Market Overview

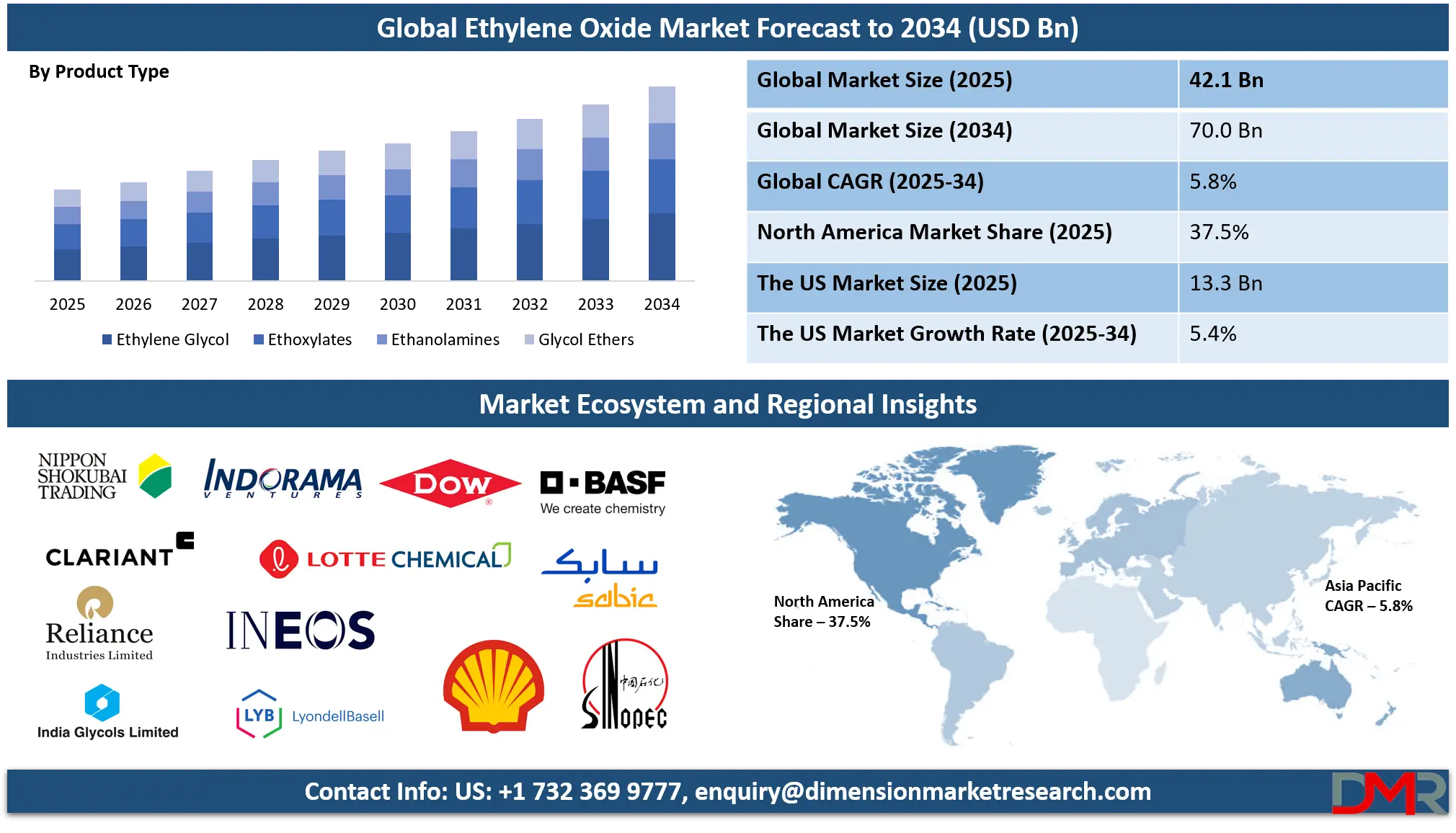

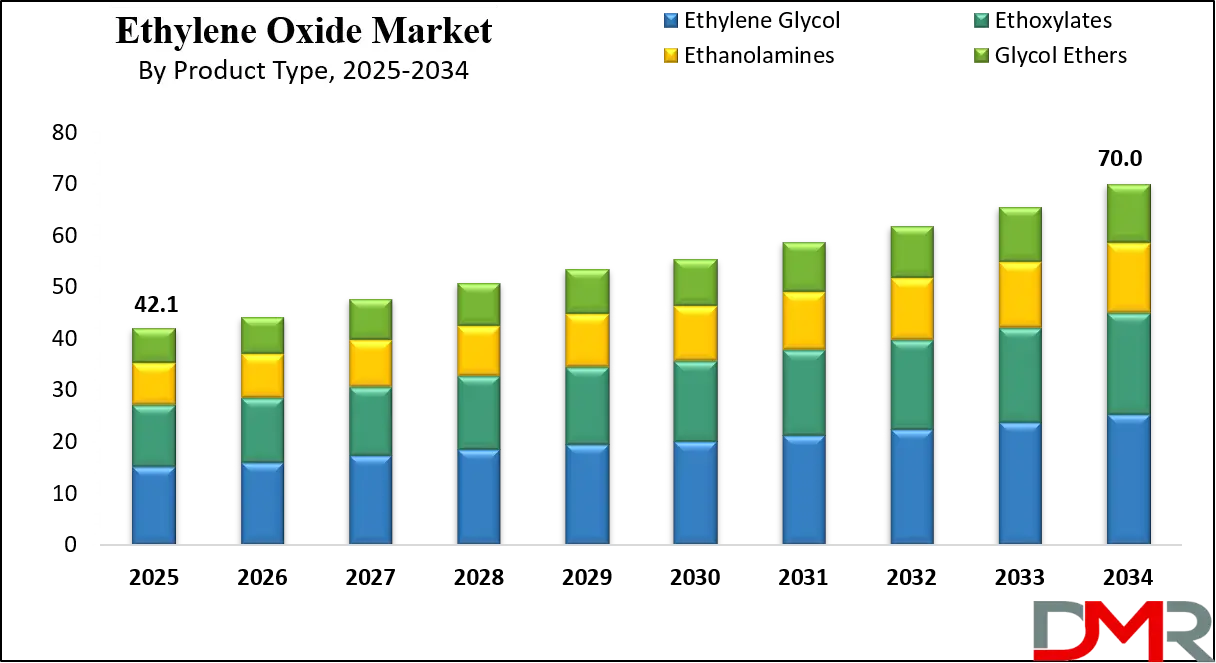

The Global Ethylene Oxide Market size is projected to reach USD 42.1 billion in 2025 and grow at a compound annual growth rate of 5.8% from there until 2034 to reach a value of USD 70.0 billion.

The global ethylene oxide market maintains stable growth rates because this chemical substance serves as the core ingredient to make ethylene glycol and surfactants and ethanolamines, and glycol ethers. The manufacturing industry requires these derivatives as essential raw materials to operate across automotive production, alongside textiles manufacturing and healthcare operations, and construction development. The market demonstrates growth because of industrial development, together with urbanization and mounting consumer demand, particularly across the Asia-Pacific regions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The ethylene oxide market demonstrates an important trend of advancing sustainable production alongside bio-based derivatives since environmental regulations and global green chemistry initiatives continue their strong momentum. The competitive environment shifts because companies deploy innovative production methods that cut emissions, along with enhancing energy efficiency.

The pharmaceutical sector is expanding rapidly thus creating an opportunity for ethylene oxide use as a sterilizing agent for delicate medical instruments. The expanding e-commerce market drives higher PET packaging demand that triggers increased usage of ethylene oxide through its product derivatives.

The industry requires attention due to significant market restrictions which exist. The toxic properties of ethylene oxide influence the adoption of extensive regulatory measures throughout Europe and North America due to health hazards and environmental issues. Market uncertainties stem from unstable feedstock costs and the necessity to use petrochemical raw materials.

The market indicates bright growth opportunities, especially in emerging economies, because industrial growth and infrastructure expansion continue at a fast pace. The global ethylene oxide market will continue its path of advancement due to the combined factors of rising product demand throughout various end-use sectors and a growing adoption of alternative clean technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

