Market Overview

The Europe Baby Products Market size is projected to reach USD 111.2 billion in 2025 and grow at a compound annual growth rate of 5.2% to reach a value of USD 175.5 billion in 2034.

The European baby products market covers a broad range of items designed for babies and toddlers from nutrition and toiletries to toys, clothing, furniture and feeding accessories. As parents become more health‑and‑safety conscious, demand is growing for high‑quality, safe, eco‑friendly and technology‑enabled baby products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The shift toward online shopping, subscription models, direct‑to‑consumer brands and heightened sustainability expectations is reshaping the market. At the same time, demographic pressures (including stagnant births in some countries) plus rising costs and supply‑chain disruption challenge the sector.

Nonetheless, innovation in smart baby monitoring devices, organic nutrition, connected feeding/nursing gear and sustainable materials is creating fresh growth levers. With strong retail infrastructure and regulatory frameworks across Europe, the baby‑products market is evolving from commodity items into differentiated, value‑added solutions centred on safety, convenience and wellbeing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Baby Products Market: Key Takeaways

- Market Growth: The Europe Baby Products Market size is expected to grow by USD 59.1 billion, at a CAGR of 5.2%, during the forecasted period of 2026 to 2034.

- By Type: The mass segment is anticipated to get the majority share of the Europe Baby Products Market in 2025.

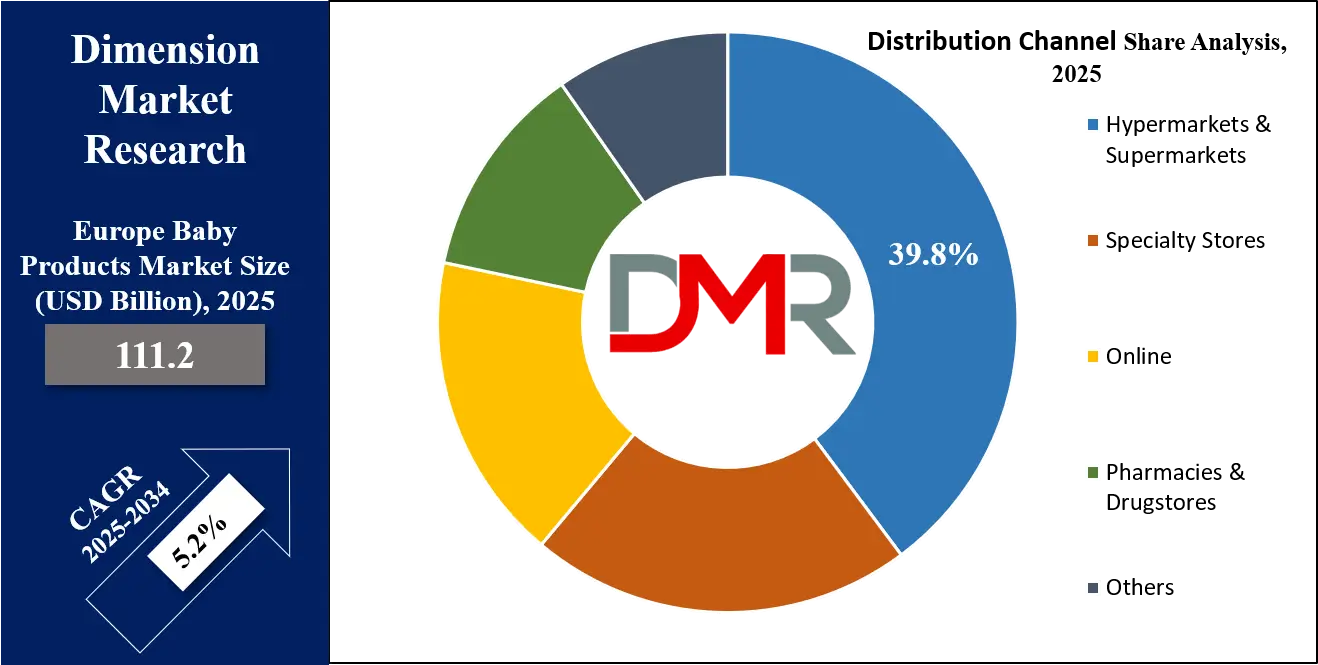

- By Distribution Channel: The hypermarkets & supermarkets segment is expected to get the largest revenue share in 2025 in the Europe Baby Products Market.

