Market Overview

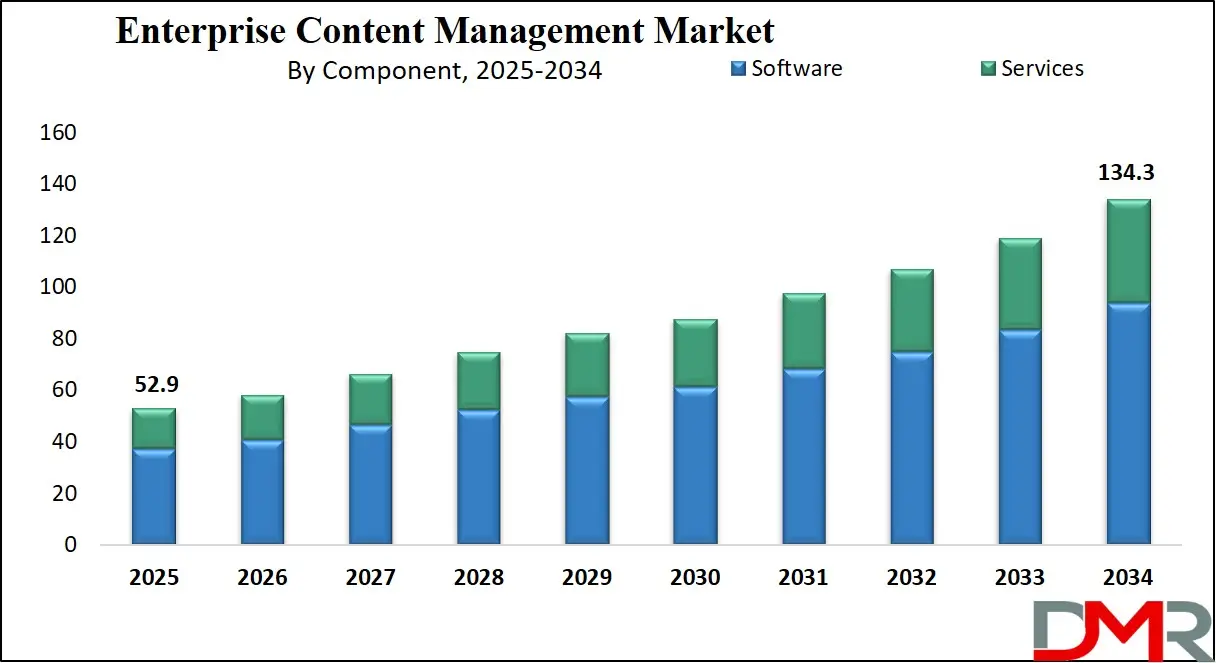

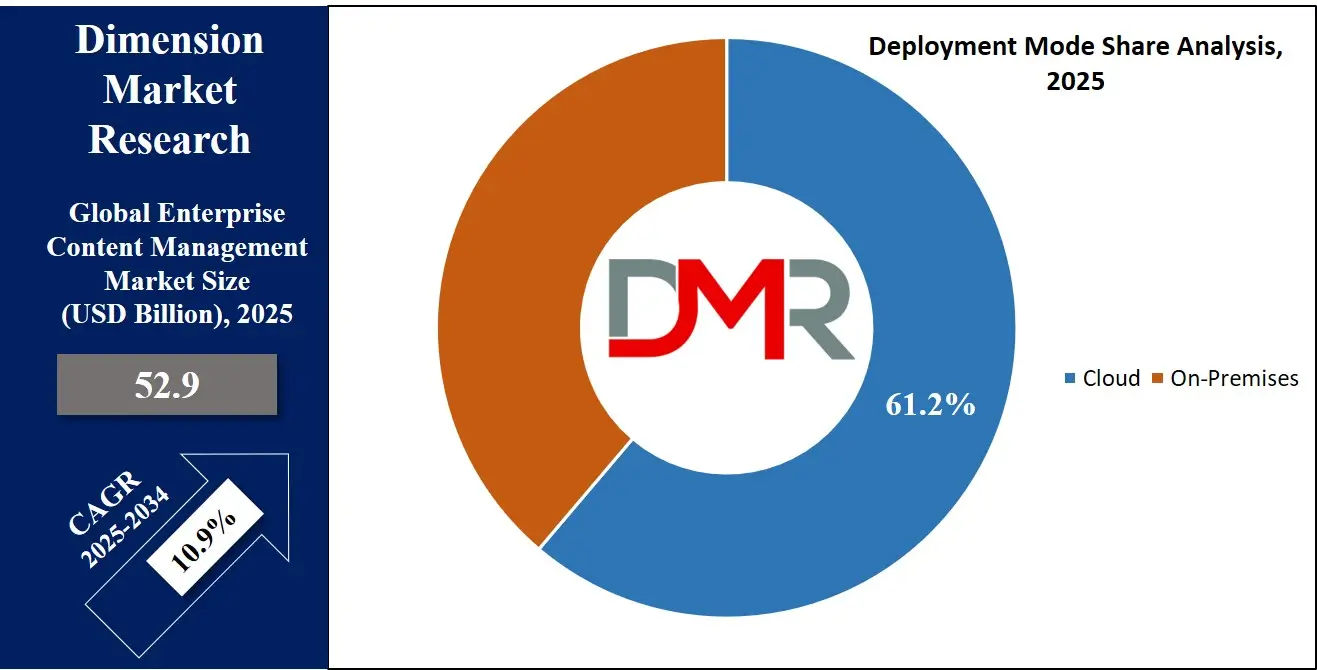

The Global Enterprise Content Management Market size is projected to reach USD 52.9 billion in 2025 and grow at a compound annual growth rate of 10.9% from there until 2034 to reach a value of USD 134.3 billion.

Enterprise Content Management (ECM) is a system that assists organizations in managing everything about content from one location. Documents, pictures, emails, videos, and other files are used during normal working, and this falls under this definition. The most important purpose of ECM is to ensure that it is easy to search, store, and distribute information while protecting it. It also helps companies comply with legal rules about the usage of data. ECM systems typically include tools for storing documents, versioning, automation of workflow, and content search.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The primary reason is that the businesses continue to grow and digital content continues to rise, and with this comes the incessant need for proper content management. Companies are processing huge volumes of data than ever, even more now with the higher prevalence of remote work and digital communication tools. This has made it more difficult to maintain everything in order through the older approaches, such as file servers, paper records. There is a demand for ECM systems because they assist companies in saving time and preventing errors, as well as improving teamwork. Employees can easily locate the necessary files, productivity is increased.

