Market Overview

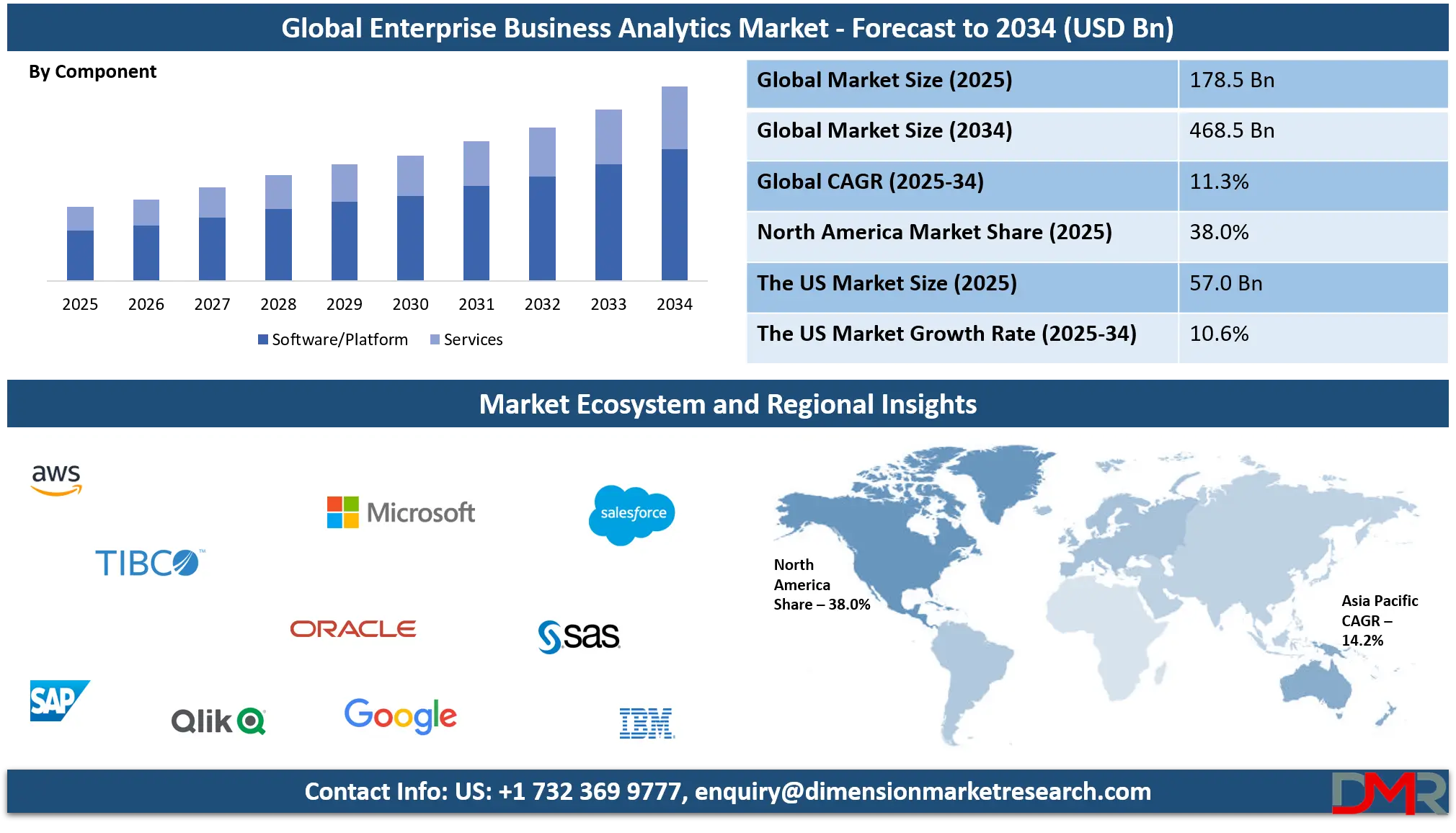

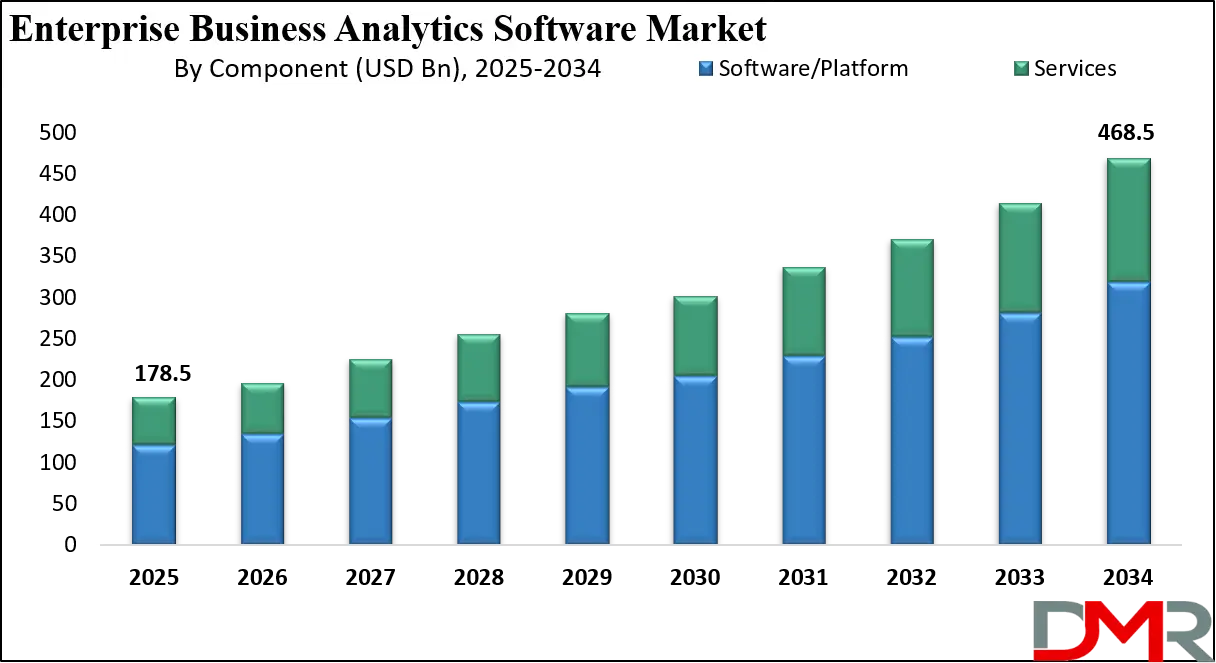

The Global Enterprise Business Analytics Software Market size is projected to reach USD 178.5 billion in 2025 and grow at a compound annual growth rate of 11.3% to reach a value of USD 468.5 billion in 2034.

Enterprise business analytics software comprises digital platforms and tools used to collect, process, analyze, and visualize structured and unstructured organizational data for decision support. These solutions include data integration tools, reporting systems, dashboards, advanced analytics engines, and AI-enabled insight capabilities. The software applies statistical analysis, modeling, and visualization techniques to convert raw data into actionable information, supporting strategic, tactical, and operational decision-making across business functions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is evolving rapidly due to the increasing volume and complexity of enterprise data generated from cloud environments, IoT systems, and digital interaction channels. Enterprises are shifting from traditional descriptive analytics toward predictive and prescriptive models to enable forward-looking insights. Integration of artificial intelligence, machine learning, and natural language processing is enhancing automation, real-time analysis, and decision intelligence, accelerating replacement of legacy analytics systems with scalable, cloud-native platforms.

Regulatory requirements related to data governance, transparency, and compliance continue to influence adoption patterns. Organizations prioritize analytics solutions that ensure data accuracy, security, and auditability while enabling cross-functional access and collaboration. Increasing integration of analytics with core enterprise applications, including ERP, CRM, and supply chain systems, reinforces the role of business analytics software as a critical component of enterprise digital infrastructure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

