Market Overview

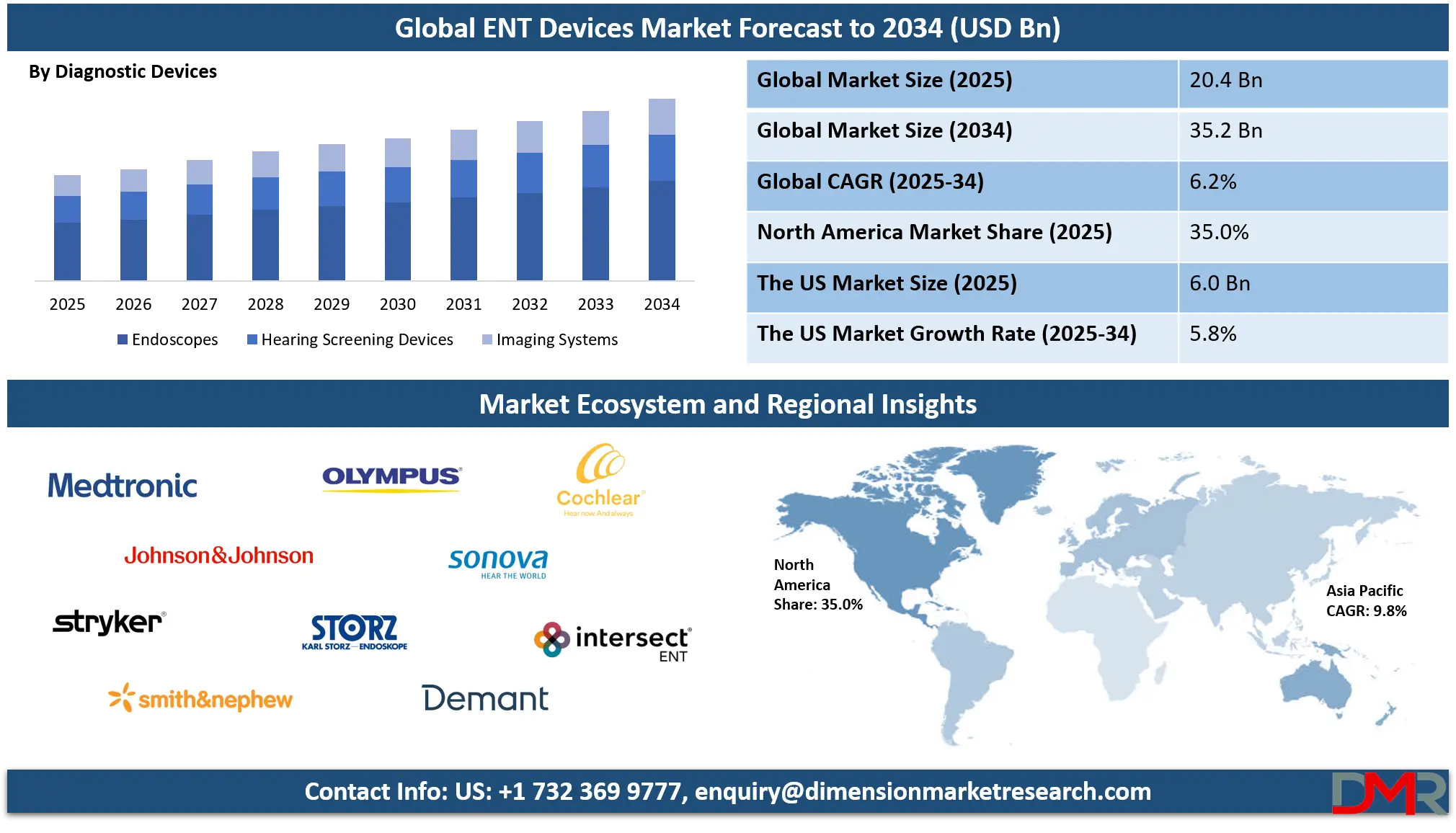

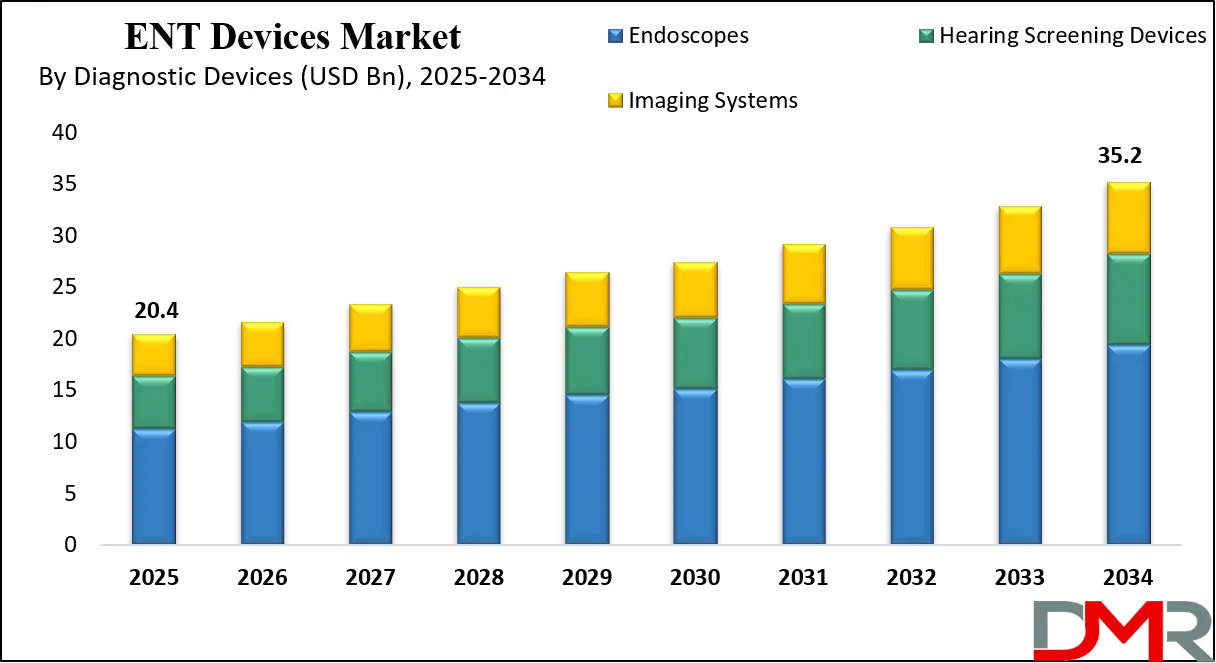

The global ENT devices market is projected to reach USD 20.4 billion in 2025 and is expected to grow to USD 35.2 billion by 2034, expanding at a CAGR of 6.2%. This growth is driven by rising cases of hearing loss, growing adoption of minimally invasive ENT procedures, and technological advancements in otolaryngology devices.

ENT devices, or ear, nose, and throat devices, are specialized medical tools and equipment designed to diagnose, treat, and manage disorders related to the otolaryngology field. These devices encompass a wide range of products, including endoscopes, hearing aids, surgical instruments, hearing implants, voice prosthetics, and diagnostic systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

ENT devices play a vital role in facilitating minimally invasive procedures and improving patient outcomes across conditions such as sinusitis, hearing loss, tonsillitis, nasal polyps, and laryngeal disorders. Advanced ENT equipment enables precise visualization, treatment planning, and rehabilitation for both acute and chronic conditions, supporting the growing demand for personalized and efficient ENT care in various healthcare settings, including hospitals, ambulatory centers, and specialty clinics.