- Use Cases: Some of the use cases of Baby Products includes safety & monitoring, play & growth and more

Europe Baby Products Market: Use Cases

- Nutrition & Development: Parents purchasing baby food, cereals or formula seek healthy, organic and allergen‑free nutrition solutions for early childhood development.

- Safety & Monitoring: Use of sensors, smart monitors, connected devices and secure materials to ensure child safety at home, during travel, in nursery & on‑the‑go.

- Comfort & Convenience: Feeding & nursing accessories, baby clothing that integrates comfort and temperature regulation, nursery furniture designed for modularity and ease‑of‑use.

- Play & Growth: Baby toys and play equipment that combine educational elements, sustainability (eco‑materials) and safety certifications for developmental stages.

- Parent Lifestyle & Eco‑Awareness: Premium baby cosmetics, toiletries and convenience gear targeting eco‑friendly, chemical‑free and design‑conscious parents looking beyond basic functionality.

Stats & Facts

- European Union safety regulation updates require children’s products (including baby toys) to have a digital product passport — QR‑coded documentation verifying origin, hazardous substance compliance and certification status.

- Increasing parental awareness of health and non‑toxicity in baby care products is driving demand for products free from known allergens, chemicals and harsh additives.

- Online retail penetration in baby‑products categories is accelerating in Europe, with shoppers favouring e‑commerce, subscription models and direct‑to‑consumer channels for convenience.

- Sustainability imperatives — such as recyclable packaging, plant‑based materials and eco‑certification — are becoming key product differentiators in baby food, clothing and toiletries markets.

Market Dynamic

Driving Factors in the Europe Baby Products Market

Health & Safety Consciousness

Parents are increasingly focused on infant health, nutrition, safety of baby gear, and non-toxic materials — driving more premiumization and differentiated products. There is growing demand for organic baby food, BPA-free bottles, dermatologically tested toiletries, and toxin-free toys. Brands that can offer clinically backed, transparent, and certified products are gaining the trust of health-conscious consumers across Europe.

Digital Retail & Innovation

The rise of e-commerce, smart baby monitoring devices, connected feeding/nursing accessories and direct-to-consumer models is creating new engagement and product-opportunity models. Tech-savvy European parents are embracing mobile apps, AI-powered baby monitors, and subscription services that offer convenience, personalization and product recommendations based on the baby's growth stage or health data.

Restraints in the Europe Baby Products Market

Demographic Decline in Some Markets

Some European countries face falling birth rates, reducing absolute unit growth potential for baby products unless offset by premiumization or higher product use per baby. Southern and Eastern Europe, in particular, are experiencing stagnation in new births, leading to a shrinking addressable market. This puts pressure on brands to either target higher-value segments or expand into adjacent age brackets (e.g., toddler, preschool).

Cost & Regulation Pressure

Stringent safety and chemical-compliance regulations add to manufacturing cost, certification burden and limit the ability of smaller brands to scale quickly. EU standards for baby product safety are among the most rigorous globally, especially for food, cosmetics, and toys. Compliance with REACH, CE marking, and allergen disclosures can delay product rollouts and increase go-to-market costs.

Opportunities in the Europe Baby Products Market

Smart & Connected Baby Products

There is room for growth in “smart” baby devices (monitors, feeding/nursing automation, safety sensors) and integrated apps/data analytics for parents. This includes AI-driven sleep monitors, temperature-tracking wearables, and digital feeding logs. The opportunity lies in creating ecosystems where data from multiple baby products sync to support informed, tech-augmented parenting.

Premium & Sustainable Lines

As parental health, environment and convenience awareness rises, there is opportunity in premium organic baby food, eco-cosmetics, sustainable toys and high-design nursery furniture. Parents are increasingly willing to pay more for sustainable packaging, ethically sourced materials, and biodegradable baby-care products. EU-level sustainability mandates and green consumerism trends are also supporting this shift.

