Market Overview

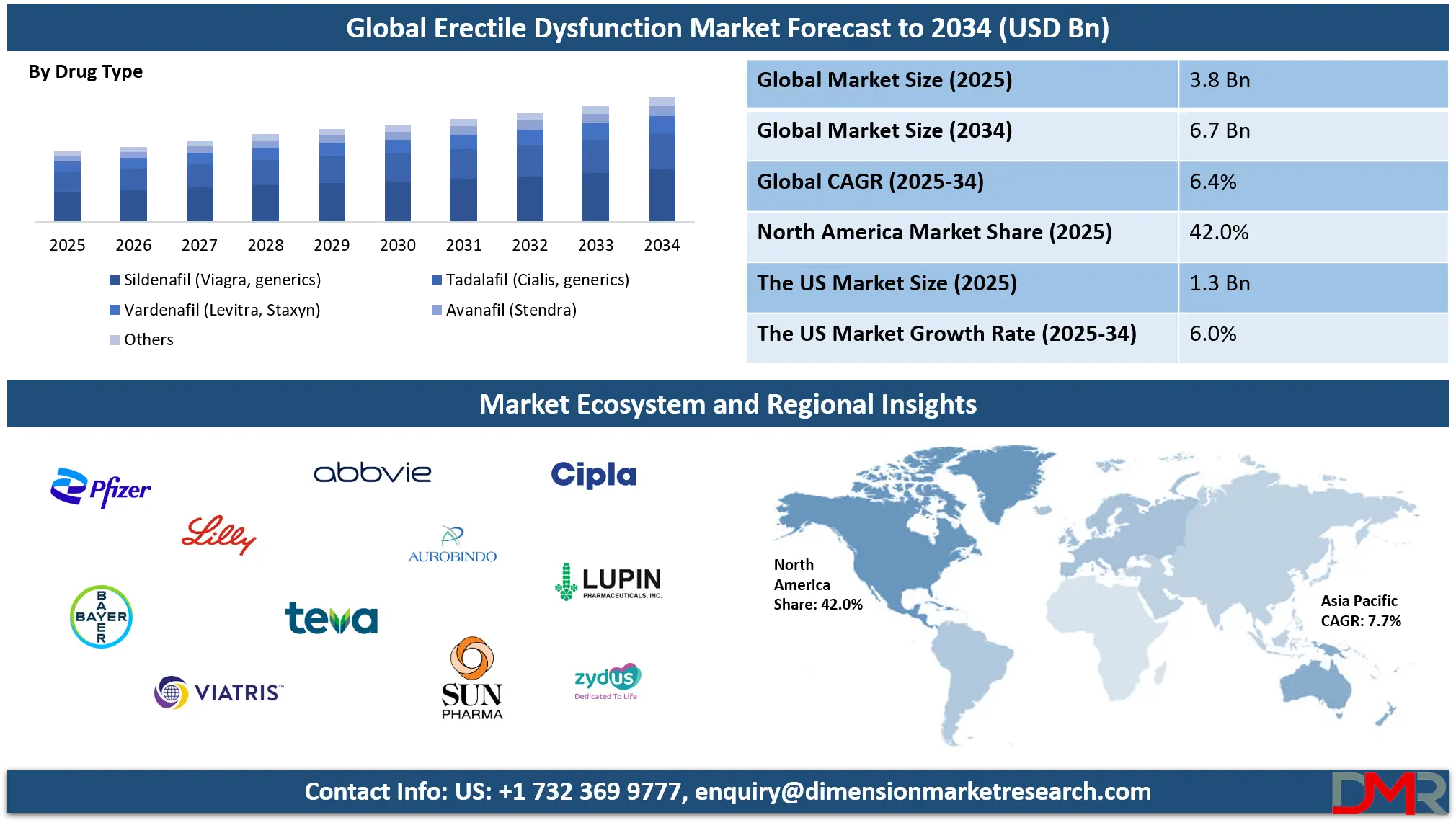

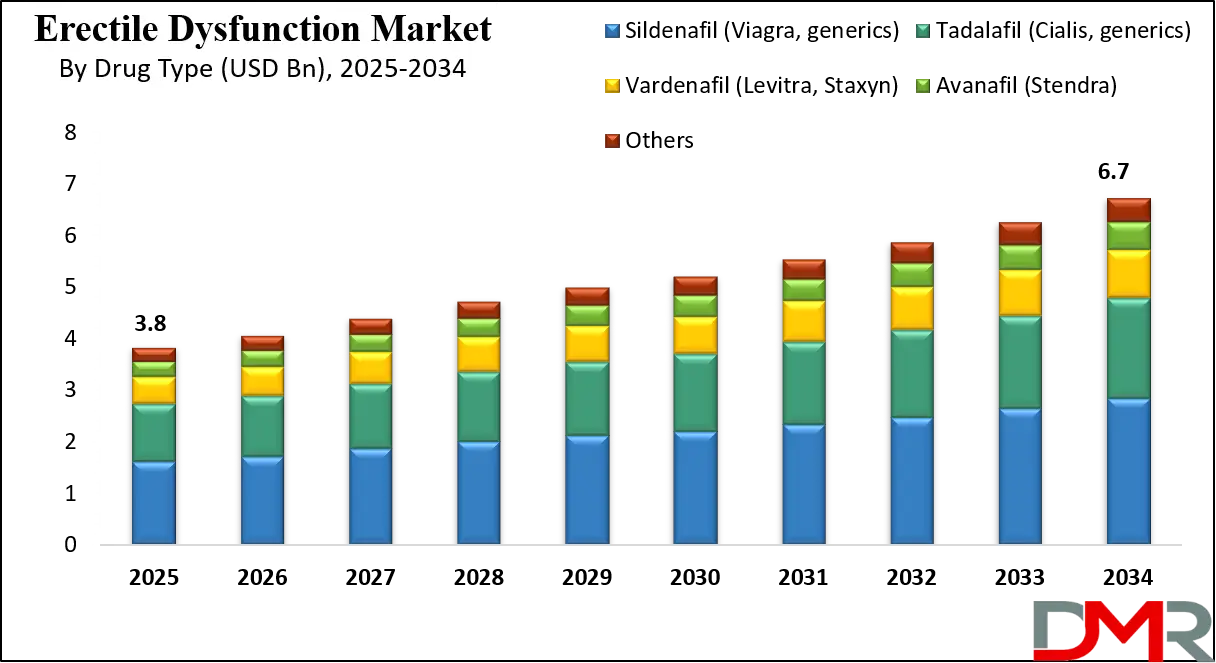

The global Erectile Dysfunction market is projected to reach USD 3.8 billion in 2025, with expectations to grow to USD 6.7 billion by 2034, registering a CAGR of 6.4%. Growth is driven by rising cases of male sexual health disorders, a growing geriatric population, lifestyle-related risk factors, and advancements in ED therapeutics, including oral drugs, regenerative therapies, and telehealth-based treatment platforms.

Erectile Dysfunction (ED) refers to the persistent inability to achieve or maintain an erection sufficient for satisfactory sexual performance. It is a common male sexual health disorder that can stem from a variety of physical, psychological, and lifestyle-related factors. Conditions such as cardiovascular disease, diabetes, obesity, hormonal imbalances, and neurological disorders often contribute to ED, while mental health issues like anxiety, stress, and depression also play a significant role.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, habits such as smoking, excessive alcohol consumption, and a sedentary lifestyle can exacerbate the problem. Erectile dysfunction not only affects sexual intimacy but also has profound implications for emotional well-being and interpersonal relationships, often leading to reduced self-esteem and quality of life.

The global Erectile Dysfunction market is driven by rising awareness around men’s sexual health, growing prevalence of chronic illnesses such as hypertension and diabetes, and the aging male population. The market has evolved significantly over the years, from traditional treatment methods to a growing reliance on oral phosphodiesterase type 5 inhibitors. With the expansion of telemedicine and online pharmacy platforms, the demand for discreet, home-based solutions has grown rapidly.

Furthermore, the introduction of next-generation ED therapies such as shockwave therapy and regenerative medicine, including stem cell and platelet-rich plasma treatments, is reshaping the clinical landscape and offering alternative solutions to patients unresponsive to conventional drugs.

The pharmaceutical sector continues to dominate the erectile dysfunction therapeutics market, supported by strong pipelines, generic drug availability, and the rising popularity of long-acting medications. However, non-pharmaceutical interventions are gaining attention due to fewer side effects and the potential for long-term improvement.

Regional growth trends highlight North America as the leading market, followed by Europe and the Asia-Pacific, where rising healthcare expenditure and shifting attitudes toward sexual wellness are stimulating demand. The market is becoming competitive, with global and regional players focusing on innovation, accessibility, and affordability to cater to a diverse and growing patient base.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Erectile Dysfunction Market

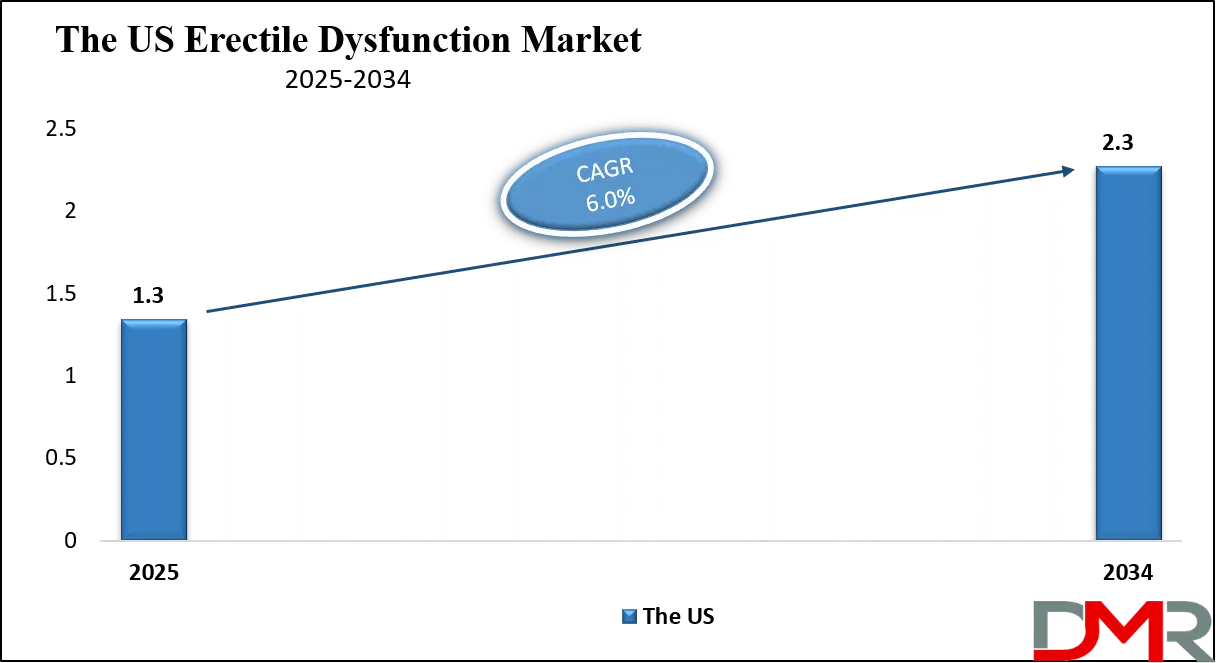

The U.S. Erectile Dysfunction Market size is projected to be valued at USD 1.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.3 billion in 2034 at a CAGR of 6.0%.

The United States Erectile Dysfunction market represents the largest share of the global landscape, driven by a high prevalence of lifestyle-related health conditions such as diabetes, obesity, and cardiovascular diseases. An aging male population, integrated with increased awareness of sexual health issues, has significantly contributed to rising diagnosis rates and demand for treatment options. The widespread availability of oral phosphodiesterase type 5 inhibitors, such as sildenafil, tadalafil, and vardenafil, along with an expanding network of urologists and sexual health clinics, supports market maturity and accessibility.

Moreover, the integration of digital health platforms and online pharmacies has revolutionized patient access, offering discreet consultations, remote prescriptions, and doorstep delivery of ED medications across the country.

Technological advancements and ongoing clinical trials in the US are further boosting the erectile dysfunction treatment landscape. Innovations such as low-intensity shockwave therapy, stem cell-based approaches, and platelet-rich plasma (PRP) injections are gaining clinical traction, particularly for patients who are unresponsive to conventional drug therapy.

Additionally, growing mental health awareness and its correlation with sexual dysfunction have led to a more holistic treatment approach, blending psychological counseling with pharmaceutical intervention. The presence of major pharmaceutical companies, favorable reimbursement frameworks, and rising investments in sexual wellness are positioning the US as a hub for erectile dysfunction innovation and long-term growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Erectile Dysfunction Market

The Europe erectile dysfunction market is projected to reach approximately USD 1.1 billion in 2025. This substantial contribution is driven by a high prevalence of chronic lifestyle diseases such as diabetes, obesity, and cardiovascular disorders, key underlying causes of erectile dysfunction. The region's aging male population is another significant factor, with a rising number of men over 50 actively seeking medical support for sexual health concerns.

Moreover, widespread awareness, strong healthcare infrastructure, and increased openness toward discussing male wellness have contributed to early diagnosis and higher treatment adoption rates. Countries like Germany, the United Kingdom, France, and Italy are leading markets within the region, supported by favorable reimbursement policies and an expanding range of treatment options.

The market is expected to grow steadily at a CAGR of 5.9% from 2025 to 2034, as innovation in treatment modalities and digital healthcare continues to gain traction. The growing penetration of telemedicine platforms and online pharmacies is making erectile dysfunction therapies more accessible and discreet, especially for younger demographics who may otherwise avoid clinical consultations.

Additionally, the shift toward holistic men’s wellness clinics and the growing interest in non-pharmacological solutions such as shockwave therapy and PRP treatments are expected to diversify the therapeutic landscape. With continued investments in research and a regulatory environment that encourages pharmaceutical innovation, Europe remains a vital and evolving segment of the global erectile dysfunction market.

Japan Erectile Dysfunction Market

Japan’s erectile dysfunction market is estimated to reach USD 209 million in 2025. This market value reflects the country’s aging demographic, with a significant portion of the male population aged 50 and above—a group particularly vulnerable to age-related sexual health issues. Cultural acceptance of prescription medications and the availability of well-established ED drugs such as sildenafil, tadalafil, and vardenafil have contributed to consistent demand across both urban and rural areas. Japan’s advanced healthcare system, high level of medical literacy, and wide accessibility to pharmacies and specialists further support the market’s steady performance. Branded and generic PDE5 inhibitors remain the dominant choice for patients, often prescribed as part of broader treatments for associated conditions like hypertension or diabetes.

With a projected CAGR of 4.7% from 2025 to 2034, the Japanese erectile dysfunction market is expected to grow modestly but steadily. Factors contributing to this growth include ongoing public health initiatives, improved awareness around male sexual wellness, and growing openness among middle-aged and older men to seek professional help for ED. In addition, Japan is beginning to embrace telehealth and e-pharmacy models, which are gradually overcoming traditional privacy concerns and reducing barriers to treatment.

Although innovation in regenerative therapies and device-based interventions is still in the early stages, their potential adoption in the coming years may further expand the market scope. Overall, Japan's ED market is characterized by its clinical maturity, slow but reliable growth, and growing integration of digital healthcare solutions.

Global Erectile Dysfunction Market: Key Takeaways

- Market Value: The global erectile dysfunction market size is expected to reach a value of USD 6.7 billion by 2034 from a base value of USD 3.8 billion in 2025 at a CAGR of 6.4%.

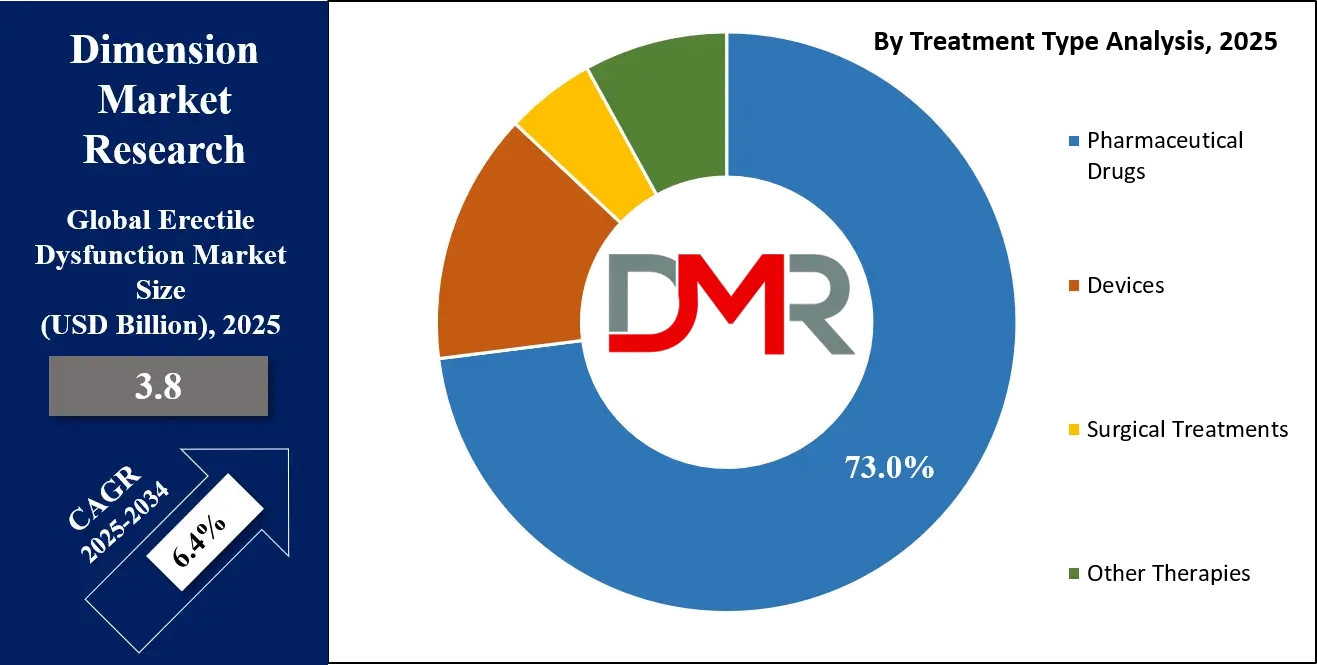

- By Treatment Type Segment Analysis: Pharmaceutical Drugs are anticipated to dominate the treatment type segment, capturing 73.0% of the total market share in 2025.

- By Drug Type Segment Analysis: Sildenafil (Viagra, generics) drugs are expected to maintain their dominance in the drug type segment, capturing 42.0% of the total market share in 2025.

- By Mode of Administration Segment Analysis: Oral mode is poised to consolidate its dominance in the mode of administration segment, capturing 85.0% of the total market share in 2025.

- By Age Group Segment Analysis: People in the 50–59 years of age group will dominate the age group segment, capturing 32.0% of the market share in 2025.

- By End-User Segment Analysis: Specialty Clinics/Urology Clinics will dominate the end-user segment, capturing 38.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global erectile dysfunction market landscape with 42.0% of total global market revenue in 2025.

- Key Players: Some key players in the global erectile dysfunction market are Pfizer Inc., Eli Lilly and Company, Bayer AG, Viatris Inc., Teva Pharmaceutical Industries Ltd., AbbVie Inc., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Ltd., Zydus Lifesciences Ltd., Dr. Reddy’s Laboratories, Torrent Pharmaceuticals Ltd., Endo International plc, and Others.

Global Erectile Dysfunction Market: Use Cases

- Telemedicine and Online Prescription Platforms Transforming ED Treatment: With the rise of digital healthcare, telemedicine platforms are revolutionizing how erectile dysfunction is diagnosed and treated. Patients can now consult licensed healthcare providers online, receive discreet diagnoses, and obtain prescriptions for PDE5 inhibitors such as sildenafil or tadalafil without visiting a clinic. This has significantly reduced stigma and increased access, particularly for younger and tech-savvy populations who prefer privacy. Platforms like Hims & Hers and Roman Health have capitalized on this trend by offering subscription-based ED treatment kits, virtual follow-ups, and automatic refills, streamlining the entire patient journey. The convenience and anonymity provided by online ED treatment services are driving rapid growth in this segment, especially in urban and developed regions.

- Adoption of Regenerative Therapies for Drug-Resistant Patients: A growing number of men with moderate to severe erectile dysfunction are seeking alternatives to oral medications due to limited efficacy or adverse side effects. This has opened up opportunities for regenerative therapies such as low-intensity extracorporeal shockwave therapy (Li-ESWT), platelet-rich plasma (PRP) injections, and stem cell therapy. These innovative treatments aim to restore natural erectile function by promoting vascular regeneration, collagen formation, and nerve repair. Clinics offering advanced male sexual health services have begun integrating these non-invasive therapies, attracting patients looking for long-term solutions beyond symptom management. As clinical studies continue to validate the safety and efficacy of these procedures, demand is expected to rise across North America, Europe, and Asia-Pacific.

- Pharmaceutical Giants Expanding Generic Drug Portfolios: As patents for blockbuster ED drugs like Viagra (sildenafil) and Cialis (tadalafil) have expired, generic drug manufacturers have seized the opportunity to offer cost-effective alternatives. Leading pharmaceutical companies such as Teva Pharmaceuticals, Lupin, and Dr. Reddy’s Laboratories are actively expanding their generic ED drug portfolios to meet growing demand in emerging markets where affordability is crucial. The availability of high-quality generics has increased access to ED treatment across various demographics and income groups, particularly in countries like India, Brazil, and South Africa. Additionally, national healthcare programs and insurance schemes are beginning to include generics for male sexual dysfunction, thereby expanding market penetration.

- Integrated Men’s Wellness Clinics Offering Holistic Treatment: Modern men’s health clinics are redefining how erectile dysfunction is treated by offering integrated care that addresses both physical and psychological causes. These specialty clinics provide comprehensive services, including hormone testing (testosterone deficiency), lifestyle counseling, cardiovascular assessments, and psychosexual therapy, along with ED medications or device-based interventions. By treating ED as a multifactorial health condition rather than a standalone issue, these centers improve patient outcomes and satisfaction. Clinics like Boston Medical Group and similar regional facilities have adopted this holistic model, catering to middle-aged and older men experiencing age-related sexual dysfunction. This model is particularly effective in urban markets where demand for preventive and personalized healthcare is rising.

Impact of Artificial Intelligence on the Erectile Dysfunction Market

Artificial Intelligence (AI) is transforming the landscape of the erectile dysfunction (ED) market by enhancing diagnostics, treatment personalization, and patient engagement. One of the most significant contributions of AI lies in early detection and risk assessment through predictive analytics. By analyzing large datasets related to medical history, lifestyle habits, psychological patterns, and genetic predispositions, AI-powered platforms can identify individuals at higher risk for developing ED.

This allows healthcare professionals to implement preventive measures and personalized interventions well before symptoms escalate. AI-based diagnostic tools, including wearable devices and smart health trackers, also enable real-time monitoring of key health indicators such as blood pressure, heart rate, and hormone levels, which are closely linked to male sexual performance.

In treatment and care delivery, AI algorithms are revolutionizing how patients receive ED therapies. AI is used in telehealth platforms to power virtual chatbots that guide patients through symptom checkers, suggest appropriate treatment options, and automate prescription fulfillment based on patient data. This not only increases accessibility but also ensures data-driven precision in drug selection and dosage. Furthermore, AI is playing a role in research and development by accelerating the discovery of new erectile dysfunction drugs through molecular modeling and clinical trial optimization.

Additionally, AI-driven mental health tools are supporting the psychological aspects of ED by offering cognitive behavioral therapy modules and mood tracking, helping address conditions like performance anxiety and depression that contribute to sexual dysfunction. Overall, AI is pushing the ED market toward a more proactive, personalized, and integrated healthcare model.

Global Erectile Dysfunction Market: Stats & Facts

World Health Organization (WHO)

- Over 150 million men were affected by erectile dysfunction in 1995, with projections rising to 320 million by 2025.

- Erectile dysfunction affects approximately 15% of men globally each year.

- An estimated 322 million men worldwide are expected to experience ED by 2025.

- Around 50% of men over age 50 are affected by erectile dysfunction, increasing to 86% in men over age 80.

- ED is most commonly caused by vascular abnormalities in the penile tissues, often linked with cardiovascular disease risk factors.

National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK – U.S.)

- Between 30 million and 50 million men in the United States are affected by ED.

- Approximately 40% of men at age 40 and up to 70% of men by age 70 experience some form of erectile dysfunction.

Centers for Disease Control and Prevention (CDC – U.S.)

- Up to 30 million men in the U.S., mostly middle-aged and older, have erectile dysfunction.

- Among men with Crohn’s disease or ulcerative colitis, 94% reported ED and 39% experienced overall sexual dysfunction.

- 58.5% of overweight men in the U.S. expressed interest in personal health coaching on male-centered issues, including ED.

WHO Eastern Mediterranean Regional Office (EMRO)

- The global prevalence of erectile dysfunction is approximately 56.9%, with 32.7% being mild and 2.3% being severe.

- Smoking increases the risk of erectile dysfunction by approximately threefold (Odds Ratio ≈ 3.1).

- The likelihood of ED increases significantly with each advancing decade of a man’s life.

U.S. National Library of Medicine / National Institutes of Health (NCBI)

- The prevalence of ED in U.S. men using IIEF‑5 criteria was measured at 24.2%.

- By age group: 52.2% of men aged 75+, 48.0% (65–74), 33.9% (55–64), 25.3% (45–54), 13.3% (25–34), and 17.9% (18–24) experience ED.

- ED diagnosis or treatment prevalence in U.S. males: 0.4% (18–29), 2.1% (30–39), 5.7% (40–49), 10.0% (50–59), 11.5% (60–69), 11.0% (70–79), 4.6% (80–89), and 0.9% (90+).

- 75.16% of coronary artery disease patients were found to have ED compared to 60.8% of non-CAD individuals.

Psychosocial and Comorbidity Studies (Government-backed or NIH-supported)

- Erectile dysfunction is a significant early marker for conditions like cardiovascular disease, diabetes, hyperlipidemia, and hypertension.

- Approximately 10% of erectile dysfunction cases are primarily linked to psychological causes such as depression, anxiety, or relationship problems.

- In patients with diabetes-related ED, psychological distress contributes significantly to social withdrawal and reduced quality of life.

Global Erectile Dysfunction Market: Market Dynamics

Global Erectile Dysfunction Market: Driving Factors

Increasing Prevalence of Lifestyle-Related Disorders

The rising incidence of chronic lifestyle diseases such as diabetes, hypertension, obesity, and cardiovascular disorders is a primary driver of erectile dysfunction globally. These health issues impair blood flow, hormonal balance, and nerve function, critical elements of male sexual performance. As sedentary lifestyles, poor diets, and high-stress levels become more widespread, the number of men experiencing sexual performance issues continues to grow, boosting the demand for effective ED treatments, including PDE5 inhibitors, hormone therapy, and non-invasive interventions.

Growing Acceptance of Male Sexual Health Treatment

Social stigma around sexual dysfunction is gradually declining, particularly in urban populations and among younger men. Increased public awareness through health campaigns, celebrity endorsements, and educational content has led to more men seeking medical advice for ED. This shift in perception, along with improved access to healthcare and insurance coverage for sexual health consultations and medications, is expanding the patient base for ED therapeutics, diagnostics, and wellness solutions.

Global Erectile Dysfunction Market: Restraints

Adverse Effects and Contraindications of ED Medications

Despite their popularity, first-line treatments such as sildenafil and tadalafil are associated with side effects like headaches, dizziness, vision disturbances, and cardiovascular risks. Men with underlying heart conditions or those taking nitrates are often advised against using these drugs, limiting the eligible patient population. This safety profile concern restricts the universal adoption of pharmacological solutions and highlights the need for alternative or more tolerable treatments.

High Cost of Advanced Therapies and Limited Insurance Coverage

While traditional oral medications have become more affordable due to generic availability, newer regenerative therapies such as stem cell injections, PRP therapy, and shockwave treatment remain expensive and are rarely covered by insurance. These high out-of-pocket costs limit accessibility, especially in developing economies. Moreover, the lack of standardized treatment protocols and clinical validation for alternative therapies further hampers their mainstream adoption.

Global Erectile Dysfunction Market: Opportunities

Expansion of Direct-to-Consumer (DTC) Telehealth Platforms

The emergence of digital health solutions is unlocking significant growth potential in the ED market. Direct-to-consumer platforms like Hims, Roman, and Lemonaid offer discreet access to consultations, prescriptions, and delivery of ED medications without the need for in-person visits. These platforms are especially appealing to younger men and those living in remote areas. With the integration of AI-powered diagnostics and user-friendly mobile apps, telehealth services are expected to reshape how ED care is delivered globally.

Innovation in Non-Pharmacological and Regenerative Therapies

There is growing interest in drug-free ED treatments that promote long-term sexual wellness. Regenerative medicine, particularly low-intensity extracorporeal shockwave therapy (Li-ESWT), stem cell therapy, and PRP injections, is gaining attention for its ability to restore natural erectile function by regenerating blood vessels and tissues. Continued investment in clinical research and the development of minimally invasive devices are creating new revenue streams and positioning these therapies as viable alternatives to traditional medications.

Global Erectile Dysfunction Market: Trends

Holistic and Integrated Men’s Health Clinics

An emerging trend in the ED market is the rise of comprehensive men’s wellness clinics that treat erectile dysfunction as part of a broader health issue. These centers offer combined services including testosterone replacement therapy, cardiovascular screening, mental health counseling, and lifestyle coaching. This holistic model is resonating with middle-aged and older men seeking not just symptom relief but long-term vitality and well-being.

Personalized Medicine and AI-Driven Treatment Plans

The integration of artificial intelligence and machine learning is ushering in a new era of personalized medicine in the ED market. By leveraging patient data, ranging from genetic profiles to lifestyle habits, AI algorithms can recommend customized treatment plans with optimal drug selection, dosage, and delivery methods. This individualized approach enhances treatment efficacy, reduces side effects, and improves patient adherence, signaling a major shift in how ED is managed.

Global Erectile Dysfunction Market: Research Scope and Analysis

By Treatment Type Analysis

Pharmaceutical drugs are expected to remain the dominant force within the treatment type segment of the erectile dysfunction market, accounting for an estimated 73.0% of the total market share in 2025. This dominance is primarily due to the widespread use and proven efficacy of oral PDE5 inhibitors such as sildenafil, tadalafil, and vardenafil, which continue to be the first-line treatment for most patients. These medications are not only easily accessible through both retail and online pharmacies but also have the advantage of rapid onset and non-invasive administration.

The availability of generic versions has further fueled market penetration by making these treatments more affordable across different demographics and regions. In addition, ongoing innovations in formulation, such as orodispersible tablets and extended-release variants, are enhancing patient compliance and expanding the pharmaceutical segment’s reach.

In contrast, the devices segment, although smaller, plays a crucial role in catering to patients who are either unresponsive to drug therapy or prefer non-pharmaceutical alternatives. This includes vacuum erection devices (VEDs), penile constriction rings, and penile implants. VEDs, in particular, are gaining traction due to their non-invasive nature and minimal side effects, offering a practical solution for men with underlying health conditions that restrict the use of oral drugs.

Penile implants, including inflatable and malleable types, are typically considered in severe or refractory cases and offer a permanent solution for restoring erectile function. While these devices require more clinical intervention and sometimes surgical procedures, they provide high satisfaction rates among select patient groups. As awareness of alternative ED therapies increases and technological advancements improve usability, the devices segment is projected to witness steady growth, particularly in specialty urology clinics and men’s health centers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Drug Type Analysis

Sildenafil, marketed under the brand name Viagra and available widely as generics, is projected to retain its leading position in the drug type segment of the erectile dysfunction market, commanding around 42.0% of the total market share in 2025. This continued dominance can be attributed to its long-standing presence in the market, high physician preference, strong brand recall, and well-documented clinical efficacy. Sildenafil’s relatively fast onset of action, widespread availability, and affordability due to the introduction of generics have made it the go-to treatment for millions of men suffering from ED globally.

The drug’s effectiveness in enhancing blood flow to the penile region by inhibiting phosphodiesterase type 5 (PDE5) has been extensively validated in clinical trials, which has contributed to strong patient confidence and repeat usage. Additionally, the drug is available through various channels, including telehealth platforms, online pharmacies, and traditional brick-and-mortar stores, boosting accessibility across both developed and emerging markets.

Tadalafil, sold under the brand name Cialis and in multiple generic formulations, represents another significant component of the erectile dysfunction drug market. While it holds a slightly smaller market share than sildenafil, it is highly valued for its longer duration of action, lasting up to 36 hours, which offers greater spontaneity for sexual activity. This extended window of efficacy has made tadalafil a preferred option among patients and healthcare providers seeking more flexibility in treatment.

Tadalafil is also prescribed for other urological conditions such as benign prostatic hyperplasia (BPH), making it a versatile medication within men’s health. Despite facing competition from other PDE5 inhibitors, tadalafil maintains a strong market presence due to its dual therapeutic benefits and once-daily low-dose formulation that supports continuous treatment. As patient awareness of its unique advantages increases and cost barriers decrease with the entry of generics, the drug is expected to experience steady demand growth within the erectile dysfunction treatment landscape.

By Mode of Administration Analysis

The oral mode of administration is expected to firmly consolidate its dominance in the erectile dysfunction market, capturing approximately 85.0% of the total market share in 2025. This overwhelming preference for oral medications is driven by their ease of use, non-invasive nature, and rapid onset of action. Drugs like sildenafil, tadalafil, and vardenafil are widely prescribed in tablet form, offering convenience and discretion that align well with patient preferences. The availability of generics has further reduced costs, growing accessibility across a broader demographic.

Oral therapies also offer flexible dosing options, ranging from on-demand usage to daily low-dose regimens, catering to different lifestyle and clinical needs. Moreover, the growing presence of online telemedicine platforms and e-pharmacies has made it even easier for patients to obtain these medications confidentially, further boosting demand for orally administered treatments.

Injectable treatments, while representing a much smaller share of the market, continue to serve a critical role for patients who do not respond adequately to oral PDE5 inhibitors. These therapies typically involve intracavernosal injections of vasodilators like alprostadil, which directly stimulate blood flow to the penis and produce reliable erections regardless of underlying systemic conditions. Although effective, injectable treatments require more patient involvement, including instruction on proper injection techniques and dosage management, which can be a deterrent for some.

However, for men with severe erectile dysfunction, particularly those with nerve damage or advanced diabetes, injectables often offer the most consistent results. As clinical understanding improves and newer delivery methods are developed to minimize discomfort, this segment is expected to maintain a stable, niche presence within urology practices and specialty clinics.

By Age Group Analysis

Individuals in the 50–59 years age group are anticipated to dominate the age group segment of the erectile dysfunction market, accounting for 32.0% of the total market share in 2025. This dominance is primarily due to the natural onset of age-related health conditions during this period, such as hypertension, type 2 diabetes, and hormonal imbalances, which significantly contribute to the development of erectile dysfunction.

Men in this age bracket are also more likely to seek medical help as they often experience a decline in sexual function that affects their overall quality of life. With increased awareness of male sexual health and better access to medical consultation and treatment options, this group represents the most actively engaged demographic in both pharmaceutical and alternative therapies. The high rate of health checkups, combined with a willingness to explore treatment, makes this age group a central focus for ED drug manufacturers and digital health providers.

Following closely behind, the 60–69 years age group also forms a significant portion of the erectile dysfunction market. While slightly older, men in this age range are living healthier, longer lives and are more proactive about maintaining their sexual wellness. Erectile dysfunction in this group is often linked to long-term vascular or neurological conditions and may require more comprehensive management strategies, including combination therapies or device-based treatments.

Despite a slightly lower percentage than the 50–59 cohort, this segment remains highly important due to the rising life expectancy and growing emphasis on quality of life in later years. As personalized treatment plans and regenerative medicine options become more mainstream, the 60–69 age group is expected to show stable and growing demand for both conventional and advanced ED therapies.

By End-User Analysis

Specialty clinics and urology clinics are projected to dominate the end-user segment of the erectile dysfunction market, capturing approximately 38.0% of the total market share in 2025. These clinics offer targeted and specialized care tailored specifically to male sexual health, making them the preferred destination for patients seeking focused treatment for erectile dysfunction.

They typically provide a comprehensive range of services, including diagnostic evaluations, hormone testing, psychosexual counseling, and access to both pharmacological and non-pharmacological therapies such as shockwave therapy and PRP treatments. The personalized nature of care in these facilities, combined with shorter wait times and enhanced patient confidentiality, contributes to their growing popularity. Furthermore, these clinics are equipped with advanced technologies and staffed by urologists and men’s health specialists, making them well-suited to address complex or refractory cases of ED, thereby solidifying their leadership in this segment.

Hospitals, while slightly behind specialty clinics in market share, remain a crucial part of the erectile dysfunction treatment ecosystem. They are particularly important for managing ED cases linked to more severe or systemic health conditions such as prostate cancer, cardiovascular disease, or neurological disorders. Hospitals often serve as the first point of contact for many patients, especially those undergoing treatment for other chronic illnesses, and are equipped to perform more advanced procedures like penile implants or vascular surgeries when required.

Additionally, their integration of multidisciplinary teams allows for holistic care that can address both the physiological and psychological aspects of ED. While hospitals may not offer the same level of specialization as standalone urology clinics, their broader infrastructure and ability to handle complex medical cases ensure their continued relevance and stable presence in the market.

The Erectile Dysfunction Market Report is segmented on the basis of the following:

By Treatment Type

- Pharmaceutical Drugs

- Devices

- Surgical Treatments

- Other Therapies

By Drug Type

- Sildenafil (Viagra, generics)

- Tadalafil (Cialis, generics)

- Vardenafil (Levitra, Staxyn)

- Avanafil (Stendra)

- Others

By Mode of Administration

- Oral

- Injectable

- Topical

- Transurethral

By Age Group

- 40-49 years

- 50-59 years

- 60-69 years

- 70+ years

By End-User

- Specialty Clinics/Urology Clinics

- Hospitals

- Online Pharmacies

- Retail Pharmacies

Global Erectile Dysfunction Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global erectile dysfunction market in 2025, capturing approximately 42.0% of the total market revenue. This dominance is driven by a combination of high prevalence of lifestyle-related disorders such as diabetes, obesity, and cardiovascular conditions, along with a well-established healthcare infrastructure and strong awareness around male sexual health.

