Market Overview

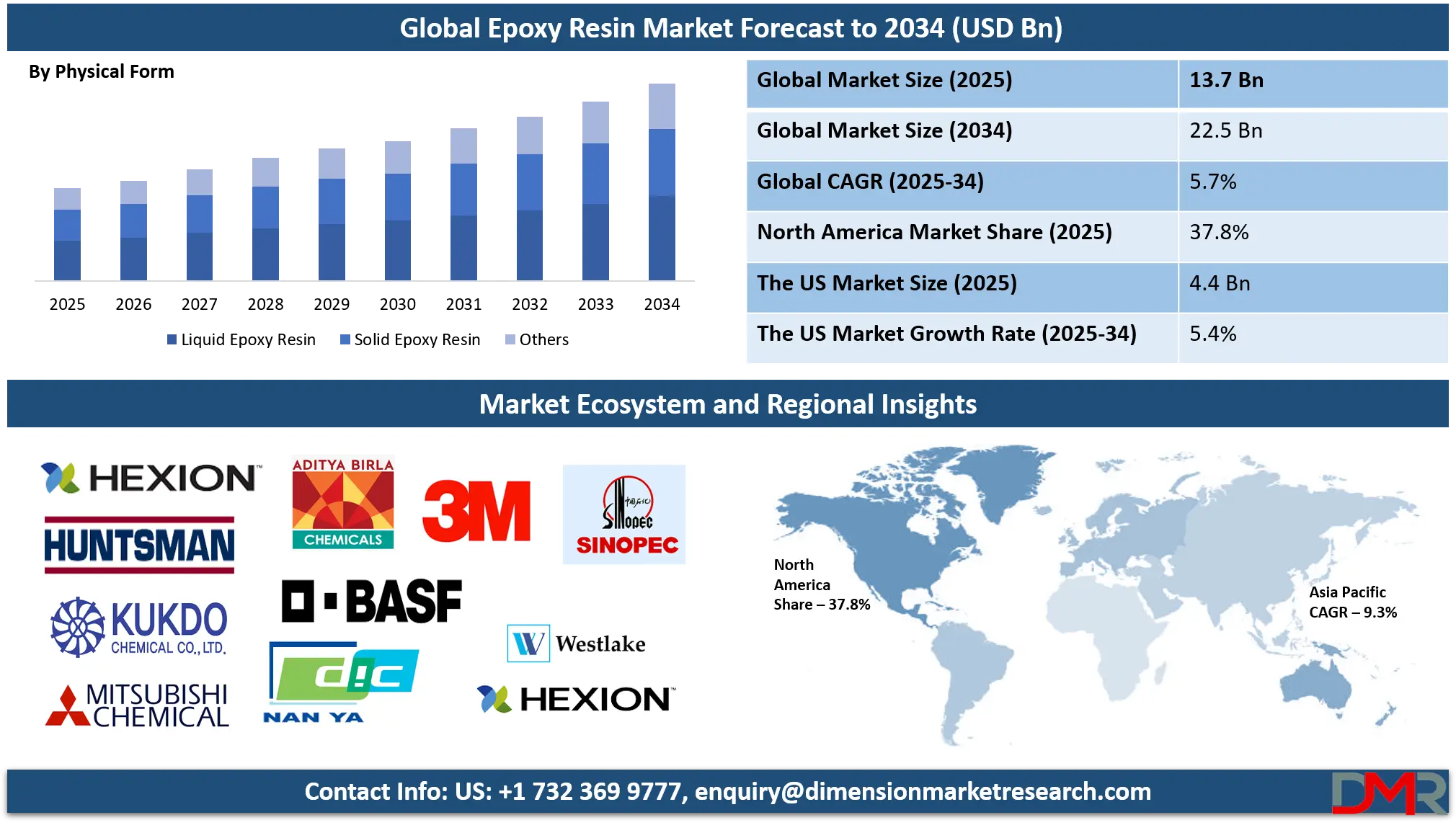

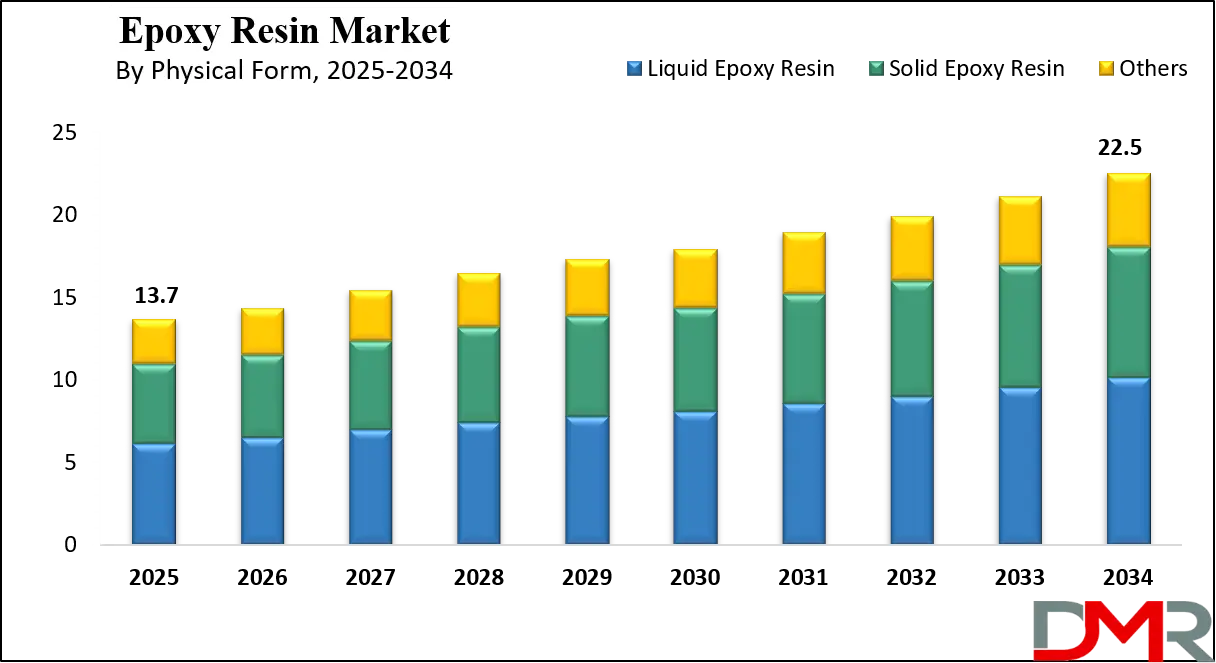

The Global Epoxy Resin Market is expected to reach a value of USD 13.7 billion by the end of 2025, and it is further anticipated to reach a market value of USD 22.5 billion by 2034 at a CAGR of 5.7%.

Epoxy resin markets globally are experiencing rapid expansion, propelled by rising demand from industries including construction, automotive, aerospace, electronics, and marine. Epoxy resins have long been revered for their exceptional mechanical properties, chemical resistance, thermal stability, and durability which make them essential components in numerous coating, adhesive sealant, and composite applications - such as coatings. Their remarkable properties also enable epoxy resins to withstand extreme conditions in harsh environments without suffering degradation over time.

The construction and infrastructure sectors are driving forces behind the market expansion. An emphasis on infrastructure development in developed and emerging economies alike has led to an explosion in epoxy resin demand, specifically coatings, adhesives, and flooring systems made with these resins in residential, commercial, and industrial infrastructure projects requiring chemical resistance, durability, and

aesthetic appeal - ideal characteristics found within smart cities as well as public infrastructure projects which boost market expansion for epoxy resins in regions such as North America, Europe, and Asia-Pacific.

Automotive and aerospace industries both contribute significantly to the expansion of epoxy resin market growth. Epoxy resins play an integral part in creating lightweight composite materials used for automotive body panels, bumpers, and lightweight structural components to reduce weight and enhance fuel efficiency, while aerospace uses epoxy resins extensively as a composite material that offers strength with lightweight properties as well as resistance against environmental influences - leading to an ever-growing need for epoxy resin-based solutions.

Epoxy resins play an integral part in electronics industry production processes, including printed circuit boards (PCBs), encapsulants, and semiconductor packaging. Due to consumer electronics' rapid advancement as well as developments such as telecommuting services and electric vehicle (EV) use, demand for high-performance epoxy resins continues to surge; with compact electronics coming under pressure in terms of heat resistance, electrical insulation requirements, adhesion properties and durability considerations driving innovations within epoxy formulation technology.

Although raw material price volatility and regulatory pressures pose difficulties to the growth of this industry, innovations like bio-based and low-VOC epoxy resins should fuel its expansion due to rising consumer interest in eco-friendly solutions. With more manufacturers developing eco-friendly high-performance solutions for sale globally, the epoxy resin market will experience continued expansion over time.

The US Epoxy Resin Market

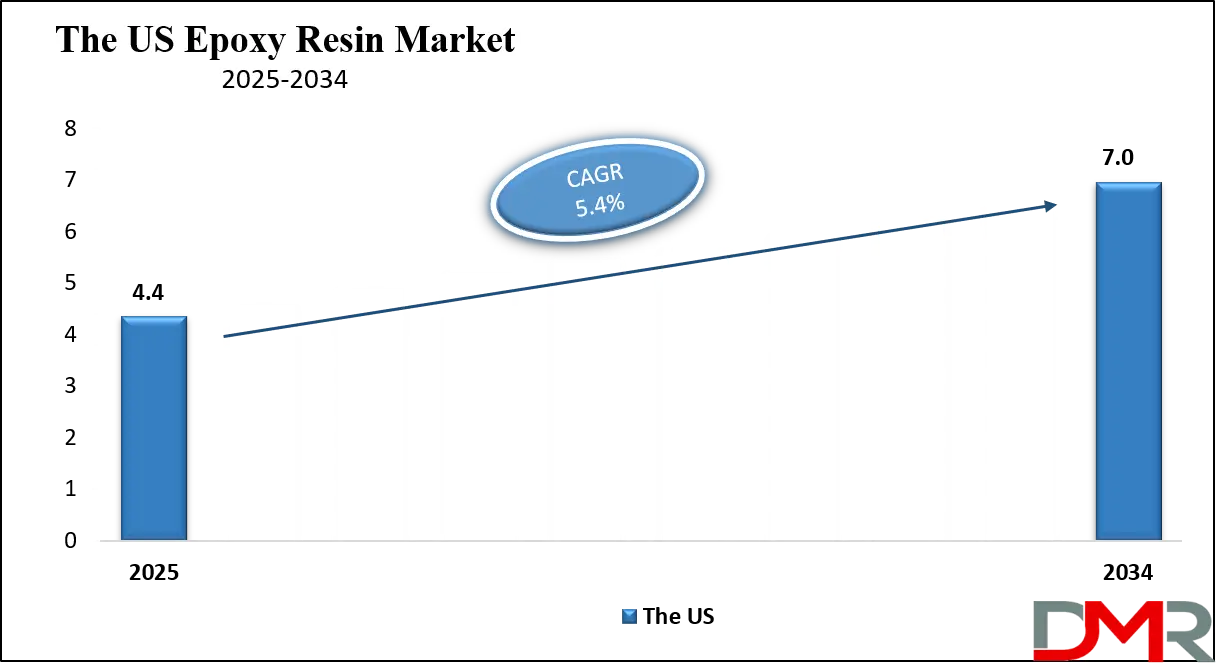

The US Epoxy Resin Market is projected to be valued at USD 4.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.0 billion in 2034 at a CAGR of 5.4%.

The United States epoxy resin industry has steady growth, with the country's solid industrial presence, research and development abilities, and huge demand from consumers for quality. The industry has encouraging growth opportunities with greater usage in automotive production, aerospace components, and electronic assembly.

The growth gains momentum with plenty of opportunities for utilization in projects of renewable energy, where epoxy resin is used in lightweight and durable wind turbine blades. The industry also gains growth with major global players and heavy research and development expenditure, and therefore, the US contributes significantly towards the growth of new goods.

Demographically, the nation has a huge engineering and manufacturing-skilled workforce, with regular flows of skills into epoxy resin industries. Residential and commercial building growth across the country also stimulates demand for protective coats and structurally adhesive solutions, contributing even more towards growth.

The need for more environment-conscious technologies also finds traction with the young generation, and therefore, research into alternative epoxy solutions with lower ecological footprint gains greater significance. With tighter regulations on the release of volatile organic compounds, American manufacturers are interested in adopting more environment-conscious processes and greener solutions. The technical know-how, solid demand, and demographic factors of the country place the US epoxy resin industry on the growth trajectory for the future.

Key Takeaways

- Global Market Value Insights: The global Epoxy resin market size is estimated to have a value of USD 13.7 billion in 2025 and is expected to reach USD 22.5 billion by the end of 2034.

- The US Market Value Insights: The US Epoxy resin market is projected to be valued at USD 4.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.0 billion in 2034 at a CAGR of 5.4%.

- Regional Insights: North America is expected to have the largest market share in the global Epoxy resin market with a share of about 37.8% in 2025.

- Key Players Insights: Some of the major key players in the global Epoxy resin market are Olin Corporation, Hexion Inc., Huntsman Corporation, Kukdo Chemical Co. Ltd., Aditya Birla Chemicals, and many others.

- Global Growth Rate Insights: The market is growing at a CAGR of 5.7 percent over the forecasted period.

Global Epoxy Resin Market: Use Cases

- Automotive Industry: Automotive body panels rely on epoxy composites for weight reduction, resistance, and fuel economy, and also for improved stability of the structure for passenger safety and overall lower vehicle maintenance.

- Electronics: In electrical printed wiring boards, epoxy encapsulants protect devices from moisture, mechanical stress, and chemicals, extending the lives of the products, lowering their maintenance requirements, and significantly improving their reliability of use in varying applications.

- Construction: High-performance epoxy coats shield infrastructure on construction projects from weather degradation and chemicals, and also offer more aesthetic value, smooth finishes, and longevity for structures.

- Marine Industry: Marine vessels use epoxy-based fiberglass hulls, which are seawater-resistant, reduce overall weight, and reinforce structures, with improved fuel economy, reduced repair costs, and longer operational lifespans.

Global Epoxy Resin Market: Stats & Facts

- Epoxy Resins as Essential Binders in Coatings: Epoxy resins are also of great importance in coatings, greatly improving durability for metals and floors. The World's Paint and Coatings Industry Association (WPCIA) identifies epoxy resins as imparting basic properties like abrasion resistance, effective curing, excellent adhesion, quick-drying, chemical resistance, durability, strength, and superior water resistance, which makes them indispensable for surface protection.

- Global Paint and Coatings Industry Market Value and Growth: The WPCIA estimated that the global paint and coatings industry was worth USD 185.5 billion in 2023, an increase of 3.2% compared to the previous year. This increase was mainly spurred by increased demand in the construction, automotive, and manufacturing industries.

- United States Paint and Coatings Industry: The American Coatings Association pointed out that the United States is among the largest and most technologically advanced markets for paints and coatings, with over 1,400 manufacturing firms in the industry. In 2022, production of paint and coatings in the U.S. was 1.32 billion gallons, and the market is expected to cross 1.34 billion gallons by 2024. Some of the leading manufacturers dominating the U.S. market are PPG, The Sherwin-Williams Company, Axalta Coating Systems, RPM Inc., and Diamond Paints.

- China’s Paint and Coatings Industry Growth: China, which is designated as a world hub for industrialization, has over 10,000 coating producers, including key players like Nippon Paint, AkzoNobel, and PPG Industries, according to European Coatings. China's coatings production was 35,772 million tons in 2023, representing a 4.5% year-on-year growth, the China Coatings Industry Association stated. Besides, exports jumped 19.6% to 262,000 tons, with domestic consumption going up by 4.2% to 35,663 million tons, reflecting the strength of the industry.

Market Dynamic

Global Epoxy Resin Market: Driving Factors

Expanding Construction and Infrastructure Sector

The rapid urbanization and industrialization across emerging economies, particularly in Asia-Pacific, are fueling the demand for epoxy resins in construction applications. Epoxy-based coatings, adhesives, and flooring materials are widely used in residential, commercial, and industrial infrastructure due to their excellent chemical resistance, durability, and aesthetic appeal. The increasing investments in smart cities, public infrastructure, and commercial real estate are expected to further drive the adoption of epoxy-based construction materials, enhancing market growth.

Growing Electronics and Electrical Industry

The electronics sector is one of the fastest-growing consumers of epoxy resins, mainly due to their application in circuit boards, encapsulants, insulators, and semiconductor packaging. With the rapid advancements in consumer electronics, telecommunications, and the increasing penetration of electric vehicles (EVs), the demand for high-performance epoxy-based materials is surging. The miniaturization of electronic devices, along with the need for heat resistance and electrical insulation, is propelling the adoption of epoxy resins in the manufacturing of electronic components, thereby driving market expansion.

Global Epoxy Resin Market: Restraints

Volatility in Raw Material Prices

Epoxy resins are produced mainly from petrochemical-derived raw materials such as bisphenol-A (BPA) and epichlorohydrin, whose prices are unpredictable due to crude oil fluctuations and supply chain breakdown. The variations in the prices of the raw material severely impact the margins of the makers, and stable end-product pricing becomes a challenge. The utilization of BPA and its potential impacts on human health can also lead to higher production with companies opting for substitute raw materials and compounds.

Environmental and Regulatory Challenges

The epoxy resin industry has regulations on VOC emissions, hazardous waste, and toxicity of some epoxy systems. Some regions, including Europe and North America, have regulations on the utilization of some chemicals in epoxy resin. Complying with such regulations translates into significant expenditure on research, innovations, and alternative solutions, and this can increase the cost of operations. Consumer demand and awareness for environment-conscious solutions can also be a challenge for companies with traditional petroleum-based epoxy resin.

Global Epoxy Resin Market: Opportunities

Emerging Applications in 3D Printing and Additive Manufacturing

Epoxy resins are gaining importance in 3D printing and additive manufacturing due to their improved mechanical properties, heat resistance, and bond. The growth of 3D printing in aerospace, automotive, and healthcare industries presents significant growth opportunities for epoxy resin manufacturers. With industries on the lookout for new and performance-driven chemicals for personalized and rapid prototyping, epoxy resin solutions are expected to register significant demand. The advancement of resin-based additive manufacturing methods will generate new avenues for epoxy resin utilization in the future.

Expansion in the Asia-Pacific Region

The Asia-Pacific, and more specifically, India, China, and Southeast Asia, present massive growth opportunities for the epoxy resin industry with its industrial growth, economic growth, and infrastructure investments. The regional automotive, construction, and electronic industries drive demand for epoxy resin.

Government policies for regional manufacturing and industrial growth also drive demand for epoxy-based coatings, adhesives, and composites. With urbanization and the growth of the middle class, demand for consumer goods, electronics, and vehicles will increase, and this will present new growth opportunities for epoxy resin manufacturers.

Global Epoxy Resin Market: Trends

Rising Demand for Lightweight and High-Performance Materials

Epoxy resins are being extensively used in industries such as aerospace, automotive, and wind, where lightweight, durable, and performance-oriented material requirements are necessary. The automotive industry, for instance, also has a transition towards epoxy-based composites for weight savings and fuel efficiency. The wind industry also extensively uses epoxy resins for wind turbines due to their improved mechanical performance, heat resistance, and bond strength. With fuel economy and sustainability becoming global mandates, epoxy-based lightweight material demand can be expected for growth in industrial processes of different kinds.

Increasing Adoption of Bio-Based and Sustainable Epoxy Resins

The global drive towards sustainability and environmental regulations are forcing research and development of bio-based epoxy resins. Conventional epoxy resins are produced from petrochemicals and release carbon. To mitigate this, industries are working on developing bio-based ones from plant oils, lignin, and bio-sourced anhydrides.

The bio-based epoxy resins are similar in their mechanical and heat properties with a lower environmental footprint. The drive towards environment-friendly composition and green chemistry will be the future of the epoxy resin industry, with key players working on developing environment-friendly solutions for regulations and customer requirements.

Research Scope and Analysis

By Physical Form

Liquid epoxy resins (LER) are expected to dominate the epoxy resin market on a global scale due to their flexibility, greater adhesion, and processibility across industries. With liquid epoxy resins, compared with solid epoxy resins, there is a greater formula that offers flexibility, viscosity, curing rate, and mechanical properties that can be modified and made customer-specific.

One of the key advantages of liquid epoxy resins is their excellent wetting properties, which enable strong adhesion to a wide range of substrates, including metals, concrete, wood, and composites. This makes them ideal for coatings, adhesives, sealants, and composite materials used in construction, automotive, and industrial applications. Their ability to provide superior chemical resistance, durability, and thermal stability further enhances their appeal across multiple industries.

Additionally, liquid epoxy resin has widespread usage in industrial, aerospace, and marine markets for high-performance protective coats, where resistance against harsh temperature fluctuations, moisture, and corrosion becomes critical. The compatibility with different curing agents, including amines and anhydrides, provides flexibility for performance customization, and therefore, they are a favorite among manufacturers.

Another significant reason for liquid epoxy resin's dominance lies in its increase in use in higher-end composite materials, such as carbon fiber and fiberglass-reinforced plastics. The employment of such materials in wind turbines' blades, automotive lightweight structures, and aerospace parts also enhances the demand for liquid epoxy resin. With their versatility in process, their performance, and extensive use, liquid epoxy resin still has the highest proportion of the global epoxy resin market.

By Raw Material

Bisphenol A Diglycidyl Ether (BADGE) is projected to be the predominant epoxy resin raw material on account of its improved mechanical properties, superior resistance towards chemicals, and widespread availability. BADGE epoxy resins are the strongest, toughest, and most resilient and therefore find widespread usage in rigorous industries for purposes of use in coatings, adhesives, laminates for electrical purposes, and composite materials.

One of the main contributing factors to BADGE's dominance is its ability to cure into very crosslinked networks when hardened with the use of proper hardeners, producing extraordinary mechanical and heat resistance. This puts BADGE epoxy resin into use where there exists a demand for maximum resistance against impacts, electrical insulation, and corrosion. Its resistance against chemicals puts BADGE into use for protecting industrial plants, pipelines, and marine environments, where exposure to harsh chemicals and water cannot be avoided.

Another major reason for its dominance is the reproducibility and cost-efficiency of its production. BADGE, unlike other epoxy precursors, is relatively easy to synthesize, and its process of preparation has been established, and therefore there's a stable supply of BADGE, meeting the global demand, which keeps on increasing. The widespread use of BADGE epoxy resin in electronic, automotive, and construction industries enhances its dominance even more.

Despite increasing ecological worries about Bisphenol A (BPA), the precursor of BADGE, there are also companies developing BPA-free variants and modified grades in response to regulations and maintaining the performance benefits of traditional BADGE-based resin. This versatility ensures BADGE remains the widely used raw material for epoxy resin.

By Application

Paints and coatings are anticipated to represent the largest application segment for epoxy resins, primarily due to their Paints and coatings are the largest end-user of epoxy resin, primarily due to their improved protection and aesthetic worth. Epoxy resin-based coatings are very good in terms of their adhesion, resistance, and toughness and therefore find widespread usage in industries such as construction, automotive, aerospace, and marine.

One of the key drivers of epoxy resin dominance in coatings is their enhanced resistance against corrosion. Epoxy coatings leave a very durable and impermeable film on substrates of metal, concrete, and wood, protecting them from weather, moisture, and chemicals. Owing to this, they are of utmost importance for industrial and marine coatings, where reliability and longevity take precedence. Epoxy coatings are extensively used for infrastructure, piping, bridge, and offshore projects for longevity and reducing future maintenance requirements.

Additionally, epoxy-based coats and paints also exhibit very good mechanical properties, such as very high tensile and impact resistance. Epoxy-based coats and paints find extensive use in industrial and commercial building floors, warehouses, hospital floors, and garage floors, where heavy usage and chemical spills are frequent. The smooth, easy-to-clean finish of epoxy-based coats and paints also finds them best for use in environments where cleanliness matters, i.e., food processing factories and pharma plants.

The rapid growth of the automotive and aerospace industries has also driven the demand for performance-driven coatings. Epoxy primers are widely utilized in automotive and aircraft industries for their capacity for promoting adhesion and resisting corrosion, extending the lifetime and longevity of vehicles and aircraft. With infrastructure development and stringent environmental regulations, demand for epoxy-based coatings will also continue its upward growth.

By End-Use Industry

The building and construction industry is projected to have the highest demand for epoxy resins, with their extensive use in floors, adhesives, sealants, coatings, and composites. The demand for durable, performance-oriented construction materials continues to rise with urbanization and infrastructure development picking up pace on a global scale.

One of the key reasons for epoxy resins' dominance in the construction industry is their extreme toughness and longevity. Materials containing epoxy resin are extensively used for their resistance against abrasions, chemicals, and heavy loads on high-performance floors. The systems are also very much in demand for use in industrial and office structures, warehouses, and even hospital floors due to their low maintenance and longevity. Epoxy coats also have higher weather and corrosion resistance, and therefore find their use in bridge, road, and other infrastructure projects.

Another significant source of contribution is the use of epoxy resin in sealants and adhesives for the construction industry. Epoxy adhesives exhibit very firm bonds, assuring stable structures in concrete restoration, tiling, and woodwork. Epoxy adhesives are used in systems for structurally reinforcing and anchorage, and also for greater safety and longevity.

Furthermore, the demand for more sustainable and energy-efficient structures has led to greater utilization of epoxy-based composites for use in lightweight structures, insulation panels, and environment-friendly building materials. Epoxy resins also play a significant role in enhanced performance and toughness of pre-fabricated building components, contributing towards greater demand. With global construction processes being on the increase, utilization of epoxy resins in this process is also expected to rise.

The Epoxy Resin Market Report is segmented on the basis of the following:

By Physical Form

- Liquid Epoxy Resin

- Solid Epoxy Resin

- Others

By Raw Material

- Bisphenol A Diglycidyl Ether (BADGE)

- Bisphenol F Diglycidyl Ether (BFDGE)

- Novolac Epoxy Resins

- Aliphatic Epoxy Resins

- Glycidyl Amine Epoxy Resins

- Other Raw Materials

By Application

- Paints & Coatings

- Composites

- Adhesives & Sealants

- Electrical & Electronics

- Wind Turbines

- Marine Applications

- Civil Engineering

- Others

By End-Use Industry

- Building & Construction

- Automotive

- Consumer Goods

- Wind Energy

- Aerospace & Aircraft

- Electrical & Electronics

- Other Industries

Regional Analysis

The region with Highest Market Share

North America is anticipated to hold a dominant position in the global epoxy resin market as it is further projected to command over 37.9% of the total market revenue by the end of 025. North America has a significant presence in the global epoxy resin market due to its established industrial infrastructure, widespread presence of key industry players, and heavy end-user industry demand from industries such as aerospace, construction, automotive, and electronics. The region has a range of key epoxy resin suppliers including Olin Corporation, Huntsman Corporation, and Hexion Inc., and has key drivers of innovations and advancements.

The robust American and Canadian construction industry also heavily contributes to epoxy resin demand, with major usage being in infrastructure, protective coatings, and adhesives. The aerospace industry growth, led by industry giants Boeing and Lockheed Martin, also contributes towards epoxy resin demand for its lightweight and high-strength.

Furthermore, North America has a very supportive regulatory regime for the growth of performance and eco-friendly epoxy resins. The growth of the use of bio-based epoxy resins and stringent environment regulations for low VOC coatings also support the market. With continuous improvements in terms of technology and wider usage, North America remains a global leader in the epoxy resin market.

Region with the Highest CAGR

The Asia-Pacific has been showing the highest compound annual growth rate (CAGR) for the epoxy resin industry, propelled by industrialization, urbanization, and the growth of end-user industries. Infrastructure growth has been on the upswing in India, China, Japan, and South Korea, and this has resulted in greater demand for epoxy-based construction chemicals, adhesives, and coatings.

China, the world leader in epoxy resin use and output, dominates the regional market with its flourishing automotive, construction, and electronic industries. Domestic production, with governmental encouragement, and greater foreign investments also stimulate demand. The expansion of the use of electric vehicles (EV) in the country also boosts demand for epoxy resin for use in EV batteries and lightweight materials.

India is also becoming a growth driver, with greater expenditure on infrastructure and the rapid growth of the manufacturing sector. The low-cost workforce and availability of raw materials in the Asia-Pacific region have made this region very appealing for epoxy resin manufacturers, and therefore, there has been massive growth and the highest CAGR for this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Epoxy Resin Market: Competitive Landscape

The global epoxy resin industry has fierce competition, with key players pursuing differentiation of their products, collaborations, and capacity expansion for solidifying their positions in the industry. The key players in this industry include Olin Corporation, Huntsman Corporation, Hexion Inc., BASF SE, Kukdo Chemical, and Aditya Birla Chemical, among others. The industry leaders invest heavily in research and development (R&D) for enhanced performance properties of epoxy resins and for developing environment-friendly, bio-based solutions.

Mergers, acquisitions, and joint ventures are common practices being pursued by industry leaders to expand their geographical presence and production capacity. To avail of the massive growth prospects of the Asia-Pacific, for instance, key players are heavily investing there. Apart from this, alliances with end-user industries, including aerospace, automotive, and construction, also keep them ahead of their competition.

Sustainability trends also drive competition, with many companies choosing low-VOC, BPA-free, and bio-based epoxy systems for meeting environment-related regulations and customer needs. With improvements in technology, competition between industry participants will also intensify, with more competition for environment-friendly, high-performance epoxy resin solutions.

Some of the prominent players in the global Epoxy Resin Market are:

- Olin Corporation

- Hexion Inc.

- Huntsman Corporation

- Kukdo Chemical Co., Ltd.

- Aditya Birla Chemicals

- Nan Ya Plastics Corporation

- Mitsubishi Chemical Corporation

- BASF SE

- 3M Company

- Westlake Epoxy (formerly part of Hexion)

- DIC Corporation

- Sinopec Baling Co., Ltd.

- Other Key Players

Global Epoxy Resin Market: Recent Developments

- November 2023: Induron Protective Coatings introduced Novasafe, a furfuryl-modified, thick-film, ceramic-filled novolac epoxy designed to endure extreme conditions commonly found in treatment facilities.

- October 2023: Matsumoto Fine Chemical (Ichikawa, Japan) developed X-1366R, a one-part thermosetting epoxy resin for composite infusion processes. It features low viscosity at ambient temperature, enabling rapid fiber penetration without the need for pre-mixing.

- February 2024: DCM Shriram announced a USD 10 billion investment in advanced material manufacturing, setting up a greenfield plant for liquid epoxy resins, solvent cuts, hardeners, formulated resins, and reactive diluents for multiple industries.

- February 2023: Huntsman launched JEFFAMINE M-3085 amine, a high molecular weight mono-polyether amine with enhanced performance over JEFFAMINE M-2070 and JEFFAMINE M-1000, improving application reliability and industrial efficiency.

- February 2022: Westlake Chemical Corporation acquired Hexion Inc.'s global epoxy business, strengthening its position and expanding capabilities in specialty resins, coatings, and composites for diverse industrial applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.7 Bn |

| Forecast Value (2034) |

USD 22.5 Bn |

| CAGR (2025–2034) |

5.7% |

| The US Market Size (2025) |

USD 4.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Physical Form (Liquid Epoxy Resin, Solid Epoxy Resin, Others), By Raw Material (BADGE, BFDGE, Novolac Epoxy Resins, Aliphatic Epoxy Resins, Glycidyl Amine Epoxy Resins, Other Raw Materials), By Application (Paints & Coatings, Composites, Adhesives & Sealants, Electrical & Electronics, Wind Turbines, Marine Applications, Civil Engineering, Others), By End-Use Industry (Building & Construction, Automotive, Consumer Goods, Wind Energy, Aerospace & Aircraft, Electrical & Electronics, Other Industries) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Olin Corporation, Hexion Inc., Huntsman Corporation, Kukdo Chemical Co. Ltd., Aditya Birla Chemicals, Nan Ya Plastics Corporation, Mitsubishi Chemical Corporation, BASF SE, 3M Company, Westlake Epoxy (formerly part of Hexion), DIC Corporation, Sinopec Baling Co., Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Epoxy resin market size is estimated to have a value of USD 13.7 billion in 2025 and is expected to reach USD 22.5 billion by the end of 2034.

The US Epoxy resin market is projected to be valued at USD 4.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.0 billion in 2034 at a CAGR of 5.4%.

North America is expected to have the largest market share in the global Epoxy resin market with a share of about 37.8% in 2025.

Some of the major key players in the global Epoxy resin market are Olin Corporation, Hexion Inc., Huntsman Corporation, Kukdo Chemical Co. Ltd., Aditya Birla Chemicals, and many others

The market is growing at a CAGR of 5.7 percent over the forecasted period.