Market Overview

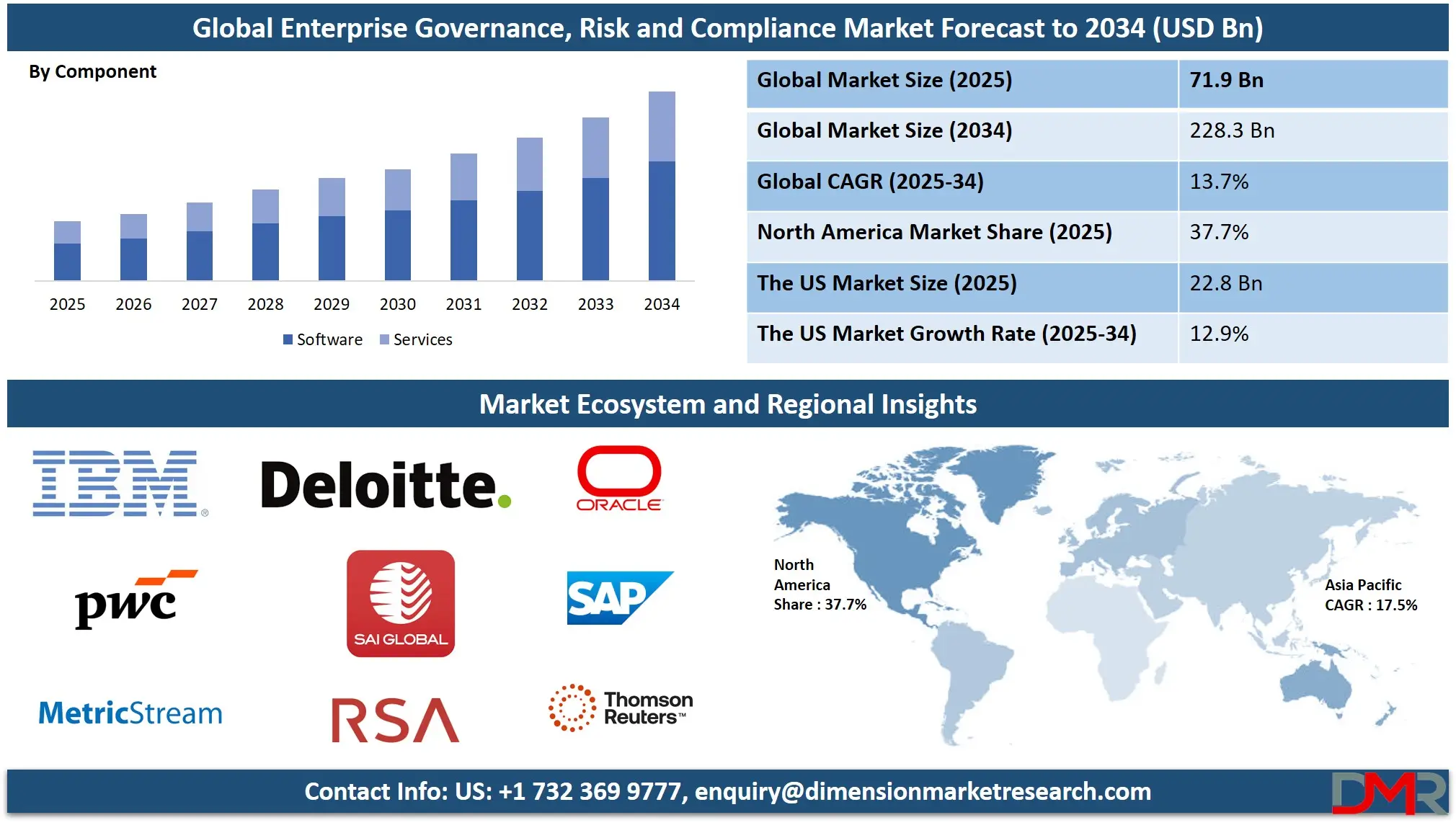

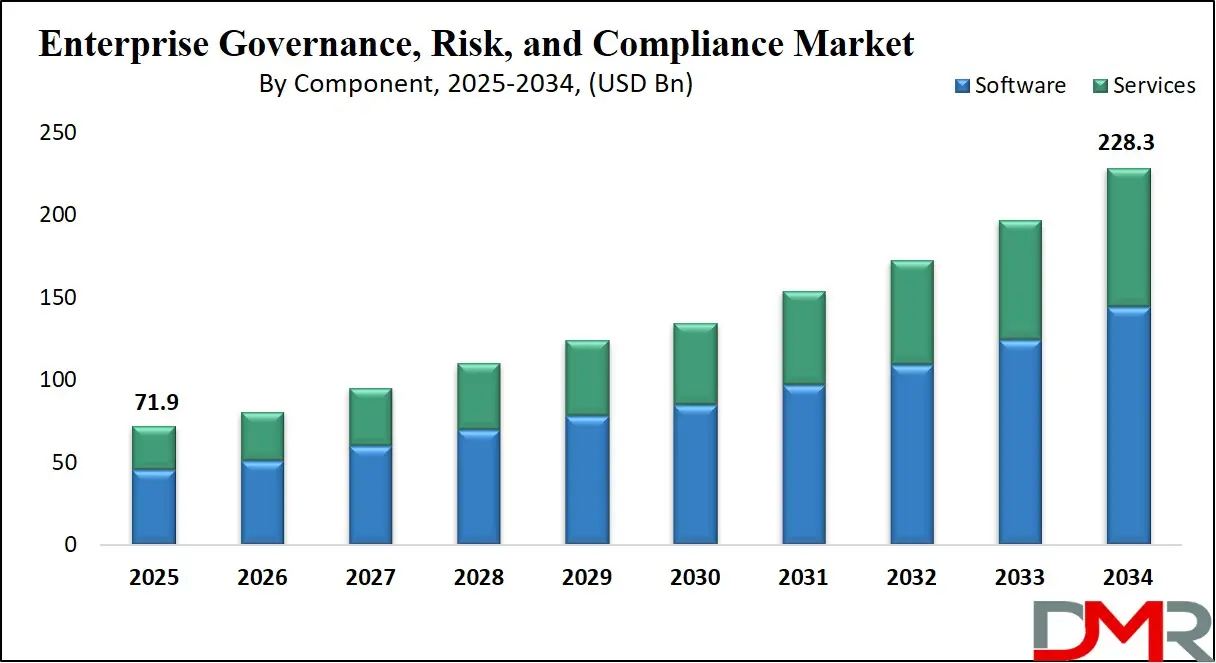

The Global Enterprise Governance, Risk, and Compliance (eGRC) Market is predicted to be valued at USD 71.9 billion in 2025 and is expected to grow to USD 228.3 billion by 2034, registering a compound annual growth rate (CAGR) of 13.7% from 2025 to 2034.

Enterprise Governance, Risk, and Compliance (eGRC) refers to an integrated framework that helps organizations align business objectives with IT operations while managing risks and meeting regulatory requirements. It combines governance (strategic direction and accountability), risk management (identifying and mitigating potential threats), and compliance (adhering to laws, regulations, and internal policies).

ℹ

To learn more about this report –

Download Your Free Sample Report Here

eGRC streamlines processes, improves decision-making, enhances transparency, and reduces costs associated with non-compliance or operational disruptions. By centralizing data and automating workflows, eGRC enables businesses to operate more efficiently and ethically, fostering a culture of accountability and proactive risk mitigation across all departments and functions.

The global Enterprise Governance, Risk, and Compliance (eGRC) market is witnessing significant transformation, driven by increasing regulatory pressures, rising cybersecurity threats, and the need for operational efficiency. Organizations across industries are adopting integrated eGRC solutions to streamline compliance management, ensure data integrity, and enhance corporate governance frameworks. This shift is motivated by the growing complexity of legal requirements and the demand for real-time risk analytics that enable faster, more informed decision-making.

Key drivers include the surge in data breaches and financial fraud, compelling enterprises to prioritize risk mitigation strategies and regulatory compliance automation. Cloud-based eGRC platforms are gaining traction, offering scalability, centralized control, and improved visibility into enterprise-wide activities. These platforms often incorporate advanced technologies such as artificial intelligence, machine learning, and predictive analytics to enhance risk assessment and policy enforcement.

Sectors such as BFSI, healthcare, IT and telecom, and energy are leading adopters, leveraging governance frameworks to manage third-party risks, monitor internal controls, and support audit management. The growing emphasis on sustainability, ethics, and corporate responsibility is also encouraging companies to integrate environmental, social, and governance (ESG) considerations within their compliance strategy. Vendors are focusing on modular and customizable solutions that cater to the dynamic regulatory environments of different regions.

Moreover, the adoption of mobile-friendly interfaces and automation in reporting processes is enhancing user experience and operational agility. With the continuous evolution of global regulations and a heightened focus on business continuity planning, the eGRC market is poised for robust expansion, fostering resilient and transparent business ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Enterprise Governance, Risk, and Compliance Market

