Market Overview

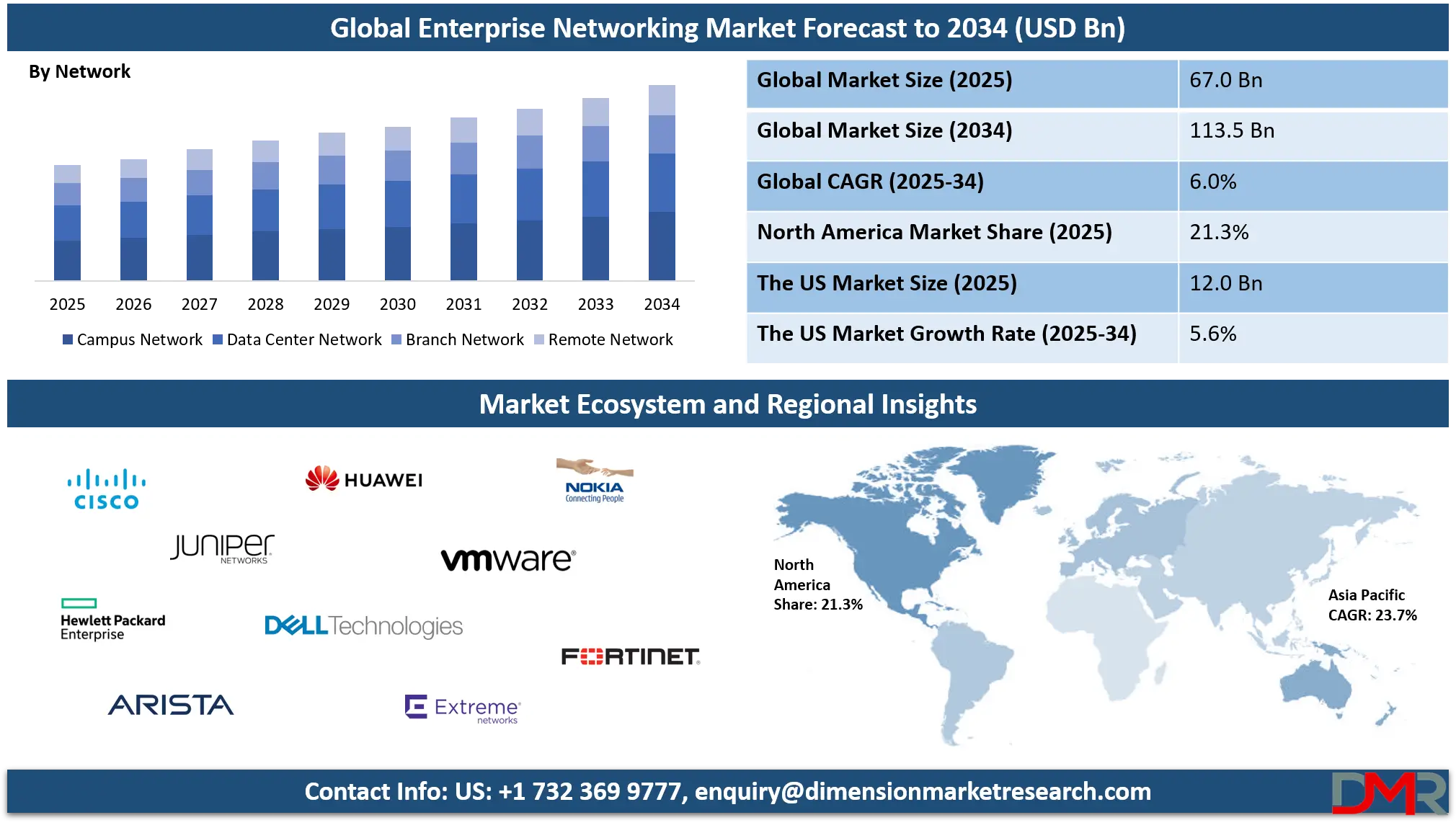

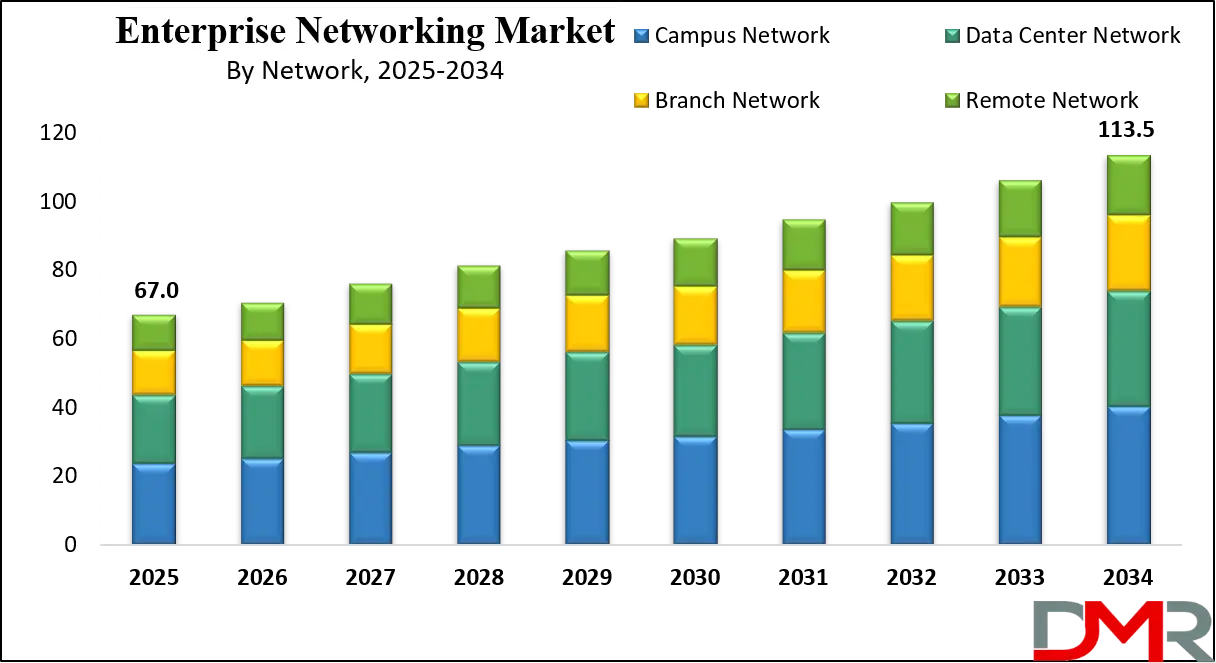

The Global Enterprise Networking Market size is projected to grow from USD 67.0 billion in 2025 to an impressive USD 113.5 billion by 2034, expanding at a robust CAGR of 6.0% during the forecast period.