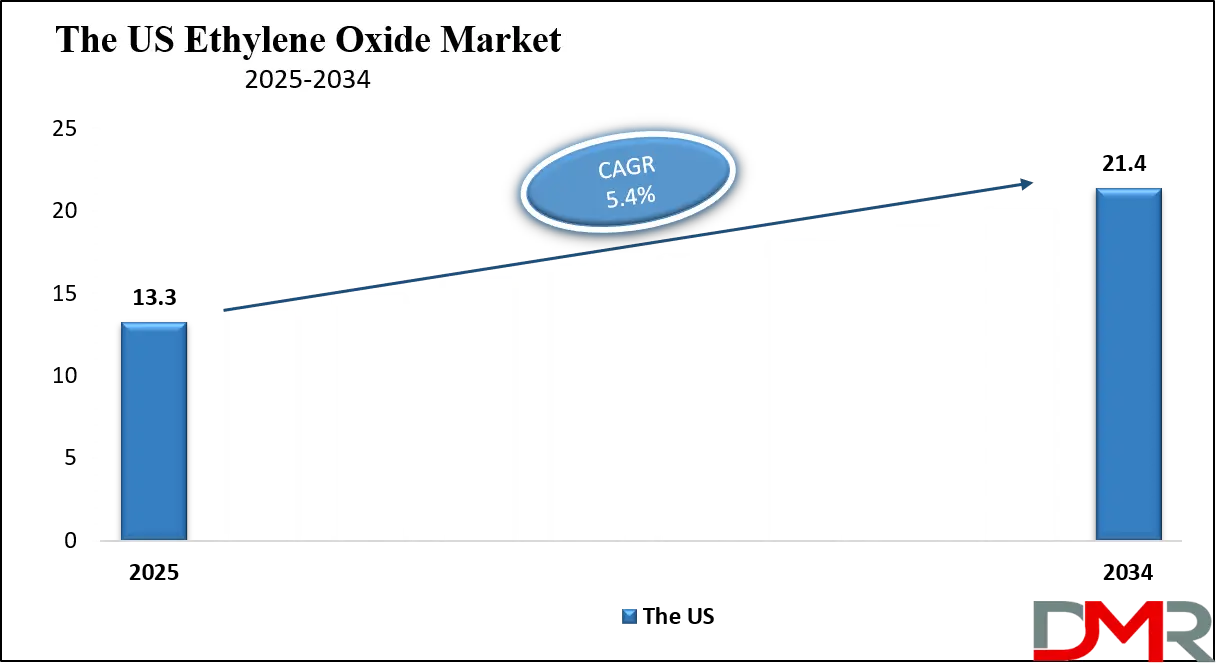

The US Ethylene Oxide Market

The US ethylene oxide market is expected to be valued at USD 13.3 billion in 2025 and expand at a CAGR of 5.4% through 2034, reaching approximately USD 21.4 billion by the end of the forecast period.

The U.S. ethylene oxide market experiences high industry demand because healthcare institutions and automotive manufacturers, together with manufacturers of consumer products, create sustained market dynamics. The market flourishes through an established chemical production sector alongside strong research capabilities and strict regulations. Medical equipment sterilization through ethylene oxide represents a critical requirement for hospitals, clinics, and device manufacturers because the health sector requirements are rising alongside population aging trends.

The United States has a high population of aging citizens, which increases surgical requirements, together with requirements for sterile medical equipment. Ethylene oxide sterilization stands as an essential technique for medical equipment that is not compatible with hot steam sterilization in outpatient and surgical facilities.

The antifreeze and coolant formulations containing ethylene glycol work to achieve engine reliability in vehicles that function during various weather conditions. The production of surfactants through ethylene oxide serves the personal care and cleaning product sectors because of growing market demand for hygiene-focused and skincare products.

The country's shale gas boom provides security to the market regarding ethylene feedstock supply that supports ongoing processing operations. However, regulatory pressure is intensifying. Stricter guidelines emerged because of occupational risks and community contamination concerns, thus leading facilities to implement new emission reduction technologies.

The U.S. maintains its position as both the production and consumption leader of petrochemicals through its advantageous population statistics, along with superior industrial systems and chemical innovation capability, which supports continuous sector demand.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Ethylene Oxide Market

By 2025, the European ethylene oxide market is forecasted to reach USD 7.41 billion and is poised to increase at a CAGR of 4.4% over the following nine years, achieving a valuation of USD 10.92 billion by 2034.

European ethylene oxide market operations are guided by market innovation, together with sustainability principles and rigorous government standards. The European chemical industry mobilizes capital into green technological advancements and sustainable manufacturing processes to achieve area-wide environmental goals. Because of its central role in producing essential chemicals, including surfactants, along with ethanolamines and glycol ethers, the European market depends on ethylene oxide to serve the pharmaceutical, cleaning product, and personal care industries.

The major benefit of Europe's population trends and healthcare system structure presents itself through its aging population combined with universal healthcare, especially in Western Europe. Growing medical supplies requirements drive up the market for ethylene oxide as a leading sterilization method because it shows successful outcomes with temperature-sensitive medical equipment.

The consumer market in Europe creates powerful demand for cosmetics and hygiene products that leads to the application of ethylene oxide derivatives in personal care products. The manufacturing sector dedicates effort to introducing low-toxic and biodegradable components, which drives value chain innovation in ethylene oxide products.

Overall environmental standards create obstacles yet stimulate manufacturers to develop pollution-reducing manufacturing systems and increase market interest in environmentally sensitive solutions. Statutory REACH requirements enforce tight regulations concerning chemical usage and emissions, which represent obstacles yet enhance product safety and consumer confidence.

The European market remains competitive for global production because of its strong research and development capabilities and its sustainable consumer base, as well as funding efforts in chemical innovation. The strategic location, together with supporting infrastructure, turns the area into an essential terminal for chemical products moving within regional and global trading networks.

The Japan Ethylene Oxide Market

The Japan ethylene oxide market is projected to set to grow from USD 2.53 billion in 2025 to USD 3.66 billion by 2034, driven by a compound annual growth rate of 4.2%.

Polyethylene oxide manufacturing in Japan functions through a structure that emphasizes exact production and high-quality standards as well as specific end-use products. The nation depends on imported feedstock while achieving strict production standards for ethylene oxide derivative products because it has limited domestic fossil fuel resources. The country requires these compounds as fundamental substances to create products which advance surfactants and solvents, while sterilizing agents for leading industrial needs.

Japan stands as one of the nations with the most elderly people within its population, which increases both medical service needs and demand for modern healthcare products. Complex medical equipment used for outpatient surgeries and surgical instruments requires ethylene oxide treatment to achieve sterilization, since they negate heat sterilization methods. Japan’s technological healthcare systems require the extensive use of medical equipment that needs sterilization procedures.

Consumer preferences in Japan also support growth in the personal care and cosmetics sectors. Japanese skincare products utilize ethylene oxide derivatives as emulsifiers, stabilizers, and thickeners due to their status as innovative, high-quality products in the market. Companies receive positive market reception from safety and environmental initiatives, which drives them to choose low-emission production techniques and create alternative bio-based products.

