Global Enterprise Information Archiving Market: Driving Factors

Increasing Regulatory Compliance Requirements

Stringent regulatory regulations in multiple industry verticals are fueling the EIA market. Governments and regulators worldwide are mandating data storage to ensure accountability, ensure security, and ensure transparency.

The GDPR (General Data Protection Regulation), HIPAA (Health Insurance Portability and Accountability Act), and SEC Rule 17a-4 regulations compel businesses to securely store their communications, financial data, and health data for extended time intervals.

Failing to do so invokes huge fines and legal lawsuits, and therefore, compliance-driven archiving is crucial for businesses. As regulations continue to evolve, businesses are investing in EIA to ensure automated legal protection and compliance management.

Exponential Growth of Data Across Enterprises

The rapid expansion of enterprise data, fueled by digital business, IoT adoption, and cloud computing, is leading to scalable archive solution adoption. Organizations generate huge volumes of structured and unstructured data through emails, documents, collaboration tools, and social media. Storage and access to such data while maintaining their security is imperative.

Structured archive models through EIA solutions provide storage expenditure optimization, enhanced data retrieval, and rationalized information governance. As companies continue to broaden their digital workflows, advanced data archive solution adoption will continue to fuel market growth.

Global Enterprise Information Archiving Market: Restraints

High Implementation and Maintenance Costs

Despite the benefits of enterprise information archiving, the prohibitive cost of implementation is a strong deterrent to adoption, particularly for small and medium enterprises. Deploying EIA solutions is expensive in terms of software, equipment, integration, and training. On-premises archiving solutions, in their case, have ongoing maintenance, IT staff, and equipment upgrade requirements, and thus cost small businesses.

Cloud-delivered EIA solutions, while keeping initial costs low, have ongoing subscription fees, and thus may be costly for financially tight companies. As companies make cost-benefit trade-offs, the cost is a strong deterrent to general adoption, and in particular, for SMEs and small and emerging markets.

Concerns Over Data Privacy and Security

The increasing use of third-party cloud-based EIA services is raising data protection and data security issues. Enterprises that deal in sensitive data, such as financial data, health data, and legal communications, are wary of keeping archive data in outsourced systems. Cyberattacks, data breaches, access by unauthorized personnel, and data protection regulations violations are serious issues.

In addition, data protection regulations, such as GDPR and CCPA, have strict data transfer and storage regulations between regions. Due to such problems, EIA vendors have to implement robust security practices, such as end-to-end encryption, access controls, and blockchain authentications, to ensure data integrity and data protection regulations' adherence.

Global Enterprise Information Archiving Market: Opportunities

Expansion of EIA Adoption Among SMEs

Historically, large companies have dictated the EIA market with their advanced compliance needs and huge data volumes. Now, small and medium-sized enterprises (SMEs) realize the benefits of information archiving, and there is a significant opportunity for solution vendors. As regulations expand to small companies, cost-effective and scalable EIA solutions for SMEs have strong market demands.

Vendors have begun to develop subscription models, cloud-native, and scalable archive systems for SME budgets while keeping data protection and regulations in check. The democratization of enterprise information archiving for companies of any size is offering market participants new business opportunities.

Industry-Specific Archiving Solutions Driving Market Expansion

Enterprises in regulated verticals such as financial services, health, legal, and governments have industry-specific archive requirements for their compliance. The industry-specific EIA market is growing, driven by industry-oriented capabilities such as automated redaction, AI-driven scanning for compliance, and data integrity checks through blockchain.

The vendors focus on industry-oriented archive solution development by industry regulations and data protection. The market growth in specialized niches is a good business opportunity to offer industry-oriented solutions to address individual archive needs of various verticals.

Global Enterprise Information Archiving Market: Trends

Rise of AI and Machine Learning in Archival Solutions

Artificial intelligence (AI) and machine learning (ML) technologies are redefining enterprise information archiving by making smart data categorization, automated indexing, and prediction analytics possible. AI-powered EIA systems can classify data in archive repositories autonomously, optimizing retrieval and compliance.