Trends in the Europe Baby Products Market

Omnichannel & Subscription Models

Brands are shifting from purely retail to online, subscription-based and omnichannel approaches to engage modern parents. Flexible delivery, product bundling, and auto-replenishment services are gaining traction, especially for diapers, formula, and wipes. Brands that offer seamless digital experiences with loyalty perks, mobile-first design, and responsive service are outperforming in this trend.

Eco-friendly & Ethical Products

Sustainable materials, chemical-free cosmetics, transparent sourcing and “clean-label” baby food are becoming top trends for differentiating in Europe. Parents are closely examining ingredient lists, packaging materials, and ethical certifications before purchase. Brands that align with climate-conscious values and provide full traceability — from farm to bottle — are seeing higher retention and engagement.

Impact of Artificial Intelligence in Europe Baby Products Market

- Personalised product recommendations: AI‑driven platforms analyse parent behaviour, baby age/stage and preferences to suggest tailored feeding, clothing, toy and safety‑gear bundles.

- Smart monitoring & safety devices: Baby monitors, sleep‑trackers, connected feeding systems use AI to interpret sensor data, detect anomalies and alert parents in real time.

- Supply‑chain optimisation: AI helps manufacturers forecast demand, optimise inventory for baby‑products, reduce waste and respond quickly to trend shifts (eco‑lines, premium demands).

- Online customer engagement: Chatbots and AI‑enabled customer service assist parents with product choices, educational content, and predictive delivery/subscription modelling.

- Quality & safety analytics: AI models support material‑testing labs, detect packaging/ingredient anomalies and help brands comply with increasingly strict EU safety/regulation frameworks.

Research Scope and Analysis

By Product Analysis

In 2025, baby food leads the European baby products market, holding an estimated 36.2% share. This segment includes infant formula, purees, cereals, and ready-to-eat baby meals. Its dominance is rooted in its essential nature nutritional products for infants are among the first purchases made by new parents.

Growing preference for organic, allergen-free, and clean-label options continues to boost the segment. Distribution through both offline and online channels ensures its accessibility. Moreover, convenience-driven variants like on-the-go pouches and fortified meals contribute to repeat buying and brand loyalty among European consumers.

Baby safety and convenience products are expanding at the fastest rate in Europe. This includes items like baby monitors, ergonomic strollers, childproofing tools, car seats, and travel accessories. The rise of smart and connected baby gear is resonating with tech-savvy parents looking for ease, safety, and automation. Urban lifestyles and rising dual-income households are prompting greater investment in multifunctional, space-efficient, and time-saving products. Evolving EU safety regulations and certifications are also helping boost consumer trust in innovative gear, accelerating category growth.

By Type Analysis

Mass-market baby products dominate the market with an estimated 63.4% share in 2025. These include widely available items such as basic diapers, mainstream baby food, regular toiletries, and entry-level clothing. Their broad distribution through hypermarkets, supermarkets, and discount chains makes them accessible to the general population.

Cost-effectiveness and routine use ensure consistent demand. Retailers’ private labels and budget-friendly offerings cater especially to middle-income families across Europe, sustaining the large volume share of this segment despite rising interest in premium alternatives.

Premium baby products are the fastest-growing type as parents become more aware of product quality, health impacts, and environmental sustainability. This includes organic food, biodegradable diapers, high-end skincare, sustainable wooden toys, and designer nursery furniture.

Affluent, urban consumers are increasingly shifting toward toxin-free, certified, and ethically sourced goods. Premium products often leverage clean labels, minimalist branding, and advanced features like smart integration or ergonomic design to appeal to discerning parents. Growth is further supported by social media influencers, boutique DTC brands, and conscious parenting trends.

By Distribution Channel Analysis

Hypermarkets and supermarkets account for the largest share of the distribution landscape, estimated at 39.8% in 2025. Their convenience, wide product assortments, and frequent promotions drive consistent traffic from parents. These outlets typically serve as primary shopping destinations for essentials such as diapers, baby food, and toiletries.

The trust and familiarity associated with in-store purchases also contribute to their dominance. In-store pharmacies and bundled family discounts further attract parents to buy baby goods during regular grocery runs, especially in suburban and semi-urban areas.