Japanese market constraints exist as a result of high energy costs coupled with stringent environmental regulations and import-based business operations. Japan makes up for its supply constraints by maintaining excellence in manufacturing, together with a commitment to sustainable operations.

Japan maintains its market competitiveness through strategic alliances with local partners in Southeast Asia as well as continuous investments that support research and development initiatives. Japan provides reliable ethylene oxide access through its highly trained personnel combined with advanced technology development, which serves the worldwide supply chain, particularly for premium-grade applications.

Global Ethylene Oxide Market: Key Takeaways

- Global Market Size Insights: The Global Ethylene Oxide Market size is estimated to have a value of USD 42.1 billion in 2025 and is expected to reach USD 70.0 billion by the end of 2034.

- The US Market Size Insights: The US Ethylene Oxide Market is projected to be valued at USD 13.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 21.4 billion in 2034 at a CAGR of 5.4%.

- Regional Insights: North America is expected to have the largest market share in the Global Ethylene Oxide Market with a share of about 37.5% in 2025.

- Key Players: Some of the major key players in the Global Ethylene Oxide Market are BASF SE, SABIC, Dow, Shell plc, Sinopec, INEOS, LyondellBasell, India Glycols, Indorama Ventures, Reliance Industries, LOTTE Chemical, and many others.

- The Global Growth Rate Insights: The market is growing at a CAGR of 5.8% over the forecasted period of 2025.

Global Ethylene Oxide Market: Use Cases

- Medical Equipment Sterilization: The complex medical devices, including catheters and endoscopes, and surgical tools, can be sterilized with ethylene oxide for widespread clinical and hospital use, especially in regions that prioritize healthcare advances.

- Automotive Coolants Production: Ethylene glycol serves as the essential starting material to produce automotive antifreeze and engine coolants because it maintains consistent engine temperatures that protect vehicles from extreme temperatures.

- Textile Processing: The production of textile surfactants alongside ethanolamines, which originate from ethylene oxide, results in enhanced fabric finishing capabilities for scouring and dyeing applications that deliver better softness combined with superior color retention and extended product lifetime for diverse fabrics.

- Personal Care Formulations: The cosmetic industry uses polyethylene glycols together with ethoxylates as stabilizers, along with emulsifiers to provide better texture characteristics and absorption properties, and consistency adjustments in cosmetics and shampoos, and lotions.

- Food Packaging: The petroleum-based substance PET functions as a raw material to produce transparent beverage bottles and food packaging materials suitable for retail and worldwide delivery mechanisms.

Global Ethylene Oxide Market: Stats & Facts

- World Bank (UN Comtrade via WITS) – Global Trade Dynamics (2022)

- Top Exporters of Ethylene Oxide:

- Vietnam: 50,045 kg

- Costa Rica: 22,139 kg

- Japan: 7,158 kg

- Kazakhstan: 84 kg

- Canada: 6,898 kg

- Top Importers of Ethylene Oxide:

- Australia: 113,232 kg

- Chile: 26,468 kg

- Argentina: 74,168 kg

- Pakistan: 108,230 kg

- Canada: 277,658 kg

- U.S. Environmental Protection Agency (EPA) – Production & Emissions

- Production Volumes (United States): In 2015, ethylene oxide production ranged between 5 to 10 billion pounds. As of 2018, 15 processing facilities in the U.S. collectively produced approximately 6.4 billion pounds of ethylene oxide annually.

- Regulatory Update (2024): In April 2024, the EPA finalized new National Emission Standards for Hazardous Air Pollutants (NESHAP) applicable to ethylene oxide sterilization facilities. These require the use of Maximum Achievable Control Technology (MACT) to significantly reduce harmful emissions.

- European Chemicals Agency (ECHA) – Health Classification

- Ethylene oxide is officially classified by the European Union as a Category 1B carcinogen, meaning it is "presumed to have carcinogenic potential for humans" under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations.

- European Industrial Developments – Strategic Investments

- BASF Expansion (Belgium): BASF has committed a €500 million investment for the expansion of its ethylene oxide production complex at the Port of Antwerp. This project will add approximately 400,000 tonnes of new annual production capacity.

- INEOS Oxide Terminal Development: INEOS is developing a 1 million tonne per year deep-sea ethylene terminal at its Zwijndrecht facility in Antwerp. This terminal aims to enhance the availability of feedstock for EO production in Europe.

Global Ethylene Oxide Market: Market Dynamics

Driving Factors in the Global Ethylene Oxide Market

Rising Demand for Ethylene Glycol in Automotive and Packaging SectorsThe automotive industry, together with packaging applications, drives the high demand for the steam-recoverable substance ethylene glycol, which is derived from ethylene oxide. Engine coolants and antifreeze production require ethylene oxide as a main component to ensure proper vehicle engine performance under different temperature ranges. The ongoing rise of global vehicles, including electric vehicles (EVs), in developing economies drives up ethylene glycol market consumption levels. Additionally, the growing electric vehicle production and adoption further boost demand, as ethylene glycol is increasingly used in thermal management systems for electric vehicles EV batteries to maintain optimal operating temperatures and enhance performance.