AI-powered data storage and retrieval systems anticipate storage needs, optimize data storage, and recognize abnormalities for potential threat scenarios through advanced ML models. AI-powered chatbots and natural languages also optimize user interactions by enabling natural search capabilities in archive repositories. As businesses generate data in unprecedented volumes, AI-powered archive and storage systems bring business competition in data stewardship and compliance and thus have become an imperative market trend.

Growing Adoption of Cloud-Based Archiving Solutions

Cloud-based enterprise information archiving systems are becoming more prominent as businesses seek scalable, cost-effective on-premises storage options. Organizations prefer to have greater access, disaster recovery, and lesser expenditure on infrastructure through cloud-based archiving. Leading vendors adopt multiple cloud interoperability and hybrid archive strategies to offer businesses better data control.

Cloud-based EIA systems also have robust encryption and security mechanisms to address data protection demands, and hence, are becoming sought-after options for regulated industries including legal services, health, and finance. The future of enterprise information archiving is shaped by the increased adoption of cloud-native technologies, driven by changes in remote working and data volumes.

Research Scope and Analysis

By Type

The content type is projected to dominate the type segment in the Enterprise Information Archiving (EIA) market as it is poised to hold 63.1% of the market share in 2025 due to the huge and ever-growing volume of content generated by enterprises, for which structured storage, retrieval, and compliance is required.

Enterprises produce huge amounts of content daily, including emails, documents, transcripts of chats, activity on social media, and multimedia content. Storage, retrieval, and compliance for such content types require robust archiving tools to offer safe, scalable, and searchable storage.

Regulatory requirements impact content archive leadership extensively. Finance, legal, and health services companies need to maintain business messages, contracts, and transaction data for multiple years to maintain regulatory adherence. Regulations including SEC Rule 17a-4, GDPR, and HIPAA mandate systematic content archiving for auditing, legal discovery, and risk oversight. Sanctions for non-compliance include serious monetary and reputational penalties, and therefore, content-oriented archive needs. Additionally, AI and machine learning-enabled archive technologies optimize content categorization, analysis, and retrieval of content in storage efficiently and effectively.

High-performance search capabilities through natural language processing (NLP) allow businesses to quickly retrieve individual pieces of content, hence business productivity and operational efficiency. With the rise of digital transformation and remote working, businesses have begun to have confidence in collaboration tools such as Microsoft Teams, Slack, and Zoom, hence fueling content archiving needs. As businesses prioritize content type in structured content governance, the content type is poised to retain leadership in the EIA market, ensuring compliance, cost savings, and seamless data access.