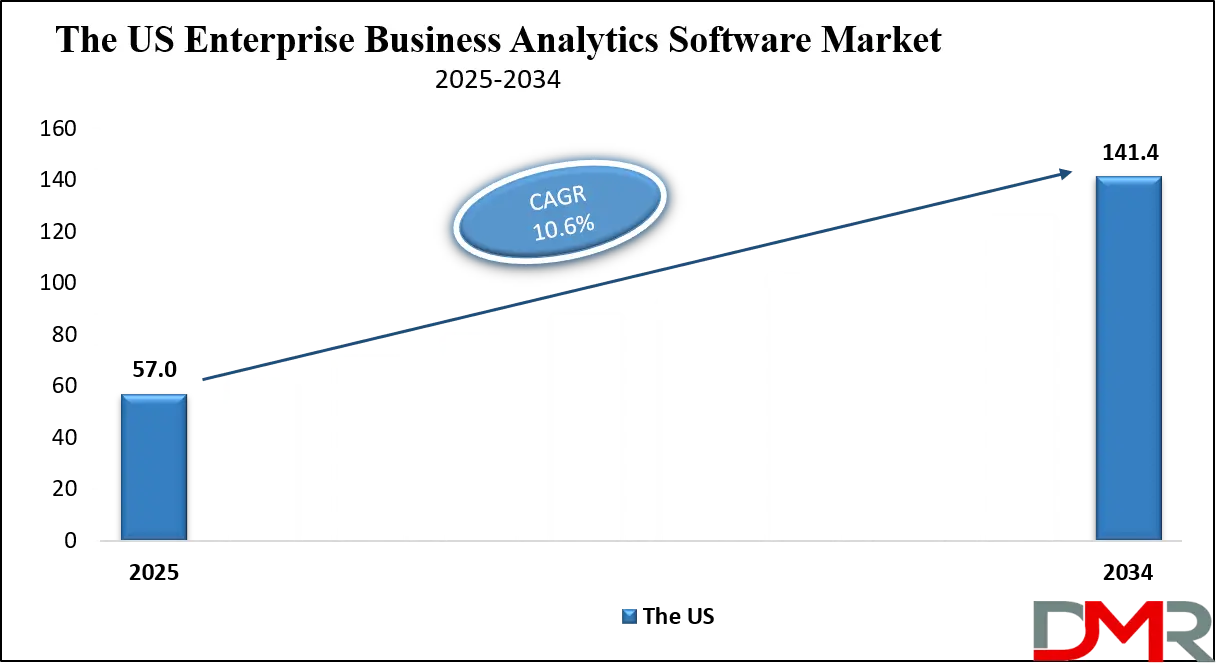

The US Enterprise Business Analytics Software Market

The US Enterprise Business Analytics Software Market size is projected to reach USD 57.0 billion in 2025 at a compound annual growth rate of 10.6% over its forecast period.

The United States represents a mature and innovation-driven market for enterprise business analytics software, supported by high digital adoption across industries such as BFSI, healthcare, retail, and technology. Large enterprises dominate demand, driven by complex data environments and advanced analytics requirements. Strong presence of cloud infrastructure providers, analytics innovators, and system integrators accelerates adoption. Government initiatives promoting data transparency, cybersecurity standards, and AI development further support market growth. The US market benefits from early adoption of AI-driven analytics, strong venture funding, and continuous enterprise investment in digital transformation initiatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Enterprise Business Analytics Software Market

Europe Enterprise Business Analytics Software Market size is projected to reach USD 53.0 billion in 2025 at a compound annual growth rate of 10.8% over its forecast period.

Europe’s enterprise business analytics software market is shaped by regulatory frameworks such as GDPR and sustainability-focused initiatives under the European Green Deal. Organizations emphasize secure data handling, compliance reporting, and ESG analytics. Adoption is strong in manufacturing, public sector, BFSI, and retail sectors, particularly in Germany, France, and the Nordics. European enterprises are steadily migrating from on-premise analytics to hybrid and cloud-based platforms while prioritizing data sovereignty. Innovation is driven by demand for transparent reporting, sustainability analytics, and cross-border operational visibility.

Japan Enterprise Business Analytics Software Market

Japan Enterprise Business Analytics Software Market size is projected to reach USD 8.9 billion in 2025 at a compound annual growth rate of 11.6% over its forecast period.

Japan’s enterprise business analytics software market is driven by digital modernization across manufacturing, automotive, and financial services sectors. Enterprises are adopting analytics to address productivity challenges, aging workforce issues, and supply chain optimization. Government-led digital transformation programs and smart industry initiatives support analytics adoption. Japanese organizations increasingly invest in AI-enabled analytics for quality control, predictive maintenance, and operational intelligence. While conservative IT adoption patterns remain a challenge, strong emphasis on precision, automation, and long-term value creation presents sustained growth opportunities.

Enterprise Business Analytics Software Market: Key Takeaways

- Market Growth: The Enterprise Business Analytics Software Market size is expected to grow by USD 271.8 billion, at a CAGR of 11.3%, during the forecasted period of 2026 to 2034.