There are emerging trends from previous years that are determining the future of ECM. Cloud-based content management is one of the significant trends, which allows teams to access and manage content from any location, which is mainly critical given the COVID-19 pandemic that forced many businesses to choose between remote and hybrid work styles. Another trend is the application of artificial intelligence (AI), and machine learning to ECM systems. These technologies assist in automatically sorting, annotating, and organizing documents, thus making content management less time-consuming and accurate.

Security is another area of concentration of great magnitude in ECM. With more data being uploaded online, the security of sensitive information has become a crucial issue. Advanced ECM systems frequently have effective access restrictions, encryption of data as well as monitoring devices to make information safe. Even companies need to abide by data privacy laws, and good content management becomes all the more crucial. ECM helps businesses prevent risks because the content is properly stored and handled there.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Over the past few years, there have been a series of events demonstrating how much ECM is needed. It has been a challenge for large companies to get important information quickly, especially during mergers and auditing. Other cases occur because of poor content management through data breaches. Such events have helped make many organizations appreciate the need to put a dependable ECM system in place.

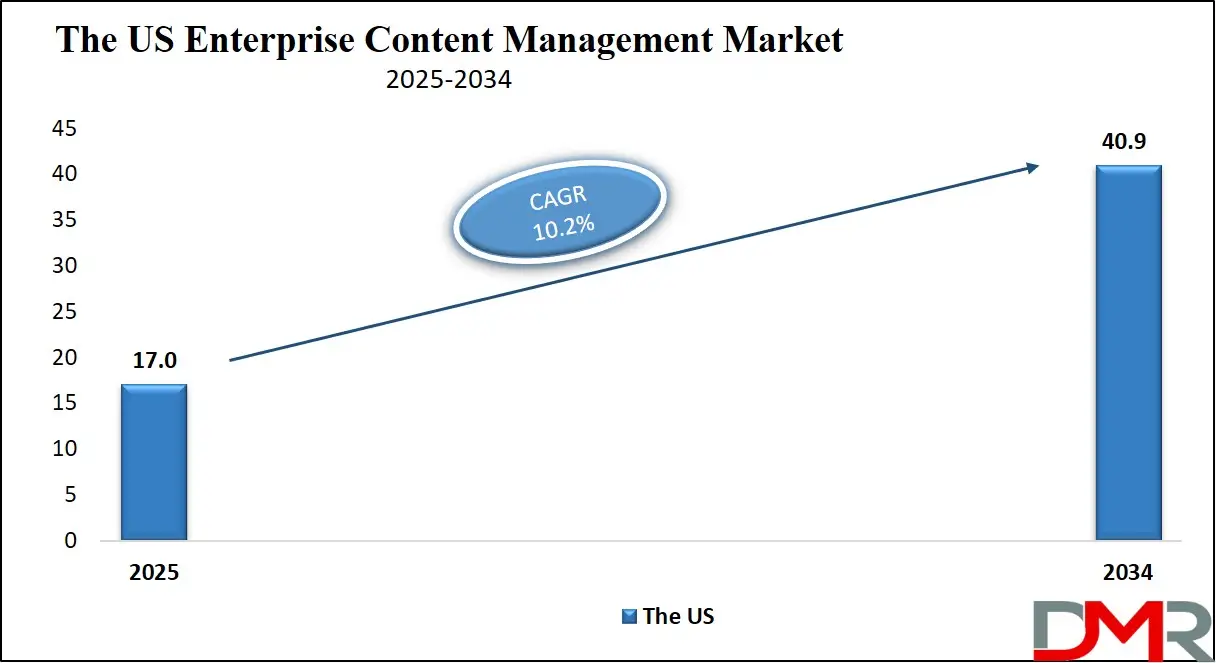

The US Enterprise Content Management Market

The US Enterprise Content Management Market size is projected to reach USD 17.0 billion in 2025 at a compound annual growth rate of 10.2% over its forecast period.