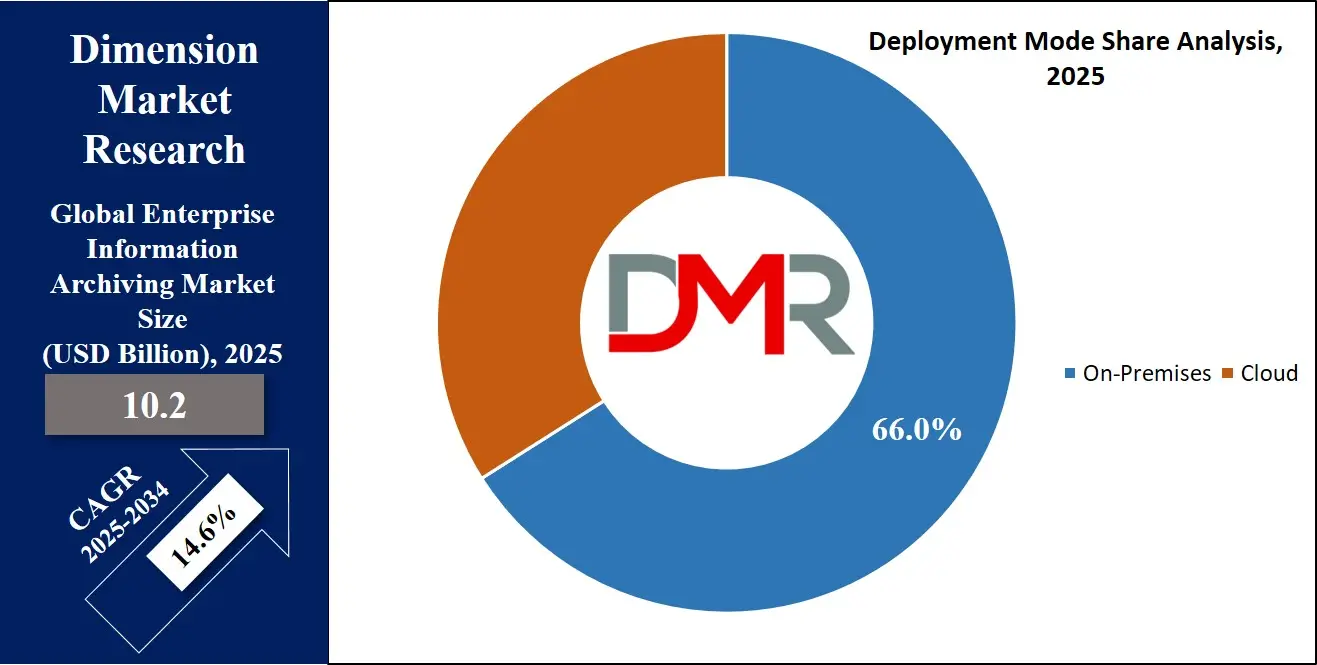

By Deployment Mode The on-premise mode is anticipated to dominate the Enterprise Information Archiving (EIA) market through unmatched data protection, regulatory adherence, and flexibility to personalize infrastructure. Enterprises, and businesses in regulated verticals such as banking, health, and governments, have strict data governance regulations on access to sensitive data by third parties.

Companies, through on-premise EIA, have full data ownership, and therefore, industry-specific mandates such as HIPAA, GDPR, and FINRA are fulfilled by them in the absence of any threat. Security concerns take priority in on-premise solution preference. Organizations handling confidential documents, financial transactions, and legal messages have their attention on in-house firewalls, encryptions, and custom security mechanisms in preference to their counterparts in the cloud.

On-premise solutions, compared to their counterparts in the cloud, restrict access to hackers, illegitimate access, and data sovereignty, and therefore have an additional layer of protection against intrusions. Moreover, on-premise implementations offer companies the flexibility to tailor storage facilities to their unique needs. Large businesses having extensive IT facilities prefer in-house data centers, archive plans, and retrieval mechanisms, optimizing storage space and minimizing future operating costs.

Despite the growing adoption of cloud-based EIA solutions, legacy systems, data localization regulations, and robust security requirements sustain on-premise installation demands. Industries requiring uninterrupted access to data stored on-premises independent of external vendors will continue to keep on-premise solutions in command in the market for EIA.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Enterprise Size

Large enterprises are expected to dominate in the Enterprise Information Archiving (EIA) space because of their massive amounts of data, strict regulations, and larger IT budgets. Large companies generate massive amounts of structured and unstructured data, including emails, financial reports, customer interactions, and transaction data, for which scalable archive mechanisms have to provide compliance and business efficiency. Regulatory compliance is also a chief factor behind large companies leading in the EIA market. Banks, health professionals, and transnational companies have to abide by SEC, GDPR, HIPAA, and SOX regulations, where enterprise data needs to be retained and securely stored.

Failing to do so draws huge fines, and thus advanced EIA solutions have to be an inevitable cost for abatement of risk and legal protection. Additionally, large companies have to maintain top-performance storage and retrieval. Large companies tend to embrace AI-powered archive systems integrated with machine learning and automated tools to optimize data categorization, discovery, and business intelligence. These technologies enhance search capabilities, save storage costs, and optimize decisions through analytics on historical data. Budgetary flexibility strengthens their grip.

Large businesses, in contrast to SMEs, have adequate means to invest in on-site, hybrid, and multi-cloud EIA solutions, such as robust disaster recovery, data protection, and seamless interoperability in their existing IT systems. Their diverse business models also have data governance strategies to be spearheaded by centralization and regulations, underpinning enterprise archive solution demands. Given their market size, their regulatory needs, and their embrace of leading technologies, large companies will retain their leadership in the EIA market, spearheading innovative and forward-looking investments in data archive technologies.