The rising popularity of e-commerce and convenience-based consumer lifestyles drives increased need for PET-based packaging that requires ethylene glycol as its manufacturing ingredient. The sharp transformation of consumer buying patterns due to digital retailing and urbanization strongly affects consumption habits in the Asia-Pacific. The massive-scale end-market applications maintain steady increases in the basic requirement for ethylene oxide raw materials. The long-term growth of PET recycling combined with advances in coolant technology creates sustained opportunities for ethylene oxide throughout the value chain.

Expansion of Global Healthcare Infrastructure and Medical Sterilization Needs

Healthcare-based institutions across the globe continue to increase their presence at a rapid rate, thanks to the dual factors of expanding hospital facilities and aging demographics, and escalating healthcare spending. The medical sterilization agent ethylene oxide serves as an essential sanitary process for heat-sensitive surgical equipment that includes catheters, endoscopes, and implantable devices.

The gold standard sterility solution for sophisticated materials, the elimination of diverse pathogens, has established Ethylene Oxide as both developing and emerging markets' preferred sterilization option. Medical device usage expansion worldwide, together with outpatient surgical procedures and home healthcare, drives the necessity for effective sterilization techniques.

The expansion of healthcare infrastructure throughout India as well as Brazil, and Southeast Asia represents particularly noteworthy growth because it leads to rising medical needs in these regions. Medical practices, along with strict regulatory needs in developed market areas, maintain constant product demand. The market for ethylene oxide experiences robust expansion because of these combined industry trends.

Restraints in the Global Ethylene Oxide Market

Stringent Regulatory Environment and Health Concerns

Environmental regulations and health standards for occupational safety continue to represent the primary limitation that slows down the expansion of the ethylene oxide market. The category of carcinogen applies to ethylene oxide while presenting considerable risks through breathing it and contact, especially in production areas and sterilization centers. The U.S. EPA and OSHA, together with the European Chemicals Agency, enforce firm rules for both workplace exposure thresholds and plant emissions systems.

Some regions have encountered community support together with legal tactics that triggered the end or restricted the use of ethylene oxide facilities. The cost of production rises because companies must fulfill regulatory requirements through investments in emission control systems, as well as continuous monitoring devices and worker protection systems.

The resistance of local communities living near industrial zones creates severe problems for both licensing authorizations and factory development strategies. The industry growth in developed countries faces constraints because of these different factors, which create a barrier to new investments.

Volatility in Feedstock Prices and Supply Chain Disruptions

The manufacturing process of Ethylene oxide depends on ethylene as its main raw material, which originates from crude oil and natural gas sources. The global oil and gas markets induce production cost and margin fluctuations because of their market changes. Various feedstock market prices undergo considerable increases when geopolitical tensions unite with natural disasters and energy policy transformations, leading to production delays and feedstock depletion.

Production of petrochemicals faced severe disruption after the Russia-Ukraine conflict, when Europe experienced an energy supply crisis. Limited regional infrastructure creates challenges for feedstocks and finished products transportation when logistical bottlenecks alongside trade restrictions occur.

The price instability, along with supply disruptions, negatively affect both ethylene oxide manufacturers and the entire chain of industries that need reliable ethylene oxide supplies. The fluctuating prices cause problems for strategic business planning and compel companies to explore different sourcing methods or postpone facility expansion plans, thus slowing market expansion.

Opportunities in the Global Ethylene Oxide Market

Penetration into Emerging Economies with Expanding Industrialization

Businesses can generate the highest commercial prospects in the ethylene oxide industry from developing markets. The rapid industrialization, together with urbanization and increased disposable income in nations including India, Indonesia, Nigeria, and Vietnam, creates fresh consumption possibilities in various end-use industries. A modern surge in textile and automotive production, along with household cleaning products and personal care products market results from the increasing requirement of ethylene oxide-derived chemicals.

Governments across these regions use their financial resources to build infrastructure development alongside manufacturing capabilities, which establishes ideal conditions for establishing new production sites along with joint venture opportunities. These economies possess minimal regulatory requirements, which makes it possible to establish new production facilities rapidly.

Global supply chains are expanding globally, and companies aim to decrease their reliance on conventional production centers, thus making emerging economies attractive locations for direct investment in ethylene oxide manufacturing and derivative chemicals. The permanent expansion of markets, coupled with a demand-supply balance, will be achieved through these measures.

Development of Safer and Energy-Efficient Production Technologies

Ethylene oxide manufacturing operations have historically needed substantial energy input because the very reactive, toxic properties of the substance create production safety challenges. Contemporary technological innovations allow experts to establish safer, more efficient catalytic methods alongside advanced reactor systems. The emphasis on process intensification involves company investments toward creating modular reactor structures to lower capital expenses and increase operating flexibility.

The combination of safer operations and lower production expenses from these innovations makes ethylene oxide production possible across wider geographical locations. Carbon capture and utilization technologies from CCU have become integrated into ethylene oxide production sites to fulfill sustainability targets. Several companies dedicate their efforts to compliance requirements while also responding to expanding opportunities in sustainable chemical production. Industrial decarbonization demands force companies select these innovations because they provide both a present operational advantage and long-term protection.