The US plays a major role in the Enterprise Content Management (ECM) market due to its advanced technology infrastructure and high adoption of digital solutions. Many key ECM innovations, like cloud integration, AI-powered content tools, and workflow automation, are driven by US-based companies and research institutions.

The US market shows strong demand from sectors like healthcare, finance, government, and legal, where content security and compliance are critical. US businesses are often early adopters of emerging ECM trends, setting benchmarks for global markets. In addition, the country’s strict data privacy laws and emphasis on cybersecurity have fueled the development of secure and scalable ECM solutions. Overall, the US remains a major force shaping ECM market growth, innovation, and global standards.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Enterprise Content Management Market

Europe Enterprise Content Management Market size is projected to reach USD 13.0 billion in 2025 at a compound annual growth rate of 9.4% over its forecast period.

Europe plays an important role in the Enterprise Content Management (ECM) market, driven by strict data protection regulations like the General Data Protection Regulation (GDPR). These laws have pushed organizations to adopt ECM systems that ensure secure data handling, storage, and compliance. European businesses across sectors like finance, healthcare, and public administration depend on ECM solutions to manage the rise in volumes of digital content efficiently.

The region also shows strong interest in cloud-based and AI-powered ECM tools to support remote work and digital transformation. Government initiatives promoting digital governance and paperless operations further support market growth. Europe continues to influence ECM development by prioritizing privacy, security, and sustainable digital practices, making it a key player in shaping global ECM standards.

Japan Enterprise Content Management Market

Japan Enterprise Content Management Market size is projected to reach USD 2.6 billion in 2025 at a compound annual growth rate of 13.1% over its forecast period.

Japan is an important region for the growth of the Enterprise Content Management (ECM) market through its focus on innovation, automation, and digital transformation. Japanese companies prioritize efficient document management and workflow automation to improve productivity and reduce reliance on paper-based processes. The country’s strong manufacturing and technology sectors drive demand for ECM solutions that support quality control, regulatory compliance, and data security.

In addition, Japan is adopting cloud-based ECM platforms to improve accessibility and collaboration, mainly as remote work becomes more common. The government’s push toward a digital society also encourages the use of ECM to streamline administrative tasks and public services. Japan’s emphasis on precision and technology adoption makes it a key player in advancing ECM technologies and practices in the Asia-Pacific region.

Enterprise Content Management Market: Key Takeaways

- Market Growth: The Enterprise Content Management Market size is expected to grow by USD 76.2 billion, at a CAGR of 10.9%, during the forecasted period of 2026 to 2034.

- By Component: The software segment is anticipated to get the majority share of the Enterprise Content Management Market in 2025.

- By Deployment Mode: Cloud segment is expected to get the largest revenue share in 2025 in the Enterprise Content Management Market.