By End User

The Banking, Finance, and Insurance (BFSI) sector is projected to dominate the Enterprise Information Archiving (EIA) market, powered by regulations, volumes of data, and pressing needs to minimize risks. Banks and financial institutions handle massive amounts of transaction data, client interactions, and reports on adherence to regulations, and such data have to be kept securely for multiple years.

Regulatory compliance is leading BFSI's leadership. Stringent data retention is required by financial regulators such as SEC, FINRA, Basel III, and GDPR for legal accountability, preventing fraud, and maintaining transparency. Email messages, trade activity, and audit activity have to be retained by institutions for multiple years, and hence, EIA solutions have become crucial for legal e-discovery and compliance management. Risk management and anti-fraud activity drive EIA solution needs in BFSI. Structured and unstructured financial data storage makes AI-driven anomaly discovery, historical data analysis, and real-time auditing possible to prevent fraud, insider trading, and regulations transgressions.

Robust access and encryption capabilities ensure the safe storage of sensitive financial data, keeping hackers' access to them to a minimum. Moreover, customer-centric business in BFSI requires timely and accurate data retrieval. Banks and insurers employ AI-powered archive tools to retrieve transaction history, interactions, and investment details for dispute resolution, underwriting, and financial analysis. Efficient data storage and retrieval optimize decisions, customer services, and business efficiency. With evolving regulations, business needs for risk management, and digitalization, the BFSI sector will continue to be the top end-user of enterprise information archiving systems, upholding data integrity, security, and business continuity.

The Enterprise Information Archiving Market Report is segmented on the basis of the following

By Type

- Content Type

- Database

- Social Media

- Web

- Instant Messaging

- E-mail

- Mobile Communication

- File & EFSS

- Services

- Consulting

- System Integration

- Training, Support & Maintenance

By Deployment Mode

By Enterprise Size

By End User

- BFSI

- Retail & E-commerce

- Government & Defense

- Healthcare & Pharmaceutical

- Manufacturing

- Others

Regional Analysis

Region with Highest Market Share

North America is projected to dominate in the Enterprise Information Archiving (EIA) market as it is anticipated to command over 41.7% of the market share in 2025, due to strict regulations, advanced adoption of technologies, and enterprise spending on regulations-compliant solutions.

The market consists of top financial institutions, healthcare institutions, and IT vendors, and is in urgent need of robust data archiving systems to maintain regulations such as SEC Rule 17a-4, HIPAA, and SOX. These regulations keep enterprise data for the long term and securely governed, driving market demands.

The presence of leading EIA vendors such as Microsoft, IBM, OpenText, and Veritas Technologies only strengthens North America's leadership. These vendors continue to advance by marrying AI, blockchain, and automation in their archive solution, securing data, and better-enabling search and compliance management.

Additionally, the growing digital culture and remote working have increased demands for cloud and hybrid EIA solutions, and hence market adoption is growing. As a result of having developed IT infrastructure and significant enterprise spending on data governance, leadership in the global EIA market in terms of revenues, technical innovations, and regulations-driven needs is expected to be retained by North America.

Region with Highest CAGR

The Asia-Pacific (APAC) market is witnessing the fastest Compound Annual Growth Rate (CAGR) in the Enterprise Information Archiving (EIA) market, influenced by digitization, intensifying regulatory enforcement, and expansion by global companies. China, India, Japan, and South Korea have rapidly growing data volumes, influenced by digital banking, e-commerce, and expansion in cloud computing.

The regulations in APAC are intensifying, and data sovereignty regulations push companies to store and keep data in-country. The governments in APAC are enforcing strict data retention in financial services, health, and telecommunications, and companies are investing in advanced archive systems.