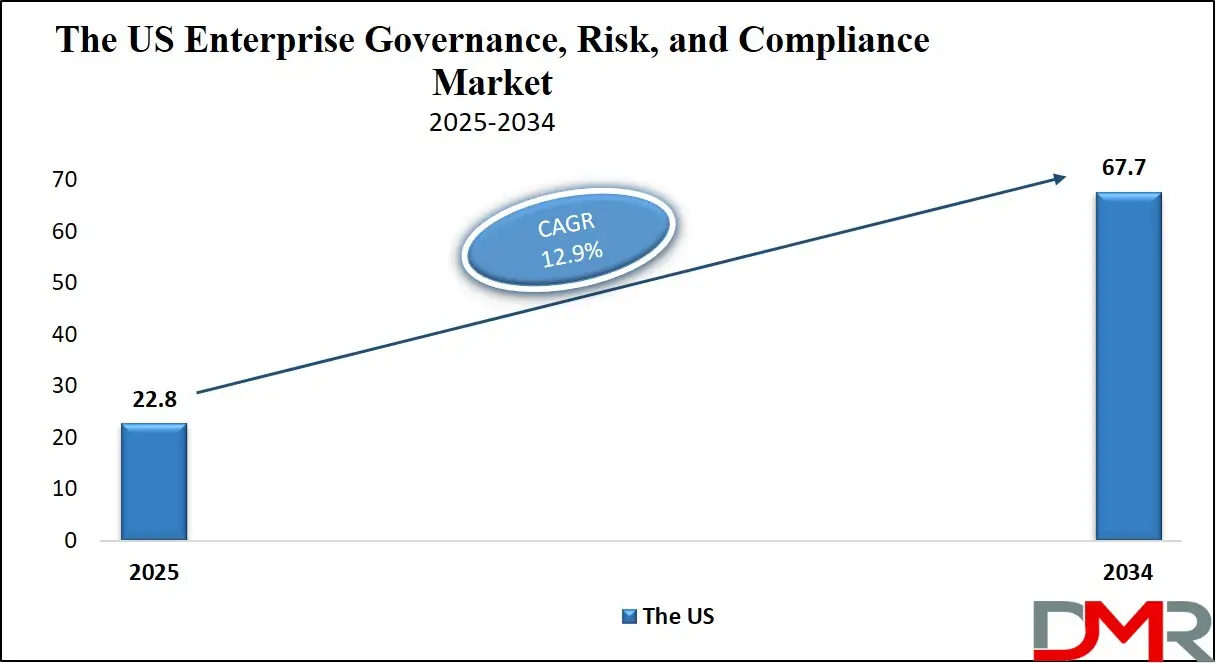

The US Enterprise Governance, Risk, and Compliance Market is projected to be valued at USD 22.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 67.7 billion in 2034 at a CAGR of 12.9%.

The US eGRC market is driven by the increasing complexity of regulatory frameworks and the growing need for integrated compliance strategies across enterprises. Heightened cybersecurity threats and data breaches are compelling organizations to adopt advanced risk management solutions.

Additionally, the emphasis on ESG (Environmental, Social, Governance) compliance is pushing companies to streamline their governance frameworks. The rise in digital transformation and cloud adoption has also expanded the need for scalable eGRC platforms. Moreover, the pressure from stakeholders and boards to maintain transparency and accountability continues to accelerate the implementation of comprehensive eGRC systems.

A significant trend in the US market is the shift towards AI-powered eGRC platforms that automate risk assessment and compliance monitoring. Cloud-based governance solutions are becoming more popular due to their flexibility and lower implementation costs. The integration of ESG metrics into core compliance workflows is also gaining momentum. Enterprises are increasingly adopting unified platforms to manage governance, audit, compliance, and risk functions holistically.

Additionally, there’s a growing trend of incorporating real-time data analytics and dashboard reporting to enhance decision-making. Cross-functional collaboration within organizations to streamline risk and compliance strategies is also on the rise.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan Enterprise Governance, Risk, and Compliance Market

The Japan Enterprise Governance, Risk, and Compliance Market is projected to be valued at USD 5.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 16.4 billion in 2034 at a CAGR of 12.3%.

Japan's eGRC market is driven by a heightened focus on corporate accountability and the modernization of compliance frameworks in line with global standards. Regulatory pressures from initiatives such as the Corporate Governance Code and Personal Information Protection Act are compelling organizations to enhance their risk and governance mechanisms. Japanese enterprises are also recognizing the importance of digital governance amid rising cybersecurity threats. As businesses increasingly adopt digital platforms, there is a stronger push for integrated eGRC tools that ensure transparency, risk mitigation, and efficient compliance management.

A key trend in Japan’s eGRC market is the integration of cybersecurity risk management within enterprise governance strategies. Companies are adopting cloud-native compliance solutions to support remote operations and agile governance. The emphasis on ethical conduct and investor trust is prompting firms to embed ESG and sustainability metrics within their compliance programs.

Additionally, there is a growing demand for customizable platforms that cater to Japan’s unique regulatory environment and business culture. Real-time risk analytics, automation of compliance workflows, and board-level visibility into governance metrics are shaping the market’s evolution.

The Europe Enterprise Governance, Risk, and Compliance Market

The Europe Enterprise Governance, Risk, and Compliance Market is projected to be valued at USD 19.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 66.5 billion in 2034 at a CAGR of 14.5%.

The Europe eGRC market is primarily driven by stringent regulatory mandates such as GDPR, MiFID II, and other industry-specific frameworks. Organizations face increasing pressure to ensure data privacy, financial accountability, and corporate transparency. The region’s focus on ethical governance and sustainability is pushing companies to adopt advanced compliance solutions.

Additionally, the rise in cross-border operations and the need for harmonized risk management practices support the demand for robust eGRC systems. Public and private sector collaboration around cybersecurity and digital trust further bolsters market adoption across industries in Europe.

Europe is witnessing a trend toward embedding ESG compliance into corporate governance structures. The demand for multilingual, cross-jurisdictional eGRC platforms is increasing as companies expand across the continent. Automation in compliance processes, particularly through AI and machine learning, is transforming how European firms approach audits and risk detection.

There is a growing preference for platforms offering real-time compliance updates and alerts. Hybrid and remote work models are also shaping risk management strategies, with more emphasis on identity governance, third-party risk, and endpoint security within the eGRC framework.