Trends in the Global Ethylene Oxide Market

Transition Toward Bio-Based and Sustainable Ethylene Oxide Derivatives

The global ethylene oxide market undergoes a major transformation because businesses shift toward sustainable bio-based derivative products. The EPA and REACH, together with other regulatory agencies, are implementing strict regulations stemming from elevated concerns about ethylene oxide toxicity along with its environmental effects.

Manufacturers who lead the chemical industry now look into renewable raw materials while following green chemistry approaches for their manufacturing processes. Bio-ethylene oxide made from bioethanol represents a promising solution for the market, especially throughout North America and Europe. Companies make substantial investments to improve the safety, along with cost-effectiveness and yield improvement of these alternative solutions.

Downstream industries that include cosmetics, food packaging, and cleaning products show growing concern for sustainability objectives, which compels suppliers to adopt circular economy principles. Regional industries now experience major shifts in their product innovation strategy as well as long-term competitiveness because of this trend.

Expansion of Ethylene Oxide Applications in High-Purity and Specialty Chemicals

The industrial production of high-purity and specialty chemicals has expanded through the increasing utilization of ethylene oxide. Specialty materials and pharmaceutical compounds, along with electronics, represent key application areas where ethylene oxide usage matters because exact chemical composition and consistent performance matter the most.

Manufacturing technologies in Japan and South Korea continue to advance, so researchers now use ethylene oxide to make precise reactions and formulation processes. A recent industry need to reduce electronic sizes while improving drug delivery systems has established fresh requirements for highly pure ethylene oxide derivatives. The adaptation of process technology optimization by companies sustains demands that produce compact modular ethylene oxide facilities with higher flexibility. The market shows enhanced stability because the industry extends its use beyond pure bulk chemicals applications.

Global Ethylene Oxide Market: Research Scope and Analysis

By Product Type Analysis

Ethylene glycol is projected to dominate the product type as it is anticipated to hold the highest market share in this segment in 2025. Ethylene glycol stands as the main product produced from ethylene oxide because the automotive and packaging sectors extensively utilize this chemical. The marketplace consumes a major portion of worldwide ethylene oxide because manufacturers utilize it to produce both antifreeze formulations and polyethylene terephthalate (PET) material.

PET functions as a main plastic material in beverage bottles and food containers because of quick urban growth combined with rising consumer earnings and society-wide moves to use ready-to-use packaging techniques. The broad range of packaging applications transforms ethylene glycol into a fundamental element for international packaging supply systems.

Manufacturing processes require ethylene glycol for producing engine coolants along with antifreeze products. The expansion of automotive markets, particularly in India, Brazil, and Southeast Asian countries, directly increases product demand for these chemicals. Regular maintenance of vehicle cooling systems in all markets ensures a constant demand for these systems.

The production process of ethylene glycol from ethylene oxide remains cost-effective and creates well-developed supply chains, which makes it the most commercially attractive derivative. The market stability of ethylene glycol derives from both its low volatility and its dependable operational characteristics. Ethylene glycol holds its market domination in the ethylene oxide industry through high use amounts and its applications in vital sectors, while serving customers across both developed and emerging markets.

