability ensures the region remains at the forefront of infrastructure development.

North America continues to lead technological advances globally, as IoT, AI, 5G, and automation drive cutting-edge technological progress across various industries that necessitate engineering services that support them. Sustainability initiatives across North America have increased due to North American commitment, from renewable energy projects and green building construction initiatives, green urban planning strategies, and renewable energy programs, which all align with global trends toward environmental responsibility, further solidifying its position as leader of engineering services in this continent.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global engineering services market is highly competitive, characterized by a mix of established multinational corporations and emerging regional players. Key firms like Wipro, Infosys, Tata Consultancy Services, and Capgemini dominate through their extensive service portfolios, digital transformation capabilities, and global reach. The market is further driven by demand for cutting-edge technologies such as AI, IoT, and automation across industries including aerospace, automotive, and construction. Regional players compete by offering cost-effective solutions and niche expertise.

Some of the prominent players in the global Engineering Services are

- STRABAG SE

- Jones Lang LaSalle Incorporated

- Balfour Beatty Inc.

- Kiewit Corporation

- AECOM Engineering Company

- NV5 Global, Inc.

- Barton Malow

- Brasfield & Gorrie LLC

- Nearby Engineers

- RMF Engineering Inc.

- Bechtel Corporation

- Other Key Players

Recent Developments

- In June 2024, AECOM, a leading global infrastructure consulting firm, announced a partnership with Ukrhydroenergo, Ukraine's primary hydropower generation company. The collaboration aims to identify and undertake projects aimed at restoring and enhancing Ukraine's hydropower assets, systems, and capabilities.

- In April 2024, WSP Global Inc. announced its agreement to acquire 1A Ingenieros, S.L. (1A Ingenieros), a Spanish consulting firm specializing in the Power & Energy sector with approximately 250 employees. The acquisition is anticipated to be finalized in the second quarter of 2024. This strategic move is set to bolster WSP’s capabilities in Spain within the Power & Energy sector, establishing a robust multidisciplinary presence in the region. It will also diversify WSP’s portfolio across its core markets of Transportation & Infrastructure, Power & Energy, and Property and Buildings while expanding its footprint in Earth and Environment services.

- In February 2023, SCF Partners announced its investment in Global E&C, a differentiated engineering, maintenance, modification, and commissioning business mainly focused on servicing the offshore energy sector. The investment is expected to significantly bolster GEC's ability to assist the evolving energy markets and enhance the growth of its digital and decarbonization offerings.

- In January 2023, L&T Technology Services Limited, a global provider of pure-play engineering services, announced that it had been selected as a strategic engineering partner to Airbus for providing advanced engineering capabilities and digital manufacturing services under a multi-year contract. Under this agreement, LTTS is expected to assist Airbus in key verticals and technology areas for its ongoing commercial and innovation programs.

- In January 2023, WSP Global announced the acquisition of Enstruct, a 75-employee structural engineering company renowned for designing and providing quality building projects across Australia.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 3.5 Tn |

| Forecast Value (2033) |

USD 5.8 Tn |

| CAGR (2024-2033) |

5.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.1 Tn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Services Type (Design and Development, Consulting, Construction and Project Management, Maintenance and Support, Specialized Engineering Services, and Technology Integration), By Discipline (Civil, Mechanical, Electrical, and Piping and Structural), By Application (Environmental Projects, Technology Implementation, Infrastructure Development, Industrial Projects, and Others), By End User (Construction, Manufacturing, Energy and Utilities, Transportation, Healthcare, Telecommunications, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

STRABAG SE, Jones Lang LaSalle Incorporated, Balfour Beatty Inc., Kiewit Corporation, AECOM Engineering Company, NV5 Global, Inc., Barton Malow, Brasfield & Gorrie LLC, Nearby Engineers, RMF Engineering Inc., Bechtel Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Engineering Services Market size is estimated to have a value of USD 3.5 trillion in 2024 and is expected to reach USD 5.8 trillion by the end of 2033.

North America is expected to be the largest market share for the Global Engineering Services Market with a share of about 37.6% in 2024.

Some of the major key players in the Global Engineering Services Market are Bechtel Corporation, AECOM Engineering Company, Balfour Beatty Inc., and many others.

The market is growing at a CAGR of 5.7 percent over the forecasted period.

The US Engineering Services Market size is estimated to have a value of USD 1.1 trillion in 2024 and is expected to reach USD 1.8 trillion by the end of 2033.