- By Component: The software/platform segment is anticipated to get the majority share of the Enterprise Business Analytics Software Market in 2025.

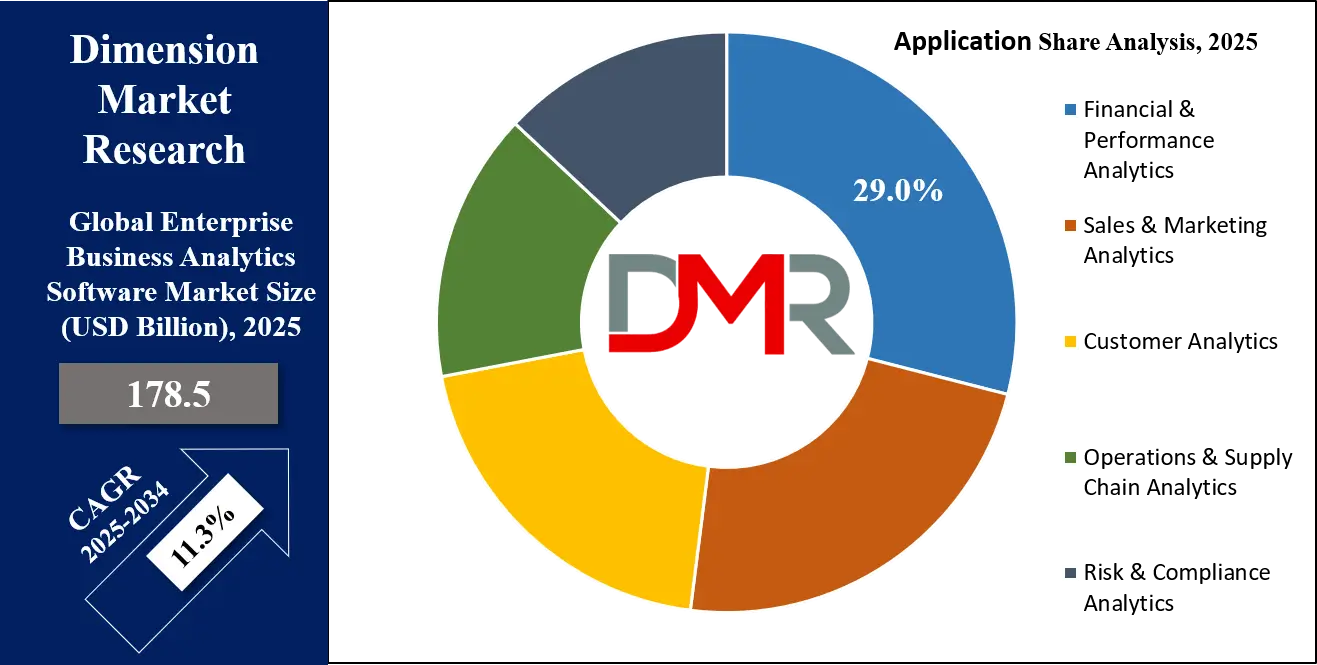

- By Application: The financial & performance analytics segment is expected to get the largest revenue share in 2025 in the Enterprise Business Analytics Software Market.

- Regional Insight: North America is expected to hold a 38.0% share of revenue in the Global Enterprise Business Analytics Software Market in 2025.

- Use Cases: Some of the use cases of Enterprise Business Analytics Software include supply chain visibility, customer behavior analysis, and more.

Enterprise Business Analytics Software Market: Use Cases

- Financial Performance Optimization: Enterprises use analytics platforms to track profitability, forecast revenue, and optimize cost structures through real-time financial intelligence.

- Customer Behavior Analysis: Advanced analytics help organizations understand customer preferences, improve segmentation, and personalize marketing strategies.

- Supply Chain Visibility: Analytics software enables demand forecasting, inventory optimization, and supplier performance monitoring.

- Risk and Compliance Management: Enterprises leverage analytics to detect fraud, ensure regulatory compliance, and manage operational risks.

Stats & Facts

- U.S. Bureau of Economic Analysis reported that data-driven industries contributed over USD 2.4 trillion to the US economy in 2024.

- Eurostat indicated that more than 58% of EU enterprises used advanced data analytics tools in 2024.