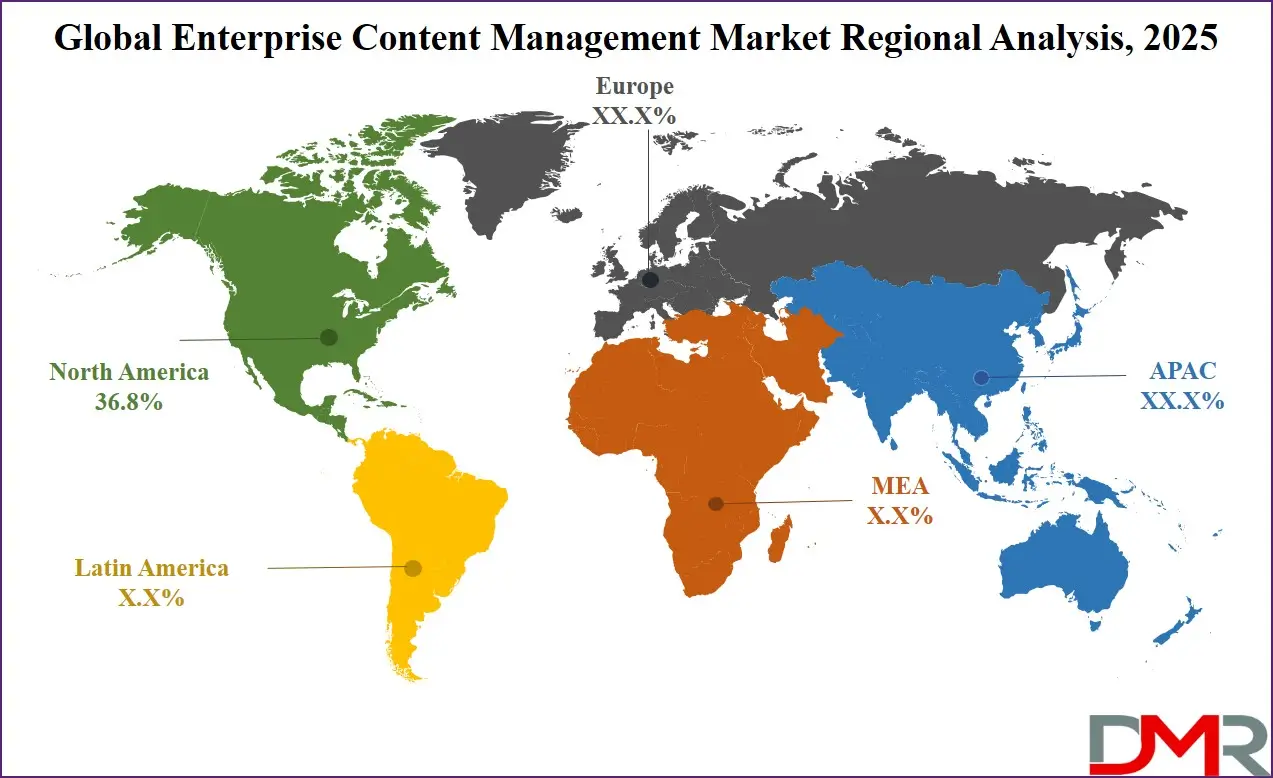

- Regional Insight: North America is expected to hold a 36.8% share of revenue in the Global Enterprise Content Management Market in 2025.

- Use Cases: Some of the use cases of Enterprise Content Management include document management, compliance & Security, and more.

Enterprise Content Management Market: Use Cases

- Document Management: ECM helps organizations store, organize, and retrieve documents quickly and efficiently. It minimizes the need for paper files and prevents data loss. Employees can easily search for the latest version of a file, saving time and improving workflow.

- Compliance and Security: With strict data privacy rules, ECM systems help ensure businesses follow legal guidelines. They offer access controls, audit trails, and encryption to protect sensitive information.

- Collaboration and Workflow Automation: Teams can work together more smoothly using ECM tools that support version control and automated approvals. Tasks like contract reviews or content publishing can be streamlined.

- Remote Access and Cloud Integration: ECM platforms allow users to access content from any location, which is key for remote or hybrid work setups. Cloud integration supports real-time updates and secure file sharing. It also reduces dependence on local storage systems.

Stats & Facts

-

Coolest Gadget reports that as of June 2024, Oracle leads the global relational database management system (RDBMS) market with a score of 08. This score reflects its dominant position in a segment that comprised 72% of all database usage by December 2022. This underscores Oracle’s continued strength in enterprise data infrastructure.

- Vena Solutions highlights that 73% of companies still spend significant time on manual tasks that AI could automate, indicating a major opportunity for efficiency gains. This inefficiency persists even as staff using AI report an 80% boost in productivity, suggesting a gap between potential and actual implementation.

- According to Coolest Gadget, only 2% of the data generated in 2020 was retained in 2021, despite global data creation, copying, and consumption being expected to soar to 149 zettabytes in 2024 and surpass 394 zettabytes by 2028. This points to massive underutilization of data amid exponential digital growth.

- Based on data from Vena Solutions, corporate profits surged by 45% between January and April 2023, largely due to heightened interest in AI models. This profit spike suggests AI is not only transformative in operations but also directly impacts financial performance at a corporate level.

- Coolest Gadget reveals that 65% of CTOs and IT professionals view real-time data access as essential for AI success, aligning closely with the 90% who say their data management strategies are either somewhat or fully aligned with AI objectives, which illustrates a strong interdependence between effective data management and successful AI deployment.

- As per Enterprise Data Management Statistics via Coolest Gadget, 90% of IT professionals believe that improving data literacy will positively influence AI initiatives, with 40% asserting that it will have a significant impact. This finding underlines the growing emphasis on workforce readiness in supporting AI maturity.

- According to Coolest Gadget, 87% of IT professionals are enthusiastic about implementing AI, with 47% expressing strong enthusiasm, while 86% claim to have made solid progress in their AI efforts, which shows a widespread commitment to advancing AI capabilities within the enterprise IT landscape.

- Vena Solutions reports that 60% of businesses using AI do not have ethical AI policies, and 74% fail to address bias risks, suggesting a serious gap in governance and oversight even as adoption increases. Ethical concerns remain a weak point in current AI strategies.

- South Korea’s enterprise data management market is expected to grow at an annual rate of 20% from 2024 to 2032, according to Coolest Gadget, as it also highlights the country’s focus on strengthening digital infrastructure and supporting AI-driven transformation at a national level.