The global ENT devices market has witnessed consistent growth due to the growing prevalence of hearing disorders, rising geriatric population, and technological advancements in audiology and endoscopic solutions. The adoption of minimally invasive ENT surgeries, integrated with innovations in hearing aid design and cochlear implants, has significantly broadened the scope of ENT care globally. Additionally, growing awareness of ENT-related health conditions and improved healthcare access in emerging economies have propelled the market further, with public and private investments enhancing the availability of advanced otolaryngology equipment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the market expansion is supported by the integration of digital technologies such as AI-based diagnostic systems, wireless connectivity in hearing aids, and image-guided ENT procedures. The shift toward outpatient ENT surgeries and home-based hearing care solutions is also reshaping the industry landscape. Market players are increasingly focusing on R&D to launch next-generation ENT tools that enhance clinical efficiency and patient comfort. As global healthcare infrastructure improves and demand for specialized ENT treatment rises, the market for ENT medical devices is poised for sustained growth across both developed and developing regions.

The US ENT Devices Market

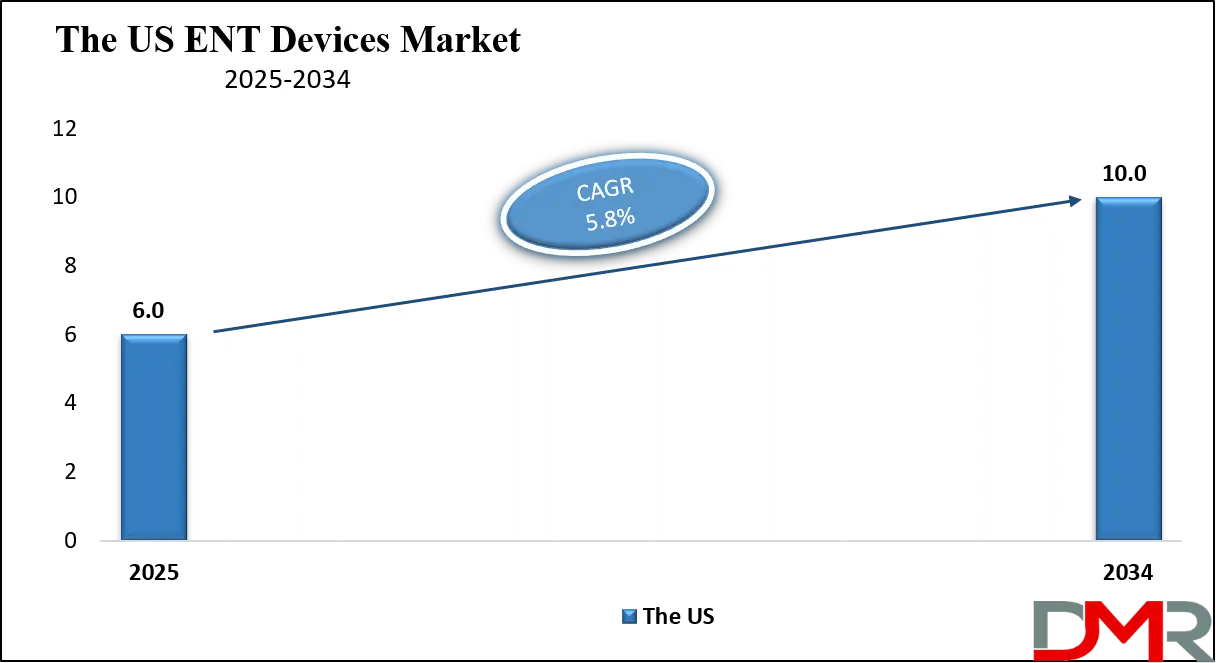

The U.S. ENT Devices market size is projected to reach USD 6.0 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 10.0 billion in 2034 at a CAGR of 5.8%.