- OECD noted that enterprise data volumes grew at an average rate of 23% annually across member countries in 2025.

- U.S. Census Bureau reported that cloud-based software spending by enterprises increased by 21% year-over-year in 2024.

- Japan Ministry of Economy, Trade and Industry recorded a 17% rise in enterprise AI and analytics investments in 2025.

Market Dynamic

Driving Factors in the Enterprise Business Analytics Software Market

Cloud Adoption and Digital Transformation Initiatives

Widespread cloud adoption is a major driver transforming the enterprise analytics landscape. Cloud-based analytics platforms offer scalability, flexibility, and lower infrastructure costs compared to traditional on-premise systems. Enterprises undergoing digital transformation initiatives increasingly integrate analytics with cloud-native ERP, CRM, and supply chain platforms. Hybrid deployment models further support gradual modernization for regulated industries. Cloud analytics also enables remote collaboration, faster deployment cycles, and continuous innovation, making it a preferred choice for enterprises globally.

High Implementation Complexity and Costs

Despite strong demand, high implementation costs and technical complexity restrain market expansion. Large-scale analytics deployments require significant investments in data integration, customization, and skilled personnel. Legacy system integration remains challenging for enterprises with fragmented IT infrastructures. Additionally, advanced analytics solutions demand expertise in data science and AI, which remains scarce in many regions. These factors increase total cost of ownership and slow adoption among small and mid-sized enterprises.

Restraints in the Enterprise Business Analytics Software Market

High Implementation Complexity and Costs

Despite strong demand, high implementation costs and technical complexity restrain market expansion. Large-scale analytics deployments require significant investments in data integration, customization, and skilled personnel. Legacy system integration remains challenging for enterprises with fragmented IT infrastructures. Additionally, advanced analytics solutions demand expertise in data science and AI, which remains scarce in many regions. These factors increase total cost of ownership and slow adoption among small and mid-sized enterprises.

Data Privacy and Security Concerns

Growing concerns around data privacy, cybersecurity, and regulatory compliance pose challenges for enterprise analytics adoption. Enterprises handle sensitive financial, customer, and operational data, making analytics platforms attractive targets for cyber threats. Compliance with regional regulations such as GDPR and industry-specific standards adds complexity to deployment. Organizations must invest heavily in security controls, encryption, and governance frameworks, which can delay implementation timelines and increase operational costs.

Opportunities in the Enterprise Business Analytics Software Market

Growing Adoption Among SMEs

Small and medium enterprises are emerging as a high-growth opportunity segment. Cloud-based and subscription-driven analytics platforms lower entry barriers by reducing upfront costs and implementation complexity. SMEs increasingly adopt analytics to improve operational efficiency, customer engagement, and financial planning. Vendors offering modular, industry-specific, and user-friendly analytics solutions are well-positioned to capture this expanding customer base.

Expansion of AI-Driven and Augmented Analytics

AI-driven and augmented analytics represent a significant growth opportunity within the market. These technologies automate data preparation, insight generation, and visualization using machine learning and natural language processing. Enterprises benefit from faster insights, reduced dependency on technical teams, and improved accessibility for business users. As AI capabilities mature, analytics platforms are evolving into decision intelligence systems, unlocking new value for organizations seeking competitive differentiation.

Trends in the Enterprise Business Analytics Software Market

Shift Toward Self-Service Analytics

Self-service analytics is reshaping enterprise analytics adoption by empowering non-technical users to access and analyze data independently. Drag-and-drop dashboards, natural language queries, and automated insights reduce reliance on IT teams. This trend accelerates decision-making and improves organizational agility. Enterprises increasingly prioritize platforms that support collaborative analytics and democratized data access.

Integration of Analytics with Enterprise Applications

Analytics platforms are increasingly embedded directly into enterprise applications such as ERP, CRM, and HR systems. This integration enables contextual insights within operational workflows, improving productivity and decision accuracy. Embedded analytics reduces data silos and enhances real-time visibility across business functions.

Impact of Artificial Intelligence in Enterprise Business Analytics Software Market

- Automated Insight Generation: AI identifies patterns and anomalies without manual analysis.

- Predictive Forecasting: Machine learning models improve demand and revenue forecasting accuracy.

- Natural Language Analytics: Users query data using conversational interfaces.

- Anomaly Detection: AI detects fraud, risks, and performance deviations in real time.