- Vena Solutions notes that 73% of employers place high importance on acquiring AI talent, yet the existing talent pool remains insufficient to meet demand. This talent shortfall could hinder innovation and implementation efforts despite organizational eagerness to scale AI use.

Market Dynamic

Driving Factors in the Enterprise Content Management Market

Digital Transformation Across Industries

One of the biggest drivers of growth in the Enterprise Content Management (ECM) market is the global shift toward digital transformation. Businesses of all sizes are moving away from paper-based systems to digital workflows, making ECM tools vital for managing documents, data, and communication, which is happening across sectors like healthcare, finance, manufacturing, and education.

Companies are focusing on enhancing operational efficiency, reducing manual work, and making data easier to access and share. ECM systems support this shift by providing centralized content storage, automated document handling, and easier collaboration. As digital processes continue to expand, the demand for reliable content management solutions becomes more urgent, which ensures a strong and steady demand for ECM solutions.

Increased Need for Data Security and Compliance

With the growth in volume of digital content, organizations experiences growing pressure to secure sensitive information and meet data privacy regulations. Laws like GDPR, HIPAA, and others require strict handling of customer and business data. ECM platforms are playing a key role in helping companies meet these requirements by offering features like access control, encryption, and audit tracking.

As cyber threats grow and data breaches become more common, companies are investing more in systems that protect their information. ECM solutions not only enhance security but also help organizations stay compliant with evolving legal standards. This growing need for safe, compliant, and well-organized content management is a major factor pushing the ECM market forward.

Restraints in the Enterprise Content Management Market

High Implementation and Maintenance Costs

One major restraint in the Enterprise Content Management (ECM) market is the high cost of implementation and ongoing maintenance. Setting up a full ECM system needs significant investment in software, hardware, and staff training. For small and medium-sized businesses, these costs can be a barrier to adoption.

In addition to upfront expenses, companies must also budget for system upgrades, cybersecurity measures, and IT support. Complex integrations with existing systems can add to the challenge. Without enough budget or technical knowledge, many organizations delay or limit their ECM efforts. These financial and operational hurdles can slow down market growth, mainly in developing regions or among businesses with limited digital infrastructure.

Complexity and User Resistance

Another challenge facing the ECM market is the complexity of the systems and resistance from users. Many ECM platforms come with a range of features that require time and training to understand fully. Employees used to traditional methods may be hesitant to switch to digital systems, fearing it will disrupt their work. If the ECM interface is not user-friendly, adoption rates can be low, which reduces the system’s effectiveness.

Poor change management and a lack of proper training can further add to the problem. As a result, even with the right technology in place, companies may struggle to fully benefit from their ECM investment. This human factor continues to limit the growth potential of the ECM market.

Opportunities in the Enterprise Content Management Market

Rising Adoption of Cloud-Based Solutions

The rise in popularity of cloud computing offers a major opportunity for the Enterprise Content Management (ECM) market. Cloud-based ECM solutions allow businesses to store, manage, and access content from anywhere, making them ideal for remote and hybrid work environments. These systems also minimize the need for expensive on-site infrastructure, making them more affordable and scalable for all business sizes.

Cloud platforms often come with automatic updates, better security, and easy integration with other digital tools. As companies mainly look for flexibility and real-time access to information, the need for cloud-based ECM systems is expected to rise, which opens the door for providers to develop more agile, user-friendly, and cost-effective cloud offerings that meet modern business needs.

Integration with Artificial Intelligence and Automation

The integration of artificial intelligence (AI) & automation technologies into ECM platforms presents a powerful growth opportunity. AI can help analyze, classify, and organize content faster and more accurately than manual methods. Features like smart search, auto-tagging, document summarization, and predictive analytics enhance the usability and intelligence of content systems. Automation, on the other hand, streamlines repetitive tasks, like approvals, data entry, and compliance checks, saving time and reducing human error.

Together, these technologies increase efficiency, improve decision-making, and allow businesses to gain deeper insights from their data. As companies look to optimize workflows and extract more value from their content, demand for AI-enhanced ECM solutions is set to increase significantly.

Trends in the Enterprise Content Management Market

AI-Driven Automation and Intelligent Workflows:

A major trend in the Enterprise Content Management (ECM) market is the integration of artificial intelligence (AI) to automate and enhance content workflows. AI technologies, including machine learning and natural language processing, are being used to simplify document classification, automate routine tasks, and improve data extraction and analysis. This automation minimizes manual effort, increases operational efficiency, and minimizes errors. For instance, AI can automatically categorize documents, extract relevant information, and route them through appropriate workflows without human intervention.

Such capabilities are particularly beneficial in managing large volumes of unstructured data, like emails and social media content, enabling organizations to respond swiftly to business needs and maintain compliance with regulatory standards. The adoption of AI in ECM systems is transforming how businesses manage and utilize their content, making these systems more adaptive and valuable in today's data-driven environment.