This growth is fueled by the rising demand for advanced network infrastructure, cloud-native networking solutions, and the ongoing shift toward digital transformation across industries. Enterprises globally are investing in SD-WAN, LAN/WAN optimization, remote connectivity, and cyber-secure IT infrastructure to enhance agility and support hybrid work models.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Enterprise networking refers to the complete infrastructure that connects all facets of an organization’s digital ecosystem, enabling seamless communication, data transfer, and application access across departments, locations, and devices. It encompasses a wide array of technologies, including routers, switches, wireless access points, firewalls, and software-defined solutions like SD-WAN. These components work in unison to ensure secure, scalable, and high-performance connectivity between enterprise data centers, branch offices, cloud platforms, and remote employees.

As digital transformation accelerates, enterprise networking plays a pivotal role in driving operational efficiency, supporting real-time collaboration, ensuring data security, and enabling uninterrupted access to mission-critical systems. The growing adoption of hybrid work models, cloud applications, and IoT devices further amplifies the demand for intelligent, adaptive, and secure networking solutions that can handle dynamic workloads and diverse access points.

The global enterprise networking market represents a critical segment of the broader IT infrastructure industry, serving as the foundation for modern business operations across sectors such as BFSI, healthcare, manufacturing, retail, and government. It is shaped by growing enterprise reliance on cloud computing, the expansion of edge computing environments, and the rising need for secure connectivity in a distributed workforce landscape.

Organizations are transitioning from legacy network models to agile, software-defined architectures that provide better visibility, control, and automation. This shift is being accelerated by the need to handle ever-growing data volumes, support next-generation applications, and defend against sophisticated cybersecurity threats.

Rapid technological advancements and vendor innovations are reshaping the market landscape, offering enterprises modular and scalable networking solutions that can adapt to their evolving needs. The adoption of AI and machine learning in network management, for example, is improving predictive maintenance, traffic analysis, and automated threat detection, helping businesses reduce downtime and improve network efficiency.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition, the growth of 5G, edge computing, and the growing deployment of private networks are opening new opportunities for vendors to deliver highly customized networking solutions customized to industry-specific use cases. As a result, enterprise networking is no longer seen merely as a utility but as a strategic enabler of business agility and digital competitiveness.

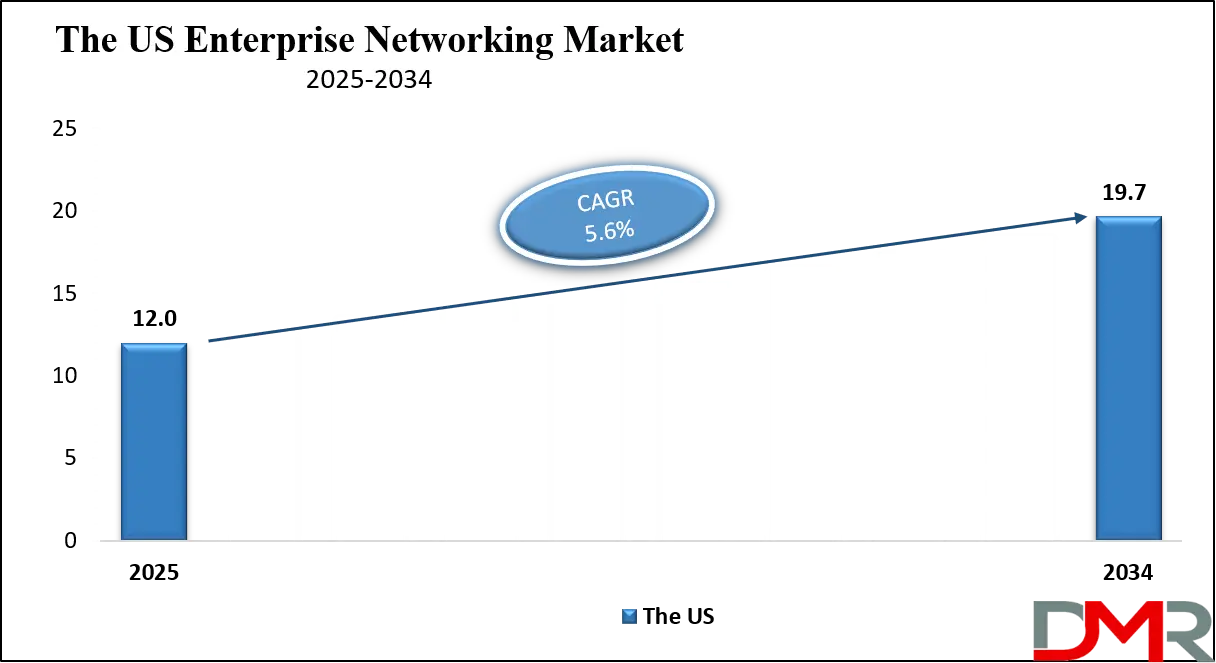

The US Enterprise Networking Market

The U.S. Enterprise Networking Market size is projected to be valued at USD 12.0 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 19.7 billion in 2034 at a CAGR of 5.6%.

The U.S. enterprise networking market stands as one of the most mature and technologically advanced segments globally, characterized by early adoption of cutting-edge infrastructure and strong demand across both public and private sectors.

The country’s dynamic business environment, integrated with its leadership in cloud computing, cybersecurity, and digital innovation, drives the continuous evolution of enterprise network architectures. With a strong emphasis on agility, security, and performance, U.S. enterprises are leveraging technologies such as SD-WAN, AI-driven network analytics, and intent-based networking to support hybrid workforces, multi-cloud strategies, and real-time collaboration. The presence of major global networking vendors, robust R&D investments, and a highly digitized workforce further strengthens the U.S. market’s position as a frontrunner in network modernization.

Key trends shaping the U.S. enterprise networking landscape include the widespread implementation of zero-trust network access (ZTNA), the integration of AI for proactive network management, and the growing reliance on edge computing for latency-sensitive applications. Enterprises are not only prioritizing the modernization of campus and data center networks but also heavily investing in secure remote access solutions to ensure business continuity in a distributed work environment.

Additionally, the rapid expansion of sectors such as e-commerce, telehealth, fintech, and smart manufacturing is fueling demand for highly reliable and scalable networking solutions. Government-led digital infrastructure programs, compliance regulations, and cybersecurity frameworks also play a significant role in shaping enterprise network investments. Together, these factors position the U.S. as a key driver of global innovation and adoption in the enterprise networking domain.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Enterprise Networking Market

The European enterprise networking market is projected to reach USD 14.4 billion in 2025, reflecting a CAGR of 5.3% during the forecast period. This growth can be attributed to several key factors, including the region's ongoing digital transformation initiatives, the rise of hybrid and multi-cloud environments, and a growing shift towards software-defined networking (SDN) and SD-WAN technologies.