- Personalized Dashboards: Analytics platforms adapt insights based on user behavior.

Research Scope and Analysis

By Component Analysis

Software and platform solutions dominate the Enterprise Business Analytics Software Market, accounting for approximately 68% market share in 2025, due to their central role in enterprise-wide data processing and decision intelligence. These platforms provide advanced data visualization, real-time dashboards, reporting tools, and AI-powered analytics capabilities that support strategic and operational decision-making.

Enterprises increasingly prioritize scalable and flexible platforms capable of integrating data from multiple internal and external sources, including ERP, CRM, cloud applications, and IoT systems. Continuous innovation in cloud-native architecture, augmented analytics, and self-service features further strengthens platform adoption. Embedded AI, automation, and natural language querying enhance usability, enabling faster insights and broader adoption across business functions and industry verticals.

Services represent the fastest-growing component segment, driven by rising enterprise demand for consulting, implementation, integration, and managed analytics services. As analytics platforms grow more sophisticated, organizations increasingly require expert support to design data architectures, migrate legacy systems, and customize analytics models aligned with business objectives. Consulting and implementation services help enterprises accelerate deployment timelines, reduce complexity, and maximize return on investment.

Additionally, support and maintenance services ensure platform reliability, performance optimization, and continuous upgrades. The growing adoption of AI-driven and cloud-based analytics further fuels demand for specialized expertise, positioning services as a critical enabler of long-term analytics success across enterprises.ye

By Deployment Mode Analysis

Cloud-based deployment dominates the Enterprise Business Analytics Software Market, accounting for approximately 61% market share in 2025, driven by its scalability, flexibility, and cost efficiency. Enterprises increasingly adopt cloud analytics platforms to handle growing data volumes, support real-time processing, and enable remote collaboration across geographically distributed teams. Cloud deployment allows faster implementation, reduced infrastructure costs, and seamless integration with SaaS-based enterprise applications such as ERP and CRM systems.

Continuous updates, AI feature enhancements, and elastic computing capabilities further enhance platform performance. Additionally, multi-cloud and hybrid strategies support data resilience and business continuity, making cloud-based analytics the preferred deployment model for organizations undergoing digital transformation initiatives.

On-premise deployment continues to maintain relevance, particularly among regulated industries such as BFSI, government, and healthcare. Organizations choose on-premise analytics solutions for greater control over sensitive data, enhanced security, and compliance with strict regulatory requirements.

These deployments allow deep customization and integration with legacy IT systems, which is critical for enterprises with complex infrastructures. However, higher capital expenditure, limited scalability, and longer implementation cycles restrict faster adoption compared to cloud-based models. While growth remains steady, on-premise analytics is increasingly complemented by hybrid approaches to balance security needs with modern analytics capabilities.

By Analytics Type Analysis

Descriptive analytics holds a leading position in the market with an estimated 42% share in 2025, as enterprises rely heavily on historical data analysis, reporting, and performance monitoring. These tools provide visibility into past business activities, enabling organizations to track KPIs, financial results, and operational efficiency. Descriptive analytics serves as the foundation of enterprise analytics strategies, particularly for compliance reporting, management dashboards, and standardized business intelligence applications.

Its ease of use, reliability, and compatibility with legacy systems contribute to widespread adoption across industries. Despite the rise of advanced analytics, descriptive analytics remains essential for establishing data-driven organizational culture.

Predictive analytics is the fastest-growing analytics type, fueled by increasing demand for forward-looking insights and proactive decision-making. Enterprises leverage machine learning and statistical models to forecast customer behavior, demand patterns, financial performance, and operational risks. Predictive analytics enables organizations to anticipate market changes, optimize resource allocation, and improve strategic planning accuracy. Growing availability of big data, cloud computing, and AI tools accelerates adoption across sectors such as retail, BFSI, manufacturing, and healthcare. As competition intensifies, enterprises increasingly view predictive analytics as a critical capability for gaining competitive advantage and improving long-term business outcomes.

By Application Analysis

Financial and performance analytics leads application-based segmentation with approximately 29% market share in 2025, driven by enterprise demand for real-time financial visibility and improved fiscal governance. Organizations rely on analytics platforms to manage budgeting, forecasting, profitability analysis, and regulatory compliance. CFO-led digital finance initiatives increasingly integrate analytics into core financial systems to enhance accuracy, transparency, and strategic planning. These solutions support scenario analysis, cash flow optimization, and performance benchmarking across business units. The growing complexity of global financial operations and regulatory requirements continues to drive strong adoption of financial and performance analytics solutions.