The online distribution channel is witnessing the fastest growth in the European baby products market. Increasing digital literacy, mobile shopping habits, and time-saving preferences among millennial and Gen Z parents are accelerating this trend.

E-commerce platforms offer convenience, product variety, user reviews, and personalized suggestions enhancing the shopping experience. Subscription models for recurring purchases like wipes or formula are particularly popular. COVID-19 further normalised online baby shopping, and brands are now doubling down on omnichannel strategies, influencer marketing, and direct-to-consumer websites to capture this surge.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Baby Products Market Report is segmented on the basis of the following:

By Product

- Baby Food

- Baby Cosmetics & Toiletries

- Baby Toys & Play Equipment

- Baby Safety & Convenience

- Baby Clothing

- Baby Nursery & Furniture

- Baby Feeding & Nursing

By Type

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Online

- Pharmacies & Drugstores

- Others

European Countries Analysis

The European baby products market exhibits varied trends across different countries. Western European countries like Germany, France, and the UK lead with strong consumer spending and high demand for premium and organic products, driven by health-conscious parents. Northern European nations such as Sweden, Norway, and Denmark emphasize sustainable and eco-friendly baby items, reflecting their environmental priorities.

In Southern Europe, countries like Italy, Spain, and Portugal primarily rely on mass-market products, although premium segments are growing in urban centers. Eastern European markets, including Poland, Romania, and Hungary, are emerging with increasing incomes and rising awareness of baby safety and nutrition. Across Europe, the overall shift toward quality, safety, and sustainability is shaping product innovation and market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Competitive Landscape

The European baby products market is highly competitive, with major international players dominating the industry. Key brands include Nestlé, Procter & Gamble, Kimberly-Clark, Philips, and Johnson & Johnson. These companies offer a wide range of products across various categories, from baby food and cosmetics to safety and nursery furniture. To maintain competitiveness, these brands are focusing on innovation, sustainability, and premium offerings. Additionally, local brands and startups are carving a niche in organic, eco-friendly, and tech-driven baby products.

Some of the prominent players in the Europe Baby Products are:

- Nestlé

- Danone

- Reckitt

- Procter & Gamble

- Kimberly-Clark

- Unilever

- Johnson & Johnson

- Beiersdorf

- Laboratoires Expanscience

- Sebapharma

- Philips Avent

- Tommee Tippee

- Medela

- Pigeon Corporation

- NUK

- MAM Baby

- Suavinex

- Chicco

- Bugaboo

- Stokke

- Other Key Players

Recent Developments

- In May 2025, Nestlé introduced a new range of organic baby food products in Europe, emphasizing sustainable sourcing and packaging to meet the increasing demand for organic options.

- In April 2025, Procter & Gamble introduced a new line of eco-friendly baby diapers made from biodegradable materials, aimed at reducing the environmental footprint

Report Details

| Report Characteristics |

| Market Size (2025) |

USD111.2 Bn |

| Forecast Value (2034) |

USD 175.5 Bn |

| CAGR (2025–2034) |

5.2% |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Baby Food, Baby Cosmetics & Toiletries, Baby Toys & Play Equipment, Baby Safety & Convenience, Baby Clothing, Baby Nursery & Furniture, and Baby Feeding & Nursing), By Type (Mass and Premium), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online, Pharmacies & Drugstores, and Others) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

Nestlé, Danone, Reckitt, Procter & Gamble, Kimberly-Clark, Unilever, Johnson & Johnson, Beiersdorf, Laboratoires Expanscience, Sebapharma, Philips Avent, Tommee Tippee, Medela, Pigeon Corporation, NUK, MAM Baby, Suavinex, Chicco, Bugaboo, Stokke, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe Baby Products Market?

▾ The Europe Baby Products Market size is expected to reach a value of USD 111.2 billion in 2025 and is expected to reach USD 175.5 billion by the end of 2034.

Who are the key Europe Baby Products Market?

▾ Some of the major key players in the Europe Baby Products Market are Nestle, P&G, Unilever, and others

What is the growth rate in the Europe Baby Products Market?

▾ The market is growing at a CAGR of 5.2 percent over the forecasted period.