The US ENT devices market holds a significant share of the global landscape, driven by advanced healthcare infrastructure, high awareness of otolaryngology disorders, and rapid adoption of cutting-edge ENT technologies. The rising prevalence of age-related hearing loss, chronic sinusitis, and sleep apnea among the aging population has driven demand for specialized ENT equipment, including digital hearing aids, powered surgical instruments, and endoscopic systems.

Moreover, favorable reimbursement policies and a strong presence of leading medical device manufacturers have accelerated product innovation and market penetration. The growing preference for outpatient ENT surgeries, driven by the proliferation of ambulatory surgical centers and ENT clinics nationwide, further contributes to the steady growth of the US ENT equipment market.

Additionally, the United States continues to witness growing integration of advanced technologies like wireless hearing devices, AI-assisted diagnostic imaging, and robot-assisted ENT surgeries, enhancing precision and patient outcomes. The surge in teleaudiology and remote monitoring tools has opened new avenues for hearing care accessibility, particularly in rural and underserved regions.

Investment in research and development, integrated with regulatory support from the FDA for novel ENT implants and instruments, is propelling market expansion. As ENT-related conditions such as tinnitus, otitis media, and deviated nasal septum become more common, the US ENT devices industry is poised to maintain robust growth through continuous innovation and strong clinical demand across hospital and home care settings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe ENT Devices Market

The Europe ENT devices market is projected to reach approximately USD 5.5 billion in 2025. This strong position is primarily driven by a well-established healthcare infrastructure, high patient awareness, and the early adoption of advanced ENT technologies across countries like Germany, France, and the UK. The growing incidence of hearing loss, sinus disorders, and sleep apnea, particularly among the aging population, has led to a growing demand for diagnostic and therapeutic ENT equipment. Public healthcare programs, favorable reimbursement systems, and government-supported initiatives for early hearing screening and otolaryngology services have further contributed to the regional market’s consistent expansion.

With a projected CAGR of 5.9% from 2025 to 2034, Europe’s ENT devices market is expected to grow steadily, supported by ongoing innovation in minimally invasive surgical tools, AI-enabled diagnostic systems, and smart hearing aid technologies. The region also benefits from the presence of several global and regional ENT device manufacturers, fostering competitive pricing and continuous product development.

Moreover, the growing emphasis on outpatient ENT procedures, the expansion of audiology care services, and rising investment in R&D are expected to reinforce Europe’s leadership in the global ENT market in the coming years. As the region continues to address both chronic and age-related ENT conditions, demand for advanced, patient-centric solutions will remain a key growth driver.

Japan ENT Devices Market

Japan's ENT devices market is estimated to reach USD 0.7 billion in 2025, contributing a notable portion to the overall Asia-Pacific market. This growth is primarily driven by the country’s rapidly aging population, with a high prevalence of age-related hearing loss, chronic rhinosinusitis, and laryngeal conditions. The demand for advanced hearing care solutions, including digital hearing aids, cochlear implants, and bone-anchored hearing systems, continues to rise in both clinical and home care settings.

Japan’s robust healthcare system, high awareness of auditory health, and government-supported screening programs for newborns and the elderly have played a critical role in shaping a proactive ENT care environment. Additionally, the presence of technologically adept local manufacturers has improved access to precision-based ENT surgical and diagnostic devices.

With a projected CAGR of 6.4% between 2025 and 2034, Japan is expected to remain one of the fastest-growing national markets in the ENT devices landscape. Innovation in minimally invasive ENT procedures, integration of AI in diagnostic imaging, and the popularity of wearable hearing technologies are key trends fueling this upward trajectory. Japanese consumers tend to prefer compact, high-performance medical devices, which has encouraged manufacturers to focus on miniaturization and user-friendly designs.

Furthermore, the rising use of teleaudiology and home-based ENT care tools in response to Japan’s aging demographics is driving demand for remote monitoring and digital intervention solutions. These factors, combined with supportive healthcare regulations and continuous investments in med-tech innovation, position Japan as a vital growth hub in the global ENT devices market.

Global ENT Devices Market: Key Takeaways

- Market Value: The global ENT devices market size is expected to reach a value of USD 35.2 billion by 2034 from a base value of USD 20.4 billion in 2025 at a CAGR of 6.2%.

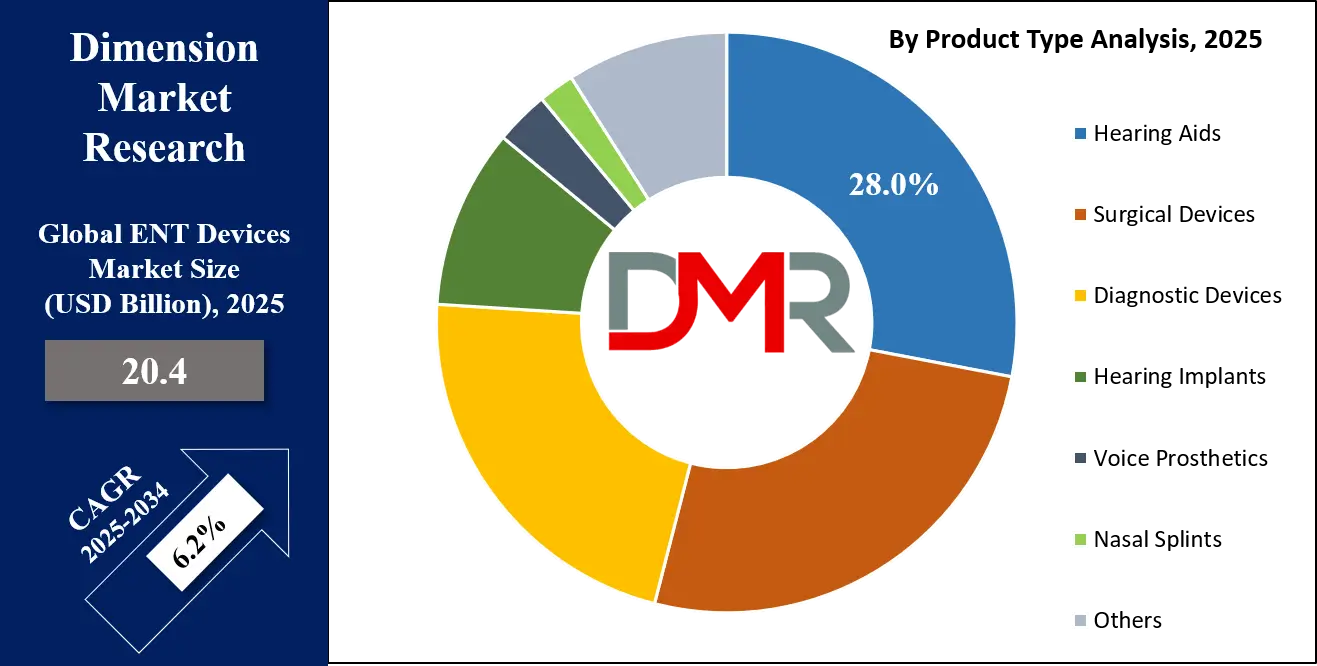

- By Product Type Segment Analysis: Hearing Aids are anticipated to dominate the product type segment, capturing 28.0% of the total market share in 2025.

- By Diagnostic Devices Segment Analysis: Endoscopes are expected to maintain their dominance in the diagnostic devices segment, capturing 55.0% of the total market share in 2025.

- By Age Group Segment Analysis: The Adult group is poised to consolidate its dominance in the age group segment, capturing 75.0% of the market share in 2025.

- By Application Segment Analysis: Hearing Disorders Users will dominate the application segment, capturing 45.0% of the market share in 2025.

- By End User Segment Analysis: Hospitals & Clinics will account for the maximum share in the end user segment, capturing 48.0% of the total market value.

- Regional Analysis: North America is anticipated to lead the global ENT devices market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global ENT devices market are Medtronic, Johnson & Johnson (Acclarent), Stryker Corporation, Smith & Nephew, Olympus Corporation, Karl Storz GmbH & Co. KG, Cochlear Limited, Sonova Holding AG, Demant A/S, GN Store Nord (ReSound), Starkey Hearing Technologies, Intersect ENT, Atos Medical, and Others.

Global ENT Devices Market: Use Cases

- Minimally Invasive ENT Surgeries Using Endoscopic Systems: The growing demand for minimally invasive surgical procedures has led to the widespread use of ENT endoscopy systems in both hospitals and ambulatory surgical centers. These devices, such as nasal and laryngeal endoscopes, offer enhanced visualization and precision during complex procedures like sinus surgeries, polypectomies, and vocal cord lesion removal. They reduce trauma to surrounding tissues, minimize recovery time, and lower the risk of infection. This application is especially critical for patients with chronic sinusitis and nasal obstructions, where traditional open surgeries were previously the norm. ENT specialists now rely on high-definition imaging, flexible endoscopes, and microdebriders to perform procedures with higher success rates and fewer complications.

- Hearing Loss Management through Advanced Hearing Aids and Implants: A major driver in the ENT devices market is the rising incidence of sensorineural and age-related hearing loss, particularly among the geriatric population. The development of digital hearing aids, cochlear implants, and bone-anchored hearing devices has transformed the hearing rehabilitation landscape. These devices provide customizable amplification, noise cancellation, Bluetooth connectivity, and AI-powered sound optimization to improve speech recognition in noisy environments. In regions with aging populations, such as North America and Europe, hearing aids are increasingly adopted for early-stage hearing impairments, while cochlear implants are used for severe to profound hearing loss. These solutions are being integrated with teleaudiology platforms to enable remote hearing care and calibration, enhancing accessibility in rural or underserved areas.

- Post-Laryngectomy Rehabilitation with Voice Prosthesis Devices: Patients undergoing laryngectomy due to laryngeal cancer require specialized support to regain vocal communication. Voice prostheses have emerged as life-changing ENT medical devices that allow patients to speak by redirecting air from the trachea to the esophagus, producing audible speech. These devices are surgically implanted and can be customized based on the patient’s anatomy and speaking needs. Leading manufacturers offer indwelling and non-indwelling voice prostheses, which significantly improve the quality of life, emotional well-being, and social reintegration of patients post-surgery. This application showcases the importance of rehabilitative ENT devices in oncology-focused ENT care.