The region benefits from early adoption of advanced treatment options, widespread availability of branded and generic PDE5 inhibitors, and a rapidly growing telehealth ecosystem that enables discreet and accessible care. Additionally, the presence of key pharmaceutical players and continuous investment in research and innovation further reinforce North America’s leadership position in the global erectile dysfunction market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is projected to witness significant growth in the erectile dysfunction market over the coming years, driven by rising awareness of male sexual health, growing healthcare expenditure, and a rapidly aging population. Countries like China, India, Japan, and South Korea are experiencing a surge in ED cases due to changing lifestyles, higher stress levels, and the growing prevalence of chronic conditions such as diabetes and hypertension.

The expansion of digital health platforms and improved access to generic medications are making treatments more accessible and affordable across urban and semi-urban areas. Additionally, cultural shifts toward open discussions about sexual wellness and government-led health initiatives are creating a more supportive environment for early diagnosis and treatment, positioning Asia-Pacific as a key growth engine in the global erectile dysfunction market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Erectile Dysfunction Market: Competitive Landscape

The global competitive landscape of the erectile dysfunction market is characterized by the strong presence of both multinational pharmaceutical giants and emerging regional players competing across drug innovation, affordability, and treatment accessibility. Industry leaders such as Pfizer, Eli Lilly, and Bayer continue to dominate through their flagship PDE5 inhibitors, Viagra, Cialis, and Levitra, while companies like Teva, Viatris, and Aurobindo have expanded market reach through cost-effective generic versions. Increasing competition is also seen from telehealth-driven direct-to-consumer brands such as Hims & Hers and Roman, which are reshaping distribution channels by offering discreet, online-based ED treatment.

Additionally, companies are investing in next-generation therapies, including regenerative medicine, injectable alternatives, and wearable technologies, aiming to capture unmet needs among patients unresponsive to traditional oral drugs. Strategic collaborations, patent expirations, regional market penetration, and the development of personalized treatment platforms continue to intensify competition and innovation within this evolving therapeutic segment.

Some of the prominent players in the global erectile dysfunction market are:

- Pfizer Inc.

- Eli Lilly and Company

- Bayer AG

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- AbbVie Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Lupin Ltd.

- Zydus Lifesciences Ltd.

- Dr. Reddy’s Laboratories

- Torrent Pharmaceuticals Ltd.

- Endo International plc

- Vivus LLC

- Metuchen Pharmaceuticals

- Sandoz (a Novartis division)

- GlaxoSmithKline plc (GSK)

- SK Chemicals

- Hims & Hers Health, Inc.

- Other Key Players

Global Erectile Dysfunction Market: Recent Developments

- June 2025: Navamedic ASA launched Eroxon gel in Denmark as the fourth Nordic rollout after Norway, Sweden, and Finland. This over-the-counter topical ED treatment delivers an erection within ten minutes and features minimal systemic absorption.

- June 2025: Grünenthal acquired commercial rights to Cialis® from Eli Lilly in Mexico, Brazil, and Colombia, including manufacturing transfer to Chile, bolstering its male health portfolio in the Latin American market.

- June 2025: Hims & Hers raised USD 1 billion through convertible senior notes maturing in 2030, aimed at expanding its telehealth infrastructure and men’s wellness offerings, including erectile dysfunction treatment subscriptions.

- June 2025: GoodRx launched a subscription-based ED service featuring virtual consultations, access to FDA-approved medications, and discreet home delivery, with the goal of improving affordability and eliminating treatment barriers for underserved male populations.

- May 2025: Grindr introduced Woodwork, a telehealth service tailored to the LGBTQ community, providing access to compounded oral ED medications like sildenafil and tadalafil via licensed clinicians. The service initially launched in Illinois and Pennsylvania, with plans for broader expansion across the U.S.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.8 Bn |

| Forecast Value (2034) |

USD 6.7 Bn |

| CAGR (2025–2034) |

6.4% |

| The US Market Size (2025) |

USD 1.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Treatment Type (Pharmaceutical Drugs, Devices, Surgical Treatments, Other Therapies), By Drug Type (Sildenafil, Tadalafil, Vardenafil, Avanafil, Others), By Mode of Administration (Oral, Injectable, Topical, Transurethral), By Age Group (40–49 years, 50–59 years, 60–69 years, 70+ years), and By End-User (Specialty Clinics/Urology Clinics, Hospitals, Online Pharmacies, Retail Pharmacies)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Pfizer Inc., Eli Lilly and Company, Bayer AG, Viatris Inc., Teva Pharmaceutical Industries Ltd., AbbVie Inc., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Ltd., Zydus Lifesciences Ltd., Dr. Reddy’s Laboratories, Torrent Pharmaceuticals Ltd., Endo International plc, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global erectile dysfunction market?

▾ The global erectile dysfunction market size is estimated to have a value of USD 3.8 billion in 2025 and is expected to reach USD 6.7 billion by the end of 2034.

What is the size of the US erectile dysfunction market?

▾ The US erectile dysfunction market is projected to be valued at USD 1.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.3 billion in 2034 at a CAGR of 6.0%.

Which region accounted for the largest global erectile dysfunction market?

▾ North America is expected to have the largest market share in the global erectile dysfunction market, with a share of about 42.0% in 2025.

Who are the key players in the global erectile dysfunction market?

▾ Some of the major key players in the global erectile dysfunction market are Pfizer Inc., Eli Lilly and Company, Bayer AG, Viatris Inc., Teva Pharmaceutical Industries Ltd., AbbVie Inc., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Ltd., Zydus Lifesciences Ltd., Dr. Reddy’s Laboratories, Torrent Pharmaceuticals Ltd., Endo International plc, and Others.

What is the growth rate of the global erectile dysfunction market?

▾ The market is growing at a CAGR of 6.4 percent over the forecasted period.