Cloud-Based ECM Solutions for Enhanced Accessibility:

Another prevailing trend is the shift towards cloud-based ECM solutions, driven by the need for scalability, flexibility, and remote accessibility. Cloud ECM platforms allow organizations to store and manage content in a centralized repository accessible from any location, facilitating collaboration among geographically dispersed teams, which is especially pertinent in the current landscape where remote and hybrid work models are becoming the norm.

Cloud solutions also offer benefits such as reduced infrastructure costs, automatic updates, and integration with other digital tools, enhancing overall productivity. Moreover, cloud-based ECM systems support business constantly ensuring that critical content is available and secure, even in the face of disruptions. The adoption of cloud ECM is enabling organizations to adapt quickly to changing business demands and is a key component of digital transformation initiatives.

Research Scope and Analysis

By Component Analysis

Software will be leading the Enterprise Content Management market in 2025 with a share of 69.8%, playing a key role in driving its growth. Businesses are using ECM software to manage digital documents, automate workflows, and ensure regulatory compliance more efficiently. The demand for features like real-time file access, version control, and seamless collaboration tools is rising.

Companies also prefer flexible software options that can be customized to specific industry needs. With the rise of hybrid work, cloud-based ECM software is becoming more common, allowing remote teams to stay connected and organized. Better security, integration with other business tools, and user-friendly design make ECM software a central part of digital transformation strategies. These benefits are pushing more organizations to invest in advanced content solutions for long-term efficiency.

Further, the services segment is having significant growth over the forecast period due to increasing demand for support, maintenance, and consulting in ECM implementation. Many organizations require expert help to properly deploy and integrate ECM systems into their existing workflows. Services such as system upgrades, user training, and data migration are also vital for ensuring smooth operations.

As ECM solutions become more complex with AI, analytics, and cloud capabilities, the demand for specialized service providers is constantly rising. Managed services and professional consulting help businesses make the most of their ECM tools while ensuring compliance and security. This support enables companies to focus on core tasks while the service providers handle system optimization and performance, leading to better outcomes and stronger market demand.

By Solution Type Analysis

Document management is expected to lead in 2025 with a share of 24.8%, playing a major role in the growth of the Enterprise Content Management market. It helps businesses organize, store, and retrieve documents easily, reducing time spent searching for information, as it supports version control, secure access, and faster collaboration, making daily operations more efficient. Companies across industries use document management tools to move away from paper-based records and digitize their workflows.

It also supports meeting compliance requirements by keeping records organized and traceable. With increasing data volumes, businesses need smart ways to manage files, and document management provides a reliable solution. Its integration with other business systems and ability to support remote work further boost its importance. These factors make document management a key driver of ECM adoption across both large enterprises and small businesses.

Further, web content management is experiencing significant growth over the forecast period due to rising demand for digital engagement and online presence. Organizations are using this solution to create, publish, and manage website content without needing technical expertise. It allows faster updates, consistent branding, and personalized experiences across digital channels.

With more businesses moving online, managing web content efficiently is becoming essential. This solution also supports integration with social media, e-commerce platforms, and mobile apps, helping companies reach wider audiences. As customer expectations grow, web content management helps ensure a smooth and interactive user experience. Its scalability and flexibility make it useful for companies of all sizes, contributing to steady growth in the ECM market.

By Business Function Analysis

Based on business function, Sales & marketing is leading in 2025 with a share of 21.7%, playing a strong role in boosting the Enterprise Content Management market, as it relies heavily on managing large volumes of content like brochures, presentations, proposals, customer emails, and promotional materials. ECM solutions help teams organize this content in one place, making it easier to access and share across departments and channels.

Real-time updates, version control, and content approval workflows improve speed and accuracy in campaign execution. With more businesses adopting digital marketing strategies, managing web content, social media assets, and customer data has become essential. ECM also supports better customer communication and lead management by keeping content consistent and timely. These benefits allow marketing teams to work smarter, respond faster, and achieve better results, making ECM a valuable tool in sales and marketing operations.

Further, HR is having significant growth over the forecast period as organizations focus on simplifying hiring, onboarding, employee records, and policy management. Enterprise Content Management tools help HR departments handle resumes, contracts, training materials, and personal documents in a structured way.

By reducing paperwork and manual processes, HR teams save time and avoid errors. Secure document storage also supports data privacy and compliance with labor laws. Workflow automation improves approval processes for leaves, promotions, and policy updates. As companies focus on enhancing employee experience and building efficient internal systems, ECM provides the right tools for organizing and managing human resources effectively. It also supports remote HR functions, making it easier to access and manage employee information across locations.

By Deployment Mode Analysis

In 2025, the Cloud segment will be leading with a share of 61.2%, becoming a major force in the growth of the Enterprise Content Management market. It provides flexibility, remote access, and cost savings, making it ideal for businesses of all sizes. Cloud-based ECM allows users to access files anytime, from anywhere, supporting hybrid and remote work models. It eliminates the need for heavy on-site infrastructure and reduces IT maintenance.