- Pediatric ENT Disorder Diagnosis Using Audiometry and Tympanometry Devices: Children are highly susceptible to middle ear infections, otitis media, and hearing impairments that can affect speech and cognitive development. ENT clinics and pediatricians use audiometers, tympanometers, and otoacoustic emission (OAE) testing devices to accurately diagnose hearing and middle ear function in infants and young children. Early screening through these diagnostic tools enables timely intervention, such as prescribing hearing aids, performing minor ENT surgeries, or recommending speech therapy. School-based hearing screening programs and pediatric ENT centers heavily rely on these devices to monitor auditory health and prevent long-term developmental issues. This use case highlights the significance of early ENT diagnostics and preventive otolaryngology in the pediatric segment.

Impact of Artificial Intelligence on the ENT Devices Market

Artificial Intelligence (AI) is revolutionizing the ENT (Ear, Nose, and Throat) devices market by enhancing diagnostic accuracy, personalizing treatment, and streamlining clinical workflows. One of the key applications is in AI-powered diagnostic imaging, where machine learning algorithms are used to analyze nasal endoscopy, otoscopic, and laryngoscopic images. These systems can detect abnormalities such as polyps, tumors, or vocal cord lesions with high precision, assisting ENT specialists in early disease detection and improving clinical decision-making. AI also plays a pivotal role in audiology, where it powers smart hearing aids that automatically adjust to ambient sound environments, filter background noise, and learn user preferences over time, leading to superior patient satisfaction and auditory rehabilitation.

In addition, AI is enabling predictive analytics and outcome modeling in ENT surgeries. Surgeons use AI-based tools for preoperative planning, particularly in complex procedures like cochlear implantation and sinus navigation. These tools help reduce surgical errors and improve recovery rates. Voice recognition and speech analytics powered by natural language processing (NLP) are being integrated with voice prosthetic devices for post-laryngectomy patients, allowing for real-time feedback and enhanced speech therapy.

Furthermore, AI is supporting remote patient monitoring and teleENT solutions, especially in rural or underserved areas, making hearing care and ENT follow-ups more accessible. As AI technologies continue to evolve, their integration with ENT medical devices is expected to significantly boost market innovation, patient outcomes, and overall operational efficiency in otolaryngology practices.

Global ENT Devices Market: Stats & Facts

World Health Organization (WHO)

- In 2023, over 1.1 billion people globally were affected by hearing loss.

- WHO estimates this number will rise to 1.5 billion by 2030.

- Approximately 430 million people required hearing rehabilitation in 2024.

- WHO projects 700 million people will need hearing care by 2050.

- Over 60% of hearing loss in children is due to preventable causes as of 2023.

Centers for Disease Control and Prevention (CDC - USA)

- In 2023, 15% of American adults (aged 18+) reported trouble hearing.

- Around 2 to 3 of every 1,000 children in the U.S. are born with a detectable level of hearing loss.

- Over 28 million adults in the U.S. could benefit from hearing aids as of 2024.

- CDC reported a 20% increase in chronic sinusitis diagnoses in outpatient visits between 2020 and 2024.

- In 2025, the U.S. is expected to perform more than 600,000 ENT surgical procedures annually.

National Institute on Deafness and Other Communication Disorders (NIDCD - USA)

- By 2023, nearly 1 in 8 people in the U.S. (13%) aged 12 years or older had hearing loss in both ears.

- The adoption rate of cochlear implants among eligible adults in the U.S. remains below 10% as of 2024.

- In 2023, about 324,000 cochlear implants had been surgically placed worldwide.

- Of those, 118,000 were in adults and over 80,000 in children in the U.S. alone.

- NIDCD projects that digital hearing aids usage among adults will surpass 65% by 2025.

NHS Digital (UK)

- In 2023, over 11 million people in the UK were affected by some form of hearing loss.

- Around 2 million people used hearing aids, but only 1.4 million used them regularly.

- ENT outpatient appointments in the UK increased by 17% from 2022 to 2024.

- NHS performed approximately 27,000 tonsillectomies and adenoidectomies in children in 2023.

- NHS aims to reduce avoidable hearing loss by 50% in children by 2030 through early screening.

Eurostat (EU)

- In 2023, 29% of the EU population aged 65+ reported some level of hearing difficulty.

- Germany and France accounted for over 40% of all ENT-related procedures in the EU in 2024.

- ENT device-related healthcare spending in the EU increased by 6.1% in 2023 alone.

- Over 70% of hearing device users in Northern Europe use digital hearing aids as of 2024.

- Average waiting time for ENT surgery in public hospitals reduced by 12% across the EU in 2023.

Japan Ministry of Health, Labour and Welfare

- As of 2023, over 14 million Japanese citizens are estimated to have hearing difficulties.

- Japan reported over 20,000 cochlear implant surgeries performed cumulatively by 2024.

- In 2023, more than 5,000 ENT specialists were active across Japan.

- By 2025, hearing aid adoption in elderly (70+) is projected to reach 52%.

- Government initiatives aim to cover 80% of early childhood hearing screenings by 2025.

Global ENT Devices Market: Market Dynamics

Global ENT Devices Market: Driving Factors

Rising Geriatric Population and Hearing Loss Incidence

The global increase in the aging population is significantly boosting demand for ENT devices, particularly hearing aids, cochlear implants, and audiology diagnostic systems. Age-related hearing loss, or presbycusis, is one of the most common health issues among seniors, and it necessitates continuous advancements in hearing rehabilitation technology. This demographic trend is encouraging the adoption of personalized hearing care solutions, including smart hearing aids integrated with Bluetooth and noise-cancellation features, thereby fueling market growth.