Customer analytics is among the fastest-growing application areas as enterprises focus on personalization, customer retention, and omnichannel engagement strategies. Analytics platforms enable organizations to analyze customer behavior, preferences, and sentiment across digital and physical touchpoints. Advanced capabilities such as predictive churn modeling, recommendation engines, and segmentation analysis help businesses enhance customer experiences and marketing effectiveness. Retail, e-commerce, BFSI, and telecommunications sectors are leading adopters. As customer expectations continue to rise, enterprises increasingly invest in customer analytics to build long-term loyalty and revenue growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

Large enterprises dominate the market with an estimated 64% share in 2025, driven by complex operational structures, large data volumes, and high analytics maturity. These organizations deploy enterprise-wide analytics platforms to support strategic decision-making, compliance reporting, and performance optimization across global operations. Significant IT budgets allow large enterprises to invest in advanced AI-driven analytics, custom integrations, and dedicated data science teams. Analytics plays a critical role in managing risk, improving efficiency, and maintaining competitive advantage. Continued digital transformation initiatives ensure sustained demand from large enterprises across all major industry verticals.

SMEs represent the fastest-growing organization size segment, supported by the increasing availability of affordable, cloud-based analytics solutions. Subscription pricing models and simplified deployment reduce entry barriers for smaller organizations. SMEs adopt analytics to improve operational efficiency, understand customer behavior, and enhance financial planning. User-friendly interfaces and preconfigured dashboards allow SMEs to derive insights without extensive technical expertise. As competition intensifies across regional and local markets, SMEs increasingly view analytics as a strategic tool to drive growth, innovation, and business resilience.

By Industry Vertical Analysis

The BFSI sector leads industry adoption with approximately 26% market share in 2025, driven by stringent regulatory requirements, risk management needs, and data-intensive operations. Financial institutions rely on analytics for fraud detection, credit risk assessment, compliance reporting, and customer intelligence. Real-time analytics supports transaction monitoring and decision-making across banking and insurance operations. Growing digital banking adoption and increasing cyber threats further strengthen demand for advanced analytics solutions within BFSI, making it a dominant vertical in the market.

Retail and e-commerce is the fastest-growing industry vertical, fueled by rapid digital commerce expansion and increasing competition. Analytics platforms help retailers optimize pricing, inventory management, demand forecasting, and personalized marketing. Customer behavior analysis and omnichannel insights enable retailers to improve customer engagement and conversion rates. The rise of AI-driven recommendation engines and real-time sales analytics accelerates adoption. As consumer expectations evolve, analytics becomes a critical tool for driving profitability and operational efficiency in the retail and e-commerce sector.

The Enterprise Business Analytics Software Market Report is segmented on the basis of the following:

By Component

- Software / Platforms

- Services

- Consulting & Implementation

- Support & Maintenance

By Deployment Mode

- Cloud-Based

- On-Premise

- Hybrid

By Analytics Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Augmented / AI-Driven Analytics

By Application

- Financial & Performance Analytics

- Sales & Marketing Analytics

- Customer Analytics

- Operations & Supply Chain Analytics

- Risk & Compliance Analytics

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry Vertical

- Banking, Financial Services & Insurance (BFSI)

- IT & Telecommunications

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing

- Government & Public Sector

Regional Analysis

Leading Region in the Enterprise Business Analytics Software Market

North America leads the Enterprise Business Analytics Software Market with an estimated 38% market share in 2025, supported by advanced digital infrastructure, high enterprise IT spending, and widespread cloud adoption. Organizations across BFSI, healthcare, retail, and technology sectors actively deploy analytics platforms to support real-time decision-making and operational efficiency.

The region benefits from early adoption of AI-driven and augmented analytics, supported by a mature SaaS ecosystem and strong presence of cloud service providers. Favorable government policies promoting artificial intelligence innovation, data governance standards, and cybersecurity frameworks further reinforce adoption. Continuous investment in digital transformation and analytics modernization ensures North America’s sustained leadership position.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Enterprise Business Analytics Software Market

Asia-Pacific represents the fastest-growing regional market, driven by rapid digitalization, expanding enterprise ecosystems, and increasing adoption of cloud technologies. Countries such as India, China, Japan, and Southeast Asian nations are witnessing strong demand for analytics across manufacturing, retail, BFSI, and telecommunications sectors. Government-led smart economy initiatives, digital infrastructure investments, and data-driven governance programs significantly support market expansion.