Enterprise Governance, Risk, and Compliance Market: Key Takeaways

- Market Overview: The Global Enterprise Governance, Risk, and Compliance (eGRC) Market is anticipated to reach USD 71.9 billion by 2025 and is projected to grow significantly to USD 228.3 billion by 2034, reflecting a compound annual growth rate (CAGR) of 13.7% during the forecast period.

- By Component: The software segment is expected to lead the global eGRC market in 2025, representing approximately 69.2% of the total market share, driven by the increasing demand for automation and integrated compliance solutions.

- By Organization Size: In terms of organization size, large enterprises are set to dominate the market in 2025, accounting for 63.4% of the total share, due to their higher investment capacity and complex regulatory requirements.

- By Application Analysis: Among various applications, legal services are projected to be the leading segment in 2025, capturing 31.9% of the global eGRC market, owing to the rising importance of regulatory compliance and legal risk mitigation.

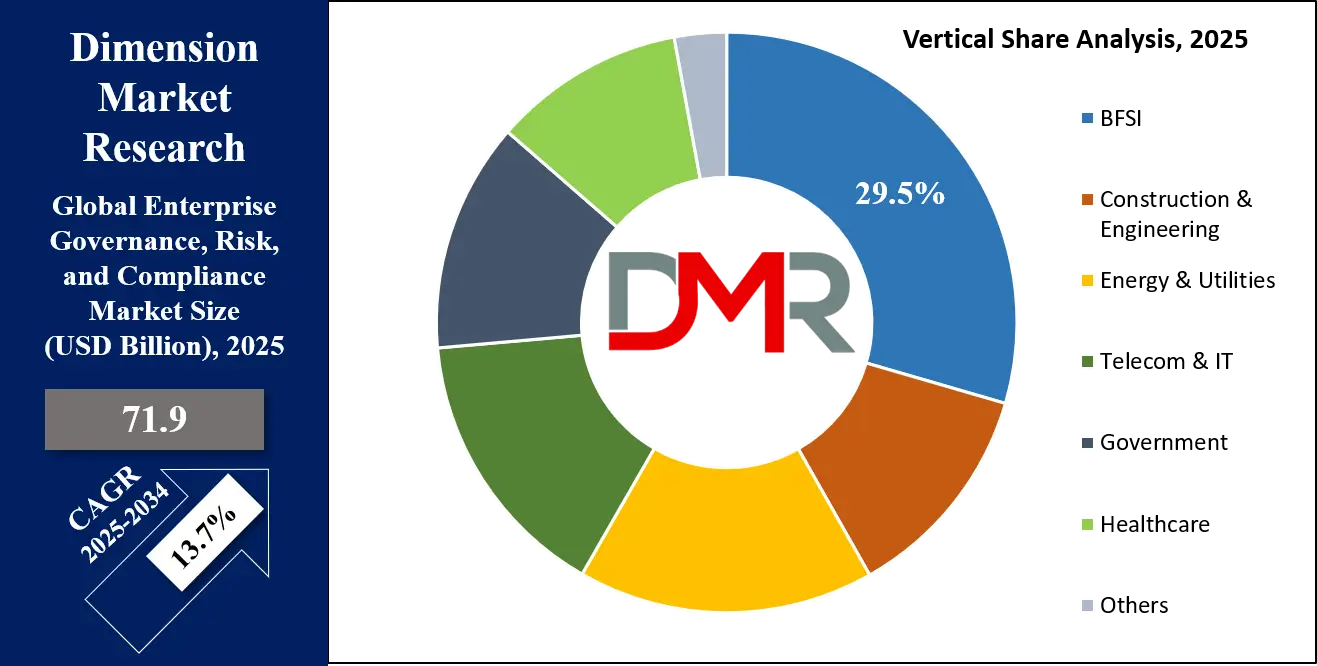

- By Vertical Analysis: The BFSI sector is forecasted to remain the top contributor to the market in 2025, with a 29.5% share, as this industry continues to face stringent regulatory scrutiny and growing cybersecurity threats.

- By Region Analysis: North America is anticipated to hold the largest regional share in 2025, comprising 37.7% of the global eGRC market, supported by the region’s advanced digital infrastructure and strict compliance mandates.

Enterprise Governance, Risk, and Compliance Market: Use Cases

- Regulatory Compliance Management: Organizations use eGRC solutions to monitor evolving regulations, ensuring adherence to laws like GDPR, HIPAA, or SOX. Automated compliance tracking minimizes manual efforts and reduces non-compliance risks, fostering transparency and avoiding penalties through real-time alerts, policy management, and documentation control across business units.

- Risk Assessment and Mitigation: eGRC platforms facilitate risk identification, assessment, and prioritization. Enterprises can quantify risks, assign mitigation actions, and continuously monitor risk exposure. By integrating risk intelligence into decision-making, businesses reduce operational disruptions and enhance resilience against financial, reputational, cybersecurity, and legal threats.

- Internal Audit Management: Organizations use eGRC tools to streamline audit planning, execution, and reporting. It helps track audit findings, corrective actions, and timelines across departments. Automating audit workflows improves accuracy, compliance visibility, and governance, while aligning internal controls with strategic objectives and industry standards.

- Policy and Document Management: eGRC software centralizes policy creation, updates, approvals, and employee acknowledgment. It ensures consistent policy enforcement and traceability across departments. This helps companies maintain transparency, enhance compliance culture, and respond efficiently to audits or regulatory inquiries with up-to-date documentation.

Enterprise Governance, Risk, and Compliance Market: Stats & Facts

- IBM states that companies using integrated GRC solutions can reduce compliance costs by up to 30%, thanks to automation and centralized risk data.

- PwC reports in its Global Risk Survey that 79% of organizations believe that keeping up with the speed of digital transformation is a major risk to their compliance functions.

- OCEG (Open Compliance and Ethics Group) highlights that mature GRC programs lead to 2.5 times more efficient business processes and 46% fewer regulatory breaches.

- Deloitte found that 67% of executives identified risk management and compliance as the biggest challenge in adopting new technologies across their organization.

- ISACA's research reveals that 60% of enterprises have increased their investment in GRC-related technologies in the last two years.

- Gartner estimates that poor data governance and compliance issues can cost organizations an average of USD 12.9 million annually.

- McKinsey reports that companies with strong enterprise risk management frameworks are 43% more likely to outperform peers on revenue growth and profitability.

- Protiviti's Executive Perspectives survey shows that 57% of board members see regulatory changes and scrutiny as a top risk in their GRC agenda.

- Forbes notes that 70% of organizations lack real-time visibility into their risk and compliance exposures, often leading to reactive rather than proactive governance.

- World Economic Forum states that cyber risk, a key area of GRC, costs the global economy over USD 1 trillion annually, prompting increased regulatory oversight and GRC investment.

- World Economic Forum mentions that over 60% of global energy firms now include cyber risk compliance within their eGRC programs due to rising attacks on critical infrastructure.

- ISACA indicates that 72% of IT leaders cite data privacy regulations (e.g., GDPR, CCPA) as the main driver behind eGRC adoption.

- IBM reports that telecoms integrating GRC with cybersecurity saw 30% faster breach detection and improved audit readiness.

- GAO (U.S. Government Accountability Office) finds that 42% of federal agencies failed at least one key compliance audit due to weak governance structures.

- U.S. Office of Management and Budget (OMB) mandates integrated risk management strategies under OMB Circular A-123, impacting all federal agencies.

- HIPAA Journal states that healthcare compliance violations cost U.S. providers over USD 28 million in fines in a single year, making eGRC adoption essential.

- ISACA reports that 56% of healthcare organizations are increasing eGRC budgets to address data privacy and operational risk.

- EDUCAUSE notes that 64% of higher education institutions have deployed GRC platforms to meet FERPA and IT compliance needs.

- Forbes reports that 70% of manufacturing companies lack a unified risk management strategy, leading to fragmented compliance approaches and increased costs.

Enterprise Governance, Risk, and Compliance Market: Market Dynamics

Driving Factors in the Enterprise Governance, Risk, and Compliance Market

Stringent Regulatory Mandates across Industries

Enterprises across sectors like BFSI, healthcare, and energy are facing increasingly complex regulatory frameworks. Compliance with data protection laws such as GDPR, HIPAA, and SOX has become a top priority, compelling organizations to adopt integrated eGRC solutions. These platforms help streamline risk identification, automate compliance tracking, and ensure real-time monitoring of policy adherence.

The demand for regulatory compliance software is surging as businesses look to avoid penalties and reputational damage. Enterprise governance solutions are increasingly viewed as essential for maintaining accountability, especially in highly regulated verticals. This rising need for legal and policy adherence continues to drive the expansion of the global eGRC market across both developed and developing economies.

Rising Incidents of Cyber Threats and Data Breaches

The surge in cyberattacks and data privacy breaches has made risk management a central concern for businesses globally. As organizations digitally transform and move toward cloud-based systems, vulnerabilities multiply. eGRC platforms equipped with cybersecurity risk management tools help enterprises detect, assess, and mitigate risks efficiently.

These tools offer predictive analytics and threat intelligence, enabling proactive protection. With increasing stakeholder scrutiny and rising data privacy concerns, demand for integrated governance risk compliance solutions is on the rise. By offering centralized control over IT governance and risk mitigation strategies, eGRC solutions are playing a critical role in strengthening enterprise resilience and ensuring data security compliance across diverse organizational frameworks.

Restraints in the Enterprise Governance, Risk, and Compliance Market

High Implementation and Integration Costs

Implementing a full-scale eGRC solution involves significant financial investment in software licensing, infrastructure, training, and consulting services. This poses a challenge, especially for small and medium-sized enterprises (SMEs), which operate under tight budget constraints. Integrating eGRC platforms with legacy systems and enterprise applications often demands extensive customization and time, increasing operational costs and deployment delays.

Despite the long-term benefits, many organizations hesitate due to the initial complexity and expense. These financial and technical barriers act as a restraint on eGRC market adoption, particularly in price-sensitive regions, thereby limiting the penetration of compliance management systems and risk governance tools across mid-tier enterprises.

Lack of Skilled Professionals and Awareness

One of the significant challenges limiting the growth of the enterprise governance, risk, and compliance market is the shortage of qualified professionals capable of managing sophisticated eGRC platforms. The effective use of such systems requires expertise in regulatory frameworks, IT governance, audit management, and risk analytics. Many organizations struggle with internal capacity to manage these tools, particularly in emerging markets.