Technological Advancements in ENT Surgical Equipment

Rapid innovation in ENT surgical tools such as powered instruments, image-guided surgery systems, and endoscopic visualization platforms is a major growth driver. These technologies support minimally invasive ENT procedures, which reduce patient recovery times, minimize scarring, and enhance surgical precision. Advanced tools are now widely used for treating chronic sinusitis, nasal polyps, and laryngeal tumors. The integration of robotics and real-time imaging further improves surgical outcomes in complex otolaryngology procedures.

Global ENT Devices Market: Restraints

High Cost of Advanced ENT Devices

The high acquisition and maintenance cost of sophisticated ENT equipment, including diagnostic imaging systems and cochlear implants, poses a barrier to adoption, especially in low- and middle-income countries. Many healthcare providers in emerging regions struggle to invest in such technology due to limited budgets and insufficient reimbursement coverage. This economic constraint can hinder the growth of the market despite rising clinical need.

Limited Skilled ENT Professionals and Training Gaps

Despite the growth in otolaryngology services, a significant challenge remains in the form of shortage of skilled ENT surgeons and audiologists, particularly in developing countries. The proper use of ENT devices requires specialized training, and a lack of awareness or expertise among healthcare providers can delay or reduce the effectiveness of treatment. Additionally, inadequate training infrastructure limits the wider deployment of complex ENT diagnostic tools and surgical systems.

Global ENT Devices Market: Opportunities

Expansion of Teleaudiology and Remote ENT Care

The emergence of teleENT platforms and remote hearing care services presents a promising opportunity for expanding access to ENT treatments. With the help of digital otoscopes, app-based hearing tests, and cloud-connected hearing aids, patients in rural and remote areas can now access quality otolaryngology care. This model also reduces the burden on urban ENT clinics and supports continuous monitoring of chronic ENT conditions from home settings.

Untapped Potential in Emerging Markets

Developing countries in Asia-Pacific, Latin America, and the Middle East represent lucrative growth avenues due to growing healthcare spending, a growing burden of ENT disorders, and improving medical infrastructure. Governments and NGOs are also initiating programs to enhance early diagnosis of hearing impairment and sinus-related conditions, encouraging the adoption of modern ENT solutions. Local manufacturing and partnerships with regional distributors are expected to further penetrate these underserved otolaryngology markets.

Global ENT Devices Market: Trends

Integration of AI and Machine Learning in ENT Diagnostics

Artificial intelligence is becoming a transformative force in the ENT sector. From AI-assisted nasal endoscopy to machine learning algorithms for analyzing audiograms and speech patterns, the use of AI is enhancing clinical decision-making and operational efficiency. These tools can rapidly detect abnormalities, suggest treatment pathways, and even support robotic-assisted ENT surgeries, leading to more precise outcomes.

Shift toward Wearable and Connected Hearing Devices

Consumer demand for convenience, comfort, and aesthetics is driving the trend toward wearable ENT technology, particularly in hearing care. Smart hearing aids now offer features like real-time language translation, fitness tracking, and Bluetooth connectivity, blurring the lines between medical devices and consumer electronics. This convergence is attracting a younger demographic to hearing solutions and driving growth in the connected ENT devices segment.

Global ENT Devices Market: Research Scope and Analysis

By Product Type Analysis

Hearing aids are expected to lead the product type segment in the global ENT devices market, accounting for approximately 28.0% of the total market share in 2025. This dominance is primarily driven by the growing prevalence of age-related and noise-induced hearing loss, particularly among the elderly population. Technological advancements such as AI-based sound processing, Bluetooth connectivity, rechargeable batteries, and miniaturized designs have significantly improved user comfort and device functionality.

The increased availability of over-the-counter hearing aids, rising awareness about early hearing loss intervention, and the growing popularity of teleaudiology services have further contributed to the widespread adoption of hearing aids. These factors collectively make hearing aids a cornerstone in the management of auditory impairments, thereby boosting their demand globally.

Surgical devices also hold a critical position in the ENT devices market, serving as essential tools for a wide range of otolaryngology procedures. These include powered surgical instruments, microdebriders, electrosurgical units, and handheld tools used in procedures such as sinus surgeries, tonsillectomies, septoplasties, and laryngeal interventions.

The market for surgical ENT instruments is being fueled by the growing preference for minimally invasive surgeries, which reduce patient recovery time, lower risk of complications, and improve overall outcomes. With advancements in endoscopic technology, navigation systems, and robotic-assisted surgical platforms, ENT surgeons are now able to perform highly complex procedures with greater precision and safety. Hospitals and surgical centers are increasingly investing in advanced ENT surgical setups, making this segment a key contributor to the market’s overall growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Diagnostic Devices Analysis

Endoscopes are projected to maintain their dominant position within the diagnostic devices segment of the global ENT devices market, accounting for around 55.0% of the total market share in 2025. This is largely due to their critical role in visualizing internal structures of the ear, nose, and throat with high clarity and precision. ENT endoscopes, including rigid and flexible variants, are extensively used for the diagnosis and management of conditions such as chronic sinusitis, nasal polyps, vocal cord abnormalities, and ear infections.

The ability of modern endoscopic systems to integrate with high-definition imaging, digital storage, and real-time navigation tools has enhanced their diagnostic accuracy and clinical utility. As minimally invasive ENT procedures become more common, the demand for advanced endoscopic solutions is expected to rise steadily across hospitals, outpatient centers, and specialized ENT clinics.

Hearing screening devices also form a crucial component of the diagnostic devices segment, particularly in the early detection and assessment of auditory impairments. These devices are widely used in newborn hearing screening programs, school health initiatives, and routine audiological evaluations across all age groups.

Technologies such as otoacoustic emissions (OAE) testing, automated auditory brainstem response (ABR), and pure-tone audiometry have made it possible to detect hearing loss at an early stage, enabling timely intervention with hearing aids or other treatments. The growing awareness of the long-term developmental impact of undiagnosed hearing loss, combined with public health efforts and improved access to audiology services, continues to drive the adoption of hearing screening devices globally.

By Age Group Analysis

The adult age group is expected to consolidate its dominance in the age group segment of the global ENT devices market, capturing approximately 75.0% of the total market share in 2025. This substantial share is primarily attributed to the high prevalence of ENT-related conditions such as age-related hearing loss, tinnitus, chronic rhinosinusitis, and obstructive sleep apnea among the adult and elderly population.

Adults are more likely to undergo ENT surgeries, use hearing aids, and seek medical consultation for conditions affecting the ear, nose, and throat due to occupational exposure, lifestyle factors, and the natural aging process. Additionally, the widespread availability of advanced ENT devices tailored for adult anatomy and the growing awareness about early intervention and auditory rehabilitation are fueling growth in this segment.

The pediatric segment, while smaller in comparison, remains critically important within the ENT devices market due to the high incidence of conditions such as otitis media, adenoid hypertrophy, and congenital hearing loss in infants and young children. Early detection and treatment are vital for proper speech and cognitive development, which has led to the growing adoption of diagnostic devices like tympanometers, otoacoustic emission testers, and portable audiometers in pediatric care.

Surgical interventions such as tonsillectomies and ear tube placements are also common in this age group, driving demand for pediatric-specific ENT instruments and technologies. Increasing government initiatives and school-based screening programs are further supporting market growth by emphasizing early ENT care in children.

By Application Analysis

Hearing disorders are anticipated to dominate the application segment of the global ENT devices market, capturing approximately 45.0% of the total market share in 2025. This dominance is largely driven by the global rise in hearing impairments caused by aging, prolonged noise exposure, genetic factors, and infections. Age-related hearing loss, also known as presbycusis, is becoming increasingly common, particularly in high-income and aging populations.

To address this growing need, the market has seen rapid advancements in hearing care technology, including the development of smart hearing aids, cochlear implants, and bone-anchored hearing systems. These devices are not only becoming more effective but also more accessible due to innovations in teleaudiology and over-the-counter hearing solutions. Additionally, growing public health initiatives for early screening and intervention, particularly in newborns and the elderly, are contributing to the continued growth of this application segment.

Sinus disorders also represent a significant share of the ENT devices market, given the high global prevalence of conditions such as chronic rhinosinusitis, nasal polyps, and allergic rhinitis. These conditions often require both medical management and surgical intervention, thereby driving the demand for specialized ENT diagnostic and therapeutic devices.

Procedures like functional endoscopic sinus surgery (FESS) have become increasingly common, relying heavily on high-definition endoscopes, balloon sinuplasty devices, and powered surgical instruments. The trend toward minimally invasive techniques, shorter recovery times, and improved patient outcomes has further increased the adoption of ENT devices in sinus-related treatments. Environmental pollution, rising allergy cases, and increased diagnosis of chronic sinus conditions are expected to sustain the demand for sinus disorder-related ENT technologies across hospitals, ambulatory centers, and outpatient settings.

By End User Analysis

Hospitals and clinics are projected to account for the largest share in the end user segment of the global ENT devices market, capturing around 48.0% of the total market value in 2025. This dominance is primarily attributed to the comprehensive range of diagnostic and surgical ENT services they offer under one roof, including complex procedures such as cochlear implantation, endoscopic sinus surgery, and laryngectomy.

These facilities are typically equipped with advanced infrastructure, trained otolaryngologists, and a wide selection of ENT diagnostic and therapeutic devices. Hospitals also handle a high volume of patients with both chronic and emergency ENT conditions, making them the primary setting for ENT device utilization. Additionally, reimbursement availability and the preference for specialist consultations in hospital environments further support the growth of this segment.

Ambulatory surgical centers (ASCs) are also playing a growing role in the ENT devices market as they cater to the growing demand for outpatient ENT procedures. These centers are especially popular for minimally invasive surgeries like tympanostomy, tonsillectomy, septoplasty, and endoscopic sinus interventions, offering a cost-effective and efficient alternative to inpatient hospital care.

ASCs are equipped with essential ENT surgical tools and imaging systems, providing same-day surgical services with shorter wait times and quicker patient turnover. The rising preference for outpatient care due to its affordability and convenience is encouraging the expansion of ENT services within these centers. As healthcare systems globally emphasize decentralization and cost optimization, the role of ASCs in delivering ENT treatments is expected to expand significantly in the coming years.

The ENT Devices Market Report is segmented on the basis of the following:

By Product Type

- Hearing Aids

- Surgical Devices

- Diagnostic Devices

- Hearing Implants

- Voice Prosthetics

- Nasal Splints

- Others

By Diagnostic Devices

- Endoscopes

- Hearing Screening Devices

- Imaging Systems

By Age Group

By Application

- Hearing Disorders

- Sinus Disorders

- Nose Disorders

- Throat Disorders

- Sleep Disorders

- Other Applications

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Use

- Research & Academic Institutes

Global ENT Devices Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global ENT devices market in 2025, accounting for approximately 35.0% of the total market revenue. This regional dominance is driven by a combination of advanced healthcare infrastructure, high prevalence of ENT-related conditions such as hearing loss and sinus disorders, and strong adoption of technologically advanced ENT diagnostic and surgical devices.