Updates and security patches are managed automatically, keeping systems current and protected. Cloud platforms also scale easily as business needs grow, which is helpful for fast-changing environments. With increased focus on digital collaboration and speed, many companies are choosing cloud deployment for easier integration, faster content sharing, and better document control. This shift is helping drive strong demand and rapid adoption of ECM solutions in the cloud.

On the other hand, on-premises is having significant growth over the forecast period due to organizations that prefer full control over their data and infrastructure. Many businesses with strict security or compliance needs choose on-premises ECM to keep sensitive documents within their networks. It gives IT teams direct access to manage systems, customize features, and handle updates based on specific requirements.

This setup is especially common in industries like government, healthcare, and finance, where privacy and internal data rules are strict. On-premises ECM also allows companies to operate independently of internet connectivity, ensuring access even during outages. Although setup and maintenance costs can be higher, the ability to tailor the system and maintain tighter control continues to drive growth in this segment. For certain businesses, on-premises deployment remains the preferred and most secure option for managing content.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Enterprise Size Analysis

Large enterprises are set to dominate in 2025 with a share of 65.3%, playing a major role in driving the growth of the Enterprise Content Management market. These organizations deal with high volumes of data and documents spread across departments, regions, and teams. ECM solutions help them organize, store, and retrieve content quickly while ensuring compliance with data regulations. Large enterprises benefit from automation, version control, and secure access, which improves efficiency and reduce errors. With multiple workflows and complex processes, ECM systems simplify operations and improve collaboration across large teams.

These companies also invest in advanced technologies like AI and cloud, which integrate well with ECM platforms. The demand to manage structured and unstructured data securely and at scale makes ECM vital for large organizations, encouraging continued investment and growth in this segment of the market.

Further, SMEs are having significant growth over the forecast period as they adopt digital tools to improve business operations and stay competitive. Enterprise Content Management systems provide these businesses an efficient way to manage documents, reduce paperwork, and improve workflow automation. SMEs benefit from affordable, scalable ECM solutions, especially cloud-based ones, which do not require heavy infrastructure.

As small businesses grow, they need better ways to handle customer data, contracts, invoices, and communication records. ECM tools provide a secure and organized method to store and access important files from anywhere. These systems also help meet data privacy regulations and support smoother team collaboration. With growing digital adoption and the need for agility, more SMEs are turning to ECM to improve productivity and streamline their content management processes.

By Industrial Vertical Analysis

Based on industry vertical, BFSI will be leading in 2025 with a share of 21.4%, playing a key role in the growth of the Enterprise Content Management market, as this sector deals with a massive volume of sensitive financial documents, customer records, compliance reports, and transaction data that must be handled securely and efficiently. ECM solutions support financial institutions in streamlining document workflows, reducing paper usage, and ensuring faster access to critical data. With strict regulatory requirements, ECM also supports record-keeping and audit trails, making compliance easier.

Banks and insurance companies benefit from features like secure storage, version control, and automated approvals. These systems also improve customer service by allowing quick retrieval of client information. As digital banking, Digital Banking Platform, and online services grow, ECM becomes even more essential for managing data and documents in a fast, secure, and compliant way.

Further, Retail & e-commerce will be having significant growth over the forecast period as businesses in this sector need better ways to manage digital content across multiple platforms. With large volumes of product information, customer data, invoices, and marketing assets, ECM solutions help retailers organize content in a structured and searchable format.

These tools also support inventory management, digital catalog updates, and customer support documentation. Retailers benefit from faster content sharing between departments and smoother workflows, mainly during campaigns and peak sales periods. In e-commerce, ECM helps manage digital assets like images, descriptions, and order histories to enhance the customer experience. Integration with CRM and ERP systems further boosts efficiency. As online shopping continues to rise, managing unstructured and structured content effectively becomes a top priority, making ECM an important part of digital operations.

The Enterprise Content Management Market Report is segmented on the basis of the following:

By Component

By Solution Type

- Document Management

- Record Management

- Content Workflow

- Case Management

- Web Content Management

- Digital Asset Management

- E-Discovery

- Mobile Content Management

By Business Function

- Human Resources

- Sales and Marketing

- Accounting and Legal

- Procurement and Supply Chain

- Others

By Deployment Mode

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- Healthcare

- Retail and E-commerce

- Government

- Manufacturing

- IT and Telecom

- Energy and Utilities

- Education

- Others

Regional Analysis

Leading Region in the Enterprise Content Management Market

North America is set to be leading in 2025 with a share of 36.8%, playing a major role in the ongoing growth of the Enterprise Content Management market. The region constantly experiences strong adoption of digital solutions across industries like finance, healthcare, government, and retail. Companies in North America are actively using ECM systems to improve workflow automation, secure document handling, and regulatory compliance. The transformation toward hybrid and remote work has also increased demand for cloud-based content management tools, allowing easy access to documents from anywhere.