Additionally, low awareness about the strategic advantages of eGRC implementation in non-regulated sectors further hampers growth. The absence of skilled personnel and a knowledge gap in governance risk compliance software usage restricts the potential for widespread adoption, especially among small-scale businesses and local institutions.

Opportunities in the Enterprise Governance, Risk, and Compliance Market

Integration of Artificial Intelligence and Automation

The incorporation of artificial intelligence and automation into eGRC platforms offers a significant opportunity for market growth. AI-powered governance solutions can predict emerging risks, streamline audit workflows, and ensure faster compliance reporting. Automation reduces human error and increases the accuracy of risk management frameworks, enhancing operational efficiency.

Machine learning algorithms also support continuous monitoring and anomaly detection across enterprise environments. These advancements are enabling intelligent compliance management and transforming the traditional landscape of risk governance. Vendors who incorporate cognitive technologies into their eGRC offerings stand to gain a competitive edge, as organizations increasingly seek smarter, more agile enterprise risk and compliance tools.

Growing Adoption in Emerging Markets and SMEs

As awareness of regulatory compliance and cybersecurity continues to rise in emerging economies, the demand for flexible, cost-effective eGRC platforms is expected to increase. Small and medium-sized enterprises (SMEs), which previously relied on manual or fragmented approaches, are now turning to cloud-based eGRC solutions for improved scalability and reduced IT burden.

Governments and regulatory bodies in Asia-Pacific, Latin America, and the Middle East are also tightening compliance requirements, creating favorable conditions for market expansion. This rising adoption across underserved regions presents a substantial opportunity for vendors to customize and deliver affordable governance, risk, and compliance software tailored to local business needs and maturity levels.

Trends in the Enterprise Governance, Risk, and Compliance Market

Shift Toward Integrated and Unified eGRC Platforms

Organizations are increasingly moving away from siloed risk and compliance tools toward centralized, integrated eGRC platforms. These unified systems offer end-to-end visibility into governance structures, compliance processes, and risk exposure across all business units. The trend reflects the growing need for strategic risk oversight and real-time insights, especially in complex, multi-regional enterprises.

Integrated compliance solutions enable seamless collaboration among legal, audit, risk, and IT teams, reducing duplication of efforts and improving decision-making. As digital transformation accelerates, demand for scalable, enterprise-wide risk management software continues to rise, reinforcing the trend toward holistic, interconnected GRC frameworks that support operational agility and corporate accountability.

Cloud-Based Deployment Models Gaining Traction

The rise of cloud computing has significantly influenced the deployment of enterprise risk and compliance solutions. Organizations are increasingly favoring cloud-based eGRC platforms due to their scalability, ease of access, cost-efficiency, and rapid implementation. This trend is particularly prevalent among SMEs and decentralized enterprises that require flexible and mobile-friendly governance tools.

Cloud-based compliance management systems also support real-time updates, ensuring that organizations stay aligned with evolving regulations. Moreover, vendors are offering Software-as-a-Service (SaaS) models to improve accessibility and reduce infrastructure requirements. As cybersecurity technologies mature, cloud-based GRC software is becoming a trusted option, driving a paradigm shift in risk governance and compliance enforcement.

Enterprise Governance, Risk, and Compliance Market: Research Scope and Analysis

By Component Analysis

The software segment is projected to dominate the global Enterprise Governance, Risk, and Compliance (eGRC) market, accounting for 69.2% of the total share in 2025. This dominance is driven by the increasing demand for automation tools that streamline audit management, policy compliance, and operational risk oversight. The rising complexity of regulatory environments across industries is encouraging organizations to deploy integrated eGRC platforms.

These platforms offer real-time monitoring, analytics dashboards, and seamless integration with enterprise systems. Enhanced data protection protocols and centralized control over corporate governance further fuel the adoption. In addition, the surge in cyber risks and data breaches compels enterprises to invest in risk mitigation solutions, strengthening the position of software in the eGRC technology ecosystem.

The services segment is expected to register the highest CAGR in the global eGRC market by the end of 2025. Organizations are increasingly relying on consulting, support, and managed services to customize eGRC solutions for their unique regulatory and business needs. This growth is fueled by the need for expert guidance in implementing frameworks that align with international compliance standards and internal governance models.

The rise of outsourced compliance services, especially among small and medium enterprises, is accelerating this trend. Moreover, rapid digital transformation and hybrid work environments have increased reliance on cloud-based advisory and technical support, boosting service-led deployments. Growing demand for flexible risk intelligence and compliance-as-a-service models will continue to drive the services segment forward.

By Organization Size Analysis

The large enterprise segment is expected to dominate the global Enterprise Governance, Risk, and Compliance (eGRC) market, holding a 63.4% share in 2025. These organizations typically face higher regulatory scrutiny, complex risk scenarios, and diverse compliance mandates across multiple geographies. As a result, they invest heavily in centralized compliance automation tools and scalable risk management platforms. With structured governance models and larger IT budgets, large enterprises are early adopters of integrated eGRC frameworks that support internal audits, policy enforcement, and real-time reporting.