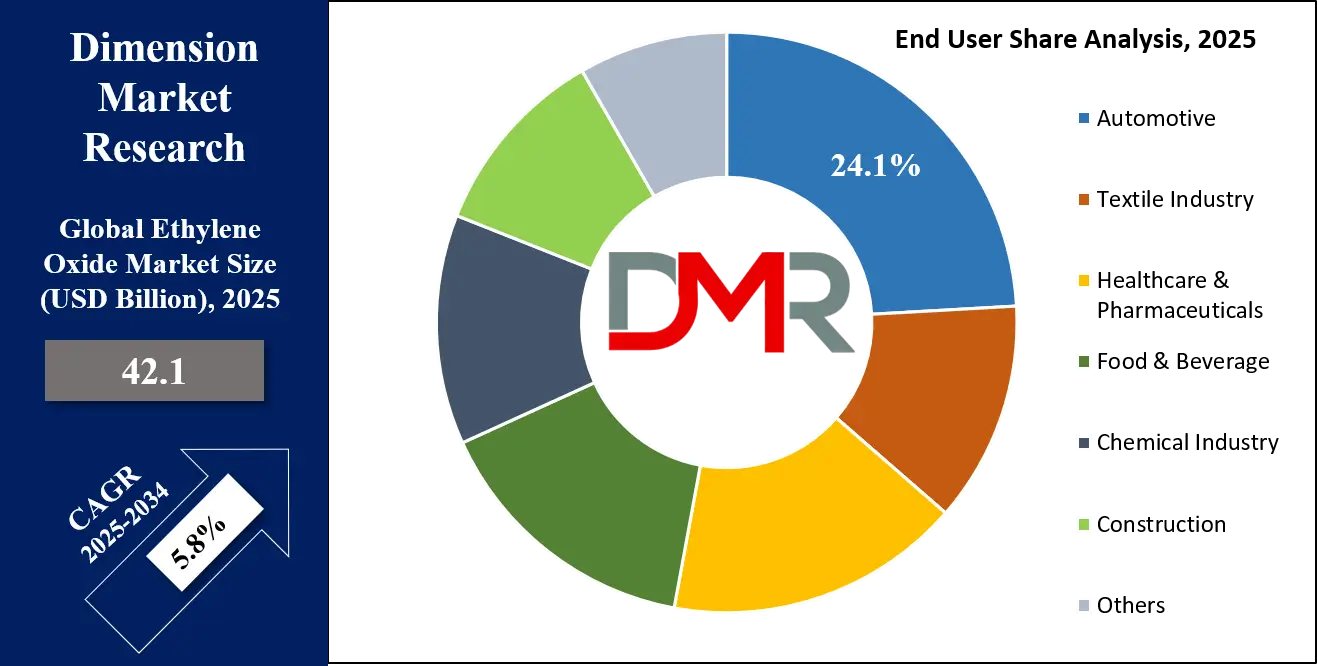

By End User Analysis

The automotive industry is projected to represent the dominant end-use sector for ethylene oxide derivatives, primarily as the automotive sector uses ethylene oxide derivatives as its primary end-use segment due to the fundamental position of ethylene glycol in automotive products. The antifreeze production process requires ethylene glycol as its essential ingredient to manufacture essential engine coolants used in vehicle thermal management systems. These substances protect engines from harm by preventing freezing during cold spells and avoiding temperature-related overheating that can damage performance over time. All vehicles need these fluids regardless of their engine type, thus resulting in continuous widespread consumption.

Vehicle demands increase rapidly worldwide, and particularly in Asia-Pacific and Latin America, due to the surge in vehicle purchases. The production and sales of automobiles increase because emerging economies experience swift urban development combined with rising household earnings and expanding road networks. The need for vehicle maintenance in cold climate zones throughout Europe and North America drives permanent antifreeze product consumption throughout the whole year.

The automotive industry utilizes ethylene oxide derivatives to generate polyurethane foams and textiles through glycol ethers and ethanolamines for interior materials production. These materials deliver safety and comfort performance and energy efficiency benefits for electric vehicles, especially because weight reduction stands as a critical factor.

The automotive sector represents the most dominant end-use because it needs massive amounts of ethylene oxide-based chemicals as functional elements within various vehicle components while experiencing continuous expansion. The automotive industry will stay as the primary market for ethylene oxide consumption due to current trends supporting electric mobility and improved vehicle efficiency.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Ethylene Oxide Market Report is segmented on the basis of the following:

By Product Type

- Ethylene Glycol

- Ethoxylates

- Ethanolamines

- Glycol Ethers

By End-Use

- Automotive

- Textile Industry

- Healthcare & Pharmaceuticals

- Food & Beverage

- Chemical Industry

- Construction

- Others

Global Ethylene Oxide Market: Regional Analysis

Region with the Highest Market Share in the Ethylene Oxide Market

North America is projected to dominate the global ethylene oxide market as it holds 37.5% of the market share in 2025, primarily due to its robust industrial infrastructure, technological advancements, and established downstream industries. The U.S., being home to several leading chemical manufacturers such as Dow, Huntsman, and LyondellBasell, has extensive ethylene oxide production capabilities with well-integrated supply chains.

Additionally, the region benefits from the abundant availability of ethylene feedstock derived from shale gas, making production cost-effective and globally competitive. The automotive, healthcare, and packaging sectors, all major consumers of ethylene oxide derivatives, are highly developed and demand a consistent supply of chemicals such as ethylene glycol and ethanolamines.

Healthcare sterilization is another major driver. The U.S. relies heavily on ethylene oxide for sterilizing over 50% of its medical equipment, supported by strict hygiene standards and an advanced healthcare system. Regulatory challenges exist, but companies are investing in emission control technologies to comply with EPA guidelines. Moreover, ongoing R&D investments and the presence of high-purity applications in the pharmaceutical and electronics industries further cement North America’s leading position in the global ethylene oxide market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR in the Ethylene Oxide Market

Asia Pacific is projected to record the highest CAGR in the ethylene oxide market due to rapid industrialization, urbanization, and expanding consumer markets. Countries such as China, India, Indonesia, and Vietnam are witnessing surging demand across key sectors like automotive, textiles, packaging, personal care, and construction, all major consumers of ethylene oxide derivatives. The region's rising middle-class population and shifting lifestyle patterns are increasing the need for packaged goods, detergents, and cosmetics, thereby driving demand for ethylene oxide-based products like ethoxylates and glycol ethers.

In addition, Asia Pacific benefits from a cost-effective labor force, favorable government policies, and increasing foreign investments in petrochemical infrastructure. China, in particular, has emerged as a global production hub, with significant capacity expansions in ethylene and ethylene oxide plants. India is also investing heavily in chemical manufacturing under initiatives like “Make in India.” These developments, combined with improving healthcare infrastructure and increasing automobile production, are propelling strong market growth and ensuring the region leads in future expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Ethylene Oxide Market: Competitive Landscape

The global ethylene oxide market is moderately consolidated, with a mix of multinational corporations and regional players competing on the basis of capacity, geographic reach, product portfolio, and technological innovation. Key players include BASF SE, Dow Inc., Shell plc, SABIC, LyondellBasell Industries, INEOS Group, Huntsman Corporation, Eastman Chemical Company, and Reliance Industries. These companies dominate through vertical integration, strategic partnerships, and investments in advanced manufacturing technologies.