North America is home to a large number of tech-driven enterprises that invest in advanced solutions like AI-powered ECM platforms to enhance efficiency and collaboration. Rising data privacy concerns, increasing digital content, and the need for faster decision-making are encouraging businesses to adopt ECM tools at a rapid pace. With strong infrastructure and technology readiness, North America remains a key region fueling innovation and market expansion in enterprise content management.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Enterprise Content Management Market

Asia Pacific is showing significant growth over the forecast period in the Enterprise Content Management market due to rapid digital transformation, expanding IT infrastructure, and major awareness about data management. Businesses across industries like manufacturing, banking, healthcare, and education are adopting ECM solutions to simplify document workflows, ensure data security, and enhance operational efficiency.

The growing number of small and medium enterprises, along with rising investments in cloud computing and automation, are supporting this upward trend. Countries like China, India, Japan, and South Korea are focusing on smarter content organization, compliance management, and real-time collaboration. As organizations in the region handle more digital content daily, the demand for scalable and reliable ECM systems is expected to increase steadily in 2025.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Enterprise Content Management (ECM) market is highly competitive, with many companies providing similar tools and features to help businesses manage their digital content. The competition is growing as more businesses move to digital platforms and remote work becomes common. New players are entering the market with modern, cloud-based solutions, while older providers are updating their systems to stay relevant.

The demand for features like document automation, secure file sharing, mobile access, and AI-powered search has increased. Companies are also focusing on offering flexible and user-friendly systems that can be used by both small businesses and large organizations. As the need for smarter and faster content management grows, the market continues to evolve with new innovations and better user experiences.

Some of the prominent players in the global Enterprise Content Management are:

- Microsoft

- IBM

- Oracle

- Adobe

- Xerox

- Nuxeo

- SAP

- Capgemini

- KYOCERA

- Fabasoft

- SER Group

- iManage

- Zoho Docs

- Everteam

- SpringCM

- Kofax

- DocuSign

- Medius

- PaperSave

- Other Key Players

Recent Developments

- In April 2025, OpenText™ launched Project Titanium X with the release of Cloud Editions 25.2 (CE 25.2), marking two years of development focused on advancing Business Clouds, AI, and Technology. CE 25.2 delivers robust capabilities in automation, data, security, and AI, empowering organizations to enhance productivity, transform cloud and supply chain operations, and elevate customer experiences. It also introduces AI agents to support knowledge workers through a powerful, next-generation Digital Workforce.

- In September 2024, Box, Inc. announced the general availability of Box Hubs, customizable portals designed to transform how teams curate and share content across the enterprise. These hubs make it easier for users to access accurate, up-to-date information, enhancing collaboration and productivity. Box Hubs support secure content sharing both internally and externally and can be tailored for HR, Sales, or Marketing needs. When combined with Box AI, they offer powerful insights and smarter content management for today’s digital workplaces.

- In July 2024, OpenText continues advancing generative AI in enterprise content management with its latest Cloud Editions 24.3 release. Its AI Aviators tools are now available across all three ECM platforms: Core, Documentum, and Extended ECM. The update enhances support for various media types by integrating technology from the Micro Focus acquisition, enabling advanced metadata capture and analytics, which allows users to analyze unstructured content, including text, audio, video, and images, helping organizations better manage and extract insights from diverse content formats.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 52.9 Bn |

| Forecast Value (2034) |

USD 134.3 Bn |

| CAGR (2025–2034) |

10.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 17.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Solution Type (Document Management, Record Management, Content Workflow, Case Management, Web Content Management, Digital Asset Management, E-Discovery, aMobile Content Management), By Business Function (Human Resources, Sales and Marketing, Accounting and Legal, Procurement and Supply Chain, and Others), By Deployment Mode (On-Premise and Cloud), By Enterprise Size (Small and Medium Enterprises (SMEs) and Large Enterprises), By Industry Vertical (BFSI, Healthcare, Retail and E-commerce, Government, Manufacturing, IT and Telecom, Energy and Utilities, Education, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microsoft, IBM, Oracle, Adobe, Xerox, Nuxeo, SAP, Capgemini, KYOCERA, Fabasoft, SER Group, iManage, Zoho Docs, Everteam, SpringCM, Kofax, DocuSign, Medius, PaperSave, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Enterprise Content Management Market?

▾ The Global Enterprise Content Management Market size is expected to reach a value of USD 52.9 billion in 2025 and is expected to reach USD 134.3 billion by the end of 2034.

Which region accounted for the largest Global Enterprise Content Management Market?

▾ North America is expected to have the largest market share in the Global Enterprise Content Management Market, with a share of about 36.8% in 2025.

How big is the Enterprise Content Management Market in the US?

▾ The Enterprise Content Management Market in the US is expected to reach USD 17.0 billion in 2025.

Who are the key players in the Global Enterprise Content Management Market?

▾ Some of the major key players in the Global Enterprise Content Management Market are SAP, Oracle, IBM, and others

What is the growth rate in the Global Enterprise Content Management Market?

▾ The market is growing at a CAGR of 10.9 percent over the forecasted period.