Moreover, sectors like banking, insurance, and manufacturing, where operational risk and regulatory exposure are significant, are accelerating their adoption of enterprise-wide governance solutions to maintain accountability and prevent reputational or financial damage.

The small & medium enterprise (SME) segment is projected to grow at the highest CAGR in the global eGRC market by the end of 2025. Driven by digital transformation and increasing exposure to cyber risks, SMEs are recognizing the importance of structured compliance and governance tools. Many are turning to cloud-based eGRC platforms due to their affordability, scalability, and minimal infrastructure requirements.

As data privacy regulations become stricter worldwide, even smaller firms are compelled to demonstrate accountability and regulatory alignment. Additionally, growing investor expectations around ethical business conduct and risk transparency are pushing SMEs to adopt modern governance practices. With rising awareness and availability of cost-effective risk management solutions, this segment is poised for rapid expansion in the evolving eGRC landscape.

By Application Analysis

The legal services segment is forecasted to dominate the global Enterprise Governance, Risk, and Compliance (eGRC) market, accounting for 31.9% of the total share in 2025. Increasing regulatory complexity and the rapid evolution of global compliance standards are driving enterprises to integrate legal risk management into their core operations. Legal departments are leveraging eGRC platforms to monitor regulatory changes, manage litigation risks, and ensure contractual compliance across jurisdictions.

As data privacy laws and anti-corruption regulations grow more stringent, organizations are prioritizing legal compliance to avoid penalties and reputational harm. The ability to centralize case management, legal workflows, and regulatory documentation through digital tools has further boosted adoption in this segment, particularly across highly regulated industries.

The ESG (Environmental, Social, and Governance) segment is expected to register the highest CAGR in the global eGRC market by the end of 2025. Driven by growing stakeholder pressure for transparency and sustainable business practices, organizations are integrating ESG metrics into their governance strategies. Companies are increasingly adopting eGRC platforms to track carbon emissions, social responsibility initiatives, and board diversity compliance.

Investors and regulators alike are demanding more structured ESG disclosures, prompting firms to align their governance frameworks with global standards such as GRI and SASB. The rising emphasis on ethical governance, climate risk mitigation, and long-term value creation is pushing enterprises to adopt advanced ESG compliance monitoring systems, positioning this segment as the fastest-growing within the eGRC ecosystem.

By Vertical Analysis

The BFSI (Banking, Financial Services, and Insurance) segment is projected to dominate the global Enterprise Governance, Risk, and Compliance (eGRC) market, securing a 29.5% share in 2025. The sector faces constant regulatory evolution, requiring strict adherence to financial compliance mandates, anti-money laundering directives, and cybersecurity laws. BFSI organizations are adopting comprehensive risk and compliance platforms to monitor transactions, ensure audit readiness, and manage operational risk.

The need for transparency in credit risk, fraud detection, and customer data protection further drives this segment’s reliance on digital GRC tools. Institutions across banking and insurance are embedding governance frameworks within their workflows to reduce regulatory fines, build stakeholder trust, and improve overall risk posture in increasingly digitized financial ecosystems.

The healthcare segment is expected to witness the highest CAGR in the global eGRC market by the end of 2025. Rising concerns over patient data privacy, clinical compliance, and regulatory audits are compelling hospitals, pharmaceutical companies, and diagnostic labs to implement integrated GRC solutions. With tightening global health regulations such as HIPAA, GDPR, and FDA compliance, healthcare providers are turning to automated platforms to track compliance activities, manage documentation, and conduct risk assessments.

The growing volume of electronic health records and telehealth services has amplified the need for strong governance protocols. As healthcare institutions aim to protect sensitive medical data while optimizing operational efficiency, the adoption of scalable eGRC tools in this vertical is accelerating significantly.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Enterprise Governance, Risk, and Compliance Market Report is segmented on the basis of the following:

By Component

- Software

- Audit Management

- Compliance Management

- Risk Management

- Policy Management

- Incident Management

- Others

- Services

- Integration

- Consulting

- Support

By Organization Size

- Small & Medium Enterprise

- Large Enterprise

By Application

- Legal Services

- ESG

- Director Board

- EHS

- Others

By Vertical

- BFSI

- Construction & Engineering

- Energy & Utilities

- Telecom & IT

- Government

- Healthcare

- Others

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share of 37.7% in the global Enterprise Governance, Risk, and Compliance (eGRC) market in 2025. This dominance is primarily driven by stringent regulatory frameworks such as SOX, HIPAA, and GDPR (for multinational companies) that compel organizations to implement robust compliance and risk management systems. The presence of a mature corporate ecosystem, early adoption of digital transformation, and high penetration of advanced governance technologies further contribute to the region’s leadership.

Additionally, leading eGRC software providers and consulting firms are headquartered in the U.S., ensuring access to sophisticated solutions and services. Growing concerns over data breaches, financial fraud, and corporate accountability have further intensified eGRC implementation across sectors such as BFSI, healthcare, and IT.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia-Pacific is expected to register the highest CAGR in the global eGRC market by the end of 2025. Rapid industrialization, rising regulatory awareness, and the growing adoption of cloud-based governance tools are key drivers across countries like China, India, Japan, and Australia. Government mandates around financial transparency, cyber resilience, and ESG reporting are also gaining momentum, pushing enterprises to integrate scalable risk management frameworks.