The presence of key market players, favorable reimbursement frameworks, and continuous innovation in hearing care and endoscopic technologies further support market growth. Additionally, growing awareness, regular ENT screenings, and the integration of telehealth solutions for remote audiology and ENT consultations are enhancing accessibility and treatment outcomes across the region, solidifying North America's position as the leading market for ENT devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness the most significant growth in the global ENT devices market over the forecast period, driven by rising healthcare expenditure, growing awareness of ENT-related conditions, and a growing geriatric population. Countries such as China, India, and Japan are experiencing a surge in demand for advanced hearing aids, endoscopic tools, and minimally invasive ENT surgical solutions due to a higher burden of untreated hearing loss, chronic sinusitis, and sleep apnea.

Rapid urbanization, improved access to healthcare services, and government-led initiatives for early diagnosis and hearing screening are also contributing to market expansion. Moreover, the rising presence of local manufacturers and strategic partnerships with global players are making advanced ENT devices more affordable and accessible, positioning Asia-Pacific as a key growth engine in the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global ENT Devices Market: Competitive Landscape

The global competitive landscape of the ENT devices market is characterized by the presence of several well-established players alongside emerging innovators, all vying for market share through technological advancement, product diversification, and strategic collaborations. Leading companies such as Medtronic, Johnson & Johnson (Acclarent), Stryker, and Cochlear Limited dominate the market with comprehensive ENT portfolios that include hearing aids, surgical instruments, and diagnostic systems.

These players are heavily investing in research and development to introduce AI-enabled devices, minimally invasive surgical tools, and connected hearing technologies. At the same time, regional and niche manufacturers are gaining traction by offering cost-effective and specialized solutions tailored to local needs. Mergers, acquisitions, and partnerships are common strategies to expand geographic presence and product capabilities, while innovation in teleENT and wearable technologies is further intensifying competition across both developed and emerging markets.

Some of the prominent players in the global ENT devices market are:

- Medtronic

- Johnson & Johnson

- Stryker Corporation

- Smith & Nephew

- Olympus Corporation

- Karl Storz GmbH & Co. KG

- Cochlear Limited

- Sonova Holding AG

- Demant A/S

- GN Store Nord (ReSound)

- Starkey Hearing Technologies

- Intersect ENT

- Atos Medical

- Rion Co., Ltd.

- Audina Hearing Instruments

- Widex A/S

- MAICO Diagnostics

- Natus Medical Incorporated

- Fujifilm Holdings Corporation

- Hill-Rom Holdings, Inc.

- Other Key Players

Global ENT Devices Market: Recent Developments

- June 2024: Cochlear Limited launched the Cochlear™ Nucleus® SmartNav System, an advanced cochlear implant solution designed to improve surgical precision and post-operative outcomes using real-time navigation and AI-assisted feedback.

- April 2024: Sonova Holding AG introduced the Phonak Audéo Lumity Life, a waterproof rechargeable hearing aid equipped with directional microphones and health tracking features, targeting both adult and active elderly users.

- February 2024: Demant A/S acquired Alpaca Audiology, a major US-based hearing care network, to expand its retail footprint across North America and strengthen its direct-to-consumer channel for hearing aids.

- December 2023: Rion Co., Ltd. secured USD 30 million in Series C funding to accelerate R&D in portable diagnostic audiology systems and expand its presence in Southeast Asian and European ENT markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 20.4 Bn |

| Forecast Value (2034) |

USD 35.2 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 6.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Hearing Aids, Surgical Devices, Diagnostic Devices, Hearing Implants, Voice Prosthetics, Nasal Splints, Others), By Diagnostic Devices (Endoscopes, Hearing Screening Devices, Imaging Systems), By Age Group (Pediatric, Adult), By Application (Hearing Disorders, Sinus Disorders, Nose Disorders, Throat Disorders, Sleep Disorders, Other Applications), and By End User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Home Use, Research & Academic Institutes) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Medtronic, Johnson & Johnson (Acclarent), Stryker Corporation, Smith & Nephew, Olympus Corporation, Karl Storz GmbH & Co. KG, Cochlear Limited, Sonova Holding AG, Demant A/S, GN Store Nord (ReSound), Starkey Hearing Technologies, Intersect ENT, Atos Medical, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global ENT Devices Market?

▾ The global ENT devices market size is estimated to have a value of USD 20.4 billion in 2025 and is expected to reach USD 35.2 billion by the end of 2034.

What is the size of the US ENT devices market?

▾ The US ENT devices market is projected to be valued at USD 6.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 10.0 billion in 2034 at a CAGR of 5.8%.

Who are the key players in the Global ENT Devices Market?

▾ Some of the major key players in the global ENT devices market are Medtronic, Johnson & Johnson (Acclarent), Stryker Corporation, Smith & Nephew, Olympus Corporation, Karl Storz GmbH & Co. KG, Cochlear Limited, Sonova Holding AG, Demant A/S, GN Store Nord (ReSound), Starkey Hearing Technologies, Intersect ENT, Atos Medical, and Others.

What is the growth rate in the Global ENT Devices Market?

▾ The market is growing at a CAGR of 6.2 percent over the forecasted period.

Which region accounted for the largest global ENT devices market?

▾ Which region accounted for the largest global ENT devices market?