Additionally, Europe's commitment to enhancing its digital infrastructure through the European Union's digital agendas and the push for enhanced cybersecurity across industries will drive further demand for advanced networking solutions.

As enterprises in Europe continue to modernize their IT systems, there is a growing need for agile, secure, and cost-effective networking solutions to support cloud migrations, remote work setups, and the integration of emerging technologies like 5G, IoT, and artificial intelligence. The adoption of managed networking services, including cloud-managed SD-WAN, is also expected to surge, as businesses look to simplify network management while ensuring high performance and robust security. The combination of regulatory drivers, growing network complexity, and the demand for seamless connectivity across distributed environments is positioning Europe as a key market for growth in the enterprise networking sector.

Furthermore, the enterprise networking market in Europe is also benefiting from the region’s strong focus on sustainability and energy efficiency. Many organizations are seeking to optimize their network infrastructure to reduce operational costs and lower their carbon footprint. This has led to increased investments in energy-efficient networking solutions, such as low-power networking devices, eco-friendly data centers, and green SD-WAN technologies.

Additionally, the rapid expansion of 5G networks and advancements in edge computing are providing enterprises with new opportunities to enhance their network capabilities and support real-time, high-performance applications. As these trends continue to evolve, they are expected to further drive the demand for modernized, scalable, and secure networking solutions across Europe, making the market competitive and dynamic.

The Japanese Enterprise Networking Market

Japan's enterprise networking market is expected to reach USD 3.8 billion in 2025, with a CAGR of 4.9% over the forecast period. This growth is driven by several key factors, including Japan’s position as a leader in technology and innovation, as well as the country's continued push toward digitalization across various sectors, including manufacturing, finance, healthcare, and retail.

The government’s strong initiatives to modernize infrastructure, especially with the rollout of 5G and the promotion of smart cities, are creating significant opportunities for enterprise networking solutions to evolve and thrive. Japan’s enterprises are adopting cloud-native networking technologies, SD-WAN, and secure access service edge (SASE) solutions to optimize network performance, improve security, and enable flexible, remote work environments.

The Japanese market is also seeing a rise in the adoption of IoT, AI, and automation, which necessitates more robust and efficient networking solutions to handle large volumes of data in real-time. As Japan continues to focus on advanced manufacturing and Industry 4.0, there is growing demand for high-speed, low-latency networks to support connected devices, industrial IoT, and big data analytics.

Additionally, Japan’s businesses are becoming more dependent on global connectivity, requiring network solutions that can integrate seamlessly with international cloud platforms and support hybrid IT environments. The shift towards SD-WAN and network virtualization is expected to be a key driver in enhancing the agility, scalability, and cost-efficiency of enterprise networks in Japan, thereby contributing to its market growth. As the country continues to invest in next-generation networking technologies and secure, high-performance infrastructures, Japan’s enterprise networking market is poised for steady expansion in the coming years.

Global Enterprise Networking Market: Key Takeaways

- Market Value: The global enterprise networking size is expected to reach a value of USD 113.5 billion by 2034 from a base value of USD 67.0 billion in 2025 at a CAGR of 6.0%.

- By Offering Type Segment Analysis: Networking Services are anticipated to maintain their dominance in the offering type segment, capturing 56.3% of the total market share in 2025.

- By Network Segment Analysis: Campus Network is poised to consolidate its dominance in the network type segment, capturing 35.2% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Managed SD-WAN deployment is expected to maintain its dominance in the deployment mode segment, capturing 44.1% of the total market share in 2025.

- By Connection Type Segment Analysis: Wired Connection type is anticipated to maintain its dominance in the connection type segment, capturing 62.5% of the market share.

- By End-User Segment Analysis: Enterprises are poised to consolidate their market position in the end-user type segment, capturing 63.9% of the total market share in 2025.

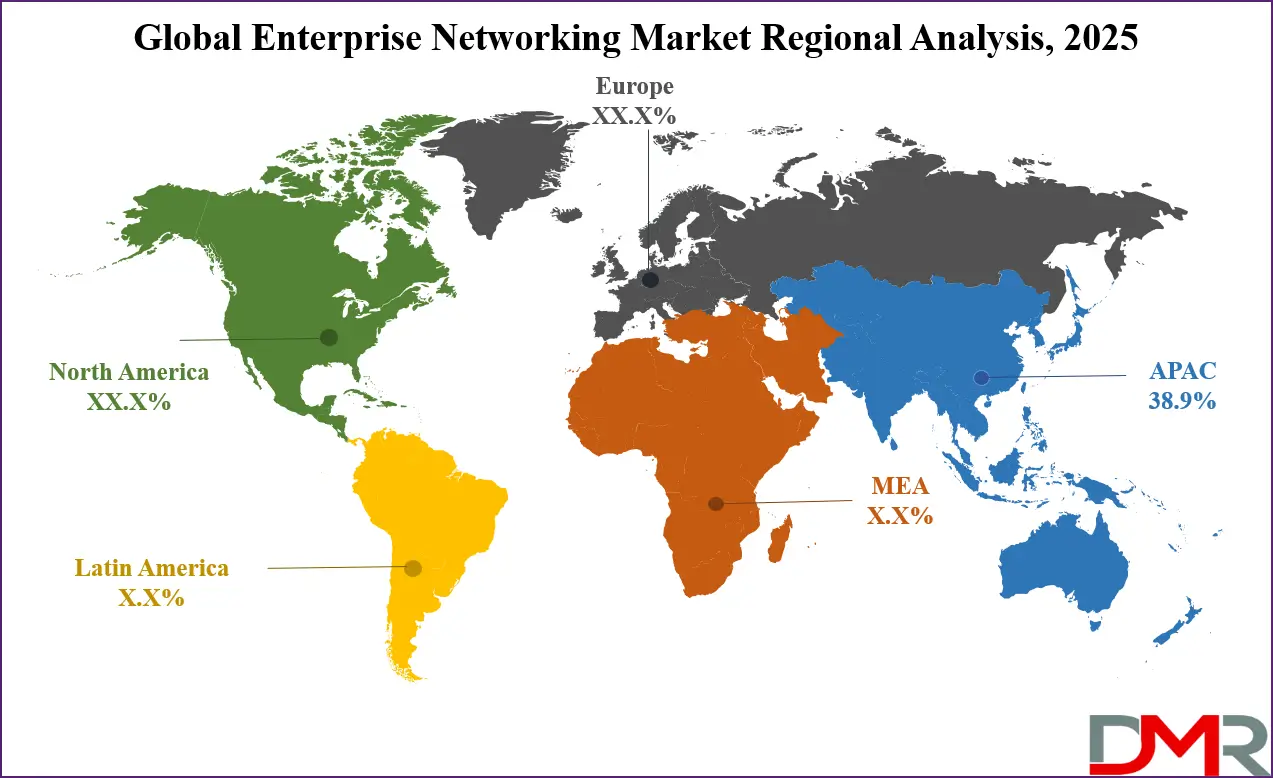

- Regional Analysis: Asia Pacific is anticipated to lead the global enterprise networking market landscape with 38.9% of total global market revenue in 2025.

- Key Players: Some key players in the global enterprise networking market are Cisco Systems, Juniper Networks, Hewlett-Packard Enterprise (HPE), Arista Networks, Huawei Technologies, Dell Technologies, Extreme Networks, Nokia (including Nuage Networks), VMware (Broadcom), Fortinet, Check Point Software Technologies, Palo Alto Networks, Avaya, Ubiquiti Inc., Riverbed Technology, Netgear, CommScope (including RUCKUS Networks), Ciena, ZTE Corporation, TP-Link Technologies, and Other key players.

Global Enterprise Networking Market: Use Cases

- Cloud Service Providers: Optimizing Data Center Connectivity with SD-WAN: Cloud Service Providers (CSPs) are responsible for delivering scalable and flexible cloud services to businesses and end-users globally. To ensure efficient cloud networking and high-performance delivery of SaaS, PaaS, and IaaS services, CSPs leverage SD-WAN (Software-Defined Wide Area Networking) to optimize their data center connectivity. SD-WAN enables CSPs to dynamically route traffic across multiple connections, ensuring high availability, reduced latency, and better application performance. This solution allows for the seamless integration of multi-cloud environments and offers enhanced network visibility to proactively manage network traffic and detect potential vulnerabilities. By leveraging SD-WAN, CSPs can easily scale their networks, improve user experience, and reduce operational costs, all while maintaining strict data security standards.

- Manufacturing: Enabling Industrial IoT for Smart Factory Operations: In the manufacturing sector, the integration of Industrial IoT (IIoT) is transforming traditional factories into smart manufacturing hubs. Enterprise networking plays a pivotal role in connecting IoT devices, sensor networks, and automation systems on the factory floor. With the growing deployment of wireless and wired networking solutions, manufacturers can achieve real-time data collection, predictive maintenance, and enhanced production workflows. SD-WAN solutions are often used to ensure reliable, low-latency connectivity between remote sites, central control systems, and the cloud. Moreover, robust network security is critical in preventing cyber threats targeting operational technology (OT). By leveraging edge computing, manufacturers can process data closer to the source, improving operational efficiency and reducing response times.

- Healthcare & Life Sciences: Securing Remote Patient Access and Telemedicine: In the healthcare sector, enterprise networking solutions enable the delivery of secure telemedicine services, ensuring remote patient access to healthcare providers. The demand for remote consultations, especially post-COVID-19, has driven healthcare organizations to adopt cloud-based applications and SD-WAN for improved connectivity and cost efficiency. SD-WAN enables seamless access to cloud-hosted Electronic Health Records (EHR), telehealth platforms, and critical medical applications. As data privacy and compliance with regulations such as HIPAA are paramount, network security becomes a key focus in protecting sensitive patient information. Managed SD-WAN services help healthcare institutions ensure data encryption, secure communication channels, and 24/7 network uptime for uninterrupted service delivery. The use of IoT devices like remote monitoring tools is also on the rise, further emphasizing the need for high-performance networks to support real-time data exchange.

- Retail & E-Commerce: Enhancing Customer Experience Through Omni-channel Connectivity: In the retail and e-commerce industries, enterprise networking solutions enable omnichannel strategies that provide seamless and integrated customer experiences across physical stores, online platforms, and mobile apps. Retailers leverage wireless networking solutions like Wi-Fi 6 to support high-demand environments, ensuring fast and reliable connections for both employees and customers. For e-commerce businesses, SD-WAN allows for fast and secure access to distributed applications, ensuring rapid transaction processing, accurate inventory management, and better customer service. Moreover, with the rise of mobile commerce and IoT devices used in smart retail, businesses require scalable networks that can handle massive volumes of data traffic. Networking technologies also play a crucial role in ensuring data security, preventing breaches during financial transactions, and providing secure remote access for supply chain management and backend operations.

Global Enterprise Networking Market: Stats & Facts

- India - Invest India & NCCS

- Internet Subscriber Base: India has approximately 954.4 million internet subscribers, with 556.05 million in urban areas and 398.35 million in rural areas, contributing to a tele-density of 85.7%.

- Data Consumption Growth: The average monthly data consumption per user reached 20.27GB as of March 2024, up from 0.27GB in 2014-15, reflecting a compound annual growth rate (CAGR) of 54%.

- IPv6 Adoption: India's IPv6 adoption level reached approximately 75% as of 2022.

- 5G Contribution to GDP: The 5G telecom sector is expected to represent nearly 2% of India's GDP by 2030.

- 5G Revenue Generation: The 5G sector in India is projected to generate revenues of nearly USD 180 billion by 2030.

- BharatNet Connectivity: BharatNet aims to provide a minimum of 100Mbit/s broadband connectivity to all 250,000 gram panchayats in India, covering nearly 625,000 villages.

- Fiber Optic Network Expansion: BharatNet Phase-II will increase the total fiber optic network to 10 million kilometers, doubling the existing infrastructure.

- Government Websites on IPv6: All government organizations in India are mandated to complete IPv6 transition and migration of their websites by 30 June 2022.

- Retail Wireline Connections: All new retail wireline customer connections provided by service providers after 31 December 2022 are required to be capable of carrying IPv6 traffic.

- BSNL and BBNL Merger: The Indian government approved the merger of Bharat Sanchar Nigam Limited (BSNL) and Bharat Broadband Network Limited (BBNL) to strengthen broadband infrastructure.

- United Kingdom - GOV.UK

- Business Data Handling: Approximately 72% of UK businesses with employees handle digitized data about their employees.

- Non-Personal Data Handling: Around 47% of UK businesses handle any type of non-personal data other than employee data.

- Innovation Activity: In 2020-2022, 36% of UK businesses were innovation active, a decrease from 45% in 2018-2020.

- Large Business Innovation: 50% of large businesses were innovation active in 2020-2022, compared to 36% of SMEs.

- Cybersecurity Strategy: 58% of medium businesses, 66% of large businesses, and 47% of high-income charities in the UK have a formal cybersecurity strategy in place.

- Board-Level Cybersecurity Responsibility: 30% of businesses and charities have board members or trustees explicitly responsible for cybersecurity as part of their job role.

- Cybersecurity Insurance: 43% of businesses and 34% of charities report being insured against cybersecurity risks.

- Data-Driven Companies: Approximately 197,000 UK companies, or 7.2%, were directly involved in the production, delivery, and/or usage of data in 2022.

- Communications Sector Employment: The UK communications sector employs over 270,000 people across about 8,000 companies.

- VAT and PAYE Businesses: As of March 2022, there were 2.768 million VAT and/or PAYE businesses in the UK, a small increase of 0.1% from the previous year.

- United States - U.S. Government & Federal Agencies

- Broadband Access: As of 2021, approximately 93% of U.S. households have access to broadband internet at speeds of 25 Mbps download and 3 Mbps upload, with rural areas still lagging.

- 5G Deployment: By 2025, nearly 70% of U.S. residents are expected to have access to 5G, which will drive adoption and growth in internet speed and capacity.

- Telecom Industry Size: The U.S. telecommunications industry generated approximately USD 1.7 trillion in revenue in 2022, contributing to 8.6% of the total U.S. GDP.

- Government Broadband Initiatives: The U.S. government allocated USD 42 billion under the Infrastructure Investment and Jobs Act to support broadband expansion in rural and underserved areas.

- Data Center Growth: The U.S. is home to nearly 60% of global data centers, with major tech companies investing heavily in building and expanding data center infrastructure.

- Cybersecurity: 46% of U.S. businesses have reported that they have a formal cybersecurity strategy in place as of 2023, ensuring protection against potential threats.

- IoT Adoption: The U.S. market for Internet of Things (IoT) devices is expected to reach USD 72.6 billion by 2025, primarily driven by industrial automation and smart homes.

- IPv6 Adoption: The U.S. has made significant progress in IPv6 adoption, with over 70% of traffic now being routed via IPv6 in 2022.

- Telemedicine Growth: Telemedicine in the U.S. has seen a 300% increase in adoption during the pandemic, with the market expected to surpass USD 50 billion by 2025.

- Federal Communications Commission (FCC) Broadband Plan: The FCC aims to ensure 100% broadband coverage in the U.S. by 2028, with a focus on underserved and rural areas.

- Europe - European Commission & Eurostat

- Broadband Penetration: Approximately 90% of households in the EU have access to fixed broadband, with 80% having access to at least 30 Mbps download speeds as of 2022.

- 5G Coverage: By 2025, 80% of European households are projected to be covered by 5G networks, spurring growth in enterprise networking.

- Data Usage: Average data usage per user in Europe is projected to increase to 8.4 GB per month by 2025, up from 3.6 GB in 2020.

- Government Investments in Digital Infrastructure: The EU has committed to investing €15 billion in digital infrastructure and broadband connectivity through its Digital Europe Programme by 2027.

- Cybersecurity in Europe: The European Commission's cybersecurity strategy aims to increase resilience across member states, with a focus on achieving a 5% reduction in cybercrime incidents by 2025.

- Digital Economy: The EU's digital economy contributed to approximately 6.5% of its GDP in 2022, with continued growth projected as digital adoption accelerates.

- Digital Services Act: The European Union introduced the Digital Services Act (DSA) to regulate digital platforms, which will have an impact on enterprise networking and the delivery of online services.

- IPv6 Adoption in EU: Europe leads globally with 85% of its internet traffic carried via IPv6, encouraging further innovation in networking services.

- Japan - Ministry of Internal Affairs and Communications (MIC) & Other Government Sources

- Broadband Coverage: 99% of Japan’s population has access to broadband internet, with 95% of households connected to high-speed internet networks.

- 5G Rollout: Japan is among the global leaders in 5G, with 85% of the population projected to have 5G coverage by 2025.

- Digital Economy Size: The digital economy in Japan was valued at USD 550 billion in 2022, contributing 6.1% to the nation’s GDP.

- IPv6 Transition: Japan is fully committed to the transition to IPv6, with 100% of its internet exchanges supporting IPv6 traffic.

- Smart City Initiatives: Japan's government is heavily investing in smart city technology, with 50 smart city projects scheduled to be implemented by 2025, driving demand for advanced networking infrastructure.

- Telecom Industry Revenue: Japan's telecommunications market generated an estimated USD 67 billion in 2022, contributing significantly to its economy.

Global Enterprise Networking Market: Market Dynamics

Global Enterprise Networking Market: Driving Factors

Rising Demand for Cloud-Based Applications and Multi-Cloud Connectivity

As enterprises continue their cloud migration journeys, the demand for robust and flexible network infrastructures that can support multi-cloud environments has significantly increased. Businesses are deploying applications across multiple public and private cloud platforms, requiring seamless, high-performance, and secure interconnectivity.

Enterprise networking solutions such as SD-WAN, cloud-native firewalls, and virtual network services help organizations achieve consistent application performance, optimize bandwidth usage, and manage traffic efficiently. The need for hybrid cloud access, remote workforce support, and real-time data exchange is pushing enterprises to invest heavily in advanced networking infrastructure.

Surge in Remote Work and Hybrid Workforce Models

The widespread shift to remote work and hybrid workplace environments has made traditional perimeter-based networking models insufficient. Organizations now require secure, scalable, and high-performing networks that can connect users and devices across geographically dispersed locations. This has driven a rapid rise in the adoption of zero trust network access (ZTNA), virtual private networks (VPNs), and cloud-delivered SD-WAN. Enterprise networking is becoming a strategic enabler for collaboration tools, video conferencing, and remote access management, all of which demand low latency, strong encryption, and consistent uptime.

Global Enterprise Networking Market: Restraints

High Initial Investment and Integration Complexity

Deploying or upgrading to a modern enterprise networking infrastructure often involves significant capital expenditure and operational disruption, especially for large organizations with legacy systems. The complexity of integrating new technologies like SD-WAN, network function virtualization (NFV), and network automation tools into existing IT environments can lead to extended timelines and additional training needs. For small and mid-sized enterprises (SMEs), the lack of in-house expertise and budget constraints further limit adoption rates.

Rising Cybersecurity Threats and Compliance Challenges

While modern enterprise networking solutions aim to enhance security, they are not immune to evolving cybersecurity threats such as ransomware, DDoS attacks, and insider threats. With an increase in endpoints, remote access points, and third-party integrations, enterprises face growing difficulty in maintaining end-to-end network visibility and compliance with data protection regulations (e.g., GDPR, HIPAA). Inadequate cybersecurity frameworks or misconfigured policies can result in serious vulnerabilities, data breaches, and reputational damage.

Global Enterprise Networking Market: Opportunities

Growing Adoption of AI and Machine Learning for Network Automation

The integration of artificial intelligence (AI) and machine learning (ML) into networking environments presents a significant opportunity for enterprises to streamline operations. AI-driven network management platforms enable predictive analytics, automated fault detection, and self-healing capabilities. This reduces downtime, enhances performance, and improves overall network efficiency. As networks become more complex, the demand for intelligent automation, real-time insights, and proactive monitoring tools will rise, opening new revenue streams for technology providers.

Expansion in Emerging Markets and Digital Infrastructure Initiatives

Emerging economies across Asia-Pacific, Latin America, the Middle East, and Africa are rapidly expanding their digital infrastructure through government initiatives and increased investment in broadband and IT services. Enterprises in these regions are embracing digital transformation, leading to growing demand for secure and scalable networking solutions. Initiatives such as smart cities, e-governance, and industrial automation are driving the need for high-speed, low-latency connectivity, creating ample opportunities for both local and global vendors to penetrate new markets.

Global Enterprise Networking Market: Trends

Shift toward Network-as-a-Service (NaaS) and Subscription-Based Models

Enterprises are adopting Network-as-a-Service (NaaS) models to reduce capital investment, simplify operations, and scale on demand. NaaS allows organizations to subscribe to networking infrastructure and services like SD-WAN, firewalls, and network monitoring on a pay-as-you-go basis. This trend is particularly appealing to businesses aiming for agile IT strategies and cost-effective scalability, especially in uncertain economic climates.

Convergence of Networking and Security with SASE Architectures

The rise of Secure Access Service Edge (SASE) is transforming how enterprises manage and secure network traffic. By combining networking functions (like SD-WAN) with security services (like CASB, SWG, ZTNA) into a unified cloud-delivered framework, SASE enables context-aware access, end-to-end visibility, and zero-trust enforcement across users and devices. This trend reflects the growing demand for converged networking and security, particularly in decentralized IT environments where performance and protection must go hand-in-hand.

Global Enterprise Networking Market: Research Scope and Analysis

By Offering Analysis

In the global enterprise networking market, networking services are expected to dominate the offering type segment by capturing an estimated 56.3% of the total market share in 2025. This dominance reflects the growing shift of enterprises toward service-centric IT strategies, where agility, scalability, and reduced complexity are top priorities. As organizations embrace digital transformation, there is a heightened reliance on managed services, consulting, integration, network monitoring, and support solutions to maintain high-performance network operations.

The demand for services such as SD-WAN as a service, cloud-managed networking, and lifecycle network support continues to grow, especially among enterprises that prefer outsourcing complex network operations to expert providers. These services enable businesses to optimize network performance, ensure compliance with cybersecurity standards, and accelerate cloud adoption with minimal in-house IT overhead. Additionally, networking services play a vital role in supporting hybrid and remote workforce environments by delivering secure, scalable, and always-on connectivity customized to evolving business needs.

On the other hand, networking devices remain an integral component of enterprise infrastructure, driving the physical and virtual backbone of organizational connectivity. These include routers, switches, wireless access points, network interface cards, and next-generation firewalls that collectively enable seamless data transmission, access control, and network segmentation. With the adoption of technologies such as Wi-Fi 6/6E, 5G, and IoT connectivity, networking devices are becoming more intelligent and application-aware. Enterprises are investing in modular, software-defined, and cloud-managed hardware that can support real-time analytics, traffic prioritization, and automation.

The rising demand for low-latency, high-throughput environments in sectors like manufacturing, healthcare, and BFSI further underscores the importance of advanced networking hardware. Although services currently lead the market, the ongoing evolution of hardware, fueled by innovations in edge computing and AI-based network management, ensures that networking devices will continue to play a foundational role in enabling resilient, secure, and high-speed enterprise networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Network Analysis

Campus networks are expected to maintain a dominant position in the global enterprise networking market, accounting for 35.2% of the total market share in 2025. This dominance is driven by the growing need for secure, high-performance internal connectivity across enterprise office campuses, university grounds, corporate parks, and institutional buildings. Campus networks are evolving rapidly due to the proliferation of connected devices, real-time collaboration tools, and growing dependence on wireless access through Wi-Fi 6 and 6E technologies.

These networks support seamless mobility, efficient resource sharing, and unified communication systems, making them foundational to the daily operations of large organizations. Enterprises are focusing on deploying scalable, software-defined campus networks that offer centralized visibility, automation, and policy enforcement to accommodate dynamic workloads and a mobile workforce. The integration of AI-powered analytics and zero-trust network access frameworks further enhances the security and agility of these network infrastructures, enabling consistent user experiences and better performance in distributed environments.

Data center networks, while distinct in function, play an equally critical role within the enterprise networking landscape. These networks form the backbone of cloud computing, virtualization, and enterprise application delivery, handling massive volumes of data transmission and storage processes. As enterprises continue to adopt hybrid and multi-cloud strategies, the demand for high-speed, low-latency data center networking infrastructure has surged.

Modern data center networks are built on advanced technologies such as leaf-spine architectures, Ethernet fabric switching, and network function virtualization, designed to ensure high availability and rapid scalability. Enterprises rely on these networks to support mission-critical applications, real-time analytics, and workload orchestration across on-premises and cloud environments.

The shift toward disaggregated hardware, intent-based networking, and energy-efficient data centers is also reshaping how data center networks are deployed and managed. Though campus networks lead in terms of user access and mobility, data center networks are essential in powering the core IT backbone that enables digital services, cloud-native applications, and enterprise agility in a data-driven world.

By Deployment Mode Analysis

Managed SD-WAN deployment is projected to dominate the global enterprise networking market’s deployment mode segment by capturing 44.1% of the total market share in 2025. This leadership stems from the growing enterprise demand for simplified network management, enhanced application performance, and centralized policy control, especially in distributed environments. Managed SD-WAN allows organizations to outsource the complexities of network deployment and optimization to third-party providers, reducing the burden on internal IT teams while ensuring round-the-clock monitoring, troubleshooting, and proactive updates.

This approach is particularly beneficial for businesses operating across multiple sites or countries, as it provides consistent service-level agreements (SLAs), robust cybersecurity integration, and seamless scalability. Enterprises are leveraging managed SD-WAN to ensure secure cloud access, improve bandwidth utilization, and enable dynamic routing of traffic across MPLS, broadband, and LTE/5G links. The managed model also aligns well with trends in IT outsourcing and pay-as-you-go service models, offering cost predictability and operational flexibility.

On the other hand, the DIY (Do-It-Yourself) deployment model appeals primarily to enterprises with mature IT capabilities and a desire for full control over their networking infrastructure. In this approach, organizations procure, configure, and manage their own SD-WAN solutions, tailoring the deployment to meet specific business requirements and security policies. DIY SD-WAN provides the advantage of deep customization, enabling enterprises to fine-tune performance parameters, apply unique routing strategies, and integrate proprietary tools or platforms.

However, this model demands significant in-house expertise in network design, security, and ongoing maintenance. While it offers flexibility and avoids vendor lock-in, it can increase the complexity of operations and require higher upfront investment. DIY deployments are often favored by tech-savvy industries such as IT services, fintech, or large-scale manufacturers with existing network management frameworks and the need for bespoke networking solutions. Despite its niche appeal compared to managed offerings, the DIY model continues to find relevance among organizations seeking autonomy, granular visibility, and a customized networking architecture.

By Connection Type Analysis

Wired connection type is expected to maintain its dominant position in the global enterprise networking market, accounting for 62.5% of the total market share in 2025. This continued dominance reflects the ongoing enterprise preference for high-speed, stable, and interference-free network connectivity, particularly in data-intensive environments. Wired networks, leveraging Ethernet, fiber optics, and advanced cabling systems, provide consistent bandwidth performance and are highly secure, making them ideal for critical applications in sectors like banking, healthcare, and manufacturing. They are foundational for back-end IT infrastructure, including data centers, server rooms, and enterprise-wide LANs, where reliability and low latency are paramount.

As organizations expand their digital capabilities, investments in structured cabling, Power over Ethernet (PoE), and 10/25/40/100 Gigabit Ethernet solutions are on the rise, ensuring robust connectivity for both traditional and software-defined networking frameworks. The scalability and longevity of wired connections continue to make them a preferred choice for organizations prioritizing network uptime, speed, and compliance with stringent security protocols.

Wireless networking, while secondary in share, is witnessing rapid growth driven by the demand for mobility, flexibility, and ease of deployment in modern workspaces. Enterprises are adopting wireless solutions to support BYOD (bring your own device) policies, mobile workforces, and smart office environments.

The evolution of wireless technologies, particularly with the rollout of Wi-Fi 6/6E and the anticipated expansion of Wi-Fi 7, has significantly improved performance, latency, and device capacity, closing the gap with traditional wired setups. Wireless connections are critical in collaborative workspaces, educational institutions, warehouses, and retail locations where physical wiring is either impractical or cost-prohibitive.

Furthermore, the integration of wireless networking with IoT ecosystems, real-time analytics platforms, and location-based services is expanding its role within the enterprise. While wired networks dominate in terms of performance and security, wireless connectivity is becoming essential for enabling agile, digitally connected, and user-centric enterprise environments.

By End-User Analysis

Enterprises are projected to dominate the end-user segment in the global enterprise networking market, capturing 63.9% of the total market share in 2025. This dominance is driven by the widespread digital transformation initiatives across diverse industry verticals such as BFSI, healthcare, manufacturing, retail, education, and government. As organizations shift toward cloud-native applications, remote workforce enablement, and data-driven decision-making, there is an escalating need for secure, scalable, and high-performance network infrastructure.

Enterprises are deploying SD-WAN, secure access service edge (SASE), and network automation solutions to ensure real-time access, cybersecurity compliance, and operational efficiency across geographically distributed environments. With the rapid growth of IoT, AI-powered analytics, and hybrid cloud ecosystems, businesses are placing networking at the center of their digital strategy to enhance user experiences, streamline workflows, and maintain business continuity.

The demand for enterprise-grade solutions that support seamless multi-cloud connectivity, unified communication, and zero-trust security frameworks is fueling sustained investments in both hardware and managed networking services. Service providers, while representing a smaller portion of the market share, play a pivotal role in the broader enterprise networking ecosystem by acting as critical enablers of connectivity and digital infrastructure. This segment includes telecom service providers and cloud service providers who deliver foundational services such as broadband internet, private LTE/5G networks, edge computing, and network-as-a-service offerings.

As businesses outsource their network needs, service providers are evolving their offerings to include cloud-managed SD-WAN, virtualized network functions (VNF), and cybersecurity-as-a-service platforms. These players are also integral to the rollout of next-generation connectivity solutions such as 5G, which is set to transform how enterprises approach mobile and edge networking.

Additionally, the growing adoption of distributed cloud architecture and content delivery networks (CDNs) has made service providers central to ensuring low-latency access and resilient network performance. Though their direct market share is comparatively lower, service providers are indispensable in supporting the digital ambitions of enterprises across sectors.

The Enterprise Networking Market Report is segmented on the basis of the following:

By Offering

- Networking Devices

- Routers

- Switches

- Access Points

- Gateways

- Firewalls

- Other Networking Devices

- Networking Software

- Network Management & Monitoring

- Network Security

- Network Virtualization

- Network Automation

- Other Networking Software

- Services

- Professional Services

- Consulting

- Deployment & Integration

- Support & Maintenance

- Managed Services

By Network

- Campus Network

- Data Center Network

- Branch Network

- Remote Network

By Deployment Mode

- DIY

- Managed SD-Wan

- SD-WAN as a Service

By Connection Type

By End-User

- Service Providers

- Cloud Service Providers

- Telecom Service Providers

- Enterprises

- IT & ITES

- BFSI

- Healthcare & Life Sciences

- Manufacturing

- Transportation & Logistics

- Education

- Retail & E-Commerce

- Government

- Media & Entertainment

- Other Enterprises

Global Enterprise Networking Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global enterprise networking market by accounting for 38.9% of the total market revenue in 2025, driven by rapid digitalization, expanding IT infrastructure, and growing cloud adoption across emerging and developed economies. Countries such as China, India, Japan, South Korea, and Australia are experiencing a surge in enterprise demand for advanced networking solutions due to the proliferation of data centers, 5G deployment, and a growing base of tech-savvy businesses.

The region’s strong push toward Industry 4.0, smart city development, and government-backed digital transformation initiatives is further accelerating investments in SD-WAN, network security, and AI-driven network management tools. Moreover, the presence of a large SME sector looking to modernize their network infrastructure, combined with the rise of remote and hybrid work models, continues to fuel market expansion. As global enterprises expand their footprint across Asia Pacific, the need for scalable, secure, and high-performance enterprise networking solutions is positioning the region as the key growth engine of the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

Asia Pacific is projected to register the highest CAGR in the global enterprise networking market over the forecast period, fueled by dynamic economic growth, rapid urbanization, and a surge in digital adoption across both emerging and developed markets. The region is witnessing exponential growth in internet penetration, mobile connectivity, and cloud-based service consumption, which is driving enterprises to upgrade their networking infrastructure to meet rising performance and security demands. Governments across countries like India, China, Indonesia, and Vietnam are heavily investing in national digital agendas, smart infrastructure, and 5G deployment, thereby creating a robust foundation for network expansion.

Additionally, the growing ecosystem of start-ups, small and medium enterprises, and multinational corporations expanding their operations in the region is amplifying the demand for agile, cost-effective, and secure networking solutions such as managed SD-WAN, Wi-Fi 6, and network virtualization. These factors collectively position Asia Pacific as the fastest-growing market, poised for sustained acceleration in enterprise networking adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Enterprise Networking Market: Competitive Landscape

The global competitive landscape of the enterprise networking market is characterized by intense innovation, strategic partnerships, and a blend of legacy leaders and agile new entrants vying for market share. Dominated by established technology giants such as Cisco Systems, Juniper Networks, Hewlett-Packard Enterprise (HPE), and Huawei Technologies, the market exhibits strong competition in areas such as routing, switching, wireless infrastructure, and network security.

These players consistently invest in R&D to enhance their product portfolios with advanced capabilities like intent-based networking, AI-driven automation, and secure access service edge (SASE) frameworks. Their global presence, combined with deep enterprise relationships and large-scale support ecosystems, enables them to maintain a strong foothold across key regions and industry verticals.

At the same time, a growing number of innovative vendors such as Arista Networks, Fortinet, VMware (Broadcom), and Extreme Networks are disrupting the landscape by offering highly specialized solutions customized to modern enterprise demands, including cloud-native architectures, zero-trust security, and SD-WAN integration. These companies often focus on software-defined capabilities and subscription-based models that provide flexibility and cost-efficiency, especially for organizations transitioning to hybrid and multi-cloud environments. Strategic acquisitions, ecosystem collaborations, and expansion into managed services are also core tactics used to strengthen market positioning and deliver end-to-end solutions.

Some of the prominent players in the global enterprise networking are:

- Cisco Systems

- Juniper Networks

- Hewlett-Packard Enterprise (HPE)

- Arista Networks

- Huawei Technologies

- Dell Technologies

- Extreme Networks

- Nokia (including Nuage Networks)

- VMware (Broadcom)

- Fortinet

- Check Point Software Technologies

- Palo Alto Networks

- Avaya

- Ubiquiti Inc.

- Riverbed Technology

- Netgear

- CommScope (including RUCKUS Networks)

- Ciena

- ZTE Corporation

- TP-Link Technologies

- Other Key Players

Global Enterprise Networking Market: Recent Developments

- February 2024: Hewlett-Packard Enterprise (HPE) announced its acquisition of Juniper Networks in a deal valued at approximately USD 14 billion, aiming to strengthen its AI-native networking portfolio and expand its edge-to-cloud strategy.

- November 2023: Cisco Systems completed its acquisition of Splunk for USD 28 billion, enhancing its capabilities in AI-powered security and observability, with implications for secure enterprise networking.

- August 2023: Extreme Networks acquired Ipanema SD-WAN (formerly part of Infovista) to bolster its cloud-managed networking offerings and deepen its presence in Europe.

- May 2023: Arista Networks acquired Pluribus Networks, a specialist in unified cloud fabric and edge networking, to accelerate its hybrid cloud and data center capabilities.

- March 2023: Broadcom finalized its acquisition of VMware for USD 61 billion, aiming to integrate network virtualization and SD-WAN into its broader semiconductor and enterprise infrastructure portfolio.

- December 2022: Fortinet acquired Alaxala Networks, a Japanese provider of switching and routing solutions, to expand its presence in Asia and enhance its integrated networking-security offerings.

- October 2022: Palo Alto Networks acquired Cider Security to strengthen its security posture across enterprise DevOps environments, with implications for secure networking and infrastructure.

- June 2022: CommScope completed the acquisition of Ruckus Networks from ARRIS (a subsidiary of Broadcom), reinforcing its wireless networking and campus connectivity portfolio.

- April 2022: Check Point Software Technologies acquired Avanan, a cloud email and collaboration security company, to broaden its secure cloud networking solutions.

- January 2022: Dell Technologies sold Boomi, its cloud integration platform, to Francisco Partners and TPG for USD 4 billion, signaling a strategic refocus on core enterprise infrastructure, including networking.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 67.0 Bn |

| Forecast Value (2034) |

USD 113.5 Bn |

| CAGR (2025–2034) |

6.0% |

| The US Market Size (2025) |

USD 12.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Networking Devices, Networking Software, Services), By Network (Campus Network, Data Center Network, Branch Network, Remote Network), By Deployment Mode (DIY, Managed SD-WAN, SD-WAN as a Service), By Connection Type (Wired, Wireless), By End-User (Service Providers, Enterprises) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cisco Systems, Juniper Networks, Hewlett-Packard Enterprise (HPE), Arista Networks, Huawei Technologies, Dell Technologies, Extreme Networks, Nokia (including Nuage Networks), VMware (Broadcom), Fortinet, Check Point Software Technologies, Palo Alto Networks, Avaya, Ubiquiti Inc., Riverbed Technology, Netgear, CommScope (including RUCKUS Networks), Ciena, ZTE Corporation, TP-Link Technologies, and Other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global enterprise networking market?

▾ The global enterprise networking market size is estimated to have a value of USD 67.0 billion in 2025 and is expected to reach USD 113.5 billion by the end of 2034.

What is the size of the US enterprise networking market?

▾ The US enterprise networking market is projected to be valued at USD 12.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 19.7 billion in 2034 at a CAGR of 5.6%.

Which region accounted for the largest global enterprise networking market?

▾ Asia Pacific is expected to have the largest market share in the global enterprise networking market, with a share of about 38.9% in 2025.

Who are the key players in the global enterprise networking market?

▾ Some of the major key players in the global enterprise networking market are Cisco Systems, Juniper Networks, Hewlett-Packard Enterprise (HPE), Arista Networks, Huawei Technologies, Dell Technologies, Extreme Networks, Nokia (including Nuage Networks), VMware (Broadcom), Fortinet, Check Point Software Technologies, Palo Alto Networks, Avaya, Ubiquiti Inc., Riverbed Technology, Netgear, CommScope (including RUCKUS Networks), Ciena, ZTE Corporation, TP-Link Technologies, and Other key players.

What is the growth rate of the global enterprise networking market?

▾ The market is growing at a CAGR of 6.0 percent over the forecasted period.