Small and medium enterprises in the region are increasingly embracing affordable compliance solutions to navigate complex policy environments. In addition, the shift toward digital finance, healthcare innovation, and telecom expansion is fostering demand for real-time compliance monitoring and integrated GRC systems. These factors collectively contribute to the region’s accelerating growth in the global landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Enterprise Governance, Risk, And Compliance Market Is characterized by the presence of several established players, as well as emerging vendors offering specialized solutions. Key players include IBM Corporation, SAP SE, Oracle Corporation, MetricStream, SAS Institute, Thomson Reuters, LogicManager, Wolters Kluwer, NAVEX Global, and SAI Global.

These companies are focusing on continuous innovation, strategic partnerships, and acquisitions to expand their offerings and enhance their market reach. Integration of AI, machine learning, and predictive analytics into eGRC platforms is becoming a key differentiator, helping organizations automate compliance workflows and gain deeper risk insights. Vendors are also tailoring solutions for industry-specific needs, such as financial risk assessment in BFSI or clinical compliance in healthcare. Moreover, cloud-based GRC tools are gaining traction due to their flexibility, scalability, and cost-effectiveness.

With the growing emphasis on ESG compliance, cybersecurity governance, and real-time audit management, market players are increasingly embedding these capabilities into their solutions. The competition is further intensified by rising demand in developing markets, prompting global firms to localize offerings and build strategic alliances with regional consultants and IT providers. This dynamic and innovation-driven environment defines the evolving competitive landscape of the eGRC market.

Some of the prominent players in the Global Enterprise Governance, Risk, and Compliance Market are:

- IBM

- Oracle

- SAP

- MetricStream

- RSA Security

- Thomson Reuters

- LogicManager

- NAVEX Global

- Wolters Kluwer

- Deloitte

- PwC

- SAI Global

- Riskonnect

- ServiceNow

- Bwise (a Nasdaq company)

- IBM OpenPages

- SAS Institute

- Galvanize (now part of Diligent)

- MEGA International

- Protiviti

- Other Key Players

Recent Developments

- In January 2025, IBM teamed up with e &, a technology group based in the UAE, to deploy a robust AI and Generative AI governance framework. This collaboration utilizes IBM's watsonx. governance platform along with the expertise of IBM Consulting to bolster ethical standards, regulatory compliance, and risk management across e&'s AI systems and operations.

- In October 2024, Thomson Reuters acquired Materia, a U.S.-based AI startup that develops intelligent assistants for tax, audit, and accounting professionals. This acquisition is intended to boost Thomson Reuters' AI capabilities, enabling greater automation in research and workflow processes. By incorporating Materia’s tools, the company aims to enhance compliance with financial regulations and support risk mitigation in financial reporting, reflecting its focus on financial innovation.

- In September 2024, Oracle launched its Financial Crime and Compliance Management (FCCM) Monitor Cloud Service, aimed at helping banks, fintechs, and financial institutions streamline their compliance operations. The platform provides a unified view of compliance activities, facilitating quicker risk detection and reducing the cost of adhering to financial crime regulations. Its advanced reporting capabilities offer tailored, visually enhanced reports that align with anti-money laundering (AML) and regulatory standards.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 71.9 Bn |

| Forecast Value (2034) |

USD 228.3 Bn |

| CAGR (2025–2034) |

13.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 22.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software, Services), By Organization Size (Small & Medium Enterprise, and Large Enterprise), By Application (Director Board, EHS, ESG, Legal Services, Others), By Vertical (BFSI, Construction & Engineering, Energy & Utilities, Telecom & IT, Government, Healthcare, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

IBM, Oracle, SAP, MetricStream, RSA Security,Thomson Reuters, LogicManager, NAVEX Global, Wolters Kluwer, Deloitte, PwC, SAI Global, Riskonnect, ServiceNow, Bwise, IBM OpenPages, SAS Institute, Galvanize, MEGA International, Protiviti, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Enterprise Governance, Risk, and Compliance Market?

▾ The Global Enterprise Governance, Risk, and Compliance Market size is estimated to have a value of USD 71.9 billion in 2025 and is expected to reach USD 228.3 billion by the end of 2034.

Which region accounted for the largest Global Enterprise Governance, Risk, and Compliance Market?

▾ North America is expected to be the largest market share for the Global Enterprise Governance, Risk, and Compliance Market with a share of about 37.7% in 2025.

Who are the key players in the Global Enterprise Governance, Risk, and Compliance Market?

▾ Some of the major key players in the Global Enterprise Governance, Risk, and Compliance Market are IBM, Oracle, SAP, and many others.

What is the growth rate in the Global Enterprise Governance, Risk, and Compliance Market?

▾ The market is growing at a CAGR of 13.7% over the forecasted period.

How big is the US Enterprise Governance, Risk, and Compliance Market?

▾ The US Enterprise Governance, Risk, and Compliance Market size is estimated to have a value of USD 22.8 billion in 2025 and is expected to reach USD 67.7 billion by the end of 2034.