Growing volumes of enterprise data, coupled with rising cloud penetration, accelerate analytics adoption among both large organizations and SMEs. Additionally, increasing awareness of data-driven decision-making and competitive pressures further position Asia-Pacific as a high-growth region for enterprise analytics solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape in the enterprise business analytics software market is characterized by innovation-driven strategies focused on AI integration, cloud scalability, and platform extensibility. Vendors prioritize continuous R&D investment, strategic partnerships, and ecosystem expansion to strengthen market positioning. High switching costs and data lock-in create strong entry barriers, while differentiation increasingly depends on usability, automation, and industry-specific analytics capabilities.

Some of the prominent players in the global Enterprise Business Analytics Software are:

- Microsoft

- SAP

- Oracle

- IBM

- Salesforce (Tableau)

- SAS Institute

- Google (Looker)

- Amazon Web Services (QuickSight)

- Qlik

- MicroStrategy

- TIBCO Software

- Alteryx

- Sisense

- Domo

- Teradata

- Zoho (Zoho Analytics)

- Board International

- GoodData

- Yellowfin BI

- Pyramid Analytics

- Other Key Players

Recent Developments

- In January 2026, IBM announced IBM Enterprise Advantage, a first-of-its-kind asset-based consulting service that combines proven AI-tools and expertise to help clients quickly build, govern, and operate their own tailored internal AI platform at scale. Organizations can now use IBM Enterprise Advantage to redesign workflows, connect AI to existing systems, and scale new agentic applications without need of any changes to their cloud providers, AI models, or core infrastructure, which includes Amazon Web Services, Google Cloud, Microsoft Azure, IBM watsonx, and both open‑and closed‑source models, allowing companies to build on their existing investments.

- In March 2024, Pyramid Analytics launched its new conversational analytics technology. Pyramid is harnessing the power of Generative AI with its Business and Decision Intelligence platform to introduce the first Generative BI solution into the market. Generative BI will make data more accessible for non-technical users. These capabilities are set to change the way people interact with data and transform the data analytics world.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 178.5 Bn |

| Forecast Value (2034) |

USD 468.5 Bn |

| CAGR (2025–2034) |

11.3% |

| The US Market Size (2025) |

USD 57.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software / Platforms and Services), By Deployment Mode (Cloud-Based, On-Premise and Hybrid), By Analytics Type (Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Augmented / AI-Driven Analytics), By Application (Financial & Performance Analytics, Sales & Marketing Analytics, Customer Analytics, Operations & Supply Chain Analytics, and Risk & Compliance Analytics), By Organization Size (Large Enterprises and Small & Medium Enterprises (SMEs)), By Industry Vertical (Banking, Financial Services & Insurance (BFSI), IT & Telecommunications, Retail & E-commerce, Healthcare & Life Sciences, Manufacturing, and Government & Public Sector) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microsoft, SAP, Oracle, IBM, Salesforce (Tableau), SAS Institute, Google (Looker), Amazon Web Services (QuickSight), Qlik, MicroStrategy, TIBCO Software, Alteryx, Sisense, Domo, Teradata, Zoho (Zoho Analytics), Board International, GoodData, Yellowfin BI, Pyramid Analytics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Enterprise Business Analytics Software Market?

▾ The Global Enterprise Business Analytics Software Market size is expected to reach USD 178.5 billion by 2025 and is projected to reach USD 468.5 billion by the end of 2034.

Which region accounted for the largest Global Enterprise Business Analytics Software Market?

▾ North America is expected to have the largest market share in the Global Enterprise Business Analytics Software Market, with a share of about 38.0% in 2025.

How big is the Enterprise Business Analytics Software Market in the US?

▾ The US Enterprise Business Analytics Software market is expected to reach USD 57.0 billion by 2025.

Who are the key players in the Enterprise Business Analytics Software Market?

▾ Some of the major key players in the Global Enterprise Business Analytics Software Market include IBM, SAP, AWS, and others

What is the growth rate in the Global Enterprise Business Analytics Software Market?

▾ The market is growing at a CAGR of11.3 percent over the forecasted period.