Moreover, cloud adoption and AI-enabled archiving technologies are fueling market growth. Large companies and SMEs are using cost-effective, scalable, and compliance-centric archiving systems to optimize data storage, protection, and access. As enterprise digitization continues to surge, regulations keep on evolving, and data protection is becoming increasingly crucial, APAC is projected to have the highest CAGR in the global EIA market and is hence becoming an attractive market for future innovations and investments.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Enterprise Information Archiving (EIA) market is highly competitive, with leading players such as Microsoft, IBM, OpenText Google Veritas Technologies Proofpoint all investing heavily in AI integration, automation, and cloud solutions to enhance data security compliance and retrieval efficiency. Leading vendors like these continue innovating to strengthen their market positions.

Microsoft excels with its Azure-based archiving solutions, boasting seamless integration with Microsoft 365 and AI-powered compliance tools. IBM relies on the Watson AI-powered platform for advanced data analytics and retrieval while Google Cloud expands its archiving abilities through AI search and compliance monitoring Veritas Technologies caters specifically to enterprises operating hybrid IT environments.

Emerging players like Mimecast and Barracuda Networks have quickly made waves within the archiving sector by providing cost-effective archiving solutions tailored specifically for SMBs and regulated industries at reasonable costs.

Through strategic partnerships, acquisitions, and developments such as blockchain-based secure archiving innovations - each is shaping the competitive landscape; with data governance becoming more of a focus than ever, vendors are increasing their focus on compliance automation tools such as compliance automation solutions; cybersecurity integration capabilities, multi-cloud archive storage options to stay ahead of competitors.

Some of the prominent players in the global Enterprise Information Archiving Market are

- Microsoft Corp

- Google LLC

- ZL Technologies

- Smarsh Inc

- Proofpoint Inc

- Altos SE

- Archive 360

- Veritas Technologies

- HPE

- Barracuda Networks

- Other Key Players

Recent Developments

- January 2025: IBM invested $500 million in AI-powered enterprise archiving solutions, aiming to enhance compliance automation, predictive analytics, and regulatory adherence for highly regulated industries such as BFSI and healthcare.

- December 2024: Veritas Technologies launched an AI-driven e-discovery tool, improving regulatory compliance, real-time threat detection, and automated data classification for BFSI and healthcare enterprises dealing with complex data governance requirements.

- November 2024: Google Cloud partnered with a major European bank to integrate secure cloud-based data archiving solutions, ensuring GDPR compliance, encrypted storage, and AI-powered search capabilities for structured and unstructured financial data.

- October 2024: Microsoft expanded Azure Compliance Center by introducing blockchain-based archiving features, ensuring tamper-proof audit trails, real-time compliance monitoring, and automated data retention for global enterprises.

- September 2024: OpenText acquired a leading data governance startup, strengthening its AI-driven archiving solutions for enterprises requiring enhanced regulatory compliance, real-time data tracking, and automated policy enforcement.

- August 2024: Proofpoint launched an automated compliance monitoring system designed for enterprise email and messaging archives, enabling AI-driven risk detection, threat intelligence, and automated data retention policies.

- June 2024: Barracuda Networks invested $200 million in R&D for cybersecurity-integrated archiving solutions, enhancing multi-layered encryption, AI-driven anomaly detection, and real-time access controls.

- May 2024: Mimecast launched a machine learning-powered archiving analytics platform, improving search efficiency, compliance automation, and proactive threat intelligence for enterprises handling vast data volumes.

- March 2024: IBM and Amazon Web Services (AWS) collaborated to develop hybrid cloud archiving solutions, focusing on scalable data storage, real-time compliance monitoring, and AI-enhanced e-discovery capabilities.

- January 2024: Microsoft introduced a quantum encryption-backed archiving solution, ensuring ultra-secure data storage, post-quantum cryptography integration, and regulatory compliance for high-security enterprises.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 8.9 Bn |

| Forecast Value (2032) |

USD 29.3 Bn |

| CAGR (2023–2032) |

14.1% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Content Type and Services), By Deployment Mode (On-Premises and Cloud), By Enterprise Size (Large Enterprises and SMEs), By End User (BFSI, Retail & E-commerce, Government & Defense, Healthcare & Pharmaceutical, Manufacturing, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Microsoft Corp, Google LLC, ZL Technologies, Smarsh Inc, Proofpoint Inc, Altos SE, Archive 360, Veritas Technologies, HPE, Barracuda Networks, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |