Market Overview

The Global Enterprise Performance Management (EPM) Market is projected to witness significant expansion in the coming years, driven by growing demand for strategic business planning, financial forecasting, and real-time performance analytics. According to recent estimates, the market size is expected to be valued at

USD 8.2 billion in 2025, and it is further anticipated to reach a staggering

USD 17.5 billion by 2034, growing at a robust

CAGR of 8.8% during the forecast period.

Enterprise Performance Management (EPM) is a comprehensive suite of processes, methodologies, and tools organizations use to monitor, manage, and enhance their business performance. EPM encompasses strategic planning, budgeting, forecasting, financial consolidation, reporting, and performance analysis. By aligning business strategy with execution, EPM enables decision-makers to evaluate performance metrics in real-time, identify inefficiencies, and make data-driven decisions across departments.

Modern EPM solutions leverage technologies like

artificial intelligence, machine learning, and predictive analytics to automate routine processes, improve accuracy in financial planning, and ensure compliance with regulatory standards. This helps enterprises maintain operational agility and drive continuous improvement in a rapidly evolving business environment.

The global enterprise performance management market is experiencing robust growth, driven by growing demand for advanced business intelligence and real-time data insights across industries. As organizations navigate complex regulatory environments and volatile market conditions, there is a growing emphasis on financial transparency and agility. Enterprises are adopting cloud-based EPM solutions due to their scalability, ease of integration, and lower total cost of ownership. The rising focus on streamlining business operations and optimizing financial planning processes is further propelling the demand for comprehensive performance management tools.

These solutions enhance accountability and productivity and enable cross-functional collaboration by consolidating data from various sources. Technological innovations and the growing need for predictive analytics in enterprise decision-making are also shaping the market. Vendors are continuously upgrading their offerings to include advanced features such as AI-driven forecasting, scenario modeling, and automated financial consolidation. These capabilities allow businesses to adapt quickly to changes in demand, resource allocation, and economic disruptions.

Additionally, the rise of remote and hybrid work environments has accelerated the need for digital transformation and integrated performance management systems that support seamless access to performance data and planning platforms. This has opened new opportunities for cloud-native EPM providers and increased competition among established players and startups alike.

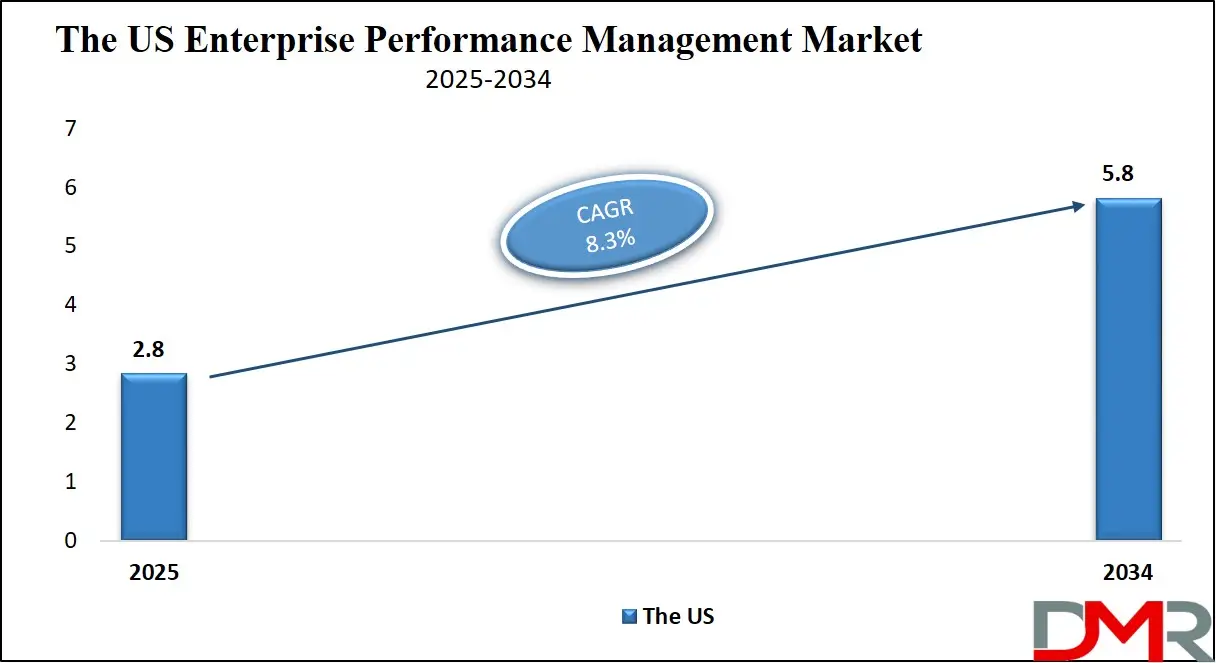

The US Enterprise Performance Management Market

The U.S. Enterprise Performance Management Market size is projected to be valued at USD 2.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.8 billion in 2034 at a CAGR of 8.3%.

The U.S. Enterprise Performance Management (EPM) market is experiencing rapid growth, fueled by the growing need for agile financial planning, strategic alignment, and real-time performance insights among organizations across various sectors. American enterprises are actively investing in advanced EPM solutions to streamline budgeting, forecasting, and reporting processes while gaining comprehensive visibility into operational and financial data.

The shift from traditional spreadsheets to integrated performance management systems is being driven by the demand for greater accuracy, efficiency, and scalability in business planning. With rising pressure to remain competitive in a fast-paced economic environment, U.S. companies are prioritizing digital transformation and turning to cloud-based EPM platforms that offer real-time analytics, collaborative dashboards, and data integration from multiple business units.

Furthermore, the U.S. market is seeing a strong push toward predictive analytics and scenario modeling, enabling organizations to make proactive, data-backed decisions. Sectors such as healthcare, manufacturing, retail, and IT & telecom are adopting EPM solutions not only to enhance financial transparency but also to support compliance with regulatory standards and improve organizational agility.

The growing emphasis on performance benchmarking, KPI tracking, and strategic goal alignment is positioning EPM software as a vital tool in enterprise governance. With a mature technological ecosystem and high cloud adoption rate, the United States remains a key innovator and adopter in the global EPM landscape, fostering continuous advancements in enterprise data management and performance optimization.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Enterprise Performance Management Market

The European Enterprise Performance Management (EPM) market is expected to reach

USD 2.0 billion in 2025, growing at a

CAGR of 8.4%. This growth is driven by the growing need for businesses to enhance financial planning, budgeting, forecasting, and analytics capabilities. Companies are adopting EPM solutions to improve decision-making, streamline operations, and ensure regulatory compliance in a dynamic economic environment.

The shift toward digital transformation and cloud-based EPM tools is a major factor, as organizations move away from legacy systems to more agile, scalable platforms. Another key factor contributing to this growth is the rising demand for real-time data analytics and AI-driven insights. Enterprises are leveraging advanced EPM solutions to integrate financial and operational data, enabling better strategic planning and performance monitoring.

Industries such as banking, healthcare, and manufacturing are particularly investing in these technologies to optimize costs and improve efficiency. Additionally, stringent financial regulations in Europe are pushing companies to adopt robust EPM systems for accurate reporting and compliance.

The competitive landscape in the European EPM market is evolving, with major players like Oracle, SAP, IBM, and Workday dominating the space. These vendors are continuously innovating by incorporating AI, machine learning, and automation into their EPM offerings. Small and medium-sized enterprises (SMEs) are also adopting cost-effective, modular EPM solutions to compete with larger corporations. The markets expansion is further supported by partnerships between software providers and consulting firms, helping businesses implement tailored EPM strategies.

The Japanese Enterprise Performance Management Market

The Japanese Enterprise Performance Management (EPM) market is projected to reach USD 0.4 billion in 2025, growing at a 5.2% CAGR, reflecting a steady but measured adoption of performance management solutions. This growth is underpinned by Japans unique corporate landscape, where traditional business practices intersect with gradual digital transformation. Unlike more aggressive tech adopters, Japanese enterprises prioritize stability and long-term integration, leading to a slower but more deliberate uptake of EPM tools.

A key driver in Japan is the growing pressure for better corporate governance and financial transparency. Regulatory reforms, such as the Corporate Governance Code and Stewardship Code, are pushing companies to enhance reporting accuracy and strategic planning. EPM solutions are gaining traction as tools to meet these requirements, particularly in industries like manufacturing, finance, and pharmaceuticals, where precision and compliance are critical.

Another distinctive factor is Japans preference for hybrid and on-premise EPM systems, even as global trends shift toward cloud-first models. Many Japanese firms remain wary of full cloud migration due to data security concerns and a cultural inclination toward maintaining control over critical systems. However, there is growing interest in AI-powered analytics and automation within EPM platforms, as companies seek to improve forecasting and operational efficiency without fully abandoning legacy infrastructure.

Global Enterprise Performance Management Market: Key Takeaways

- Market Value: The global enterprise performance management market size is expected to reach a value of USD 17.5 billion by 2034 from a base value of USD 8.2 billion in 2025 at a CAGR of 8.8%.

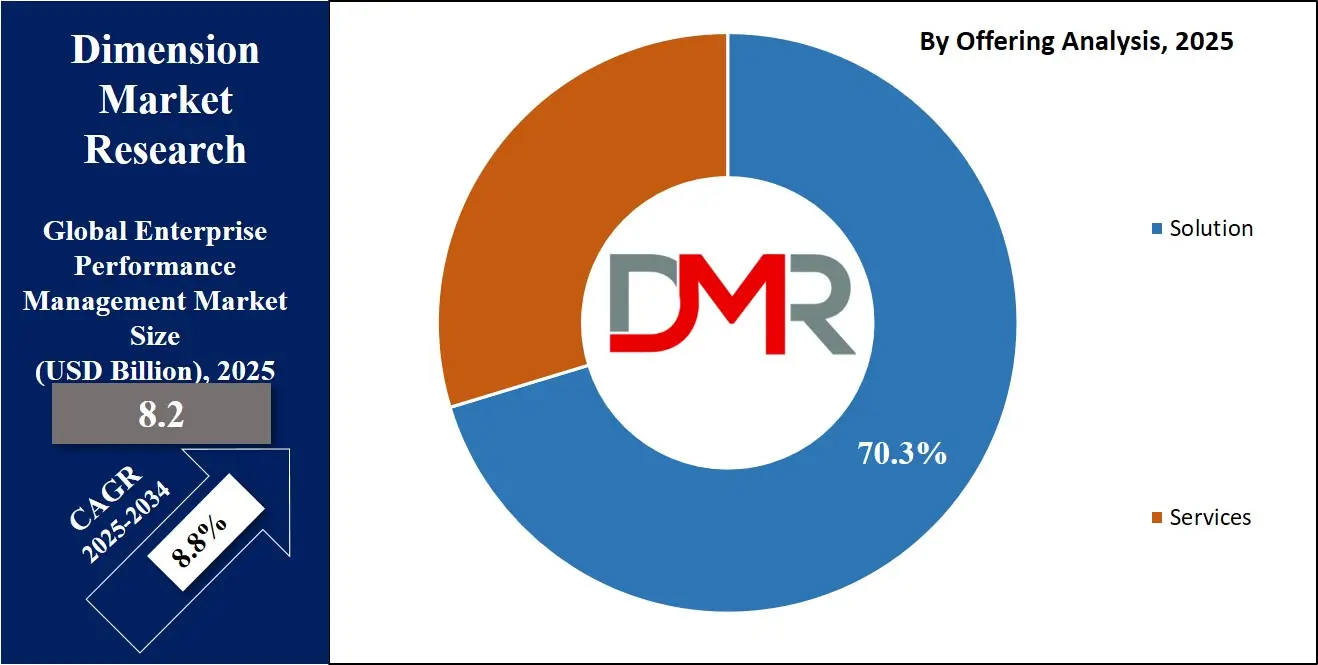

- By Offering Type Segment Analysis: Solutions are expected to maintain their dominance in the offering type segment, capturing 70.3% of the total market share in 2025.

- By Deployment Type Segment Analysis: On-Premises deployment mode is poised to consolidate its dominance in the deployment type segment, capturing 65.7% of the total market share in 2025.

- By Enterprise Size Segment Analysis: Large Enterprises are expected to maintain their dominance in the enterprise size type segment, capturing 78.5% of the market share in 2025.

- By Function Segment Analysis: Supply Chain functions are expected to maintain their dominance in the function type segment, capturing 36.1% of the market share in 2025.

- By Industry Vertical Analysis: The IT & Telecom industry is poised to maintain its dominance in the industry vertical segment, capturing 24.3% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global enterprise performance management market landscape with 41.3% of total global market revenue in 2025.

- Key Players: Some key players in the global enterprise performance management market are Oracle Corporation, SAP SE, IBM Corporation, Anaplan Inc., Workday Inc., Infor Inc., SAS Institute Inc., Board International, OneStream Software, Tagetik (Wolters Kluwer), Unit4, Prophix Software, Epicor Software Corporation, Adaptive Insights (A Workday Company), Longview Solutions, Kepion, Solver Inc., Axiom Software (Syntellis Performance Solutions), Vena Solutions, Planful Inc., and Other key players.

Global Enterprise Performance Management Market: Use Cases

- Financial Planning and Budgeting Optimization: Enterprise Performance Management solutions are widely used to enhance financial planning and streamline budgeting processes. By leveraging centralized data repositories and real-time analytics, organizations can eliminate manual spreadsheets and automate financial workflows. EPM platforms enable finance teams to build dynamic financial models, track variances, and adjust forecasts with precision. This use case is especially valuable in industries such as BFSI and manufacturing, where accurate cost management and cash flow forecasting are essential. The integration of AI-powered algorithms helps identify trends, detect anomalies, and support proactive decision-making, thereby improving overall financial governance and strategic allocation of resources.

- Real-Time Performance Monitoring and KPI Tracking: EPM systems provide robust tools for tracking key performance indicators (KPIs) and aligning departmental objectives with overall business goals. With dashboards and visual reporting tools, enterprises can monitor operational performance in real-time and gain insights into areas such as sales performance, project efficiency, and resource utilization. This use case is crucial for retail, healthcare, and IT sectors, where dynamic performance metrics must be assessed regularly. By consolidating data from various systems (ERP, CRM, HRMS), EPM solutions ensure seamless performance analysis and enable stakeholders to make data-driven adjustments to improve profitability and operational effectiveness.

- Regulatory Compliance and Financial Consolidation: Global enterprises face growing pressure to comply with regional and international financial reporting standards such as IFRS, GAAP, and SOX. EPM platforms help automate the financial consolidation process, ensuring data integrity, audit readiness, and timely reporting. This use case supports multinational corporations in streamlining intercompany eliminations, currency conversions, and financial disclosures. EPM software also includes audit trails and version control capabilities, which are essential for maintaining transparency and governance. Industries with high regulatory scrutiny, like pharmaceuticals, energy, and finance, heavily rely on EPM systems to maintain compliance while reducing the administrative burden on finance teams.

- Strategic Scenario Planning and Forecasting: In volatile and rapidly changing markets, EPM tools support advanced scenario modeling and what-if analysis to prepare for multiple business outcomes. Organizations use these platforms to simulate various business environments, such as supply chain disruptions, economic downturns, or market expansions, to test strategies and understand potential impacts. This strategic planning capability empowers executives to make informed decisions regarding investments, resource deployment, and risk mitigation. Especially in sectors like logistics, telecom, and aerospace, where external factors can significantly impact business continuity, EPM systems provide the foresight necessary to stay competitive and resilient.

Global Enterprise Performance Management Market: Stats & Facts

U.S. Government Reports (Department of Commerce, SEC, Federal Reserve)

- The U.S. financial analytics software market (including EPM) grew by 7.1% YoY in 2023.

- 78% of U.S. publicly traded companies now use some form of EPM software for SEC compliance.

- Federal spending on financial management systems (including EPM) reached USD 2.8 billion in 2024.

European Union (Eurostat, ECB, EU Commission)

- 62% of EU enterprises adopted cloud-based financial planning tools by 2024.

- The EUs GDPR compliance costs drove a 12% increase in EPM adoption among mid-sized firms (ECB Financial Stability Review).

- Public sector EPM spending in the EU grew to €1.2 billion in 2023.

Japan (Ministry of Economy, Trade and Industry - METI)

- Only 34% of Japanese firms fully migrated from legacy EPM systems to cloud-based solutions.

- Government subsidies for digital transformation in SMEs boosted EPM adoption by 9% in 2023.

- Japans on-premise EPM software market still accounts for 58% of total revenue.

India (Ministry of Electronics & IT, RBI)

- 45% of Indian banks now mandate AI-driven EPM tools for risk assessment.

- Government-led "Digital India" initiatives increased EPM adoption in PSUs by 22% since 2022.

- Indias public cloud spending on EPM grew by 31% in 2023.

China (Ministry of Industry and IT - MIIT, National Bureau of Statistics)

- State-owned enterprises (SOEs) allocated USD 1.5 billion for EPM modernization in 2024.

- AI-powered EPM tools are now mandatory for 60% of listed Chinese firms.

- Chinas domestic EPM software market grew by 18% YoY in 2023.

Australia (Australian Bureau of Statistics, APRA)

- 53% of ASX-listed companies now integrate ESG metrics into EPM systems.

- Government tax incentives for EPM adoption led to a 14% increase in SME usage.

- Public sector EPM spending reached AUD 420 million in 2024.

Canada (Statistics Canada, Bank of Canada)

- 67% of Canadian financial institutions use EPM for stress-testing.

- Federal grants for digital finance tools boosted EPM adoption by 11% in 2023.

- Cloud-based EPM adoption grew by 23% among Canadian enterprises.

Brazil (Brazilian Central Bank, Ministry of Economy)

- Regulatory mandates increased EPM adoption in Brazilian banks by 19% in 2024.

- Public sector EPM investments reached BRL 1.8 billion in 2023.

- Only 28% of Brazilian SMEs use advanced EPM tools.

South Korea (Ministry of Science & ICT, Bank of Korea)

- Government-funded AI projects drove a 15% rise in EPM usage in 2024.

- 79% of Korean conglomerates now use predictive analytics in EPM.

- Public EPM spending grew by 9% YoY in 2023.

Singapore (MAS, IMDA)

- 100% of Singaporean banks comply with MAS EPM reporting requirements.

- Government co-funding schemes led to a 40% EPM adoption growth in SMEs.

- Cloud EPM usage in Singapore grew by 27% in 2023.

Global Enterprise Performance Management Market: Market Dynamics

Global Enterprise Performance Management Market: Driving Factors

Growing Need for Data-Driven Decision Making

The growing complexity of global business operations has intensified the demand for real-time, data-driven insights. Enterprise Performance Management solutions enable companies to unify financial and operational data, offering decision-makers actionable intelligence through predictive analytics and integrated dashboards. As businesses strive for agility in a rapidly shifting economic environment, the ability to make informed strategic decisions based on historical and real-time data has become a key driver for EPM adoption. This demand is particularly strong in sectors like retail, manufacturing, and BFSI, where operational efficiency and financial transparency are critical.

Rising Adoption of Cloud-Based EPM Solutions

The shift from on-premise to cloud-based EPM platforms is transforming the market landscape. Cloud EPM software offers scalable infrastructure, lower upfront costs, and seamless integration with enterprise resource planning (ERP) systems, making it accessible for both large enterprises and mid-sized businesses. Additionally, the cloud model supports remote access and collaboration, vital in todays hybrid work environment, while enabling regular updates and innovation. This evolution aligns with broader digital transformation goals and strengthens enterprise-wide performance management capabilities.

Global Enterprise Performance Management Market: Restraints

High Implementation and Integration Costs

Despite the long-term benefits, the initial costs associated with deploying EPM systems can be prohibitive for small and medium-sized enterprises (SMEs). These include expenses related to software licensing, customization, system integration, and staff training. Integrating EPM tools with legacy systems, especially in traditionally structured organizations, presents technical and financial challenges. This barrier slows down the adoption rate among cost-sensitive organizations and restricts market growth in developing economies.

Data Privacy and Security Concerns

With EPM solutions handling sensitive financial, strategic, and operational data, concerns about data breaches and cybersecurity threats persist. Cloud-based platforms, while convenient, raise questions about data ownership, regulatory compliance, and third-party access. Enterprises in highly regulated industries, such as healthcare and finance, are especially cautious, as any breach can lead to significant legal and reputational damage. These apprehensions can hinder the full-scale implementation of EPM systems across certain sectors.

Global Enterprise Performance Management Market: Opportunities

Integration of Artificial Intelligence and Machine Learning

The incorporation of AI and ML in EPM platforms presents a major growth opportunity. These technologies enhance the automation of forecasting, anomaly detection, and performance analysis, allowing organizations to identify trends and risks with greater accuracy. AI-driven EPM tools support cognitive decision-making and continuous learning, making performance management more intelligent and adaptive. Vendors investing in AI-enhanced features are well-positioned to attract forward-thinking enterprises seeking to modernize their financial planning and analysis (FP&A) functions.

Expanding Demand in Emerging Economies

As businesses in Asia-Pacific, Latin America, and the Middle East modernize their financial infrastructure, there is a growing appetite for enterprise-level planning and performance solutions. Government-led digital transformation initiatives, integrated with rising SME investments in IT modernization, are opening new markets for EPM vendors. These regions offer significant growth potential due to their evolving regulatory environments and growing need for agile and transparent performance management.

Global Enterprise Performance Management Market: Trends

Shift toward Unified Performance and Financial Planning Platforms

Enterprises are moving away from siloed tools in favor of integrated platforms that combine financial planning, budgeting, operational reporting, and strategic analytics. This convergence streamlines performance monitoring, eliminates data redundancy, and enhances collaboration across business units. The trend reflects the growing demand for holistic enterprise performance visibility, helping organizations achieve better alignment between corporate strategy and execution.

Increased Focus on ESG Reporting and Sustainability Metrics

With Environmental, Social, and Governance (ESG) compliance becoming a corporate priority, EPM platforms are evolving to include sustainability metrics within performance dashboards. Companies are using EPM tools to track carbon footprints, energy usage, diversity goals, and other ESG indicators alongside traditional KPIs. This trend highlights the growing role of performance management systems in supporting sustainable business practices and stakeholder transparency.

Global Enterprise Performance Management Market: Research Scope and Analysis

By Offering Analysis

By Offering Type Segment Analysis: Solutions are expected to maintain their dominance in the global enterprise performance management market, capturing an impressive 70.3% of the total market share in 2025. This dominance is primarily driven by the growing reliance of enterprises on advanced EPM software solutions that support strategic planning, financial modeling, budgeting, and performance analytics. These solutions empower organizations to centralize their data infrastructure, integrate disparate systems, and gain real-time insights into key business metrics.

As companies strive to improve financial agility and operational transparency, the adoption of intelligent performance management software continues to surge across industries such as BFSI, manufacturing, and IT & telecommunications. The ability of EPM solutions to automate routine financial processes, enhance forecasting accuracy, and support compliance with global reporting standards further solidifies their market leadership.

While solutions dominate the offering segment, services play a critical and complementary role in the enterprise performance management ecosystem. Services in this market encompass consulting, implementation, training, support, and system integration. These offerings are essential for organizations looking to customize their EPM platforms according to specific business requirements.

Consulting services help enterprises align their performance management strategy with technology deployment, ensuring a smooth transition from legacy systems. Implementation and integration services enable seamless connectivity between EPM platforms and core enterprise applications such as ERP, CRM, and HRMS.

Additionally, managed services and technical support ensure continuous optimization and troubleshooting, thereby maximizing ROI. The growing demand for personalized performance management frameworks and long-term vendor support has made services a vital component in sustaining and scaling EPM adoption, especially in highly regulated and complex enterprise environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Deployment Analysis

By Deployment Type Segment Analysis: On-premises deployment mode is poised to consolidate its dominance in the enterprise performance management market, capturing

65.7% of the total market share in 2025. This continued preference for on-premises solutions is largely attributed to organizations that prioritize data sovereignty, internal control, and stringent security protocols.

Many large enterprises, particularly in sectors such as finance, government, and healthcare, opt for on-premises EPM systems to retain full ownership of sensitive financial and operational data. These deployments allow businesses to customize infrastructure and access configurations based on their unique compliance and risk management frameworks. Additionally, the on-premises model provides greater flexibility in integrating with legacy systems, which is essential for companies with established IT environments that require tailored performance analytics, secure financial planning, and controlled access to internal business processes.

While on-premises solutions currently lead the market, cloud-based enterprise performance management platforms are gaining significant traction due to their scalability, cost-efficiency, and remote accessibility. Cloud EPM offerings enable businesses to eliminate the need for extensive IT infrastructure while benefiting from real-time updates, seamless collaboration, and continuous innovation. These platforms are particularly attractive to small and medium-sized enterprises and startups looking for flexible deployment, faster implementation, and low upfront investment.

Moreover, the integration of artificial intelligence, machine learning, and advanced analytics is more seamless in cloud environments, allowing organizations to enhance forecasting accuracy, scenario modeling, and decision support systems. As remote work models become more prevalent and digital transformation initiatives accelerate, cloud deployment is expected to grow rapidly and reshape the competitive landscape of enterprise performance management.

By Enterprise Size Analysis

By Enterprise Size Segment Analysis: Large enterprises are expected to maintain their dominance in the enterprise size segment, capturing 78.5% of the market share in 2025. This significant share is largely driven by the complex operational structures and extensive financial ecosystems within large organizations that demand robust enterprise performance management solutions.

These enterprises typically operate across multiple geographies and manage diversified business units, necessitating advanced tools for financial consolidation, multi-scenario planning, and strategic performance tracking. Large corporations often require deep customization, high-level data security, and seamless integration with other enterprise systems such as ERP and business intelligence platforms. As a result, they invest heavily in comprehensive EPM software to drive efficiency, ensure regulatory compliance, and support data-driven decision-making across departments.

On the other hand, small and medium-sized enterprises (SMEs) are recognizing the strategic value of enterprise performance management systems, although their market share remains comparatively lower. The growing availability of affordable, cloud-based EPM solutions is helping SMEs overcome traditional barriers such as high upfront costs and limited IT infrastructure. For these businesses, EPM platforms offer essential functionalities like simplified budgeting, real-time analytics, and financial forecasting that can improve competitiveness and operational agility.

As SMEs aim to scale and adapt in volatile markets, the adoption of performance management tools becomes instrumental in aligning resources with strategic goals, improving cash flow visibility, and enhancing overall business resilience. With vendors offering flexible pricing models and modular capabilities, the EPM market is gradually becoming more accessible to the SME segment, which is expected to contribute significantly to future growth.

By Function Analysis

By Function Segment Analysis: Supply chain functions are expected to maintain their dominance in the function type segment of the enterprise performance management market, capturing 36.1% of the market share in 2025. This dominance is fueled by the growing need for supply chain optimization, demand forecasting, and real-time visibility into inventory and logistics operations. In a globalized business environment, companies rely on EPM solutions to align procurement, production, and distribution with financial and operational objectives.

Advanced analytics embedded in EPM platforms enable businesses to monitor key supply chain performance indicators, assess supplier performance, and respond swiftly to disruptions. Industries such as manufacturing, retail, and consumer goods, which operate within highly dynamic and demand-sensitive ecosystems, are investing significantly in EPM tools to enhance supply chain agility, reduce costs, and improve service delivery. The integration of enterprise resource planning systems with EPM platforms further supports end-to-end supply chain visibility and drives strategic planning across the value chain.

While supply chain management takes the lead, sales and marketing functions are also gaining prominence within the enterprise performance management ecosystem. Organizations are leveraging EPM tools to measure marketing ROI, optimize sales strategies, and align revenue targets with broader corporate objectives. By analyzing data from customer relationship management (CRM) systems, digital campaigns, and sales performance metrics, businesses can make informed decisions about resource allocation, pricing strategies, and market expansion.

EPM platforms enable predictive modeling and trend analysis that help identify high-performing segments, forecast future sales, and evaluate campaign effectiveness. This analytical approach supports customer-centric strategies and enhances competitive positioning in saturated markets. As businesses adopt omnichannel marketing and personalized engagement models, EPMs role in sales and marketing performance optimization will continue to grow in relevance.

By Industry Vertical Analysis

By Industry Vertical Analysis: The IT & Telecom industry is poised to maintain its dominance in the industry vertical segment of the enterprise performance management market, capturing 24.3% of the market share in 2025. This leadership is primarily driven by the industry's fast-paced nature, constant innovation cycles, and the need to manage complex operational models spread across geographies. Companies in this sector deal with large volumes of transactional data and require advanced tools to oversee project portfolios, optimize resource allocation, and align technology investments with strategic outcomes.

EPM platforms support IT & Telecom organizations by enabling accurate financial forecasting, performance benchmarking, and agile decision-making. The rising adoption of 5G technology, cloud infrastructure, and digital transformation initiatives further amplifies the need for real-time performance insights and predictive analytics. These capabilities help IT & Telecom enterprises remain competitive, reduce operational risks, and enhance service delivery in a digital economy.

In parallel, the BFSI sector is emerging as a significant contributor to the enterprise performance management market due to its high demand for regulatory compliance, financial transparency, and risk management. Banks, insurance companies, and financial institutions operate within tightly regulated environments where timely and accurate reporting is critical.

EPM solutions help these institutions streamline financial planning and analysis (FP&A), monitor risk exposures, and improve profitability through detailed performance tracking. With growing customer expectations and digital banking trends, BFSI organizations are turning to EPM tools to optimize customer segmentation, product performance, and strategic initiatives.

These platforms also support capital planning, stress testing, and liquidity management, making them essential in navigating volatile economic conditions. As the financial services industry continues to embrace digital transformation and adopt AI-driven financial tools, the role of EPM systems in enhancing operational efficiency and compliance will become even more central.

The Enterprise Performance Management Market Report is segmented on the basis of the following:

By Offering

By Deployment

By Enterprise Size

By Function

- Finance

- Human Resources

- Supply Chain

- Sales and Marketing

- Others

By Industry Vertical

- BFSI

- Retail & Consumer

- Government

- Healthcare

- Manufacturing

- IT and Telecom

- Other

Global Enterprise Performance Management Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global enterprise performance management market landscape with 41.3% of total global market revenue in 2025. This regional dominance can be attributed to the strong presence of major EPM vendors, early adoption of advanced digital technologies, and a highly mature enterprise infrastructure across the United States and Canada. Organizations in North America are at the forefront of integrating performance management platforms into their strategic planning and financial processes, driven by a need for real-time data visibility, predictive analytics, and regulatory compliance.

The region’s enterprises, particularly in sectors such as IT & telecommunications, BFSI, healthcare, and manufacturing, are leveraging EPM solutions to streamline budgeting, forecasting, and performance monitoring, which enables more agile and informed decision-making. The growth in North America is further supported by a robust ecosystem of cloud service providers and enterprise software developers, as well as a strong culture of digital transformation.

Region with significant growth

The Asia-Pacific region is expected to witness the highest CAGR growth in the Enterprise Performance Management (EPM) market due to several factors, including rapid digital transformation, increased adoption of cloud-based solutions, and the growing demand for real-time analytics and data-driven decision-making across various industries.

As businesses in countries like China, India, and Japan focus on enhancing operational efficiency, cost-effectiveness, and strategic planning, the need for advanced EPM solutions has surged. Additionally, the rise of small and medium enterprises in the region, integrated with growing government initiatives to promote digitalization, further drives the demand for EPM systems, positioning Asia-Pacific as a key growth hub in the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- •Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Enterprise Performance Management Market: Competitive Landscape

The global competitive landscape of the Enterprise Performance Management (EPM) market is highly fragmented, with a mix of established players and emerging startups vying for market share. Key industry giants, such as Oracle, SAP, IBM, and Microsoft, dominate the market, leveraging their extensive product portfolios, strong brand recognition, and vast global presence. These companies offer comprehensive EPM solutions that integrate with other enterprise resource planning (ERP) and business intelligence tools to provide end-to-end performance management capabilities.

Additionally, cloud-based EPM platforms are becoming a focus, with companies like Anaplan and Adaptive Insights (now part of Workday) capitalizing on the growing trend of businesses shifting to cloud solutions for enhanced scalability, flexibility, and cost-efficiency. The competitive environment is further characterized by ongoing innovations, such as AI and machine learning integration, which help organizations streamline decision-making and improve forecasting accuracy.

While large enterprises benefit from comprehensive solutions offered by these key players, small and medium-sized businesses are also driving competition by adopting more affordable and user-friendly EPM tools. As a result, companies in this market are focusing on strategic partnerships, acquisitions, and product enhancements to maintain a competitive edge and meet the diverse needs of global customers.

Some of the prominent players in the Global Enterprise Performance Management are:

- Oracle Corporation

- SAP SE

- IBM Corporation

- Anaplan, Inc.

- Workday, Inc.

- Infor, Inc.

- SAS Institute Inc.

- Board International

- OneStream Software

- Tagetik (Wolters Kluwer)

- Unit4

- Prophix Software

- Epicor Software Corporation

- Adaptive Insights (A Workday Company)

- Longview Solutions

- Kepion

- Solver, Inc.

- Axiom Software (Syntellis Performance Solutions)

- Vena Solutions

- Planful, Inc.

- Other Key Players

Global Enterprise Performance Management Market: Recent Developments

- April 2025: Oracle Corporation acquired a leading EPM software company to enhance its cloud-based financial planning and performance management offerings.

- January 2024: SAP acquired a startup specializing in artificial intelligence (AI) and machine learning-powered EPM solutions to strengthen its analytics capabilities.

- November 2023: IBM announced the acquisition of a mid-sized EPM vendor focused on providing performance management solutions for the healthcare industry.

- September 2023: Microsoft acquired a cloud-native EPM software provider, expanding its Dynamics 365 suite with advanced budgeting and forecasting features.

- July 2023: Workday acquired Adaptive Insights, further enhancing its EPM platform with advanced financial planning, analytics, and reporting tools.

- June 2022: Anaplan merged with a leading data integration firm to provide seamless connectivity with other business applications, enhancing real-time data analysis for performance management.

- March 2022: Oracle acquired an innovative EPM provider offering advanced integrated planning and analytics for enterprises in the retail sector.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.2 Bn |

| Forecast Value (2034) |

USD 17.5 Bn |

| CAGR (2025–2034) |

8.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Solutions and Services), By Deployment (On-Premises and Cloud), By Enterprise Size (SMEs and Large Enterprises), By Function (Finance, Human Resources, Supply Chain, Sales and Marketing, and Others), and By Industry Vertical (BFSI, Retail & Consumer, Government, Healthcare, Manufacturing, IT and Telecom, and Others). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Oracle Corporation, SAP SE, IBM Corporation, Anaplan Inc., Workday Inc., Infor Inc., SAS Institute Inc., Board International, OneStream Software, Tagetik (Wolters Kluwer), Unit4, Prophix Software, Epicor Software Corporation, Adaptive Insights (A Workday Company), Longview Solutions, Kepion, Solver Inc., Axiom Software (Syntellis Performance Solutions), Vena Solutions, Planful Inc., and Other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the global enterprise performance management market?

▾ The global enterprise performance management market size is estimated to have a value of USD 8.2 billion in 2025 and is expected to reach USD 17.5 billion by the end of 2034.

What is the size of the US enterprise performance management market?

▾ The US enterprise performance management market is projected to be valued at USD 2.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.8 billion in 2034 at a CAGR of 8.3%.

Which region accounted for the largest global enterprise performance management market?

▾ North America is expected to have the largest market share in the global enterprise performance management market, with a share of about 41.3% in 2025.

Who are the key players in the global enterprise performance management market?

▾ Some of the major key players in the global enterprise performance management market are Oracle Corporation, SAP SE, IBM Corporation, Anaplan Inc., Workday Inc., Infor Inc., SAS Institute Inc., Board International, OneStream Software, Tagetik (Wolters Kluwer), Unit4, Prophix Software, Epicor Software Corporation, Adaptive Insights (A Workday Company), Longview Solutions, Kepion, Solver Inc., Axiom Software (Syntellis Performance Solutions), Vena Solutions, Planful Inc., and Other key players.

What is the growth rate of the global enterprise performance management market?

▾ The market is growing at a CAGR of 8.8 percent over the forecasted period.