North American and European players benefit from advanced R&D capabilities and regulatory compliance systems, while Asian producers leverage cost advantages and proximity to high-growth markets. Expansion projects and capacity upgrades are common competitive strategies. For instance, many companies are investing in Asia-Pacific to tap into the region’s rising demand.

Sustainability is becoming a key differentiator, with top players pursuing greener production methods and carbon reduction targets. Innovations in bio-based ethylene oxide and energy-efficient catalysts are gaining traction. Moreover, companies are enhancing value through the production of high-purity derivatives tailored for specialty applications like electronics and pharmaceuticals.

The competitive landscape is also influenced by regulatory pressures, especially in North America and Europe, prompting companies to upgrade emissions control systems. Overall, strategic agility and investment in cleaner technologies will determine long-term market leadership.

Some of the prominent players in the Global Ethylene Oxide Market are:

- BASF SE

- SABIC

- Dow

- Shell plc

- China Petrochemical Corporation (Sinopec)

- INEOS

- LyondellBasell Industries Holdings B.V.

- India Glycols Limited

- Indorama Ventures Public Company Limited

- Reliance Industries Limited

- LOTTE Chemical Corporation

- Clariant

- NIPPON SHOKUBAI CO., LTD.

- Formosa Plastics Corporation

- Indian Oil Corporation Ltd.

- Huntsman International LLC

- Akzo Nobel N.V.

- Celanese Corporation

- PTT Global Chemical Public Company Limited

- Kazanorgsintez

- Other Key Players

Recent Developments in the Global Ethylene Oxide Market

- December 2023: INEOS completed the acquisition of LyondellBasell's ethylene oxide and derivatives business, including the Bayport, Texas, production site, for $700 million. This strategic move enhances INEOS's position in the EO market.

- October 2023: BASF announced a significant investment exceeding €500 million to expand its production capabilities at the Verbund site in Antwerp, Belgium. This expansion adds approximately 400,000 metric tons per year to BASF's production capacity for ethylene oxide and its derivatives.

- September 2023: INEOS Enterprises acquired the Norwegian business of Eramet Titanium & Iron for $245 million. The acquisition includes an ilmenite transformation plant capable of producing titanium dioxide slag and high-purity pig iron, aligning with INEOS's strategy to diversify its chemical portfolio.

- July 2023: INEOS signed a deal to acquire TotalEnergies' 50% share in several joint ventures, including Naphtachimie (720 ktpa steam cracker), Appryl (300 ktpa polypropylene business), and Gexaro (270 ktpa aromatics business), at the Lavéra site in France. This acquisition makes INEOS the sole owner of these units, enhancing its feedstock integration and production capabilities.

- April 2022: Indorama Ventures completed the acquisition of Brazilian chemical manufacturer Oxiteno, extending its growth profile into attractive surfactant markets. The acquisition was finalized on April 4, 2022.

- January 2022: SABIC and ExxonMobil announced the successful startup of the Gulf Coast Growth Ventures' world-scale manufacturing facility in San Patricio County, Texas. The new facility includes a mono-ethylene glycol unit with a capacity of 1.1 million metric tons per year.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 42.1 Bn |

| Forecast Value (2034) |

USD 70.0 Bn |

| CAGR (2025–2034) |

5.8% |

| The US Market Size (2025) |

USD 13.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Ethylene Glycol, Ethoxylates, Ethanolamines, Glycol Ethers), By End-Use (Automotive, Textile Industry, Cosmetics & Personal Care, Healthcare & Pharmaceuticals, Food & Beverage, Chemical Industry, Construction, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, SABIC, Dow, Shell plc, Sinopec, INEOS, LyondellBasell, India Glycols, Indorama Ventures, Reliance Industries, LOTTE Chemical, Clariant, Nippon Shokubai, Formosa Plastics, Indian Oil, Huntsman, Akzo Nobel, Celanese, PTT Global Chemical, Kazanorgsintez., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Ethylene Oxide Market?

▾ The Global Ethylene Oxide Market size is estimated to have a value of USD 42.1 billion in 2025 and is expected to reach USD 70.0 billion by the end of 2034

What is the size of the US Ethylene Oxide Market?

▾ The US Ethylene Oxide Market is projected to be valued at USD 13.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 21.4 billion in 2034 at a CAGR of 5.4%.

Which region accounted for the largest Global Ethylene Oxide Market?

▾ North America is expected to have the largest market share in the Global Ethylene Oxide Market with a share of about 37.5% in 2025.

Who are the key players in the Global Ethylene Oxide Market?

▾ Some of the major key players in the Global Ethylene Oxide Market are BASF SE, SABIC, Dow, Shell plc, Sinopec, INEOS, LyondellBasell, India Glycols, Indorama Ventures, Reliance Industries, LOTTE Chemical, and many others.

What is the growth rate in the Global Ethylene Oxide Market in 2025?

▾ The market is growing at a CAGR of 5.8 percent over the forecasted period of 2025.